Generative AI in Life Insurance Market By Deployment Model(Cloud-based, On-premise), By Technology(Natural Language Processing (NLP), Machine Learning Algorithms, Deep Learning Models, Other Technologies), By Application(Underwriting and Claims Processing, Personalized Policy Recommendations, Customer Service and Chatbots), By End-User(Life Insurance Companies, Brokers and Agents, Reinsurers), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43351

-

Jan 2022

-

189

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Generative AI in Life Insurance Market Report Overview

- Key Takeaways

- Driving Factors

- Restraining Factors

- Generative AI in Life Insurance Market Segmentation Analysis

- Generative AI in Life Insurance Industry Segments

- Generative AI in Life Insurance Market Growth Opportunities

- Generative AI in Life Insurance Market Regional Analysis

- Generative AI in the Life Insurance Industry By Region

- Generative AI in Life Insurance Market Competitive Analysis

- Generative AI in Life Insurance Industry Key Players

- Generative AI in Life Insurance Market Recent Development

- Report Scope

Generative AI in Life Insurance Market Report Overview

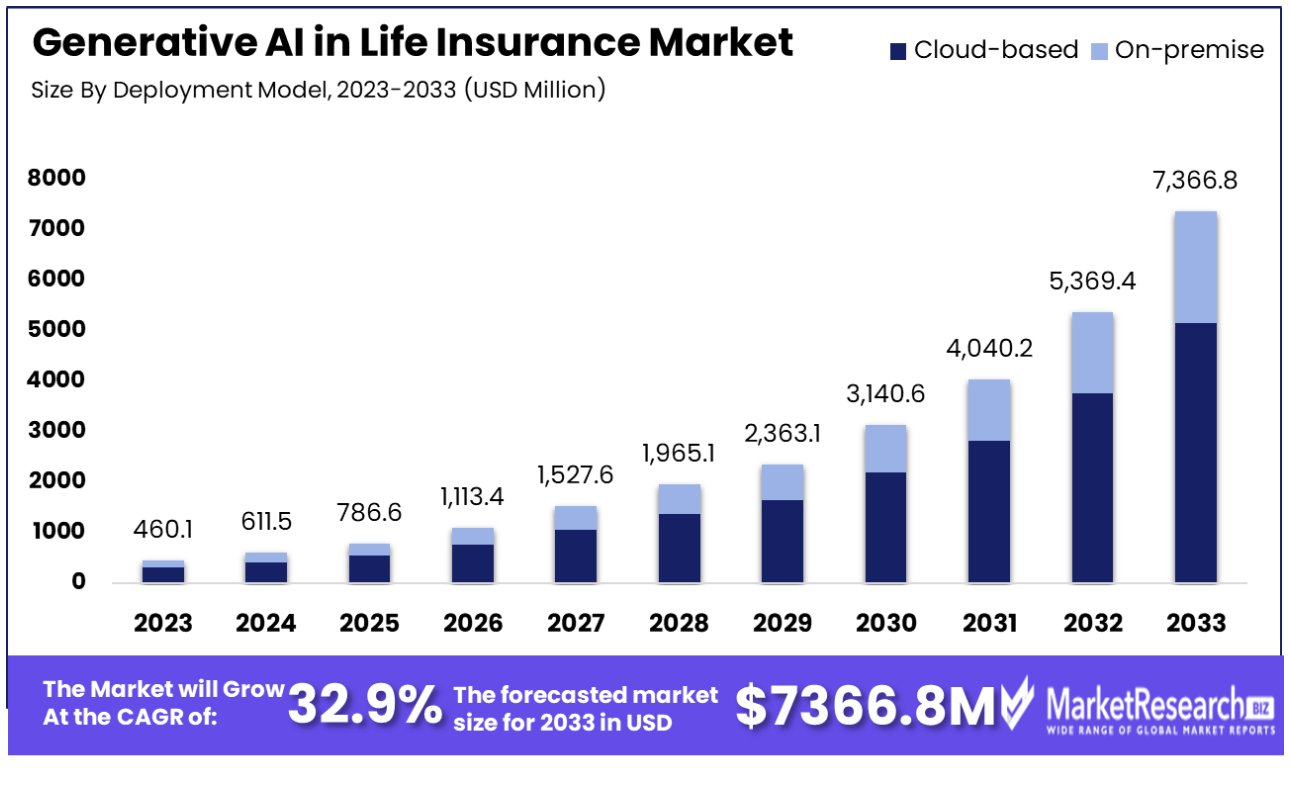

The Generative AI in Life Insurance Market was valued at USD 460.1 Million in 2023. It is expected to reach USD 7366.8 Million by 2033, with a CAGR of 32.9% during the forecast period from 2024 to 2033.

