Femtech Market Report By Application Type (Reproductive Health, Fertility Tracking and Optimization, Sexual Wellness, Pregnancy and Postpartum Care, Pelvic Health Solutions), By Technological Focus (Wearable Devices, Mobile Applications, Telemedicine and Telehealth), By Service, By End User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

43442

-

Feb 2024

-

134

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

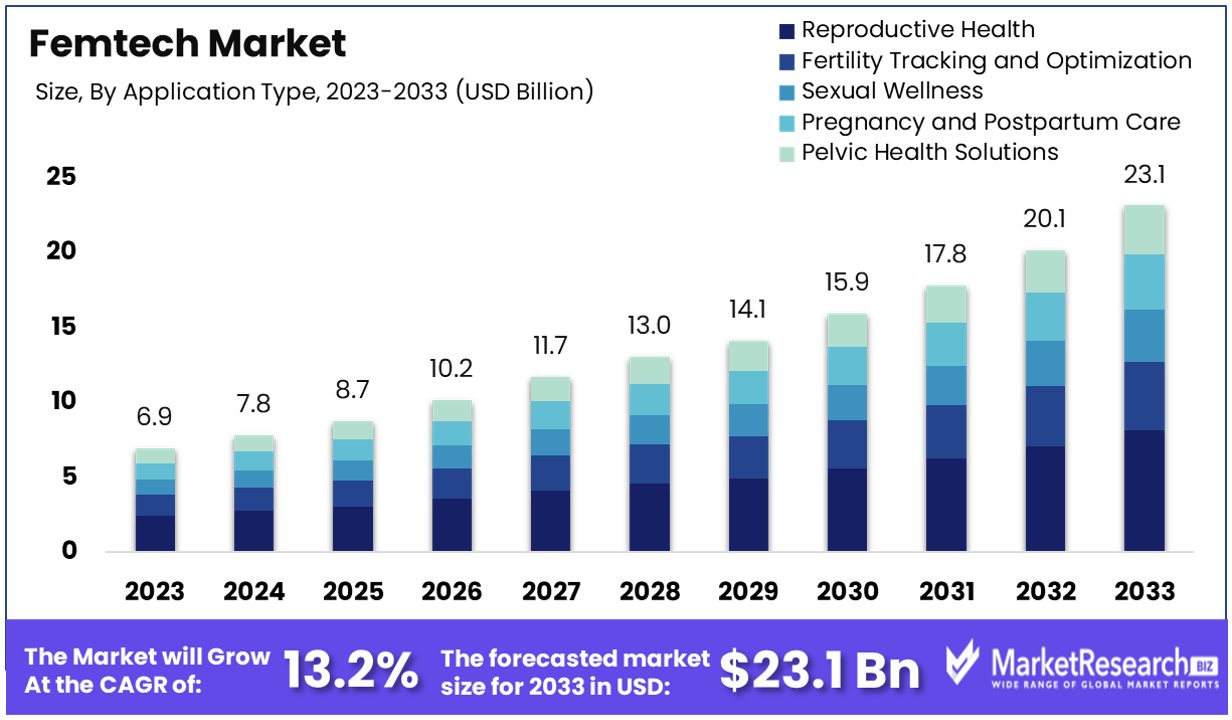

The Global Femtech Market size is expected to be worth around USD 23.1 Billion by 2033, from USD 6.9 Billion in 2023, growing at a CAGR of 13.20% during the forecast period from 2024 to 2033.

The Femtech Market refers to the burgeoning sector focused on women's health technologies and services. This market encompasses a wide range of products and solutions designed to address various aspects of female health, including reproductive health, menstrual cycle tracking, fertility solutions, pregnancy and nursing care, women's sexual wellness, and menopause.

With the advancement of technology, the Femtech industry has seen significant growth, driven by increasing awareness and demand for personalized healthcare solutions.

In the context of the evolving healthcare landscape, the Femtech Market emerges as a pivotal domain with substantial growth potential. This is underscored by a unique convergence of digital health technologies and healthcare needs specific to women.

Reports highlight a notable trend: women are 75% more likely than men to utilize digital healthcare tools, underscoring the significant demand and receptiveness within this demographic towards innovative health solutions. This inclination towards digital platforms positions the Femtech sector as a promising avenue for development and investment.

