Generative AI in Wealth Management Market By Type (Natural Language Processing (NLP), Predictive Analytics, Robotic Process Automation, and Deep Learning), By Application, By Deployment, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

-

38996

-

March 2024

-

136

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

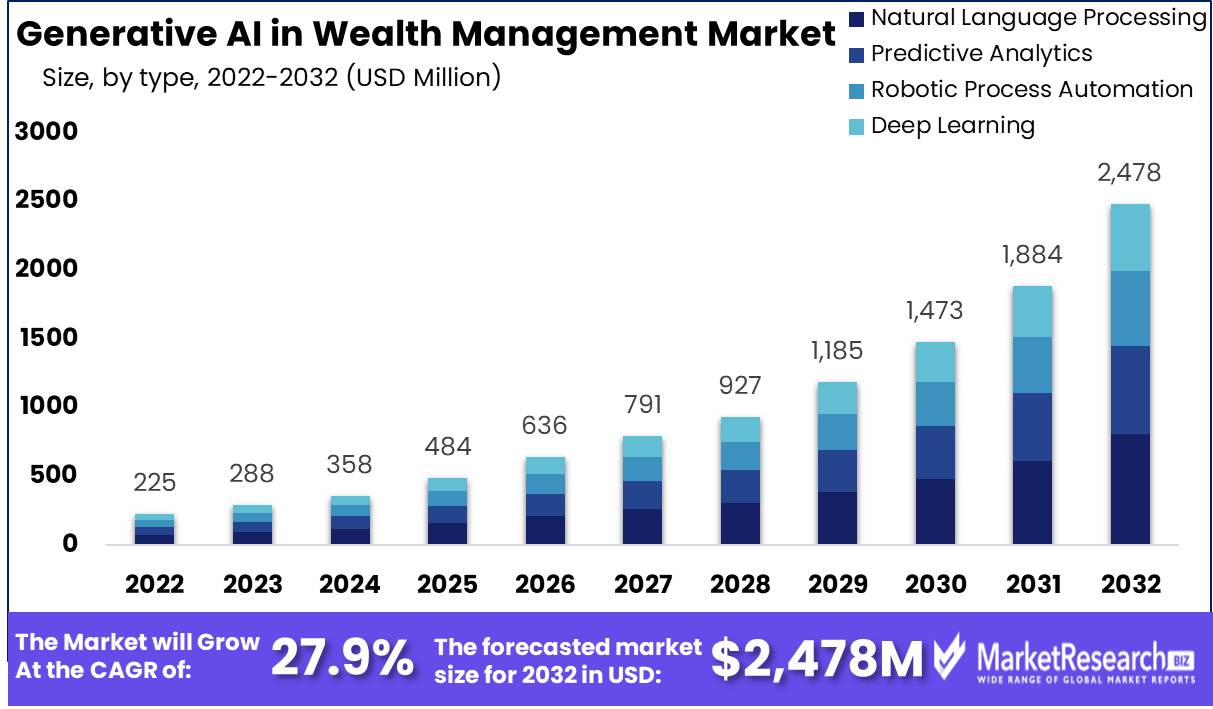

The Global Generative AI In Wealth Management Market size is expected to be worth around USD 2,478 Million by 2032, from USD 225 Million in 2022, growing at a CAGR of 27.90% during the forecast period from 2023 to 2032.

The surge in demand for advanced technologies and rise of different businesses, firm and enterprises are some of the main key driving factors for the generative AI in wealth management market.

Generative artificial intelligence in wealth management is defined as the application of AI methods that is particularly used in generative models to improve and automate different aspects of monetary advisory and investment tactics.

Such advanced technologies leverages algorithms that can produce realistic and contextually relevant information, support in simulations, predictive modelling and situation analysis.

Wealth management organizations uses generative AI to build customized financial plans, enhance asset allocations and simulate capable market results. It can also support in producing natural language reports by developing complex financial information more accessible to clients.

By implementing generative AI in wealth management, organizations focus to offer more sophisticated, data-driven insights, delivers customized investment solutions and automate daily tasks which finally improvise the efficacy and effectiveness of monetory advisory services in an evolving and dynamic market landscape.

The integration of the generative AI in wealth management displays a paradigm change that introduces unprecedented efficacy and customization. This technology makes the design of highly individualized financial plans by simulating wider market situations, enhancing asset samples and forecasting capable results.

Moreover, generative AI contributes to improvise risk management through sophisticated situation analysis by helping investors make informed decisions in wider market. The ability to produce realistic financial information nurtures new innovations in product developments and investment tactics. This change tool encourages wealth management experts to provide customized solutions that strengthens client relationships and nurtures trust.

Additionally, generative AI in wealth management streamlines operations, boost decision making technique and escorts in a new era of accuracy, customization and resilience in monetory advisory services. The demand for the generative AI in wealth management will increase due to its requirement in vertical industries that will help in market expansion in the coming years.

Key Takeaways

- Market Value Projection: The Global Generative AI in Wealth Management Market is projected to reach around USD 2,478 Million by 2032, growing from USD 225 Million in 2022, with a remarkable CAGR of 27.90% during the forecast period from 2023 to 2032.

- Major Segments:

- Type Analysis: Natural Language Processing (NLP) leads with a market share of 32.4%, followed by segments like Predictive Analytics, Robotic Process Automation (RPA), and Deep Learning, each contributing significantly to market expansion.

