Generative AI in Cryptocurrency Market By Application (Price Prediction and Analysis, Trading Strategy Optimization, Risk Management, Portfolio Optimization, Market Sentiment Analysis, and Fraud Detection and Security), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

-

39225

-

March 2024

-

181

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

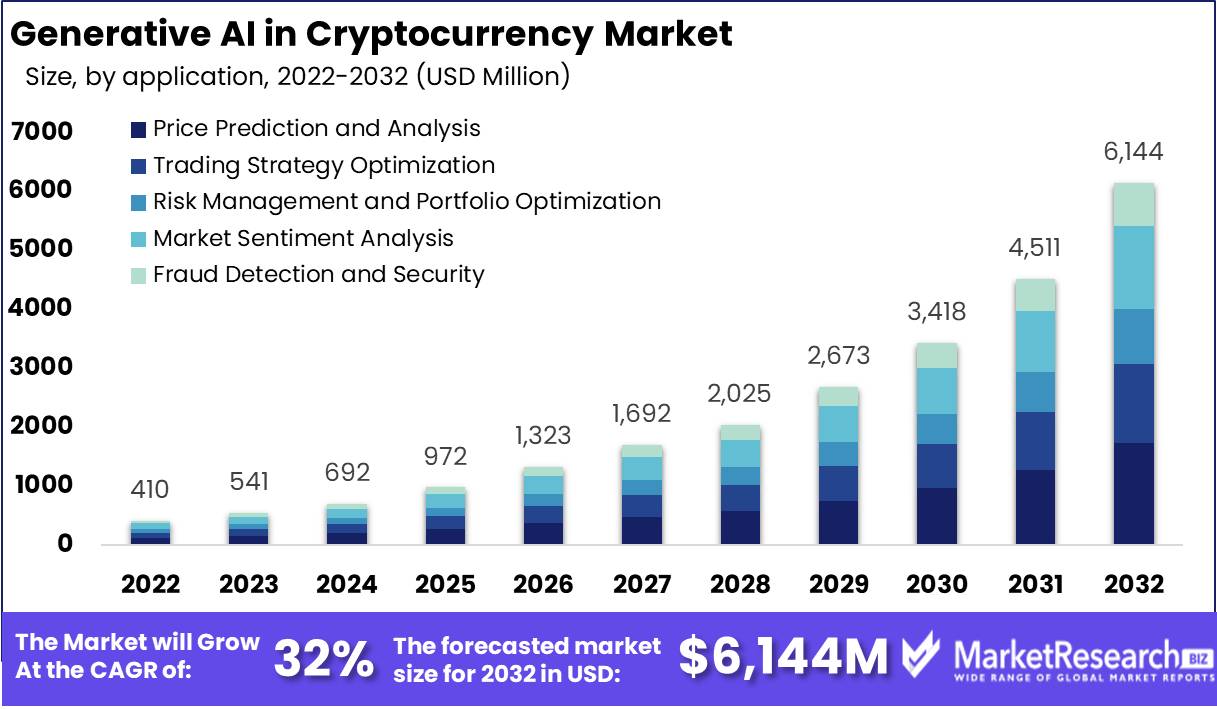

The Generative AI in Cryptocurrency Market size is expected to be worth around USD 6,144 Mn by 2032 from USD 410 Mn in 2022, growing at a CAGR of 32% during the forecast period from 2023 to 2032.

The surge in demand for new advanced technologies and the immerse popularity of AI-based cryptocurrency platforms are some of the main driving factors for the generative AI in the cryptocurrency market. Generative AI refers to the building of computer systems or software that has the capability to showcase tasks that primarily require human intelligence.

Such systems are developed to examine, understand, and respond to information in a manner that mimics the human thought process. Generative artificial intelligence models are developed using ML methods, which consist of training algorithms on a huge information set to analyze patterns, make forecasts, and produce outputs.

Cryptocurrencies have gained immense popularity due to their capability for monetary innovations, their centralized nature, and their potential to simplify quick and minimal-cost cross-border transactions. They are also enthused to have created multiple applications and channels like smart contracts, which are self-implemented contracts based on pre-defined situations, and DeFi, which is also known as decentralized finance procedures that provide substitute monetary solutions.

