Glamping Market By Accommodation(Yurts, Cabins and Pods, Others), By Target(Families, Young couples), Age Group(18-32 years, 33-50 years, above 65 years), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

15866

-

Nov 2023

-

181

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Glamping Market Size, Share, Trends Analysis

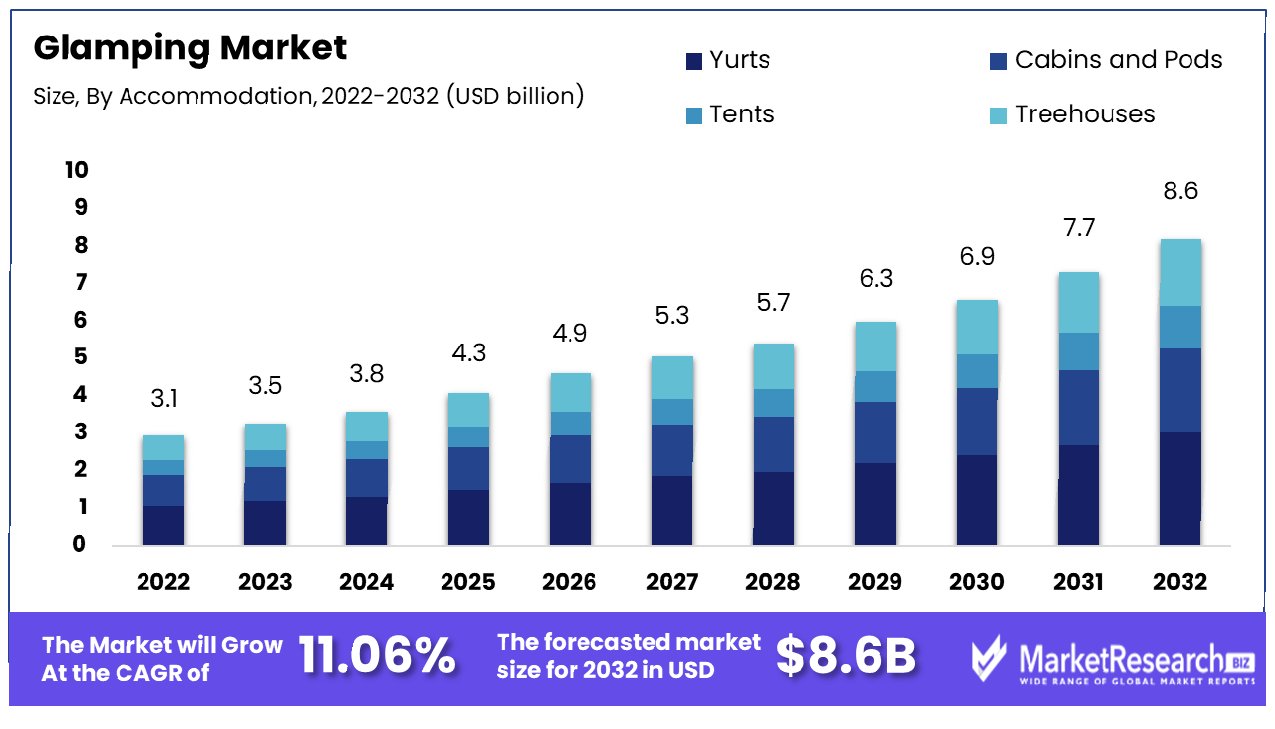

The glamping market was valued at USD 3.11 Billion in 2022. It is expected to reach USD 8.6 Billion by 2032, with a CAGR of 11.06% during the forecast period from 2023 to 2032.

Modernization and the surge in sustainable tourism are some of the main key factors for the growth of the Glamping Trend. Glamping allows travelers to experience quality time close to nature. It signifies the combination of camping and pleasure. Glamorous Camping adds charm to the traditional concept of camping. Many boutique camping organizations offer luxury facilities in nature’s arms.

There is a sizable high-income market that can support the glamping industry. Approximately 12.9 million US households earn over $275,000 annually and have over $100,000 in discretionary spending even after necessities. Additionally, the average luxury traveler spends $6,260 per year on leisure trips - over $2,000 more than the mainstream traveler.

This indicates an appetite and budget among affluent consumers for premium accommodations while traveling. As glamping offers a unique and upscale outdoor hospitality experience compared to traditional camping, the industry is well positioned to attract these travelers and capture part of the lucrative luxury travel market. With millions of wealthy travelers looking to spend on memorable trips, there is substantial demand for elevated glamping experiences.