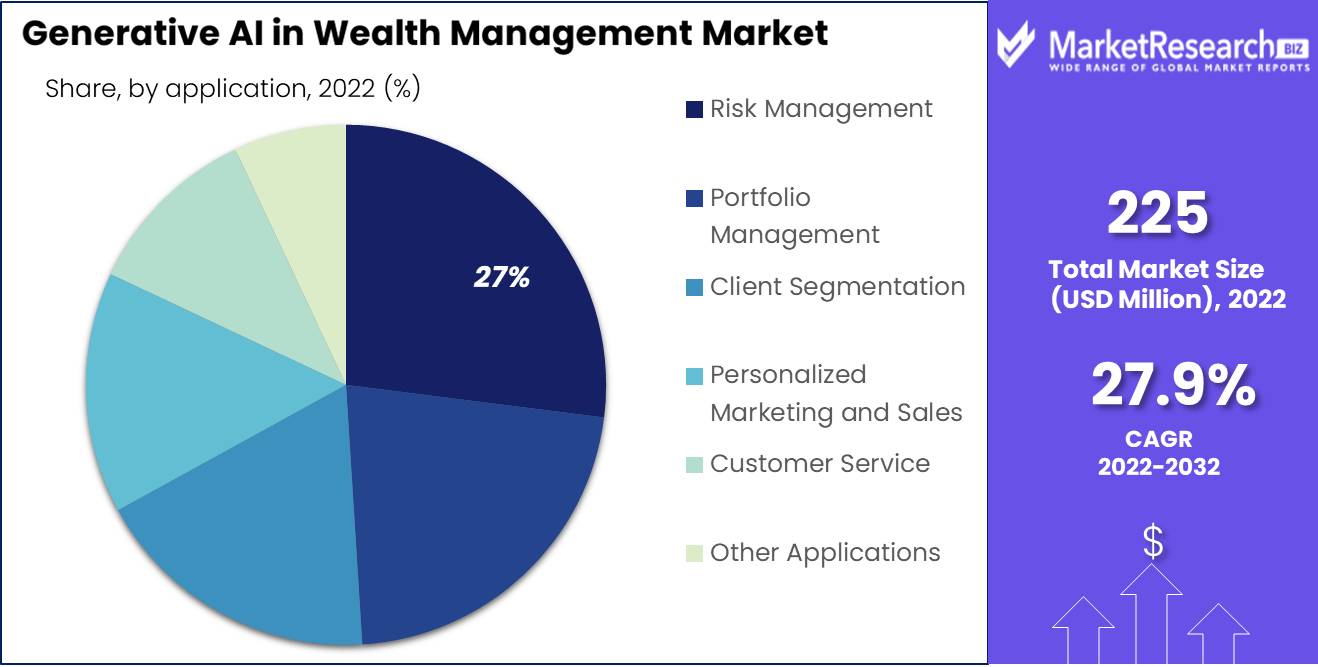

- Application Analysis: Risk Management dominates with a 27% market share, crucial for navigating the complexities of financial markets. Other essential segments include Portfolio Management, Client Segmentation, Personalized Marketing and Sales, Customer Service, and Other Applications.

- Deployment Analysis: Cloud-Based solutions hold the majority share at 37.4%, offering flexibility, scalability, and cost-effectiveness. On-Premises, Hybrid, and Edge deployments complement the ecosystem, catering to diverse needs regarding data sovereignty, latency, and computational requirements.

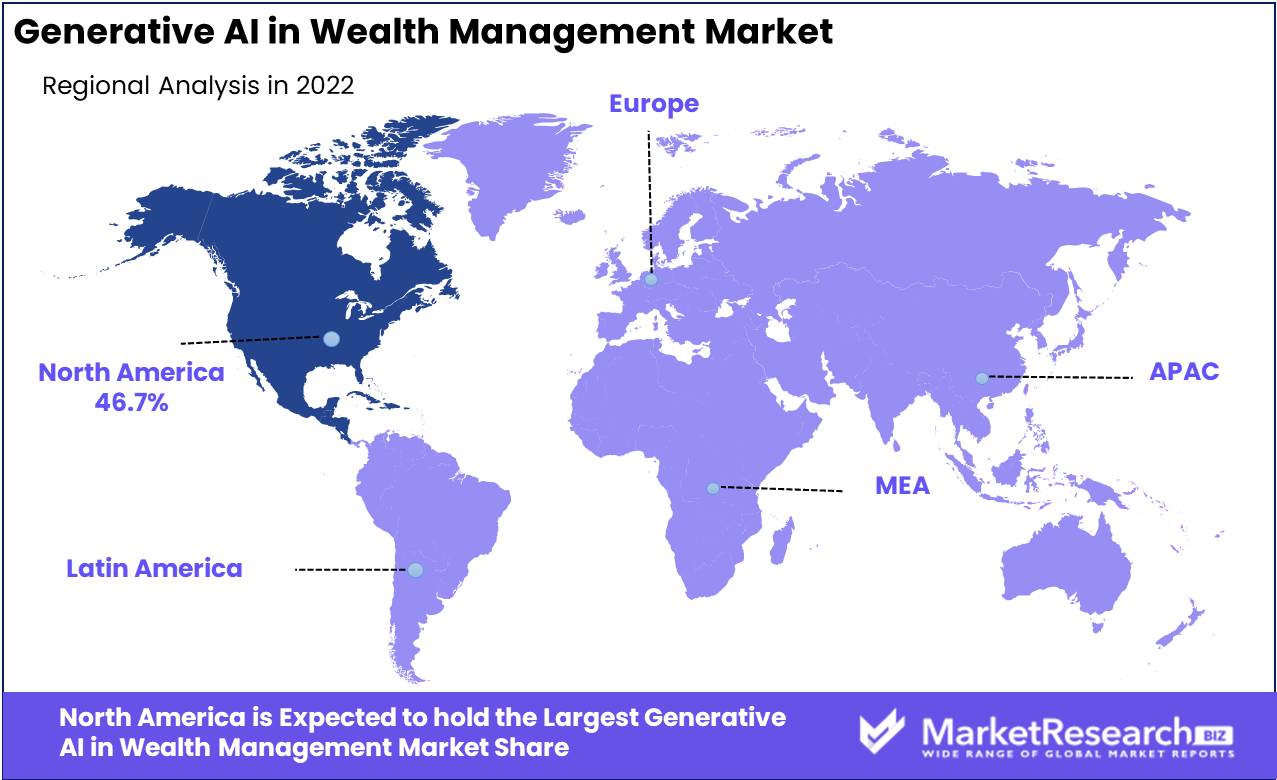

- Regional Dynamics: North America dominates with a 42% market share, driven by technological advancements and a mature financial sector. Europe holds a significant position with approximately 30% market share.

- Analyst Viewpoint: Analysts foresee substantial growth opportunities in the Generative AI in Wealth Management market, driven by increasing demand for AI-powered solutions to optimize risk management, portfolio management, client engagement, and operational efficiency. The evolving regulatory landscape and focus on digital transformation within the financial sector further fuel market growth.

- Growth Opportunities: Opportunities lie in developing more advanced AI algorithms and solutions to address evolving client needs, regulatory requirements, and market dynamics. Additionally, expanding into emerging markets, enhancing data security and privacy measures, and fostering collaborations between AI developers and wealth management firms.

