Global Fleet Management Solution Market By Component(Solutions(Operation Management, Vehicle Maintenance and Diagnostics, Performance Management, Fleet analytics and reporting, Others), Services(Professional Services, Consulting & Advisory, Integration & Implementation), Managed Services), By Communication Technology(Cellular system, GNSS), By Deployment Type(On-Premises, Cloud), By Industry(Construction, Transportation, Government, Logistics, Retail, Automotive, Oil and Gas, Others), By Region And Companies - Industry Segment Outlook, Market Assess

-

23253

-

July 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

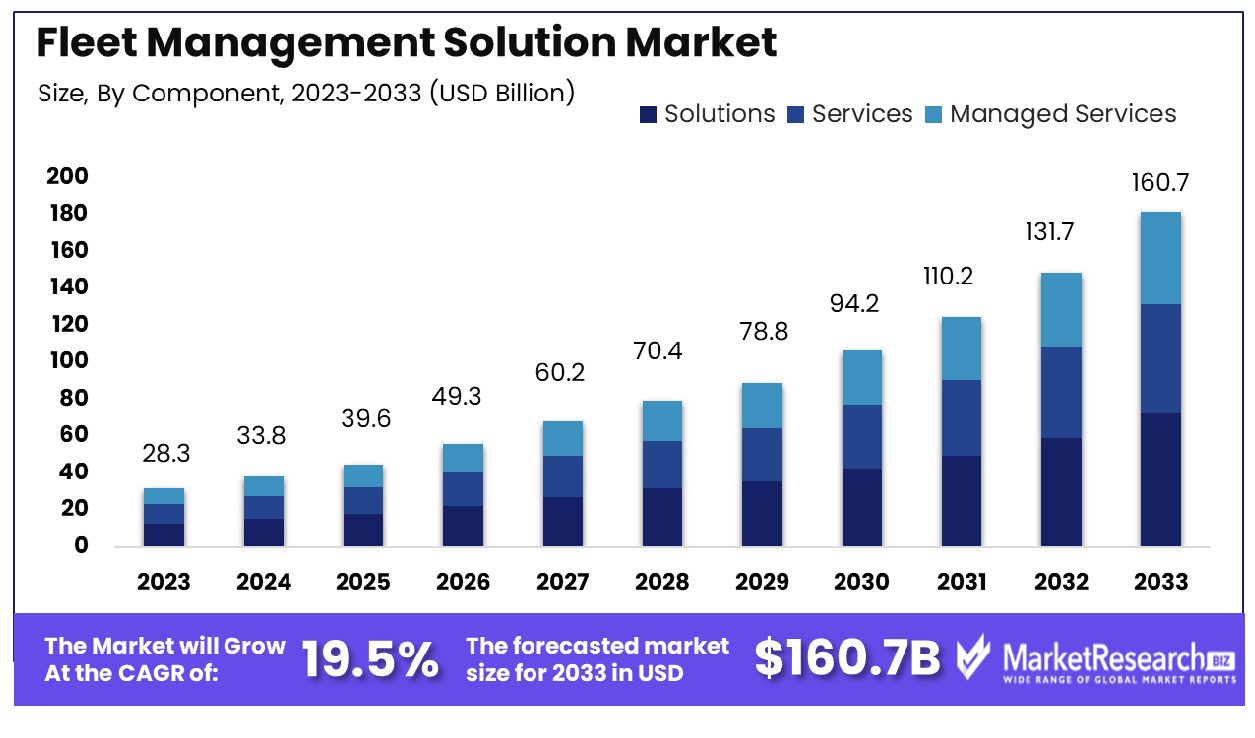

The Global Fleet Management Solution Market was valued at USD 28.3 billion in 2023. It is expected to reach USD 160.7 billion by 2033, with a CAGR of 19.5% during the forecast period from 2024 to 2033.

The Fleet Management Solution Market encompasses advanced software, hardware, and communication technologies designed to optimize fleet operations, enhance efficiency, and reduce costs. These solutions provide real-time monitoring, vehicle tracking, fuel management, and predictive maintenance capabilities. Leveraging data analytics and IoT technologies, fleet management solutions empower decision-makers to streamline logistical operations, ensure compliance with regulatory standards, and improve overall fleet performance.

As these technologies evolve, they play a critical role in supporting scalable growth and operational excellence in logistics-heavy industries. This market is integral for organizations aiming to maintain competitive advantage and operational sustainability in a rapidly digitizing global economy.

