Fermentation Chemicals Market By Product (Organic Acid, Enzymes, Alcohol, Others), By Application (Food and Beverages, Pharmaceuticals, Plastic and Fibers, Industrial, Others), By Form (Liquid and Powder), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48155

-

June 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

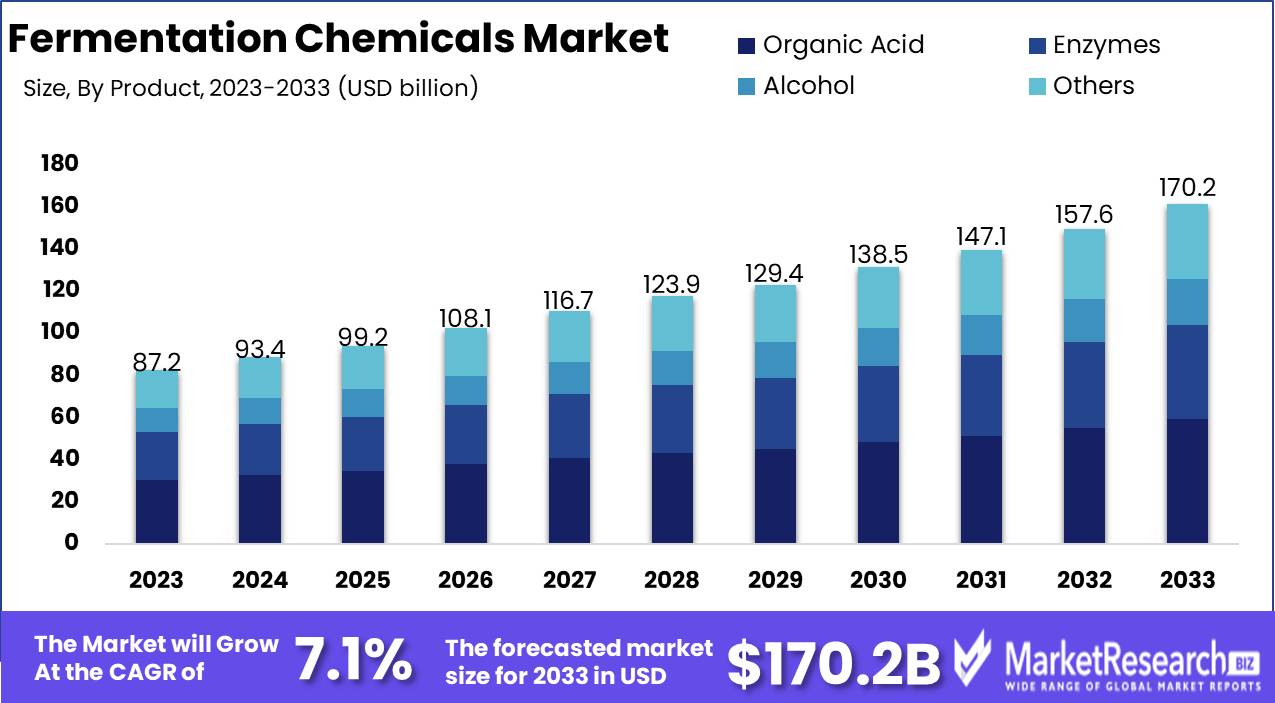

The Fermentation Chemicals Market was valued at USD 87.2 billion in 2023. It is expected to reach USD 170.2 billion by 2033, with a CAGR of 7.1% during the forecast period from 2024 to 2033.

The fermentation chemicals market encompasses the production and application of chemicals derived from fermentation processes, which utilize microorganisms to convert organic substrates into valuable products. Key chemicals include ethanol, acetic acid, citric acid, and lactic acid, which are integral in various industries such as pharmaceuticals, food and beverages, biofuels, and agriculture. The market is driven by growing demand for sustainable and bio-based chemicals, advancements in fermentation technology, and increasing application scope in emerging sectors. With a focus on enhancing production efficiency and environmental sustainability, this market is poised for significant growth, reflecting broader industrial trends towards greener solutions.