Generative AI in the life insurance market refers to the application of advanced artificial intelligence technologies that can generate new content, insights, or data based on existing information sets. This innovative approach enables life insurance companies to enhance various aspects of their operations, including personalized policy creation, risk assessment, customer service, and fraud detection. By leveraging generative AI, insurers can simulate numerous scenarios to better understand risks, tailor policies to individual customer profiles, optimize claim processing and improve overall customer engagement.

This technology fosters more efficient, accurate, and personalized services, potentially transforming underwriting processes and customer interactions, thereby increasing operational efficiency and customer satisfaction in the life insurance sector.

From an analytical perspective, the integration of Generative AI into the life insurance market is poised to significantly disrupt traditional paradigms, offering transformative potential for both operational efficiencies and customer experiences. Despite its promising capabilities, the adoption of these technologies has been relatively slow, and there is substantial room for improvement in enhancing customer satisfaction with insurance claims handling experiences. Notably, poor claims experiences could jeopardize up to $170 billion of global insurance premiums by 2027, underscoring the urgent need for insurers to innovate and improve their claims processes.

Generative AI's capacity to generate predictive models and simulate complex scenarios allows for a more nuanced understanding of risk profiles, leading to more accurate and dynamic pricing strategies. Consequently, the adoption of Generative AI facilitates the development of highly personalized insurance products, tailored to individual clients' specific needs and risk factors. This level of personalization extends to customer service, where AI-driven insights can significantly enhance interaction and engagement strategies.

Furthermore, 79% of claims executives surveyed believe that automation, AI, and data analytics can bring value across the entire claims value chain, highlighting the potential of these technologies to transform the claims process. By automating and enhancing traditionally labor-intensive and error-prone processes, insurers can achieve significant cost savings, improve accuracy, and reduce response times, enhancing customer satisfaction and trust.

The strategic integration of Generative AI in the life insurance sector is gaining traction, particularly in Asia, where 62% of respondents in an Oliver Wyman Forum's Global Consumer Sentiment Survey reported using generative AI in their businesses over the past three months. This indicates a growing recognition of the technology's value and a shift towards its adoption.

Despite these advancements, the implementation of Generative AI in the life insurance market faces challenges, including data privacy, ethical considerations, and the need for robust regulatory frameworks. Nevertheless, the strategic integration of Generative AI holds the promise of reshaping the life insurance landscape, driving innovation, and offering a competitive edge to early adopters. As the technology matures and adoption increases, its impact on market dynamics, customer expectations, and industry standards will undoubtedly become more pronounced, making it a pivotal area for ongoing research and investment.

Key Takeaways

- Market Growth: Generative AI in Life Insurance Market was valued at USD 460.1 Million in 2023. It is expected to reach USD 7366.8 Million by 2033, with a CAGR of 32.9% during the forecast period from 2024 to 2033.

- By Deployment Model: Cloud-based deployment emerges as the dominant model, accounting for 70% of the Generative AI deployment in the life insurance sector.

- By Technology: The technology segment, Natural Language Processing (NLP) is the standout, capturing 52% of the market.

- By Application: Underwriting and Claims Processing stands as a key application area segment

- By End-User: Life Insurance Companies are the primary beneficiaries of Generative AI technologies

Driving Factors

Data-Driven Insights Propel Underwriting and Claims Precision

The burgeoning accumulation of customer data through wearables, social media, and online activities is revolutionizing the life insurance sector by refining generative AI models for underwriting and claims assessments. This data integration enhances the accuracy and efficiency of risk assessment, enabling more informed decision-making. As insurers harness these insights, they not only streamline operations but also tailor their services to individual risk profiles, significantly reducing costs and improving customer trust. The trend towards data-driven precision in underwriting and claims processing is setting a new industry standard, with long-term implications pointing towards a more dynamic, responsive, and efficient insurance market.