GenAI also supports the development of the tokenomics of new cryptocurrency projects. Tokenomics refers to the economic structure of a token that comprises token circulation, supply mechanisms, and utility within the ecosystem.

Al algorithms to examine market information, build multiple tokenomics situations, and boost token parameters to make sure a balanced and workable marketplace. AI tokens are cryptographic assets. There are some AI tokens that have great capabilities. For example, Injective is a level 1 blockchain that makes sure that users develop monetary-oriented decentralized applications, which are known as dApps for Web 3.

According to CoinGecko, which is a trading platform, with a distribution supply of 84 million INJ, the market cap price of the injective (INJ) is USD 3,298,996,689. It makes sure old token switches, margin trading, and forex future trading are all across different blockchains. INJ is basically an injective native cryptocurrency. It is also utilized for governance, verifying transactions on the networks, as well as inducements for developers.

The use of generative AI in cryptocurrency has surged over the years due to its potential to analyze huge amounts of information, analyze patterns, and create market forecasts. GenAI helps cryptocurrency enhance efficacy, maintain precise market forecasts, decrease the risk of loss, boost security, augment transparency, and help develop enriched trading tactics in the market. The demand for generative AI in cryptocurrency will gradually increase due to its high demand in trading, which will help in market expansion during the forecasted period.

Key Takeaways

- Market Value: The Generative AI in Cryptocurrency Market is projected to reach USD 6,144 million by 2032, experiencing significant growth from USD 410 million in 2022, with a remarkable CAGR of 32% during the forecast period from 2023 to 2032.

- Dominant Segments:

- By Application Analysis: Price Prediction and Analysis, Accounted for the largest revenue share in 2022, expected to remain the most lucrative segment. Generative AI aids traders and investors in making informed decisions by forecasting cryptocurrency price movements.

- By End-User Analysis: Individual Traders and Investors, accounted for the largest revenue share in 2022, expected to remain the most lucrative segment. Individual traders and investors actively explore AI-based tools and platforms for market analysis, price prediction, and generating trading strategies.

