Ammonium Nitrate Market By Application(Fertilizers, Explosives, Others), By End Use(Agriculture, Industries, Mining, Defense, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43375

-

Feb 2024

-

179

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

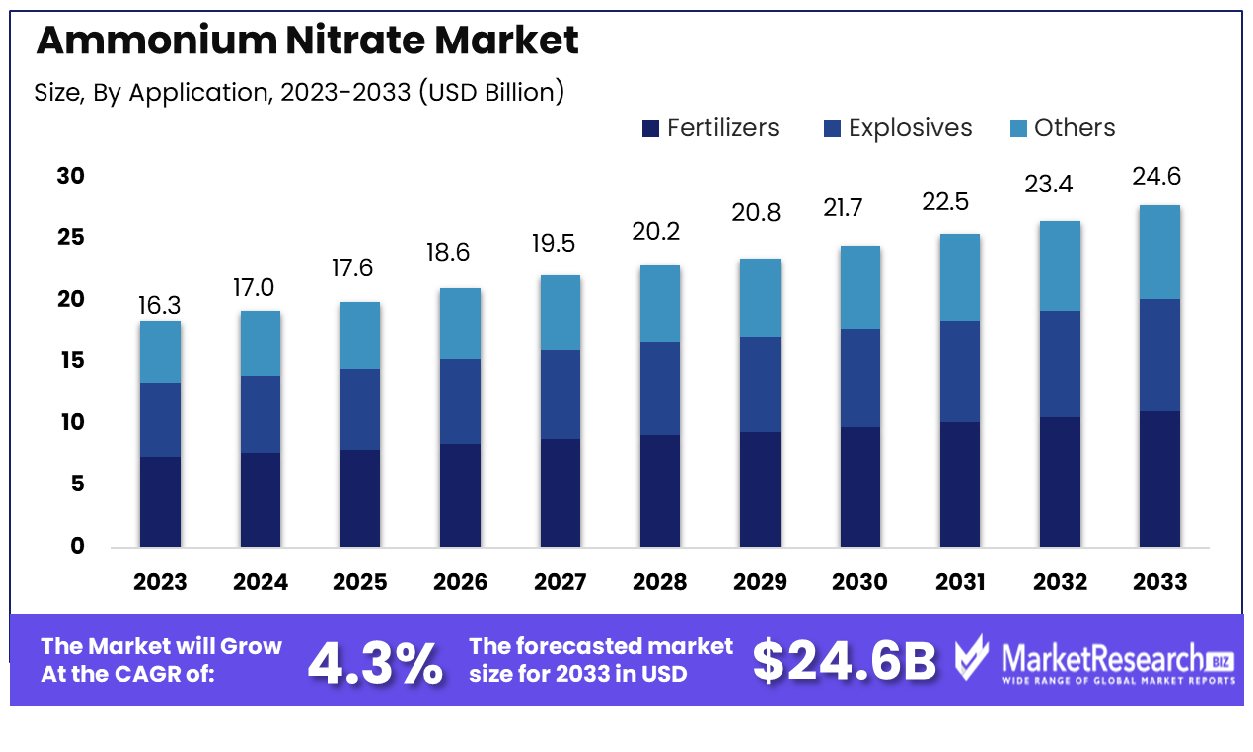

The Ammonium Nitrate Market was valued at USD 16.3 billion in 2023. It is expected to reach USD 24.6 billion by 2033, with a CAGR of 4.3% during the forecast period from 2024 to 2033.

The surge in demand for the fertilizers in agricultural sector and the rise in the requirement for ammonium nitrate fuel oil are some of the main key driving factors for the ammonium nitrate market.

Ammonium nitrate is defined as a chemical compound with the formula NH4NO3. It is a white crystalline solid compound that is commonly used in the agricultural sector due to its high nitrogen content. This compound is composed of ammonium ions and nitrate ions which makes it a versatile source of nitrogen as an important nutrient for plant growth. Besides its usage in agricultural applications, ammonium nitrate has been lately used in the production of explosives, as it can form exothermic reactions when integrated with some substances.

But, due to its capability of misusing in making the bomb, there have been strict regulations, guidelines, and safety measures, which can monitor its handling and distribution. The compound got much international attention after being involved in many industrial accidents and terrorist attacks, prominence the importance of responsible handling and stage.

An article published by ICIS in April 2023, highlights that India’s Chambal Fertilizers is developing a greenfield 240,000 tonnes/year technical ammonium nitrate plant at its Gadepan complex in the north-western Rajasthan state. As per this report, the firm plans to build up the ammonium nitrate plant (TAN) as well as 210,000 tonne/year weak nitric acid (WNA) line at an anticipated cost of USD 201 million. Moreover, an article published by MarketScreener in January 2023, highlights that KAZAZOT, one of the well-known firms in industry in Kazakhstan has selected Tecnicas Reunidas as the contractor to make new ammonium urea, nitric acid, and ammonium nitrate complex, with a total investment around USD 1 billion. Furthermore, Tecnicas Reunidas will start the engineering design first under a FEED OBE that will need about 200.00 engineering hours.