Hyper personalization Enhances Customer Engagement

Generative AI's capacity for hyperpersonalization is transforming the life insurance industry by enabling the creation of highly customized recommendations and offerings. This personal touch increases customer satisfaction and loyalty, crucial in a market where differentiation is key. By leveraging detailed customer data, insurers can predict individual needs and preferences with unprecedented accuracy, offering tailored insurance solutions that resonate on a personal level. This shift towards individualized customer engagement is anticipated to redefine competitive dynamics in the industry, fostering a more customer-centric approach that could significantly boost market growth over the long term.

Automation Accelerates Service Delivery

The demand for faster service in the life insurance sector is being met by generative AI's ability to automate complex processes like underwriting and claims management. This automation not only speeds up service delivery but also enhances accuracy and reduces operational costs. Customers benefit from quicker response times and more efficient resolution of claims and inquiries, factors that directly contribute to higher satisfaction rates. The integration of AI-driven automation within life insurance operations is expected to escalate, potentially setting new benchmarks for service speed and efficiency. As this trend continues, the sector may witness a substantial shift towards more agile and responsive service models, reshaping expectations and standards across the industry.

Restraining Factors

Privacy Concerns Curb Generative AI Integration in Life Insurance

The sensitive nature of life insurance data, encompassing medical records and biometrics, presents a significant barrier to the adoption of generative AI technologies within the sector. Potential customers' apprehensions about data privacy and the risk of misuse hinder the collection of comprehensive datasets necessary for training generative models effectively. This limitation restricts the ability of insurers to leverage AI for personalized policy generation or risk assessment, thus impeding market growth by stifling innovation and the development of more tailored insurance products.

Regulatory Scrutiny Intensifies Interpretability Challenges in Life Insurance AI

The complex nature of generative models, such as Generative Adversarial Networks (GANs), poses interpretability and auditability challenges, making life insurers cautious about their deployment. The inability to fully explain or trace the decision-making process of these AI systems raises concerns amidst stringent regulatory scrutiny in the insurance industry. Regulators demand transparency and accountability, especially in sectors dealing with sensitive personal data. Insurers' wariness to adopt technologies that could potentially violate compliance requirements thereby limits the growth potential of generative AI in the life insurance market, emphasizing the need for advancements in AI interpretability and governance.

Generative AI in Life Insurance Market Segmentation Analysis

By Deployment Model Analysis

Cloud-based deployment emerges as the dominant model, accounting for 70% of the Generative AI deployment in the life insurance sector. This preference is largely due to the cloud's scalability, flexibility, and cost-effectiveness, which align with the needs of modern insurance companies seeking to innovate and adapt to changing market demands rapidly. Cloud-based solutions offer life insurance companies the ability to deploy AI capabilities without substantial initial investments in IT infrastructure, facilitating easier updates and scaling of AI functionalities as business needs evolve. In contrast, On-premise solutions, while offering enhanced control and security, are increasingly seen as less flexible and more capital-intensive, especially for companies looking to rapidly scale and adapt their AI capabilities.

By Technology Analysis

Within the technology segment, Natural Language Processing (NLP) is the standout, capturing 52% of the market. NLP technologies enable life insurance companies to process and understand human language, facilitating more efficient document processing, policy analysis, and customer interactions. NLP's dominance is attributed to its critical role in automating underwriting processes, analyzing policy documents for insights and compliance, and enhancing customer service through chatbots and automated assistants. Other significant technologies like Machine Learning Algorithms, Deep Learning Models, and Other Technologies contribute to the sector by driving advancements in risk assessment, fraud detection, and personalized policy recommendations, further showcasing the diverse technological foundation supporting Generative AI applications in life insurance.

