Halloysite Market By Grade (High-Grade Halloysite, Low-Grade Halloysite), By End-Use (Pharmaceuticals, Cosmetics, Ceramics, Polymers, Cement, Paints & Coatings, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

7133

-

July 2024

-

173

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

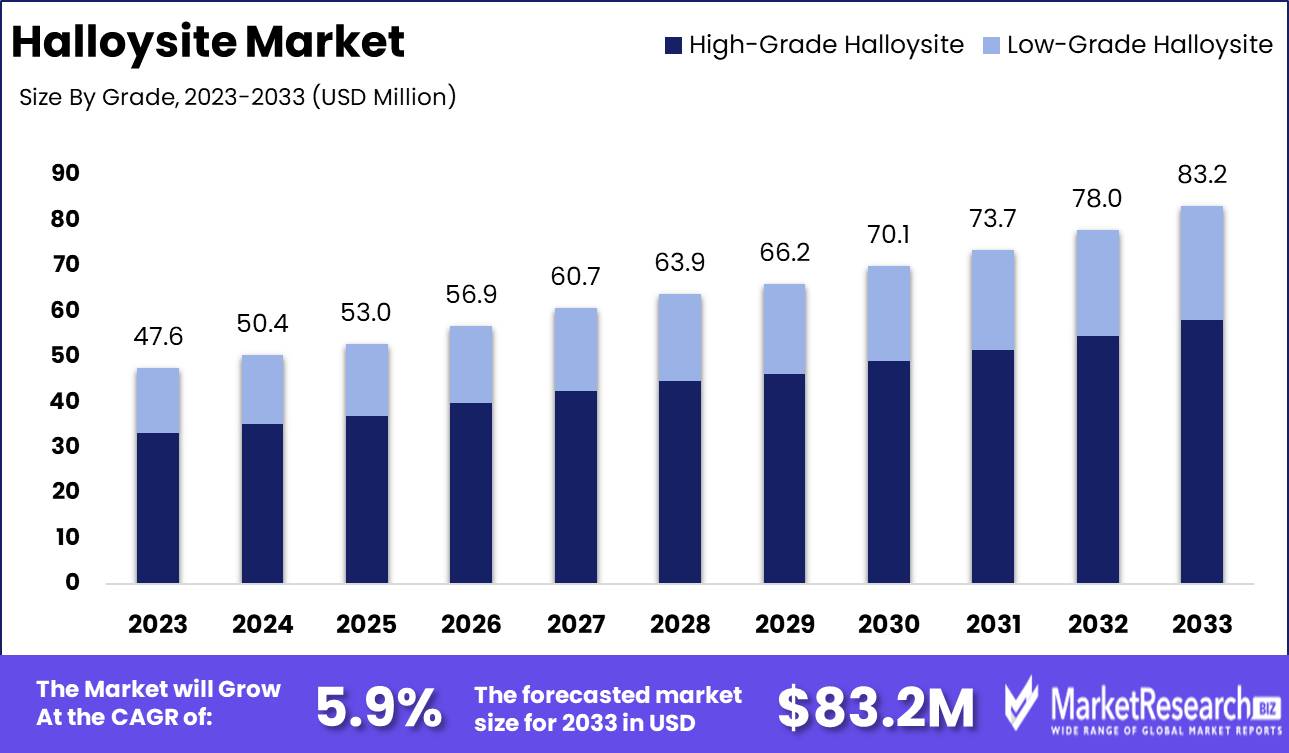

The Global Halloysite Market was valued at USD 47.6 Mn in 2023. It is expected to reach USD 43.8 Mn by 2033, with a CAGR of 5.9% during the forecast period from 2024 to 2033.

The Halloysite Market encompasses the global production, application, and commercialization of halloysite, a naturally occurring clay mineral. Renowned for its unique tubular structure, halloysite is utilized across diverse industries, including ceramics, cosmetics, pharmaceuticals, and nanotechnology. Its applications range from serving as a carrier for active ingredients in drug delivery systems to enhancing mechanical properties in advanced materials.

The market is driven by increasing demand for high-performance materials and sustainable solutions, with significant growth potential in emerging sectors such as environmental remediation and biotechnology. Continuous research and innovation are expected to further expand halloysite's applications and market opportunities. The Halloysite Market is poised for significant growth, driven by its unique properties and diverse industrial applications. Halloysite's tubular structure and high purity levels, with commercial grades containing between 92% to 99.1% halloysite, make it a valuable material across various sectors.