People want to know and spend time with nature so that they can stay close to the natural habitat. Traditional and old-style camping does not have any comfortable services and facilities, but now people can get luxurious service in nature itself. This shift in People Toward Glamping Boosts the market significantly.

Some of the most famous places for glamping include Alafia River State Park in Florida, The Resort at Paws Up in Montana, Under Canvas Mount Rushmore in South Dakota, and Collective Retreats with locations in New York City, Texas Hill Country, and near Vail, Colorado. These glamping destinations offer a range of luxurious accommodations and amenities, making them perfect for those looking to experience the great outdoors with a touch of comfort and style.

These glamping sites provide several amenities such as comfortable beds, swimming pools, internet connectivity, and much more, according to the consumer’s requirement. It also offers 24 hours of water, electricity, and everything that a consumer expects from the resort-like services. The Scope of Glamping is thus expanding rapidly.

Luxury camping is gaining popularity due to its wide range of accommodation styles for different classes and ages of people. From luxurious tents and yurts to cabins and treehouses, luxury camping offers according to the consumer's taste and preferences. Such types of options offer an Authentic Experience and yet memorable experience for the guests making it an ideal choice for vacations.

When the tourism industry faced a lockdown due to COVID-19, camping and glamping sites were the preferred choices for lodging. Travelers were searching for a shift in change of environment while adhering to the safety guidelines issued by the government and posh camping was the best fit in the bills.

The surge in booking at glamping sites can be ascribed to their intrinsic benefits, such as offering guests an ample amount of space and separation from others, which was the perfect way of doing social distancing. The demand for glamping will rapidly increase due to its popularity in wellness tourism, which will contribute to the glamping market expansion in the coming years.

Glamping Market Dynamics

Luxurious Camping Desires Drive Glamping Market Growth

The burgeoning demand for luxurious and comfortable camping experiences is a Major Factor propelling the glamping market's growth. This trend, a Growth-Inducing Factor, reflects a shift in consumer preferences from traditional camping to more upscale, amenity-rich outdoor experiences. In response, the creation of glamping sites that blend the allure of nature with comfort has emerged as one of the Key Driving Factors in this market. Attracting a demographic that seeks outdoor serenity along with modern hospitality conveniences, this demand is likely to continue, leading to sustained growth and diversification in the glamping market.

Eco-Tourism and Adventure Travel Uplift Glamping Industry

The rise in eco-tourism and consumer inclination toward adventure travel is a significant Growth Factor in the glamping market. Today's travelers are increasingly drawn to experiences that are both environmentally sustainable and adventurous. Boutique camping, aligning perfectly with these values, serves as a Forces Analysis element in the industry, expanding the market's reach with its blend of immersive nature experiences and minimal ecological footprint. Within the glamping market, safari tourism experiences offer a unique blend of adventure and comfort, attracting nature enthusiasts seeking unconventional luxury.

Strategic Marketing and Branding Elevate Glamping Experiences

The growing emphasis on effective marketing and branding strategies plays a vital role in the expansion of the glamping market. As competition intensifies, distinctive branding and targeted marketing become crucial in attracting and retaining customers. This involves not just showcasing the unique features of glamping sites but also communicating the ethos of sustainable and luxurious outdoor travel. The anticipated long-term effect is a market that increasingly relies on strong brand identities and innovative marketing techniques to differentiate and elevate glamping experiences.

Online Booking Systems Streamline Glamping Market Operations

The increasing adoption of online booking and reservation systems is a key growth driver for boutique camping. These systems streamline the booking process, making it easier for consumers to access and reserve glamping experiences. This convenience enhances customer experience and broadens the market's reach, attracting a tech-savvy demographic. Additionally, these systems provide valuable data that can be used for market analysis and personalized marketing strategies. In the long run, this digital integration is expected to further professionalize the market, optimizing operations and enhancing the overall customer journey in upscale camping.

Seasonal Demand and Growing Competition Restrains Glamping Market Growth

The glamping market faces a significant challenge due to its seasonal nature, with demand peaking primarily during favorable weather conditions. This seasonality leads to uneven revenue streams, making it difficult for operators to maintain profitability year-round. Furthermore, the market is experiencing heightened competition as more players enter the field, attracted by the sector's growing popularity. This increased competition not only fragments the market but also puts pressure on pricing strategies, potentially reducing margins. Consequently, luxury camping businesses must innovate and differentiate their offerings to attract customers outside peak seasons and stand out in a crowded market.