By Application Analysis

Underwriting and Claims Processing stands as a key application area, significantly benefitting from Generative AI's capabilities to streamline operations and reduce processing times. By leveraging AI, life insurance companies can automate the evaluation of applications and claims, making the process faster and more accurate. Other application areas such as Personalized Policy Recommendations, Customer Service and Chatbots, Fraud Detection, Risk Management, Predictive Analytics, and Document Processing Automation play crucial roles in harnessing AI to tailor policies to individual needs, improve customer interactions, identify fraudulent activities, and manage risks more effectively. Each application demonstrates how Generative AI is being used to innovate and enhance various facets of the life insurance business, contributing to overall market growth.

By End-User Analysis

Life Insurance Companies are the primary beneficiaries of Generative AI technologies, utilizing these advancements to optimize their core operations and customer engagement strategies. Brokers and Agents, as well as Reinsurers, also leverage AI to improve their services and operational efficiencies. For brokers and agents, AI tools facilitate better policy matching and customer service, while reinsurers use AI for more sophisticated risk assessment and predictive modeling, highlighting the widespread applicability of Generative AI across different stakeholders in the life insurance ecosystem.

Generative AI in Life Insurance Industry Segments

By Deployment Model

- Cloud-based

- On-premise

By Technology

- Natural Language Processing (NLP)

- Machine Learning Algorithms

- Deep Learning Models

- Other Technologies

By Application

- Underwriting and Claims Processing

- Personalized Policy Recommendations

- Customer Service and Chatbots

- Fraud Detection

- Risk Management and Predictive Analytics

- Natural Language Processing (NLP) for Policy Analysis

- Document Processing Automation

By End-User

- Life Insurance Companies

- Brokers and Agents

- Reinsurers

Generative AI in Life Insurance Market Growth Opportunities

Personalized Pricing Revolutionizes Life Insurance Affordability

The integration of Generative AI into life insurance heralds a new era of personalized pricing, where premiums are precisely tailored to individual risk profiles. This innovation not only enhances affordability for consumers but also refines the underwriting process for insurers. By leveraging generative models to analyze a wide array of data points—from lifestyle choices to biometric indicators—insurers can offer dynamic premium pricing that accurately reflects the actual risk each customer presents. This approach not only makes life insurance more accessible to a broader demographic but also incentivizes healthier lifestyle choices among policyholders, potentially reducing claim rates over time.

Predictive Analytics for Proactive Customer Management

Generative AI's capability to predict future outcomes based on vast datasets offers transformative potential for the life insurance sector. By identifying high-risk individuals through analysis of lifestyle, biometrics, and other critical variables, insurers can implement proactive strategies to mitigate risks. This could include offering personalized health improvement programs or adjusting coverage terms to better align with the individual's risk profile. Such predictive analytics not only improve customer service by offering tailored interventions but also enhance insurers' risk management, leading to a more sustainable business model. This strategic foresight could redefine customer engagement, fostering a preventative approach to health and wellness within the insured population. The Generative AI in Insurance Market is transforming life insurance with enhanced risk assessment and customer service.

Generative AI in Life Insurance Market Regional Analysis

North America Dominates with 32% Market Share in the Generative AI in Life Insurance Market

North America's significant 32% market share in the Generative AI in the Life Insurance sector is anchored by its advanced technological landscape and the early adoption of innovative digital solutions within the insurance industry. The region, led by the United States and Canada, showcases a strong ecosystem of tech startups and established tech giants driving advancements in AI technologies. This technological edge, combined with a robust financial services sector that is open to digital transformation, has facilitated the integration of generative AI tools in life insurance, from customer service automation to personalized policy generation.

The deployment of generative AI in the North American life insurance market is marked by its capacity to enhance customer experience, streamline claim processing, and improve risk assessment with predictive analytics. The region benefits from a highly competitive market environment that encourages innovation, alongside a regulatory framework that is gradually adapting to accommodate AI's role in financial services. Furthermore, the presence of a tech-savvy consumer base demanding more personalized and efficient services has spurred the adoption of AI technologies.

Europe: Ethical Innovation and Regulatory Compliance

Europe's life insurance market is also embracing generative AI, with a focus on ethical AI use and strict adherence to regulatory standards like GDPR. The region's emphasis on data protection and consumer rights has shaped a unique approach to incorporating AI, prioritizing transparency and fairness. European insurers are leveraging AI to personalize offerings and optimize operations while navigating the complex landscape of EU regulations. This balance between innovation and regulation positions Europe as a key player in the ethical advancement of AI in life insurance.