Driving Factors

Personalized Investment Advisory Drives Market Growth

The integration of Generative AI into wealth management through personalized investment advisory services represents a significant driver of market growth. By leveraging the capacity to analyze extensive datasets encompassing market trends, financial news, and individual preferences, Generative AI enables the creation of investment advice and portfolio recommendations that are highly tailored to each client's specific objectives and risk tolerance.

This customization enhances client satisfaction and leads to better investment outcomes, as evidenced by the success of platforms, which utilize AI to devise customized, tax-optimized portfolios for their clients. The trend towards personalization facilitated by AI not only attracts more clients seeking bespoke investment strategies but also encourages higher levels of client engagement and retention, thereby expanding the market.

Automated Trading and Portfolio Optimization Enhances Returns

Through advanced data analysis and predictive modeling, generative AI algorithms continuously refine portfolio compositions to maximize returns and minimize risks for investors. Generative AI's ability to discern patterns and insights within financial datasets facilitates the deployment of automated trading strategies and the optimization of portfolios in real time.

This technological advancement promotes improved risk management and the execution of trades, culminating in enhanced returns for investors. Hedge funds exemplify the successful application of AI models in executing trading decisions and managing portfolios efficiently. The integration of AI in trading and optimization not only boosts the market's growth by improving financial outcomes but also by setting new standards in operational efficiency and strategic investment planning.

Natural Language Processing Improves Client Engagement

Natural Language Processing (NLP), a facet of Generative AI, significantly influences market growth by fostering more natural and intuitive client interactions. Through understanding and generating human-like language, NLP technologies like conversational chatbots, voice assistants, and automated report generators enhance the client experience and operational efficiency.

Firms including Vanguard and Fidelity have adopted AI-powered chatbots to respond to client inquiries and offer investment advice, showcasing the technology's potential to transform client service. This enhancement in client interaction not only strengthens the relationship between advisors and clients but also positions NLP as a pivotal element in the industry's drive towards more accessible and efficient client communication. The synergy between NLP and other AI-driven services underlines a holistic growth in the wealth management market, emphasizing the technology's role in improving both the client experience and the industry's operational dynamics.

Restraining Factors

Regulatory Concerns and Compliance Challenges Restrains Market Growth

The wealth management sector faces significant growth limitations due to regulatory concerns and compliance challenges associated with Generative AI. As an industry under strict regulatory oversight, the introduction of AI technologies introduces complexities around data privacy, algorithmic bias, and demands for transparency and explainability.

For instance, the General Data Protection Regulation (GDPR) enacted by the European Union in 2019 sets stringent guidelines on personal data usage, presenting hurdles for AI systems that rely heavily on client data for personalized services. These regulatory challenges compel wealth managers to navigate a constantly evolving legal landscape, potentially hampering the swift adoption and integration of AI technologies. The necessity for compliance can slow innovation and increase operational costs, thus restraining market growth.

Ethical Considerations and Trust Issues Restrains Market Growth

Ethical considerations and trust issues surrounding the use of Generative AI in wealth management significantly impede market expansion. The ethical deployment of AI, especially in critical areas like financial decision-making, is a major concern. Algorithmic bias, transparency shortcomings, and the risk of reinforcing existing inequalities can severely undermine client trust.

The industry must ensure AI systems are developed and operated in a manner that is fair, ethical, and aligned with client interests. Addressing these ethical challenges is essential for maintaining client trust and fostering a conducive environment for AI adoption. Failure to do so not only risks alienating clients but also poses a barrier to the broader acceptance and utilization of AI in wealth management, thus limiting market growth potential.

Type Analysis

In the Generative AI in Wealth Management market, the type segmentation reveals that Natural Language Processing (NLP) holds the leading position with a 32.4% market share. This dominance is attributed to NLP's pivotal role in enhancing client communication and operational efficiency through chatbots, voice assistants, and automated report generation. NLP's ability to process and understand human language makes it an indispensable tool in today's data-driven wealth management sector, facilitating more personalized and efficient client interactions.

Other segments such as Predictive Analytics, Robotic Process Automation (RPA), and Deep Learning also play crucial roles in the market's growth. Predictive Analytics is instrumental in forecasting market trends and client behavior, enabling wealth managers to make informed decisions.

RPA streamlines repetitive tasks, improving operational efficiency, while Deep Learning offers profound insights into complex financial data, enhancing investment strategies. Although NLP leads the segment, the integration of Predictive Analytics, RPA, and Deep Learning contributes significantly to the market's expansion by optimizing operations and decision-making processes.

Application Analysis

Within the application segmentation of the Generative AI in Wealth Management market, Risk Management emerges as the dominant sub-segment, accounting for 27% of the market. The prominence of Risk Management can be linked to the increasing complexity of financial markets and the demand for sophisticated tools to identify, assess, and mitigate potential risks. Generative AI enhances risk management strategies by providing wealth managers with advanced analytics and predictive capabilities, thereby improving the decision-making process and safeguarding client investments. Generative AI technology is revolutionizing the financial sector by providing advanced solutions for wealth management and investment strategies.

Other vital segments include Portfolio Management, Client Segmentation, Personalized Marketing and Sales, Customer Service, and Other Applications. Portfolio Management benefits from AI's ability to optimize investment strategies and manage assets efficiently. Client Segmentation and Personalized Marketing leverage AI to tailor services and marketing efforts to individual client needs, enhancing engagement and satisfaction.

Customer Service is revolutionized through AI-powered chatbots and assistants that provide immediate, 24/7 support. The "Other Applications" segment encompasses a variety of uses, from regulatory compliance to operational automation, each contributing to the market's growth by enhancing service delivery and operational efficiency. Despite the significance of these segments, Risk Management stands out for its critical role in protecting assets and ensuring the longevity of wealth management practices.

Deployment Analysis

In the Generative AI in Wealth Management market, the deployment segmentation shows that Cloud-Based solutions lead with a 37.4% market share. This prominence is largely due to the flexibility, scalability, and cost-effectiveness that cloud-based platforms offer. Wealth management firms are increasingly adopting cloud services to leverage the vast computational power and storage capabilities required for processing large datasets and running complex AI models.

The cloud's accessibility enables firms to deploy advanced analytics and AI tools without significant upfront investment in IT infrastructure, making it an attractive option for both large and small firms aiming to enhance their service offerings with AI capabilities.

On-Premises solutions, while offering higher control over data and systems, face limitations in scalability and require substantial investment in hardware and maintenance. Hybrid models combine the best of both worlds, offering flexibility and control by allowing data and applications to be distributed across cloud-based services and on-premises infrastructure. Edge computing is emerging as a complement to cloud-based solutions, especially in applications requiring real-time processing and analysis at the source of data generation.