The Fleet Management Solution Market is witnessing a significant transformation, driven by advancements in technology and changing industry priorities. A 2023 survey revealed that 62% of fleet managers now prioritize the safe and proper operation of vehicles, reflecting a substantial 39% increase from the previous year. This shift underscores the growing emphasis on safety and regulatory compliance, which has become a cornerstone for operational strategies in this sector.

Simultaneously, the market is adapting to the increasing demand for sustainability. Projections indicate that electric vehicles (EVs) will constitute 42% of the fleet management market by 2032. This transition towards EVs represents a dual focus on reducing environmental impact and enhancing energy efficiency within fleet operations.

Furthermore, the expansion of fleet sizes contributes to the market's dynamics. For instance, India has experienced consistent growth in its fleet size, with a Compound Annual Growth Rate (CAGR) of 4.78% from 2003 to 2022. The current fleet includes 1,039 coastal vessels and 490 overseas vessels, highlighting the substantial market opportunities in both domestic and international waterways.

These trends illustrate a market that is increasingly focused on integrating technological innovation with stringent safety standards and sustainable practices. Fleet management solutions are not just about tracking and maintenance anymore; they are evolving into comprehensive systems that ensure operational efficiency, compliance, and sustainability. For stakeholders, this evolution represents a strategic imperative to invest in advanced fleet management technologies to remain competitive in a rapidly evolving industry landscape.

Key Takeaways

- Market Growth: The Global Fleet Management Solution Market was valued at USD 28.3 billion in 2023. It is expected to reach USD 160.7 billion by 2033, with a CAGR of 19.5% during the forecast period from 2024 to 2033.

- By Component: The solutions component overwhelmingly dominated with a 70% market share.

- By Communication Technology: Cellular systems led communication technology, securing 65% dominance.

- By Deployment Type: Cloud deployment massively prevailed, accounting for 70% dominance.

- By Industry: The transportation industry emerged as the top sector with 30% dominance.

- Regional Dominance: North America dominates with 38% of the Fleet Management Market.

Driving factors

Enhanced Operational Efficiency and Cost Reduction in Transportation

The primary driver for the growth of the Fleet Management Solution Market is the increasing emphasis on operational efficiency and cost reduction in the transportation sector. Companies are constantly seeking ways to optimize fuel usage, reduce idle times, and enhance route management to cut down on operational costs. Fleet management solutions offer real-time tracking and data analytics, enabling businesses to make informed decisions that directly impact their bottom line.

By integrating these technologies, companies can achieve significant reductions in operational expenses, thereby boosting profitability. The integration of these solutions can lead to measurable cost savings—reports indicate that proper fleet management can reduce fuel costs by up to 20% and increase overall operational efficiency by approximately 25%.

Compliance with Regulatory Mandates for Safety and Emissions

Growing regulatory mandates for safety and emissions stand as another pivotal factor propelling the Fleet Management Solution Market. Governments worldwide are tightening regulations to ensure higher safety standards and lower emissions, compelling fleet operators to adopt advanced management solutions.

These solutions enable compliance through features like automated logs for driver hours, vehicle maintenance reminders, and emissions tracking, ensuring adherence to legal standards. This regulatory pressure not only mitigates the risk of penalties but also promotes a sustainable approach to fleet management, aligning with global environmental goals.

Advancements in IoT and Real-Time Data Analytics

The advancements in IoT and real-time data analytics have revolutionized fleet operations, significantly contributing to the growth of the fleet management market. IoT technology facilitates the seamless integration of sensors and devices within vehicles, providing fleet managers with extensive data on vehicle health, driver behavior, and environmental conditions. This influx of real-time data enables predictive maintenance, optimized routing, and enhanced security measures.

Analytics derived from this data help in making strategic decisions that improve service reliability and customer satisfaction. The adoption of IoT in fleet management not only enhances operational efficiency but also provides a competitive edge in a rapidly evolving market.

Restraining Factors

Data Privacy and Security Concerns

Data privacy and security concerns significantly influence the growth trajectory of the Fleet Management Solution Market. As these solutions collect and analyze vast amounts of sensitive data, including vehicle locations, driver behavior, and operational logistics, the potential for data breaches and unauthorized access becomes a prominent risk.

These security concerns can deter organizations from adopting fleet management systems, fearing the repercussions of data mishandling or cyber-attacks. Statistics show that nearly 30% of fleet operators cite data security as a primary concern when considering new technologies. This apprehension can slow market growth as potential users weigh the risks against the benefits of implementing such systems.

