Goat Milk Powder Market By Type (Skimmed Milk Powder and Full Cream Milk Powder), By Distribution Channel (Hypermarkets & Supermarket, Convenience Stores, Specialty Stores, Medical & Pharmacy Stores, and Online Sales), By End-User (Adult, Elderly, Teenager, and Infant)- Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

-

40252

-

July 2023

-

136

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

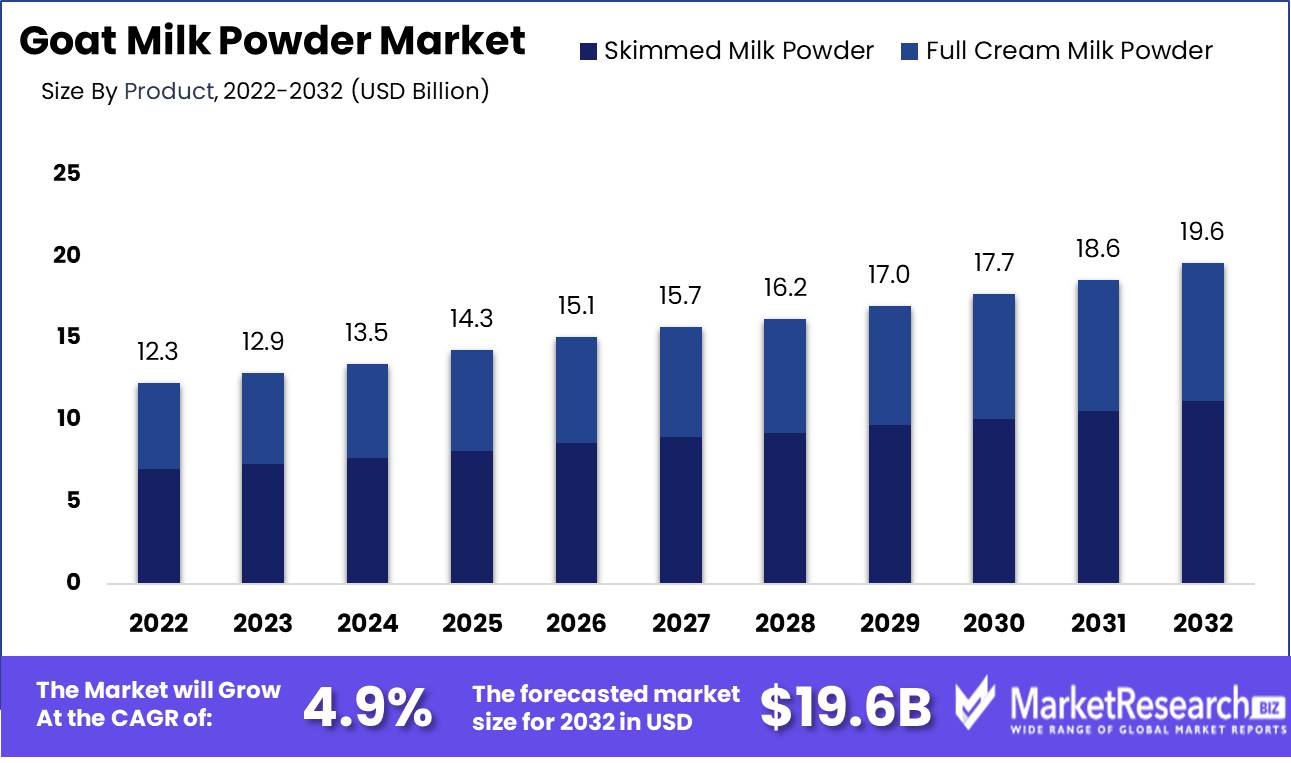

Goat Milk Powder Market size is expected to be worth around USD 19.6 Bn by 2032 from USD 12.3 Bn in 2022, growing at a CAGR of 4.9% during the forecast period from 2023 to 2032.