The fermentation chemicals market is poised for significant growth, driven by several key factors that align with broader industry and environmental trends. Notably, the rising demand for bio-based products is a primary catalyst. As environmental concerns escalate, both consumers and regulators are advocating for sustainable alternatives, pushing companies towards bio-based fermentation chemicals. This shift is underpinned by stringent regulations promoting eco-friendly solutions, thereby creating a fertile ground for market expansion.

Additionally, there is a marked increase in health awareness among consumers, fueling demand for natural and organic products, particularly in the food and pharmaceutical sectors. This trend is prompting manufacturers to innovate and diversify their product portfolios, leveraging fermentation processes to meet consumer preferences for healthier, more sustainable options.

However, the market is not without its challenges. High production costs associated with fermentation processes remain a significant barrier to growth. The capital-intensive nature of these processes, coupled with the complexity of scaling production, limits the ability of companies to achieve cost efficiency. This financial strain is particularly acute for smaller players and new entrants, who may struggle to compete with established firms with greater resources. Despite these challenges, the long-term outlook for the fermentation chemicals market remains positive. Continued advancements in technology and process optimization are expected to mitigate some cost-related issues, enhancing production efficiency and making bio-based products more accessible. In summary, while the fermentation chemicals market faces cost challenges, the overall trajectory is upward, driven by environmental imperatives and health-conscious consumer behavior.

Key Takeaways

- Market Growth: The Fermentation Chemicals Market was valued at USD 87.2 billion in 2023. It is expected to reach USD 170.2 billion by 2033, with a CAGR of 7.1% during the forecast period from 2024 to 2033.

- By Product: Organic Acid led the Fermentation Chemicals Market by Product.

- By Application: Food and Beverages dominated the Fermentation Chemicals Market applications.

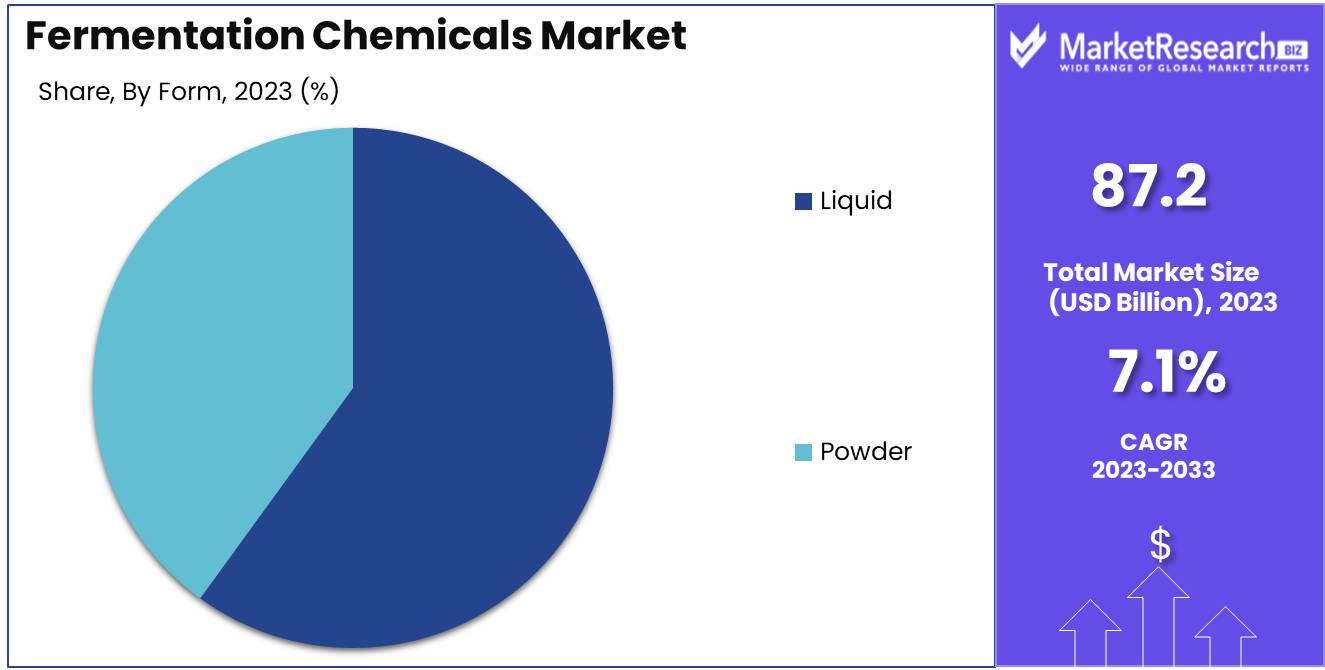

- By Form: Liquid form dominated, but Powder remains crucial for stability.