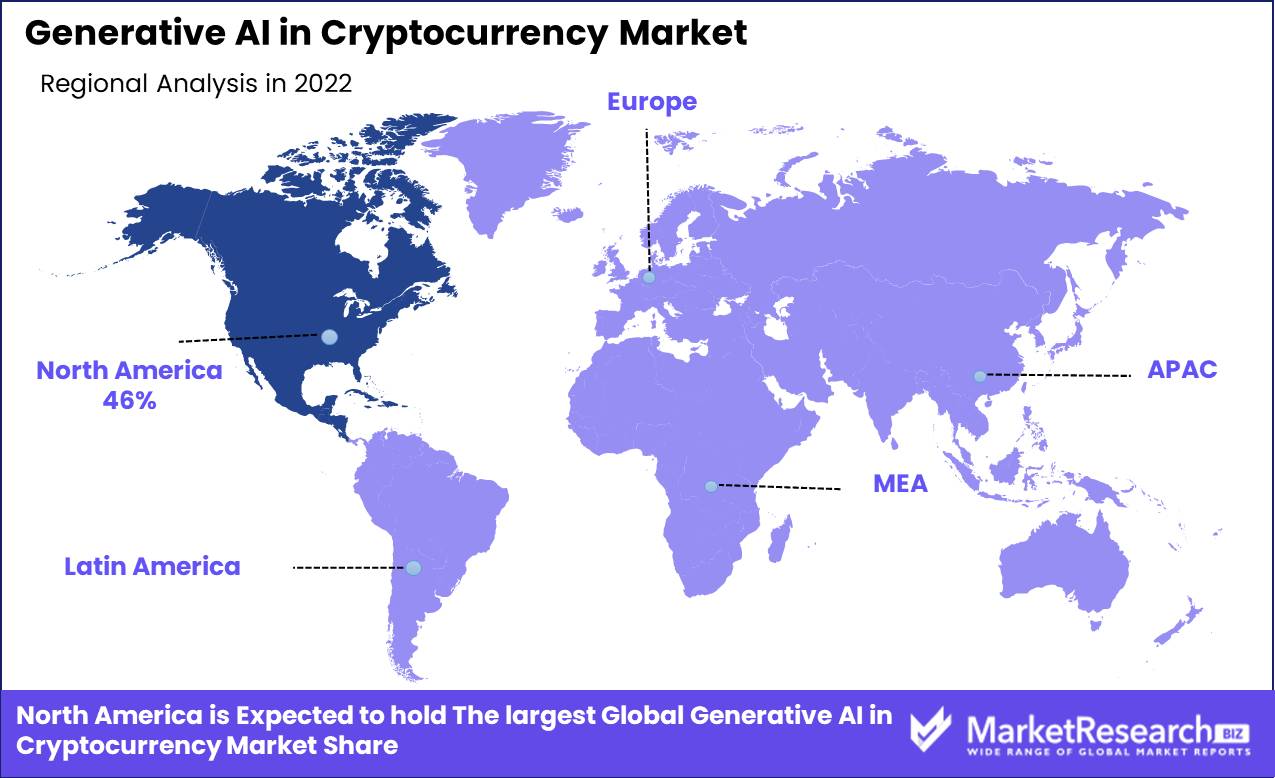

- Regional Analysis: North America, accounted for the largest revenue share in 2022, indicating significant market presence and growth opportunities.

- Market Key Players: Major players include AlgoTrader, Empirica, CoinGenius, Numerai, Open AI, Microsoft Corporation, Google LLC, Genie AI Ltd., IBM Corporation, MOSTLY AI Inc., Veesual AI, Adobe Inc., Synthesis AI, Paige.AI, Rephrase.ai, among others.

- Analyst Viewpoint: The Generative AI in Cryptocurrency Market is witnessing exponential growth, driven by increasing demand for AI-based solutions to enhance trading strategies, optimize decision-making processes, and improve market analysis and prediction capabilities.

Driving factors

Growing Use for Cryptocurrencies

The increasing acceptance and use of cryptocurrency as a viable type of digital currency have increased the need for Generative AI in Cryptocurrency Market. As more businesses and individuals are embracing cryptocurrency, it is becoming necessary for advanced technologies such as generative AI to analyze data, anticipate market trends, and enable an informed decision-making process.

Market Complexity and Volatility

The cryptocurrency market is renowned for its extreme variability and complicated dynamic. Generative AI allows investors and traders the ability to study massive amounts of information and recognize certain patterns, trends, and other indicators that might not be discernible using conventional analysis techniques. This technology helps in understanding the behavior of markets by predicting price fluctuations and managing risks in a market characterized by rapid changes.

Restraining Factors

Regulatory Uncertainty

The cryptocurrency market operates in a regulatory environment that is still evolving and varies across different jurisdictions. Regulatory uncertainty can create challenges for the adoption of Generative AI in Cryptocurrency Market, as unclear or stringent regulations may restrict the use of AI algorithms or pose compliance hurdles for market participants. Ambiguous or inconsistent regulations can hinder the development and deployment of generative AI solutions in this space.

Data Privacy and Security Concerns

Generative AI relies on large volumes of data to generate insights and predictions. However, privacy and security concerns related to handling sensitive financial and personal information can restrain the adoption of Generative AI in Cryptocurrency Market. Stricter data protection regulations, data breaches, and the potential misuse of data can undermine trust in generative AI solutions, limiting their usage in sensitive financial domains like cryptocurrencies.

By Application Analysis

The Price Prediction and Analysis Segment Accounted for the Largest Revenue Share in Global Generative AI in Cryptocurrency Market in 2022.

Based on application, the market is segmented into price prediction and analysis, trading strategy optimization, risk management, and portfolio optimization, market sentiment analysis, and fraud detection and security. Among these applications, the price prediction and analysis segment is expected to be the most lucrative in the global generative AI in cryptocurrency market.