In the agricultural sector, ammonium nitrate plays a vital role as it is widely used as fertilizer by offering important nitrogen to improve plant growth and cultivation. It is water soluble and allows excellent nutrient absorption by plants. Moreover, ammonium nitrates are also being used in instant cold packs, for the treatment of some titanium ores and it is being used for the preparation of nitrous oxide. Demand for ammonium nitrate will steadily increase due to its demand from agriculture, leading to market expansion during this forecast period.

Key Takeaways

- Market Growth: Ammonium Nitrate Market was valued at USD 16.3 billion in 2023 and is expected to reach USD 24.6 billion by 2033, with a CAGR of 4.3% during the forecast period from 2024 to 2033.

- By Application: Fertilizers hold the dominant share in the ammonium nitrate market in terms of application.

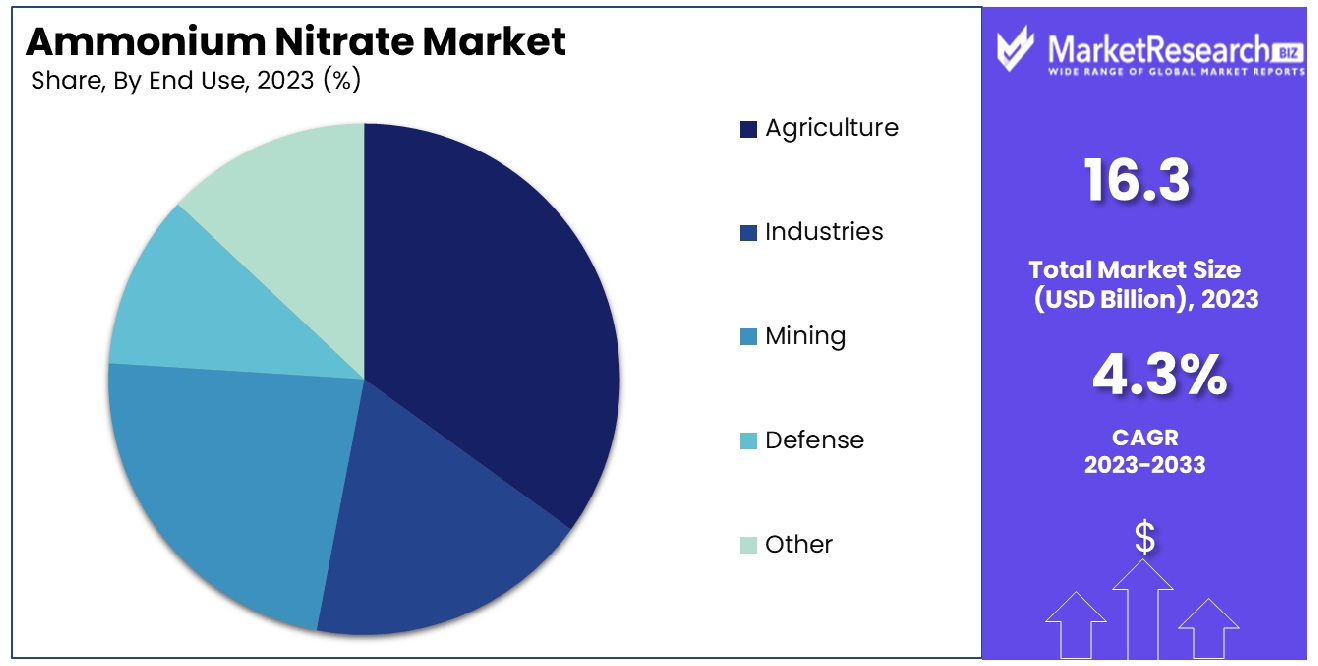

- By End Use: Agriculture emerges as the primary consumer, dominating the end-use sector for ammonium nitrate.

