Guidewires Market Report By Material (Stainless Steel Guidewires, Nitinol Guidewires, Hybrid Guidewires, Others), By Coating (Hydrophilic Coated Guidewires, Hydrophobic Coated Guidewires, Silicon Coated Guidewires, PTFE Coated Guidewires, Others), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47044

-

June 2024

-

290

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

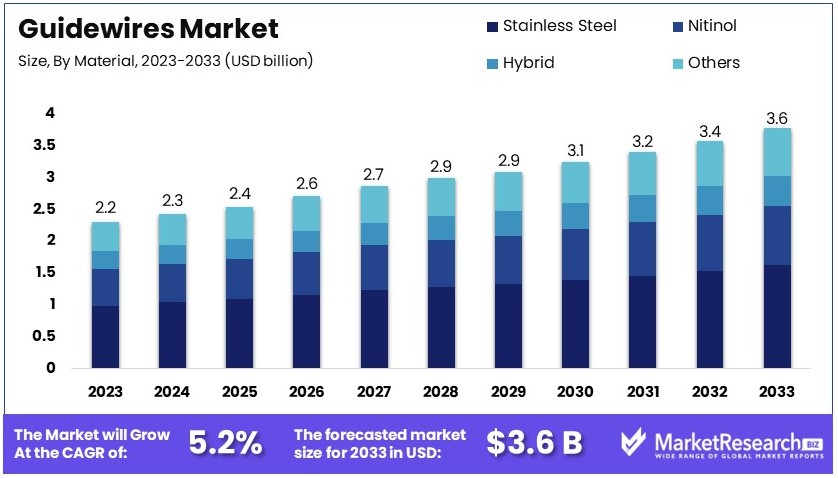

The Global Guidewires Market size is expected to be worth around USD 3.6 Billion by 2033, from USD 2.2 Billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

The Guidewires Market encompasses devices used in medical procedures to navigate blood vessels and other bodily channels. Guidewires are essential in minimally invasive surgeries, providing a pathway for catheters and other instruments.

This market includes various types of guidewires such as coronary guidewires, peripheral guidewires, and neurovascular guidewires. The increasing prevalence of cardiovascular diseases and the rising number of minimally invasive surgeries drive the demand for guidewires.

Key players in this market focus on developing advanced guidewires with improved flexibility, durability, and precision. Innovations in materials and design contribute to the growth of this market, making procedures safer and more effective.

The Guidewires Market is experiencing robust growth driven by the increasing prevalence of cardiovascular diseases (CVD). In the United States alone, CVD accounted for 928,741 deaths in 2020, making it the leading cause of death. Additionally, between 2017 and 2020, 127.9 million US adults were diagnosed with some form of CVD. This high prevalence underscores the critical need for effective medical interventions, including guidewires.

Guidewires are essential in minimally invasive surgeries, particularly for cardiovascular procedures. They provide a pathway for catheters and other instruments, enabling precise navigation through blood vessels. The demand for guidewires is expected to rise as the rates of cardiovascular risk factors and diseases continue to increase. By 2060, the projected rates of cardiovascular conditions are anticipated to grow significantly, further driving the need for advanced medical devices like guidewires.

Key players in the guidewires market are focusing on innovation to enhance the flexibility, durability, and precision of these devices. Technological advancements, such as the development of next-generation guidewires with improved material properties, are expected to boost market growth. These innovations aim to make procedures safer and more effective, meeting the evolving needs of healthcare providers and patients.

In summary, the Guidewires Market is poised for significant expansion due to the rising incidence of cardiovascular diseases and the growing demand for minimally invasive surgical procedures. As healthcare providers seek to improve patient outcomes, the adoption of advanced guidewires will continue to increase, offering substantial growth opportunities for market participants.

Key Takeaways

- Market Value: The Global Guidewires Market size is expected to be worth USD 2.2 Billion in 2023, growing at a CAGR of 5.2%, expected to reach USD 3.6 Billion by 2033.

- Material Analysis: Stainless Steel Guidewires dominate with 45% due to high strength and cost-effectiveness.

- Coating Analysis: Hydrophilic Coated Guidewires lead with 55% due to enhanced lubricity and ease of navigation.

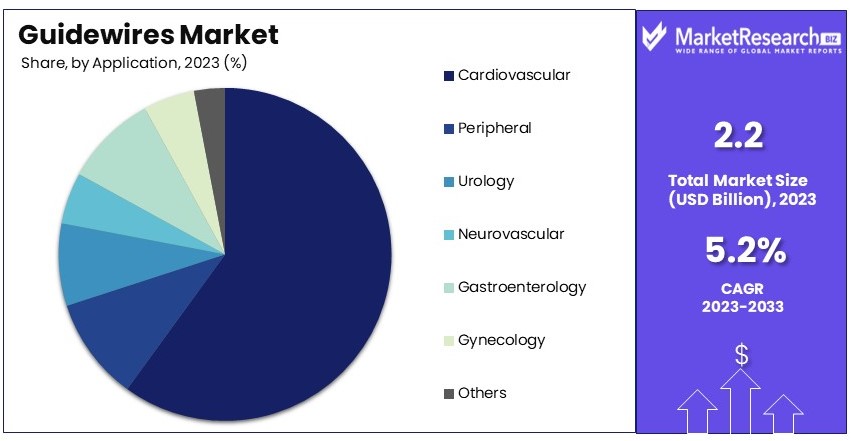

- Application Analysis: Cardiovascular Guidewires dominate with 60% due to increasing cardiovascular disease prevalence and procedural volume.

