Global Glucagon Market By Route of Administration(Injectable, Inhalation), By Application(Hypoglycemia, Diagnostic Aid), By Distribution Channel(Hospital Pharmacies, Drug Stores & Retail Pharmacies, Online Pharmacies), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

45629

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

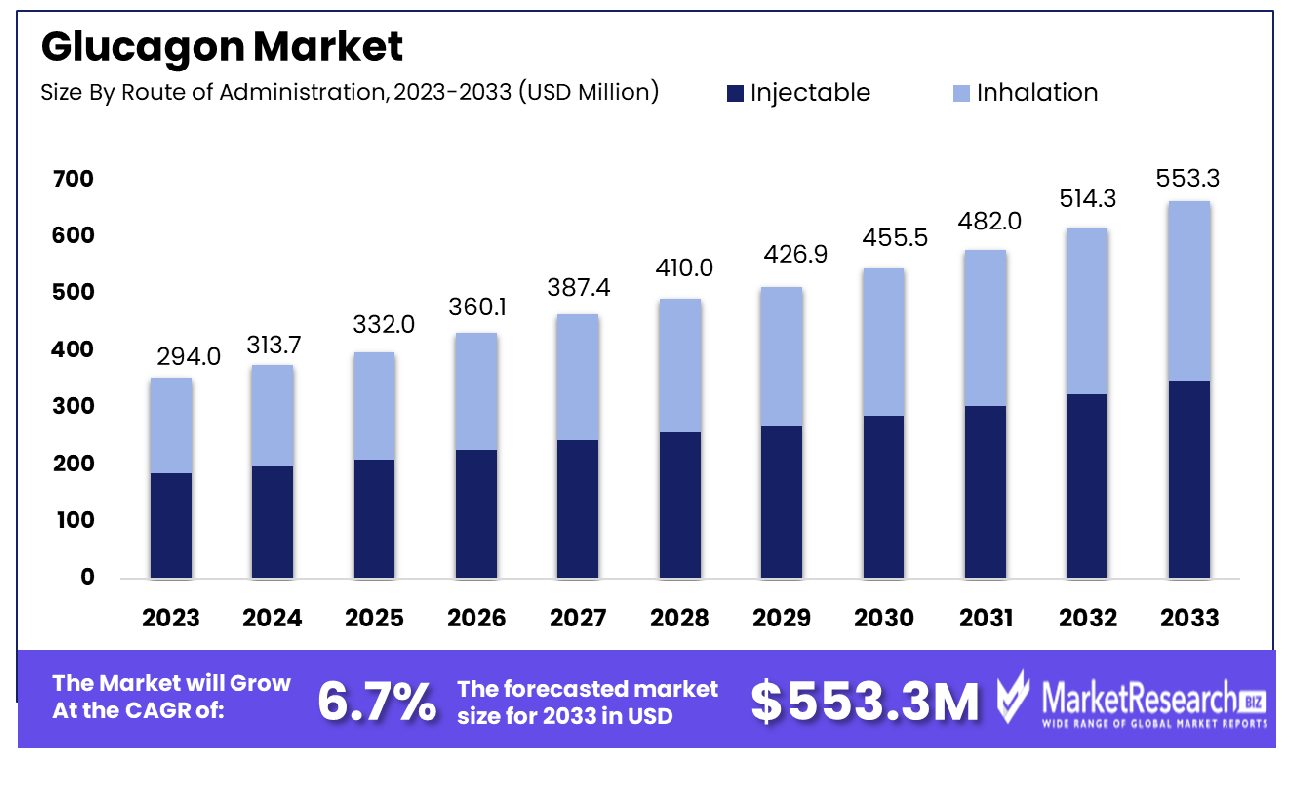

The Global Glucagon Market was valued at USD 294.0 million in 2023. It is expected to reach USD 553.3 million by 2033, with a CAGR of 6.7% during the forecast period from 2024 to 2033.

The Glucagon Market pertains to the segment within the pharmaceutical industry focused on the production, distribution, and utilization of glucagon-based products. Glucagon, a hormone crucial in regulating blood sugar levels, finds application primarily in emergency medical situations such as severe hypoglycemia and diabetic emergencies.

