Ammonium Nitrate Market By Application(Fertilizers, Explosives, Others), By End Use(Agriculture, Industries, Mining, Defense, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43375

-

Feb 2024

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

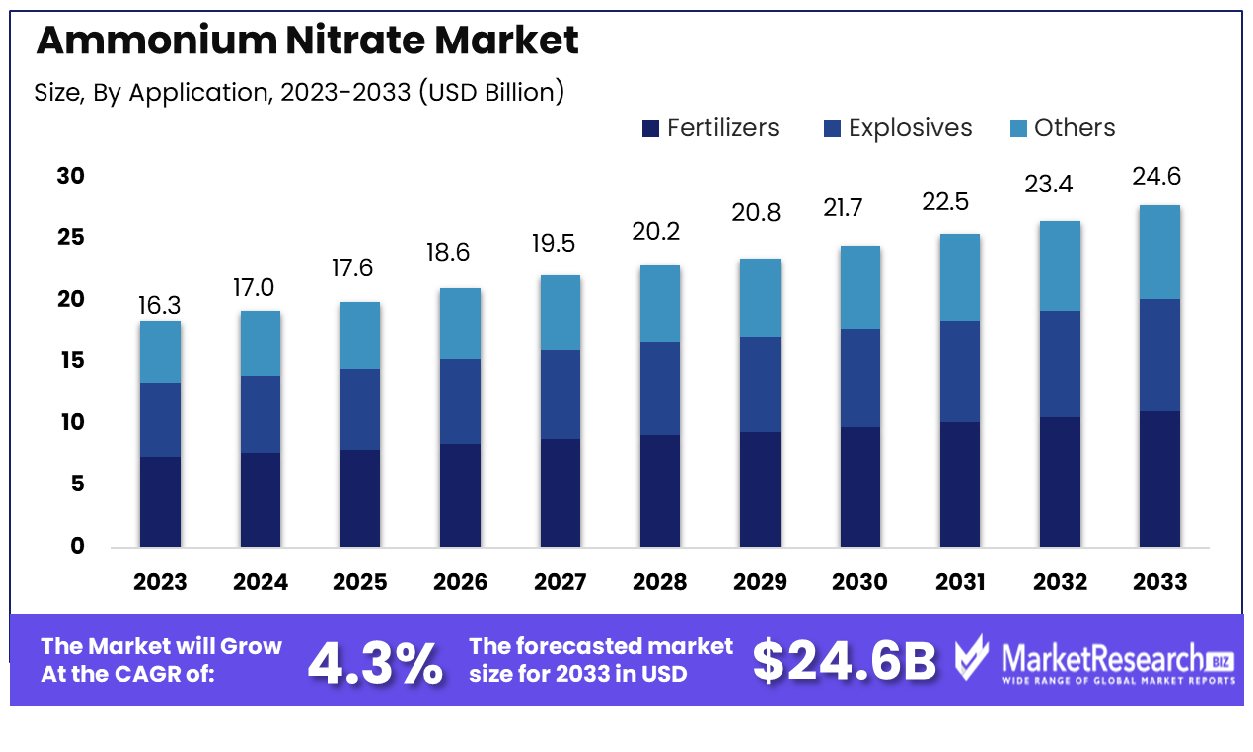

The Ammonium Nitrate Market was valued at USD 16.3 billion in 2023. It is expected to reach USD 24.6 billion by 2033, with a CAGR of 4.3% during the forecast period from 2024 to 2033.

The surge in demand for the fertilizers in agricultural sector and the rise in the requirement for ammonium nitrate fuel oil are some of the main key driving factors for the ammonium nitrate market.

Ammonium nitrate is defined as a chemical compound with the formula NH4NO3. It is a white crystalline solid compound that is commonly used in the agricultural sector due to its high nitrogen content. This compound is composed of ammonium ions and nitrate ions which makes it a versatile source of nitrogen as an important nutrient for plant growth. Besides its usage in agricultural applications, ammonium nitrate has been lately used in the production of explosives, as it can form exothermic reactions when integrated with some substances.

But, due to its capability of misusing in making the bomb, there have been strict regulations, guidelines, and safety measures, which can monitor its handling and distribution. The compound got much international attention after being involved in many industrial accidents and terrorist attacks, prominence the importance of responsible handling and stage.