Price prediction and analysis using generative AI techniques can help traders and investors make informed decisions by forecasting cryptocurrency price movements based on historical data and market trends. These predictive models can assist in identifying potential buying or selling opportunities. Generative AI can be utilized to optimize trading strategies by generating synthetic data and simulating trading scenarios. By training AI models on historical data and running simulations, traders can refine and optimize their trading strategies to improve profitability and reduce risks.

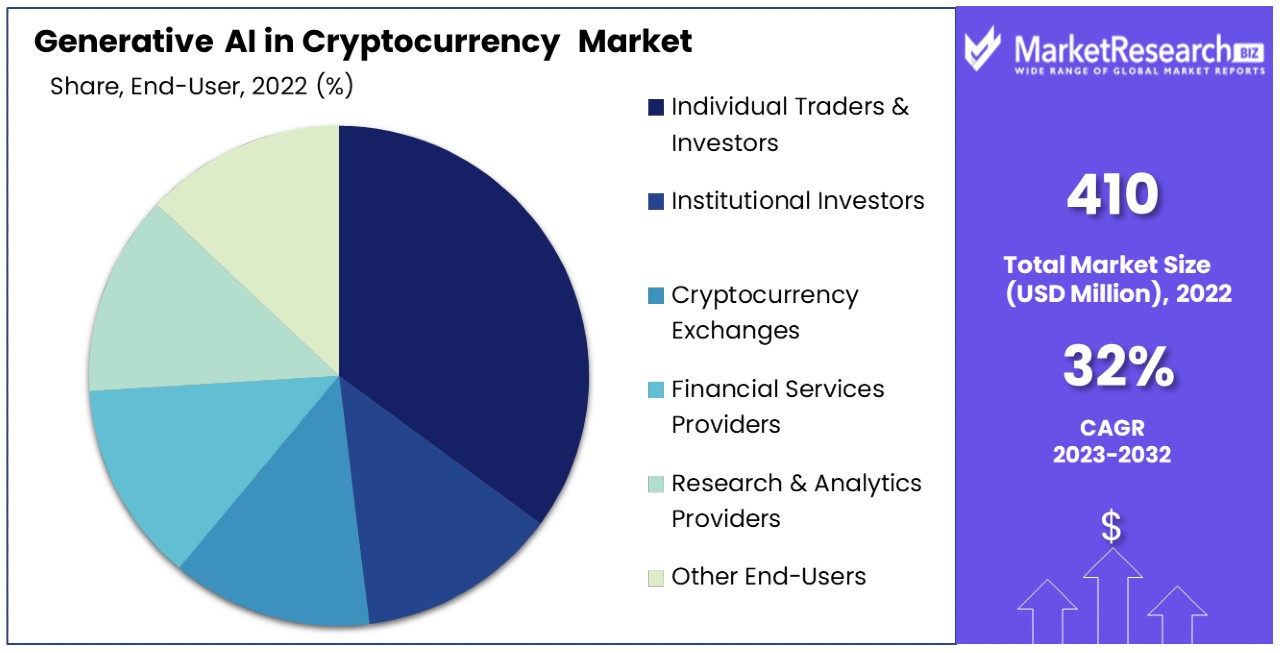

By End-User Analysis

The Individual Traders and Investors Segment Accounted for the Largest Revenue Share in Global Generative AI in Cryptocurrency Market in 2022.

Based on end-user, the market is segmented into individual traders and investors, institutional investors, cryptocurrency exchanges, financial services providers, research and analytics providers, and other end-user. Among these end-users, the individual traders and investors segment is expected to be the most lucrative in the global generative AI in cryptocurrency market. Individual traders and investors were prominent participants in the cryptocurrency market, actively exploring AI-based tools and platforms.

Individual traders and investors were keen on leveraging generative AI algorithms for market analysis, price prediction, and generating trading strategies to enhance their decision-making processes. Cryptocurrency exchanges also play a critical role in facilitating trading activities and providing market infrastructure. These platforms may explore and utilize generative AI to enhance their services, such as providing price prediction and analysis tools, optimizing user trading strategies, and improving fraud detection and security measures.

