Generative AI in Health Insurance Market By Component (Software and Services), By Application, By Deployment Mode (Cloud-based and On-premises), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

-

38808

-

July 2023

-

168

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Driving factors

- Restraining Factors

- Covid-19 Impact on Generative AI in Health Insurance Market

- By Component Analysis

- By Application Analysis

- By Deployment Mode Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Market Share & Key Players Analysis

- Recent Development

- Report Scope:

Report Overview

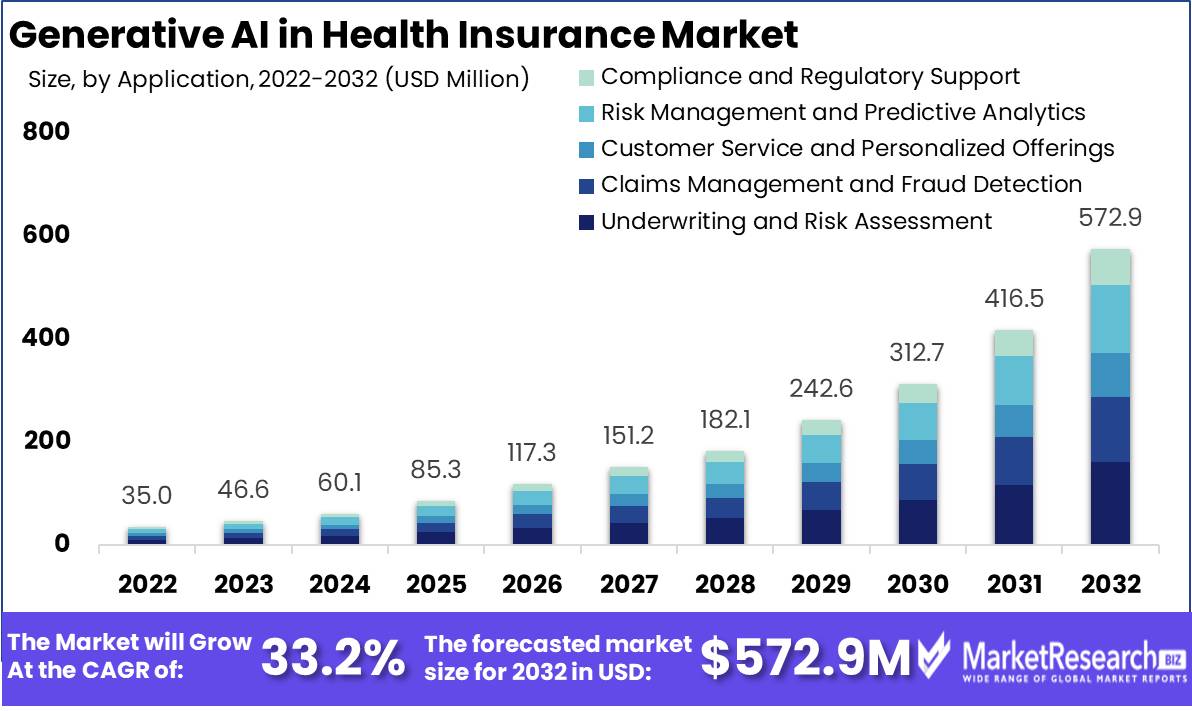

Generative AI in Health Insurance Market size is expected to be worth around USD 572.9 Mn by 2032 from USD 35.0 Mn in 2022, growing at a CAGR of 33.2% during the forecast period from 2023 to 2032.

The global market for generative AI in health insurance is emerging, and Generative AI has the potential to transform various aspects of the health insurance industry, offering innovative solutions to improve risk assessment, underwriting processes, claims management, fraud detection, and customer experience. One of the key drivers for the adoption of generative AI in health insurance is the ability to leverage vast amounts of healthcare data to assess individual health risks accurately. By applying advanced analytics and machine learning algorithms, generative AI can analyze medical records, demographics, lifestyle factors, and genetic information to provide more precise risk assessment and enable personalized insurance plans.

Driving factors

Increasing Complexity of Healthcare Data

The healthcare industry generates vast amounts of data from electronic health records, medical imaging, wearable devices, and other sources. Generative AI can handle the complexity and volume of this data, allowing insurers to extract valuable insights and make informed decisions.

Personalization and Precision:

Generative AI enables insurers to personalize insurance plans and services based on individual health profiles, demographics, and other relevant factors. This precision in risk assessment and underwriting can lead to more accurate pricing and coverage tailored to the specific needs of policyholders.