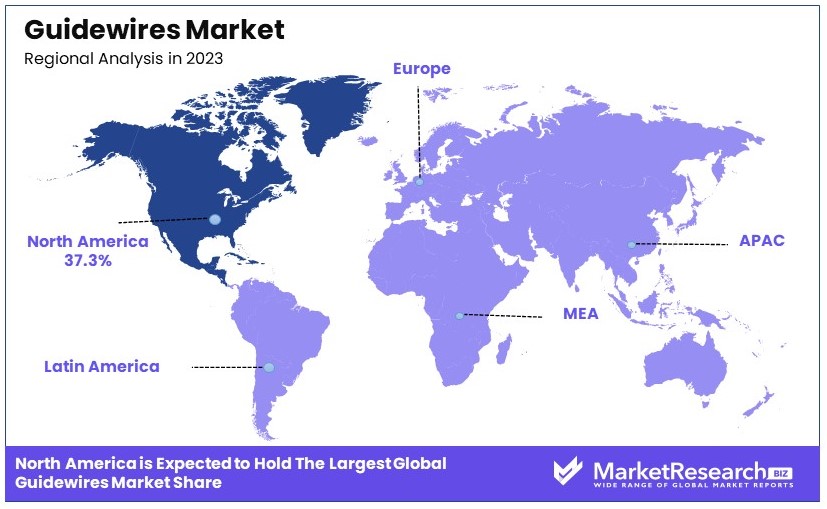

- Dominant Region: North America with 37.3% due to advanced healthcare infrastructure.

- High Growth Region: Europe with 29.4%, driven by technological advancements in medical devices.

- Analyst Viewpoint: The market shows steady growth with moderate competition; future innovations in material and coating technologies will drive advancements.

- Growth Opportunities: Companies can focus on developing advanced coatings and materials to enhance performance and expand in emerging markets.

Driving Factors

Increasing Prevalence of Cardiovascular Diseases Drives Market Growth

The escalating incidence of cardiovascular diseases globally acts as a primary catalyst for the expansion of the guidewires market. Guidewires are integral in conducting minimally invasive cardiac procedures like angioplasty and stent placements.

As cardiovascular diseases continue to be the leading cause of death worldwide, claiming approximately 17.9 million lives annually according to the World Health Organization, the demand for such procedures is surging. This upsurge is further fueled by an aging population and the prevalence of lifestyle-related health risks, enhancing the need for efficient cardiovascular interventions. The consequential rise in these medical procedures directly influences the growth trajectory of the guidewires market, underpinning its critical role in contemporary healthcare solutions.

Technological Advancements Enhance Guidewires Market

Technological innovations within the guidewires sector have significantly improved their functionality and application scope. Advancements such as hydrophilic coatings, the use of shape memory alloys, and enhanced torque control have not only optimized the performance of guidewires but also broadened their utility across various interventional disciplines.

For instance, the advent of guidewires designed for navigating complex neuro-vascular structures has revolutionized procedures, making them more precise and effective. These technological strides have facilitated the expansion of guidewires into new medical areas, thereby driving their market growth. Enhanced tool capabilities combined with growing procedural success rates amplify their adoption, directly impacting market expansion.

Rising Adoption of Minimally Invasive Procedures Boosts Guidewires Demand

The shift towards minimally invasive medical procedures is a significant growth driver for the guidewires market. These procedures, favored for benefits such as reduced recovery times and lower medical costs, rely heavily on guidewires for the successful navigation and placement of various interventional devices.

The rising demand across medical specialties including neurology, interventional cardiology and peripheral vascular devices propels the need for advanced guidewires. As healthcare providers continue to adopt these less invasive approaches, the guidewires market is set to expand, supported by the procedural advantages that these innovative medical practices offer. This trend not only enhances patient outcomes but also drives continual innovation and demand within the guidewires industry.

Restraining Factors

Risk of Complications Restrains Market Growth

The essential role of guidewires in interventional procedures is counterbalanced by the inherent risks of complications, which can significantly impede market growth. Complications such as vascular injuries, perforations, or embolisms occur at a rate of 0.5% to 2% during procedures like percutaneous coronary interventions (PCI), as reported by the Journal of the American College of Cardiology.

These risks can cause both healthcare professionals and patients to be cautious about opting for procedures that involve guidewires. The potential for severe outcomes not only affects the decision-making of medical practitioners but also impacts patient confidence, thereby restraining the adoption and expansion of the guidewires market. The fear of legal repercussions and the desire to avoid medical complications are key factors contributing to slower market growth.

Regulatory Challenges Hinder Guidewires Market

Navigating the complex landscape of regulatory requirements poses a significant challenge to the guidewires market. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose stringent standards and approval processes that are both time-consuming and costly. These regulations ensure safety and efficacy but also act as a barrier to the swift introduction of innovative guidewire technologies into the market.

The lengthy approval process can delay market entry for new products, curtailing rapid innovation and adoption. Consequently, the rigorous and often expensive compliance requirements limit the ability of manufacturers to quickly respond to market needs and opportunities, thereby restraining the growth of the guidewires market.

Material Analysis

Stainless Steel Guidewires dominate with 45% due to high strength and cost-effectiveness.

The Material segment of the Guidewires Market primarily comprises Stainless Steel Guidewires, Nitinol Guidewires, Hybrid Guidewires, and other materials. Stainless Steel Guidewires hold the dominant position in this segment, commanding approximately 45% of the market share. The popularity of stainless steel in guidewires is attributed to its high tensile strength, which is crucial for achieving precise device navigation during interventional procedures without compromising the wire's integrity. Additionally, stainless steel offers excellent cost-effectiveness compared to other materials, making it a preferred choice in various healthcare settings, especially in regions with budget constraints.

Nitinol Guidewires, known for their superelasticity and shape memory properties, are increasingly being adopted for their ability to return to their original shape after bending. This characteristic is particularly valuable in complex vascular procedures where navigation through tortuous pathways is required. Hybrid Guidewires, which combine the features of both stainless steel and nitinol, are also gaining traction due to their balanced performance attributes.

Other materials in the guidewires market include various alloys and composites designed for specialized applications. These materials are selected based on specific procedural requirements, such as flexibility, stiffness, and biocompatibility. The continual development and refinement of these materials contribute significantly to the overall growth of the guidewires market, catering to the evolving needs of medical interventions.

Coating Analysis

Hydrophilic Coated Guidewires dominate with 55% due to enhanced lubricity and ease of navigation.

In the Coating segment, Hydrophilic Coated Guidewires lead with a market share of 55%. The dominance of hydrophilic coatings is primarily due to their ability to significantly reduce friction, allowing easier and smoother navigation through blood vessels. This feature is essential for minimizing vascular trauma during procedures and improving patient outcomes. The hydrophilic coating absorbs water, which enhances the lubricity of the guidewire, making it highly preferred in complex interventional procedures.

