Gastrointestinal Therapeutics Market Report By Type of Disease (Gastroesophageal Reflux Disease (GERD), Inflammatory Bowel Disease (IBD), Crohn's Disease, Ulcerative Colitis, Irritable Bowel Syndrome (IBS), Gastroenteritis, Peptic Ulcer Disease, Celiac Disease, Others), By Diagnostic Techniques (Endoscopy, Upper GI Endoscopy, Colonoscopy, Imaging Techniques, CT Scan, MRI, X-ray, Laboratory Tests, Blood Tests, Stool Tests, Others), By Treatment Type, By End User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scena

-

47614

-

June 2024

-

321

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

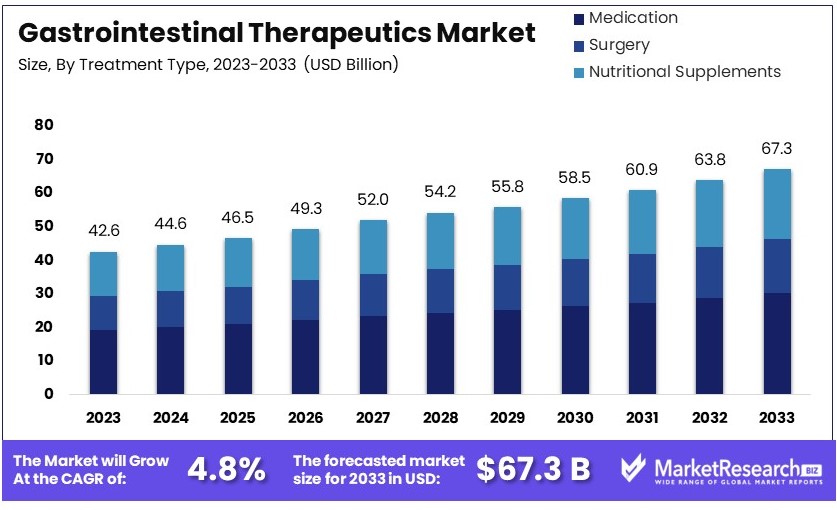

The Global Gastrointestinal Therapeutics Market size is expected to be worth around USD 67.3 Billion by 2033, from USD 42.6 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

The Gastrointestinal Therapeutics Market encompasses a range of medications and treatments specifically designed to address disorders affecting the gastrointestinal tract. These conditions include, but are not limited to, chronic diseases such as Crohn's disease, ulcerative colitis, and irritable bowel syndrome. The market also covers therapies for acute ailments like gastroenteritis and peptic ulcers.

This sector is critical due to the increasing prevalence of gastrointestinal disorders globally, driven by dietary habits, aging populations, and higher stress levels. Therapeutic advancements and innovations, such as biologics and targeted therapies, are propelling market growth, offering new relief avenues and improved quality of life for patients.

The Gastrointestinal Therapeutics Market reflects significant growth potential underpinned by robust epidemiological data. Between 1990 and 2019, digestive diseases manifested in approximately 2276.27 million prevalent cases globally, leading to 2.56 million fatalities and accruing 88.99 million disability-adjusted life years (DALYs) across 204 countries. These statistics highlight the pervasive impact of gastrointestinal ailments and underscore the critical need for effective therapeutic solutions.

In the United States alone, digestive diseases impact 60 to 70 million individuals annually, imposing economic burdens totaling approximately $141.8 billion. This economic strain reflects both direct medical costs and indirect costs due to loss of productivity, reinforcing the market's demand for innovative and effective gastrointestinal therapies.

Given this backdrop, the market for gastrointestinal therapeutics is poised for expansion. Pharmaceutical companies and healthcare providers are increasingly focused on developing treatments that offer improved efficacy, reduced side effects, and enhanced patient compliance. Biologics and targeted therapies are emerging as key growth areas, driven by technological advances and a deeper understanding of gastrointestinal pathophysiology.

Key Takeaways

- Market Value: The Global Gastrointestinal Therapeutics Market was valued at USD 42.6 Billion in 2023, and is expected to reach USD 67.3 Billion by 2033, with a CAGR of 4.80%.