Restraining Factors

Cost and Return on Investment

Implementing generative AI solutions involves significant investments in technology, infrastructure, data management, and talent acquisition. The costs associated with deploying and maintaining AI systems may pose a barrier for some health insurance companies, especially smaller organizations.

Integration with Existing Systems

Integrating generative AI solutions into existing health insurance systems and workflows can be complex and require significant changes to infrastructure and processes. Legacy systems, interoperability issues, and resistance to change may slow down the adoption of generative AI in health insurance.

Covid-19 Impact on Generative AI in Health Insurance Market

Increased Demand for Digital Solutions:

The pandemic accelerated the healthcare industry's adoption of digital technologies and remote services. Health insurers increasingly turned to AI-powered solutions, including generative AI, to facilitate telehealth, remote claims processing, and customer support. The demand for digital solutions may have further accelerated the integration of generative AI into health insurance processes.

Impact on Claims Processing and Fraud Detection:

The COVID-19 pandemic led to an increase in healthcare claims related to testing, treatment, and hospitalization. Insurers faced challenges in processing these claims efficiently and accurately. Generative AI may have been utilized to streamline claims processing and enhance fraud detection capabilities to handle the surge in claims and identify potentially fraudulent activities.

By Component Analysis

Based on components, the market is segmented into software and services. Both software and services are important components in the implementation of generative AI in the health insurance industry. Software refers to the technology and algorithms used to develop and deploy generative AI models, while services encompass the implementation, customization, and ongoing support provided by AI solution providers.

By Application Analysis

Based on application, the market is segmented into underwriting and risk assessment, claims management and fraud detection, customer service and personalized offerings, risk management and predictive analytics, compliance, and regulatory support. Among these applications, the underwriting and risk assessment is expected to be the most lucrative in the global generative AI in the health insurance market. Underwriting and risk assessment are critical functions in the health insurance industry.

Generative AI can analyze vast amounts of data, such as medical histories, demographics, and lifestyle factors, to assess risk and determine appropriate underwriting decisions. This application is essential for accurate risk evaluation and pricing of insurance policies. Claims management is a key area where generative AI can be applied. AI models can analyze claims data, identify patterns, and detect anomalies to streamline claims processing and detect potentially fraudulent activities. This application helps improve the efficiency and accuracy of claims management while minimizing financial losses due to fraud.