The market is driven by increasing demand for high-performance materials and sustainable solutions, with significant growth potential in emerging sectors such as environmental remediation and biotechnology. Continuous research and innovation are expected to further expand halloysite's applications and market opportunities. The Halloysite Market is poised for significant growth, driven by its unique properties and diverse industrial applications. Halloysite's tubular structure and high purity levels, with commercial grades containing between 92% to 99.1% halloysite, make it a valuable material across various sectors.Its applications range from ceramics and cosmetics to advanced uses in nanotechnology and pharmaceuticals, where it serves as an effective carrier for active ingredients in drug delivery systems. The market's expansion is further supported by the mineral's relative softness, with a Mohs hardness of 2 to 2.5, facilitating its processing and adaptation in multiple industries.

Innovations in material science and technology are unlocking new potential uses for halloysite, particularly in emerging fields such as environmental remediation and biotechnology. The demand for high-performance, sustainable materials is propelling research and development efforts, aiming to enhance the mechanical properties and functional capabilities of halloysite-based products.

Halloysite Market is witnessing increased interest from industries seeking environmentally friendly alternatives. Halloysite's natural abundance and low environmental impact during extraction and processing align with global sustainability trends, making it an attractive option for companies prioritizing eco-friendly solutions.

Key Takeaways

- Market Value: The Global Halloysite Market was valued at USD 47.6 Mn in 2023. It is expected to reach USD 43.8 Mn by 2033, with a CAGR of 5.9% during the forecast period from 2024 to 2033.

- By Grade: High-grade halloysite represents 70% of the halloysite market by grade.

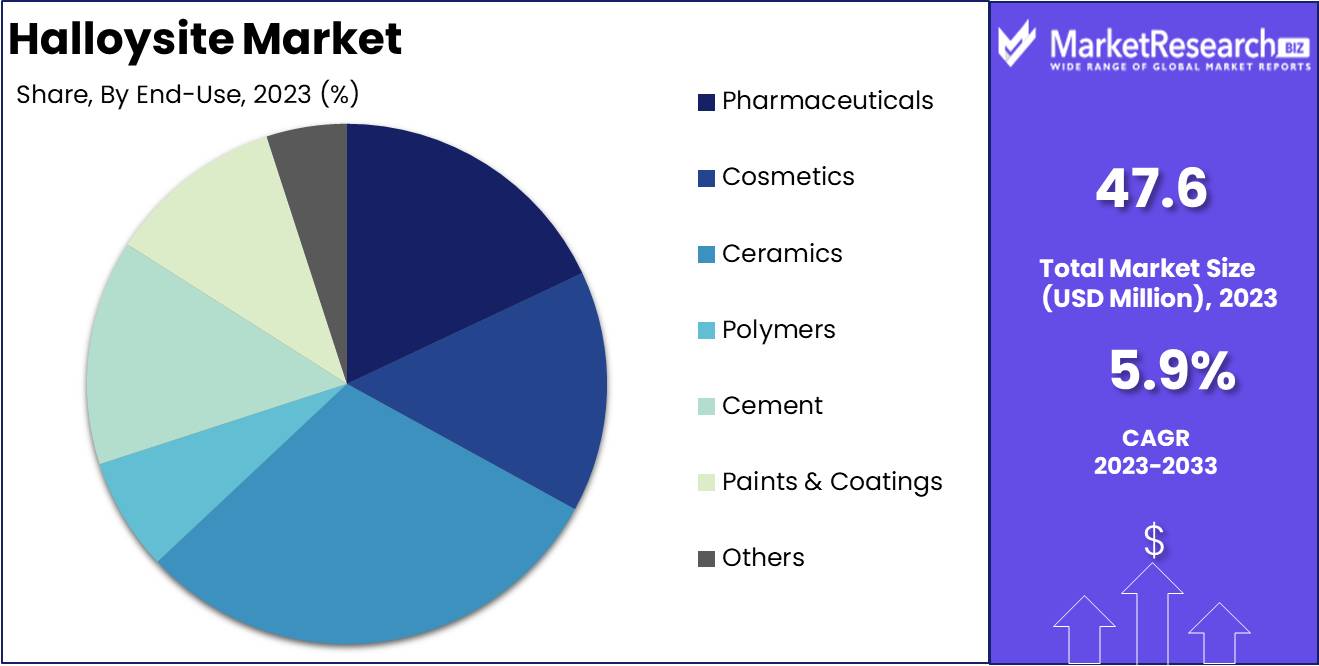

- By End-Use: The ceramics industry is the primary end-use sector, constituting 30% of the halloysite market