Hydrophobic Coated Guidewires, which repel water and prevent clumping, and Silicon Coated Guidewires, known for their non-reactive properties, are also integral to the guidewires market. PTFE Coated Guidewires offer another layer of versatility with their excellent biocompatibility and minimal friction characteristics.

The "Others" category in coatings includes emerging innovations such as antimicrobial coatings, which are being developed to reduce the risk of infection during procedures. The development of such specialized coatings reflects the market's adaptation to healthcare needs and regulatory standards, ensuring safety and effectiveness in clinical settings. The diversity in coating technologies supports the dynamic nature of the guidewires market, addressing specific clinical demands and enhancing the procedural success rates across various medical disciplines.

Application Analysis

Cardiovascular Guidewires dominate with 60% due to increasing cardiovascular disease prevalence and procedural volume.

The Application segment is significantly led by Cardiovascular Guidewires, which hold a dominant market share of 60%. The high prevalence of cardiovascular diseases globally, coupled with the increasing number of interventional cardiology procedures such as angioplasties and stent placements, primarily drives this dominance. Cardiovascular guidewires are specifically designed to navigate the unique anatomical challenges of heart and blood vessel procedures, providing the necessary precision and reliability required for successful outcomes.

Other key sub-segments within this category include Peripheral Guidewires, used in treatments involving peripheral blood vessels, and Neurovascular Guidewires, which are essential for interventions in the brain, nerve repair and its vascular structures. Urology Guidewires facilitate procedures within the urinary tract, while Gastroenterology Guidewires are used for gastrointestinal endoscopy in the gastrointestinal tract. Gynecology Guidewires aid in procedures related to the female reproductive system.

Each of these sub-segments contributes to the market's growth by catering to the specific needs of different medical specialties. The ongoing advancements in guidewire technology, combined with the increasing demand for minimally invasive procedures across various medical fields, ensure the sustained growth and expansion of the guidewires market. The development and refinement of application-specific guidewires continue to open new avenues for innovation, addressing the complex and diverse needs of modern medicine.

Key Market Segments

By Material

- Stainless Steel Guidewires

- Nitinol Guidewires

- Hybrid Guidewires

- Others

By Coating

- Hydrophilic Coated Guidewires

- Hydrophobic Coated Guidewires

- Silicon Coated Guidewires

- PTFE Coated Guidewires

- Others

By Application

- Cardiovascular Guidewires

- Peripheral Guidewires

- Urology Guidewires

- Neurovascular Guidewires

- Gastroenterology Guidewires

- Gynecology Guidewires

- Others

Growth Opportunities

Development of Specialized Guidewires Offers Growth Opportunity

The development of specialized guidewires presents a significant growth opportunity within the Guidewires Market. As medical procedures become increasingly complex, the demand for guidewires that can navigate challenging anatomical structures grows. Manufacturers have an excellent opportunity to cater to specific medical fields, such as neurovascular, peripheral vascular, and complex cardiac interventions, by creating guidewires that offer enhanced navigation, visibility, and torque control.

Companies like Terumo Medical Corporation and Boston Scientific Corporation are already leading the way with specialized guidewires for neurovascular applications, providing solutions that enable access to hard-to-reach areas. This specialization not only meets the precise needs of various interventional procedures but also positions these manufacturers at the forefront of innovation in the guidewires market. By continuing to focus on this area, companies can tap into new market segments and drive significant growth.

Adoption of Advanced Materials and Coatings Offers Growth Opportunity

The utilization of advanced materials and coatings in the manufacturing of guidewires marks a pivotal growth area for the industry. Innovations in materials, such as shape memory alloys and hydrophilic coatings, enhance the performance of guidewires by improving their flexibility, reducing friction, and increasing visibility during procedures. These advancements present substantial opportunities for manufacturers to improve the functionality and safety of their products.

For instance, Abbott Vascular’s introduction of guidewires with proprietary polymer jacket coatings is a testament to the potential of advanced coatings in enhancing lubricity and reducing procedural complications. As manufacturers invest in these technologies, they not only enhance their product offerings but also strengthen their competitive edge in the market. This focus on material and coating advancements is crucial for meeting the evolving demands of healthcare providers and patients, thereby driving market expansion.

Trending Factors

Increasing Focus on Patient Safety Are Trending Factors

Enhancing patient safety has become a critical focus within the healthcare industry, influencing significant trends in the Guidewires Market. As safety becomes a paramount concern, there is an increasing demand for guidewires that improve visibility, trackability, and resistance to kinking, thereby reducing the risk of procedural complications.

Leading companies like Medtronic and Boston Scientific are addressing this need by developing guidewires with improved radiopacity and visibility under fluoroscopy. These innovations not only meet the heightened safety requirements but also reassure healthcare providers and patients of the safety and efficacy of interventional procedures. This trend towards prioritizing patient safety is reshaping the guidewires market, encouraging ongoing innovation and adaptation to enhance safety features across product lines.

Adoption of Robotic-Assisted Interventions Are Trending Factors

The integration of robotic technology into interventional procedures represents a transformative trend in the Guidewires Market. Robotic-assisted interventions, known for their precision and stability, require guidewires that are specifically engineered to meet the demands of robotic systems. These guidewires must offer exceptional torque control and maneuverability to complement the robotic technology's capabilities.

Companies like Corindus Vascular Robotics and Stereotaxis are at the forefront of this trend, driving the demand for guidewires that are compatible with robotic-assisted systems. The development of guidewires for robotic applications not only supports the advancement of interventional technologies but also opens up new avenues for market growth and innovation. As robotic-assisted procedures become more prevalent, the demand for specialized guidewires is expected to increase, further fueling market trends and opportunities.

Regional Analysis

North America Dominates with 37.3% Market Share

North America's commanding 37.3% share of the Guidewires Market is driven by a combination of advanced healthcare infrastructure, high prevalence of cardiovascular and other chronic diseases, and substantial investments in medical research and development. The region's focus on minimally invasive procedures, which often utilize guidewires, contributes significantly to this dominance. Additionally, the presence of leading medical device companies in the U.S. and Canada, which continually innovate in guidewire technology, bolsters the market's growth in this region.

The regional dynamics of North America are characterized by an aging population more prone to chronic conditions requiring interventional procedures. This demographic shift fuels the demand for medical innovations, including advanced guidewires. Moreover, the well-established healthcare system and favorable reimbursement policies in the region enhance patient access to advanced medical treatments, further driving the adoption of guidewires.