Market analysis of the Glucagon Market encompasses factors like technological advancements, regulatory frameworks, competitive landscape, and emerging therapeutic indications. As demand for diabetic care continues to surge globally, propelled by the rising prevalence of diabetes and increasing awareness about advanced treatment options, the Glucagon Market presents substantial growth opportunities for stakeholders across the pharmaceutical value chain.

The glucagon market, a vital component within the realm of diabetes management, has undergone nuanced shifts reflective of evolving patient demographics and treatment paradigms. Amidst this landscape, our analysis reveals intriguing trends underscoring both challenges and opportunities within the market.

Over the period from 2013 to 2017, our data elucidates a notable divergence in quarterly glucagon prescription rates among distinct patient cohorts. While the overall quarterly rates of glucagon prescriptions among U.S. adults with diabetes and kidney failure undergoing replacement therapy exhibited a modest decline from 1.73% to 1.46%, this trend masks distinct patterns within type 1 and type 2 diabetes populations.

Remarkably, despite stability among type 1 diabetes patients, rates decreased significantly among type 2 diabetes patients, signaling a nuanced response to therapeutic interventions or shifts in treatment guidelines.

Furthermore, the ascendancy of novel therapeutic agents, exemplified by the meteoric rise of Ozempic (semaglutide), underscores a pivotal inflection point within the glucagon market. The unprecedented surge in Ozempic users, catapulting it to the forefront as the most frequently utilized GLP-1 agonist, reflects both shifting treatment preferences and the compelling efficacy profile of newer entrants.

These insights illuminate a dynamic landscape within the glucagon market, punctuated by evolving therapeutic paradigms and shifting patient preferences. Amidst these developments, stakeholders must navigate this intricate terrain with agility, leveraging data-driven strategies to capitalize on emerging opportunities and mitigate potential challenges.

Key Takeaways

- Market Growth: The Global Glucagon Market was valued at USD 294.0 million in 2023. It is expected to reach USD 553.3 million by 2033, with a CAGR of 6.7% during the forecast period from 2024 to 2033.

- By Route of Administration: The injectable route dominates the glucagon market with a commanding 60% share.

- By Application Analysis: Hypoglycemia application holds a significant market share, commanding 45% dominance.

- By Distribution Channel: Drug stores & retail pharmacies lead in distribution, dominating with a 60% share.