- Type of Disease Analysis: Inflammatory Bowel Disease (IBD) dominates with significant market share due to rising global prevalence and increased research focus.

- Diagnostic Techniques Analysis: Endoscopy dominates with a major market share due to its critical role in accurate diagnosis and treatment planning.

- Treatment Type Analysis: Medication dominates with a substantial market share due to its first-line treatment status in many gastrointestinal disorders.

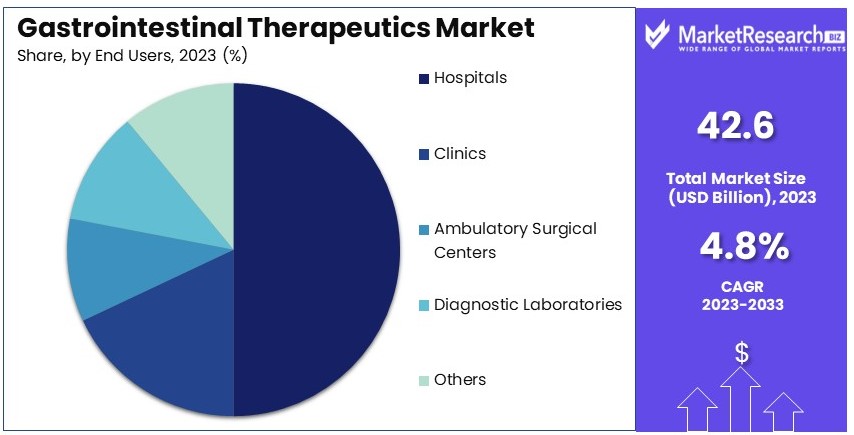

- End User Analysis: Hospitals dominate with a major market share due to their comprehensive care facilities and high patient influx.

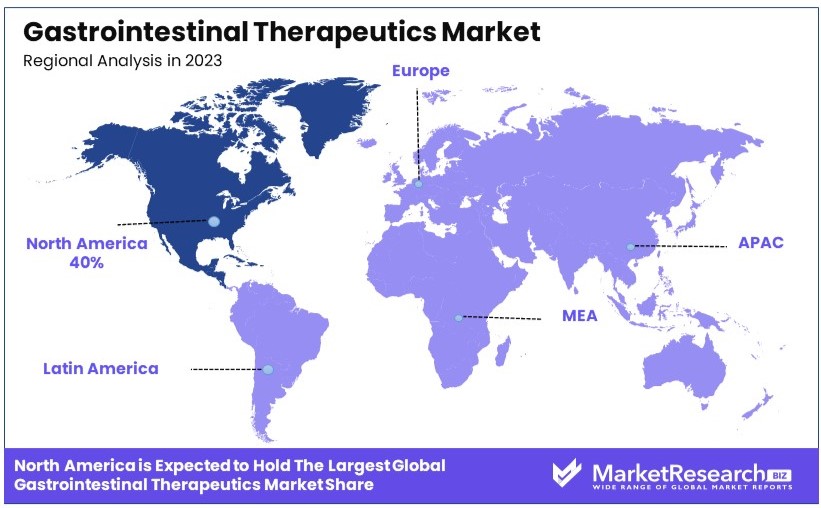

- Dominant Region: North America dominates with 40% market share, driven by advanced healthcare infrastructure and high disease prevalence.

- High Growth Region: Europe holds a 28% market share, significant for its strong healthcare system and increasing adoption of advanced therapeutics.

- Analyst Viewpoint: The market is experiencing steady growth with moderate competition, driven by rising disease prevalence and advancements in therapeutic options. Future predictions indicate a focus on personalized medicine and biologics.

- Growth Opportunities: Key players can leverage opportunities in personalized medicine, biologic drugs, and expanding in emerging markets to stand out.

