Wastewater Treatment Services Market Size, Share, Growth, And Industry Analysis - By Service Type (Design & Engineering, Operation & Maintenance), By Treatment Process (Physical Treatment, Chemical Treatment), By End-Use, By Application - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

9482

-

Aug 2023

-

162

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

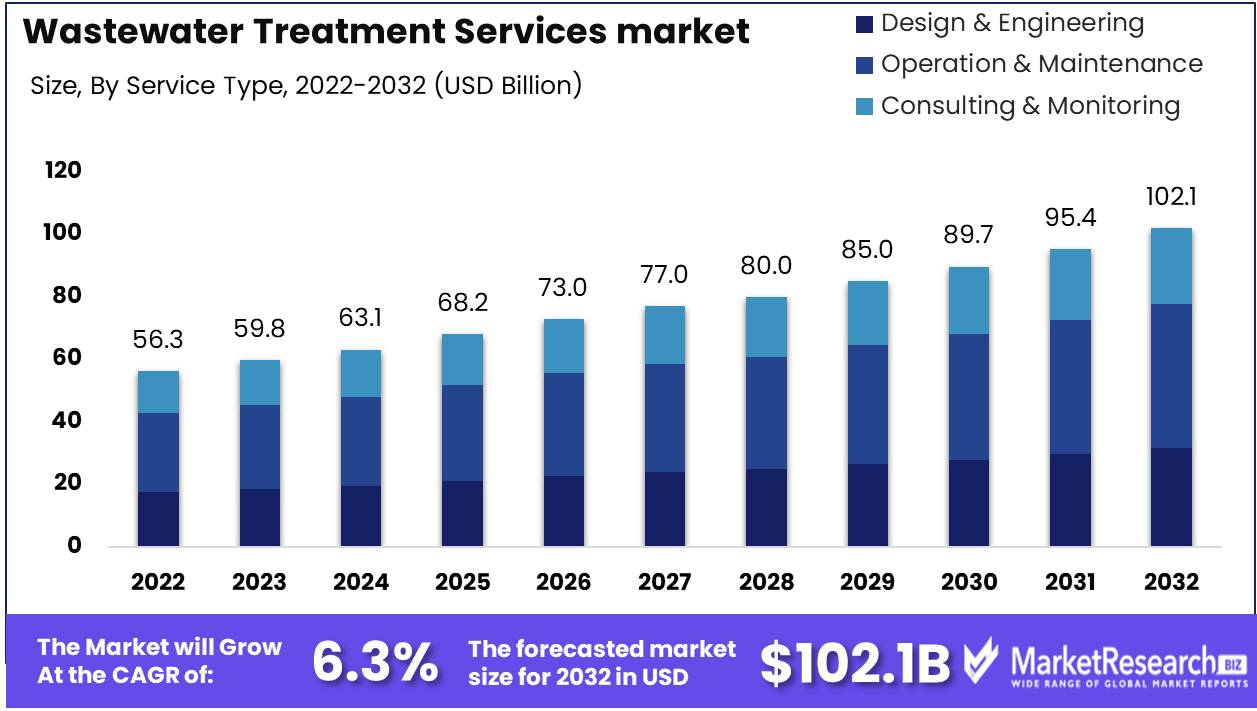

The Global Wastewater Treatment Services Market revenue is expected to increase to USD 102.1 Bn in 2032 from USD 56.3 Bn in 2022, and register a revenue CAGR of 6.3% during the forecast period (2023 to 2032).

Wastewater treatment services play a crucial role in removing pollutants and contaminants from wastewater before it is released into the environment. This essential process safeguards water quality, protects ecosystems, and promotes public health. Wastewater treatment is used across industries, municipalities, and residential areas to treat water before discharge or reuse. Factors such as increasing environmental awareness, stringent regulations, and the need to conserve water resources are driving the demand for efficient and sustainable wastewater treatment services, making it a critical component of modern infrastructure.