An article published by ICIS in April 2023, highlights that India’s Chambal Fertilizers is developing a greenfield 240,000 tonnes/year technical ammonium nitrate plant at its Gadepan complex in the north-western Rajasthan state. As per this report, the firm plans to build up the ammonium nitrate plant (TAN) as well as 210,000 tonne/year weak nitric acid (WNA) line at an anticipated cost of USD 201 million. Moreover, an article published by MarketScreener in January 2023, highlights that KAZAZOT, one of the well-known firms in industry in Kazakhstan has selected Tecnicas Reunidas as the contractor to make new ammonium urea, nitric acid, and ammonium nitrate complex, with a total investment around USD 1 billion. Furthermore, Tecnicas Reunidas will start the engineering design first under a FEED OBE that will need about 200.00 engineering hours.

In the agricultural sector, ammonium nitrate plays a vital role as it is widely used as fertilizer by offering important nitrogen to improve plant growth and cultivation. It is water soluble and allows excellent nutrient absorption by plants. Moreover, ammonium nitrates are also being used in instant cold packs, for the treatment of some titanium ores and it is being used for the preparation of nitrous oxide. Demand for ammonium nitrate will steadily increase due to its demand from agriculture, leading to market expansion during this forecast period.

Key Takeaways

- Market Growth: Ammonium Nitrate Market was valued at USD 16.3 billion in 2023 and is expected to reach USD 24.6 billion by 2033, with a CAGR of 4.3% during the forecast period from 2024 to 2033.

- By Application: Fertilizers hold the dominant share in the ammonium nitrate market in terms of application.

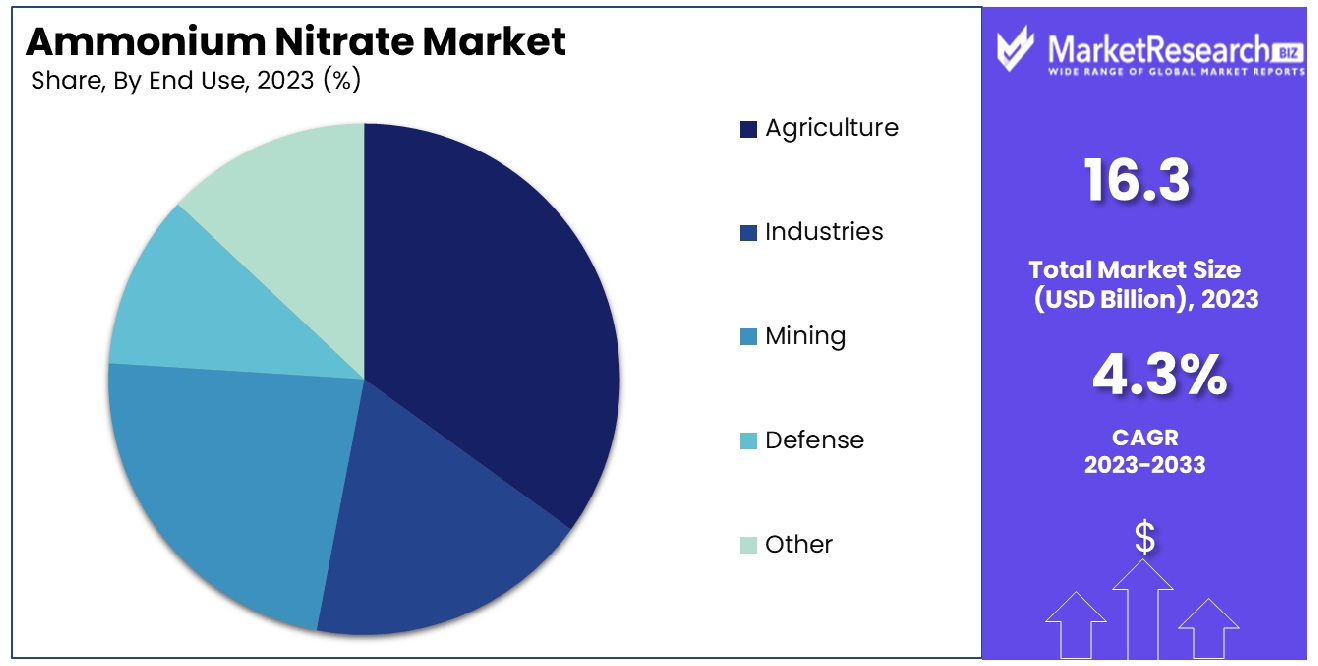

- By End Use: Agriculture emerges as the primary consumer, dominating the end-use sector for ammonium nitrate.