Driving Factors

Increasing Prevalence of Gastrointestinal Diseases Drives Market Growth

The escalating incidence of gastrointestinal diseases such as irritable bowel syndrome (IBS), gastroesophageal reflux disease (GERD), and colorectal cancer is a pivotal driver for the growth of the gastrointestinal therapeutics market. The rising number of patients, highlighted by the Crohn's & Colitis Foundation's report of approximately 1.6 million Americans with IBD—a number expected to increase—underscores a growing demand for effective therapeutic solutions.

This surge necessitates ongoing development and distribution of innovative treatments, directly contributing to market expansion. The prevalence of these conditions also encourages pharmaceutical companies and medical device manufacturers to invest in research and development, ensuring a continuous pipeline of advanced therapeutic options. Consequently, this rising patient base not only demands but also drives the enhancement of gastrointestinal healthcare infrastructures and services.

Aging Population Boosts Gastrointestinal Therapeutics Market

An aging global population significantly impacts the gastrointestinal therapeutics market, particularly as gastrointestinal disorders become more common with advancing age. Diseases such as constipation, diverticulitis, and gastrointestinal cancers are notably prevalent among older adults, increasing the demand for specialized gastrointestinal care.

This demographic trend is coupled with an enhanced awareness and understanding of gastrointestinal health, which promotes higher consumption of both preventive measures and advanced therapeutic options. As healthcare systems adapt to this demographic shift, the market for gastrointestinal therapeutics is further propelled by the need for tailored medical assistance to diseases like irritable bowel syndrome treatment that cater to the unique requirements of the elderly, thereby fostering market growth through both increased patient numbers and the heightened complexity of care required.

Technological Advancements Propel Gastrointestinal Therapeutics Market

Innovative breakthroughs in medical technology, particularly in the realms of diagnostics and surgery, significantly drive the gastrointestinal therapeutics market. Advanced diagnostic tools, like capsule endoscopy, offer less invasive, highly accurate alternatives to traditional methods, enhancing patient compliance and diagnostic efficacy.

These technological advancements extend to minimally invasive surgical techniques and improved imaging technologies, which not only elevate the standard of care but also reduce recovery times and increase treatment success rates. The integration of such technologies into clinical practice boosts the efficiency and effectiveness of gastrointestinal treatment modalities, thus expanding the overall market. As these technologies evolve, they create a cycle of continuous improvement and increased adoption in healthcare settings, further stimulating market growth.

Restraining Factors

Stringent Regulatory Processes Restrain Market Growth

Stringent regulatory frameworks significantly slow down the growth of the gastrointestinal therapeutics market. The comprehensive and rigorous approval process for new drugs and medical devices, designed to ensure safety and efficacy, can extend the time required to bring these products to market. This delay not only affects the availability of new treatments but also impacts the pace of innovation within the industry.

As regulatory timelines extend, the costs associated with research and development escalate, posing financial strains on healthcare companies. This can deter investment in new projects and slow down the overall growth trajectory of the market, as companies may be hesitant to invest heavily in development processes characterized by uncertainty and extended durations.

Lack of Awareness and Stigma Restrains Market Growth

The growth of the gastrointestinal therapeutics market is notably hampered by a lack of awareness and societal stigma surrounding certain conditions. Disorders such as irritable bowel syndrome (IBS) and fecal incontinence are often not discussed openly due to their sensitive nature, leading to underreporting and delays in diagnosis. This stigma can prevent individuals from seeking early treatment, which is crucial for effective bowel management system and improved outcomes.

Additionally, the general lack of awareness about symptoms and treatment options for gastrointestinal disorders restricts market expansion, as fewer patients seek help and thus, a smaller market base exists for therapeutic solutions. This reduced patient engagement directly impacts the demand for treatments and hinders market growth.

Type of Disease Analysis

Inflammatory Bowel Disease (IBD) dominates with significant market share due to rising global prevalence and increased research focus.

The "Type of Disease" segment of the Gastrointestinal Therapeutics Market is highly diversified, encompassing various diseases that affect the gastrointestinal tract. Among these, Inflammatory Bowel Disease (IBD), which includes Crohn's Disease and Ulcerative Colitis, is the dominant sub-segment.

