Fluoropolymers Market By Product(Polytetrafluoroethylene (PTFE), Polyvinylidene fluoride (PVDF), Fluorinated Ethylene Propylene (FEP), Polyvinylfluoride (PVF), Others), By Application(Coatings, Films, Additives, Others), By End-Use(Industrial Equipment, Construction, Electrical & Electronics, Automotive, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

45054

-

April 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

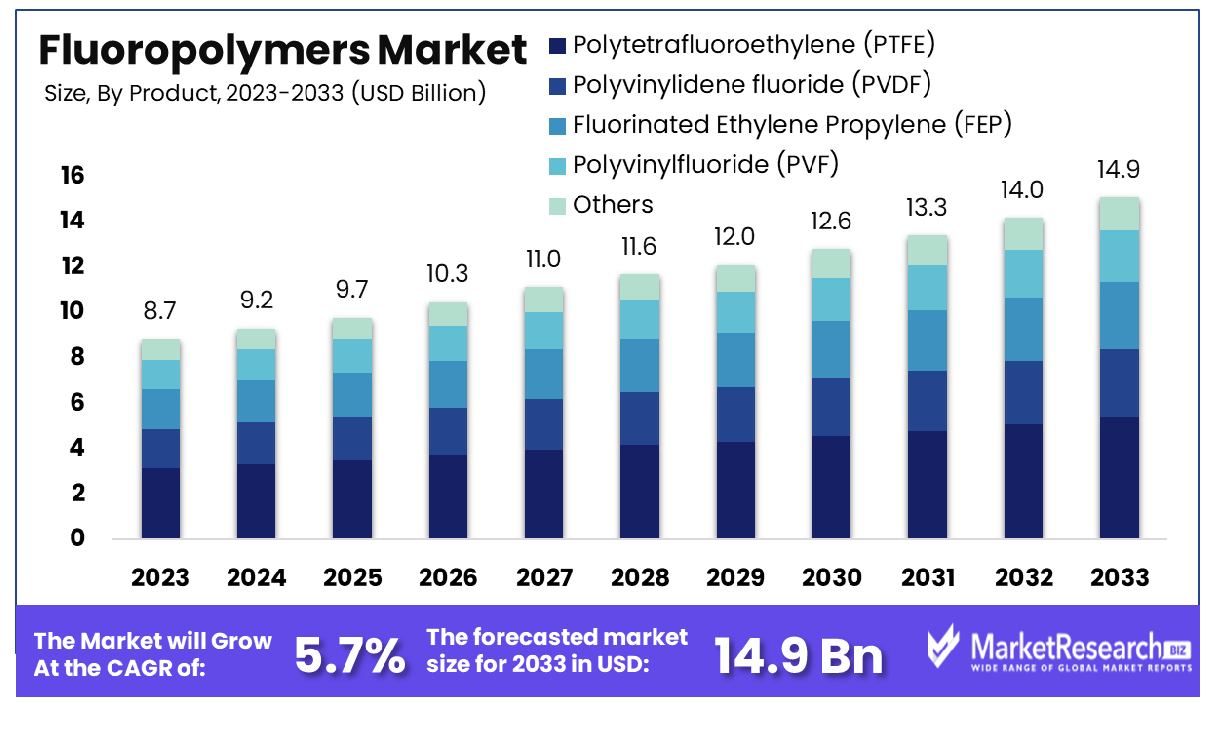

The Global Fluoropolymers Market was valued at USD 8.7 billion in 2023. It is expected to reach USD 14.9 billion by 2033, with a CAGR of 5.7% during the forecast period from 2024 to 2033.

The surge in demand from end-use application sectors as well as in the medical sector are some of the major factors for fluoropolymers market growth. Fluoropolymers are widely used in pharmaceuticals and biopharmaceutical equipment as it has excellent chemical and heat resistance. It also has physiochemical elements like hydrophobicity and lipophobicity, good bio-inertness, and low surface energy. In terms of biomedical applications, fluoropolymers are majorly used in gene delivery, cytosolic protein delivery, drug delivery, tissue engineering, and other medical applications.