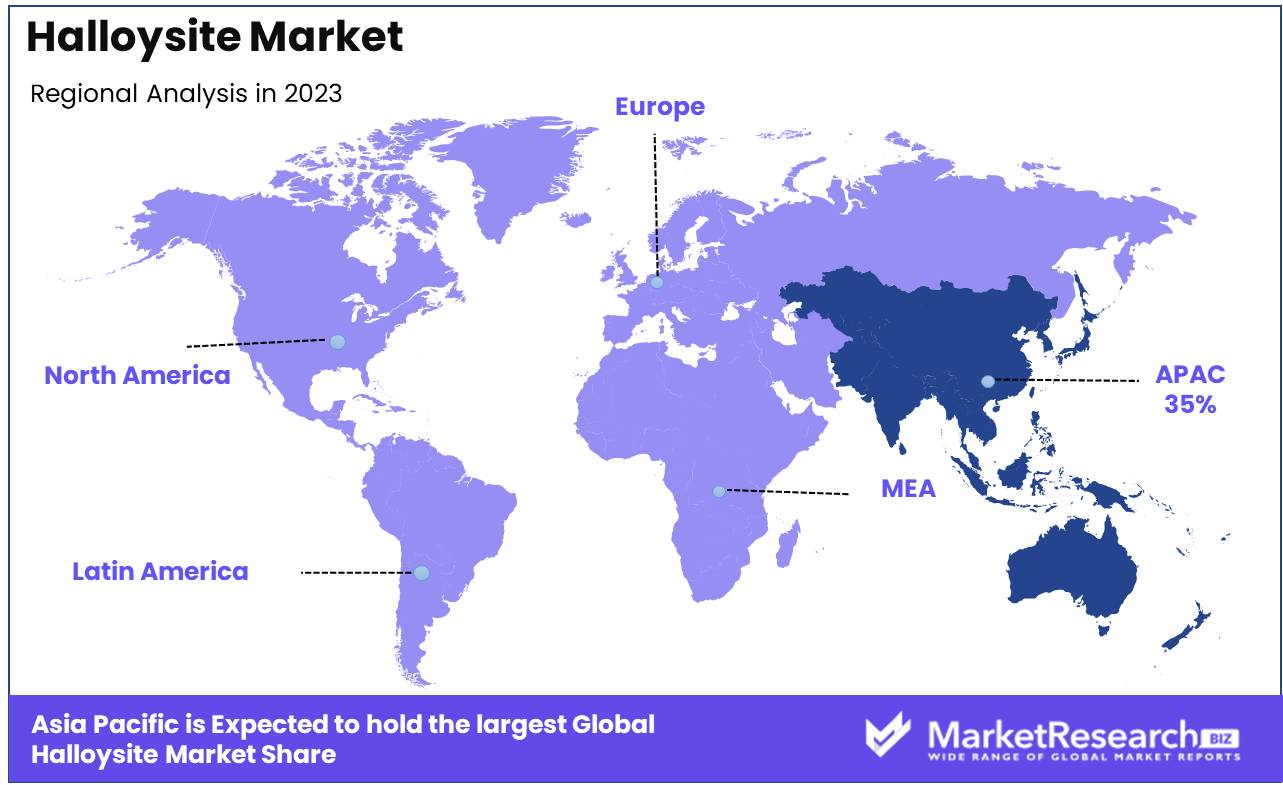

- Regional Dominance: The Halloysite Market is primarily dominated by the Asia-Pacific region, holding around 35% share.

- Growth Opportunity: The rising use of halloysite in nanotechnology and advanced ceramics presents substantial growth prospects.

Driving factors

Demand in Ceramics Industry

The ceramics industry represents a significant segment driving the growth of the halloysite market. Halloysite, a naturally occurring aluminosilicate clay, is highly valued in ceramics for its unique properties, including high plasticity, fine particle size, and thermal stability. These characteristics make halloysite an ideal component for improving the strength, durability, and overall quality of ceramic products.