North America is expected to maintain its leadership in the Guidewires Market due to ongoing technological advancements and the increasing adoption of robotic-assisted surgeries, which rely heavily on high-precision guidewires. The region's robust R&D landscape and strong regulatory support for medical devices also suggest continued growth and innovation, ensuring its prominent position in the global market.

Regional Market Shares:

- Europe: Europe holds the second-largest market share with 29.4%. The region's strong healthcare infrastructure and increasing elderly population contribute to its significant market presence.

- Asia Pacific: Asia Pacific is rapidly growing with a market share of 20.8%, driven by improving healthcare facilities, rising medical tourism, and increasing prevalence of diseases requiring interventional procedures.

- Middle East & Africa: The Middle East & Africa has a smaller, yet growing, market share of 6.2%. The expansion is supported by gradual enhancements in healthcare infrastructure and increased investments in healthcare.

- Latin America: Latin America has a market share of 6.3%. The region shows potential for growth due to rising healthcare expenditure and the gradual adoption of newer medical technologies.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Guidewires Market is characterized by the presence of several major companies, each playing a significant role in shaping market dynamics. Boston Scientific Corporation and Abbott Laboratories are leading the market with their extensive product portfolios and innovative solutions. Medtronic plc and Terumo Corporation hold strong market positions due to their broad distribution networks and advanced technological offerings.

Johnson & Johnson (Cordis) and Teleflex Incorporated are also prominent, leveraging their brand reputation and global reach to influence market trends. Cook Medical and Integer Holdings Corporation contribute through specialized products and focused R&D efforts. Asahi Intecc Co., Ltd. and B. Braun Melsungen AG are noted for their high-quality manufacturing standards and strategic partnerships.

Merit Medical Systems, Inc., and Smiths Medical have significant market shares due to their comprehensive product ranges and customer-focused strategies. AngioDynamics, Inc., and CONMED Corporation are enhancing their market positions through mergers and acquisitions. Stryker Corporation is impactful with its robust R&D investments and strategic market expansions.

These companies collectively drive innovation, set market standards, and foster competitive pricing. Their strategic positioning involves continuous product development, geographical expansion, and enhancing customer relations. Overall, their influence on the Guidewires Market ensures steady growth and the introduction of advanced medical technologies, meeting evolving healthcare needs.

Market Key Players

- Boston Scientific Corporation

- Abbott Laboratories

- Medtronic plc

- Terumo Corporation

- Johnson & Johnson (Cordis)

- Teleflex Incorporated

- Cook Medical

- Integer Holdings Corporation

- Asahi Intecc Co., Ltd.

- B. Braun Melsungen AG

- Merit Medical Systems, Inc.

- Smiths Medical

- AngioDynamics, Inc.

- CONMED Corporation

- Stryker Corporation

Recent Developments

- May 2024: A randomized trial finds paramagnetic seeds effective for breast cancer localization, offering shorter operative times and logistical advantages over guidewires. Results published in JAMA Surgery support their clinical adoption.

- May 2024: Teleflex announces the limited market release of its Wattson Temporary Pacing Guidewire at Columbia University Irving Medical Center for transcatheter aortic valve replacement and balloon aortic valvuloplasty procedures.

- November 2023: Xenter introduces a wireless guidewire for TAVR procedures, gathering real-time data to aid clinical decisions and improve patient outcomes. The device supports AI tools and integrates with hospital EHRs for seamless operation.

Report Scope

Report Features Description Market Value (2023) USD 2.2 Billion Forecast Revenue (2033) USD 3.6 Billion CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Stainless Steel Guidewires, Nitinol Guidewires, Hybrid Guidewires, Others), By Coating (Hydrophilic Coated Guidewires, Hydrophobic Coated Guidewires, Silicon Coated Guidewires, PTFE Coated Guidewires, Others), By Application (Cardiovascular Guidewires, Peripheral Guidewires, Urology Guidewires, Neurovascular Guidewires, Gastroenterology Guidewires, Gynecology Guidewires, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Boston Scientific Corporation, Abbott Laboratories, Medtronic plc, Terumo Corporation, Johnson & Johnson (Cordis), Teleflex Incorporated, Cook Medical, Integer Holdings Corporation, Asahi Intecc Co., Ltd., B. Braun Melsungen AG, Merit Medical Systems, Inc., Smiths Medical, AngioDynamics, Inc., CONMED Corporation, Stryker Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Guidewires Market Overview

- 2.1. Guidewires Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Guidewires Market Dynamics

- 3. Global Guidewires Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Guidewires Market Analysis, 2016-2021

- 3.2. Global Guidewires Market Opportunity and Forecast, 2023-2032

- 3.3. Global Guidewires Market Analysis, Opportunity and Forecast, By Material, 2016-2032

- 3.3.1. Global Guidewires Market Analysis by Material: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material, 2016-2032

- 3.3.3. Stainless Steel Guidewires

- 3.3.4. Nitinol Guidewires

- 3.3.5. Hybrid Guidewires

- 3.3.6. Others

- 3.4. Global Guidewires Market Analysis, Opportunity and Forecast, By Coating, 2016-2032

- 3.4.1. Global Guidewires Market Analysis by Coating: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Coating, 2016-2032

- 3.4.3. Hydrophilic Coated Guidewires

- 3.4.4. Hydrophobic Coated Guidewires

- 3.4.5. Silicon Coated Guidewires

- 3.4.6. PTFE Coated Guidewires

- 3.4.7. Others

- 3.5. Global Guidewires Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 3.5.1. Global Guidewires Market Analysis by Application: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 3.5.3. Cardiovascular Guidewires

- 3.5.4. Peripheral Guidewires

- 3.5.5. Urology Guidewires

- 3.5.6. Neurovascular Guidewires

- 3.5.7. Gastroenterology Guidewires

- 3.5.8. Gynecology Guidewires

- 3.5.9. Others

- 4. North America Guidewires Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Guidewires Market Analysis, 2016-2021

- 4.2. North America Guidewires Market Opportunity and Forecast, 2023-2032

- 4.3. North America Guidewires Market Analysis, Opportunity and Forecast, By Material, 2016-2032

- 4.3.1. North America Guidewires Market Analysis by Material: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material, 2016-2032