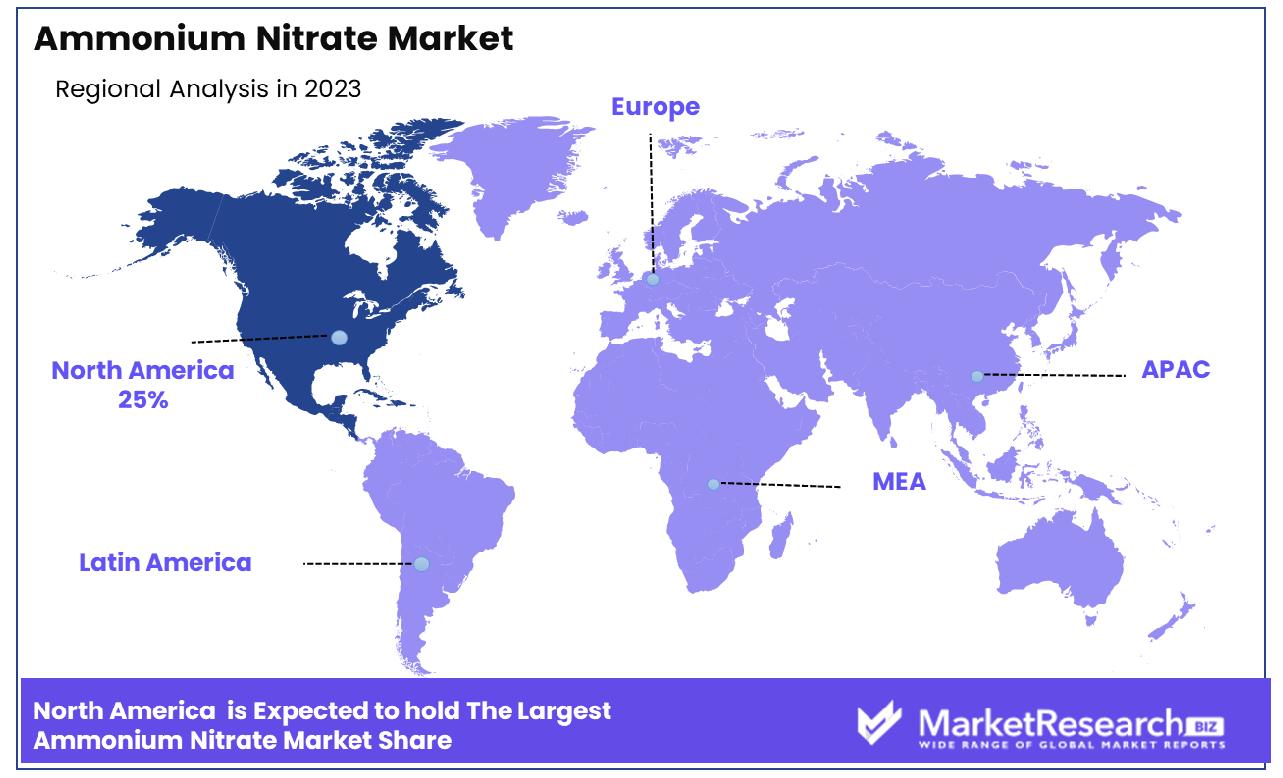

- Regional Dominance: In the Ammonium Nitrate industry, North America commands a substantial market share of 25%.

- Growth Opportunity: Precision farming technologies and controlled-release fertilizers are driving growth in the ammonium nitrate market by enhancing efficiency and sustainability.

Driving factors

Population Surge Elevates Ammonium Nitrate Demand for Food Production

The burgeoning global population, projected by the UN to reach 9.7 billion by 2050, necessitates a substantial increase in food production. This scenario is elevating the demand for fertilizers, including ammonium nitrate, to enhance crop yields. The correlation is clear: as the population grows, so does the need for efficient and effective agricultural practices, where ammonium nitrate plays a pivotal role in boosting food grain production.

Agricultural Subsidies Fuel Ammonium Nitrate Usage

Government initiatives, particularly in major agricultural economies like China, India, and the United States, are bolstering the use of ammonium nitrate. For example, China's significant subsidy of 20 billion yuan ($3.1 billion) to grain farmers exemplifies this industry trend. These subsidies and favorable policies are instrumental in promoting fertilizer use, thus propelling the demand for ammonium nitrate in these regions.

Biofuel Production Spurs Fertilizer Consumption

The escalating production of biofuels, utilizing crops like corn, sugar, and palm acid oil, is another driver for ammonium nitrate market growth. As biofuel production reaches new heights, with ethanol production alone surpassing 28 billion gallons globally in 2022, the demand for fertilizers to support high-yielding biofuel feedstocks is concurrently rising. Ammonium nitrate demand has skyrocketed alongside biofuel production due to rising crop production yields required.

Restraining Factors

Regulatory Constraints Dampen Ammonium Nitrate Market Expansion

Ammonium nitrate, due to its potential misuse in explosives, is subject to rigorous regulatory controls affecting its sale, storage, and transportation. These stringent regulations have notably increased compliance costs for manufacturers and distributors, which in turn restrains the market's growth potential. In the United States, for instance, purchasers of ammonium nitrate must register with the Department of Homeland Security, reflecting the heightened security measures surrounding its use.

Environmental and Health Concerns Limit Ammonium Nitrate Adoption

The use of ammonium nitrate poses significant environmental and health risks, notably in terms of water pollution and toxic emissions during production. The runoff of ammonium nitrate into water bodies can lead to serious contamination issues, while its manufacturing process is associated with the release of harmful nitrogen oxide (NOx) gases. These environmental and health concerns are increasingly influencing regulatory policies and consumer preferences. For example, the European Union, under its Farm to Fork Strategy, is actively working to reduce fertilizer pollution, which includes mitigating the adverse impacts of substances like ammonium nitrate.