Though Cloud-Based solutions dominate the market due to their overarching benefits, On-Premises, Hybrid, and Edge deployments each play a crucial role in the ecosystem. They cater to diverse needs regarding data sovereignty, latency, and computational requirements, contributing to the market's overall growth by providing wealth management firms with a range of options to tailor their AI deployment strategies according to their specific operational needs and strategic goals.

Key Market Segments

By Type

- Natural Language Processing (NLP)

- Predictive Analytics

- Robotic Process Automation

- Deep Learning

By Application

- Risk Management

- Portfolio Management

- Client Segmentation

- Personalized Marketing and Sales

- Customer Service

- Other Applications

By Deployment

- Cloud-Based

- On-Premises

- Hybrid

- Edge

Growth Opportunities

Robo-Advisory and Hybrid Advisory Models Offer Growth Opportunity

Robo-advisory and hybrid advisory models, underpinned by Generative AI, present significant growth opportunities within the Generative AI in Wealth Management Market. These models address key pain points in traditional wealth management, such as high costs and lack of accessibility, by offering automated investment management services that appeal particularly to the mass-affluent and millennial segments.

For instance, some platforms have successfully deployed robo-advisory services, making wealth management more accessible. Moreover, firms like Vanguard and Charles Schwab have introduced hybrid models that blend AI-driven insights with the personalized touch of human advisors, catering to clients who desire a mix of technology efficiency and human interaction. This dual approach not only broadens the market reach by catering to diverse client preferences but also enhances service offerings, driving the market's growth potential.

Alternative Data Analysis and Alpha Generation Offers Growth Opportunity

The use of Generative AI for alternative data analysis and alpha generation represents another avenue for growth within the wealth management sector. By analyzing vast and varied data sources such as social media sentiment, satellite imagery, and consumer behavior, AI technologies can uncover unique insights and identify untapped investment opportunities.

This capability addresses the limitation of relying solely on traditional financial data, which may not fully capture the complexity of market dynamics. The ability to generate alpha through advanced data analysis not only provides a competitive edge but also attracts clients looking for superior returns, thereby expanding the market's potential.

Trending Factors

Explainable AI (XAI) and Transparency Are Trending Factors

Explainable AI (XAI) and transparency are emerging as crucial trending factors in the Generative AI in Wealth Management Market. The increasing integration of AI in wealth management brings to light the need for systems that clients and regulators can easily understand and trust.

The demand for XAI stems from the challenge of AI being perceived as a "black box," where its decision-making processes are obscure. Firms like UBS and Morgan Stanley are investing in XAI to make AI models more transparent and interpretable. This move towards XAI is driven by the necessity to build trust and meet regulatory demands, marking it as a significant trend that enhances client satisfaction and compliance.

Collaboration and Ecosystem Partnerships Are Trending Factors

Collaboration and ecosystem partnerships have become key trending factors in the wealth management sector's adaptation of Generative AI. The complexity of developing and implementing AI solutions necessitates a collaborative approach, involving wealth managers, AI technology providers, data vendors, and other industry stakeholders.

This collaborative trend is underscored by efforts to pool expertise, data, and resources, thereby accelerating innovation and the creation of sophisticated AI solutions. For example, UBS's partnership with Microsoft reflects the industry's move towards leveraging external expertise to overcome the challenges of building in-house AI capabilities. These partnerships are not just about sharing resources but also about fostering an environment conducive to innovation, making collaboration a pivotal trend in the market's evolution.

Regional Analysis

North America Dominates with 42% Market Share

North America holds a commanding 42% share of the Generative AI in Wealth Management Market, attributing its leadership to several key factors. This region's high market share is driven by the presence of a robust financial sector, significant investments in AI and technology, and a strong regulatory framework that supports innovation while ensuring consumer protection. The concentration of tech giants and startups alike in Silicon Valley and beyond has fostered a culture of innovation, making North America a hotbed for AI development.

The market dynamics in North America are influenced by its advanced technological infrastructure and the early adoption of digital solutions within the wealth management sector. The region's wealth managers are among the first to integrate AI into their service offerings, providing personalized investment advice and enhancing operational efficiency. This proactive approach towards technology adoption has set a high standard for wealth management services, influencing both client expectations and industry benchmarks.

Looking forward, North America's dominance in the market is expected to persist, driven by continuous technological innovation, supportive policies, and the growing demand for AI-driven financial solutions. As AI technologies evolve and regulatory frameworks adapt, North America is likely to remain at the forefront of the industry, shaping global trends and standards.

Europe: A Strong Contender in AI Wealth Management

Europe holds a significant position in the Generative AI in Wealth Management Market, characterized by its robust regulatory environment and focus on digital innovation within the financial sector. With a market share of approximately 30%, Europe's strength lies in its comprehensive approach to data protection, ethical AI usage, and the fostering of technological advancements.

Asia Pacific: Rapid Growth and Digital Transformation

The Asia Pacific region is witnessing rapid growth in the Generative AI in Wealth Management Market, with a market share projected to increase significantly, showcasing a growth rate surpassing 25%. This surge is fueled by widespread digital transformation initiatives, increasing technological adoption among consumers, and the rise of fintech startups.

Middle East & Africa: Emerging Markets with Potential

The Middle East & Africa (MEA) region, while currently holding a smaller share of the Generative AI in Wealth Management Market at around 10%, shows promising growth potential. Countries like the United Arab Emirates and Saudi Arabia are leading the way in tech adoption, aiming to diversify their oil-dependent economies. The MEA region's focus on innovation and digital financial services is expected to drive its market share upwards in the coming years.

Latin America: Steady Growth in Fintech Adoption

Latin America's Generative AI in Wealth Management Market is gradually expanding, with a current market share of around 8%. The region's growth is propelled by a burgeoning fintech ecosystem, increasing mobile and internet penetration, and a young population eager to embrace digital financial solutions.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the rapidly evolving Generative AI in Wealth Management Market, key players such as OpenAI, Wealthfront Inc., Betterment LLC, and others are redefining the landscape. These asset management firms and financial advisors leverage generative AI to enhance the wealth management business, adapting to market volatility and streamlining routine tasks. This adoption not only improves customer experience but also positions generative AI as a powerful tool within the wealth management space.