- 4.3.3. Stainless Steel Guidewires

- 4.3.4. Nitinol Guidewires

- 4.3.5. Hybrid Guidewires

- 4.3.6. Others

- 4.4. North America Guidewires Market Analysis, Opportunity and Forecast, By Coating, 2016-2032

- 4.4.1. North America Guidewires Market Analysis by Coating: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Coating, 2016-2032

- 4.4.3. Hydrophilic Coated Guidewires

- 4.4.4. Hydrophobic Coated Guidewires

- 4.4.5. Silicon Coated Guidewires

- 4.4.6. PTFE Coated Guidewires

- 4.4.7. Others

- 4.5. North America Guidewires Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 4.5.1. North America Guidewires Market Analysis by Application: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 4.5.3. Cardiovascular Guidewires

- 4.5.4. Peripheral Guidewires

- 4.5.5. Urology Guidewires

- 4.5.6. Neurovascular Guidewires

- 4.5.7. Gastroenterology Guidewires

- 4.5.8. Gynecology Guidewires

- 4.5.9. Others

- 4.6. North America Guidewires Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Guidewires Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Guidewires Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Guidewires Market Analysis, 2016-2021

- 5.2. Western Europe Guidewires Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Guidewires Market Analysis, Opportunity and Forecast, By Material, 2016-2032

- 5.3.1. Western Europe Guidewires Market Analysis by Material: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material, 2016-2032

- 5.3.3. Stainless Steel Guidewires

- 5.3.4. Nitinol Guidewires

- 5.3.5. Hybrid Guidewires

- 5.3.6. Others

- 5.4. Western Europe Guidewires Market Analysis, Opportunity and Forecast, By Coating, 2016-2032

- 5.4.1. Western Europe Guidewires Market Analysis by Coating: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Coating, 2016-2032

- 5.4.3. Hydrophilic Coated Guidewires

- 5.4.4. Hydrophobic Coated Guidewires

- 5.4.5. Silicon Coated Guidewires

- 5.4.6. PTFE Coated Guidewires

- 5.4.7. Others

- 5.5. Western Europe Guidewires Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 5.5.1. Western Europe Guidewires Market Analysis by Application: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 5.5.3. Cardiovascular Guidewires

- 5.5.4. Peripheral Guidewires

- 5.5.5. Urology Guidewires

- 5.5.6. Neurovascular Guidewires

- 5.5.7. Gastroenterology Guidewires

- 5.5.8. Gynecology Guidewires

- 5.5.9. Others

- 5.6. Western Europe Guidewires Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Guidewires Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Guidewires Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Guidewires Market Analysis, 2016-2021

- 6.2. Eastern Europe Guidewires Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Guidewires Market Analysis, Opportunity and Forecast, By Material, 2016-2032

- 6.3.1. Eastern Europe Guidewires Market Analysis by Material: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material, 2016-2032

- 6.3.3. Stainless Steel Guidewires

- 6.3.4. Nitinol Guidewires

- 6.3.5. Hybrid Guidewires

- 6.3.6. Others

- 6.4. Eastern Europe Guidewires Market Analysis, Opportunity and Forecast, By Coating, 2016-2032

- 6.4.1. Eastern Europe Guidewires Market Analysis by Coating: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Coating, 2016-2032

- 6.4.3. Hydrophilic Coated Guidewires

- 6.4.4. Hydrophobic Coated Guidewires

- 6.4.5. Silicon Coated Guidewires

- 6.4.6. PTFE Coated Guidewires

- 6.4.7. Others

- 6.5. Eastern Europe Guidewires Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 6.5.1. Eastern Europe Guidewires Market Analysis by Application: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 6.5.3. Cardiovascular Guidewires

- 6.5.4. Peripheral Guidewires

- 6.5.5. Urology Guidewires

- 6.5.6. Neurovascular Guidewires

- 6.5.7. Gastroenterology Guidewires

- 6.5.8. Gynecology Guidewires

- 6.5.9. Others

- 6.6. Eastern Europe Guidewires Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Guidewires Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Guidewires Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Guidewires Market Analysis, 2016-2021

- 7.2. APAC Guidewires Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Guidewires Market Analysis, Opportunity and Forecast, By Material, 2016-2032

- 7.3.1. APAC Guidewires Market Analysis by Material: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material, 2016-2032

- 7.3.3. Stainless Steel Guidewires

- 7.3.4. Nitinol Guidewires

- 7.3.5. Hybrid Guidewires

- 7.3.6. Others

- 7.4. APAC Guidewires Market Analysis, Opportunity and Forecast, By Coating, 2016-2032

- 7.4.1. APAC Guidewires Market Analysis by Coating: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Coating, 2016-2032

- 7.4.3. Hydrophilic Coated Guidewires

- 7.4.4. Hydrophobic Coated Guidewires

- 7.4.5. Silicon Coated Guidewires

- 7.4.6. PTFE Coated Guidewires

- 7.4.7. Others

- 7.5. APAC Guidewires Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 7.5.1. APAC Guidewires Market Analysis by Application: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 7.5.3. Cardiovascular Guidewires

- 7.5.4. Peripheral Guidewires

- 7.5.5. Urology Guidewires

- 7.5.6. Neurovascular Guidewires

- 7.5.7. Gastroenterology Guidewires

- 7.5.8. Gynecology Guidewires

- 7.5.9. Others

- 7.6. APAC Guidewires Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Guidewires Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Guidewires Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Guidewires Market Analysis, 2016-2021

- 8.2. Latin America Guidewires Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Guidewires Market Analysis, Opportunity and Forecast, By Material, 2016-2032

- 8.3.1. Latin America Guidewires Market Analysis by Material: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material, 2016-2032

- 8.3.3. Stainless Steel Guidewires

- 8.3.4. Nitinol Guidewires

- 8.3.5. Hybrid Guidewires

- 8.3.6. Others

- 8.4. Latin America Guidewires Market Analysis, Opportunity and Forecast, By Coating, 2016-2032

- 8.4.1. Latin America Guidewires Market Analysis by Coating: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Coating, 2016-2032

- 8.4.3. Hydrophilic Coated Guidewires

- 8.4.4. Hydrophobic Coated Guidewires

- 8.4.5. Silicon Coated Guidewires

- 8.4.6. PTFE Coated Guidewires

- 8.4.7. Others

- 8.5. Latin America Guidewires Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 8.5.1. Latin America Guidewires Market Analysis by Application: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 8.5.3. Cardiovascular Guidewires