Rising Popularity of Recreational Vehicles Restrains Glamping Market Growth

The burgeoning popularity of recreational vehicles (RVs) presents a direct challenge to the glamping market. RVs offer a similar appeal of combining comfort with outdoor experience but with the added advantage of mobility and autonomy. As more consumers invest in RVs, they may opt for this form of travel over stationary glamping sites. This shift can lead to a decrease in demand for glamping, particularly among demographics that prioritize flexibility and variety in their travel experiences. The RV trend requires comfort camping providers to innovate and offer unique experiences that cannot be replicated by RV travel.

Land Use Policies and Environmental Conservation Regulations Restrains Glamping Market Growth

Land use policies and environmental conservation regulations significantly impact the glamping market. These regulations can restrict where glamping sites can be developed and dictate the extent of modifications allowed in natural settings. While these policies are essential for preserving the environment, they can limit the availability and scope of suitable locations for camping. Additionally, compliance with these regulations often involves additional costs and procedural complexities, which can be a deterrent for new entrants and a financial strain for existing operators. Navigating these regulatory landscapes requires careful planning and a commitment to sustainable practices, which can be challenging for market growth.

Glamping Market Segmentation Analysis

By Accommodation Type Analysis

Yurts stand out as the preeminent segment in glamping accommodations. Their traditional design, combined with modern luxuries, appeals to a wide range of glampers seeking an authentic yet comfortable experience. The circular structure of yurts, often coupled with panoramic windows and high-quality interiors, offers a unique blend of intimacy with nature and luxury. This segment's popularity is bolstered by its adaptability to various locations and climates, making it a versatile choice for glamping sites globally.

The cabins segment and pods segment provide a more solid structure, appealing to those who favor stability and a more 'home-like' feel. Tents, including safari and bell tents, cater to traditional camping enthusiasts looking for an upgraded experience. Treehouses, a niche but growing segment, offer an enchanting experience, particularly popular among younger audiences and families. Each of these segments contributes uniquely to the market, catering to different preferences and enhancing the overall diversity of the glamping experience.