Goat milk is one of the most widely consumed dairy products worldwide. Goat milk is consumed by approximately 3/4 of the world's population on a daily basis. This is partly because goats are more comfortable to keep than cows in changing economies, where goat milk is an important source of protein, calories, and fat. People in several countries say they prefer goat milk to cow milk. Goat milk is thicker and creamier than cow or plant milk, and it contains more nutrients that may benefit one's health.

Goat milk powder is made after whole cream goat milk is evaporated and spray-dried. After skimming all of the goat milk's cream, it is dried. Baby food, cheese and yogurt, sports diets, chocolate dishes, and elderly diets all use skimmed goat milk powder and full cream. The demand for goat milk powder is rising as a result of its longer shelf life and improved transportation efficiency over liquid milk. Since powdered milk contains very little moisture, it does not require refrigeration and has a much longer shelf life than liquid milk.

Driving factors

Lactose Intolerance and Allergies

Goat milk is often considered a suitable alternative for individuals who are lactose intolerant or have cow's milk allergies. Goat milk contains lower levels of lactose and a different protein structure compared to cow's milk, making it more easily digestible for those with sensitivities or allergies. The growing prevalence of lactose intolerance and milk allergies has fueled the demand for goat milk powder.

The Ease of Use and Substantial Discounts Offered by Online

Several websites are making it simple to buy products online as the internet grows. As a time-saving and cost-effective method of purchasing goods, the e-retailing of various goods, including goat milk products, is growing in popularity. Retailers, many people now prefer to shop online. There are numerous opportunities for vendors who use e-commerce as a business platform to increase their profits.

Due to its nutritional benefits, infants are increasingly consuming goat milk powder. Although goat milk powder is not an alternative to breast milk, its protein makes it the closest thing to human breast milk. Goat milk contains A2 casein, which aids in infant milk digestion and is also found in human breast milk. It is also a good alternative to cow milk because it contains A1 casein, which is allergic to infants and can cause diarrhea and abdominal cramping in those who consume it. Additionally, goat milk powder's relatively smaller fat globule diameter facilitates easier absorption.

Restraining Factors

The high labor costs are primarily responsible for the lower productivity of goat milk.

Goat milk powder is a specialty product made from goat milk that costs about twice as much as cow milk. Goat milk production is lower than other dairy milk types due to the difficulty of large-scale manufacturing. Goat milk's higher price is because it costs more to make. Fewer farmers produce goat milk than cow milk, despite dairy goats being more profitable and easier to feed than dairy cows. Consequently, a large number of dairy goats would be required to mass produce goat milk, increasing labor costs associated with goat farming. The costs of collecting small quantities of milk and conducting quality assurance tests are the most significant obstacles for goat milk production, which impedes goat milk powder market expansion.

Product Type Analysis

Health-Conscious and Embrace Products with Better Nutritional Benefits and Lower Fat Content Increase Demand for Skimmed Milk

The most widely used kind of goat milk powder is skimmed milk powder. During the forecast period, skimmed milk powder is expected to generate the highest revenue. Due to changing eating habits, obesity & high cholesterol levels are becoming more common worldwide. Skimmed goat milk powder has seen an increase in demand in recent years as customers become more health-conscious and embrace products with better nutritional benefits and lower fat content.

Due to its increased use in infant formula and low shipping and warehousing costs, the full cream goat milk powder market is likely to expand at the fastest rate. However, due to the widespread use of nutritional formulas for infants, whole cream goat milk powder is expected to grow at the highest CAGR over the forecast period.

Distribution Channel Analysis

Supermarkets & Hypermarkets Segment is Expected to See a Significant Growth.

Over the forecast period, the supermarkets & hypermarkets segment is expected to see a significant CAGR and hold the highest revenue share. Customers are more comfortable choosing their products in person, especially when it comes to grocery and dairy products. Another factor anticipated to fuel the expansion of this sales channel is the availability of a wide range of products in a single location.