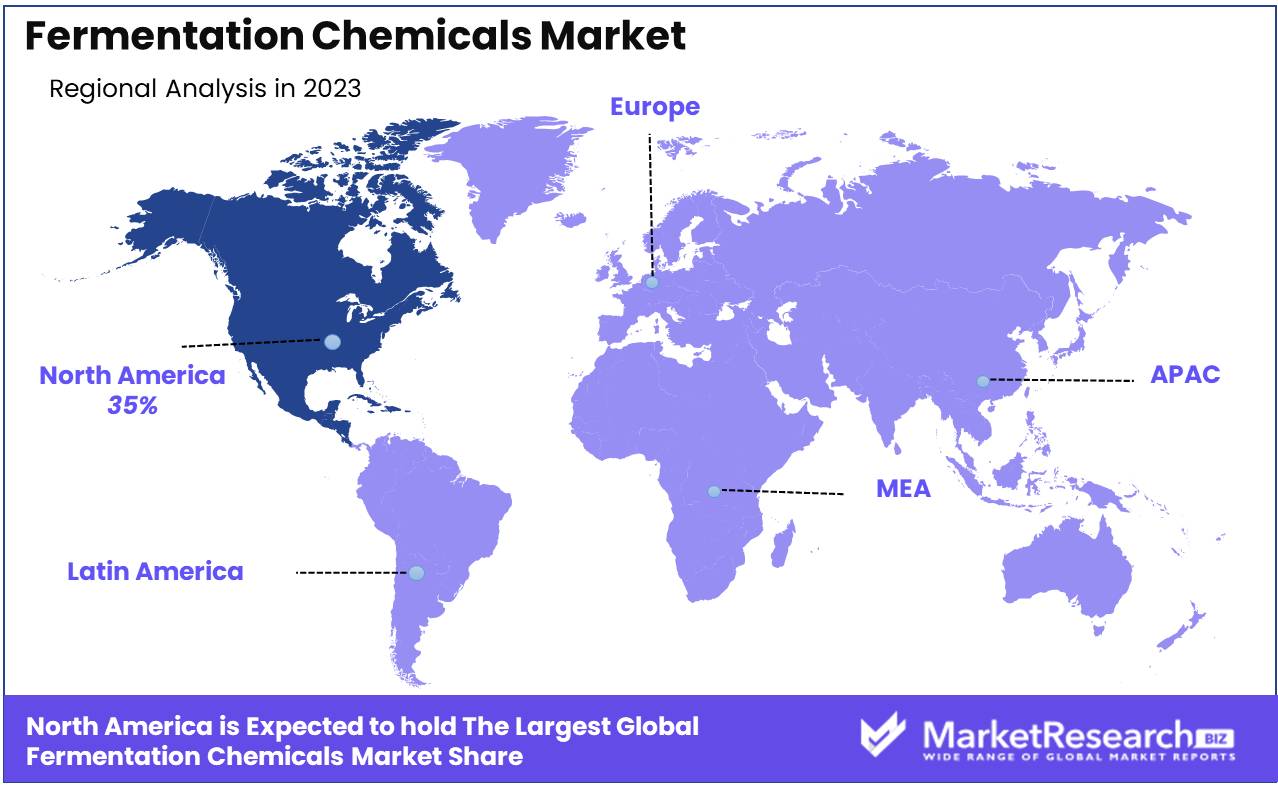

- Regional Dominance: North America dominates the global fermentation chemicals market share with 35%.

- Growth Opportunity: The global fermentation chemicals market is set to grow, driven by the expanding food and beverage industry and rising demand for fermentation-derived enzymes across various sectors.