Key Market Segments

Based on Application

- Price Prediction & Analysis

- Trading Strategy Optimization

- Risk Management & Portfolio Optimization

- Market Sentiment Analysis

- Fraud Detection & Security

Based on End-User

- Individual Traders & Investors

- Institutional Investors

- Cryptocurrency Exchanges

- Financial Services Providers

- Research & Analytics Providers

- Other End-Users

Growth Opportunity

Development of Advanced AI Models

The continuous advancement of AI technologies and techniques opens doors for developing more sophisticated generative AI models specifically tailored for the cryptocurrency market. Improved algorithms, enhanced natural language processing capabilities, and deep learning and neural network advancements can lead to more accurate price predictions, sentiment analysis, and automated trading strategies. The development of advanced AI models will provide market participants with a competitive edge and further boost the growth of Generative AI in Cryptocurrency Market.

Integration of Generative AI with Blockchain Technology

Integrating generative AI with blockchain technology, which forms the foundation of many cryptocurrencies, presents a unique growth opportunity. Blockchain technology provides a transparent and secure data sharing and verification platform, while generative AI offers valuable insights and predictions. Combining these technologies makes it possible to create decentralized AI models, enabling secure and privacy-preserving analysis of cryptocurrency-related data. This integration can lead to innovative solutions and further enhance the capabilities of Generative AI in Cryptocurrency Market.

Latest Trends

NFT Market and Generative AI

Non-Fungible Tokens (NFTs) have gained significant popularity, and generative AI is being used to create unique and original digital artworks and collectibles. Generative AI algorithms can generate random variations and combinations to create distinct NFTs, enhancing the creativity and uniqueness of these digital assets.

Decentralized Finance (DeFi) Applications

The rise of DeFi applications in the cryptocurrency market has opened up new opportunities for generative AI. AI-powered smart contracts and decentralized prediction markets are being developed to provide more accurate price predictions, risk assessment, and automated trading strategies within the DeFi ecosystem.

Sentiment Analysis

Sentiment analysis using generative AI is becoming increasingly important in the cryptocurrency market. AI models can analyze social media sentiment, news articles, and other textual data to gauge market sentiment and predict price movements based on public perception and emotions. This trend helps traders and investors make more informed decisions.

Regional Analysis

North America Accounted for the Largest Revenue Share in Generative AI in Cryptocurrency Market in 2022.

North America has been at the forefront of cryptocurrency adoption and generative AI advancements. The region has a thriving cryptocurrency market, with major financial hubs and a strong ecosystem of blockchain startups. The United States, in particular, has seen significant developments in generative AI technologies and regulatory frameworks. The presence of major cryptocurrency exchanges and tech giants actively investing in AI research and development contribute to the growth of the generative AI market in this region.

Europe is the second most prominent region in the global Generative AI in Cryptocurrency Market. Countries like the United Kingdom, Germany, and Switzerland have been leading in blockchain and cryptocurrency innovation. European countries have shown a keen interest in regulating cryptocurrencies, which can influence the adoption and development of generative AI solutions in compliance with regional regulations. The European Union's General Data Protection Regulation (GDPR) also shapes the data privacy aspects of generative AI applications.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Share & Key Players Analysis

In Generative AI within the cryptocurrency market, several key players have emerged, each contributing distinct capabilities and innovative solutions. This analysis provides insights into the top key players shaping this dynamic sector.

AlgoTrader stands out for its sophisticated algorithmic trading solutions powered by Generative AI. With a focus on optimizing trading strategies and enhancing decision-making processes, AlgoTrader offers a competitive edge to cryptocurrency traders.

Empirica specializes in developing advanced trading platforms leveraging Generative AI technology. Its solutions enable automated trading, portfolio management, and risk analysis, catering to the evolving needs of cryptocurrency investors and institutions.