Additionally, Fluoropolymers are a highly performing group of elements with an exceptional combination of properties that are important to semiconductor manufacturing. Fluoropolymers are special materials that can provide strength durability, heat resistance, and high-performance electrical insulations. This combination of elements provides longevity of the components that help in the enhancement of fire safety and boosts transmission speed with the creation of smaller yet more powerful and advanced electronic products as per market demand.

In the semiconductor sector, fluoropolymers help the pipes, pumps, and vessels that can be used in semiconductor manufacturing conditions and maintain the purity of the elements that are crucial for this industry. Whereas in the automotive industry, fluoropolymers like polytetrafluoroethylene (PTFE), polyvinylidene fluoride (PVDF), and polychlorotrifluoroethylene (PCTFE) are used for automobile fuel and engine systems.

The automobile engine and fuel system show an excess amount of aggressive chemicals and fuel mixtures. Major elements that have fuel systems are comprised of quick-connect, fuel seats, and seals among different other systems. These fuels system requires fuel resistance, long unrestrained life, chemical and heat resistance, and low pervasion rates with the compliance to purify air regulations and rigid emission rules.

Moreover, fluoropolymers improve the properties of coatings that are used in construction equipment, modern industrial products, and household items. These properties are displayed by fluoropolymer resins making them a perfect choice for any end-use application that requires less friction and high resistance to any type of element. The fluoropolymer coatings showcase properties like high heat and chemical resistance, and high weather sustainability. Such demand for fluoropolymers in different sectors has led to an increase in popularity leading to the fluoropolymers market expansion in the coming years.

Key Takeaways

- Market Growth: The Global Fluoropolymers Market was valued at USD 8.7 billion in 2023. It is expected to reach USD 14.9 billion by 2033, with a CAGR of 5.7% during the forecast period from 2024 to 2033.

- By Product: Polytetrafluoroethylene (PTFE) reigns supreme as the predominant product in fluoropolymers.

- By Application: Coatings emerge as the dominant application sector within the fluoropolymers market.

- By End-Use: Industrial equipment stands out as the primary end-use segment for fluoropolymers.

- Regional Dominance: The Asia-Pacific region dominates the Fluoropolymers Market with an 82.3% share.

- Growth OpportunityThe 2023 global Fluoropolymers Market showcases significant opportunities, driven by rising demand for PTFE across industries and increasing utilization of fluoropolymer films in the energy sector.

Driving factors

Construction Boom Fuels Fluoropolymers Demand

The Fluoropolymers Market experiences a significant upsurge due to the escalating demand within the construction sector. As global infrastructure development accelerates, so does the need for materials that offer exceptional durability and chemical resistance.

Fluoropolymers, with their remarkable properties including non-stickiness, low friction, and high resistance to chemicals and weathering, have become indispensable in various construction applications. The surge in construction spending, particularly in emerging economies, propels the demand for fluoropolymers in coatings, sealants, and architectural membranes.

Health-Driven Demand: Flourishing Biocompatibility in Medical Applications

Fluoropolymers witness a surge in demand, particularly in the medical sector, owing to their exceptional biocompatibility and advantageous health attributes. Their inert nature and resistance to chemicals make them ideal for medical applications, including implants, surgical instruments, and medical device coatings.

The flourishing demand is not solely propelled by the medical industry's stringent requirements but also by the growing awareness among consumers regarding health and safety standards.

Technology Boom Drives Fluoropolymers Adoption in Electronics

Fluoropolymers are experiencing heightened demand propelled by the rapid advancements in the electronics and telecommunication industries. With the relentless pursuit of miniaturization and performance enhancement in electronic devices, fluoropolymers have emerged as a crucial components due to their exceptional electrical properties, thermal stability, and chemical resistance.

From high-frequency cables to printed circuit boards, fluoropolymers play a pivotal role in ensuring the reliability and longevity of electronic products.

Restraining Factors

Cost Barrier Hinders Market Expansion

The Fluoropolymers Market faces a significant challenge due to the comparatively high cost of fluoropolymers when juxtaposed with conventional materials. This pricing gap poses a deterrent to widespread adoption across various industries, particularly in price-sensitive sectors such as construction and consumer goods. Despite the unparalleled performance advantages offered by fluoropolymers, cost-conscious consumers and manufacturers often opt for alternative materials to minimize expenses.