Driving factors

Rising Industrial Applications Fuel Fermentation Chemicals Market

The increasing demand from the methanol and ethanol industries significantly propels the growth of the fermentation chemicals market. Methanol and ethanol are integral to numerous industrial applications, including biofuels, solvents, and chemical intermediates. As the global push for sustainable and renewable energy sources intensifies, ethanol, particularly as a biofuel, has seen a surge in demand. According to recent industry reports, the global ethanol market is projected to grow at a CAGR of 5.3% from 2020 to 2027. This growth trajectory directly influences the fermentation chemicals market, as ethanol production relies heavily on fermentation processes involving chemicals such as enzymes and yeast. The methanol industry similarly benefits from advancements in fermentation technology, further driving demand for high-quality fermentation chemicals. The convergence of these factors underscores the pivotal role of the methanol and ethanol industries in accelerating the market for fermentation chemicals.

Pharmaceutical Advancements Spur Fermentation Chemicals Demand

The pharmaceutical industry's escalating demand for fermentation chemicals is a crucial driver of market expansion. Fermentation processes are essential in the production of various pharmaceuticals, including antibiotics, vaccines, and biologics. Fermentation chemicals are indispensable in synthesizing active pharmaceutical ingredients (APIs) and in biopharmaceutical manufacturing, which involves the cultivation of microbial cells to produce therapeutic proteins. The rise in chronic diseases and the consequent need for innovative treatments further bolster the demand for fermentation chemicals. This robust growth in the pharmaceutical sector not only highlights the critical importance of fermentation chemicals but also signals sustained market expansion driven by pharmaceutical innovations and the increasing complexity of drug manufacturing processes.

Sustainability Trends Drive Bio-Based Fermentation Chemicals Market

The global shift towards bio-based products represents a transformative force in the fermentation chemicals market. As environmental concerns and sustainability goals become more prominent, industries are increasingly adopting bio-based alternatives to reduce their carbon footprint. Bio-based fermentation chemicals, derived from renewable resources, are gaining traction across various sectors, including agriculture, food and beverages, and personal care. The adoption of bio-based fermentation chemicals aligns with global sustainability trends, driven by consumer demand for eco-friendly products and stringent regulatory policies aimed at reducing reliance on fossil fuels. Companies investing in bio-based fermentation processes benefit from reduced environmental impact and enhanced market competitiveness. This paradigm shift not only fosters innovation in fermentation technology but also ensures long-term growth prospects for the fermentation chemicals market, anchored by sustainability imperatives.

Restraining Factors

Product Recovery Challenges: Hindering Efficiency and Profitability

The process of recovering fermentation chemicals, which involves the separation and purification of the desired product from the fermentation broth, poses significant technical and economic challenges. These recovery processes can be complex and costly, requiring advanced technologies and extensive energy input. As a result, the high costs associated with product recovery can erode profit margins, making fermentation-based production less economically viable compared to other methods.

For instance, the need for sophisticated equipment and high energy consumption can inflate operational expenses, which are ultimately passed on to consumers, making the end products more expensive. This price sensitivity can limit market expansion, as higher prices may reduce the competitiveness of fermentation chemicals in industries like food and beverages, pharmaceuticals, and biofuels.

Additionally, inefficiencies in recovery processes can lead to lower yields, further diminishing the cost-effectiveness of fermentation methods. When product recovery is suboptimal, the overall efficiency of the fermentation process is compromised, resulting in waste and increased production costs. This can discourage manufacturers from investing in fermentation technology, thereby restraining market growth.

Competition from Petrochemicals: A Threat to Market Penetration

The fermentation chemicals market faces significant competition from petrochemical-derived alternatives. Petrochemicals, often produced at larger scales and lower costs due to well-established and optimized industrial processes, can be more attractive to manufacturers. The economies of scale achieved in petrochemical production translate to lower prices, making these chemicals more appealing to cost-sensitive industries.

Moreover, the entrenched infrastructure for petrochemical production, including extensive distribution networks and established market presence, gives petrochemical products a competitive edge. The long-standing reliability and familiarity with petrochemical products can lead to resistance against switching to fermentation chemicals, especially in applications where cost considerations are paramount.

This competition is particularly evident in markets where price is a critical factor, such as in bulk chemicals for industrial use. While fermentation chemicals offer benefits such as sustainability and reduced environmental impact, these advantages may not always outweigh the cost benefits provided by petrochemicals. As a result, the market penetration of fermentation chemicals can be significantly hindered.