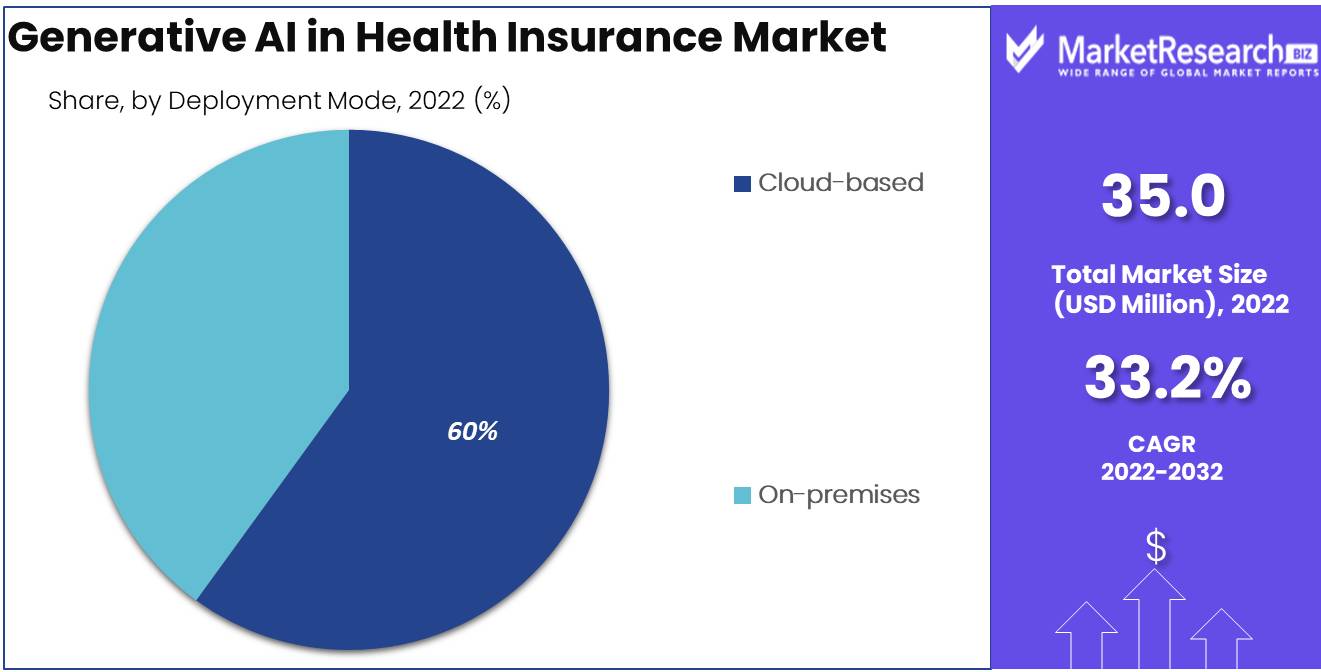

By Deployment Mode Analysis

Based on deployment mode, the market is segmented into cloud-based and on-premises. Among these, the cloud-based is expected to be the most lucrative in the global generative AI in the health insurance market. The Cloud-based deployments offer scalability, flexibility, and accessibility allowing organizations to leverage the power of generative AI without significant upfront infrastructure investments.

The cloud-based platforms provide collaboration, data sharing, and integration opportunities with other cloud-based services. On-premises deployments offer organizations more control over their data & infrastructure. Some health insurance companies may prefer to keep sensitive data on-premises due to privacy concerns or regulatory requirements. On-premises deployments require organizations to invest in their own hardware, software, and IT resources, which can provide higher customization and security.

Key Market Segments

Based on Component

- Software

- Services

Based on Application

- Underwriting and Risk Assessment

- Claims Management and Fraud Detection

- Customer Service and Personalized Offerings

- Risk Management and Predictive Analytics

- Compliance and Regulatory Support

Based on the Deployment Mode

- Cloud-based

- On-premises

Growth Opportunity

Enhanced Risk Assessment and Underwriting

Generative AI can significantly improve risk assessment and underwriting processes in health insurance. As AI algorithms become more sophisticated and capable of analyzing vast amounts of health data, insurers can make more accurate predictions of individual health risks. This enables personalized insurance plans, optimized premiums, and better risk management strategies.

Data-Driven Insights and Decision-Making

Generative AI in health insurance can provide valuable insights and support data-driven decision-making. AI algorithms can identify trends, patterns, and correlations by analyzing large volumes of healthcare data. These insights can help insurers optimize pricing strategies, develop targeted interventions, and improve risk management practices.

Latest Trends

Advanced Fraud Detection:

Generative AI models are being leveraged to enhance fraud detection capabilities in health insurance. By analyzing claims data and identifying patterns indicative of potential fraud, insurers can improve their ability to detect and prevent fraudulent activities, ultimately reducing losses and protecting the integrity of the insurance system.

Telehealth and Remote Services:

The COVID-19 pandemic has accelerated the adoption of telehealth and remote services in healthcare. Generative AI can support remote health monitoring, diagnosis, and treatment, as well as facilitate telehealth consultations and claims processing.

Natural Language Processing (NLP) Applications:

NLP techniques are being increasingly integrated into generative AI solutions in health insurance. NLP allows insurers to extract insights from unstructured healthcare data, such as medical records and doctor's notes, enabling better risk assessment, claims processing, and customer support.