Firms like BlackRock, Inc., JPMorgan Chase & Co., and The Vanguard Group, Inc. are at the forefront, integrating generative AI into digital wealth management to analyze market conditions and manage portfolios more effectively. This strategic positioning allows them to expand their addressable market, offering tailored advice and solutions.

Moreover, Charles Schwab Corporation, Fidelity Investments, and Morgan Stanley emphasize the use of AI in delivering advanced market analysis, facilitating better decision-making. In contrast, UBS Group AG, Goldman Sachs Group Inc., and State Street Corporation focus on enhancing the wealth management industry's resilience against market shifts.

Citigroup Inc., BNY Mellon, and Robo Global exemplify how diversification and innovation in using generative AI technologies can lead to a competitive edge in managing a money market fund and other investment vehicles. Overall, these key players significantly impact the wealth management market, driving the industry towards more efficient, personalized, and adaptive financial management strategies.

Market Key Players

- OpenAI

- Wealthfront Inc.

- Betterment LLC

- BlackRock, Inc.

- JPMorgan Chase & Co.

- The Vanguard Group, Inc.

- Charles Schwab Corporation

- Fidelity Investments

- Morgan Stanley

- UBS Group AG

- Goldman Sachs Group Inc.

- State Street Corporation

- Citigroup Inc.

- BNY Mellon

- Robo Global

Recent Developments

- On September 2023, Temenos made history by becoming the first to launch a secure Generative AI solution in banking, revolutionizing how banks can offer personalized experiences to their customers.

- On September 2023, Ant Group unveiled an artificial intelligence tool for wealth management and insurance services, joining the competitive landscape of AI applications in the financial sector.

- On January 2024, Powder was introduced as a generative AI co-pilot for wealth advisors, aimed at streamlining manual sales processes to provide immediate value for prospective clients.

Report Scope

Report Features Description Market Value (2022) USD 225 Mn Forecast Revenue (2032) USD 2,478 Mn CAGR (2023-2032) 27.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Content Generation, Visual Effects, Post-production and Editing, Budget Optimization, Audience Engagement, Creative Inspiration)

By Application (Filmmaking and Production, Virtual Reality (VR) and Augmented Reality (AR), Marketing and Promotion, Movie Recommendation)

By Deployment (Cloud-Based, On-Premises, Hybrid)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape OpenAI, Wealthfront Inc., Betterment LLC, BlackRock, Inc., JPMorgan Chase & Co., The Vanduard Group, Inc., Charles Schwab Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Generative AI in Wealth Management Market Overview

- 2.1. Generative AI in Wealth Management Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Generative AI in Wealth Management Market Dynamics

- 3. Global Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Generative AI in Wealth Management Market Analysis, 2016-2021

- 3.2. Global Generative AI in Wealth Management Market Opportunity and Forecast, 2023-2032

- 3.3. Global Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Type, 2016-2032

- 3.3.1. Global Generative AI in Wealth Management Market Analysis by Based On Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Type, 2016-2032

- 3.3.3. Natural Language Processing (NLP)

- 3.3.4. Predictive Analytics

- 3.3.5. Robotic Process Automation

- 3.3.6. Deep Learning

- 3.4. Global Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 3.4.1. Global Generative AI in Wealth Management Market Analysis by Based On Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 3.4.3. Risk Management

- 3.4.4. Portfolio Management

- 3.4.5. Client Segmentation

- 3.4.6. Personalized Marketing and Sales

- 3.4.7. Customer Service

- 3.4.8. Other Applications

- 3.5. Global Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Deployment, 2016-2032

- 3.5.1. Global Generative AI in Wealth Management Market Analysis by Based On Deployment: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment, 2016-2032

- 3.5.3. Cloud-Based

- 3.5.4. On-Premises

- 3.5.5. Hybrid

- 3.5.6. Edge

- 4. North America Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Generative AI in Wealth Management Market Analysis, 2016-2021

- 4.2. North America Generative AI in Wealth Management Market Opportunity and Forecast, 2023-2032

- 4.3. North America Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Type, 2016-2032

- 4.3.1. North America Generative AI in Wealth Management Market Analysis by Based On Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Type, 2016-2032

- 4.3.3. Natural Language Processing (NLP)

- 4.3.4. Predictive Analytics

- 4.3.5. Robotic Process Automation

- 4.3.6. Deep Learning

- 4.4. North America Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 4.4.1. North America Generative AI in Wealth Management Market Analysis by Based On Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 4.4.3. Risk Management

- 4.4.4. Portfolio Management

- 4.4.5. Client Segmentation

- 4.4.6. Personalized Marketing and Sales

- 4.4.7. Customer Service

- 4.4.8. Other Applications

- 4.5. North America Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Deployment, 2016-2032

- 4.5.1. North America Generative AI in Wealth Management Market Analysis by Based On Deployment: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment, 2016-2032

- 4.5.3. Cloud-Based

- 4.5.4. On-Premises

- 4.5.5. Hybrid

- 4.5.6. Edge

- 4.6. North America Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Generative AI in Wealth Management Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Generative AI in Wealth Management Market Analysis, 2016-2021

- 5.2. Western Europe Generative AI in Wealth Management Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Type, 2016-2032

- 5.3.1. Western Europe Generative AI in Wealth Management Market Analysis by Based On Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Type, 2016-2032

- 5.3.3. Natural Language Processing (NLP)

- 5.3.4. Predictive Analytics

- 5.3.5. Robotic Process Automation

- 5.3.6. Deep Learning

- 5.4. Western Europe Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 5.4.1. Western Europe Generative AI in Wealth Management Market Analysis by Based On Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 5.4.3. Risk Management

- 5.4.4. Portfolio Management

- 5.4.5. Client Segmentation

- 5.4.6. Personalized Marketing and Sales

- 5.4.7. Customer Service

- 5.4.8. Other Applications

- 5.5. Western Europe Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Deployment, 2016-2032

- 5.5.1. Western Europe Generative AI in Wealth Management Market Analysis by Based On Deployment: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment, 2016-2032

- 5.5.3. Cloud-Based

- 5.5.4. On-Premises

- 5.5.5. Hybrid

- 5.5.6. Edge

- 5.6. Western Europe Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Generative AI in Wealth Management Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Generative AI in Wealth Management Market Analysis, 2016-2021

- 6.2. Eastern Europe Generative AI in Wealth Management Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Type, 2016-2032

- 6.3.1. Eastern Europe Generative AI in Wealth Management Market Analysis by Based On Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Type, 2016-2032

- 6.3.3. Natural Language Processing (NLP)