Consequently, the market encounters resistance in penetrating certain segments where cost considerations outweigh performance benefits. Industry data suggests that the price differential between fluoropolymers and traditional materials remains substantial, with fluoropolymers priced higher on average. Mitigating this cost barrier through innovations in manufacturing processes and economies of scale is imperative to unlock new growth opportunities within the Fluoropolymers Market.

Regulatory Hurdles Impede Market Growth

The Fluoropolymers Market faces regulatory challenges stemming from stringent frameworks imposed by various governing bodies. Regulatory standards governing the manufacturing, usage, and disposal of fluoropolymers have a profound impact on market dynamics, influencing production practices, product formulations, and market access. Heightened scrutiny surrounding environmental and health concerns associated with fluoropolymers, particularly per- and polyfluoroalkyl substances (PFAS), has led to increased regulatory oversight and compliance requirements.

Stringent regulations not only affect the cost structure of fluoropolymer production but also necessitate continuous innovation to develop eco-friendly alternatives and sustainable manufacturing processes. Industry statistics indicate a rise in regulatory interventions, of market players reporting increased compliance costs over the past year. Overcoming regulatory barriers through proactive engagement, technological innovation, and sustainable practices is crucial for sustained market growth in the face of evolving regulatory landscapes.

By Product Analysis

Polytetrafluoroethylene (PTFE) reigns supreme, commanding the fluoropolymers market with its versatile properties.

In 2023, Polytetrafluoroethylene (PTFE) held a dominant market position in the by-product segment of the Fluoropolymers Market. Among the array of fluoropolymers, Polytetrafluoroethylene (PTFE) asserted its prominence, primarily due to its exceptional chemical resistance, high-temperature stability, and low friction properties. These characteristics have positioned PTFE as a preferred material across diverse industries, including automotive, electronics, chemical processing, and medical devices.

Polytetrafluoroethylene (PTFE) garnered substantial market share owing to its widespread application spectrum, ranging from non-stick coatings in cookware to insulation in wiring and cables. Additionally, its extensive use in manufacturing mechanical components such as seals, gaskets, and bearings further propelled its market dominance.

Despite Polytetrafluoroethylene (PTFE)’s stronghold, other fluoropolymers such as Polyvinylidene fluoride (PVDF), Fluorinated Ethylene Propylene (FEP), and Polyvinylfluoride (PVF) also exhibited notable market presence. Polyvinylidene fluoride (PVDF) particularly showcased significant growth attributed to its superior mechanical properties, excellent chemical resistance, and versatility in applications including piping systems, coatings, and membranes.

Fluorinated Ethylene Propylene (FEP) emerged as another key contender in the fluoropolymer market segment, valued for its transparency, high melting point, and robust electrical properties. This enabled its adoption in industries requiring optical clarity, such as pharmaceutical packaging and semiconductor manufacturing.

Polyvinylfluoride (PVF) and other fluoropolymers also contributed to the market landscape, albeit to a lesser extent, demonstrating niche applications and catering to specific industry requirements.

By Applications Analysis

Coatings emerge as the dominant force, leveraging fluoropolymers for their protective and functional qualities.

In 2023, Coatings held a dominant market position in the By Application segment of the Fluoropolymers Market. Coatings emerged as the frontrunner due to their extensive usage across diverse industries, driven by the exceptional properties of fluoropolymers such as durability, weather resistance, chemical inertness, and non-stick characteristics. These attributes positioned fluoropolymer-based coatings as indispensable solutions in applications ranging from architectural to automotive coatings, industrial equipment protection, and aerospace applications.

Films represented another significant segment within the fluoropolymers market, offering exceptional barrier properties, electrical insulation, and heat resistance. Fluoropolymer films found applications in flexible packaging, electrical insulations, and photovoltaic modules, leveraging their unique combination of properties to enhance product performance and longevity.

Additives also played a vital role in the fluoropolymers market, albeit in a more supplementary capacity. Additives such as fillers, reinforcements, and processing aids complemented fluoropolymer formulations, enhancing mechanical properties, reducing costs, and improving processability in various applications.

Furthermore, the "Others" category encompassed a range of niche applications where fluoropolymers found utility but did not fit neatly into the predefined segments. This category included specialty applications such as lubricants, textiles, and medical devices, where the unique properties of fluoropolymers addressed specific industry needs and regulatory requirements.