High Initial Investment and Integration Complexity

The high initial investment required for deploying fleet management solutions, along with the complexity involved in integrating these technologies with existing systems, also serves as a significant restraining factor. Many organizations find the upfront costs prohibitive, particularly small to medium-sized enterprises with limited budgets. Additionally, the integration of advanced fleet management technologies with legacy systems poses technical challenges, requiring specialized skills and potentially leading to operational disruptions during the transition period.

This complexity can result in hesitancy among potential adopters, further restraining market growth. Despite these challenges, the long-term benefits such as cost savings, enhanced compliance, and improved operational efficiency present a compelling investment case, albeit at a moderated growth rate.

By Component Analysis

In the component category, solutions significantly dominated, accounting for 70% of the market share.

In 2023, Solutions held a dominant market position in the "By Component" segment of the Fleet Management Solution Market, capturing more than a 70% share. This segment encompasses various subcategories including Operation Management, Vehicle Maintenance and Diagnostics, Performance Management, Fleet Analytics and Reporting, and Others. Each subcategory plays a pivotal role in streamlining operations, enhancing diagnostics, and improving overall fleet performance through data-driven insights.

Operation Management solutions emerged as a cornerstone, ensuring efficient route planning and cargo management, thereby optimizing fleet operations and reducing operational costs. Vehicle Maintenance and Diagnostics solutions also contributed significantly, facilitating real-time monitoring of vehicle health, which helps in preemptive maintenance and minimizing downtime. Performance Management tools have been instrumental in monitoring fleet efficiency and driver performance, leading to enhanced operational productivity.

Moreover, Fleet Analytics and Reporting solutions provide essential data insights, enabling businesses to make informed decisions based on comprehensive analytics of fleet operations. The "Others" category includes various emerging technologies that integrate with fleet management systems to offer additional functionalities and innovations.

On the services side, the market is segmented into Professional Services, which includes Consulting & Advisory and Integration & Implementation, along with Managed Services. These services are crucial for the implementation of fleet management solutions, providing expert guidance and ensuring seamless integration with existing systems. Managed Services have seen a rise in demand due to the ongoing need for operational excellence and reduced IT overhead, making it a vital component of the Fleet Management Solution Market.