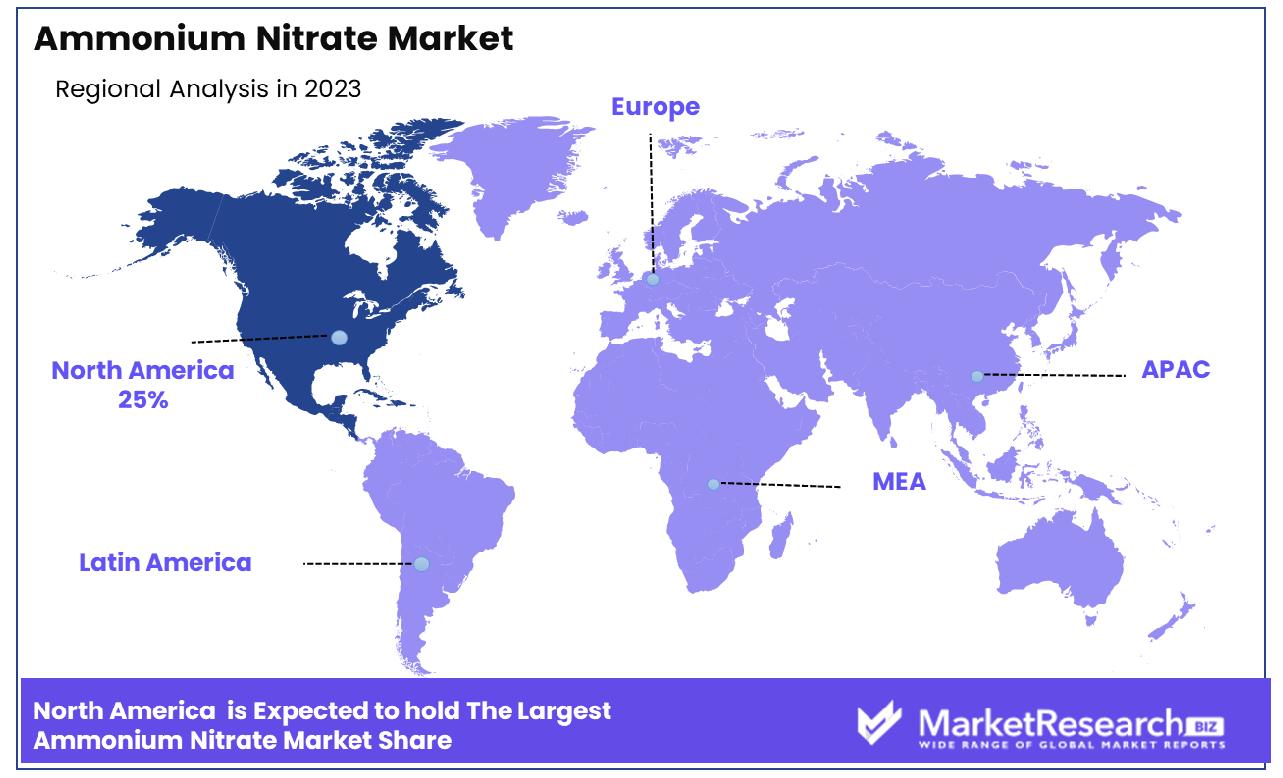

- Regional Dominance: In the Ammonium Nitrate industry, North America commands a substantial market share of 25%.

- Growth Opportunity: Precision farming technologies and controlled-release fertilizers are driving growth in the ammonium nitrate market by enhancing efficiency and sustainability.

Driving factors

Population Surge Elevates Ammonium Nitrate Demand for Food Production

The burgeoning global population, projected by the UN to reach 9.7 billion by 2050, necessitates a substantial increase in food production. This scenario is elevating the demand for fertilizers, including ammonium nitrate, to enhance crop yields. The correlation is clear: as the population grows, so does the need for efficient and effective agricultural practices, where ammonium nitrate plays a pivotal role in boosting food grain production.

Agricultural Subsidies Fuel Ammonium Nitrate Usage

Government initiatives, particularly in major agricultural economies like China, India, and the United States, are bolstering the use of ammonium nitrate. For example, China's significant subsidy of 20 billion yuan ($3.1 billion) to grain farmers exemplifies this industry trend. These subsidies and favorable policies are instrumental in promoting fertilizer use, thus propelling the demand for ammonium nitrate in these regions.

Biofuel Production Spurs Fertilizer Consumption

The escalating production of biofuels, utilizing crops like corn, sugar, and palm acid oil, is another driver for ammonium nitrate market growth. As biofuel production reaches new heights, with ethanol production alone surpassing 28 billion gallons globally in 2022, the demand for fertilizers to support high-yielding biofuel feedstocks is concurrently rising. Ammonium nitrate demand has skyrocketed alongside biofuel production due to rising crop production yields required.