- 6.3.4. Predictive Analytics

- 6.3.5. Robotic Process Automation

- 6.3.6. Deep Learning

- 6.4. Eastern Europe Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 6.4.1. Eastern Europe Generative AI in Wealth Management Market Analysis by Based On Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 6.4.3. Risk Management

- 6.4.4. Portfolio Management

- 6.4.5. Client Segmentation

- 6.4.6. Personalized Marketing and Sales

- 6.4.7. Customer Service

- 6.4.8. Other Applications

- 6.5. Eastern Europe Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Deployment, 2016-2032

- 6.5.1. Eastern Europe Generative AI in Wealth Management Market Analysis by Based On Deployment: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment, 2016-2032

- 6.5.3. Cloud-Based

- 6.5.4. On-Premises

- 6.5.5. Hybrid

- 6.5.6. Edge

- 6.6. Eastern Europe Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Generative AI in Wealth Management Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Generative AI in Wealth Management Market Analysis, 2016-2021

- 7.2. APAC Generative AI in Wealth Management Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Type, 2016-2032

- 7.3.1. APAC Generative AI in Wealth Management Market Analysis by Based On Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Type, 2016-2032

- 7.3.3. Natural Language Processing (NLP)

- 7.3.4. Predictive Analytics

- 7.3.5. Robotic Process Automation

- 7.3.6. Deep Learning

- 7.4. APAC Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 7.4.1. APAC Generative AI in Wealth Management Market Analysis by Based On Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 7.4.3. Risk Management

- 7.4.4. Portfolio Management

- 7.4.5. Client Segmentation

- 7.4.6. Personalized Marketing and Sales

- 7.4.7. Customer Service

- 7.4.8. Other Applications

- 7.5. APAC Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Deployment, 2016-2032

- 7.5.1. APAC Generative AI in Wealth Management Market Analysis by Based On Deployment: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment, 2016-2032

- 7.5.3. Cloud-Based

- 7.5.4. On-Premises

- 7.5.5. Hybrid

- 7.5.6. Edge

- 7.6. APAC Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Generative AI in Wealth Management Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Generative AI in Wealth Management Market Analysis, 2016-2021

- 8.2. Latin America Generative AI in Wealth Management Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Type, 2016-2032

- 8.3.1. Latin America Generative AI in Wealth Management Market Analysis by Based On Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Type, 2016-2032

- 8.3.3. Natural Language Processing (NLP)

- 8.3.4. Predictive Analytics

- 8.3.5. Robotic Process Automation

- 8.3.6. Deep Learning

- 8.4. Latin America Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 8.4.1. Latin America Generative AI in Wealth Management Market Analysis by Based On Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 8.4.3. Risk Management

- 8.4.4. Portfolio Management

- 8.4.5. Client Segmentation

- 8.4.6. Personalized Marketing and Sales

- 8.4.7. Customer Service

- 8.4.8. Other Applications

- 8.5. Latin America Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Deployment, 2016-2032

- 8.5.1. Latin America Generative AI in Wealth Management Market Analysis by Based On Deployment: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment, 2016-2032

- 8.5.3. Cloud-Based

- 8.5.4. On-Premises

- 8.5.5. Hybrid

- 8.5.6. Edge

- 8.6. Latin America Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Generative AI in Wealth Management Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Generative AI in Wealth Management Market Analysis, 2016-2021

- 9.2. Middle East & Africa Generative AI in Wealth Management Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Type, 2016-2032

- 9.3.1. Middle East & Africa Generative AI in Wealth Management Market Analysis by Based On Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Type, 2016-2032

- 9.3.3. Natural Language Processing (NLP)

- 9.3.4. Predictive Analytics

- 9.3.5. Robotic Process Automation

- 9.3.6. Deep Learning

- 9.4. Middle East & Africa Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 9.4.1. Middle East & Africa Generative AI in Wealth Management Market Analysis by Based On Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 9.4.3. Risk Management

- 9.4.4. Portfolio Management

- 9.4.5. Client Segmentation

- 9.4.6. Personalized Marketing and Sales

- 9.4.7. Customer Service

- 9.4.8. Other Applications

- 9.5. Middle East & Africa Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Based On Deployment, 2016-2032

- 9.5.1. Middle East & Africa Generative AI in Wealth Management Market Analysis by Based On Deployment: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment, 2016-2032

- 9.5.3. Cloud-Based

- 9.5.4. On-Premises

- 9.5.5. Hybrid

- 9.5.6. Edge

- 9.6. Middle East & Africa Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Generative AI in Wealth Management Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Generative AI in Wealth Management Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Generative AI in Wealth Management Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Generative AI in Wealth Management Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. OpenAI

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Wealthfront Inc.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Betterment LLC

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. BlackRock, Inc.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. JPMorgan Chase & Co.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. The Vanduard Group, Inc.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Charles Schwab Corporation

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Other Key Players

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Type in 2022

- Figure 2: Global Generative AI in Wealth Management Market Attractiveness Analysis by Based On Type, 2016-2032

- Figure 3: Global Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 4: Global Generative AI in Wealth Management Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 5: Global Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Deploymentin 2022

- Figure 6: Global Generative AI in Wealth Management Market Attractiveness Analysis by Based On Deployment, 2016-2032

- Figure 7: Global Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Generative AI in Wealth Management Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Generative AI in Wealth Management Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Type (2016-2032)

- Figure 12: Global Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 13: Global Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Deployment (2016-2032)

- Figure 14: Global Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Type (2016-2032)

- Figure 16: Global Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 17: Global Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Deployment (2016-2032)

- Figure 18: Global Generative AI in Wealth Management Market Share Comparison by Region (2016-2032)

- Figure 19: Global Generative AI in Wealth Management Market Share Comparison by Based On Type (2016-2032)

- Figure 20: Global Generative AI in Wealth Management Market Share Comparison by Based On Application (2016-2032)

- Figure 21: Global Generative AI in Wealth Management Market Share Comparison by Based On Deployment (2016-2032)

- Figure 22: North America Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Typein 2022

- Figure 23: North America Generative AI in Wealth Management Market Attractiveness Analysis by Based On Type, 2016-2032

- Figure 24: North America Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 25: North America Generative AI in Wealth Management Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 26: North America Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Deploymentin 2022

- Figure 27: North America Generative AI in Wealth Management Market Attractiveness Analysis by Based On Deployment, 2016-2032

- Figure 28: North America Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Generative AI in Wealth Management Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Generative AI in Wealth Management Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Type (2016-2032)

- Figure 33: North America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 34: North America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Deployment (2016-2032)