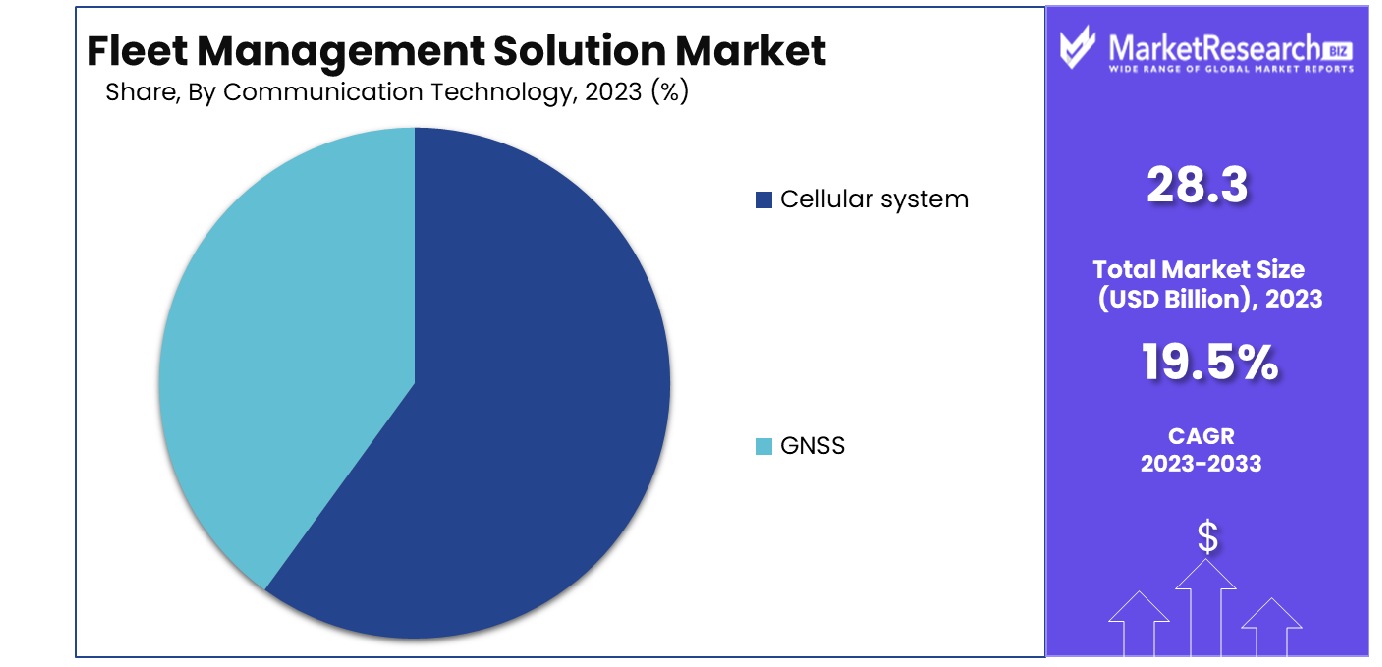

By Communication Technology Analysis

Cellular systems led the communication technology segment with a commanding 65% market dominance.

In 2023, the Cellular system held a dominant market position in the "By Communication Technology" segment of the Fleet Management Solution Market, capturing more than a 65% share. This segment is primarily divided into two technologies: Cellular system and GNSS (Global Navigation Satellite System). The substantial share held by the Cellular system underscores its critical role in providing robust, reliable communication and data transfer capabilities across fleet operations.

The Cellular system's prominence in fleet management is largely due to its widespread availability and the reliability of data communication it offers. It enables real-time tracking and monitoring of vehicles, which is essential for operational efficiency and security. This technology supports various applications, including vehicle tracking, telematics, and real-time data transmission, which are integral to modern fleet management solutions.

On the other hand, GNSS technology, which includes GPS tracking devices and other satellite navigation systems, complements cellular systems by providing precise location data crucial for routing and geofencing. Although GNSS is indispensable for location tracking, the integration with cellular technology enhances functionality by facilitating the transmission of location data over cellular networks, thus providing comprehensive coverage and enhanced data accuracy.

The synergy between Cellular systems and GNSS technologies in the Fleet Management Solution Market underscores a trend towards integrated solutions that leverage both communication and satellite technologies to enhance fleet efficiency and management. The dominance of the Cellular system within this segment is expected to continue as innovations in mobile technology and network coverage expand, further embedding cellular solutions as the backbone of fleet communication infrastructures.

By Deployment Type Analysis

Cloud deployment types prevailed, capturing 70% of the market, reflecting a strong preference.

In 2023, Cloud deployment held a dominant market position in the "By Deployment Type" segment of the Fleet Management Solution Market, capturing more than a 70% share. This segment is categorized into two types: On-Premises and Cloud. The significant preference for Cloud-based solutions is indicative of the ongoing shift towards more scalable, flexible, and cost-effective deployment options in fleet management.

The Cloud deployment type offers numerous advantages that have contributed to its dominance. These include reduced initial capital expenditures, scalability to accommodate fleet size fluctuations, and enhanced accessibility, allowing fleet managers to access systems from any location in real-time. Moreover, cloud solutions provide higher data security levels and regular updates, improving system capabilities without additional hardware costs.

On-premises solutions, while offering direct control over the servers and data, involve higher upfront costs and require continuous maintenance and updates. These factors make On-Premises solutions less attractive to many businesses that are looking to optimize operational costs and improve efficiency.

The substantial market share of Cloud solutions in fleet management is also driven by the increasing integration of IoT (Internet of Things) devices and telematics in fleet operations, which are more seamlessly supported by cloud infrastructure. This integration facilitates enhanced data analytics capabilities, predictive maintenance, and improved decision-making processes.

As businesses continue to recognize the benefits of reduced IT overhead, enhanced data security, and improved operational flexibility, Cloud-based fleet management solutions are expected to maintain their dominance in the market, further driving innovation and technology adoption in this sector.

By Industry Analysis

Within the industry breakdown, transportation emerged as the leader, holding 30% of the market.

In 2023, the Transportation sector held a dominant market position in the "By Industry" segment of the Fleet Management Solution Market, capturing more than a 30% share. This segment encompasses various industries, including Construction, Government, Logistics, Retail, Automotive, Oil and Gas, and Others. The Transportation industry's leading position reflects its critical reliance on efficient fleet operations and management systems.