Restraining Factors

Regulatory Constraints Dampen Ammonium Nitrate Market Expansion

Ammonium nitrate, due to its potential misuse in explosives, is subject to rigorous regulatory controls affecting its sale, storage, and transportation. These stringent regulations have notably increased compliance costs for manufacturers and distributors, which in turn restrains the market's growth potential. In the United States, for instance, purchasers of ammonium nitrate must register with the Department of Homeland Security, reflecting the heightened security measures surrounding its use.

Environmental and Health Concerns Limit Ammonium Nitrate Adoption

The use of ammonium nitrate poses significant environmental and health risks, notably in terms of water pollution and toxic emissions during production. The runoff of ammonium nitrate into water bodies can lead to serious contamination issues, while its manufacturing process is associated with the release of harmful nitrogen oxide (NOx) gases. These environmental and health concerns are increasingly influencing regulatory policies and consumer preferences. For example, the European Union, under its Farm to Fork Strategy, is actively working to reduce fertilizer pollution, which includes mitigating the adverse impacts of substances like ammonium nitrate.

By Application Analysis

Fertilizers Lead In Ammonium Nitrate Market, Driven By Application.

In the ammonium nitrate market, Fertilizers are the dominant application segment. This dominance is primarily driven by the critical role ammonium nitrate plays as a nitrogenous fertilizer, providing essential nutrients to crops. Its high nitrogen content makes it particularly effective for various agricultural applications, enhancing crop yield and quality. Food crops have seen increased global demand in recent years, necessitating more efficient fertilizers like ammonium nitrate.

Explosives applications make extensive use of ammonium nitrate, especially in mining and construction where it serves as a key ingredient of ANFO (Ammonium Nitrate Fuel Oil) explosives. However, the fertilizer segment surpasses Explosives in terms of volume and market share due to the widespread and growing global agricultural sector. Other applications of ammonium nitrate include industrial uses, but these are relatively minor compared to its use in Fertilizers and Explosives.

By End-Use Analysis

Agriculture Dominates Ammonium Nitrate Market By End-Use Demand.

Agriculture is the foremost end-use segment for ammonium nitrate, largely owing to its efficiency as a nitrogenous fertilizer. The agricultural sector's reliance on effective fertilization methods to enhance crop productivity has made ammonium nitrate a staple in farming practices. Its quick solubility and the rapid availability of liquid nitrogen to plants are key factors driving its demand in agriculture.

In other end-use sectors like Industries, Mining, and Defense, ammonium nitrate finds applications primarily in explosives manufacturing. In Mining, it is used in blasting and quarrying operations. The Defense sector also utilizes it in some munitions. However, usage in these sectors remains significantly lower compared to Agriculture which remains the leading consumer of ammonium nitrate as fertilizer due to global expansion and continued demand for agricultural produce, thus driving demand for ammonium nitrate as fertilizer.

Key Market Segments

By Application

- Fertilizers

- Explosives

- Others

By End Use

- Agriculture

- Industries

- Mining

- Defense

- Other

Growth Opportunity

Precision Farming Technologies: A Catalyst for Ammonium Nitrate Market Growth

The integration of precision farming technologies is revolutionizing the ammonium nitrate market. With the global precision farming market projected to grow significantly, reaching around USD 33.8 billion by 2032, the application of technologies like GPS, soil sensors, and variable rate fertilizers is enhancing the efficiency of ammonium nitrate usage. This trend not only addresses sustainability concerns by minimizing wastage and environmental impact but also bolsters demand for ammonium nitrate. Precision farming facilitates the optimal application of this fertilizer, ensuring that its use aligns with specific agricultural requirements and environmental considerations, thereby sustainably driving market growth.

Controlled-Release Fertilizers: Enhancing Efficiency in Ammonium Nitrate Utilization

The development of controlled-release fertilizers presents substantial growth opportunities for the ammonium nitrate market. By incorporating controlled-release coatings on ammonium nitrate prills, these fertilizers ensure an extended and more efficient nutrient release. This approach, exemplified by products like Nutrients ESN controlled-release fertilizer, is increasingly preferred by farmers for its ability to provide nutrients tailored to crop cycles. Compared to conventional fertilizers, these controlled-release solutions enhance the effectiveness and efficiency of ammonium nitrate, thereby not only meeting the agronomic needs of diverse crops but also propelling growth and innovation within the ammonium nitrate market.

Latest Trends

Enhanced Safety Regulations

Recent trends show a surge in demand for ammonium nitrate propelled by heightened safety regulations in various industries. Stricter enforcement of safety protocols, particularly in mining and construction sectors, compels businesses to seek safer yet effective alternatives for explosives and fertilizers, boosting the consumption of ammonium nitrate.