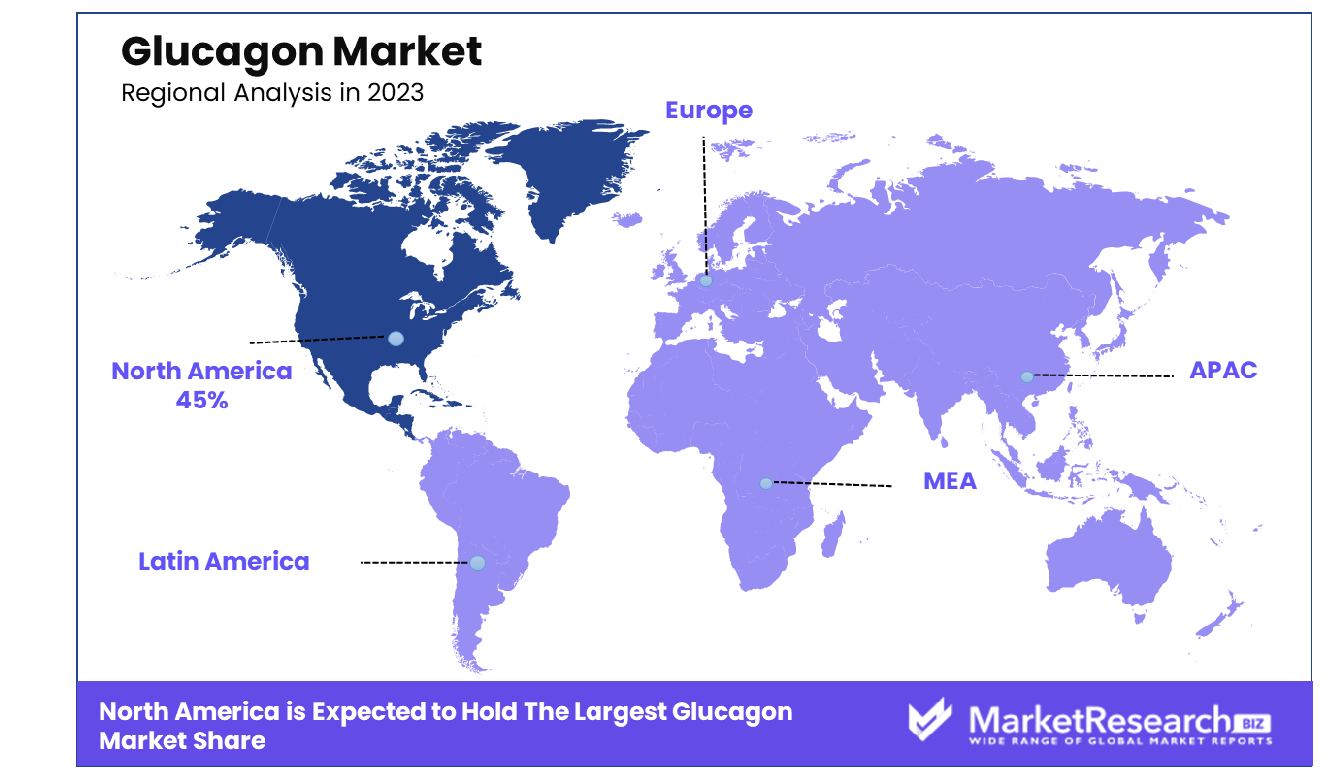

- Regional Dominance: In North America, the Glucagon market commands a significant 45% share.

- Growth Opportunity: In 2023, the global Glucagon Market experienced growth driven by innovative formulations for easier administration and the expansion of healthcare infrastructure in emerging markets.

Driving factors

Advancements in Glucagon Delivery Methods Driving Market Expansion

The glucagon market is experiencing significant growth propelled by advancements in delivery methods, notably the emergence of nasal sprays. Nasal sprays offer a non-invasive, user-friendly alternative to traditional injection methods, addressing patient preferences for painless administration and convenience. As a result, the adoption of nasal sprays is escalating, driving market expansion.

According to recent statistics, the global nasal delivery devices market, which encompasses nasal sprays, is projected to witness a compound annual growth rate (CAGR) of over 6% during the forecast period. This growth is attributed to the increasing prevalence of diabetes and hypoglycemia, coupled with rising demand for efficient and user-friendly glucagon delivery solutions.

Strategic Alliances and R&D Investments Fueling Market Growth

Key players in the glucagon market are actively engaging in strategic alliances and ramping up research and development (R&D) investments to capitalize on emerging opportunities. Collaborations between pharmaceutical companies and technology firms are facilitating the development of innovative glucagon delivery systems and enhancing product portfolios.

These strategic initiatives are underpinned by substantial investments in R&D aimed at advancing drug formulations, optimizing delivery mechanisms, and improving therapeutic outcomes. Notably, recent market analysis indicates a surge in R&D spending by major industry players, with a notable portion allocated to glucagon-related research.

Favorable Regulatory Frameworks and Reimbursement Policies Stimulating Market Expansion

Favorable regulatory frameworks and reimbursement policies are playing a pivotal role in stimulating market expansion for glucagon products. Regulatory agencies are streamlining approval processes for novel glucagon formulations and delivery devices, expediting market entry and commercialization.

Moreover, robust reimbursement policies are enhancing patient access to glucagon therapies, driving adoption rates and market penetration. The implementation of reimbursement schemes and insurance coverage for glucagon products is alleviating financial barriers for patients, thereby fostering market growth.

Restraining Factors

Ignorance Hinders Glucagon Market Growth

The glucagon market faces significant challenges due to a lack of awareness about the importance of maintaining normal blood sugar levels. Ignorance among the general population about the risks associated with hypoglycemia and the need for glucagon medication contributes to a limited market for these medicines. Despite the growing prevalence of diabetes and related conditions, a substantial portion of the population remains unaware of the critical role glucagon plays in managing hypoglycemic episodes.