By Application Analysis

Fertilizers Lead In Ammonium Nitrate Market, Driven By Application.

In the ammonium nitrate market, Fertilizers are the dominant application segment. This dominance is primarily driven by the critical role ammonium nitrate plays as a nitrogenous fertilizer, providing essential nutrients to crops. Its high nitrogen content makes it particularly effective for various agricultural applications, enhancing crop yield and quality. Food crops have seen increased global demand in recent years, necessitating more efficient fertilizers like ammonium nitrate.

Explosives applications make extensive use of ammonium nitrate, especially in mining and construction where it serves as a key ingredient of ANFO (Ammonium Nitrate Fuel Oil) explosives. However, the fertilizer segment surpasses Explosives in terms of volume and market share due to the widespread and growing global agricultural sector. Other applications of ammonium nitrate include industrial uses, but these are relatively minor compared to its use in Fertilizers and Explosives.

By End-Use Analysis

Agriculture Dominates Ammonium Nitrate Market By End-Use Demand.

Agriculture is the foremost end-use segment for ammonium nitrate, largely owing to its efficiency as a nitrogenous fertilizer. The agricultural sector's reliance on effective fertilization methods to enhance crop productivity has made ammonium nitrate a staple in farming practices. Its quick solubility and the rapid availability of liquid nitrogen to plants are key factors driving its demand in agriculture.

In other end-use sectors like Industries, Mining, and Defense, ammonium nitrate finds applications primarily in explosives manufacturing. In Mining, it is used in blasting and quarrying operations. The Defense sector also utilizes it in some munitions. However, usage in these sectors remains significantly lower compared to Agriculture which remains the leading consumer of ammonium nitrate as fertilizer due to global expansion and continued demand for agricultural produce, thus driving demand for ammonium nitrate as fertilizer.

Key Market Segments

By Application

- Fertilizers

- Explosives

- Others

By End Use

- Agriculture

- Industries

- Mining

- Defense

- Other

Growth Opportunity

Precision Farming Technologies: A Catalyst for Ammonium Nitrate Market Growth

The integration of precision farming technologies is revolutionizing the ammonium nitrate market. With the global precision farming market projected to grow significantly, reaching around USD 33.8 billion by 2032, the application of technologies like GPS, soil sensors, and variable rate fertilizers is enhancing the efficiency of ammonium nitrate usage. This trend not only addresses sustainability concerns by minimizing wastage and environmental impact but also bolsters demand for ammonium nitrate. Precision farming facilitates the optimal application of this fertilizer, ensuring that its use aligns with specific agricultural requirements and environmental considerations, thereby sustainably driving market growth.

Controlled-Release Fertilizers: Enhancing Efficiency in Ammonium Nitrate Utilization

The development of controlled-release fertilizers presents substantial growth opportunities for the ammonium nitrate market. By incorporating controlled-release coatings on ammonium nitrate prills, these fertilizers ensure an extended and more efficient nutrient release. This approach, exemplified by products like Nutrients ESN controlled-release fertilizer, is increasingly preferred by farmers for its ability to provide nutrients tailored to crop cycles. Compared to conventional fertilizers, these controlled-release solutions enhance the effectiveness and efficiency of ammonium nitrate, thereby not only meeting the agronomic needs of diverse crops but also propelling growth and innovation within the ammonium nitrate market.

Latest Trends

Enhanced Safety Regulations

Recent trends show a surge in demand for ammonium nitrate propelled by heightened safety regulations in various industries. Stricter enforcement of safety protocols, particularly in mining and construction sectors, compels businesses to seek safer yet effective alternatives for explosives and fertilizers, boosting the consumption of ammonium nitrate.

Innovative Applications in Agriculture

The agricultural sector witnesses a notable trend towards the adoption of ammonium nitrate due to its effectiveness as a fertilizer. Innovations in agronomic practices and precision farming techniques further drive this demand, as farmers increasingly rely on high-quality nitrogen sources like ammonium nitrate to optimize crop yields while minimizing environmental impact.

Regional Analysis

North America Dominates with 25% Market Share in the Ammonium Nitrate Industry

North America's 25% share in the global ammonium nitrate market is principally driven by its robust agricultural sector, where ammonium nitrate is widely used as a high-nitrogen fertilizer. Due to advanced agricultural practices in the region, efficient and effective fertilizers such as ammonium nitrate are in high demand. Additionally, the region's well-established industrial base, particularly in the mining sector, where ammonium nitrate is used as an explosive, further consolidates its market position. The presence of leading chemical manufacturers in the United States and Canada also supports this market dominance.

Ammonium nitrate sales in North America are heavily governed by stringent storage and transport regulations due to their potential use as explosives. This regulatory environment impacts market operations and supply chains. Innovations in fertilizer technology and a shift towards sustainable agricultural practices are also reshaping market dynamics. The market faces challenges from alternative nitrogenous fertilizers and the fluctuating costs of raw materials.

