Gravure Printing Inks Market Report By Type of Ink (Solvent-based Gravure Printing Inks, Water-based Gravure Printing Inks, UV-curable Gravure Printing Inks, EB-curable Gravure Printing Inks, Others), By Resin (Nitrocellulose-based inks, Polyamide-based inks, Polyurethane-based inks, Acrylic-based inks, Vinyl-based inks, Others), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46269

-

May 2024

-

325

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

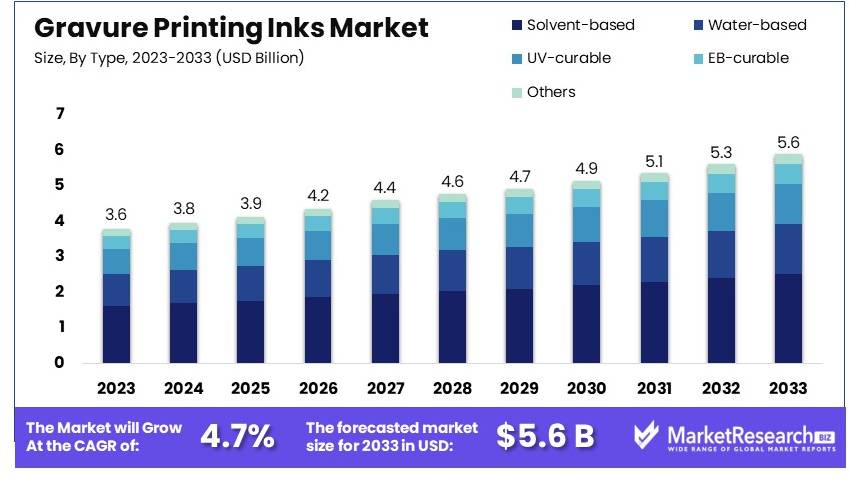

The Global Gravure Printing Inks Market size is expected to be worth around USD 5.6 billion by 2033, from USD 3.6 billion in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

The Gravure Printing Inks Market encompasses a range of specialized inks used in gravure printing, a technique primarily for high-volume printing of packaging, magazines, and catalogues. These inks are valued for their high-quality print clarity and vibrant color output.

As companies increasingly focus on attractive packaging to boost product sales, the demand for these inks rises. This market serves crucial sectors including food and beverage, pharmaceuticals, and consumer goods. Understanding the dynamics of this market is essential for decision-makers aiming to leverage printing for brand enhancement and consumer engagement.

The Gravure Printing Inks Market is poised for growth, driven by robust demand in key regions and sectors. As the world’s largest exporter of packaged goods, China plays a significant role in the market dynamics, accounting for approximately 12% of global packaging exports. This high volume of exports underscores the demand for high-quality gravure inks, essential for creating visually appealing and durable packaging.

Similarly, Germany and the United States are prominent players in the packaging sector, with export shares of around 8% and 6%, respectively. The strength of these markets highlights the widespread reliance on advanced printing technologies, including gravure printing, which is renowned for its ability to produce sharp, fine images and its efficiency in long-run printing operations.

Moreover, the global market for printed materials remains substantial. In 2022 alone, the exports of printed books, brochures, and similar printed matter reached a value of $26.5 billion, indicating a strong consumer and business demand for printed products. This demand directly correlates with the need for specialized printing inks, providing a stable outlet for gravure inks.

These data points suggest a continuing expansion of the Gravure Printing Inks Market. Factors such as technological advancements in printing and the increasing aesthetic standards for packaging will likely fuel further growth.

Key Takeaways

- Market Value: The Gravure Printing Inks Market is projected to grow from USD 3.6 billion in 2023 to approximately USD 5.6 billion by 2033, at a CAGR of 4.7%.

- Type of Ink Analysis: Solvent-based gravure printing inks dominate with 45% due to their fast drying times and superior adhesion, crucial for high-speed printing applications, especially in the packaging industry.

- Resin Analysis: Nitrocellulose-based inks dominate with 40% due to their excellent film-forming properties and fast drying times, making them ideal for high-performance printing applications, particularly in packaging.