According to recent surveys, a significant percentage of individuals with diabetes or prediabetes lack adequate knowledge about hypoglycemia and its management, including the use of glucagon. This lack of awareness translates into low demand for glucagon products, hindering market growth.

Underdiagnosis of Diabetes Dampens Demand for Glucagon Products

The underdiagnosis of diabetes poses a notable constraint on the growth of the glucagon market. A considerable portion of the diabetic population remains undiagnosed, resulting in lower demand for glucagon products. The failure to identify individuals with diabetes deprives them of essential treatments and preventive measures, including glucagon therapy.

Recent epidemiological studies indicate that a significant proportion of diabetes cases worldwide remain undiagnosed, particularly in low- and middle-income countries where healthcare infrastructure and access to diagnostic services are limited. This underdiagnosis not only compromises patient outcomes but also curtails the market potential for glucagon products.

By Route of Administration Analysis

Injectable route of administration dominates the glucagon market with a commanding share of 60%.

In 2023, Injectable held a dominant market position in the By Route of Administration segment of the Glucagon Market, capturing more than a 60% share. This remarkable dominance can be attributed to the inherent advantages of injectable formulations, including rapid onset of action and ease of administration, particularly in emergencies such as severe hypoglycemia. Injectable glucagon products offer healthcare professionals a reliable and efficient means of raising blood sugar levels quickly, thereby averting potentially life-threatening complications associated with hypoglycemia.

The growing prevalence of diabetes, coupled with the increasing awareness regarding the importance of managing hypoglycemia effectively, has significantly propelled the demand for injectable glucagon formulations. Moreover, advancements in drug delivery technologies have further enhanced the usability and efficacy of injectable products, thereby reinforcing their position as the preferred choice among healthcare practitioners and patients alike.

Looking ahead, the Injectable segment is poised for continued growth, driven by ongoing research and development initiatives aimed at improving formulation stability, enhancing ease of administration, and prolonging shelf life. Additionally, strategic collaborations between pharmaceutical companies and healthcare organizations are anticipated to facilitate the introduction of innovative injectable glucagon formulations into the market, catering to the evolving needs of patients and healthcare professionals.

As the cornerstone of the Glucagon Market, the Injectable segment is projected to maintain its dominant position in the coming years, offering promising opportunities for market players to capitalize on the growing demand for effective hypoglycemia management solutions.