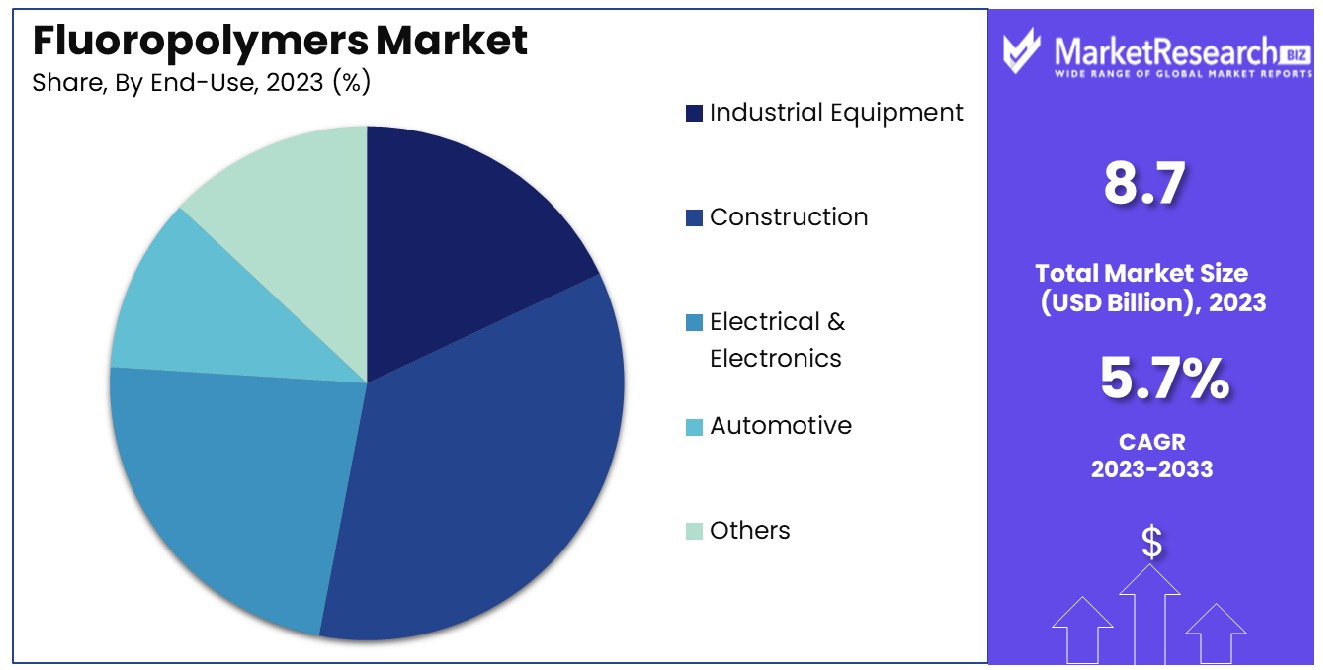

By End-Use Analysis

Across end-uses, industrial equipment stands at the forefront, harnessing fluoropolymers for durability and performance.

In 2023, Industrial Equipment held a dominant market position in the By End-Use segment of the Fluoropolymers Market. The significant presence of fluoropolymers in industrial equipment applications can be attributed to their exceptional properties, including high chemical resistance, thermal stability, low friction, and dielectric properties. These characteristics make fluoropolymers indispensable in a wide range of industrial equipment, where performance reliability, and longevity are paramount.

Construction emerged as another prominent segment within the fluoropolymers market, driven by the increasing demand for durable and weather-resistant materials in architectural coatings, sealants, and membranes. Fluoropolymer-based construction materials offer superior resistance to harsh environmental conditions, UV radiation, and chemicals, making them ideal for applications in roofing, facades, and infrastructure projects.

The Electrical & Electronics sector also demonstrated substantial demand for fluoropolymers, driven by the need for high-performance insulation materials in wiring, cable jackets, and electronic components. Fluoropolymers' excellent electrical properties, combined with their thermal stability and flame resistance, position them as preferred materials in the manufacture of high-voltage cables, printed circuit boards, and semiconductor components.