- 8.5.4. Peripheral Guidewires

- 8.5.5. Urology Guidewires

- 8.5.6. Neurovascular Guidewires

- 8.5.7. Gastroenterology Guidewires

- 8.5.8. Gynecology Guidewires

- 8.5.9. Others

- 8.6. Latin America Guidewires Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Guidewires Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Guidewires Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Guidewires Market Analysis, 2016-2021

- 9.2. Middle East & Africa Guidewires Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Guidewires Market Analysis, Opportunity and Forecast, By Material, 2016-2032

- 9.3.1. Middle East & Africa Guidewires Market Analysis by Material: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material, 2016-2032

- 9.3.3. Stainless Steel Guidewires

- 9.3.4. Nitinol Guidewires

- 9.3.5. Hybrid Guidewires

- 9.3.6. Others

- 9.4. Middle East & Africa Guidewires Market Analysis, Opportunity and Forecast, By Coating, 2016-2032

- 9.4.1. Middle East & Africa Guidewires Market Analysis by Coating: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Coating, 2016-2032

- 9.4.3. Hydrophilic Coated Guidewires

- 9.4.4. Hydrophobic Coated Guidewires

- 9.4.5. Silicon Coated Guidewires

- 9.4.6. PTFE Coated Guidewires

- 9.4.7. Others

- 9.5. Middle East & Africa Guidewires Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 9.5.1. Middle East & Africa Guidewires Market Analysis by Application: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 9.5.3. Cardiovascular Guidewires

- 9.5.4. Peripheral Guidewires

- 9.5.5. Urology Guidewires

- 9.5.6. Neurovascular Guidewires

- 9.5.7. Gastroenterology Guidewires

- 9.5.8. Gynecology Guidewires

- 9.5.9. Others

- 9.6. Middle East & Africa Guidewires Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Guidewires Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Guidewires Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Guidewires Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Guidewires Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Boston Scientific Corporation

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Abbott Laboratories

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Medtronic plc

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Terumo Corporation

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Johnson & Johnson (Cordis)

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Teleflex Incorporated

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Cook Medical

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Integer Holdings Corporation

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Asahi Intecc Co., Ltd.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. B. Braun Melsungen AG

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Merit Medical Systems, Inc.

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. AngioDynamics, Inc.

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. CONMED Corporation

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Stryker Corporation

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Guidewires Market Revenue (US$ Mn) Market Share by Material in 2022

- Figure 2: Global Guidewires Market Attractiveness Analysis by Material, 2016-2032

- Figure 3: Global Guidewires Market Revenue (US$ Mn) Market Share by Coatingin 2022

- Figure 4: Global Guidewires Market Attractiveness Analysis by Coating, 2016-2032

- Figure 5: Global Guidewires Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 6: Global Guidewires Market Attractiveness Analysis by Application, 2016-2032

- Figure 7: Global Guidewires Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Guidewires Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Guidewires Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Guidewires Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Guidewires Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Figure 12: Global Guidewires Market Revenue (US$ Mn) Comparison by Coating (2016-2032)

- Figure 13: Global Guidewires Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 14: Global Guidewires Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Guidewires Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Figure 16: Global Guidewires Market Y-o-Y Growth Rate Comparison by Coating (2016-2032)

- Figure 17: Global Guidewires Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 18: Global Guidewires Market Share Comparison by Region (2016-2032)

- Figure 19: Global Guidewires Market Share Comparison by Material (2016-2032)

- Figure 20: Global Guidewires Market Share Comparison by Coating (2016-2032)

- Figure 21: Global Guidewires Market Share Comparison by Application (2016-2032)

- Figure 22: North America Guidewires Market Revenue (US$ Mn) Market Share by Materialin 2022

- Figure 23: North America Guidewires Market Attractiveness Analysis by Material, 2016-2032

- Figure 24: North America Guidewires Market Revenue (US$ Mn) Market Share by Coatingin 2022

- Figure 25: North America Guidewires Market Attractiveness Analysis by Coating, 2016-2032

- Figure 26: North America Guidewires Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 27: North America Guidewires Market Attractiveness Analysis by Application, 2016-2032

- Figure 28: North America Guidewires Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Guidewires Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Guidewires Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Guidewires Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Figure 33: North America Guidewires Market Revenue (US$ Mn) Comparison by Coating (2016-2032)

- Figure 34: North America Guidewires Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 35: North America Guidewires Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Guidewires Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Figure 37: North America Guidewires Market Y-o-Y Growth Rate Comparison by Coating (2016-2032)

- Figure 38: North America Guidewires Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 39: North America Guidewires Market Share Comparison by Country (2016-2032)

- Figure 40: North America Guidewires Market Share Comparison by Material (2016-2032)

- Figure 41: North America Guidewires Market Share Comparison by Coating (2016-2032)

- Figure 42: North America Guidewires Market Share Comparison by Application (2016-2032)

- Figure 43: Western Europe Guidewires Market Revenue (US$ Mn) Market Share by Materialin 2022

- Figure 44: Western Europe Guidewires Market Attractiveness Analysis by Material, 2016-2032

- Figure 45: Western Europe Guidewires Market Revenue (US$ Mn) Market Share by Coatingin 2022

- Figure 46: Western Europe Guidewires Market Attractiveness Analysis by Coating, 2016-2032

- Figure 47: Western Europe Guidewires Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 48: Western Europe Guidewires Market Attractiveness Analysis by Application, 2016-2032

- Figure 49: Western Europe Guidewires Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Guidewires Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Guidewires Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Guidewires Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Figure 54: Western Europe Guidewires Market Revenue (US$ Mn) Comparison by Coating (2016-2032)

- Figure 55: Western Europe Guidewires Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 56: Western Europe Guidewires Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Guidewires Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Figure 58: Western Europe Guidewires Market Y-o-Y Growth Rate Comparison by Coating (2016-2032)

- Figure 59: Western Europe Guidewires Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 60: Western Europe Guidewires Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Guidewires Market Share Comparison by Material (2016-2032)

- Figure 62: Western Europe Guidewires Market Share Comparison by Coating (2016-2032)

- Figure 63: Western Europe Guidewires Market Share Comparison by Application (2016-2032)