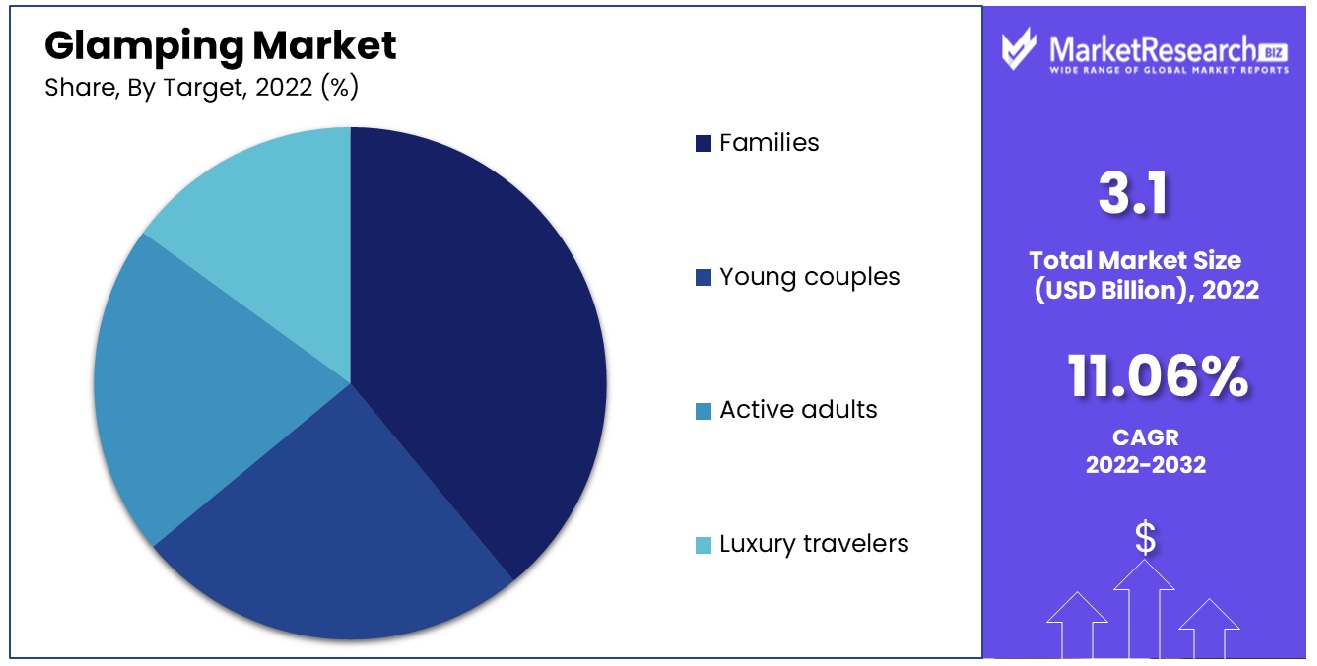

By Target Market Analysis

Families constitute the primary target market segments in luxury camping drawn to the blend of adventure and comfort it offers. This family travel segment is significant, with family-oriented glamping sites often providing additional facilities like play areas, guided tours, and family-friendly activities, making them attractive for family vacations. The segment's growth is driven by the increasing desire for unique, bonding experiences that are both nature-centric and convenient, underscoring the segment growth in this area.

Young couples are drawn to the romantic and secluded aspects of luxury camping, often seeking out unique accommodations like treehouses or luxury tents. Active adults, including retirees, are increasingly turning to luxury camping as a way to enjoy nature without foregoing comfort, often seeking out sites with wellness and leisure activities. These segments, while smaller than the family segment, are significant in diversifying the market and catering to specific demographic preferences, further expanding the segment scope within the luxury camping market.

By Age Group Analysis

18-32 years (Young Adults): This age group is the dominant segment and is attracted to luxury camping for its blend of adventure, social media appeal, and the opportunity to experience nature without sacrificing comfort. Glamping sites that offer unique, Instagram-worthy experiences, and a social atmosphere are particularly appealing to this demographic.

33-50 years (Middle-Aged Adults): Individuals in this age group often seek glamping experiences that offer a balance of relaxation and adventure. They are likely to appreciate higher-end accommodations and may opt for luxury camping as a family activity, thus intersecting with the dominant family segment.

51-65 years and above 65 years (Older Adults): These age groups are increasingly participating in luxury camping, drawn to the comfort and accessibility it provides. They may prefer more tranquil locations, with an emphasis on comfort and ease of access. Health and wellness-oriented glamping experiences are particularly appealing to this demographic.

Glamping Industry Segments

By Accommodation

- Yurts

- Cabins and Pods

- Tents

- Treehouses

- Others

By Target

- Families

- Young couples

- Active adults

- Luxury travelers

By Age Group

- 18-32 years

- 33-50 years

- 51-65 years

- above 65 years

Glamping Market Growth Opportunity

Growing Preference for Outdoor Activities Offers Growth Opportunity in Glamping Market

The escalating preference for outdoor activities and experiences close to nature significantly boosts the glamping market's growth. In recent years, there has been a marked shift in leisure preferences towards outdoor experiences, partly driven by a desire to escape the urban environment and reconnect with nature. This trend is particularly pronounced among demographics seeking a balance between the outdoors and comfort. The glamping market caters to this demand by offering luxurious accommodations in natural settings, blending adventure with comfort. Data shows a consistent rise in outdoor leisure activities, directly correlating with increased interest in luxury camping as a preferred way to experience nature. This surge in interest has led to impeccable forecasts for the sales of glamping products.

Shift from Traditional Camping to Glamping Drives Market Expansion

The notable shift in consumer interest from traditional camping to luxury camping presents a considerable opportunity for market expansion. This transition reflects a broader trend in travel and leisure, where consumers increasingly seek experiences that combine the essence of camping – being in nature – with the amenities and comforts of high-end accommodation. Recent trends indicate a growing segment of the population, especially among millennials and Gen Z, who prefer travel experiences that offer a unique blend of adventure and luxury. This shift not only expands the customer base for the glamping market but also encourages diversification in luxury camping offerings, catering to a range of preferences and budgets. The evolving landscape of consumer preferences and spending habits provides accurate analysis and market forecasts for the future industry.