Innovative Applications in Agriculture

The agricultural sector witnesses a notable trend towards the adoption of ammonium nitrate due to its effectiveness as a fertilizer. Innovations in agronomic practices and precision farming techniques further drive this demand, as farmers increasingly rely on high-quality nitrogen sources like ammonium nitrate to optimize crop yields while minimizing environmental impact.

Regional Analysis

North America Dominates with 25% Market Share in the Ammonium Nitrate Industry

North America's 25% share in the global ammonium nitrate market is principally driven by its robust agricultural sector, where ammonium nitrate is widely used as a high-nitrogen fertilizer. Due to advanced agricultural practices in the region, efficient and effective fertilizers such as ammonium nitrate are in high demand. Additionally, the region's well-established industrial base, particularly in the mining sector, where ammonium nitrate is used as an explosive, further consolidates its market position. The presence of leading chemical manufacturers in the United States and Canada also supports this market dominance.

Ammonium nitrate sales in North America are heavily governed by stringent storage and transport regulations due to their potential use as explosives. This regulatory environment impacts market operations and supply chains. Innovations in fertilizer technology and a shift towards sustainable agricultural practices are also reshaping market dynamics. The market faces challenges from alternative nitrogenous fertilizers and the fluctuating costs of raw materials.

Europe’s Role in the Ammonium Nitrate Market

Europe holds a significant share of the ammonium nitrate market, supported by its strong agricultural industry growth. Environmental policies and advanced farming techniques drive the demand for efficient fertilizers.

Asia Pacific’s Impact on the Ammonium Nitrate Market

Asia Pacific is quickly emerging as a key market for ammonium nitrate production, thanks to its expanding agricultural and mining sectors. Countries like China and India are major contributors, with their increasing demand for high-efficiency fertilizers and industrial explosives.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

Within the global ammonium nitrate market, key players' interdependence dictates its trajectory. EuroChem Group, a formidable player, leverages its expansive production capabilities and distribution networks, significantly influencing market supply chains. Their strategic global positioning enables them to cater to diverse agricultural and industrial sectors.

Orica Limited and CF Industries Holdings, Inc., are renowned for their specialized focus on the mining and agricultural sectors, respectively. Their targeted approach and continuous innovation in product offerings and supply chain management significantly impact their market segments.

URALCHEM JSC and Yara International ASA stand out for their extensive global presence and commitment to sustainable practices. Their strategies often involve significant investments in environmentally friendly technologies and practices, catering to a growing demand for eco-efficient products.

Market Key Players

- EuroChem GroupOrica Limited

- CF Industries Holdings, Inc.

- URALCHEM JSC

- Yara International ASA

- Enaex S.A

- San Corporation

- OSTCHEM Holding Company

- Austin Powder International

- CSBP Limited

- TradeMark Nitrogen

- Achema AB

- Agrico Canada L.P. (Sollio Cooperative Group)

- Barium & Chemicals

- Wentong Potassium Salt Group Co. Ltd.

Recent Development

- In January 2024, Tecnimont, leading a consortium, secured a $300 million EPC contract to construct an advanced ammonium nitrate plant in Egypt, aimed at improving environmental standards, energy efficiency, and agricultural productivity.

- In December 2023, City University of Hong Kong researchers engineered a bimetallic alloy nanocatalyst, RuFe nanoflowers, to improve electrochemical ammonia synthesis from nitrate, a potential breakthrough for carbon-neutral fuel production.

Report Scope

Report Features Description Market Value (2023) USD 16.3 Billion Forecast Revenue (2033) USD 24.6 Billion CAGR (2024-2032) 4.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application(Fertilizers, Explosives, Others), By End Use(Agriculture, Industries, Mining, Defense, Other) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape EuroChem Group, Orica Limited, CF Industries Holdings, Inc., URALCHEM JSC, Yara International ASA, Enaex S.A, San Corporation, OSTCHEM Holding Company, Austin Powder International, CSBP Limited, TradeMark Nitrogen, Achema AB, Agrico Canada L.P. (Sollio Cooperative Group), Barium & Chemicals, Wentong Potassium Salt Group Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- EuroChem GroupOrica Limited

- CF Industries Holdings, Inc.

- URALCHEM JSC

- Yara International ASA

- Enaex S.A

- San Corporation

- OSTCHEM Holding Company

- Austin Powder International

- CSBP Limited

- TradeMark Nitrogen

- Achema AB

- Agrico Canada L.P. (Sollio Cooperative Group)

- Barium & Chemicals

- Wentong Potassium Salt Group Co. Ltd.