The global wastewater treatment services market is registering robust growth due to rising urbanization, industrialization, and growing concerns over water pollution. Governments and industries are investing in advanced treatment technologies to meet stringent regulatory requirements and ensure sustainable water management.

Wastewater treatment services encompass a range of solutions, from physical and chemical treatments to biological processes. With the global focus on sustainable development and circular economy principles, wastewater treatment services are anticipated to continue their expansion, fostering environmental protection, water conservation, and safer water reuse practices

Driving factors

Stringent Environmental Regulations & Urbanization and Industrial Expansion

Heightened environmental awareness and concerns and stringent regulations mandating the treatment of wastewater before discharge are resulting in need for industries and municipalities to seek professional wastewater treatment services. This regulatory push has created a robust demand for efficient and effective treatment solutions.

Rapid urbanization and industrialization are resulting in increased wastewater generation. The need to manage the rising volumes of wastewater to prevent contamination and health risks is boosting the demand for wastewater treatment services market, particularly in densely populated areas.

Technological Innovations & Water Scarcity and Reuse

Advances in wastewater treatment technologies, such as membrane filtration, biological treatment, and nanotechnology, are enhancing treatment efficiency, reducing energy consumption, and minimizing environmental impact. These innovations are attracting investments and driving market growth.

Growing concerns about water scarcity are other factors driving adoption of wastewater recycling and reuse initiatives. Wastewater treatment services are playing a pivotal role in reclaiming and treating water for non-potable purposes, thereby contributing to sustainable water management.

Public Health Focus & Sustainable Development Goals

The awareness of the direct link between untreated wastewater and public health risks is driving governments and industries to prioritize wastewater treatment. This emphasis on safeguarding public health is fostering the expansion of the wastewater treatment services market.

The global pursuit of sustainable development goals, including clean water and sanitation targets, is directing attention to wastewater treatment as a means to achieve these objectives. This alignment is encouraging investments and initiatives that positively impact market revenue growth.

Restraining Factors

High Initial Costs & Complex Regulations

Implementing advanced wastewater treatment technologies can require substantial capital investments. High initial costs can deter smaller municipalities and industries from adopting these solutions, limiting the market's reach.

While stringent regulations drive demand, navigating a complex landscape of varying regional and international standards can be challenging for service providers, potentially leading to compliance difficulties.

Lack of Awareness & Energy Intensity

Some regions and industries might have limited awareness of the importance of proper wastewater treatment, hindering the uptake of services and hindering market growth.

Certain advanced treatment methods can be energy-intensive, leading to concerns about their environmental footprint and contributing to operational costs, which might deter adoption.

Limited Infrastructure & Skill Shortages

Developing countries and rural areas often lack the necessary infrastructure for wastewater treatment, making it challenging to implement effective solutions and limiting market penetration.

The expertise required for advanced wastewater treatment techniques might be scarce in some regions. Skill shortages can hinder the implementation and operation of sophisticated treatment processes

By Service Type

Among the service type segments, the operation & maintenance segment is expected to account for a major revenue share during the forecast period. This is because the ongoing operation and maintenance of wastewater treatment facilities are critical for ensuring efficient and effective treatment processes. Companies providing operation and maintenance services play a key role in managing the day-to-day functioning of treatment plants, optimizing processes, and maintaining compliance with regulatory standards.

As wastewater treatment facilities become more complex and diverse, the demand for specialized and consistent operation and maintenance services is expected to drive significant revenue growth in this segment.

By Treatment Process

Among the treatment process segments, the biological treatment segment is expected to account for a major revenue share during the forecast period. Biological treatment processes involve the use of microorganisms to break down organic matter in wastewater, resulting in cleaner and environmentally friendly treated water. This segment's prominence can be attributed to the increasing emphasis on sustainable and eco-friendly wastewater treatment solutions.

As regulations become stricter and industries and municipalities strive for efficient and environmentally conscious wastewater management, the demand for biological treatment processes is projected to grow. This growth is driven by the effectiveness of biological treatment in removing contaminants and its alignment with environmental sustainability goals.