- Figure 35: North America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Type (2016-2032)

- Figure 37: North America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 38: North America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Deployment (2016-2032)

- Figure 39: North America Generative AI in Wealth Management Market Share Comparison by Country (2016-2032)

- Figure 40: North America Generative AI in Wealth Management Market Share Comparison by Based On Type (2016-2032)

- Figure 41: North America Generative AI in Wealth Management Market Share Comparison by Based On Application (2016-2032)

- Figure 42: North America Generative AI in Wealth Management Market Share Comparison by Based On Deployment (2016-2032)

- Figure 43: Western Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Typein 2022

- Figure 44: Western Europe Generative AI in Wealth Management Market Attractiveness Analysis by Based On Type, 2016-2032

- Figure 45: Western Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 46: Western Europe Generative AI in Wealth Management Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 47: Western Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Deploymentin 2022

- Figure 48: Western Europe Generative AI in Wealth Management Market Attractiveness Analysis by Based On Deployment, 2016-2032

- Figure 49: Western Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Generative AI in Wealth Management Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Generative AI in Wealth Management Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Type (2016-2032)

- Figure 54: Western Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 55: Western Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Deployment (2016-2032)

- Figure 56: Western Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Type (2016-2032)

- Figure 58: Western Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 59: Western Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Deployment (2016-2032)

- Figure 60: Western Europe Generative AI in Wealth Management Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Generative AI in Wealth Management Market Share Comparison by Based On Type (2016-2032)

- Figure 62: Western Europe Generative AI in Wealth Management Market Share Comparison by Based On Application (2016-2032)

- Figure 63: Western Europe Generative AI in Wealth Management Market Share Comparison by Based On Deployment (2016-2032)

- Figure 64: Eastern Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Typein 2022

- Figure 65: Eastern Europe Generative AI in Wealth Management Market Attractiveness Analysis by Based On Type, 2016-2032

- Figure 66: Eastern Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 67: Eastern Europe Generative AI in Wealth Management Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 68: Eastern Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Deploymentin 2022

- Figure 69: Eastern Europe Generative AI in Wealth Management Market Attractiveness Analysis by Based On Deployment, 2016-2032

- Figure 70: Eastern Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Generative AI in Wealth Management Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Generative AI in Wealth Management Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Type (2016-2032)

- Figure 75: Eastern Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 76: Eastern Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Deployment (2016-2032)

- Figure 77: Eastern Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Type (2016-2032)

- Figure 79: Eastern Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 80: Eastern Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Deployment (2016-2032)

- Figure 81: Eastern Europe Generative AI in Wealth Management Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Generative AI in Wealth Management Market Share Comparison by Based On Type (2016-2032)

- Figure 83: Eastern Europe Generative AI in Wealth Management Market Share Comparison by Based On Application (2016-2032)

- Figure 84: Eastern Europe Generative AI in Wealth Management Market Share Comparison by Based On Deployment (2016-2032)

- Figure 85: APAC Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Typein 2022

- Figure 86: APAC Generative AI in Wealth Management Market Attractiveness Analysis by Based On Type, 2016-2032

- Figure 87: APAC Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 88: APAC Generative AI in Wealth Management Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 89: APAC Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Deploymentin 2022

- Figure 90: APAC Generative AI in Wealth Management Market Attractiveness Analysis by Based On Deployment, 2016-2032

- Figure 91: APAC Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Generative AI in Wealth Management Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Generative AI in Wealth Management Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Type (2016-2032)

- Figure 96: APAC Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 97: APAC Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Deployment (2016-2032)

- Figure 98: APAC Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Type (2016-2032)

- Figure 100: APAC Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 101: APAC Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Deployment (2016-2032)

- Figure 102: APAC Generative AI in Wealth Management Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Generative AI in Wealth Management Market Share Comparison by Based On Type (2016-2032)

- Figure 104: APAC Generative AI in Wealth Management Market Share Comparison by Based On Application (2016-2032)

- Figure 105: APAC Generative AI in Wealth Management Market Share Comparison by Based On Deployment (2016-2032)

- Figure 106: Latin America Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Typein 2022

- Figure 107: Latin America Generative AI in Wealth Management Market Attractiveness Analysis by Based On Type, 2016-2032

- Figure 108: Latin America Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 109: Latin America Generative AI in Wealth Management Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 110: Latin America Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Deploymentin 2022

- Figure 111: Latin America Generative AI in Wealth Management Market Attractiveness Analysis by Based On Deployment, 2016-2032

- Figure 112: Latin America Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Generative AI in Wealth Management Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Generative AI in Wealth Management Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Type (2016-2032)

- Figure 117: Latin America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 118: Latin America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Deployment (2016-2032)

- Figure 119: Latin America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Type (2016-2032)

- Figure 121: Latin America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 122: Latin America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Deployment (2016-2032)

- Figure 123: Latin America Generative AI in Wealth Management Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Generative AI in Wealth Management Market Share Comparison by Based On Type (2016-2032)

- Figure 125: Latin America Generative AI in Wealth Management Market Share Comparison by Based On Application (2016-2032)

- Figure 126: Latin America Generative AI in Wealth Management Market Share Comparison by Based On Deployment (2016-2032)

- Figure 127: Middle East & Africa Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Typein 2022

- Figure 128: Middle East & Africa Generative AI in Wealth Management Market Attractiveness Analysis by Based On Type, 2016-2032

- Figure 129: Middle East & Africa Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 130: Middle East & Africa Generative AI in Wealth Management Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 131: Middle East & Africa Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Based On Deploymentin 2022

- Figure 132: Middle East & Africa Generative AI in Wealth Management Market Attractiveness Analysis by Based On Deployment, 2016-2032

- Figure 133: Middle East & Africa Generative AI in Wealth Management Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Generative AI in Wealth Management Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Generative AI in Wealth Management Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Type (2016-2032)

- Figure 138: Middle East & Africa Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 139: Middle East & Africa Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Deployment (2016-2032)

- Figure 140: Middle East & Africa Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Type (2016-2032)

- Figure 142: Middle East & Africa Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 143: Middle East & Africa Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Deployment (2016-2032)

- Figure 144: Middle East & Africa Generative AI in Wealth Management Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Generative AI in Wealth Management Market Share Comparison by Based On Type (2016-2032)

- Figure 146: Middle East & Africa Generative AI in Wealth Management Market Share Comparison by Based On Application (2016-2032)

- Figure 147: Middle East & Africa Generative AI in Wealth Management Market Share Comparison by Based On Deployment (2016-2032)

- List of Tables

- Table 1: Global Generative AI in Wealth Management Market Comparison by Based On Type (2016-2032)