The increasing demand for high-performance ceramics in construction, automotive, and consumer goods industries fuels the need for halloysite. As manufacturers strive to produce more resilient and aesthetically appealing ceramic items, the utilization of halloysite continues to expand, thereby contributing substantially to the market's growth.

Cosmetics and Personal Care Products

The cosmetics and personal care industry is increasingly adopting halloysite due to its beneficial properties, such as high absorbency, natural purity, and gentle exfoliation capabilities. Halloysite is used in various products, including skincare creams, facial masks, and anti-aging treatments, for its ability to deliver active ingredients effectively and enhance product performance. Its natural and non-toxic nature aligns well with the growing consumer preference for clean and green beauty products.

This shift towards sustainable and natural ingredients in cosmetics drives the demand for halloysite, as brands seek to formulate innovative products that cater to environmentally conscious consumers. Consequently, the rising adoption of halloysite in cosmetics and personal care products significantly propels the market forward.

Medical and Pharmaceutical Applications

Halloysite's unique tubular structure and biocompatibility make it highly suitable for various medical and pharmaceutical applications. It is used in drug delivery systems, where its nanotube structure can encapsulate and release therapeutic agents in a controlled manner, enhancing the efficacy and precision of treatments.

Halloysite is employed in tissue engineering and wound healing products due to its ability to promote cell growth and regeneration. The increasing focus on advanced drug delivery systems and biocompatible materials in the medical field drives the demand for halloysite. As the healthcare sector continues to innovate and seek more effective treatment solutions, the role of halloysite in medical and pharmaceutical applications becomes increasingly prominent, thereby augmenting market growth.

Restraining Factors

Limited Availability of High-Purity Deposits

The limited availability of high-purity halloysite deposits poses a significant challenge to the growth of the halloysite market. High-purity halloysite, essential for applications requiring stringent quality standards such as in the medical, pharmaceutical, and cosmetics industries, is relatively rare. This scarcity limits the supply and can lead to increased competition among manufacturers for the available resources.

The dependence on a few high-purity deposits elevates the risks associated with supply chain disruptions and can result in price volatility. The limited availability necessitates extensive exploration and mining efforts, which further complicates the procurement process and poses a barrier to the expansion of the halloysite market.

High Processing and Production Costs

The high processing and production costs associated with halloysite present another critical challenge to market growth. Extracting and refining halloysite to meet the high purity requirements for specialized applications involves complex and expensive processes. These processes include advanced techniques for separation, purification, and modification of halloysite to enhance its properties for specific industrial uses.

The substantial financial investment required for these sophisticated processing technologies can be a deterrent for new entrants and smaller companies, thereby limiting market competition and innovation. Furthermore, high production costs translate to higher prices for end products, which can affect market demand and limit the adoption of halloysite-based solutions, particularly in price-sensitive markets.

By Grade Analysis

High-grade halloysite constitutes 70% of the Halloysite market by grade.

In 2023, High-Grade Halloysite held a dominant market position in the Halloysite Market's By Grade segment, capturing more than a 70% share. High-grade halloysite is characterized by its superior purity, fine particle size, and unique tubular structure, which makes it highly desirable for applications in ceramics, catalysis, and pharmaceuticals. This dominance is driven by the material's exceptional properties, including high aspect ratio and surface area, which enhance its performance in various industrial and scientific applications.

Low-Grade Halloysite accounted for the remaining market share. Low-grade halloysite typically exhibits lower purity levels and larger particle sizes compared to its high-grade counterpart. Despite these differences, low-grade halloysite finds applications in less demanding sectors such as construction materials, paper coatings, and environmental remediation, where cost-effectiveness and bulk availability are prioritized over specific material properties.

The Halloysite Market is characterized by steady growth driven by increasing research and development activities, expanding applications in nanotechnology, and rising demand for sustainable and eco-friendly materials. Future market trends indicate continued exploration of halloysite's unique properties and potential for innovation across diverse industries, supporting sustained market expansion.

By End-Use Analysis

Ceramics stand out as the primary end-use sector, accounting for 30% of the Halloysite market.