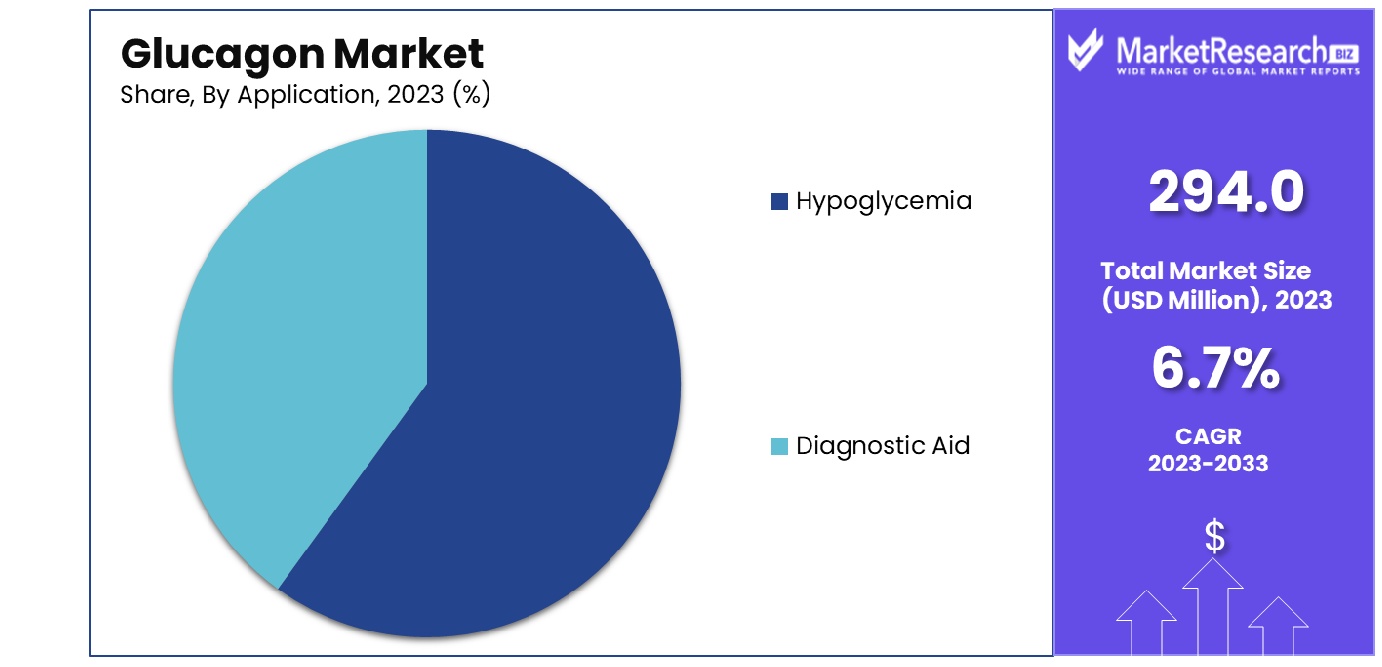

By Application Analysis

Hypoglycemia application holds a significant market share, commanding 45% of the total.

In 2023, Hypoglycemia held a dominant market position in the By Application segment of the Glucagon Market, capturing more than a 45% share. This substantial market share underscores the critical role of glucagon in managing hypoglycemic episodes, both in clinical settings and for self-administration by patients with diabetes. As a rapid-acting hormone, glucagon effectively counteracts hypoglycemia by stimulating the liver to release stored glucose into the bloodstream, thereby restoring blood sugar levels to within a normal range.

The Hypoglycemia segment encompasses a wide range of applications, with Diagnostic Aid emerging as a prominent use case. Glucagon serves as an invaluable tool for diagnosing and confirming hypoglycemia, enabling healthcare professionals to promptly identify and address this potentially life-threatening condition. By facilitating accurate and timely diagnosis, glucagon plays a pivotal role in guiding appropriate treatment interventions and ensuring optimal patient outcomes.

The growing prevalence of diabetes, coupled with the increasing recognition of hypoglycemia as a significant complication of diabetes management, has fueled the demand for glucagon as a diagnostic aid. Moreover, advancements in glucometer technology and the integration of glucagon rescue kits into diabetes management protocols have further bolstered the adoption of glucagon for hypoglycemia diagnosis.

Looking ahead, the Hypoglycemia segment is poised for sustained growth, driven by the continued emphasis on proactive hypoglycemia management strategies and the expanding application of glucagon in various healthcare settings. As stakeholders continue to prioritize patient safety and optimize diabetes care pathways, the Hypoglycemia segment is expected to remain at the forefront of the Glucagon Market, presenting lucrative opportunities for market participants to capitalize on the growing demand for hypoglycemia management solutions.

By Distribution Channel Analysis

Drug stores & retail pharmacies are the primary distribution channels, accounting for a dominant 60%.

In 2023, Drug Stores & Retail Pharmacies held a dominant market position in the By Distribution Channel segment of the Glucagon Market, capturing more than a 60% share. This significant market dominance underscores the widespread accessibility and convenience offered by drug stores and retail pharmacies in distributing glucagon products to consumers.

With their extensive network of outlets and established distribution channels, drug stores and retail pharmacies play a pivotal role in ensuring timely access to essential medications, including glucagon, for individuals managing diabetes and related conditions.

The appeal of drug stores and retail pharmacies as preferred distribution channels for glucagon products lies in their proximity to consumers and their ability to provide personalized guidance and support for patients requiring emergency hypoglycemia treatment.

Moreover, the availability of over-the-counter (OTC) glucagon formulations in these establishments enhances convenience for individuals seeking immediate access to emergency hypoglycemia management solutions without the need for a prescription.

The dominance of Drug Stores & Retail Pharmacies in the Glucagon Market is further reinforced by the increasing emphasis on self-care and patient empowerment in diabetes management. As individuals take a more proactive approach to their health and seek greater autonomy in managing their condition, the convenience and accessibility offered by drug stores and retail pharmacies become increasingly valuable.