This dominance is attributed to the increasing global incidence of these diseases, heightened awareness, and significant advancements in therapeutic options. The prevalence of IBD is rising, with recent studies indicating that over 6.8 million people worldwide are affected, and this number is projected to increase due to factors such as dietary habits and genetic predispositions.

IBD's market leadership is also driven by the substantial funding directed towards research and development, resulting in innovative and effective therapeutic modalities. Pharmaceutical advancements, such as biologics and small molecule drugs, have transformed treatment paradigms, offering patients better management solutions and improving quality of life. These factors cumulatively drive the growth of the IBD sub-segment within the gastrointestinal market.

Other diseases such as Gastroesophageal Reflux Disease (GERD), Irritable Bowel Syndrome (IBS), and Celiac Disease also contribute significantly to the market. GERD, for instance, widely prevalent among adults due to lifestyle factors like diet and obesity, demands ongoing therapeutic intervention, thus maintaining a strong segment presence. Similarly, the growing recognition of IBS and Celiac Disease and the evolving dietary management therapies continue to expand their market shares. Despite their substantial roles, they do not overshadow the market impact of IBD but rather complement the overall growth of the gastrointestinal therapeutics sector by broadening the scope of available treatments and diagnostic approaches.

Diagnostic Techniques Analysis

Endoscopy dominates with a major market share due to its critical role in accurate diagnosis and treatment planning.

Diagnostic Techniques in the Gastrointestinal Therapeutics Market are crucial for accurate disease identification and management, with Endoscopy standing out as the most significant sub-segment. This dominance is largely due to the pivotal role endoscopy plays in the direct visualization, diagnosis, and sometimes treatment of gastrointestinal diseases.

Techniques such as Upper GI Endoscopy and Colonoscopy are essential, not only for diagnosing various conditions but also for performing therapeutic interventions like polypectomies or biopsies. The advancement in endoscopic technologies, including high-definition visuals and non-invasive capabilities, further solidifies its central role in gastrointestinal diagnostics.

The importance of endoscopy is underscored by its ability to provide precise and immediate results, which is critical for effective treatment planning. This has led to widespread adoption in healthcare facilities, from hospitals to specialized diagnostic centers, ensuring its market dominance.

Other diagnostic methods, including Imaging Techniques like CT Scans, MRIs, and X-rays detector, and Laboratory Tests such as blood and stool tests, also play vital roles in the gastrointestinal diagnostics market. These techniques complement endoscopy by providing additional data crucial for a comprehensive assessment of gastrointestinal conditions.

Imaging techniques, for instance, are indispensable for evaluating disease extent and monitoring treatment response, particularly in conditions like Crohn’s Disease where tissue penetration is necessary. Laboratory tests offer biochemical insights that are crucial for diagnosing infections or inflammation. While these segments are essential, they typically support the diagnostic process rather than lead it, thereby positioning endoscopy as the cornerstone of gastrointestinal diagnostics.

Treatment Type Analysis

Medication dominates with a substantial market share due to its first-line treatment status in many gastrointestinal disorders.

In the Treatment Type segment of the Gastrointestinal Therapeutics Market, Medication holds the predominant position. This sub-segment includes Proton Pump Inhibitors (PPIs), Antacids, Immunosuppressants, and Anti-diarrheal Agents, among others. The dominance of medication is primarily due to its role as the first-line treatment for a myriad of gastrointestinal conditions, from acute ailments like gastroenteritis to chronic diseases such as GERD and IBD. The widespread prevalence of these conditions ensures a consistent demand for pharmacological treatments, which are often the initial intervention before considering more invasive options.

The ongoing development of more effective and targeted drugs continues to drive growth within this sub-segment. For example, the advent of biologics has revolutionized the treatment of severe IBD, offering options that specifically target inflammatory processes at the molecular level. This specificity not only improves treatment outcomes but also reduces side effects compared to traditional therapies.