By Product Analysis

In 2023, Organic Acid led the Fermentation Chemicals Market by Product.

In 2023, Organic Acid held a dominant market position in the by-product segment of the Fermentation Chemicals Market. The robust demand for organic acids, particularly in food and beverage preservation, significantly contributed to this leadership. Organic acids, such as citric acid and lactic acid, are integral in enhancing the shelf-life and flavor of various consumables, driving their adoption. Moreover, their role in pharmaceuticals and personal care products, for pH adjustment and preservation, bolstered their market penetration.

Enzymes, another critical segment, saw substantial growth due to their essential application in biocatalysis, detergents, and biofuel production. The increasing inclination towards sustainable industrial processes has amplified enzyme utilization across sectors.

Alcohol, predominantly ethanol, maintained a significant market share due to its widespread use in fuel, beverages, and hand sanitizers. The ongoing biofuel initiatives and heightened hygiene standards post-pandemic have further propelled its demand.

The "Others" category, encompassing amino acids, antibiotics, and vitamins, also exhibited considerable market presence. These products are crucial in animal feed, medical treatments, and dietary supplements, underlining their indispensable role in diverse applications within the fermentation chemicals market.

By Application Analysis

In 2023, Food and Beverages dominated the Fermentation Chemicals Market applications.

In 2023, The Food and Beverages segment held a dominant market position in the By Application segment of the Fermentation Chemicals Market. This dominance is driven by the increasing demand for fermented products such as yogurt, cheese, and alcoholic beverages, which leverage fermentation chemicals for their production. The growing consumer preference for natural ingredients and probiotics has significantly bolstered the utilization of fermentation processes in food and beverage manufacturing.

The Pharmaceuticals segment also saw substantial growth, attributed to the rising application of fermentation chemicals in the production of antibiotics, insulin, and vaccines. As healthcare demands increase globally, the pharmaceutical industry's reliance on fermentation technologies continues to expand, ensuring high-quality and efficient drug production.

Plastic and Fibers emerged as a crucial segment, propelled by the shift towards sustainable and biodegradable materials. Fermentation chemicals play a key role in producing bioplastics and biofibers, aligning with the environmental goals of reducing plastic waste and lowering carbon footprints.

In the Industrial segment, fermentation chemicals are integral to biofuel production and waste treatment processes. The push for cleaner energy sources and effective waste management solutions has amplified the sector's reliance on these chemicals.

Lastly, the Others category, encompassing applications like textiles and animal feed, continues to grow steadily. Fermentation chemicals enhance the nutritional value of animal feed and improve the quality of textile products, further diversifying their application across various industries.

By Form Analysis

In 2023, Liquid form dominated, but Powder remains crucial for stability.

In 2023, The Liquid form held a dominant market position in the By Form segment of the Fermentation Chemicals Market. This supremacy can be attributed to the liquid form's superior ease of use, which facilitates more consistent mixing and application in various industrial processes, including food and beverage, pharmaceuticals, and biofuels. The liquid form's high solubility ensures efficient microbial activity, leading to enhanced fermentation efficiency and product yield. Additionally, the transportation and storage advantages of liquid fermentation chemicals, such as reduced risk of contamination and ease of handling, further bolster their market preference.

Conversely, the Powder form of fermentation chemicals, while slightly less dominant, remains integral due to its longer shelf life and stability under diverse environmental conditions. Powders are particularly favored in regions where logistical challenges are prevalent, as they are less prone to degradation and easier to store without special conditions. Their precise dosing capability also makes powders an ideal choice for applications requiring stringent control over fermentation processes. Despite the liquid form's dominance, the powder form continues to secure a significant market share by addressing specific industry needs and logistical considerations.