Additionally, the Automotive industry showcased notable utilization of fluoropolymers, particularly in applications requiring resistance to extreme temperatures, fuels, and lubricants. Fluoropolymer-based components such as gaskets, seals, hoses, and bearings contribute to improved vehicle performance, reliability, and longevity.

The "Others" category encompassed a diverse array of end-use applications where fluoropolymers found niche utility, including aerospace, healthcare, chemical processing, and oil & gas. In these industries, fluoropolymers fulfill specific performance requirements such as corrosion resistance, biocompatibility, and purity, driving their adoption in specialized applications.

Key Market Segments

By Product

- Polytetrafluoroethylene (PTFE)

- Polyvinylidene fluoride (PVDF)

- Fluorinated Ethylene Propylene (FEP)

- Polyvinylfluoride (PVF)

- Others

By Application

- Coatings

- Films

- Additives

- Others

By End-Use

- Industrial Equipment

- Construction

- Electrical & Electronics

- Automotive

- Others

Growth Opportunity

Demand Surge in PTFE Across Industries

The global Fluoropolymers Market in 2023 presents promising prospects, particularly fueled by the escalating demand for PolyTetraFluoroEthylene (PTFE) in key sectors. PTFE finds extensive applications in the food and beverage, construction, and chemical processing and manufacturing industries. Its unparalleled properties, including high chemical resistance, thermal stability, and non-stick characteristics, render it indispensable across various applications.

In the food and beverage sector, PTFE coatings ensure hygienic processing and packaging, while in construction, they contribute to the durability and longevity of structures. Moreover, the chemical processing and manufacturing industries rely on PTFE for its corrosion resistance and inert nature, ensuring the integrity of equipment and processes.

Flourishing Demand for Fluoropolymer Films in the Energy Sector

Another noteworthy trend driving opportunities in the global Fluoropolymers Market is the increasing demand for fluoropolymer films within the energy sector. These films find diverse applications in energy-related activities, including solar panels, batteries, and insulation.

With the escalating focus on renewable energy sources, fluoropolymer films emerge as crucial components due to their exceptional properties such as high dielectric strength, thermal stability, and UV resistance. The robust growth of the energy sector, coupled with advancements in renewable energy technologies, propels the demand for fluoropolymer films, creating lucrative opportunities for market players.

Latest Trends

Expansion of Production Capacities by Leading Manufacturers

In 2023, the global Fluoropolymers Market is witnessing a notable trend characterized by leading manufacturers' strategic expansion of production capacities. This proactive approach is driven by the imperative to meet the escalating demand generated by end-users across various sectors.

As industries increasingly recognize the unparalleled properties and diverse applications of fluoropolymers, the need for a reliable and sustainable supply becomes paramount. Consequently, major players in the market are investing in expanding their manufacturing capabilities to ensure adequate product availability and cater to the growing market requirements effectively.

Market Growth Driven by Industrial Processing & Application and Electrical & Electronics Sectors

Two key sectors, namely industrial processing & application and electrical & electronics, are emerging as significant drivers of growth in the global Fluoropolymers Market in 2023. In the industrial processing & application sector, fluoropolymers play a crucial role due to their exceptional chemical resistance, high-temperature stability, and low friction properties, making them indispensable for various industrial processes and applications.

Similarly, in the electrical & electronics sector, fluoropolymers find extensive utilization in insulation, wiring, and electronic components owing to their excellent electrical insulation properties, thermal stability, and resistance to chemicals and environmental factors. The relentless innovation and technological advancements in these sectors further fuel the demand for fluoropolymers, propelling the market growth.