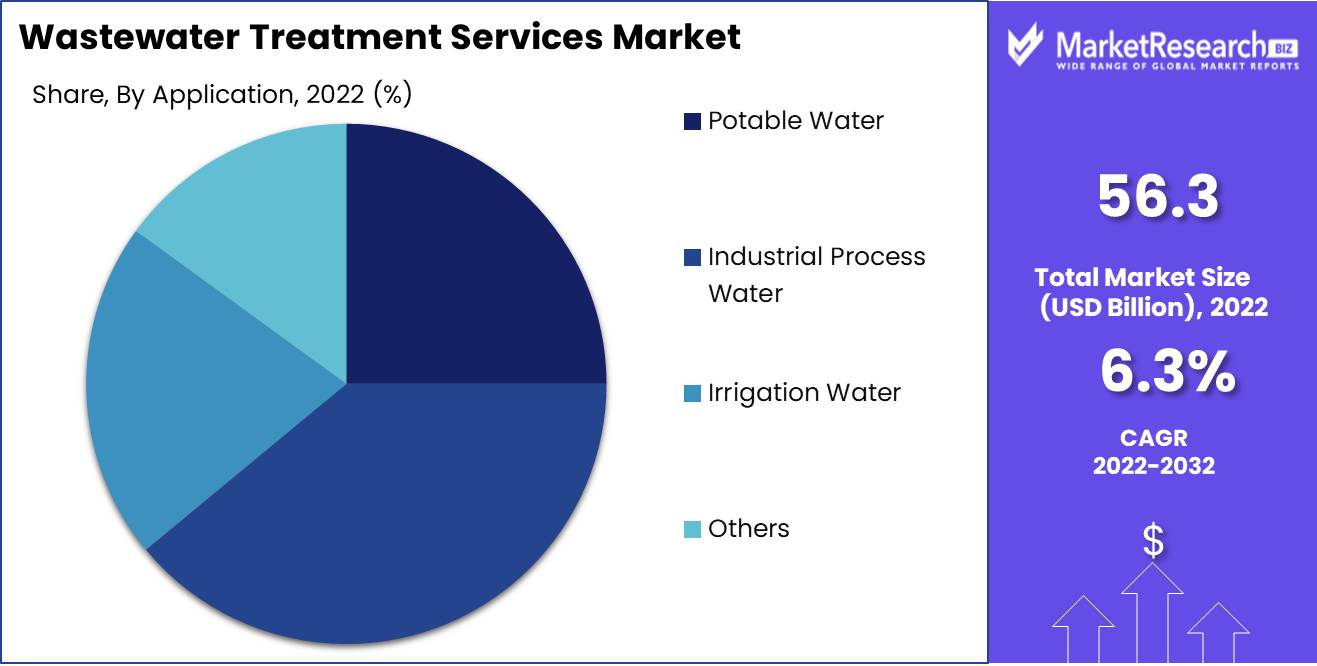

By Application

Among the application segments, the industrial process water segment is expected to account for a major revenue share during the forecast period. Industrial processes require significant amounts of water for various operations, and ensuring the quality of process water is crucial to maintain production efficiency and product quality. As industries continue to expand and regulatory standards for water quality become more stringent, the demand for wastewater treatment services focused on treating industrial process water is expected to rise.

Companies across sectors such as manufacturing, chemical processing, and food and beverage are increasingly recognizing the importance of effective wastewater treatment to comply with regulations and optimize their operations. This drives the preference for specialized wastewater treatment services tailored to industrial process water treatment, thereby boosting the revenue share of this segment in the global wastewater treatment services market.

Key Market Segments

By Service Type

- Design & Engineering

- Operation & Maintenance

- Consulting & Monitoring

By Treatment Process

- Physical Treatment

- Chemical Treatment

- Biological Treatment

By End-Use

- Municipal

- Industrial

By Application

- Potable Water

- Industrial Process Water

- Irrigation Water

- Others

Opportunity

Industrial Expansion & Rising Urbanization

As industries continue to expand and evolve, the generation of industrial wastewater increases. This creates a significant opportunity for wastewater treatment services to cater to diverse sectors, including manufacturing, chemicals, and food processing, by providing efficient and compliant solutions.