CoinGenius has established itself as a prominent player in cryptocurrency intelligence, utilizing Generative AI to analyze market trends, sentiment, and volatility. Its insights-driven approach empowers investors and stakeholders to make informed decisions in the volatile cryptocurrency landscape.

Numerai pioneers the concept of crowdsourced hedge fund management through its innovative platform powered by Generative AI. By incentivizing data scientists to develop predictive models, Numerai fosters a collaborative ecosystem aimed at maximizing returns in cryptocurrency markets.

Open AI, renowned for its contributions to artificial intelligence research, explores the intersection of Generative AI and cryptocurrencies. Its initiatives focus on developing cutting-edge models and algorithms to address challenges such as price prediction and risk management in cryptocurrency trading.

Microsoft's involvement in the Generative AI space extends to cryptocurrency applications, with a focus on developing scalable and secure solutions for blockchain technology. Leveraging its extensive resources and expertise, Microsoft contributes to the advancement of AI-driven innovations in the cryptocurrency ecosystem.

Google's foray into Generative AI within the cryptocurrency market emphasizes data-driven insights and predictive analytics. Through initiatives such as research collaborations and algorithm development, Google aims to enhance the efficiency and reliability of cryptocurrency trading strategies.

Genie AI specializes in personalized investment recommendations and portfolio optimization using Generative AI algorithms. Its platform offers tailored solutions for cryptocurrency investors seeking to maximize returns while minimizing risk in volatile market conditions.

In addition to the aforementioned key players, numerous other companies contribute to the evolving landscape of Generative AI in the cryptocurrency market. These players encompass a diverse range of capabilities, including data analytics, algorithm development, and blockchain integration, collectively shaping the future of AI-driven innovations in cryptocurrency trading and management.

Top Key Players in Generative AI in Cryptocurrency Market

- AlgoTrader

- Empirica

- CoinGenius

- Numerai

- Open AI

- Microsoft Corporation

- Google LLC

- Genie AI Ltd.

- IBM Corporation

- MOSTLY AI Inc.

- Veesual AI

- Adobe Inc.

- Synthesis AI

- Paige.AI

- Rephrase.ai

- Other Market Players

Recent Developments

- Notable gains have been observed in the performance of certain AI-related crypto assets. For instance, Fetch.ai's native cryptocurrency, FET, experienced a remarkable increase of over 590% since 2023, focusing on automating tasks through AI and machine learning.

- In October 2023, Coinbase, a leading cryptocurrency exchange, has achieved a major milestone by gaining a full license from Singapore's central bank. This payment institution (MPI) license allows Coinbase to expand its digital asset services in Singapore and cater to both retail and institutional customers. The approval positions Coinbase to meet the growing demand for crypto in Asia, particularly in Singapore, known for being a crypto-friendly jurisdiction with a significant presence of Web3 companies.

- Visa, the financial giant, is riding the artificial intelligence hype by announcing a $100 million Generative AI Venture Fund in October 2023. This initiative, funded by Visa Ventures, the company's corporate venture capital arm, aims to support early-stage startups developing generative AI technologies for commerce and payments.

- In october 2023, Worldcoin, a cryptocurrency project founded by OpenAI CEO Sam Altman was launched. The core offering of Worldcoin is its World ID, described as a "digital passport" designed to establish the authenticity of individuals as genuine humans. To obtain a World ID, individuals must undergo an in-person iris scan using a unique device called the 'orb.' The project aims to expand its "orbing" operations to 35 cities across 20 countries.

Report Scope

Report Features Description Market Value (2022) USD 410 Mn Forecast Revenue (2032) USD 6,144 Mn CAGR (2023-2032) 32% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application (Price Prediction & Analysis, Trading Strategy Optimization, Risk Management & Portfolio Optimization, Market Sentiment Analysis, and Fraud Detection & Security); By End-User (Individual Traders & Investors, Institutional Investors, Cryptocurrency Exchanges, Financial Services Providers, Research & Analytics Providers, and Other End-User) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AlgoTrader, Empirica, CoinGenius, Numerai, and Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- AlgoTrader

- Empirica

- CoinGenius

- Numerai

- Other Market Players