The stores' 24-hour operation to customers is one of the leading factors in the retail sale of goat milk. Leading suppliers of goat milk products are taking advantage of this opportunity to advertise and sell their products through the online distribution channel in addition to the high rate of digitization and technology adoption across regions.

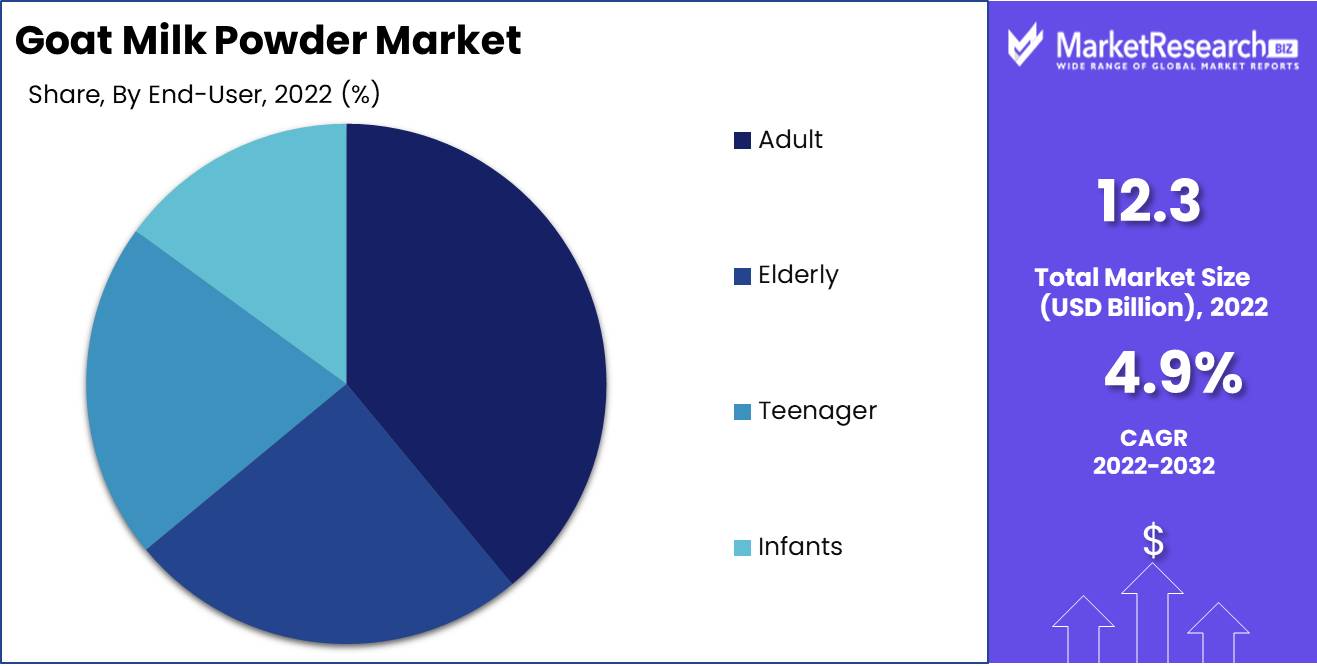

End-User Analysis

The goat milk powder market's largest contributor is the adult segment, which is expected to expand over the forecast period. Dairy products like goat milk are very popular. Compared to cows, goats can be kept easily in underdeveloped countries, where goat milk is a valuable source of protein supplements, calories, and lipids. Goat milk accounts for 60% to 70% of all dairy consumed worldwide. Goat milk is preferred by many people in many countries to cow milk. Additionally, goat milk is a good source of vitamin A, which can help adults reduce their risk of cataracts and some types of cancer.

Due to its high calcium and fatty acid content, goat milk powder aids infant digestion. Additionally, it is low in cholesterol. When infants are given goat milk powder, problems with the gastrointestinal tract, such as constipation, diarrhea, vomiting, colic, and respiratory abnormalities, are all eliminated. Infants with gastrointestinal or respiratory complaints can tolerate pasteurized goat milk. When compared to cow's milk, fermented milk produces a soft curd that facilitates digestion and absorption.