- Figure 64: Eastern Europe Guidewires Market Revenue (US$ Mn) Market Share by Materialin 2022

- Figure 65: Eastern Europe Guidewires Market Attractiveness Analysis by Material, 2016-2032

- Figure 66: Eastern Europe Guidewires Market Revenue (US$ Mn) Market Share by Coatingin 2022

- Figure 67: Eastern Europe Guidewires Market Attractiveness Analysis by Coating, 2016-2032

- Figure 68: Eastern Europe Guidewires Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 69: Eastern Europe Guidewires Market Attractiveness Analysis by Application, 2016-2032

- Figure 70: Eastern Europe Guidewires Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Guidewires Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Guidewires Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Guidewires Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Figure 75: Eastern Europe Guidewires Market Revenue (US$ Mn) Comparison by Coating (2016-2032)

- Figure 76: Eastern Europe Guidewires Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 77: Eastern Europe Guidewires Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Guidewires Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Figure 79: Eastern Europe Guidewires Market Y-o-Y Growth Rate Comparison by Coating (2016-2032)

- Figure 80: Eastern Europe Guidewires Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 81: Eastern Europe Guidewires Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Guidewires Market Share Comparison by Material (2016-2032)

- Figure 83: Eastern Europe Guidewires Market Share Comparison by Coating (2016-2032)

- Figure 84: Eastern Europe Guidewires Market Share Comparison by Application (2016-2032)

- Figure 85: APAC Guidewires Market Revenue (US$ Mn) Market Share by Materialin 2022

- Figure 86: APAC Guidewires Market Attractiveness Analysis by Material, 2016-2032

- Figure 87: APAC Guidewires Market Revenue (US$ Mn) Market Share by Coatingin 2022

- Figure 88: APAC Guidewires Market Attractiveness Analysis by Coating, 2016-2032

- Figure 89: APAC Guidewires Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 90: APAC Guidewires Market Attractiveness Analysis by Application, 2016-2032

- Figure 91: APAC Guidewires Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Guidewires Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Guidewires Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Guidewires Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Figure 96: APAC Guidewires Market Revenue (US$ Mn) Comparison by Coating (2016-2032)

- Figure 97: APAC Guidewires Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 98: APAC Guidewires Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Guidewires Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Figure 100: APAC Guidewires Market Y-o-Y Growth Rate Comparison by Coating (2016-2032)

- Figure 101: APAC Guidewires Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 102: APAC Guidewires Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Guidewires Market Share Comparison by Material (2016-2032)

- Figure 104: APAC Guidewires Market Share Comparison by Coating (2016-2032)

- Figure 105: APAC Guidewires Market Share Comparison by Application (2016-2032)

- Figure 106: Latin America Guidewires Market Revenue (US$ Mn) Market Share by Materialin 2022

- Figure 107: Latin America Guidewires Market Attractiveness Analysis by Material, 2016-2032

- Figure 108: Latin America Guidewires Market Revenue (US$ Mn) Market Share by Coatingin 2022

- Figure 109: Latin America Guidewires Market Attractiveness Analysis by Coating, 2016-2032

- Figure 110: Latin America Guidewires Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 111: Latin America Guidewires Market Attractiveness Analysis by Application, 2016-2032

- Figure 112: Latin America Guidewires Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Guidewires Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Guidewires Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Guidewires Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Figure 117: Latin America Guidewires Market Revenue (US$ Mn) Comparison by Coating (2016-2032)

- Figure 118: Latin America Guidewires Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 119: Latin America Guidewires Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Guidewires Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Figure 121: Latin America Guidewires Market Y-o-Y Growth Rate Comparison by Coating (2016-2032)

- Figure 122: Latin America Guidewires Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 123: Latin America Guidewires Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Guidewires Market Share Comparison by Material (2016-2032)

- Figure 125: Latin America Guidewires Market Share Comparison by Coating (2016-2032)

- Figure 126: Latin America Guidewires Market Share Comparison by Application (2016-2032)

- Figure 127: Middle East & Africa Guidewires Market Revenue (US$ Mn) Market Share by Materialin 2022

- Figure 128: Middle East & Africa Guidewires Market Attractiveness Analysis by Material, 2016-2032

- Figure 129: Middle East & Africa Guidewires Market Revenue (US$ Mn) Market Share by Coatingin 2022

- Figure 130: Middle East & Africa Guidewires Market Attractiveness Analysis by Coating, 2016-2032

- Figure 131: Middle East & Africa Guidewires Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 132: Middle East & Africa Guidewires Market Attractiveness Analysis by Application, 2016-2032

- Figure 133: Middle East & Africa Guidewires Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Guidewires Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Guidewires Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Guidewires Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Figure 138: Middle East & Africa Guidewires Market Revenue (US$ Mn) Comparison by Coating (2016-2032)

- Figure 139: Middle East & Africa Guidewires Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 140: Middle East & Africa Guidewires Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Guidewires Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Figure 142: Middle East & Africa Guidewires Market Y-o-Y Growth Rate Comparison by Coating (2016-2032)

- Figure 143: Middle East & Africa Guidewires Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 144: Middle East & Africa Guidewires Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Guidewires Market Share Comparison by Material (2016-2032)

- Figure 146: Middle East & Africa Guidewires Market Share Comparison by Coating (2016-2032)

- Figure 147: Middle East & Africa Guidewires Market Share Comparison by Application (2016-2032)

- List of Tables

- Table 1: Global Guidewires Market Comparison by Material (2016-2032)

- Table 2: Global Guidewires Market Comparison by Coating (2016-2032)

- Table 3: Global Guidewires Market Comparison by Application (2016-2032)

- Table 4: Global Guidewires Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Guidewires Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Guidewires Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Guidewires Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Table 8: Global Guidewires Market Revenue (US$ Mn) Comparison by Coating (2016-2032)

- Table 9: Global Guidewires Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 10: Global Guidewires Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Guidewires Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Table 12: Global Guidewires Market Y-o-Y Growth Rate Comparison by Coating (2016-2032)

- Table 13: Global Guidewires Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 14: Global Guidewires Market Share Comparison by Region (2016-2032)

- Table 15: Global Guidewires Market Share Comparison by Material (2016-2032)

- Table 16: Global Guidewires Market Share Comparison by Coating (2016-2032)

- Table 17: Global Guidewires Market Share Comparison by Application (2016-2032)

- Table 18: North America Guidewires Market Comparison by Coating (2016-2032)