Europe’s Role in the Ammonium Nitrate Market

Europe holds a significant share of the ammonium nitrate market, supported by its strong agricultural industry growth. Environmental policies and advanced farming techniques drive the demand for efficient fertilizers.

Asia Pacific’s Impact on the Ammonium Nitrate Market

Asia Pacific is quickly emerging as a key market for ammonium nitrate production, thanks to its expanding agricultural and mining sectors. Countries like China and India are major contributors, with their increasing demand for high-efficiency fertilizers and industrial explosives.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

Within the global ammonium nitrate market, key players' interdependence dictates its trajectory. EuroChem Group, a formidable player, leverages its expansive production capabilities and distribution networks, significantly influencing market supply chains. Their strategic global positioning enables them to cater to diverse agricultural and industrial sectors.

Orica Limited and CF Industries Holdings, Inc., are renowned for their specialized focus on the mining and agricultural sectors, respectively. Their targeted approach and continuous innovation in product offerings and supply chain management significantly impact their market segments.

URALCHEM JSC and Yara International ASA stand out for their extensive global presence and commitment to sustainable practices. Their strategies often involve significant investments in environmentally friendly technologies and practices, catering to a growing demand for eco-efficient products.

Market Key Players

- EuroChem GroupOrica Limited

- CF Industries Holdings, Inc.

- URALCHEM JSC

- Yara International ASA

- Enaex S.A

- San Corporation

- OSTCHEM Holding Company

- Austin Powder International

- CSBP Limited

- TradeMark Nitrogen

- Achema AB

- Agrico Canada L.P. (Sollio Cooperative Group)

- Barium & Chemicals

- Wentong Potassium Salt Group Co. Ltd.

Recent Development

- In January 2024, Tecnimont, leading a consortium, secured a $300 million EPC contract to construct an advanced ammonium nitrate plant in Egypt, aimed at improving environmental standards, energy efficiency, and agricultural productivity.

- In December 2023, City University of Hong Kong researchers engineered a bimetallic alloy nanocatalyst, RuFe nanoflowers, to improve electrochemical ammonia synthesis from nitrate, a potential breakthrough for carbon-neutral fuel production.

Report Scope

Report Features Description Market Value (2023) USD 16.3 Billion Forecast Revenue (2033) USD 24.6 Billion CAGR (2024-2032) 4.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application(Fertilizers, Explosives, Others), By End Use(Agriculture, Industries, Mining, Defense, Other) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape EuroChem Group, Orica Limited, CF Industries Holdings, Inc., URALCHEM JSC, Yara International ASA, Enaex S.A, San Corporation, OSTCHEM Holding Company, Austin Powder International, CSBP Limited, TradeMark Nitrogen, Achema AB, Agrico Canada L.P. (Sollio Cooperative Group), Barium & Chemicals, Wentong Potassium Salt Group Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Ammonium Nitrate Market Overview

- 2.1. Ammonium Nitrate Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Ammonium Nitrate Market Dynamics

- 3. Global Ammonium Nitrate Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Ammonium Nitrate Market Analysis, 2016-2021

- 3.2. Global Ammonium Nitrate Market Opportunity and Forecast, 2023-2032

- 3.3. Global Ammonium Nitrate Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.3.1. Global Ammonium Nitrate Market Analysis by By Application: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.3.3. Fertilizers

- 3.3.4. Explosives

- 3.3.5. Others

- 3.4. Global Ammonium Nitrate Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 3.4.1. Global Ammonium Nitrate Market Analysis by By End Use: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 3.4.3. Agriculture

- 3.4.4. Industries

- 3.4.5. Mining

- 3.4.6. Defense

- 3.4.7. Other

- 4. North America Ammonium Nitrate Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Ammonium Nitrate Market Analysis, 2016-2021

- 4.2. North America Ammonium Nitrate Market Opportunity and Forecast, 2023-2032

- 4.3. North America Ammonium Nitrate Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.3.1. North America Ammonium Nitrate Market Analysis by By Application: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.3.3. Fertilizers

- 4.3.4. Explosives

- 4.3.5. Others

- 4.4. North America Ammonium Nitrate Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 4.4.1. North America Ammonium Nitrate Market Analysis by By End Use: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 4.4.3. Agriculture

- 4.4.4. Industries

- 4.4.5. Mining

- 4.4.6. Defense

- 4.4.7. Other

- 4.5. North America Ammonium Nitrate Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Ammonium Nitrate Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Ammonium Nitrate Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Ammonium Nitrate Market Analysis, 2016-2021

- 5.2. Western Europe Ammonium Nitrate Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Ammonium Nitrate Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.3.1. Western Europe Ammonium Nitrate Market Analysis by By Application: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.3.3. Fertilizers