Goat milk consumption increases serum vitamin, mineral, and hemoglobin levels, body weight gain, and mineralization of the skeleton. Additionally, because it lacks the micronutrients (such as iron and vitamin D) that young children may require during their rapid growth and development, whole cow milk powder may not be the best option. As a result, drinks made from fortified milk have been developed to add to children's diets over the course of a year.

Key Market Segments

Based on Product

- Skimmed Milk Powder

- Full Cream Milk Powder

Based on Distribution Channel

- Hypermarkets & Supermarket

- Convenience Store

- Specialty Stores

- Medical & Pharmacy Store

- Online Sales

Based on End-User

- Adult

- Elderly

- Teenager

- Infants

Growth Opportunity

Surge in the usage of goat milk powder in other industries

Goat milk powder is a component in cream, bath soap, lotions, shampoos, conditioners, and other cosmetics. Because goat milk powder has a high capacity to hydrate, it is an ideal raw material for moisturizing lotions and creams. Additionally, dairy manufacturing businesses produce their final products using goat milk powder. Cheese, yogurt, ice cream, candies, and sweets are all made with goat milk powder. Goat milk powder is an important raw material for making cakes, pies, pastries, chocolate cookies, and other desserts from goat milk. The use of goat milk powder also helps the pharmaceutical industry's continued success.

Latest Trends

The Trend Toward Healthy Lifestyle

Goat milk powder's expansion is fueled by consumers' growing health awareness and the trend toward healthy lifestyle choices. People are substituting goat milk for cow milk as they shift toward healthier eating habits. The consumption of dietary supplements made from goat milk powder has also increased due to this shift in consumer preference.