- Table 19: North America Guidewires Market Comparison by Application (2016-2032)

- Table 20: North America Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Guidewires Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Guidewires Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Table 24: North America Guidewires Market Revenue (US$ Mn) Comparison by Coating (2016-2032)

- Table 25: North America Guidewires Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 26: North America Guidewires Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Guidewires Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Table 28: North America Guidewires Market Y-o-Y Growth Rate Comparison by Coating (2016-2032)

- Table 29: North America Guidewires Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 30: North America Guidewires Market Share Comparison by Country (2016-2032)

- Table 31: North America Guidewires Market Share Comparison by Material (2016-2032)

- Table 32: North America Guidewires Market Share Comparison by Coating (2016-2032)

- Table 33: North America Guidewires Market Share Comparison by Application (2016-2032)

- Table 34: Western Europe Guidewires Market Comparison by Material (2016-2032)

- Table 35: Western Europe Guidewires Market Comparison by Coating (2016-2032)

- Table 36: Western Europe Guidewires Market Comparison by Application (2016-2032)

- Table 37: Western Europe Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Guidewires Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Guidewires Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Table 41: Western Europe Guidewires Market Revenue (US$ Mn) Comparison by Coating (2016-2032)

- Table 42: Western Europe Guidewires Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 43: Western Europe Guidewires Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Guidewires Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Table 45: Western Europe Guidewires Market Y-o-Y Growth Rate Comparison by Coating (2016-2032)

- Table 46: Western Europe Guidewires Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 47: Western Europe Guidewires Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Guidewires Market Share Comparison by Material (2016-2032)

- Table 49: Western Europe Guidewires Market Share Comparison by Coating (2016-2032)

- Table 50: Western Europe Guidewires Market Share Comparison by Application (2016-2032)

- Table 51: Eastern Europe Guidewires Market Comparison by Material (2016-2032)

- Table 52: Eastern Europe Guidewires Market Comparison by Coating (2016-2032)

- Table 53: Eastern Europe Guidewires Market Comparison by Application (2016-2032)

- Table 54: Eastern Europe Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Guidewires Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Guidewires Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Table 58: Eastern Europe Guidewires Market Revenue (US$ Mn) Comparison by Coating (2016-2032)

- Table 59: Eastern Europe Guidewires Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 60: Eastern Europe Guidewires Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Guidewires Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Table 62: Eastern Europe Guidewires Market Y-o-Y Growth Rate Comparison by Coating (2016-2032)

- Table 63: Eastern Europe Guidewires Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 64: Eastern Europe Guidewires Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Guidewires Market Share Comparison by Material (2016-2032)

- Table 66: Eastern Europe Guidewires Market Share Comparison by Coating (2016-2032)

- Table 67: Eastern Europe Guidewires Market Share Comparison by Application (2016-2032)

- Table 68: APAC Guidewires Market Comparison by Material (2016-2032)

- Table 69: APAC Guidewires Market Comparison by Coating (2016-2032)

- Table 70: APAC Guidewires Market Comparison by Application (2016-2032)

- Table 71: APAC Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Guidewires Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Guidewires Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Table 75: APAC Guidewires Market Revenue (US$ Mn) Comparison by Coating (2016-2032)

- Table 76: APAC Guidewires Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 77: APAC Guidewires Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Guidewires Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Table 79: APAC Guidewires Market Y-o-Y Growth Rate Comparison by Coating (2016-2032)

- Table 80: APAC Guidewires Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 81: APAC Guidewires Market Share Comparison by Country (2016-2032)

- Table 82: APAC Guidewires Market Share Comparison by Material (2016-2032)

- Table 83: APAC Guidewires Market Share Comparison by Coating (2016-2032)

- Table 84: APAC Guidewires Market Share Comparison by Application (2016-2032)

- Table 85: Latin America Guidewires Market Comparison by Material (2016-2032)

- Table 86: Latin America Guidewires Market Comparison by Coating (2016-2032)

- Table 87: Latin America Guidewires Market Comparison by Application (2016-2032)

- Table 88: Latin America Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Guidewires Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Guidewires Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Table 92: Latin America Guidewires Market Revenue (US$ Mn) Comparison by Coating (2016-2032)

- Table 93: Latin America Guidewires Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 94: Latin America Guidewires Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Guidewires Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Table 96: Latin America Guidewires Market Y-o-Y Growth Rate Comparison by Coating (2016-2032)

- Table 97: Latin America Guidewires Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 98: Latin America Guidewires Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Guidewires Market Share Comparison by Material (2016-2032)

- Table 100: Latin America Guidewires Market Share Comparison by Coating (2016-2032)

- Table 101: Latin America Guidewires Market Share Comparison by Application (2016-2032)

- Table 102: Middle East & Africa Guidewires Market Comparison by Material (2016-2032)

- Table 103: Middle East & Africa Guidewires Market Comparison by Coating (2016-2032)

- Table 104: Middle East & Africa Guidewires Market Comparison by Application (2016-2032)

- Table 105: Middle East & Africa Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Guidewires Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Guidewires Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Guidewires Market Revenue (US$ Mn) Comparison by Material (2016-2032)

- Table 109: Middle East & Africa Guidewires Market Revenue (US$ Mn) Comparison by Coating (2016-2032)

- Table 110: Middle East & Africa Guidewires Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 111: Middle East & Africa Guidewires Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Guidewires Market Y-o-Y Growth Rate Comparison by Material (2016-2032)

- Table 113: Middle East & Africa Guidewires Market Y-o-Y Growth Rate Comparison by Coating (2016-2032)

- Table 114: Middle East & Africa Guidewires Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 115: Middle East & Africa Guidewires Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Guidewires Market Share Comparison by Material (2016-2032)

- Table 117: Middle East & Africa Guidewires Market Share Comparison by Coating (2016-2032)

- Table 118: Middle East & Africa Guidewires Market Share Comparison by Application (2016-2032)

- 1. Executive Summary

-

- Boston Scientific Corporation

- Abbott Laboratories

- Medtronic plc

- Terumo Corporation

- Johnson & Johnson (Cordis)

- Teleflex Incorporated

- Cook Medical

- Integer Holdings Corporation

- Asahi Intecc Co., Ltd.

- B. Braun Melsungen AG

- Merit Medical Systems, Inc.

- Smiths Medical

- AngioDynamics, Inc.

- CONMED Corporation

- Stryker Corporation