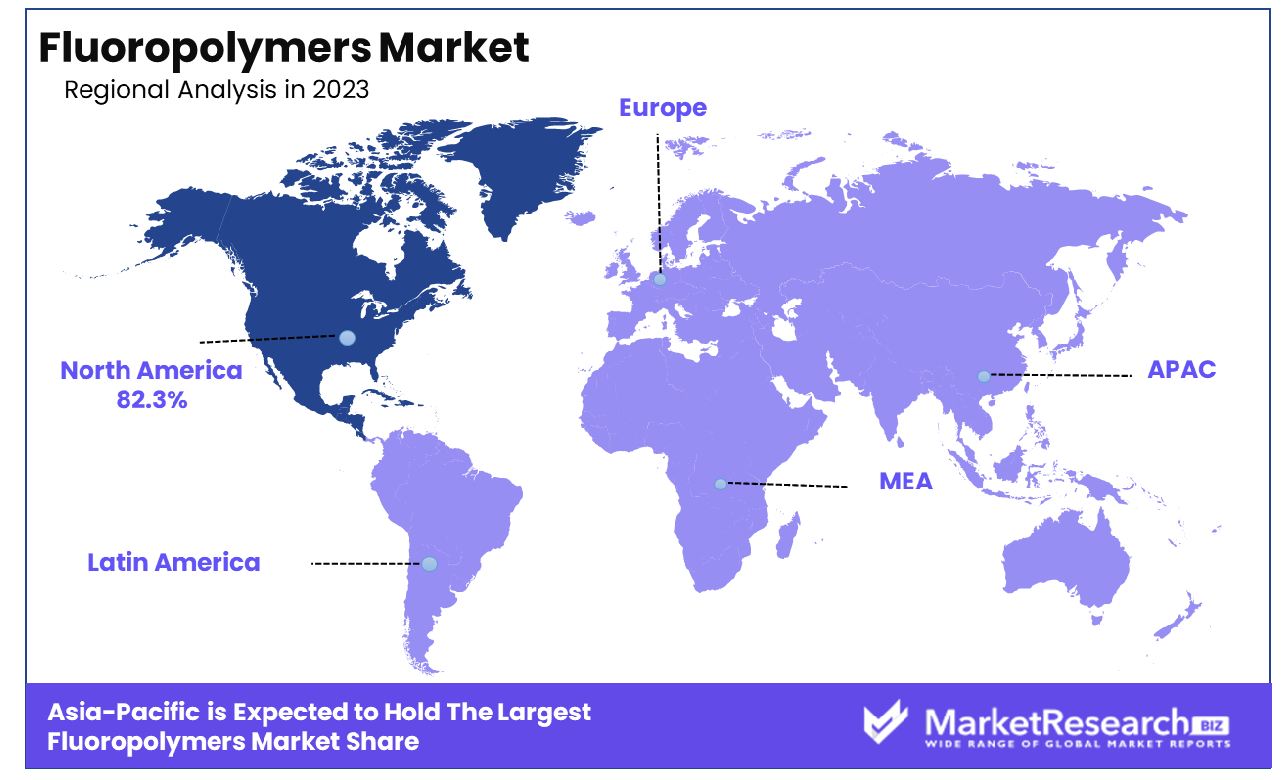

Regional Analysis

The Asia-Pacific region dominates the Fluoropolymers Market, commanding an impressive market share of 82.3%.

In the global Fluoropolymers market, regional dynamics play a pivotal role in shaping industry trends and growth trajectories. Across the spectrum of North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each region exhibits distinct characteristics and market drivers.

In North America, the Fluoropolymers market demonstrates resilience, buoyed by robust industrial infrastructure and stringent regulatory standards. The region is characterized by a steady demand from key end-user industries such as automotive, electronics, and healthcare. With a projected CAGR of 5.7% during the forecast period, North America is poised to maintain its prominent position in the global Fluoropolymers market.

Europe, renowned for its advanced manufacturing capabilities and emphasis on sustainability, presents a mature yet evolving market landscape for Fluoropolymers. Stringent environmental regulations and a growing focus on energy efficiency drive the adoption of Fluoropolymers in various applications. The region is anticipated to witness moderate growth, with a projected CAGR of 4.2% over the forecast period.

Asia Pacific emerges as the dominating force in the global Fluoropolymers market, commanding a substantial market share of 82.3%. Rapid industrialization, urbanization, and infrastructural developments fuel the demand for Fluoropolymers across diverse sectors such as electronics, construction, and automotive. With a burgeoning middle class and increasing disposable incomes, the region offers lucrative growth opportunities for market players.

In the Middle East & Africa and Latin America regions, the Fluoropolymers market demonstrates steady growth, supported by infrastructure development and expanding industrial sectors. However, challenges such as political instability and economic fluctuations may temper the growth momentum to some extent.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

The global fluoropolymers market witnessed dynamic growth in 2023, driven by an array of key players strategically positioned across various regions. Among these, several notable companies emerged as pivotal influencers, shaping the market landscape with their innovative products, extensive distribution networks, and commitment to sustainability.