Regional Analysis

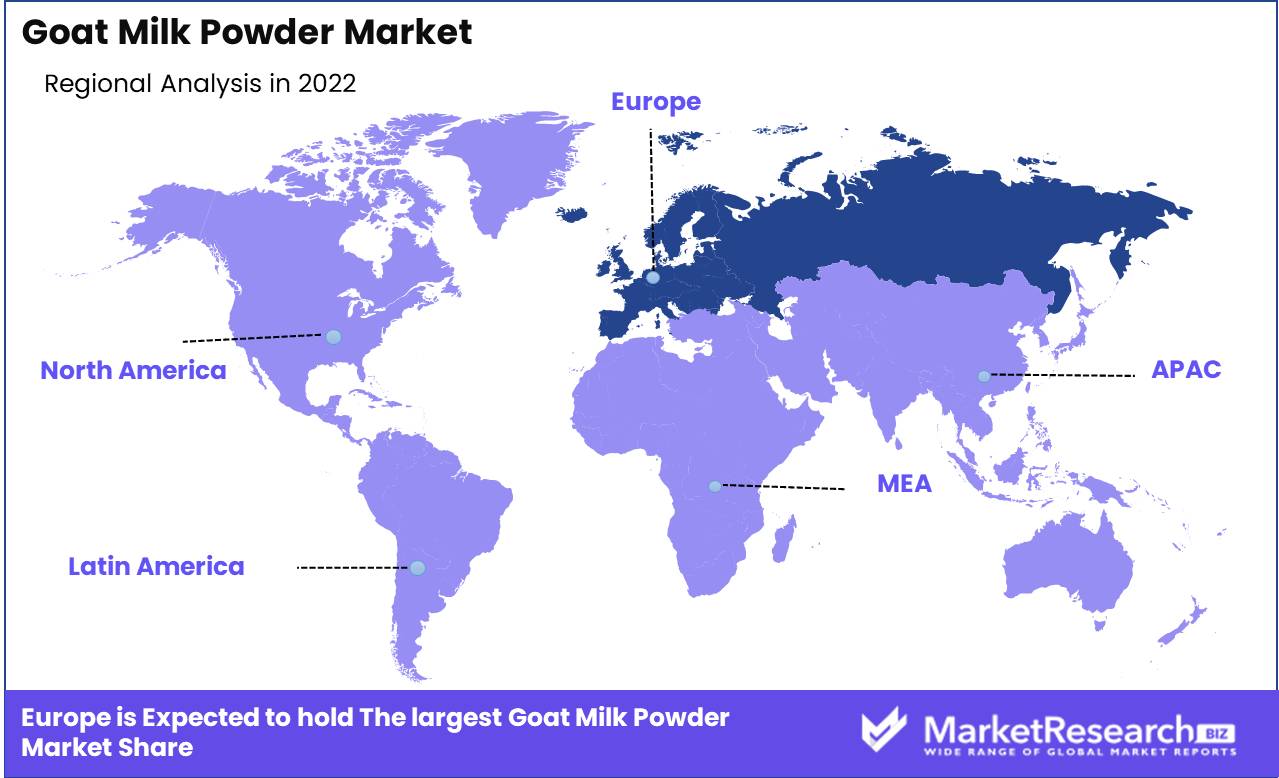

APAC dominated the global market for goat milk powder in 2022 with a 48% share, followed by Europe with a 23% share. APAC is still anticipated to surpass other regions in terms of income from goat milk powder by 2027, making it the largest goat milk powder market in the world. In 2022, China will account for over half of the APAC market's revenue. Due to the rising demand for infant formula made with goat milk in the country, it is also anticipated to expand rapidly over the forecast period. Goat cheese, in particular, is in high demand in Western Europe, a well-established market.

The primary drivers of goat milk consumption in North America are the rapidly changing consumer preference for healthier alternatives, a government education campaign, an increasing number of lactose-intolerant individuals, and a well-developed retail environment that encourages new product introductions.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Key Vendors in the global goat milk powder market compete for customers based on product quality, new product development, and competitive pricing. Consequently, customer preferences and choices change over time in response to regional, economic, demographic, and marketing competition factors as well as social trends. Future market expansion primarily depends on adapting, gauging, and anticipating rapidly evolving goat milk powder market trends and the timely introduction of new products. In an effort to gain a larger market share, several players are expanding their global presence, particularly in the APAC region's rapidly developing nations.

Top Key Players in Goat Milk Powder Market

- Emmi Group

- Ausnutria Dairy Corporation Ltd.

- Goat Partners International Inc

- Granarolo Group

- Goat Partners International, Inc

- Xi'an Baiyue Goat Dairy Group Co.Ltd

- AVH Dairy Trade B.V.

- Bubs Organic

- Goat Milk Stuff

- Other Key Players

Recent Development

- The first company to process goat milk and its derivatives, such as Aadvik Foods' 100% Natural Goat Milk Powder, was founded in March 2022.

- A company headquartered in Rajkot introduced goat-milk-based lassi and shrikhand in March 2021. The players in the goat milk powder market are trying out goat milk derivatives to take the place of other animal-based products.

Report Scope:

Report Features Description Market Value (2022) USD 12.3 Bn Forecast Revenue (2032) USD 19.6 Bn CAGR (2023-2032) 4.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product- Skimmed Milk Powder, Full Creamed Milk Powder; By Distribution Channel- Hypermarkets & Supermarket, Convenience Store, Specialty Stores, Medical & Pharmacy Store, and Online Sales. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Emmi Group, Ausnutria Dairy Corporation Ltd., Goat Partners International Inc, Granarolo Group, Goat Partners International, Inc, Xi'an Baiyue Goat Dairy Group Co.Ltd, AVH Dairy Trade B.V., Bubs Organic, Goat Milk Stuff, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Emmi Group

- Ausnutria Dairy Corporation Ltd.

- Goat Partners International Inc

- Granarolo Group

- Goat Partners International, Inc

- Xi'an Baiyue Goat Dairy Group Co.Ltd

- AVH Dairy Trade B.V.

- Bubs Organic

- Goat Milk Stuff

- Other Key Players