Global Process Analyzer Market By Liquid Analyzer(PH Analyzer, Conductivity Analyzer, Turbidity Analyzer), By Gas Analyzer(Oxygen Analyzer, Carbon Dioxide Analyzer, Moisture Analyzer), By Industry(Oil & Gas, Petrochemcial, Pharmaceuticals, Water & Wastewater, Power, Food & Beverages), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

42733

-

Jan 2024

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Process Analyzer Market Size, Share, Trends Analysis

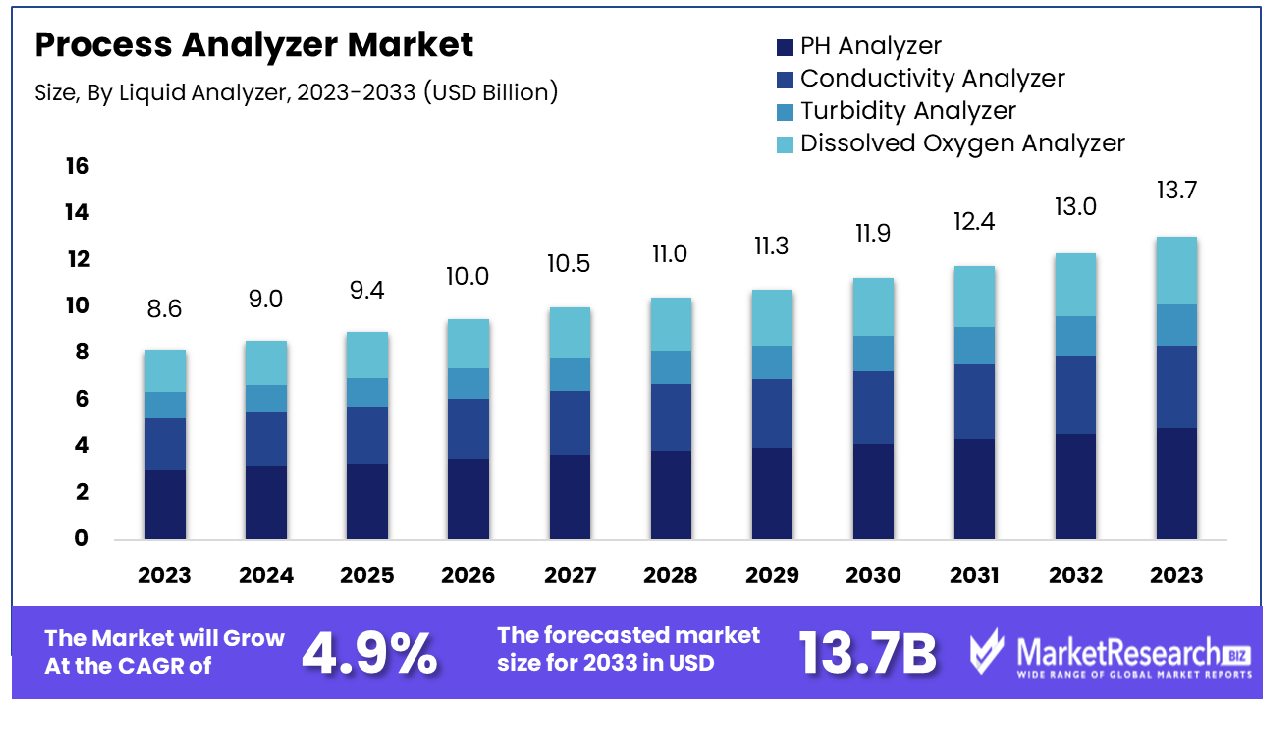

The Global process analyzer market was valued at USD 8.6 billion in 2023. It is expected to reach USD 13.7 billion by 2033, with a CAGR of 4.9% during the forecast period from 2024 to 2033.

The surge in demand in the oil and gas industry and the automation of industrial processes are some of the main driving factors for the process analyzer market expansion. Process analyzer market signifies the sector that deals with the production, development, and distribution of process analyzers.