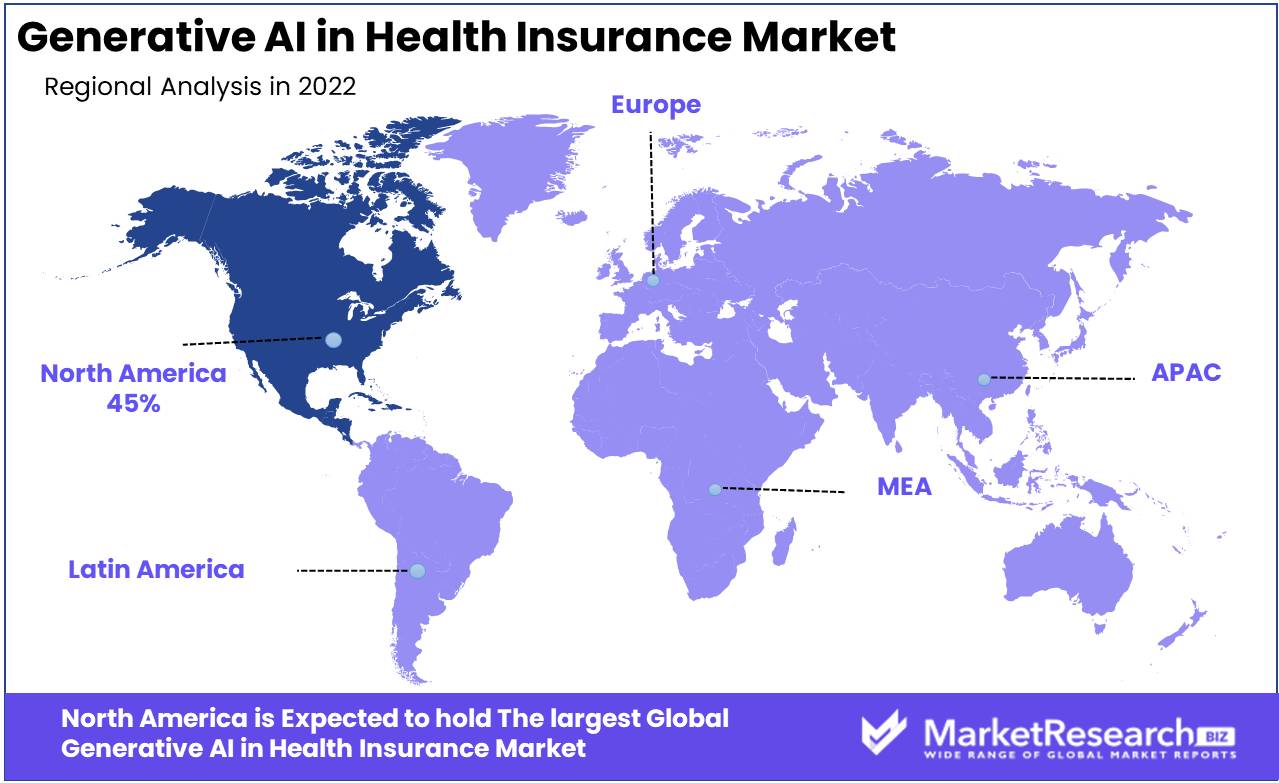

Regional Analysis

North America, especially the United States, has been at the forefront of adopting generative artificial intelligence technologies in health insurance. The region has a well-developed health insurance market and advanced AI capabilities. The United States, in particular, has seen a rise in AI-driven solutions in areas such as risk assessment, claims processing, and fraud detection.

Asia Pacific countries like China, Japan, South Korea, and Singapore are investing heavily in R&D focused on healthcare applications of generative AI technologies, with major countries investing heavily into healthcare research & development projects for healthcare applications specifically. The region's large population and growing healthcare needs make it an attractive market for generative AI solutions in health insurance.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Startups and insurtech companies focusing on AI-driven solutions may play a significant role in the generative AI space within health insurance. Companies offer a range of AI-powered solutions and technologies that can be relevant to risk assessment, claims processing, fraud detection, and personalized healthcare in the health insurance sector.

Top Key Players in Generative AI in Health Insurance Market

- Oscar Health

- Tractable

- Anthem Inc.

- DataRobot Inc.

- Allstate

- Lemonade

- Microsoft Corporation

- Amazon Web Services

- Google LLC

- IBM Watson

- Other Key Players

Recent Development

- Jan 2023: Microsoft Azure OpenAI Service has become compliant with HIPAA (Health Insurance Portability and Accountability Act) regulations, making it even easier for healthcare companies to utilize generative AI to predict better medical outcomes.

Report Scope:

Report Features Description Market Value (2022) USD 35.0 Mn Forecast Revenue (2032) USD 572.9 Mn CAGR (2023-2032) 33.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Component (Software, Services)

Based on Application (Underwriting and Risk Assessment, Claims Management and Fraud Detection, Customer Service and Personalized Offerings, Risk Management and Predictive Analytics, Compliance and Regulatory Support)

Based on the Deployment Mode (Cloud-based, On-premises)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Oscar Health, Tractable, Anthem Inc., DataRobot Inc., Allstate, Lemonade, Microsoft Corporation, Amazon Web Services, Google LLC, IBM Watson, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Oscar Health

- Tractable

- Anthem Inc.

- DataRobot Inc.

- Allstate

- Lemonade

- Microsoft Corporation

- Amazon Web Services

- Google LLC

- IBM Watson

- Other Key Players