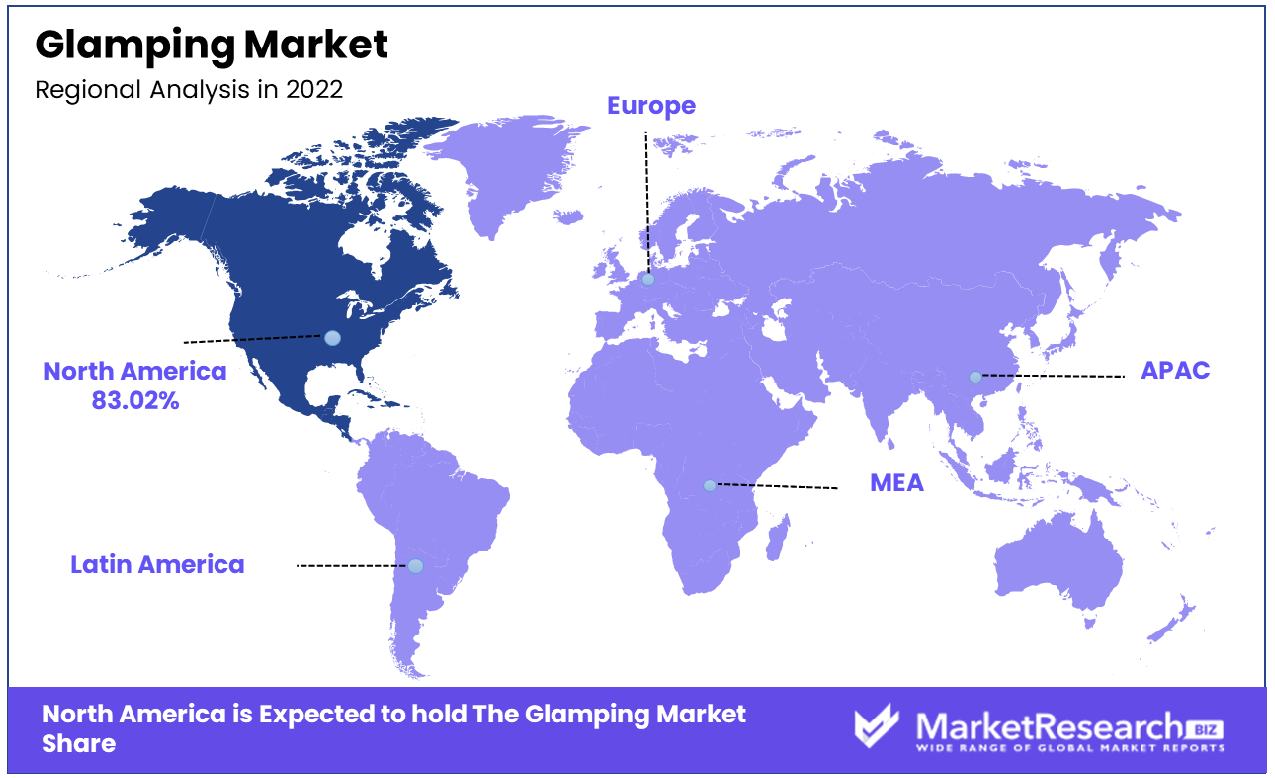

Glamping Market Regional Analysis

North America Dominates with 83.02% Market Share

North America holds the largest market share in the glamping market, accounting for 83.02%. This dominance is largely attributed to the region's diverse natural landscapes and a culture that embraces outdoor leisure activities. The region's affluence and a strong preference for unique, luxurious outdoor experiences have significantly propelled the popularity of glamping.

The future of North America's glamping market appears promising, indicative of a positive Regional Market Revenue Forecast. Trends are leaning towards more innovative and eco-conscious glamping experiences. As people increasingly seek new forms of escapism and connection with nature, the demand for unique luxury camping offerings is expected to rise, further cementing the region's dominance in this sector.

Europe: Blending Tradition with Luxury

Europe's glamping market is flourishing, underpinned by its rich cultural heritage and scenic landscapes. The region offers a unique blend of traditional camping experiences with modern luxuries, attracting a diverse clientele. Europe’s focus on sustainable tourism and luxury travel is expanding the Glamping Market Share, with countries like France and Italy leading the way in this trend.

Asia Pacific: Emerging Market with Immense Potential

In Asia Pacific, the glamping market is emerging rapidly, fueled by the region's natural beauty and growing middle class. Countries like Australia and Thailand are becoming popular luxury camping destinations, offering unique experiences that combine local culture with luxury. The increasing interest in experiential travel among the region's populace is setting the stage for significant growth in this market.