- Table 2: Global Generative AI in Wealth Management Market Comparison by Based On Application (2016-2032)

- Table 3: Global Generative AI in Wealth Management Market Comparison by Based On Deployment (2016-2032)

- Table 4: Global Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Generative AI in Wealth Management Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Type (2016-2032)

- Table 8: Global Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 9: Global Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Deployment (2016-2032)

- Table 10: Global Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Type (2016-2032)

- Table 12: Global Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Table 13: Global Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Deployment (2016-2032)

- Table 14: Global Generative AI in Wealth Management Market Share Comparison by Region (2016-2032)

- Table 15: Global Generative AI in Wealth Management Market Share Comparison by Based On Type (2016-2032)

- Table 16: Global Generative AI in Wealth Management Market Share Comparison by Based On Application (2016-2032)

- Table 17: Global Generative AI in Wealth Management Market Share Comparison by Based On Deployment (2016-2032)

- Table 18: North America Generative AI in Wealth Management Market Comparison by Based On Application (2016-2032)

- Table 19: North America Generative AI in Wealth Management Market Comparison by Based On Deployment (2016-2032)

- Table 20: North America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Generative AI in Wealth Management Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Type (2016-2032)

- Table 24: North America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 25: North America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Deployment (2016-2032)

- Table 26: North America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Type (2016-2032)

- Table 28: North America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Table 29: North America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Deployment (2016-2032)

- Table 30: North America Generative AI in Wealth Management Market Share Comparison by Country (2016-2032)

- Table 31: North America Generative AI in Wealth Management Market Share Comparison by Based On Type (2016-2032)

- Table 32: North America Generative AI in Wealth Management Market Share Comparison by Based On Application (2016-2032)

- Table 33: North America Generative AI in Wealth Management Market Share Comparison by Based On Deployment (2016-2032)

- Table 34: Western Europe Generative AI in Wealth Management Market Comparison by Based On Type (2016-2032)

- Table 35: Western Europe Generative AI in Wealth Management Market Comparison by Based On Application (2016-2032)

- Table 36: Western Europe Generative AI in Wealth Management Market Comparison by Based On Deployment (2016-2032)

- Table 37: Western Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Generative AI in Wealth Management Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Type (2016-2032)

- Table 41: Western Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 42: Western Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Deployment (2016-2032)

- Table 43: Western Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Type (2016-2032)

- Table 45: Western Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Table 46: Western Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Deployment (2016-2032)

- Table 47: Western Europe Generative AI in Wealth Management Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Generative AI in Wealth Management Market Share Comparison by Based On Type (2016-2032)

- Table 49: Western Europe Generative AI in Wealth Management Market Share Comparison by Based On Application (2016-2032)

- Table 50: Western Europe Generative AI in Wealth Management Market Share Comparison by Based On Deployment (2016-2032)

- Table 51: Eastern Europe Generative AI in Wealth Management Market Comparison by Based On Type (2016-2032)

- Table 52: Eastern Europe Generative AI in Wealth Management Market Comparison by Based On Application (2016-2032)

- Table 53: Eastern Europe Generative AI in Wealth Management Market Comparison by Based On Deployment (2016-2032)

- Table 54: Eastern Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Generative AI in Wealth Management Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Type (2016-2032)

- Table 58: Eastern Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 59: Eastern Europe Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Deployment (2016-2032)

- Table 60: Eastern Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Type (2016-2032)

- Table 62: Eastern Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Table 63: Eastern Europe Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Deployment (2016-2032)

- Table 64: Eastern Europe Generative AI in Wealth Management Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Generative AI in Wealth Management Market Share Comparison by Based On Type (2016-2032)

- Table 66: Eastern Europe Generative AI in Wealth Management Market Share Comparison by Based On Application (2016-2032)

- Table 67: Eastern Europe Generative AI in Wealth Management Market Share Comparison by Based On Deployment (2016-2032)

- Table 68: APAC Generative AI in Wealth Management Market Comparison by Based On Type (2016-2032)

- Table 69: APAC Generative AI in Wealth Management Market Comparison by Based On Application (2016-2032)

- Table 70: APAC Generative AI in Wealth Management Market Comparison by Based On Deployment (2016-2032)

- Table 71: APAC Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Generative AI in Wealth Management Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Type (2016-2032)

- Table 75: APAC Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 76: APAC Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Deployment (2016-2032)

- Table 77: APAC Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Type (2016-2032)

- Table 79: APAC Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Table 80: APAC Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Deployment (2016-2032)

- Table 81: APAC Generative AI in Wealth Management Market Share Comparison by Country (2016-2032)

- Table 82: APAC Generative AI in Wealth Management Market Share Comparison by Based On Type (2016-2032)

- Table 83: APAC Generative AI in Wealth Management Market Share Comparison by Based On Application (2016-2032)

- Table 84: APAC Generative AI in Wealth Management Market Share Comparison by Based On Deployment (2016-2032)

- Table 85: Latin America Generative AI in Wealth Management Market Comparison by Based On Type (2016-2032)

- Table 86: Latin America Generative AI in Wealth Management Market Comparison by Based On Application (2016-2032)

- Table 87: Latin America Generative AI in Wealth Management Market Comparison by Based On Deployment (2016-2032)

- Table 88: Latin America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Generative AI in Wealth Management Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Type (2016-2032)

- Table 92: Latin America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 93: Latin America Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Based On Deployment (2016-2032)

- Table 94: Latin America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Type (2016-2032)

- Table 96: Latin America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Table 97: Latin America Generative AI in Wealth Management Market Y-o-Y Growth Rate Comparison by Based On Deployment (2016-2032)

- Table 98: Latin America Generative AI in Wealth Management Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Generative AI in Wealth Management Market Share Comparison by Based On Type (2016-2032)

- Table 100: Latin America Generative AI in Wealth Management Market Share Comparison by Based On Application (2016-2032)

- Table 101: Latin America Generative AI in Wealth Management Market Share Comparison by Based On Deployment (2016-2032)

- Table 102: Middle East & Africa Generative AI in Wealth Management Market Comparison by Based On Type (2016-2032)

- Table 103: Middle East & Africa Generative AI in Wealth Management Market Comparison by Based On Application (2016-2032)

- Table 104: Middle East & Africa Generative AI in Wealth Management Market Comparison by Based On Deployment (2016-2032)

- Table 105: Middle East & Africa Generative AI in Wealth Management Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Generative AI in Wealth Management Market Revenue (US$ Mn) (2016-2032)