- 5.3.4. Explosives

- 5.3.5. Others

- 5.4. Western Europe Ammonium Nitrate Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 5.4.1. Western Europe Ammonium Nitrate Market Analysis by By End Use: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 5.4.3. Agriculture

- 5.4.4. Industries

- 5.4.5. Mining

- 5.4.6. Defense

- 5.4.7. Other

- 5.5. Western Europe Ammonium Nitrate Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Ammonium Nitrate Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Ammonium Nitrate Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Ammonium Nitrate Market Analysis, 2016-2021

- 6.2. Eastern Europe Ammonium Nitrate Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Ammonium Nitrate Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.3.1. Eastern Europe Ammonium Nitrate Market Analysis by By Application: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.3.3. Fertilizers

- 6.3.4. Explosives

- 6.3.5. Others

- 6.4. Eastern Europe Ammonium Nitrate Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 6.4.1. Eastern Europe Ammonium Nitrate Market Analysis by By End Use: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 6.4.3. Agriculture

- 6.4.4. Industries

- 6.4.5. Mining

- 6.4.6. Defense

- 6.4.7. Other

- 6.5. Eastern Europe Ammonium Nitrate Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Ammonium Nitrate Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Ammonium Nitrate Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Ammonium Nitrate Market Analysis, 2016-2021

- 7.2. APAC Ammonium Nitrate Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Ammonium Nitrate Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.3.1. APAC Ammonium Nitrate Market Analysis by By Application: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.3.3. Fertilizers

- 7.3.4. Explosives

- 7.3.5. Others

- 7.4. APAC Ammonium Nitrate Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 7.4.1. APAC Ammonium Nitrate Market Analysis by By End Use: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 7.4.3. Agriculture

- 7.4.4. Industries

- 7.4.5. Mining

- 7.4.6. Defense

- 7.4.7. Other

- 7.5. APAC Ammonium Nitrate Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Ammonium Nitrate Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Ammonium Nitrate Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Ammonium Nitrate Market Analysis, 2016-2021

- 8.2. Latin America Ammonium Nitrate Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Ammonium Nitrate Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.3.1. Latin America Ammonium Nitrate Market Analysis by By Application: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.3.3. Fertilizers

- 8.3.4. Explosives

- 8.3.5. Others

- 8.4. Latin America Ammonium Nitrate Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 8.4.1. Latin America Ammonium Nitrate Market Analysis by By End Use: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 8.4.3. Agriculture

- 8.4.4. Industries

- 8.4.5. Mining

- 8.4.6. Defense

- 8.4.7. Other

- 8.5. Latin America Ammonium Nitrate Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Ammonium Nitrate Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Ammonium Nitrate Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Ammonium Nitrate Market Analysis, 2016-2021

- 9.2. Middle East & Africa Ammonium Nitrate Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Ammonium Nitrate Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.3.1. Middle East & Africa Ammonium Nitrate Market Analysis by By Application: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.3.3. Fertilizers

- 9.3.4. Explosives

- 9.3.5. Others

- 9.4. Middle East & Africa Ammonium Nitrate Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 9.4.1. Middle East & Africa Ammonium Nitrate Market Analysis by By End Use: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 9.4.3. Agriculture

- 9.4.4. Industries

- 9.4.5. Mining

- 9.4.6. Defense

- 9.4.7. Other

- 9.5. Middle East & Africa Ammonium Nitrate Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Ammonium Nitrate Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Ammonium Nitrate Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Ammonium Nitrate Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Ammonium Nitrate Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. EuroChem Group

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Orica Limited

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. CF Industries Holdings, Inc.

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. URALCHEM JSC

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Yara International ASA

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Enaex S.A

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. San Corporation

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. OSTCHEM Holding Company

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Austin Powder International

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. CSBP Limited

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. TradeMark Nitrogen

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Agrico Canada L.P. (Sollio Cooperative Group)

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Barium & Chemicals

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Wentong Potassium Salt Group Co. Ltd.

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Ammonium Nitrate Market Revenue (US$ Mn) Market Share by By Application in 2022

- Figure 2: Global Ammonium Nitrate Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 3: Global Ammonium Nitrate Market Revenue (US$ Mn) Market Share by By End Usein 2022

- Figure 4: Global Ammonium Nitrate Market Market Attractiveness Analysis by By End Use, 2016-2032

- Figure 5: Global Ammonium Nitrate Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Ammonium Nitrate Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Ammonium Nitrate Market Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 10: Global Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Figure 11: Global Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 13: Global Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Figure 14: Global Ammonium Nitrate Market Market Share Comparison by Region (2016-2032)

- Figure 15: Global Ammonium Nitrate Market Market Share Comparison by By Application (2016-2032)

- Figure 16: Global Ammonium Nitrate Market Market Share Comparison by By End Use (2016-2032)

- Figure 17: North America Ammonium Nitrate Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 18: North America Ammonium Nitrate Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 19: North America Ammonium Nitrate Market Revenue (US$ Mn) Market Share by By End Usein 2022