While Medication leads the market, other treatments like Surgery and Nutritional Supplements also contribute to the market dynamics. Surgery may be necessary for advanced disease stages or when medication fails, and nutritional supplements can play a crucial role in managing conditions like Celiac Disease and IBS. These treatments support the overall market by providing comprehensive care options across the spectrum of gastrointestinal disorders, but their usage is generally more conditional compared to the broad application of medication.

End User Analysis

Hospitals dominate with a major market share due to their comprehensive care facilities and high patient influx.

In the Gastrointestinal Therapeutics Market, the "End User" segment is critical for understanding the distribution and application of therapies. Hospitals are the dominant sub-segment, primarily due to their role as primary care centers for most gastrointestinal disorders. The capability of hospitals to provide both diagnostic and therapeutic services under one roof makes them indispensable in the healthcare landscape. The extensive infrastructure and the availability of specialized personnel, including gastroenterologists and surgeons, enable hospitals to manage a wide range of gastrointestinal conditions from acute emergencies to chronic care management.

The high patient influx and the comprehensive nature of care provided by hospitals ensure their continued dominance in the market. Additionally, hospitals are often the first point of contact for patients seeking treatment for severe or complex gastrointestinal issues, which sustains their market leadership.

Other end users such as Clinics, Ambulatory Surgical Centers, and Diagnostic Laboratories also play significant roles. Clinics offer specialized but less comprehensive care, often focusing on outpatient treatment, which is crucial for the management of chronic conditions like GERD or IBS. Ambulatory surgery centers provide a cost-effective alternative for procedures that do not require hospital admission, and Diagnostic Laboratories are essential for the accurate diagnosis and monitoring of gastrointestinal diseases. While each of these segments contributes to the market, their impact is more specialized compared to the broad and integral role of hospitals in the gastrointestinal therapeutics landscape.

Key Market Segments

By Type of Disease

- Gastroesophageal Reflux Disease (GERD)

- Inflammatory Bowel Disease (IBD)

- Crohn's Disease

- Ulcerative Colitis

- Irritable Bowel Syndrome (IBS)

- Gastroenteritis

- Peptic Ulcer Disease

- Celiac Disease

- Others

By Diagnostic Techniques

- Endoscopy

- Upper GI Endoscopy

- Colonoscopy

- Imaging Techniques

- CT Scan

- MRI

- X-ray

- Laboratory Tests

- Blood Tests

- Stool Tests

- Others

By Treatment Type

- Medication

- Proton Pump Inhibitors (PPIs)

- Antacids

- Immunosuppressants

- Anti-diarrheal Agents

- Others

- Surgery

- Nutritional Supplements

By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Others

Growth Opportunities

Personalized Medicine and Targeted Therapies Offer Growth Opportunity

Personalized medicine and targeted therapies represent significant growth opportunities within the Gastrointestinal Therapeutics Market. These approaches utilize precision medicine techniques to identify specific genetic markers and biomarkers that influence gastrointestinal diseases. By tailoring treatments to the individual characteristics of each patient, these therapies enhance the effectiveness of treatments, leading to improved patient outcomes and increased patient satisfaction.

Recent advancements in genomics and bioinformatics have facilitated the development of these personalized treatments, making it a rapidly growing segment. This personalized approach not only increases the therapeutic efficacy but also minimizes side effects, encouraging greater adoption among healthcare providers and patients alike, thus driving market growth.

Expansion of Biologics and Biosimilars Offers Growth Opportunity

The expansion of biologics and biosimilars presents a substantial growth opportunity in the Gastrointestinal Therapeutics Market. Biologics, including monoclonal antibodies and therapeutic proteins, have transformed the treatment landscape for serious conditions such as inflammatory bowel disease (IBD) and gastrointestinal cancers.

With the expiration of patents on several leading biologics, the market for biosimilars is set to expand significantly. Biosimilars offer similar therapeutic benefits at a lower cost, increasing accessibility and affordability for patients. This expansion is anticipated to drive competition, reduce healthcare costs, and broaden the patient base able to access high-quality treatments, thereby contributing to overall market growth.