In 2023, Ceramics held a dominant market position in the Halloysite Market's By End-Use segment, capturing more than a 30% share. Halloysite is extensively utilized in ceramics production due to its unique properties such as high aspect ratio, whiteness, and ability to act as a filler and reinforcement agent. This dominance is driven by increasing demand for advanced ceramics in electronics, construction, and automotive industries, where halloysite enhances mechanical strength, thermal stability, and aesthetic appeal of ceramic products.

Ceramics, Pharmaceuticals constituted a notable share in the market. Halloysite nanoparticles are explored for drug delivery systems, encapsulation of active pharmaceutical ingredients (APIs), and controlled release applications. Halloysite's biocompatibility, high surface area, and tubular structure make it suitable for targeted drug delivery and sustained release formulations, addressing challenges in pharmaceutical manufacturing and enhancing therapeutic efficacy.

Halloysite contributed significantly to the Cosmetics segment. In cosmetics, halloysite is utilized for its absorbent properties, texture enhancement, and natural origin appeal. Halloysite clay is incorporated into skincare products such as masks, scrubs, and creams, offering benefits such as oil absorption, gentle exfoliation, and skin detoxification, catering to consumer preferences for natural and sustainable cosmetic ingredients.

Halloysite sourced for polymeric sand, Cement, and Paints & Coatings applications played vital roles in industrial sectors. In polymers, halloysite nanotubes are used as nanofillers to improve mechanical properties, barrier properties, and flame retardancy of polymer composites.

Key Market Segments

By Grade

- High-Grade Halloysite

- Low-Grade Halloysite

By End-Use

- Pharmaceuticals

- Cosmetics

- Ceramics

- Polymers

- Cement

- Paints & Coatings

- Others

Growth Opportunity

Development of New Applications in Nanotechnology

The development of new applications in nanotechnology presents a significant opportunity for the halloysite market in 2024. Halloysite nanotubes (HNTs) are gaining traction in nanotechnology due to their unique tubular structure, high surface area, and biocompatibility. These properties make HNTs suitable for a range of advanced applications, including drug delivery systems, nanocomposites, and electronic devices. In drug delivery, HNTs can encapsulate and release therapeutic agents in a controlled manner, enhancing the efficacy and precision of treatments.

In nanocomposites, they improve mechanical strength and thermal stability, benefiting industries such as aerospace, automotive, and electronics. The expanding scope of nanotechnology applications drives demand for halloysite, unlocking new market segments and fostering innovation.

Utilization in Advanced Water Purification Systems

The utilization of halloysite in advanced water purification systems offers another promising growth avenue. Halloysite's high surface area and adsorption capabilities make it an effective material for removing contaminants from water. In water purification, HNTs can adsorb heavy metals, organic pollutants, and pathogens, providing a cost-effective and sustainable solution for clean water.

The growing global need for safe and accessible drinking water, coupled with increasing regulatory standards for water quality, drives the demand for advanced purification technologies. Halloysite-based solutions address these needs, offering a versatile and efficient approach to water treatment. The integration of halloysite in water purification systems not only supports environmental sustainability but also enhances market potential.

Latest Trends

Halloysite Nanotubes in Polymer Composites

The incorporation of halloysite nanotubes (HNTs) in polymer composites is emerging as a significant trend in the halloysite market for 2024. HNTs are highly valued for their ability to enhance the mechanical, thermal, and barrier properties of polymers. By integrating HNTs, manufacturers can produce composites with superior strength, durability, and resistance to thermal and chemical degradation. These enhanced properties are particularly beneficial in industries such as automotive, aerospace, construction, and packaging, where advanced materials are crucial for performance and safety.

The rising demand for lightweight and high-performance materials drives the adoption of HNT-reinforced composites, promoting innovation and growth in the halloysite market. As industries continue to seek improvements in material performance and sustainability, the use of HNTs in polymer composites is expected to expand, offering significant market opportunities.

Environmentally Friendly Extraction Methods

The adoption of environmentally friendly extraction methods is another pivotal trend shaping the halloysite market in 2024. Traditional mining and extraction processes can have significant environmental impacts, including habitat destruction, water pollution, and high energy consumption. In response to increasing environmental regulations and consumer demand for sustainable practices, companies are investing in cleaner, more sustainable extraction technologies. These methods aim to minimize ecological disruption and reduce the carbon footprint associated with halloysite production.