Rapid urbanization is resulting in higher concentrations of population centers and, consequently, increased wastewater generation. Wastewater treatment services can capitalize on this trend by offering tailored solutions for urban areas, addressing the need for proper sanitation and wastewater management.

Wastewater Reuse & Smart Technologies

The concept of wastewater reuse for non-potable purposes, such as irrigation and industrial processes, is gaining traction. Wastewater treatment services can tap into this opportunity by providing technologies and expertise to transform treated wastewater into valuable resources.

The integration of smart technologies, including real-time monitoring and data analytics, can enhance the efficiency and effectiveness of wastewater treatment processes. Companies that offer innovative solutions leveraging these technologies can attract demand from municipalities and industries looking to optimize their operations.

Government Initiatives, Emerging Markets, & Public Awareness

Government policies promoting water conservation and environmental protection drive the demand for wastewater treatment services. Service providers that align their offerings with these initiatives can access government contracts and funding, contributing to revenue growth.

Developing economies are increasingly recognizing the importance of wastewater treatment for public health and environmental sustainability. Penetrating these markets with tailored solutions can yield substantial growth opportunities for established players and new entrants.

Growing environmental consciousness among consumers and communities is putting pressure on industries and municipalities to adopt responsible wastewater management practices. Companies that offer transparent and sustainable solutions can attract businesses and local authorities seeking to align with public sentiment.

Regional Analysis

North America

In North America, countries such as the US and Canada exhibit strong demand for wastewater treatment services due to strict environmental regulations and a focus on sustainable water management. The market share is significant, driven by industries and municipalities adopting advanced treatment technologies. Continuous revenue growth is fueled by industrial expansion and urbanization. The region boasts technological advancements, including smart monitoring systems. Government initiatives, such as the Clean Water State Revolving Fund in the US, support revenue growth by providing funding for wastewater infrastructure upgrades

Europe

European countries, including Germany, France, and the UK, contribute to the substantial market share in the region. Stringent wastewater quality standards and a circular economy approach drive demand. Revenue growth is projected due to increasing investments in water treatment infrastructure. Europe is at the forefront of technological advancements, with innovations in nutrient recovery and membrane technologies. Government initiatives like the EU Water Framework Directive and circular economy policies stimulate revenue growth by mandating sustainable water management practices

Asia Pacific

In Asia, countries such as China, India, and Japan are experiencing rapid urbanization and industrialization, leading to substantial demand for wastewater treatment services. The market share is significant due to the large population and industrial base. Revenue growth is driven by urban expansion and environmental awareness. The region witnesses industry growth as more companies adopt sustainable practices. Technological advancements in decentralized treatment systems cater to varied needs. Government initiatives such as the Clean Ganga project in India and China's Water Ten Plan promote revenue growth by focusing on water pollution control and treatment

Latin America

Countries like Brazil and Mexico contribute to the market share in Latin America. Rapid urbanization and industrial development drive demand for wastewater treatment services. Revenue growth is supported by infrastructure projects aimed at improving water quality. The region is witnessing industry growth with increased awareness of water pollution issues. Technological advancements include decentralized treatment solutions. Government initiatives like Brazil's National Sanitation Plan and Mexico's National Water Program foster revenue growth by addressing water pollution challenges.

Middle East & Africa

In this region, countries like Saudi Arabia and South Africa drive demand for wastewater treatment services due to water scarcity and urban growth. Revenue growth is anticipated as governments invest in water infrastructure. The industry is growing with a focus on sustainable water management. Technological advancements include desalination and water reuse technologies. Government initiatives like Saudi Vision 2030 and South Africa's National Water Resource Strategy support revenue growth by addressing water scarcity and promoting efficient water use.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

The global wastewater treatment services market features a competitive landscape characterized by a mix of established industry players and innovative startups. Key companies such as Suez, Veolia, and Xylem dominate the market with their extensive service portfolios and global presence. These players leverage technological advancements to provide comprehensive solutions for wastewater treatment and management.