Looking ahead, Drug Stores & Retail Pharmacies are poised to maintain their stronghold in the Glucagon Market, supported by evolving consumer preferences, expanding retail footprints, and ongoing efforts to enhance the availability and affordability of glucagon products. As stakeholders continue to prioritize patient-centric care delivery models, drug stores and retail pharmacies will remain integral to ensuring widespread access to vital diabetes management medications, including glucagon.

Key Market Segments

By Route of Administration

- Injectable

- Inhalation

By Application

- Hypoglycemia

- Diagnostic Aid

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

Growth Opportunity

Development of Novel Formulations for Convenient Administration

In 2023, the global Glucagon Market witnessed a significant growth opportunity spurred by the development of novel formulations tailored for convenient administration. As medical technology continues to advance, pharmaceutical companies have innovated new delivery methods for glucagon, catering to the evolving needs of patients and healthcare providers.

These formulations offer enhanced ease of use, ensuring swift and effective administration during critical situations such as severe hypoglycemia episodes. By addressing the challenges associated with traditional glucagon delivery, such as complex reconstitution processes, these innovations are poised to expand the market reach and accessibility of glucagon products.

Expansion of Healthcare Infrastructure in Emerging Markets

Furthermore, the expansion of healthcare infrastructure in emerging markets has presented a promising avenue for growth in the global Glucagon Market. As economies develop and healthcare spending increases, there is a growing demand for essential pharmaceuticals, including glucagon, to address the rising prevalence of diabetes and related complications.

Governments and private stakeholders in emerging economies are investing in healthcare infrastructure, bolstering access to essential medicines and medical services. This trend not only enhances the availability of glucagon products but also fosters greater awareness and adoption of diabetes management strategies, driving market expansion.

Latest Trends

Development of Glucagon Rescue Kits for Home Use

In 2023, the global Glucagon Market witnessed a notable trend with the development of glucagon rescue kits tailored for home use. Traditionally, glucagon has been administered by healthcare professionals or caregivers in emergency settings. However, advancements in technology and formulation have enabled the creation of user-friendly glucagon kits designed for self-administration by patients or their family members.

These kits typically feature pre-filled syringes or auto-injectors, along with simplified instructions for use. This trend reflects a shift towards empowering individuals with diabetes to manage severe hypoglycemia episodes independently, enhancing their autonomy and quality of life.

Integration of Glucagon in Closed-Loop Insulin Delivery Systems

Another significant trend in the global Glucagon Market in 2023 was the integration of glucagon in closed-loop insulin delivery systems. Closed-loop systems, also known as artificial pancreas systems, automate insulin delivery based on real-time glucose monitoring, providing precise control of blood sugar levels.

The integration of glucagon alongside insulin in these systems aims to mitigate the risk of hypoglycemia by administering glucagon when glucose levels fall too low. This innovation represents a paradigm shift in diabetes management, offering a comprehensive solution for optimizing glycemic control while minimizing the burden of hypoglycemic events.

Regional Analysis

In North America, the glucagon market holds a dominant share, accounting for approximately 45%.

In the global glucagon market, North America emerges as a dominant force, commanding a significant share of approximately 45%. This region's prominence is attributed to several factors, including the high prevalence of diabetes and increasing awareness regarding hypoglycemia management. With a robust healthcare infrastructure and substantial investments in research and development, North America remains at the forefront of glucagon adoption and innovation.

Europe stands as another key player in the glucagon market, characterized by a growing diabetic population and rising demand for advanced therapeutics. The region benefits from favorable government initiatives promoting diabetes management and healthcare accessibility.

Additionally, the presence of prominent pharmaceutical companies and research institutions fosters the development of novel glucagon formulations and delivery methods. Europe accounts for a substantial portion of the global market share, reflecting its significant contribution to industry growth.

In the Asia Pacific region, rapid urbanization, changing lifestyles, and increasing healthcare expenditure drive the demand for glucagon products. Countries like China and India witness a surge in diabetes prevalence, fueling market expansion. Moreover, heightened awareness about diabetes management and advancements in healthcare infrastructure propel the adoption of glucagon therapies across the region. Asia Pacific emerges as a lucrative market opportunity with considerable growth potential in the forecast period.