These equipment are widely used in different verticals of industries to examine and supervise the quality of products and processes uninterruptedly. These are important for maintaining high-quality standards of production, making sure about safety, and adhering to all regulatory needs.

Process analyzer helps to analyze as it goes through processing and defining among other things, chemical composition, freezing point, pressure, and viscidness. It also helps in recognizing critical process parameters and critical quality attributes to make sure that the result is quality by design. The process analysis will opt for various testing techniques based on which parameters are being examined.

Process analyzers gather all the required information points in a continuous channel of samples and measurements are made in real-time without delaying or wasting any time that prevails when a test sample is being taken to the industrial laboratory. Process measurement is important because all the data are required to supervise and regulate the procedure.

These process analyzers can be measured in several methods that comprise simple and easy measurements like high temperature, pressure, and viscosity. A photometer is a tool used for measuring the capacity of electromagnetic radiation. These tools are used in the process analyzers. Another is the spectrophotometer, which is equipment that is used for defining the potentiality of the electromagnetic energy at every wavelength of light in a particular area.

For example, IR spectrophotometers are used for evaluating wavelengths in the IR range, and UV-Vis spectrophotometers are tools used for the wavelengths in the UV and visible ranges.

Process analyzer has numerous benefits such as it is used to measure and examine various factors like temperature, pressure, pH, composition, and other important elements. A process analyzer is also known as a process analytical technology system, which is an advanced tool used in different sectors to supervise and analyze the main parameters and features of a manufacturing process in actual real-time.

It also offers uninterrupted data procurement, analysis, and feedback to make sure optimal process regulation, efficacy, and quality. Process analysis is important because data are required to supervise and regulate the overall process. The demand for the process analyzer will gradually increase due to its demand in various verticals of industries that will help in market expansion during the forecast period.

Process Analyzer Market Dynamics

Process Analyzers Enhance Operational Efficiency

Global Process analyzers have become a critical tool across industries for tracking and optimizing production processes, which has spurred their market. Process analyzers help reduce human errors while improving efficiency by providing real-time insight. As industries place an increased focus on safety, quality, and cost savings measures; demand for advanced Global process analyzers that offer consistent and precise monitoring is expected to increase as more businesses recognize automation's benefits for process control.

Environmental Monitoring Policies Spur Market Demand

Environmental monitoring regulations and policies from the government are driving an unprecedented surge in process analyzer demand. Industries must adhere to regulations mandating emissions monitoring and effluent reporting. Process analyzers play an integral part in complying with these regulations while upholding environmental standards - thus leading to their wider adoption by industries across industries.

Innovations Set the Pace for Market Growth

Continuous technological advancements and innovations are key drivers of the process analyzer market. The development of more accurate, reliable, and cost-effective analyzers is making these tools indispensable for modern industrial operations. Innovations in areas such as automotive sensors technology, data analytics, and wireless communication services are enhancing the performance and functionality of Global process analyzers. As technology continues to advance, new and improved analyzers are expected to emerge, meeting the evolving needs of industries and propelling market growth further.

High Initial Investment Required Restrains Process Analyzer Market Growth

Installation costs for process analyzers represent one of the major obstacles to market expansion. Due to their advanced technology and ability to be tailored specifically to specific industry needs, process analyzers tend to be costly instruments that must be purchased upfront to be installed successfully. Initial expenses associated with purchasing or installing Global process analyzers may be prohibitively expensive for many small and midsized businesses, limiting their ability to make investments in tools. Unfortunately, until prices become more affordable, their market expansion will likely remain limited to major companies that can make initial capital investments.

Lack of Skilled Personnel Hinders Process Analyzer Market Growth

An insufficient workforce capable of operating, interpreting, and maintaining Global process analyzers may impede market expansion. While these sophisticated instruments require expertise in operation, data interpretation, and maintenance; often there aren't enough skilled individuals available to do these jobs efficiently resulting in operational inefficiency, longer downtime periods, increased expenses, and unfavorable results - making analysis tools less attractive as companies are reluctant to invest without an experienced workforce backing them up; potentially slowing expansion.