New entrants and regional players focus on niche segments and innovative technologies to gain market share. Collaborations, partnerships, and acquisitions are common strategies to expand market reach and enhance service offerings. The competitive landscape reflects a balance between industry giants and agile disruptors, driving innovation and driving the market forward.

Top Key Players in Wastewater Treatment Services Market

- Suez

- Veolia

- Xylem Inc.

- Aquatech International LLC

- Ecolab Inc.

- Pentair plc

- Danaher Corporation

- IDEXX Laboratories, Inc.

- Evoqua Water Technologies

- AECOM

- Jacobs Engineering Group Inc.

- SWA Water Holdings Pty Ltd.

- SUEZ Water Technologies & Solutions

- WSP Global Inc.

- Aqualia

Recent Development

- In 2022, Xylem is an American water technology company that provides solutions for water treatment, water distribution, and water reuse. Xylem acquired Pure Water Technology, a leading provider of water treatment solutions for the food and beverage industry.

- In 2022, Ecolab is an American cleaning and water technology company that provides solutions for industrial and institutional customers. Ecolab acquired Nalco Water, a leading provider of water treatment chemicals and services.

- In 2022, Evoqua Water Technologies is an American water treatment company that provides solutions for municipal, industrial, and commercial customers. In 2022, Evoqua Water Technologies acquired Puretec, a leading provider of membrane filtration systems for water treatment.

- In 2022, Thermax Group is an Indian multinational engineering company that provides water treatment solutions. Thermax Group acquired Aquatech, a leading provider of water treatment solutions for the oil and gas industry.

Report Scope

Report Features Description Market Value (2022) USD 56.3 Bn Forecast Revenue (2032) USD 102.1 Bn CAGR (2023-2032) 6.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Competitive Analysis, Segment and Sub-segment Breakdown and Analysis, Trend Analysis, Opportunity & Strategy Reporting Segments Covered By Service Type (Design & Engineering, Operation & Maintenance, Consulting & Monitoring), By Treatment Process (Physical Treatment, Chemical Treatment, Biological Treatment), By End-Use (Municipal, Industrial), By Application (Potable Water, Industrial Process Water, Irrigation Water, Others) Regional Analysis North America (United States, Canada); Asia Pacific (China, India, Japan, Australia & New Zealand, Association of Southeast Asian Nations (ASEAN), Rest of Asia Pacific); Europe (Germany, U.K., France, Spain, Italy, Russia, Poland, BENELUX [Belgium, the Netherlands, Luxembourg], NORDIC [Norway, Sweden, Finland, Denmark], Rest of Europe); Latin America (Brazil, Mexico, Argentina, Rest of Latin America); Middle East & Africa (Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, Rest of Middle East & Africa) Competitive Landscape Suez, Veolia, Xylem Inc., Aquatech International LLC, Ecolab Inc., Pentair plc, Danaher Corporation, IDEXX Laboratories, Inc., Evoqua Water Technologies, AECOM, Jacobs Engineering Group Inc., SWA Water Holdings Pty Ltd., SUEZ Water Technologies & Solutions, WSP Global Inc., Aqualia Customization Scope Further customization of segments, regions/country-breakdown can be provided upon request. Purchase Options Licenses Available are Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Suez

- Veolia

- Xylem Inc.

- Aquatech International LLC

- Ecolab Inc.

- Pentair plc

- Danaher Corporation

- IDEXX Laboratories, Inc.

- Evoqua Water Technologies

- AECOM

- Jacobs Engineering Group Inc.

- SWA Water Holdings Pty Ltd.

- SUEZ Water Technologies & Solutions

- WSP Global Inc.

- Aqualia