The Middle East & Africa and Latin America regions exhibit a growing interest in glucagon therapies, albeit at a slower pace compared to their counterparts. Limited healthcare infrastructure and economic constraints pose challenges to market penetration.

However, rising diabetes awareness initiatives and improving access to healthcare services contribute to incremental growth in these regions. As the global market evolves, strategic investments and partnerships are anticipated to drive market penetration and enhance product accessibility in these regions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global glucagon market witnessed dynamic competition among key players, including Novo Nordisk A/S, Fresenius SE & Co. KGaA, Amphastar Pharmaceuticals, Inc., Xeris Biopharma Holdings, Inc., ILS Inc., United Biotech (P) Limited, Zealand Pharma A/S, and Taj Pharmaceuticals Limited. Each of these companies played a pivotal role in shaping the market landscape, offering innovative products and strategic initiatives to address the evolving needs of healthcare providers and patients.

Novo Nordisk A/S, a prominent player based in Denmark, continued to maintain its stronghold in the glucagon market through its extensive product portfolio and strong global presence. The company's commitment to research and development, coupled with its focus on technological advancements, positioned it as a frontrunner in delivering effective glucagon therapies.

Meanwhile, Fresenius SE & Co. KGaA from Germany demonstrated notable growth, leveraging its diversified healthcare portfolio and robust distribution network to expand its market reach. Amphastar Pharmaceuticals, Inc., based in the United States, showcased resilience and agility in responding to market dynamics, with a focus on product innovation and strategic partnerships.

Xeris Biopharma Holdings, Inc. emerged as a key innovator, particularly in the field of ready-to-use glucagon formulations, catering to the needs of patients with diabetes. Additionally, companies such as ILS Inc., United Biotech (P) Limited, Zealand Pharma A/S, and Taj Pharmaceuticals Limited contributed to the market's competitiveness through their regional expertise, product differentiation strategies, and commitment to quality healthcare solutions.

Market Key Players

- Novo Nordisk A/S (Denmark)

- Fresenius SE & Co. KGaA (Germany)

- Amphastar Pharmaceuticals, Inc. (U.S.)

- Xeris Biopharma Holdings, Inc. (U.S.)

- ILS Inc. (Japan)

- United Biotech (P) Limited (India)

- Zealand Pharma A/S (Denmark)

- Taj Pharmaceuticals Limited (India)

Recent Development

- In January 2024, Bain & Company's report revealed $60B in global healthcare PE deals in 2023. Focus on biopharma, AI, GLP-1s, and India as a key investment hub. HCIT remains attractive amidst macro challenges.

- In February 2024, NTNU and St. Olavs Hospital developed MicroGlucagon, enhancing insulin therapy for type 1 diabetics. It accelerates insulin absorption, potentially reducing low blood sugar risks, and promising improved management.

Report Scope

Report Features Description Market Value (2023) USD 294.0 Million Forecast Revenue (2033) USD 553.3 Million CAGR (2024-2032) 6.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Route of Administration(Injectable, Inhalation), By Application(Hypoglycemia, Diagnostic Aid), By Distribution Channel(Hospital Pharmacies, Drug Stores & Retail Pharmacies, Online Pharmacies) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Novo Nordisk A/S (Denmark), Fresenius SE & Co. KGaA (Germany), Amphastar Pharmaceuticals, Inc. (U.S.), Xeris Biopharma Holdings, Inc. (U.S.), ILS Inc. (Japan), United Biotech (P) Limited (India), Zealand Pharma A/S (Denmark), Taj Pharmaceuticals Limited (India) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Novo Nordisk A/S (Denmark)

- Fresenius SE & Co. KGaA (Germany)

- Amphastar Pharmaceuticals, Inc. (U.S.)

- Xeris Biopharma Holdings, Inc. (U.S.)

- ILS Inc. (Japan)

- United Biotech (P) Limited (India)

- Zealand Pharma A/S (Denmark)

- Taj Pharmaceuticals Limited (India)