- Figure 20: North America Ammonium Nitrate Market Market Attractiveness Analysis by By End Use, 2016-2032

- Figure 21: North America Ammonium Nitrate Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Ammonium Nitrate Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Ammonium Nitrate Market Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 26: North America Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Figure 27: North America Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 29: North America Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Figure 30: North America Ammonium Nitrate Market Market Share Comparison by Country (2016-2032)

- Figure 31: North America Ammonium Nitrate Market Market Share Comparison by By Application (2016-2032)

- Figure 32: North America Ammonium Nitrate Market Market Share Comparison by By End Use (2016-2032)

- Figure 33: Western Europe Ammonium Nitrate Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 34: Western Europe Ammonium Nitrate Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 35: Western Europe Ammonium Nitrate Market Revenue (US$ Mn) Market Share by By End Usein 2022

- Figure 36: Western Europe Ammonium Nitrate Market Market Attractiveness Analysis by By End Use, 2016-2032

- Figure 37: Western Europe Ammonium Nitrate Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Ammonium Nitrate Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Ammonium Nitrate Market Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 42: Western Europe Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Figure 43: Western Europe Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 45: Western Europe Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Figure 46: Western Europe Ammonium Nitrate Market Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Ammonium Nitrate Market Market Share Comparison by By Application (2016-2032)

- Figure 48: Western Europe Ammonium Nitrate Market Market Share Comparison by By End Use (2016-2032)

- Figure 49: Eastern Europe Ammonium Nitrate Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 50: Eastern Europe Ammonium Nitrate Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 51: Eastern Europe Ammonium Nitrate Market Revenue (US$ Mn) Market Share by By End Usein 2022

- Figure 52: Eastern Europe Ammonium Nitrate Market Market Attractiveness Analysis by By End Use, 2016-2032

- Figure 53: Eastern Europe Ammonium Nitrate Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Ammonium Nitrate Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Ammonium Nitrate Market Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 58: Eastern Europe Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Figure 59: Eastern Europe Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 61: Eastern Europe Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Figure 62: Eastern Europe Ammonium Nitrate Market Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Ammonium Nitrate Market Market Share Comparison by By Application (2016-2032)

- Figure 64: Eastern Europe Ammonium Nitrate Market Market Share Comparison by By End Use (2016-2032)

- Figure 65: APAC Ammonium Nitrate Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 66: APAC Ammonium Nitrate Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 67: APAC Ammonium Nitrate Market Revenue (US$ Mn) Market Share by By End Usein 2022

- Figure 68: APAC Ammonium Nitrate Market Market Attractiveness Analysis by By End Use, 2016-2032

- Figure 69: APAC Ammonium Nitrate Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Ammonium Nitrate Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Ammonium Nitrate Market Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 74: APAC Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Figure 75: APAC Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 77: APAC Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Figure 78: APAC Ammonium Nitrate Market Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Ammonium Nitrate Market Market Share Comparison by By Application (2016-2032)

- Figure 80: APAC Ammonium Nitrate Market Market Share Comparison by By End Use (2016-2032)

- Figure 81: Latin America Ammonium Nitrate Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 82: Latin America Ammonium Nitrate Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 83: Latin America Ammonium Nitrate Market Revenue (US$ Mn) Market Share by By End Usein 2022

- Figure 84: Latin America Ammonium Nitrate Market Market Attractiveness Analysis by By End Use, 2016-2032

- Figure 85: Latin America Ammonium Nitrate Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Ammonium Nitrate Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Ammonium Nitrate Market Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 90: Latin America Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Figure 91: Latin America Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 93: Latin America Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Figure 94: Latin America Ammonium Nitrate Market Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Ammonium Nitrate Market Market Share Comparison by By Application (2016-2032)

- Figure 96: Latin America Ammonium Nitrate Market Market Share Comparison by By End Use (2016-2032)

- Figure 97: Middle East & Africa Ammonium Nitrate Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 98: Middle East & Africa Ammonium Nitrate Market Market Attractiveness Analysis by By Application, 2016-2032

- Figure 99: Middle East & Africa Ammonium Nitrate Market Revenue (US$ Mn) Market Share by By End Usein 2022

- Figure 100: Middle East & Africa Ammonium Nitrate Market Market Attractiveness Analysis by By End Use, 2016-2032

- Figure 101: Middle East & Africa Ammonium Nitrate Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Ammonium Nitrate Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Ammonium Nitrate Market Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 106: Middle East & Africa Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Figure 107: Middle East & Africa Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 109: Middle East & Africa Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Figure 110: Middle East & Africa Ammonium Nitrate Market Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Ammonium Nitrate Market Market Share Comparison by By Application (2016-2032)

- Figure 112: Middle East & Africa Ammonium Nitrate Market Market Share Comparison by By End Use (2016-2032)

"

- List of Tables

- "

- Table 1: Global Ammonium Nitrate Market Market Comparison by By Application (2016-2032)

- Table 2: Global Ammonium Nitrate Market Market Comparison by By End Use (2016-2032)