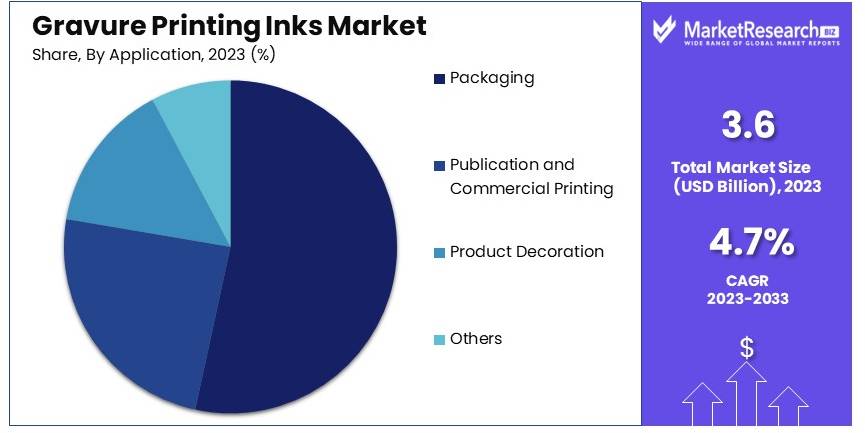

- Application Analysis: Packaging dominates with 55% due to the increasing demand for visually appealing and high-quality packaging materials, driven by e-commerce and urbanization trends.

- Dominant Region: APAC dominates with 40.8% market share, reflecting rapid industrialization and increasing consumer demand for packaged goods.

- High Growth Region: North America holds 25.5%, showing significant growth potential in the gravure printing inks market, driven by technological advancements and environmental regulations.

- Analyst Viewpoint: The market shows steady growth with moderate competition. Future growth is expected to be driven by innovation in eco-friendly inks, expansion in the packaging sector, and increasing demand for high-quality printed materials.

Driving Factors

Increasing Demand from Packaging Industry Drives Market Growth

The increasing demand from the packaging industry significantly drives the growth of the gravure printing inks market. Gravure printing is widely used for printing on flexible packaging materials such as plastics, aluminum foils, and laminates. This sector's expansion is propelled by urbanization, evolving lifestyles, and the rise of e-commerce. For instance, gravure inks are extensively used in food packaging, pharmaceutical packaging, and consumer goods packaging due to their durability and high-quality print results.

Urbanization and changing consumer habits have led to a higher demand for packaged goods. E-commerce has surged, requiring more packaging materials to protect and market products. The global packaging market is projected to grow from USD 917.1 billion in 2021 to USD 1.05 trillion by 2026, at a CAGR of 2.8%. This growth directly boosts the demand for gravure printing inks, as companies seek efficient and high-quality printing solutions for their packaging needs.

Moreover, as packaging requirements become more sophisticated, the preference for gravure printing inks increases due to their ability to produce fine details and vibrant colors. This factor, combined with advancements in packaging materials and technologies, enhances the overall market growth for gravure printing inks.

Growth of Publication and Commercial Printing Drives Market Growth

The growth of publication and commercial printing is a significant driver of the gravure printing inks market. Gravure printing is a preferred method for producing high-quality magazines, catalogs, brochures, and other commercial print materials. The demand for these high-quality prints fuels the market for gravure inks, known for their excellent color reproduction and print quality.

This growth is sustained by the advertising and publishing sectors, which continue to thrive and demand high-quality print products. Gravure inks' ability to produce vivid images and sharp text makes them ideal for these applications, driving their market growth.

Furthermore, the synergy between the need for quality prints and technological advancements in printing presses bolsters the demand for gravure printing inks. High-quality prints remain essential in marketing and advertising, ensuring the continued relevance and expansion of the gravure printing inks market.

Technological Advancements Drive Market Growth

Technological advancements in gravure printing technology are pivotal in driving the growth of the gravure printing inks market. Innovations such as high-speed gravure presses and new ink formulations enhance print quality, production speed, and substrate compatibility. These advancements cater to the growing demand for superior print results and efficient production processes.

For instance, the development of low-migration gravure inks for food packaging addresses safety concerns, opening new market opportunities. This growth is partly attributed to continuous technological improvements that enable better print performance and expanded application areas.

Additionally, these technological strides interact with the packaging industry's evolving needs, reinforcing the demand for advanced gravure inks. The combined impact of technology and industry requirements propels the gravure printing inks market forward, ensuring sustained growth and innovation.

Restraining Factors

Environmental Concerns and Regulations Restrain Market Growth

Environmental concerns and regulations significantly restrain the growth of the gravure printing inks market. Despite advancements in eco-friendly formulations, traditional gravure inks often contain volatile organic compounds (VOCs) and other harmful substances. Strict environmental regulations, such as those implemented by the European Union, limit the use of certain solvents and chemicals in printing inks.