Asia Pacific: Rapid Growth and Digital Transformation

The Asia Pacific region is witnessing rapid growth in the use of generative AI within the life insurance market, fueled by digital transformation initiatives and an expanding middle class. Countries like China, Japan, and South Korea are at the forefront, utilizing AI for everything from customer interaction to fraud detection and risk assessment. The region's diverse market dynamics, characterized by high mobile penetration and a growing demand for financial services, offer a fertile ground for AI-driven innovations. However, the varied regulatory environments and the need for localized solutions present unique challenges to harnessing AI's full potential in life insurance.

Generative AI in the Life Insurance Industry By Region

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Generative AI in Life Insurance Market Competitive Analysis

In life insurance, generative AI is revolutionizing the sector by enhancing risk assessment, personalizing customer experiences, and streamlining operational efficiencies. The companies leading this technological frontier are not only shaping competitive strategies but are also setting new standards in customer service and product innovation.

IBM Corporation stands out with its AI-powered analytics and cognitive solutions, which are instrumental in transforming underwriting processes and claims management, offering insurers the ability to make more informed decisions swiftly.

Google LLC, through its advanced machine learning models, provides life insurance companies with tools to analyze vast datasets, improving risk assessment accuracy and enabling more personalized policy offerings to meet diverse customer needs.

Microsoft Corporation leverages its AI and cloud computing capabilities to offer insurers robust platforms for data analysis, customer relationship management, and fraud detection, thereby enhancing operational efficiency and customer satisfaction.

Salesforce integrates AI into its customer relationship management (CRM) solutions, enabling life insurance companies to deliver highly personalized customer experiences through automated interactions and predictive analytics.

Amazon Web Services (AWS) offers a wide range of AI services that empower life insurance companies to innovate and scale with the flexibility of cloud technology, facilitating the development of new insurance models and customer engagement strategies.

Cognizant provides AI-driven analytics and process automation solutions that help life insurers optimize underwriting, claims processing, and customer service, driving efficiencies and reducing operational costs.

Accenture offers consulting and technology services that include AI-driven innovations, helping life insurers reimagine their business models and customer engagement strategies in the digital era.

Intel Corporation's AI technologies enhance the computational capabilities needed for complex data analysis in life insurance, supporting advanced risk assessment and policy personalization.

Generative AI in Life Insurance Industry Key Players

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Salesforce

- Amazon Web Services (AWS)

- Cognizant

- Accenture

- Intel Corporation

- Palantir Technologies

- Guidewire

- Insurify

- Lemonade

- Other Key Players

Generative AI in Life Insurance Market Recent Development

- In April 2023, Lloyd's of London announced dramatic changes, including exemptions for state-backed cyber attacks in their policies. Recognition that the status quo of cyber insurance is unsustainable due to the evolving nature of cyber threats and the insurance landscape.

- In 2023, Lemonade, a leading AI-driven insurance company, expressed its commitment to harnessing generative AI for improving business processes and achieving cost savings. The company aims to integrate generative AI into its already advanced AI and machine learning platforms.

Report Scope

Report Features Description Market Value (2023) USD 460.1 Million Forecast Revenue (2033) USD 7366.8 Million CAGR (2024-2032) 6.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Raisins, Apricots, Figs, Dates, Berries, Others), By Application(Bakery and Confectionery, Dairy and Frozen Desserts, Breakfast Cereals,Beverages, Sweet and Savory Snacks, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Namrong Foodstuff Co., Ltd (China), Qingdao Kington Produce Co., Ltd (China), Shanxin Exxon Trading Co., Ltd (China), AGRANA Beteiligungs-AG (Austria), Agthia Group PJSC (UAE), Angas Park Fruit Co. (Australia), Archer Daniels Midland Company (USA), Bergin Fruit and Nut Co. Inc. (USA), Berrifine A/S (Denmark), Chaucer Foods Ltd (UK), Dohler GmbH (Germany), European Freeze Dry (UK), Farmley by Connedit Business Solutions Private Limited (India), FutureCeuticals, Inc. (USA), Geobres S.A. (Greece) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-