The Transportation industry's significant share is driven by the essential need for real-time fleet tracking, route optimization, and cost management, which are pivotal in improving operational efficiencies and reducing downtime. Fleet management solutions in this sector help streamline operations, ensuring timely deliveries and enhanced service quality, which are crucial for customer satisfaction and competitive differentiation.

Adjacent industries such as Logistics and Retail also heavily utilize fleet management solutions to manage their distribution networks effectively. However, the Transportation sector's unique demands for high compliance, safety standards, and environmental considerations push for more advanced and integrated fleet management technologies.

Moreover, sectors like Oil and Gas and Construction, although smaller in market share, utilize fleet management solutions to enhance safety measures, monitor equipment, and ensure compliance with regulatory standards. These industries benefit from specific functionalities like hazardous material handling and off-road navigation, which are tailored within the fleet management systems.

As the market continues to evolve, the integration of AI and IoT within fleet management solutions is expected to further propel the adoption across these industries, particularly in Transportation, where efficiency and compliance are continuously being optimized. The growing trend towards sustainability and carbon footprint reduction also offers additional growth opportunities for deploying advanced fleet management technologies within this sector.

Key Market Segments

By Component

- Solutions

- Operation Management

- Vehicle Maintenance and Diagnostics

- Performance Management

- Fleet analytics and reporting

- Others

- Services

- Professional Services

- Consulting & Advisory

- Integration & Implementation

- Managed Services

By Communication Technology

- Cellular system

- GNSS

By Deployment Type

- On-Premises

- Cloud

By Industry

- Construction

- Transportation

- Government

- Logistics

- Retail

- Automotive

- Oil and Gas

- Others

Growth Opportunity

Expansion in Emerging Economies

The global Fleet Management Solution Market is poised for substantial growth in 2023, particularly through expansion in emerging economies. Countries such as India, Brazil, and South Africa are experiencing rapid industrial growth and urbanization, which are key drivers for increased logistics and transportation needs. As these economies continue to expand, the demand for efficient fleet operations becomes critical.

Fleet management solutions can offer significant advantages in these markets by optimizing transportation costs and enhancing vehicle utilization. Furthermore, the growing middle class in these regions increases the demand for goods and services, subsequently boosting the logistics sector. As a result, local and international players in the fleet management market are likely to find lucrative opportunities for expansion in these areas, potentially increasing their market share and presence significantly.

Integration of AI and Machine Learning

Another significant growth opportunity for the Fleet Management Solution Market in 2023 lies in the integration of AI and machine learning technologies. These technologies enable predictive maintenance, which can foresee vehicle maintenance issues before they lead to costly downtimes. Additionally, AI-enhanced algorithms are capable of optimizing routes more effectively, considering variables such as traffic patterns, weather conditions, and vehicle performance data. This not only reduces operational costs but also improves service delivery.

The adoption of AI and machine learning not only streamline fleet operations but also offers a competitive edge by enabling companies to provide reliable and efficient services. The potential for these technologies to transform fleet management is immense, making their integration a primary focus for development and innovation within the industry this year.

Latest Trends

Adoption of Electric Vehicles in Fleet Management

In 2023, one of the most transformative trends within the global Fleet Management Solution Market is the increased adoption of electric vehicles (EVs) in fleets, accompanied by tailored management solutions. As environmental concerns mount and regulations on emissions become stricter, companies are rapidly shifting towards electric fleets to reduce their carbon footprint. This transition is supported by fleet management solutions that are specifically designed to handle the unique needs of electric vehicles, such as charge management, range optimization, and energy consumption analytics.

These specialized solutions help in overcoming traditional barriers to EV adoption by maximizing operational efficiency and ensuring seamless integration with existing fleet operations. The move towards electric fleets not only aids in compliance with environmental regulations but also offers long-term cost savings on fuel and maintenance, significantly influencing fleet management strategies.

Increasing Use of Telematics and Cloud-Based Platforms

Another prominent trend in the Fleet Management Solution Market is the increasing use of telematics and cloud-based platforms, which enhance scalability and connectivity across fleet operations. These technologies allow for the real-time monitoring of vehicles, providing critical data on vehicle performance, driver behavior, and logistical efficiency. Cloud-based platforms facilitate the integration of this data across a centralized system that can be accessed remotely, enhancing the flexibility and responsiveness of fleet management operations.