These regulations aim to reduce the negative impact on the environment and human health, but they also increase production costs and complicate the manufacturing process. The global trend toward sustainability further pressures manufacturers to develop safer, compliant products, which can slow market growth. For example, the EU’s Regulation No 1907/2006 (REACH) restricts the use of specific hazardous chemicals, affecting the production and usage of certain gravure inks.

Competition from Other Printing Technologies Restrains Market Growth

Competition from other printing technologies restrains the growth of the gravure printing inks market. Flexography, offset lithography, and digital printing offer various advantages over gravure printing. Flexography is cost-effective and versatile, while digital printing is ideal for short-run and variable data printing. These alternatives can reduce the demand for gravure printing inks, particularly in applications where cost and flexibility are critical.

For example, digital printing’s ability to provide quick turnaround times and minimal setup costs makes it increasingly popular for personalized and small-batch printing. This shift challenges the gravure printing inks market, as businesses may opt for more adaptable and economical solutions. The rise of digital printing, projected to grow at a CAGR of 6.6% from 2021 to 2026, highlights this competitive pressure.

Type of Ink Analysis

Solvent-based gravure printing inks dominate with 45% due to their fast drying times and superior adhesion.

The gravure printing inks market is segmented based on ink type, with solvent-based gravure printing inks dominating the market. Solvent-based inks are widely used due to their fast drying times and superior adhesion to various substrates, making them ideal for high-speed printing applications. They are especially preferred in the packaging industry, where efficiency and print quality are crucial. The global demand for solvent-based gravure inks is driven by their ability to provide vibrant colors and durability, which are essential for attractive and long-lasting packaging.

Water-based gravure printing inks are gaining popularity due to their environmental benefits. They emit fewer volatile organic compounds (VOCs) compared to solvent-based inks, aligning with increasing environmental regulations and sustainability goals. Although they currently hold a smaller market share, the demand for water-based inks is expected to grow as manufacturers seek eco-friendly alternatives. The market for UV-curable gravure printing inks is also expanding, driven by their quick curing times and high-quality finishes.

These inks are particularly used in applications requiring superior durability and chemical resistance. EB-curable gravure printing inks, while niche, offer benefits such as low energy consumption and minimal environmental impact, making them suitable for specialized applications. Other types of gravure inks, including hybrid formulations, cater to specific printing needs and continue to evolve with technological advancements.

Resin Analysis

Nitrocellulose-based inks dominate with 40% due to their excellent film-forming properties and fast drying times.

The resin segment in the gravure printing inks market is dominated by nitrocellulose-based inks. Nitrocellulose resins are favored for their excellent film-forming properties, fast drying times, and compatibility with various pigments and additives. These characteristics make nitrocellulose-based inks highly suitable for high-speed printing processes and applications requiring robust print quality and durability. This dominance is particularly evident in the packaging industry, where the demand for high-performance inks is critical for product differentiation and protection.

Polyamide-based inks are also significant in the market, known for their strong adhesion properties and resistance to oils and solvents. They are commonly used in applications where chemical resistance and flexibility are essential. Polyurethane-based inks offer excellent elasticity and adhesion, making them suitable for printing on flexible packaging materials. Acrylic-based inks provide good weather resistance and color retention, often used in outdoor applications and product decoration. Vinyl-based inks, while less common, are valued for their durability and resistance to environmental factors, suitable for specific niche applications. Other resin types, including hybrid formulations, continue to develop to meet the evolving demands of various printing applications.

Application Analysis

Packaging dominates with 55% due to the growing demand for high-quality, visually appealing packaging materials.

The application segment of the gravure printing inks market is led by the packaging industry. Packaging is the largest application area for gravure printing inks due to the growing demand for high-quality, visually appealing packaging materials. The rise in e-commerce, urbanization, and changing consumer preferences for packaged goods drive this demand. Gravure printing inks are widely used for printing on flexible packaging materials like plastics, foils, and laminates, providing vibrant colors and durable prints. The global packaging market's growth, projected to reach USD 1.05 trillion by 2026, underscores the significant role of gravure printing inks in this sector.

Publication and commercial printing is another important segment, utilizing gravure inks for producing high-quality magazines, catalogs, and brochures. Despite the digital shift, the demand for high-quality printed materials remains steady in certain niches, supporting the market for gravure inks. Product decoration, including labels and decorative prints, also uses gravure inks for their ability to produce fine details and vibrant colors. Other applications, although smaller in market share, cater to specific printing needs and continue to contribute to the overall growth of the gravure printing inks market.