Trending Factors

Microbiome Research and Therapeutics Are Trending Factors

The exploration of the human microbiome as a critical element in gastrointestinal health represents a trending factor in the market. Increasing evidence of the microbiome's role in digestion, immunity, and overall health has spurred significant interest in developing new therapeutic interventions targeting these microbial communities.

Innovations such as probiotics, prebiotics, and fecal microbiota transplantation (FMT) are gaining traction as potential treatments for a variety of gastrointestinal disorders, including chronic conditions like IBD. This trend is supported by ongoing research and clinical trials aimed at understanding microbial interactions and their therapeutic potentials, marking the microbiome as a frontier for innovation in gastrointestinal therapeutics.

Telehealth and Remote Monitoring Are Trending Factors

The adoption of telehealth and remote monitoring technologies has become a trending factor in the Gastrointestinal Therapeutics Market, especially accelerated by the COVID-19 pandemic. These technologies enhance patient access to care, enable early intervention, and improve the management of chronic gastrointestinal conditions by allowing continuous monitoring and timely medical advice.

The convenience and efficiency of telehealth services have significantly increased their popularity among patients and providers, establishing these technologies as fundamental components of modern healthcare practices. This trend is expected to continue growing as more healthcare systems integrate digital health solutions into their standard care protocols, further influencing the market dynamics and expansion.

Regional Analysis

North America Dominates with 40% Market Share

North America's leading position in the Gastrointestinal Therapeutics Market is primarily driven by advanced healthcare infrastructure, high healthcare expenditure, and a strong focus on research and innovation. The region benefits from the presence of major pharmaceutical and biotechnology companies investing heavily in the development of new treatments for gastrointestinal disorders. Additionally, high awareness levels among the population regarding the availability of advanced therapies and a robust regulatory framework supporting rapid approvals contribute to its dominance.

The market dynamics in North America are characterized by rapid adoption of new technologies, such as biologics and personalized medicine. The region's healthcare system is geared towards early diagnosis and treatment, facilitating significant market penetration of advanced therapeutics. Furthermore, partnerships between academic institutions, healthcare providers, and private firms enhance the development and commercialization of effective treatments, reinforcing the region's market position.

Regional Market Shares and Dynamics:

- Europe: Holds a 28% market share. The region's market is driven by strong government support for healthcare, widespread public health coverage, and a growing geriatric population which increases the prevalence of gastrointestinal conditions.

- Asia Pacific: Commands a 22% market share. This region is witnessing rapid growth due to increasing healthcare expenditure, rising patient awareness, and improvements in healthcare infrastructure, particularly in countries like China and India.

- Middle East & Africa: Has a smaller market share of 5%. The market is gradually growing with improvements in healthcare systems, rising economic standards, and increasing access to treatments.

- Latin America: Accounts for 5% of the market. Growth in this region is fueled by gradual enhancements in healthcare infrastructure and increasing awareness of gastrointestinal disorders among the population.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Gastrointestinal Therapeutics Market, several leading companies play pivotal roles in shaping industry dynamics and advancing therapeutic innovations. These key players include well-established pharmaceutical giants such as AbbVie Inc., Johnson & Johnson Services, Inc., Takeda Pharmaceutical Company Limited, and Pfizer Inc., alongside others like GlaxoSmithKline plc, AstraZeneca, and Bayer AG.

AbbVie and Johnson & Johnson, noted for their significant investments in R&D, have been instrumental in introducing breakthrough treatments that have set industry standards. Takeda’s strategic focus on gastroenterology has bolstered its market presence, especially in the biologics segment, aligning with current trends toward more targeted therapies. Pfizer’s global reach and extensive portfolio ensure its strong influence across multiple market segments, including gastrointestinal drugs.

Companies such as AstraZeneca and GlaxoSmithKline are recognized for their consistent innovation and adaptive market strategies, which have enabled them to maintain competitive positions. Bayer AG’s integration of consumer health insights with pharmaceutical innovations provides a unique edge in addressing patient needs.