Stringent Regulatory Requirements Act as a Restraint for Process Analyzer Market

Pharmaceutical, petrochemical, and food industries all face stringent requirements regarding the quality and safety of their products. Global Process analyzers play an essential role in meeting these regulations - however, their constantly shifting regulatory environment presents unique challenges to process analyzer manufacturers who must adapt their products to stay compliant with them or risk higher prices and less availability of products.

Process Analyzer Market Segmentation Analysis

By Liquid Analyzer Analysis

Within the liquid analyzer segment of the process analyzer market, the pH Analyzer emerges as the dominant sub-segment. pH analyzers play an essential role across several industries ranging from pharmaceuticals and water treatments, making their presence even more critical. Accurate measurement of pH ensures quality products with safety assurance measures in line with environmental regulations - making them essential tools.

As pH Analyzers remain popular due to their wide use and importance for process monitoring, additional analyzers such as Conductivity Analyzers, Turbidity Analyzers, and Dissolved Oxygen Analyzers also hold significant positions on the market. These analyzers play an integral part in some applications where purity of particulate matter or oxygen concentration are key elements to ensure the integrity of a process or final product's quality.

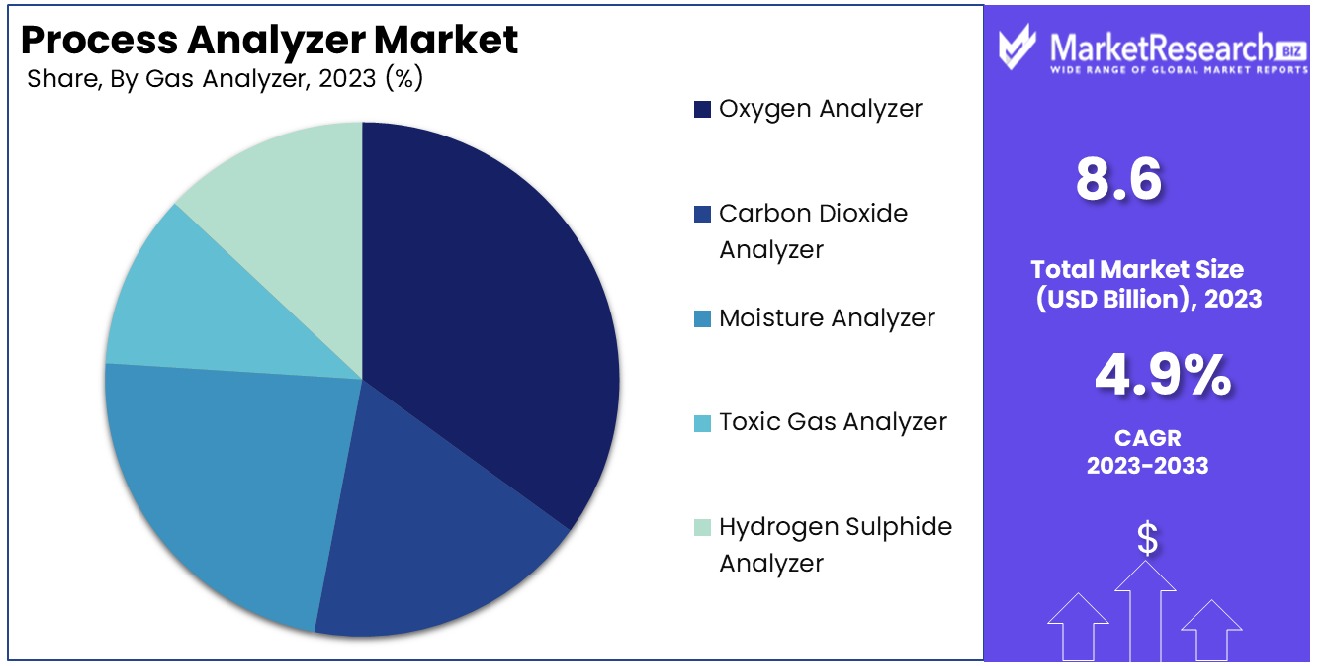

By Gas Analyzer Analysis

In the gas analyzer market, Oxygen Analyzers are the most prominent sub-segment. The critical importance of oxygen level monitoring in various processes, especially in combustion control and safety, makes these analyzers essential across multiple industries. These devices can help improve combustion efficiency, lower emissions levels, and ensure safety in places where gas levels must be carefully monitored.