One such influential player is The Chemours Company, headquartered in Delaware, U.S. Leveraging its advanced R&D capabilities, Chemours has consistently introduced cutting-edge fluoropolymer solutions, catering to diverse industrial applications. The company's focus on technological advancements and sustainable practices has cemented its position as a leader in the market.

In addition, DAIKIN INDUSTRIES from Osaka, Japan, and Solvay SA from Brussels, Belgium, have played significant roles in driving market growth. With their robust product portfolios and global reach, these companies have successfully penetrated key markets, offering high-performance fluoropolymer solutions tailored to meet evolving customer demands.

Furthermore, the emergence of regional players such as INOFLON from Noida, India, and NexGen Fluoropolymers Pvt. Ltd. from Delhi, India, highlights the growing importance of Asia-Pacific in the fluoropolymers market. These companies have demonstrated agility and innovation, catering to the specific needs of local industries while also expanding their presence on a global scale.

Market Key Players

- The Chemours Company (Delaware, U.S.)

- INOFLON (Noida, India)

- DAIKIN INDUSTRIES (Osaka, Japan)

- Solvay SA (Brussels, Belgium)

- Arkema SA (Colombes, France)

- NexGen Fluoropolymers Pvt. Ltd. (Delhi, India)

- 3M (Minnesota, U.S.)

- Shandong Dongyue Polymer Material Co, Ltd. (China)

- Saint-Gobain (Courbevoie, France)

- KUREHA CORPORATION (Japan)

- HaloPolymer (Moscow, Russia)

- AGC Chemicals (Tokyo, Japan)

- Honeywell International, Inc. (North Carolina, U.S.)

Recent Development

- In February 2024, Akin Gump Strauss Hauer & Feld LLP examines fluoropolymers' vital role across industries and legislative implications, advocating for nuanced regulation to preserve critical applications.

- In January 2024, Toray Industries unveils a groundbreaking UHMWPE film mirroring stainless steel's strength with polymer benefits. Its nanostructure enables applications in cryogenic conditions, superconductivity, and electronics.

- In January 2024, The American Chemistry Council (ACC) reports a surge in regulations stifling U.S. chemical manufacturing, impacting national priorities like clean energy, semiconductors, biotechnology, healthcare, and infrastructure.

Report Scope

Report Features Description Market Value (2023) USD 8.7 Billion Forecast Revenue (2033) USD 14.9 Billion CAGR (2024-2032) 5.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Polytetrafluoroethylene (PTFE), Polyvinylidene fluoride (PVDF), Fluorinated Ethylene Propylene (FEP), Polyvinylfluoride (PVF), Others), By Application(Coatings, Films, Additives, Others), By End-Use(Industrial Equipment, Construction, Electrical & Electronics, Automotive, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape The Chemours Company (Delaware, U.S.), INOFLON (Noida, India), DAIKIN INDUSTRIES (Osaka, Japan), Solvay SA (Brussels, Belgium), Arkema SA (Colombes, France), NexGen Fluoropolymers Pvt. Ltd. (Delhi, India), 3M (Minnesota, U.S.), Shandong Dongyue Polymer Material Co, Ltd. (China), Saint-Gobain (Courbevoie, France), KUREHA CORPORATION (Japan), HaloPolymer (Moscow, Russia), AGC Chemicals (Tokyo, Japan), Honeywell International, Inc. (North Carolina, U.S.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- The Chemours Company (Delaware, U.S.)

- INOFLON (Noida, India)

- DAIKIN INDUSTRIES (Osaka, Japan)

- Solvay SA (Brussels, Belgium)

- Arkema SA (Colombes, France)

- NexGen Fluoropolymers Pvt. Ltd. (Delhi, India)

- 3M (Minnesota, U.S.)

- Shandong Dongyue Polymer Material Co, Ltd. (China)

- Saint-Gobain (Courbevoie, France)

- KUREHA CORPORATION (Japan)

- HaloPolymer (Moscow, Russia)

- AGC Chemicals (Tokyo, Japan)

- Honeywell International, Inc. (North Carolina, U.S.)