Additionally, the scalability offered by cloud solutions enables businesses to adjust their fleet operations based on real-time insights and changing business conditions. This adaptability is crucial for maintaining efficiency and competitiveness in a dynamic market environment. The integration of telematics and cloud computing is set to redefine fleet management practices by offering more connected, data-driven solutions.

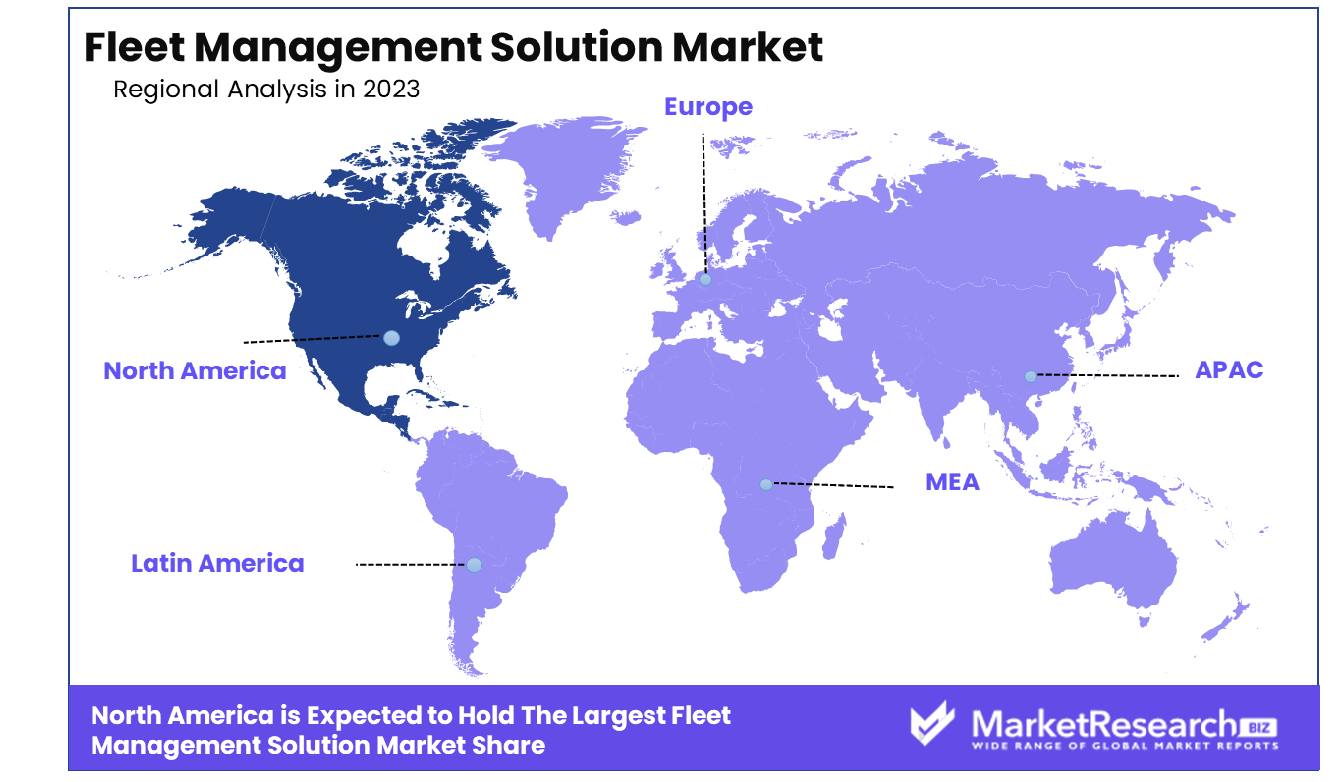

Regional Analysis

The North American Fleet Management Solution Market commands a dominant 38% share of the global market.

North America remains the dominant region, holding approximately 38% of the market share. This leadership can be attributed to the advanced technological infrastructure and the early adoption of innovations such as IoT, AI, and telematics in fleet management. The U.S. and Canada show significant investment in fleet solutions driven by stringent regulations on emissions and a strong focus on enhancing operational efficiencies.

In Europe, the market is driven by strict environmental regulations and the increasing adoption of electric vehicles (EVs) within fleets. European countries, with their high environmental consciousness and supportive government policies towards sustainable transportation, are rapidly integrating fleet management solutions to optimize EV operations and comply with regulatory frameworks.

Asia Pacific is witnessing the fastest growth, spurred by the expansion of the logistics and e-commerce sectors, particularly in emerging economies like China and India. The increasing urbanization and industrial activities in this region demand efficient fleet management solutions to handle the rising volume of goods and passenger traffic.