Techniques such as selective mining, advanced beneficiation, and the use of renewable energy sources are being developed and implemented to achieve these goals. The shift towards environmentally friendly extraction methods not only aligns with global sustainability initiatives but also enhances the reputation and marketability of halloysite as a green material. This trend is crucial for ensuring the long-term sustainability and competitiveness of the halloysite market.

Regional Analysis

Asia-Pacific leading with a significant 35% share, the global halloysite market showcases dynamic growth opportunities across diverse regions.

Asia-Pacific emerges as the dominant region in the global halloysite market, capturing a significant share of approximately 35%. This leadership is attributed to robust industrial activities, particularly in countries like China and India, where halloysite finds extensive application in ceramics, catalysts, and nanotechnology. The region benefits from increasing research and development investments aimed at exploring new applications for halloysite, driving market growth.

Asia-Pacific, Europe and North America hold substantial shares in the halloysite market. In Europe, countries like France and Germany are pivotal in ceramic manufacturing, utilizing halloysite for its unique properties in porcelain production. The region also witnesses growing demand for halloysite in cosmetics and pharmaceutical applications, contributing to market expansion.

North America benefits from a strong presence of end-user industries such as automotive and electronics, where halloysite is utilized in advanced materials and coatings. The region's emphasis on technological advancements and sustainability further supports market growth, with ongoing research enhancing halloysite's potential in emerging applications.

Middle East & Africa and Latin America exhibit potential in the halloysite market, driven by expanding construction and healthcare sectors. These regions are increasingly adopting halloysite-based materials for infrastructure development and medical applications, supported by favorable government initiatives and investments in technological infrastructure.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global halloysite market is projected to witness substantial growth, driven by its increasing applications across various industries such as ceramics, paints and coatings, and nanotechnology. Key players are focusing on expanding their production capacities and enhancing product quality to meet the rising demand.

English Indian Clays Ltd. and Thiele Kaolin Company are expected to leverage their extensive mining expertise and established market presence. Their strategic investments in advanced extraction and processing technologies are set to enhance product purity and performance, positioning them as leaders in the high-quality halloysite segment.

Ashapura Group of Industries and I-Minerals Inc. are anticipated to focus on diversifying their product portfolios to cater to a wider range of applications. Their emphasis on R&D will likely drive innovation, particularly in the development of new, high-value applications in nanotechnology and pharmaceuticals.

SCR-Sibelco NV and Imerys Ceramics are poised to capitalize on their global distribution networks and robust supply chains. By ensuring a consistent and reliable supply of halloysite, they can meet the growing demands of their international customer base, particularly in the ceramics and coatings industries.

Global Industrial Solutions Inc. and Una Kaolin Company are set to enhance their competitive edge through strategic partnerships and collaborations. These initiatives will likely facilitate the development of new applications and markets, driving long-term growth.

KaMin LLC and Active Minerals International are focusing on sustainable mining practices and environmental stewardship. Their commitment to eco-friendly extraction and processing methods aligns with global sustainability trends, appealing to environmentally conscious consumers and industries.

KeraSolutions Ltd. and Halloysite Ltd. are expected to lead in specialized applications of halloysite, particularly in advanced materials and nanocomposites. Their technical expertise and innovation capabilities will be critical in driving the adoption of halloysite in cutting-edge technologies.

BASF SE and Applied Minerals Inc. are leveraging their strong R&D capabilities and industry experience to explore new applications for halloysite. Their focus on high-performance materials and functional additives will likely open new avenues for market expansion.

LB MINERALS, Ltd. is anticipated to strengthen its market position through strategic expansions and acquisitions. By broadening their production capabilities and geographical reach, they can tap into emerging markets and increase their market share.

Market Key Players

- English Indian Clays Ltd.

- Thiele Kaolin Company

- Ashapura Group of Industries

- I-Minerals Inc.

- SCR-Sibelco NV

- Imerys Ceramics

- Global Industrial Solutions Inc.

- Una Kaolin Company

- KaMin LLC

- Active Minerals International

- KeraSolutions Ltd.

- Halloysite Ltd.

- BASF SE

- Applied Minerals Inc.

- LB MINERALS, Ltd.

Recent Development

- In June 2024, I-Minerals Inc. launched a new research initiative to develop halloysite nanotube applications in biomedicine and electronics, partnering with leading academic institutions.