Glamping Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Glamping Market Key Player Analysis

In the dynamic glamping market, a constellation of key players is driving innovation and shaping consumer experiences. Hilleberg Ab and Johnson Outdoors Inc., with their high-quality, durable products, highlight the market's trend towards combining luxury with robust outdoor performance. The North Face Inc., synonymous with outdoor adventure, underscores the fusion of brand reputation with the evolving luxury camping segment.

AMG GROUP and Newell Brands Inc., through their diverse product portfolios, illustrate the market players' need for a broad range of luxury camping solutions, from high-end tents to luxury camping accessories. Oase Outdoors and The Coleman Company, known for their user-friendly and innovative products, reflect the market's focus on enhancing the convenience and comfort of glamping experiences.

Simex Outdoor International and Kampa demonstrate the importance of catering to different luxury camping styles and preferences, emphasizing the market's diversity. Exxel Outdoors, with its focus on family-friendly camping solutions, showcases the market's expansion to include a wider demographic.

Bushtec Safari and Sawday’s Canopy & Stars Ltd., rooted in specific regional markets like South Africa and the UK, highlight the significance of localized experiences in luxury camping, catering to unique cultural and geographical landscapes. Huttopia and Wigwam Holidays Ltd, with their emphasis on eco-friendly and immersive experiences, represent the market's shift towards sustainable and authentic outdoor engagements.

Arena Campsites, operating across Europe, illustrates the importance of geographical reach and the ability to provide diverse, high-quality luxury camping experiences across different regions. Collective Retreats, along with these companies, not only fuels the growth of the glamping market but also reflects its multifaceted nature - from luxury and comfort to sustainability and regional uniqueness. This panorama provides a comprehensive competitive analysis and player positioning, shaping this rapidly evolving sector.

Glamping Market Key Players

- Hilleberg Ab.

- Johnson Outdoors Inc.

- The North Face Inc.

- AMG GROUP

- Newell Brands Inc.

- Oase Outdoors

- The Coleman Company

- Simex Outdoor International

- Kampa

- Exxel Outdoors

- Bushtec Safari (South Africa)

- Sawday’s Canopy & Stars Ltd. (UK)

- Huttopia (France)

- Wigwam Holidays Ltd (UK)

- Arena Campsites (Europe)

- Nightfall Camp Pty Ltd.

- Getaway House Inc.

Glamping Market Recent Development

- In 2022, It is anticipated that the glamping industry will continue to grow in popularity, with bookings increasing by an additional 15% year-over-year, along with the growing popularity of sustainable travel and the rise of wellness tourism.

- In 2021, The glamping industry continued to grow in popularity, with bookings increasing by an additional 25% year-over-year, the continued demand for outdoor experiences, and the rise of remote work and hybrid work arrangements.

- In 2020, During the COVID-19 pandemic, the glamping industry saw a surge in popularity as people looked for safe and socially-distant travel options.

Report Scope:

Report Features Description Market Value (2022) USD 3.11 Bn Forecast Revenue (2032) USD 8.6 Bn CAGR (2023-2032) 11.06% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Accommodation(Yurts, Cabins and Pods, Tents, Treehouses, Others), By Target(Families, Young couples, Active adults, Luxury travelers), By Age Group(18-32 years, 33-50 years, 51-65 years, above 65 years) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Hilleberg Ab., Johnson Outdoors Inc., The North Face Inc., AMG GROUP, Newell Brands Inc., Oase Outdoors, The Coleman Company, Simex Outdoor International, Kampa, Exxel Outdoors, Bushtec Safari (South Africa), Sawday’s Canopy & Stars Ltd. (UK), Huttopia (France), Wigwam Holidays Ltd (UK), Arena Campsites (Europe), Nightfall Camp Pty Ltd., Getaway House Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Hilleberg Ab.

- Johnson Outdoors Inc.

- The North Face Inc.

- AMG GROUP

- Newell Brands Inc.

- Oase Outdoors

- The Coleman Company

- Simex Outdoor International

- Kampa

- Exxel Outdoors

- Bushtec Safari (South Africa)

- Sawday’s Canopy & Stars Ltd. (UK)

- Huttopia (France)

- Wigwam Holidays Ltd (UK)

- Arena Campsites (Europe)

- Nightfall Camp Pty Ltd.

- Getaway House Inc.