- Table 3: Global Ammonium Nitrate Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Ammonium Nitrate Market Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 7: Global Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Table 8: Global Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 10: Global Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Table 11: Global Ammonium Nitrate Market Market Share Comparison by Region (2016-2032)

- Table 12: Global Ammonium Nitrate Market Market Share Comparison by By Application (2016-2032)

- Table 13: Global Ammonium Nitrate Market Market Share Comparison by By End Use (2016-2032)

- Table 14: North America Ammonium Nitrate Market Market Comparison by By End Use (2016-2032)

- Table 15: North America Ammonium Nitrate Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Ammonium Nitrate Market Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 19: North America Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Table 20: North America Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 22: North America Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Table 23: North America Ammonium Nitrate Market Market Share Comparison by Country (2016-2032)

- Table 24: North America Ammonium Nitrate Market Market Share Comparison by By Application (2016-2032)

- Table 25: North America Ammonium Nitrate Market Market Share Comparison by By End Use (2016-2032)

- Table 26: Western Europe Ammonium Nitrate Market Market Comparison by By Application (2016-2032)

- Table 27: Western Europe Ammonium Nitrate Market Market Comparison by By End Use (2016-2032)

- Table 28: Western Europe Ammonium Nitrate Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Ammonium Nitrate Market Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 32: Western Europe Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Table 33: Western Europe Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 35: Western Europe Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Table 36: Western Europe Ammonium Nitrate Market Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Ammonium Nitrate Market Market Share Comparison by By Application (2016-2032)

- Table 38: Western Europe Ammonium Nitrate Market Market Share Comparison by By End Use (2016-2032)

- Table 39: Eastern Europe Ammonium Nitrate Market Market Comparison by By Application (2016-2032)

- Table 40: Eastern Europe Ammonium Nitrate Market Market Comparison by By End Use (2016-2032)

- Table 41: Eastern Europe Ammonium Nitrate Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Ammonium Nitrate Market Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 45: Eastern Europe Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Table 46: Eastern Europe Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 48: Eastern Europe Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Table 49: Eastern Europe Ammonium Nitrate Market Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Ammonium Nitrate Market Market Share Comparison by By Application (2016-2032)

- Table 51: Eastern Europe Ammonium Nitrate Market Market Share Comparison by By End Use (2016-2032)

- Table 52: APAC Ammonium Nitrate Market Market Comparison by By Application (2016-2032)

- Table 53: APAC Ammonium Nitrate Market Market Comparison by By End Use (2016-2032)

- Table 54: APAC Ammonium Nitrate Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Ammonium Nitrate Market Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 58: APAC Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Table 59: APAC Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 61: APAC Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Table 62: APAC Ammonium Nitrate Market Market Share Comparison by Country (2016-2032)

- Table 63: APAC Ammonium Nitrate Market Market Share Comparison by By Application (2016-2032)

- Table 64: APAC Ammonium Nitrate Market Market Share Comparison by By End Use (2016-2032)

- Table 65: Latin America Ammonium Nitrate Market Market Comparison by By Application (2016-2032)

- Table 66: Latin America Ammonium Nitrate Market Market Comparison by By End Use (2016-2032)

- Table 67: Latin America Ammonium Nitrate Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Ammonium Nitrate Market Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 71: Latin America Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Table 72: Latin America Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 74: Latin America Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Table 75: Latin America Ammonium Nitrate Market Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Ammonium Nitrate Market Market Share Comparison by By Application (2016-2032)

- Table 77: Latin America Ammonium Nitrate Market Market Share Comparison by By End Use (2016-2032)

- Table 78: Middle East & Africa Ammonium Nitrate Market Market Comparison by By Application (2016-2032)

- Table 79: Middle East & Africa Ammonium Nitrate Market Market Comparison by By End Use (2016-2032)

- Table 80: Middle East & Africa Ammonium Nitrate Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Ammonium Nitrate Market Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 84: Middle East & Africa Ammonium Nitrate Market Market Revenue (US$ Mn) Comparison by By End Use (2016-2032)

- Table 85: Middle East & Africa Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 87: Middle East & Africa Ammonium Nitrate Market Market Y-o-Y Growth Rate Comparison by By End Use (2016-2032)

- Table 88: Middle East & Africa Ammonium Nitrate Market Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Ammonium Nitrate Market Market Share Comparison by By Application (2016-2032)

- Table 90: Middle East & Africa Ammonium Nitrate Market Market Share Comparison by By End Use (2016-2032)

- 1. Executive Summary

-

- EuroChem GroupOrica Limited

- CF Industries Holdings, Inc.

- URALCHEM JSC

- Yara International ASA

- Enaex S.A

- San Corporation

- OSTCHEM Holding Company

- Austin Powder International

- CSBP Limited

- TradeMark Nitrogen

- Achema AB

- Agrico Canada L.P. (Sollio Cooperative Group)

- Barium & Chemicals

- Wentong Potassium Salt Group Co. Ltd.