- In April 2024, Applied Minerals expanded production capacity for halloysite-based materials used in environmental remediation and advanced ceramics, targeting increased demand from various industries.

Report Scope

Report Features Description Market Value (2023) USD 47.6 Mn Forecast Revenue (2033) USD 43.8 Mn CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (High-Grade Halloysite, Low-Grade Halloysite), By End-Use (Pharmaceuticals, Cosmetics, Ceramics, Polymers, Cement, Paints & Coatings, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape English Indian Clays Ltd., Thiele Kaolin Company, Ashapura Group of Industries, I-Minerals Inc., SCR-Sibelco NV, Imerys Ceramics, Global Industrial Solutions Inc., Una Kaolin Company, KaMin LLC, Active Minerals International, KeraSolutions Ltd., Halloysite Ltd., BASF SE, Applied Minerals Inc., LB MINERALS, Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Halloysite Market Overview

- 2.1. Halloysite Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Halloysite Market Dynamics

- 3. Global Halloysite Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Halloysite Market Analysis, 2016-2021

- 3.2. Global Halloysite Market Opportunity and Forecast, 2023-2032

- 3.3. Global Halloysite Market Analysis, Opportunity and Forecast, By By Grade, 2016-2032

- 3.3.1. Global Halloysite Market Analysis by By Grade: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Grade, 2016-2032

- 3.3.3. High-Grade Halloysite

- 3.3.4. Low-Grade Halloysite

- 3.4. Global Halloysite Market Analysis, Opportunity and Forecast, By By End-Use, 2016-2032

- 3.4.1. Global Halloysite Market Analysis by By End-Use: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-Use, 2016-2032

- 3.4.3. Pharmaceuticals

- 3.4.4. Cosmetics

- 3.4.5. Ceramics

- 3.4.6. Polymers

- 3.4.7. Cement

- 3.4.8. Paints & Coatings

- 3.4.9. Others

- 4. North America Halloysite Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Halloysite Market Analysis, 2016-2021

- 4.2. North America Halloysite Market Opportunity and Forecast, 2023-2032

- 4.3. North America Halloysite Market Analysis, Opportunity and Forecast, By By Grade, 2016-2032

- 4.3.1. North America Halloysite Market Analysis by By Grade: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Grade, 2016-2032

- 4.3.3. High-Grade Halloysite

- 4.3.4. Low-Grade Halloysite

- 4.4. North America Halloysite Market Analysis, Opportunity and Forecast, By By End-Use, 2016-2032

- 4.4.1. North America Halloysite Market Analysis by By End-Use: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-Use, 2016-2032

- 4.4.3. Pharmaceuticals

- 4.4.4. Cosmetics

- 4.4.5. Ceramics

- 4.4.6. Polymers

- 4.4.7. Cement

- 4.4.8. Paints & Coatings

- 4.4.9. Others

- 4.5. North America Halloysite Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Halloysite Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Halloysite Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Halloysite Market Analysis, 2016-2021

- 5.2. Western Europe Halloysite Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Halloysite Market Analysis, Opportunity and Forecast, By By Grade, 2016-2032

- 5.3.1. Western Europe Halloysite Market Analysis by By Grade: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Grade, 2016-2032

- 5.3.3. High-Grade Halloysite

- 5.3.4. Low-Grade Halloysite

- 5.4. Western Europe Halloysite Market Analysis, Opportunity and Forecast, By By End-Use, 2016-2032

- 5.4.1. Western Europe Halloysite Market Analysis by By End-Use: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-Use, 2016-2032

- 5.4.3. Pharmaceuticals

- 5.4.4. Cosmetics

- 5.4.5. Ceramics

- 5.4.6. Polymers

- 5.4.7. Cement

- 5.4.8. Paints & Coatings

- 5.4.9. Others

- 5.5. Western Europe Halloysite Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Halloysite Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Halloysite Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Halloysite Market Analysis, 2016-2021

- 6.2. Eastern Europe Halloysite Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Halloysite Market Analysis, Opportunity and Forecast, By By Grade, 2016-2032

- 6.3.1. Eastern Europe Halloysite Market Analysis by By Grade: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Grade, 2016-2032

- 6.3.3. High-Grade Halloysite

- 6.3.4. Low-Grade Halloysite

- 6.4. Eastern Europe Halloysite Market Analysis, Opportunity and Forecast, By By End-Use, 2016-2032