Oxygen Analyzers may be the go-to option, but other gas analyzers such as Carbon Dioxide Analyzers, Moisture Analyzers, Toxic Gas Analyzers, and Hydrogen Sulfide Analyzers play important roles as well. Each analyzer can provide valuable data that can optimize processes while fulfilling environmental compliance regulations or safety monitoring needs.

By Industry Analysis

Oil & Gas industry operations represent one of the highest consumers for process analyzers, making them indispensable tools in controlling processes, monitoring results, assuring product quality, and meeting safety regulations. Due to its complex operations, exact and reliable measurements are crucial; making advanced process analyzers an integral component.

Oil & Gas companies may lead the pack in using process analyzers, but other industries such as petrochemicals, Pharmaceuticals, Water/wastewater treatment services plants, Power plants, and Food/beverages also heavily rely on global process analyzers for quality efficiency, efficacy, and compliance purposes. Each sector has unique specifications that dictate different analyzer types to meet specialized regulations in each area of application.

Process Analyzer Industry Segments

By Liquid Analyzer

- PH Analyzer

- Conductivity Analyzer

- Turbidity Analyzer

- Dissolved Oxygen Analyzer

By Gas Analyzer

- Oxygen Analyzer

- Carbon Dioxide Analyzer

- Moisture Analyzer

- Toxic Gas Analyzer

- Hydrogen Sulphide Analyzer

By Industry

- Oil & Gas

- Petrochemical

- Pharmaceuticals

- Water & Wastewater

- Power

- Food & Beverages

Process Analyzer Market Growth Opportunity

Growing Concern for Water Quality Boosts Process Analyzer Market in Water & Wastewater Industry

As environmental regulations become ever more stringent and public awareness about environmental health increases, reliable and accurate water monitoring becomes ever more crucial. Process analyzers play a pivotal role in detecting contaminants present in water treatment processes as well as meeting regulatory agency requirements for compliance. With increased investment into monitoring technology resulting from increasing emphasis on the quality of water, process analyzers may expand significantly into this vital sector of business growth.

Automation and Real-Time Monitoring Increase Process Analyzer Adoption

Industry sectors with stringent quality and efficiency standards demand real-time monitoring to maintain control over manufacturing processes, which guarantees optimal product performance and quality. Integrating process analyzers into automated systems enables continuous collection and analysis of data that leads to more informed decision-making and improved operational efficiencies. As more businesses adopt automation technologies, demand for Global process analyzers with sophisticated capabilities that can keep up with these advances may increase exponentially and present lucrative growth opportunities for the market.