Key Market Segments

By Type of Ink

- Solvent-based Gravure Printing Inks

- Water-based Gravure Printing Inks

- UV-curable Gravure Printing Inks

- EB-curable Gravure Printing Inks

- Others

By Resin

- Nitrocellulose-based inks

- Polyamide-based inks

- Polyurethane-based inks

- Acrylic-based inks

- Vinyl-based inks

- Others

By Application

- Packaging

- Publication and Commercial Printing

- Product Decoration

- Others

Growth Opportunities

Development of Inks for New Substrates Offers Growth Opportunity

The development of inks for new substrates presents a significant growth opportunity in the gravure printing inks market. As gravure printing extends beyond traditional packaging materials, manufacturers can create specialized inks for innovative applications.

For example, the rising demand for printed electronics and the use of gravure printing for conductive inks on flexible substrates opens new markets. These inks must adhere well and meet specific performance needs, such as conductivity and flexibility. By developing inks tailored to these new substrates, manufacturers can tap into expanding industries and drive growth.

Expansion into Emerging Applications Offers Growth Opportunity

Expansion into emerging applications provides significant growth potential for the gravure printing inks market. Gravure inks can find new uses beyond traditional packaging and publishing. One promising area is decorative laminates for furniture and interior design. Inks designed for these applications must resist scratches, stains, and fading.

This includes printing on laminate flooring or countertops, where durability and color fastness are crucial. By developing inks that meet these unique requirements, manufacturers can unlock new growth avenues and increase market share.

Trending Factors

Sustainability and Eco-Friendly Inks Are Trending Factors

Sustainability and eco-friendly inks are trending factors in the gravure printing inks market. Driven by regulations and consumer demand, manufacturers are developing environmentally friendly formulations. These include water-based, vegetable oil-based, or bio-based inks, which minimize harmful substances like VOCs and heavy metals.

Compliance with strict regulations, such as the Swiss Ordinance on Materials and Articles in Contact with Food, is increasingly essential. Sustainable packaging is a significant market driver. By offering eco-friendly inks, manufacturers cater to this trend and enhance their market position.

Digital Integration and Industry 4.0 Are Trending Factors

Digital integration and Industry 4.0 are prominent trending factors in the gravure printing inks market. The adoption of digital technologies and automation principles improves efficiency and reduces waste. Intelligent ink management systems, automated dispensing and mixing, and digital color management tools are transforming the industry.

These technologies ensure accurate and consistent color application, enhance productivity, and minimize setup times. The integration of Industry 4.0 is expected to grow, with the global smart manufacturing market projected to reach USD 506.33 billion by 2027. By embracing these innovations, gravure ink manufacturers can stay competitive and meet the evolving needs of the printing industry.

Regional Analysis

APAC Dominates with 40.8% Market Share

The Asia-Pacific (APAC) region leads the gravure printing inks market with a 40.8% share. This dominance is driven by the robust packaging industry, significant population growth, and rising consumer goods demand. Major countries like China, India, and Japan are central to this growth. China, the world's largest packaging market, significantly boosts regional demand. Additionally, rapid industrialization and urbanization fuel the need for high-quality packaging, further propelling the market.

Regional characteristics such as cost-effective manufacturing, abundant raw materials, and advanced printing technology adoption enhance APAC’s market performance. The region's large consumer base and expanding middle class increase the demand for packaged goods, supporting the growth of gravure printing inks. Furthermore, investments in infrastructure and technology advancements in countries like India and China strengthen market dynamics.

North America: 25.5% Market Share

North America holds a 25.5% share of the gravure printing inks market. The region benefits from a well-established printing industry and high demand for packaging. The U.S. and Canada lead the market, driven by advancements in printing technology and sustainability efforts. The North American market is projected to grow at a CAGR of 3.1% from 2021 to 2026, supported by increasing demand for eco-friendly inks.

Europe: 22.3% Market Share

Europe accounts for 22.3% of the gravure printing inks market. The region's stringent environmental regulations and strong focus on sustainability drive the demand for eco-friendly inks. Germany, France, and the UK are key markets, benefiting from advanced printing technologies and high-quality standards. The European market is expected to grow at a CAGR of 2.8% from 2021 to 2026, driven by innovations in sustainable packaging solutions.

Middle East & Africa: 6.8% Market Share

The Middle East & Africa (MEA) region holds a 6.8% share of the gravure printing inks market. Growth is driven by expanding packaging industries in countries like Saudi Arabia and South Africa. The region's market is supported by rising investments in infrastructure and increasing demand for consumer goods. The MEA market is projected to grow at a CAGR of 3.5% from 2021 to 2026, with a focus on developing sustainable packaging solutions.