Key Market Segments

By Product

- Organic Acid

- Enzymes

- Alcohol

- Others

By Application

- Food and Beverages

- Pharmaceuticals

- Plastic and Fibers

- Industrial

- Others

By Form

- Liquid

- Powder

Growth Opportunity

Expanding Food and Beverage Industry

The global fermentation chemicals market is poised for significant growth in 2024, driven by robust expansion in the food and beverage industry. As consumers increasingly seek natural and sustainable food products, fermentation chemicals have become essential in the production of various foods and beverages. Fermentation-derived products such as organic acids, amino acids, and enzymes are integral in enhancing food quality, safety, and shelf-life. The growing demand for plant-based and functional foods, alongside the rising health consciousness among consumers, is amplifying the need for innovative fermentation solutions. Consequently, manufacturers are investing heavily in R&D to develop advanced fermentation processes, further propelling market growth.

Rising Popularity of Fermentation-Derived Enzymes

Fermentation-derived enzymes are gaining traction across multiple industries, including pharmaceuticals, textiles, and biofuels, in addition to food and beverages. These enzymes offer environmentally friendly and cost-effective solutions for various industrial processes. In the food industry, they are critical for processes like brewing, baking, and dairy production, where they help in improving texture, flavor, and nutritional content. The pharmaceutical industry leverages these enzymes for drug development and manufacturing, capitalizing on their precision and efficiency. The biofuels sector benefits from fermentation-derived enzymes' ability to convert biomass into renewable energy, aligning with global sustainability goals. This rising popularity underscores a substantial growth opportunity, with market players expanding their enzyme portfolios to cater to diverse applications.

Latest Trends

Increasing Adoption of Sustainable and Green Chemistry

The fermentation chemicals market is poised for significant transformation driven by the increasing adoption of sustainable and green chemistry. This trend is fueled by a growing awareness of environmental impacts and stringent regulations aimed at reducing carbon footprints. Companies are investing heavily in research and development to create bio-based fermentation chemicals, which offer an eco-friendly alternative to traditional petrochemical-based products. The push towards sustainability is also enhancing the appeal of fermentation chemicals in various industries, including pharmaceuticals, food and beverages, and biofuels. As businesses seek to align with global sustainability goals, the demand for green fermentation chemicals is expected to rise, driving market growth and fostering innovation.

Government Initiatives Promoting Domestic Manufacturing

Government initiatives aimed at bolstering domestic manufacturing capabilities are also playing a pivotal role in shaping the fermentation chemicals market. Countries worldwide are implementing policies to reduce reliance on imports and strengthen local production infrastructures. These initiatives include financial incentives, subsidies, and the development of specialized industrial zones. For instance, the United States and the European Union are investing in bio-manufacturing hubs to support the domestic production of fermentation chemicals. This not only enhances supply chain resilience but also creates opportunities for small and medium-sized enterprises to enter the market. Moreover, these government efforts are expected to lead to advancements in production technologies and a more competitive market landscape.

Regional Analysis

North America dominates the global fermentation chemicals market share with 35%.

The global fermentation chemicals market exhibits diverse growth patterns across various regions, driven by regional industrial capabilities, consumer demand, and technological advancements. North America dominates the market, accounting for approximately 35% of the global largest market share. This dominance is underpinned by the presence of major industry players, advanced biotechnological research, and significant investments in sustainable chemical processes. The United States leads this growth, propelled by high demand in pharmaceuticals, food and beverages, and biofuel sectors.

Europe follows closely, contributing around 30% to the global market, with Germany, France, and the UK at the forefront due to their strong industrial base and stringent environmental regulations promoting the use of bio-based chemicals. The region's focus on reducing carbon footprints and enhancing bio-economy further fuels market expansion.

In the Asia-Pacific region, rapid industrialization and urbanization, particularly in China and India, drive market growth, capturing roughly 25% of the global market. The burgeoning food and beverage industry, coupled with increasing pharmaceutical manufacturing, augments demand for fermentation chemicals.

The Middle East & Africa, though a smaller segment, is witnessing steady growth, spurred by rising investments in biotechnology and an expanding food processing industry. Latin America, with Brazil and Argentina as key players, is experiencing moderate growth, driven by the agricultural sector's demand for bio-based chemicals.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global fermentation chemicals market in 2024 is poised for significant growth, driven by advancements in biotechnology and increasing demand across various sectors, including food and beverages, pharmaceuticals, and biofuels.