Process Analyzer Market Regional Analysis

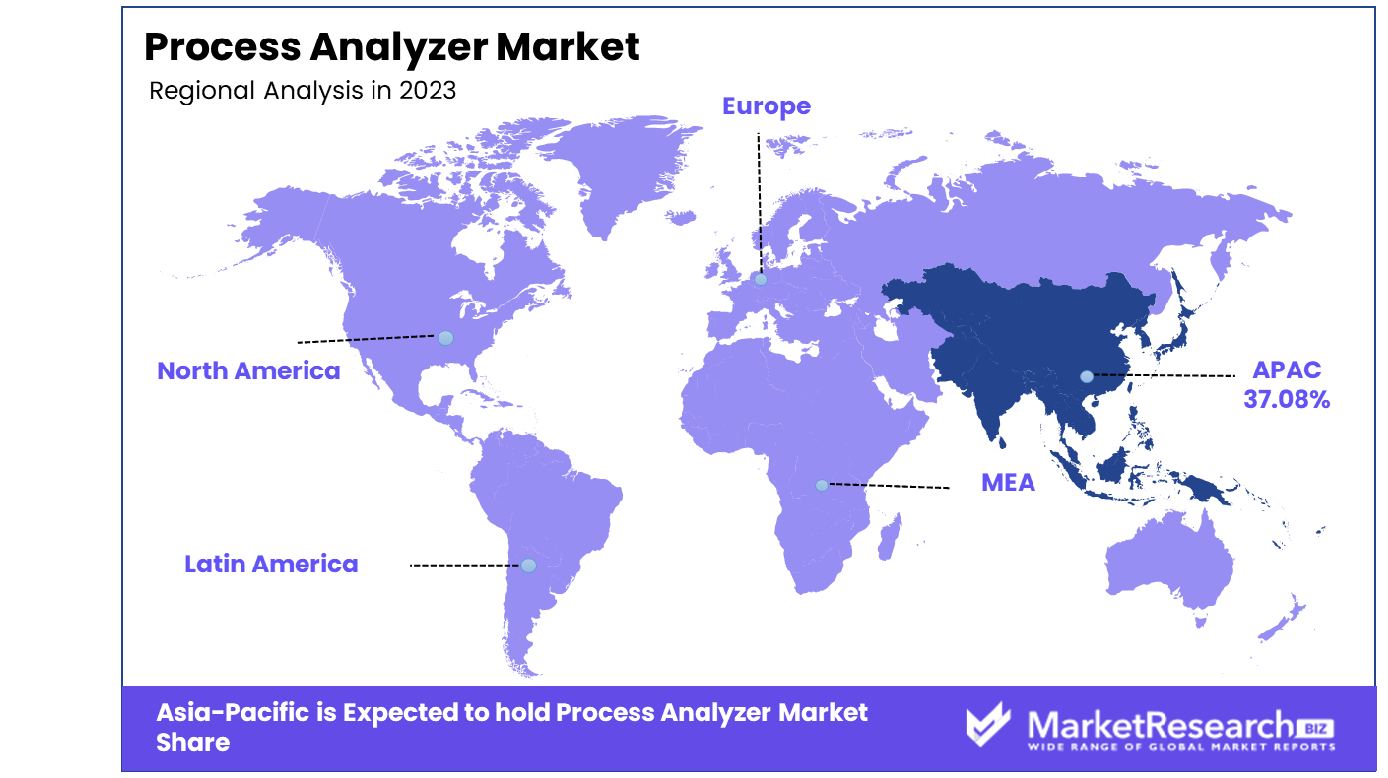

Asia-Pacific Dominates with 37.08% Market Share in Process Analyzer Market

Process analyzers account for an impressive 37.08% market share due to rapid industry expansion across Asia-Pacific regions such as pharmaceuticals, chemicals, oil and gas as well as water and wastewater treatment industries. China, India, and Japan are experiencing explosive industrial expansion which requires stringent controls over processes and quality assurance thus further driving demand for Process Analyzers in this region. Furthermore, the emphasis placed on using advanced manufacturing techniques and improving operational efficiencies adds further to this rising trend in demand for process analyzers in this region.

Asia-Pacific market dynamics depend heavily on both its industrial landscape and increasing efforts to optimize production and security. Production processes increasingly employ IoT solutions/automation techniques while Global process analyzers become essential tools. Furthermore, investments in research and development provide substantial growth potential within this region.

North America: Advanced Technology Adoption and Regulatory Compliance

North America's process analyzer market is driven by advanced technology adoption and a strong emphasis on regulatory compliance across industries. A robust industrial sector and major market players contribute to an increased need for Global process analyzers in this region.