- 6.4.1. Eastern Europe Halloysite Market Analysis by By End-Use: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-Use, 2016-2032

- 6.4.3. Pharmaceuticals

- 6.4.4. Cosmetics

- 6.4.5. Ceramics

- 6.4.6. Polymers

- 6.4.7. Cement

- 6.4.8. Paints & Coatings

- 6.4.9. Others

- 6.5. Eastern Europe Halloysite Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Halloysite Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Halloysite Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Halloysite Market Analysis, 2016-2021

- 7.2. APAC Halloysite Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Halloysite Market Analysis, Opportunity and Forecast, By By Grade, 2016-2032

- 7.3.1. APAC Halloysite Market Analysis by By Grade: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Grade, 2016-2032

- 7.3.3. High-Grade Halloysite

- 7.3.4. Low-Grade Halloysite

- 7.4. APAC Halloysite Market Analysis, Opportunity and Forecast, By By End-Use, 2016-2032

- 7.4.1. APAC Halloysite Market Analysis by By End-Use: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-Use, 2016-2032

- 7.4.3. Pharmaceuticals

- 7.4.4. Cosmetics

- 7.4.5. Ceramics

- 7.4.6. Polymers

- 7.4.7. Cement

- 7.4.8. Paints & Coatings

- 7.4.9. Others

- 7.5. APAC Halloysite Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Halloysite Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Halloysite Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Halloysite Market Analysis, 2016-2021

- 8.2. Latin America Halloysite Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Halloysite Market Analysis, Opportunity and Forecast, By By Grade, 2016-2032

- 8.3.1. Latin America Halloysite Market Analysis by By Grade: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Grade, 2016-2032

- 8.3.3. High-Grade Halloysite

- 8.3.4. Low-Grade Halloysite

- 8.4. Latin America Halloysite Market Analysis, Opportunity and Forecast, By By End-Use, 2016-2032

- 8.4.1. Latin America Halloysite Market Analysis by By End-Use: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-Use, 2016-2032

- 8.4.3. Pharmaceuticals

- 8.4.4. Cosmetics

- 8.4.5. Ceramics

- 8.4.6. Polymers

- 8.4.7. Cement

- 8.4.8. Paints & Coatings

- 8.4.9. Others

- 8.5. Latin America Halloysite Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Halloysite Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Halloysite Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Halloysite Market Analysis, 2016-2021

- 9.2. Middle East & Africa Halloysite Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Halloysite Market Analysis, Opportunity and Forecast, By By Grade, 2016-2032

- 9.3.1. Middle East & Africa Halloysite Market Analysis by By Grade: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Grade, 2016-2032

- 9.3.3. High-Grade Halloysite

- 9.3.4. Low-Grade Halloysite

- 9.4. Middle East & Africa Halloysite Market Analysis, Opportunity and Forecast, By By End-Use, 2016-2032

- 9.4.1. Middle East & Africa Halloysite Market Analysis by By End-Use: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-Use, 2016-2032

- 9.4.3. Pharmaceuticals

- 9.4.4. Cosmetics

- 9.4.5. Ceramics

- 9.4.6. Polymers

- 9.4.7. Cement

- 9.4.8. Paints & Coatings

- 9.4.9. Others

- 9.5. Middle East & Africa Halloysite Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Halloysite Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Halloysite Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Halloysite Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Halloysite Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. English Indian Clays Ltd.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Thiele Kaolin Company

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Ashapura Group of Industries

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. I-Minerals Inc.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. SCR-Sibelco NV

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Imerys Ceramics

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Global Industrial Solutions Inc.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Una Kaolin Company

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. KaMin LLC

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Active Minerals International

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. KeraSolutions Ltd.

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. BASF SE

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Applied Minerals Inc.

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. LB MINERALS, Ltd.

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- English Indian Clays Ltd.

- Thiele Kaolin Company

- Ashapura Group of Industries

- I-Minerals Inc.

- SCR-Sibelco NV

- Imerys Ceramics

- Global Industrial Solutions Inc.

- Una Kaolin Company

- KaMin LLC

- Active Minerals International

- KeraSolutions Ltd.

- Halloysite Ltd.

- BASF SE

- Applied Minerals Inc.

- LB MINERALS, Ltd.