Latin America: 4.6% Market Share

Latin America accounts for 4.6% of the gravure printing inks market. Brazil and Mexico are the leading countries, driven by the growing packaging industry and rising consumer demand. Economic development and increasing investments in printing technologies support market growth. The Latin American market is expected to grow at a CAGR of 3.2% from 2021 to 2026, bolstered by advancements in packaging and printing technologies.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Gravure Printing Inks Market, the role of key players is pivotal in shaping market dynamics and trends. These companies are instrumental in driving innovations, setting industry standards, and maintaining supply chain robustness, which are crucial for meeting the diverse demands of the packaging, publishing, and commercial printing sectors.

The companies listed typically exhibit strong market presence and influence through extensive product portfolios and strategic global distribution networks. They focus on sustainability and technological advancements, such as developing eco-friendly inks and enhancing print quality and efficiency. This not only aligns with global environmental regulations but also meets the increasing consumer demands for sustainable products.

Their strategic positioning often involves significant investment in R&D to innovate and adapt to the rapidly changing technology landscape in the printing industry. Additionally, these key players frequently engage in mergers, acquisitions, and collaborations to expand their market reach and capabilities, thus ensuring they remain competitive and relevant in a global context.

The market influence of these companies extends beyond just product offerings; they also play a critical role in shaping industry standards by participating in regulatory discussions and leading industry consortia. Their leadership positions enable them to influence market trends and drive the development of new technologies that can open up new market segments and opportunities.

Overall, these key players in the Gravure Printing Inks Market are not just influential in terms of market share but also in defining the trajectory of the industry through innovation, strategic market actions, and thought leadership.

Market Key Players

- DIC Corporation

- Flint Group

- Toyo Ink SC Holdings Co., Ltd.

- Siegwerk Druckfarben AG & Co. KGaA

- Sakata INX Corporation

- Huber Group

- Sun Chemical Corporation

- ALTANA AG

- Zeller+Gmelin GmbH & Co. KG

- T&K Toka Co., Ltd.

- Tokyo Printing Ink Mfg Co., Ltd.

- Royal Dutch Printing Ink Factories Van Son

- Wikoff Color Corporation

- Fujifilm Sericol India Pvt. Ltd.

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

Recent Developments

- In July 2023, Tokan Kogyo Co., Ltd., a consolidated subsidiary of Toyo Seikan Group Holdings Ltd., will replace all ink used for the gravure printing of paper cups produced in Japan with biomass ink, which partially uses renewable plant-based materials, with the aim of reducing environmental impact.

- As a result of the switch to biomass ink, CO2 emissions will be reduced by approximately 10% (approximately 40 ton-CO2 per year) from conventional ink, and the use of oil and other exhaustible resources will be reduced by approximately 6.5 tons per year.

Report Scope

Report Features Description Market Value (2023) USD 3.6 Billion Forecast Revenue (2033) USD 5.6 Billion CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Ink (Solvent-based Gravure Printing Inks, Water-based Gravure Printing Inks, UV-curable Gravure Printing Inks, EB-curable Gravure Printing Inks, Others), By Resin (Nitrocellulose-based inks, Polyamide-based inks, Polyurethane-based inks, Acrylic-based inks, Vinyl-based inks, Others), By Application (Packaging, Publication and Commercial Printing, Product Decoration, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape DIC Corporation, Flint Group, Toyo Ink SC Holdings Co., Ltd., Siegwerk Druckfarben AG & Co. KGaA, Sakata INX Corporation, Huber Group, Sun Chemical Corporation, ALTANA AG, Zeller+Gmelin GmbH & Co. KG, T&K Toka Co., Ltd., Tokyo Printing Ink Mfg Co., Ltd., Royal Dutch Printing Ink Factories Van Son, Wikoff Color Corporation, Fujifilm Sericol India Pvt. Ltd., Dainichiseika Color & Chemicals Mfg. Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- DIC Corporation

- Flint Group

- Toyo Ink SC Holdings Co., Ltd.

- Siegwerk Druckfarben AG & Co. KGaA

- Sakata INX Corporation

- Huber Group

- Sun Chemical Corporation

- ALTANA AG

- Zeller+Gmelin GmbH & Co. KG

- T&K Toka Co., Ltd.

- Tokyo Printing Ink Mfg Co., Ltd.

- Royal Dutch Printing Ink Factories Van Son

- Wikoff Color Corporation

- Fujifilm Sericol India Pvt. Ltd.

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.