Europe: Focus on Quality and Safety Standards

Europe's process analyzer market is marked by a strong emphasis on quality and safety standards, driven by stringent regulatory environments as well as an emphasis on producing top-quality products. Automation and data-driven manufacturing techniques in European industries further fuel this market growth; furthermore, Europe's commitment to environmental sustainability plays an integral part in driving demand for advanced process analyzers.

Process Analyzer Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Process Analyzer Market Share Analysis

In the process analyzer market, key players such as Emerson Electric Co., Yokogawa Electric Corporation, ABB, Endress+Hauser, and Thermo Fisher Scientific, significantly influence market dynamics through their comprehensive product offerings and technological innovations.

These companies are industry leaders, offering advanced analytical solutions for various industries including oil and gas accumulators, pharmaceuticals, and food and beverage. Their commitment to R&D allows for constant improvement in the accuracy, efficiency, and reliability of Global process analyzers while meeting evolving quality control needs and production processes.

Ametek, Suez, and Mettler Toledo are also noteworthy for their specialized contributions, particularly in providing precise instrumentation and environmental monitoring solutions. Their focus on customer-specific requirements and adaptability to changing market trends have established them as reliable partners in the industry.

Process Analyzer Industry Key Players

- Emerson Electric Co. (US)

- Yokogawa Electric Corporation (Japan)

- ABB (Switzerland)

- Endress+Hauser Group Services AG (Switzerland)

- Thermo Fisher Scientific, Inc. (US)

- Ametek, Inc. (US)

- Suez (US)

- Mettler Toledo (US)

- Honeywell International Inc. (US)

- Schneider Electric (France)

- Siemens AG

- Yokogawa Electric Corp.

- Hach Lange GmbH

Process Analyzer Market Recent Development

- In April 2023, Thermo Fisher Scientific Inc. introduced two novel wet chemistry analyzers, providing fully automated testing in compliance with the U.S. Environmental Protection Agency (EPA) standards. These systems cater to environmental, agricultural, and industrial testing laboratories with precise and streamlined analytical capabilities.

- In December 2022, ABB launched a Sensi+ analyzer, revolutionizing natural gas quality monitoring. This single device detects H2S, H2O, and CO2 contaminants, enhancing pipeline safety, efficiency, and cost-effectiveness with real-time analysis, swift upset responses, and reduced emissions.

- In November 2022, Mettler Toledo introduced the latest iteration of Easy Vis, a compact solution for analyzing liquid samples. This device evaluates optical spectrum, color, and water characteristics, combining functionalities of a colorimeter, spectrophotometer, and water testing methods within a single, portable unit, replacing the need for three separate instruments.

Report Scope

Report Features Description Market Value (2023) USD 8.6 Billion Forecast Revenue (2033) USD 13.7 Billion CAGR (2024-2032) 4.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Liquid Analyzer(PH Analyzer, Conductivity Analyzer, Turbidity Analyzer, Dissolved Oxygen Analyzer), By Gas Analyzer(Oxygen Analyzer, Carbon Dioxide Analyzer, Moisture Analyzer, Toxic Gas Analyzer, Hydrogen Sulphide Analyzer), By Industry(Oil & Gas, Petrochemcial, Pharmaceuticals, Water & Wastewater, Power, Food & Beverages) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Emerson Electric Co. (US), Yokogawa Electric Corporation (Japan), ABB (Switzerland), Endress+Hauser Group Services AG (Switzerland), Thermo Fisher Scientific, Inc. (US), Ametek, Inc. (US), Suez (US), Mettler Toledo (US), Honeywell International Inc. (US), Schneider Electric (France), Siemens AG, Hach Lange GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Emerson Electric Co. (US)

- Yokogawa Electric Corporation (Japan)

- ABB (Switzerland)

- Endress+Hauser Group Services AG (Switzerland)

- Thermo Fisher Scientific, Inc. (US)

- Ametek, Inc. (US)

- Suez (US)

- Mettler Toledo (US)

- Honeywell International Inc. (US)

- Schneider Electric (France)

- Siemens AG

- Yokogawa Electric Corp.

- Hach Lange GmbH