Emerging players like Allergan, Sanofi, and Novartis AG are also significant, each contributing to market growth through diversified gastrointestinal portfolios and strong geographic footprints. Boehringer Ingelheim, F. Hoffmann-La Roche, Merck & Co., Amgen, and Eli Lilly are known for their pioneering approaches to addressing unmet medical needs, including in the gastrointestinal space.

Market Key Players

- AbbVie Inc.

- Johnson & Johnson Services, Inc.

- Takeda Pharmaceutical Company Limited

- Pfizer Inc.

- GlaxoSmithKline plc

- AstraZeneca

- Bayer AG

- Allergan

- Sanofi

- Novartis AG

- Boehringer Ingelheim International GmbH

- F. Hoffmann-La Roche Ltd

- Merck & Co., Inc.

- Amgen Inc.

- Eli Lilly and Company

- Other Key Players

Recent Developments

- 2024: A recent phase 1 trial has demonstrated promising results for claudin18.2-specific CAR T cells in treating gastrointestinal cancers. The study reported a 30% objective response rate and a 93% disease control rate among heterogenous second-line colorectal cancer (CRC) patients. These findings highlight the potential of claudin18.2-specific CAR T cells as a viable treatment option, showcasing both efficacy and a favorable safety profile.

- 2024: Leap Therapeutics is set to present new clinical data from Part A of the DeFianCe study at the 2024 ASCO Gastrointestinal Cancers Symposium. This study evaluates the combination of DKN-01, bevacizumab, and chemotherapy in advanced colorectal cancer patients. The data reveal a 30% objective response rate and a 93% disease control rate in second-line patients, with notable activity observed in left-sided and rectal tumors.

- 2024: Inhibikase Therapeutics has shared preliminary outcomes from its pre-NDA meeting with the FDA regarding the approval pathway for IkT-001Pro. This investigational treatment targets blood and gastrointestinal cancers, and the company is focused on advancing its development to potentially offer new therapeutic options for patients suffering from these conditions.

- 2024: Researchers have uncovered genetic connections between type 2 diabetes and gut disorders. The study identified specific genetic variants that are associated with both conditions, suggesting a shared underlying mechanism. This discovery opens the door to new therapeutic strategies aimed at managing both type 2 diabetes and gut disorders, potentially leading to more effective treatments for these interconnected health issues.

Report Scope

Report Features Description Market Value (2023) USD 42.6 Billion Forecast Revenue (2033) USD 67.3 Billion CAGR (2024-2033) 4.80% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Disease (Gastroesophageal Reflux Disease (GERD), Inflammatory Bowel Disease (IBD), Crohn's Disease, Ulcerative Colitis, Irritable Bowel Syndrome (IBS), Gastroenteritis, Peptic Ulcer Disease, Celiac Disease, Others), By Diagnostic Techniques (Endoscopy, Upper GI Endoscopy, Colonoscopy, Imaging Techniques, CT Scan, MRI, X-ray, Laboratory Tests, Blood Tests, Stool Tests, Others), By Treatment Type (Medication, Proton Pump Inhibitors (PPIs), Antacids, Immunosuppressants, Anti-diarrheal Agents, Others, Surgery, Nutritional Supplements), By End User (Hospitals, Clinics, Ambulatory Surgical Centers, Diagnostic Laboratories, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AbbVie Inc., Johnson & Johnson Services, Inc., Takeda Pharmaceutical Company Limited, Pfizer Inc., GlaxoSmithKline plc, AstraZeneca, Bayer AG, Allergan, Sanofi, Novartis AG, Boehringer Ingelheim International GmbH, F. Hoffmann-La Roche Ltd, Merck & Co., Inc., Amgen Inc., Eli Lilly and Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- AbbVie Inc.

- Johnson & Johnson Services, Inc.

- Takeda Pharmaceutical Company Limited

- Pfizer Inc.

- GlaxoSmithKline plc

- AstraZeneca

- Bayer AG

- Allergan

- Sanofi

- Novartis AG

- Boehringer Ingelheim International GmbH

- F. Hoffmann-La Roche Ltd

- Merck & Co., Inc.

- Amgen Inc.

- Eli Lilly and Company

- Other Key Players