BASF SE is likely to leverage its strong position in the chemicals industry by focusing on sustainable production processes and innovative product offerings. Novozymes A/S, renowned for its enzymatic solutions, will continue to capitalize on its expertise in biotechnology, driving efficiency and sustainability in industrial processes. Dow Chemical Company, with its diversified portfolio, is expected to benefit from its integrated supply chain and emphasis on high-performance materials.

Evonik Industries AG and Ajinomoto Co. Inc. will play critical roles in the amino acids and specialty chemicals segments, respectively. Their focus on high-quality, application-specific products positions them well to cater to niche markets. Archer Daniels Midland Company and Cargill Incorporated, giants in the agricultural sector, will likely expand their influence in fermentation chemicals by integrating their robust supply chains and leveraging their extensive market reach.

DuPont de Nemours Inc. and Lonza Group AG, with their strong R&D capabilities, will continue to drive innovation in bio-based chemicals, catering to the growing demand for eco-friendly products. DSM and AB Enzymes GmbH will enhance their market positions by focusing on health and nutrition applications, aligning with global trends toward healthier lifestyles.

Emerging players like BioAmber Inc. and Lallemand Inc. will contribute to market diversity through their specialized products and innovative approaches. Overall, the competitive landscape will be characterized by strategic collaborations, technological advancements, and a strong emphasis on sustainability, driving the global fermentation chemicals market toward robust growth.

Market Key Players

- BASF SE

- Novozymes A/S

- Dow Chemical Company

- Evonik Industries AG

- Ajinomoto Co. Inc.

- Archer Daniels Midland Company

- Cargill Incorporated

- Hansen Holding A/S

- DuPont de Nemours Inc.

- Lonza Group AG

- DSM

- AB Enzymes GmbH

- BioAmber Inc.

- Lallemand Inc.

- Kyowa Hakko Bio Co. Ltd.

- Novamont S.p.A.

- Tereos SA

- Sumitomo Chemical Co. Ltd.

- Tate & Lyle PLC

- Amano Enzyme Inc.

- Others

Recent Development

- In May 2024, Cargill unveiled a major expansion of its fermentation facility in Blair, Nebraska, to meet the growing demand for bio-based chemicals. This $150 million investment highlights Cargill's strategic focus on scaling up production capabilities to support the increasing market need for sustainable chemical alternatives.

- In March 2024, BASF SE announced the launch of a new line of bio-based fermentation chemicals aimed at reducing carbon footprint and enhancing sustainability in various industrial processes. This initiative aligns with BASF’s commitment to sustainable solutions and innovation in chemical production.

- In January 2024, Novozymes, a leader in enzyme production, introduced a breakthrough fermentation technology designed to significantly increase yield and efficiency in biofuel production. This development is expected to lower production costs and boost the adoption of renewable energy sources.

Report Scope

Report Features Description Market Value (2023) USD 87.2 Billion Forecast Revenue (2033) USD 170.2 Billion CAGR (2024-2032) 7.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Organic Acid, Enzymes, Alcohol, Others), By Application (Food and Beverages, Pharmaceuticals, Plastic and Fibers, Industrial, Others), By Form (Liquid and Powder) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape BASF SE, Novozymes A/S, Dow Chemical Company, Evonik Industries AG, Ajinomoto Co. Inc., Archer Daniels Midland Company, Cargill Incorporated, Hansen Holding A/S, DuPont de Nemours Inc., Lonza Group AG, DSM, AB Enzymes GmbH, BioAmber Inc., Lallemand Inc., Kyowa Hakko Bio Co. Ltd., Novamont S.p.A., Tereos SA, Sumitomo Chemical Co. Ltd., Tate & Lyle PLC, Amano Enzyme Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BASF SE

- Novozymes A/S

- Dow Chemical Company

- Evonik Industries AG

- Ajinomoto Co. Inc.

- Archer Daniels Midland Company

- Cargill Incorporated

- Hansen Holding A/S

- DuPont de Nemours Inc.

- Lonza Group AG

- DSM

- AB Enzymes GmbH

- BioAmber Inc.

- Lallemand Inc.

- Kyowa Hakko Bio Co. Ltd.

- Novamont S.p.A.

- Tereos SA

- Sumitomo Chemical Co. Ltd.

- Tate & Lyle PLC

- Amano Enzyme Inc.

- Others