The Middle East & Africa region shows promising growth potential, with an increasing focus on smart transportation solutions amid urban development initiatives. Countries like the UAE and Saudi Arabia are investing in smart city projects that include the integration of advanced fleet management technologies.

Latin America, though smaller in market size compared to other regions, is experiencing growth in fleet management adoption, driven by the need to enhance safety and reduce operational costs within the transportation and logistics sectors. The region is gradually adopting digital technologies to modernize its fleet operations.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

TomTom N.V. continues to be a leader in providing advanced GPS navigation and map products, integrating traffic and travel data that enhance fleet efficiency. Trimble Inc. stands out for its robust telematics and asset-tracking solutions, which are pivotal in optimizing transportation and logistics operations. Their recent advancements in integrating AI for predictive maintenance and route optimization have set high industry standards.

Cisco Systems, Inc., traditionally known for networking, has made significant inroads into fleet management through its connected vehicle solutions, emphasizing security and data analytics. Zebra Technologies Corp. enhances fleet operations through real-time tracking and data visualization tools, aiding businesses in achieving greater operational transparency and efficiency.

Emerging players like Geotab Inc. and GPS Trackit are also making notable contributions, particularly in terms of scalability and the utilization of cloud-based platforms, making fleet management more accessible to smaller fleets. Fleetmatics Group PLC (now part of Verizon Connect), continues to expand its market presence with mobile workforce solutions that integrate vehicle diagnostics with driver management.

Digital Matter, GoFleet Corporation, and GoGPS are recognized for their durable hardware and user-friendly software solutions, catering especially to harsh environments and demanding logistical operations.

Smaller yet agile companies like Linxio and Teletrac Navman provide tailored solutions that focus on driver safety and compliance with regulatory standards, a niche that is increasingly critical as regulatory frameworks evolve.

Market Key Players

- TomTom N.V.

- Zebra Technologies Corp.

- Trimble Inc.

- Cisco Systems, Inc.

- GoFleet Corporation

- Geotab Inc.

- Digital Matter

- GPS Trackit

- Fleetmatics Group PLC

- GoGPS

- Wireless Links

- Embitel

- Gurtam

- Teletrac Navman

- Linxio

- StreetFleet

- TigerFleet

- Ruptela

- Trakm8 Limited

- WebEye Telematics Group

Recent Development

- In February 2024, Cisco Systems, Inc., a global leader in networking and IT, introduced a comprehensive fleet management solution that leverages IoT and AI technologies. This solution is designed to provide enhanced connectivity and real-time data analysis for fleet operators, aiming to reduce downtime and improve safety.

- In January 2024, GoFleet Corporation, a Canadian company specializing in GPS fleet management, secured a $50 million investment to expand its product offerings and market reach. The investment will support the development of new features and integrations, enhancing GoFleet's position in the competitive fleet management market.

Report Scope

Report Features Description Market Value (2023) USD 28.3 Billion Forecast Revenue (2033) USD 160.7 Billion CAGR (2024-2032) 19.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Solutions(Operation Management, Vehicle Maintenance and Diagnostics, Performance Management, Fleet analytics and reporting, Others), Services(Professional Services, Consulting & Advisory, Integration & Implementation), Managed Services), By Communication Technology(Cellular system, GNSS), By Deployment Type(On-Premises, Cloud), By Industry(Construction, Transportation, Government, Logistics, Retail, Automotive, Oil and Gas, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape TomTom N.V., Zebra Technologies Corp., Trimble Inc., Cisco Systems, Inc., GoFleet Corporation, Geotab Inc., Digital Matter, GPS Trackit, Fleetmatics Group PLC, GoGPS, Wireless Links, Embitel, Gurtam, Teletrac Navman, Linxio, StreetFleet, TigerFleet, Ruptela, Trakm8 Limited, WebEye Telematics Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- TomTom N.V.

- Zebra Technologies Corp.

- Trimble Inc.

- Cisco Systems, Inc.

- GoFleet Corporation

- Geotab Inc.

- Digital Matter

- GPS Trackit

- Fleetmatics Group PLC

- GoGPS

- Wireless Links

- Embitel

- Gurtam

- Teletrac Navman

- Linxio

- StreetFleet

- TigerFleet

- Ruptela

- Trakm8 Limited

- WebEye Telematics Group