Moreover, an examination of health trends reveals a nuanced picture. The Centers for Disease Control and Prevention (CDC) reports a decline in women's mortality rates from critical diseases such as heart disease, lung cancer, and breast cancer, pointing towards advancements in healthcare interventions and awareness. Conversely, the increasing incidence of chlamydia and diabetes among women signals emerging health challenges that necessitate focused attention and innovation within the Femtech space.

Additionally, the CDC's findings that approximately 15.2% of women aged 18 and older report fair or poor health, coupled with high obesity (42.1%) and hypertension (45.7%) rates, further accentuates the imperative for targeted health solutions. The fertility domain also underscores the need for specialized focus, with about 10% of women aged 15–44 facing challenges in conceiving or sustaining pregnancy.

These data points collectively underscore the Femtech Market's strategic importance. They highlight not only the market's capacity for addressing specific health concerns through technology-driven solutions but also its role in enhancing overall healthcare accessibility and effectiveness for women.

Key Takeaways

- Market Growth: The Global Femtech Market is projected to reach USD 23.1 Billion by 2033, growing at a CAGR of 13.20% from USD 6.9 Billion in 2023.

- Application Focus: Reproductive Health dominates, alongside segments like Fertility Tracking, Sexual Wellness, Pregnancy Care, and Pelvic Health.

- Technology: Wearable Devices lead, followed by Mobile Apps and Telemedicine solutions.

- Services: Diagnostics are primary, with Monitoring and Therapeutic services also significant.

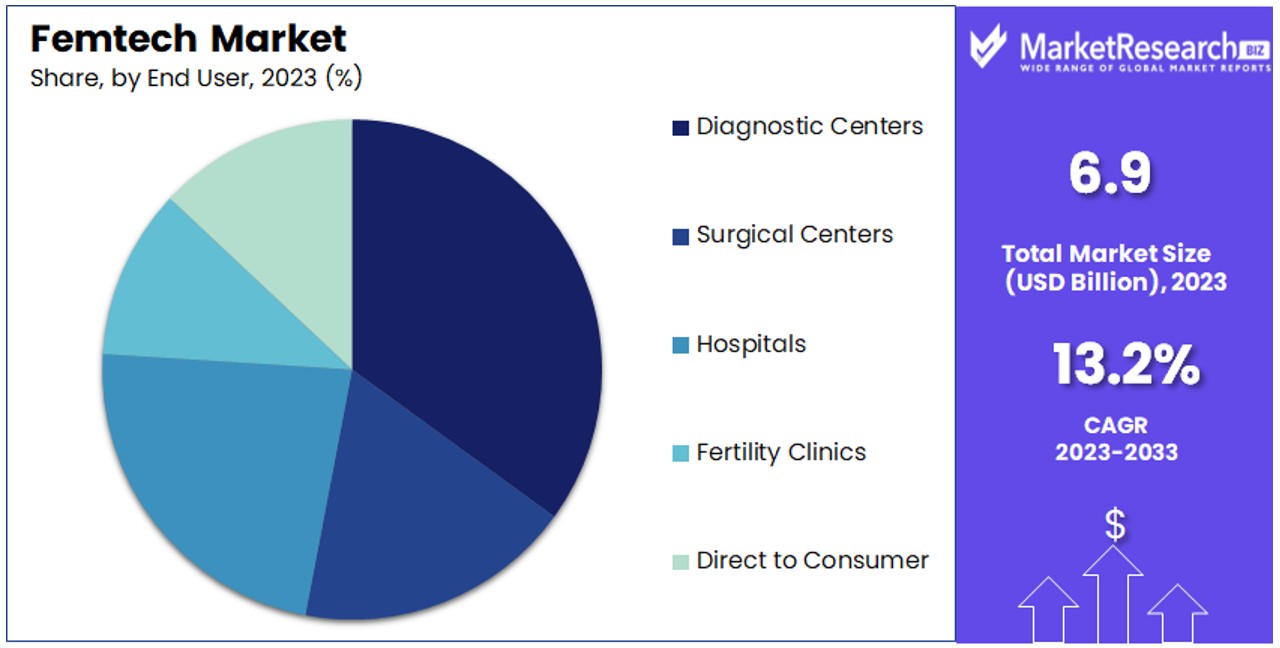

- End Users: Diagnostic Centers hold major share, followed by Surgical Centers, Hospitals, Fertility Clinics, and Direct-to-Consumer platforms.

- Regional Dynamics:

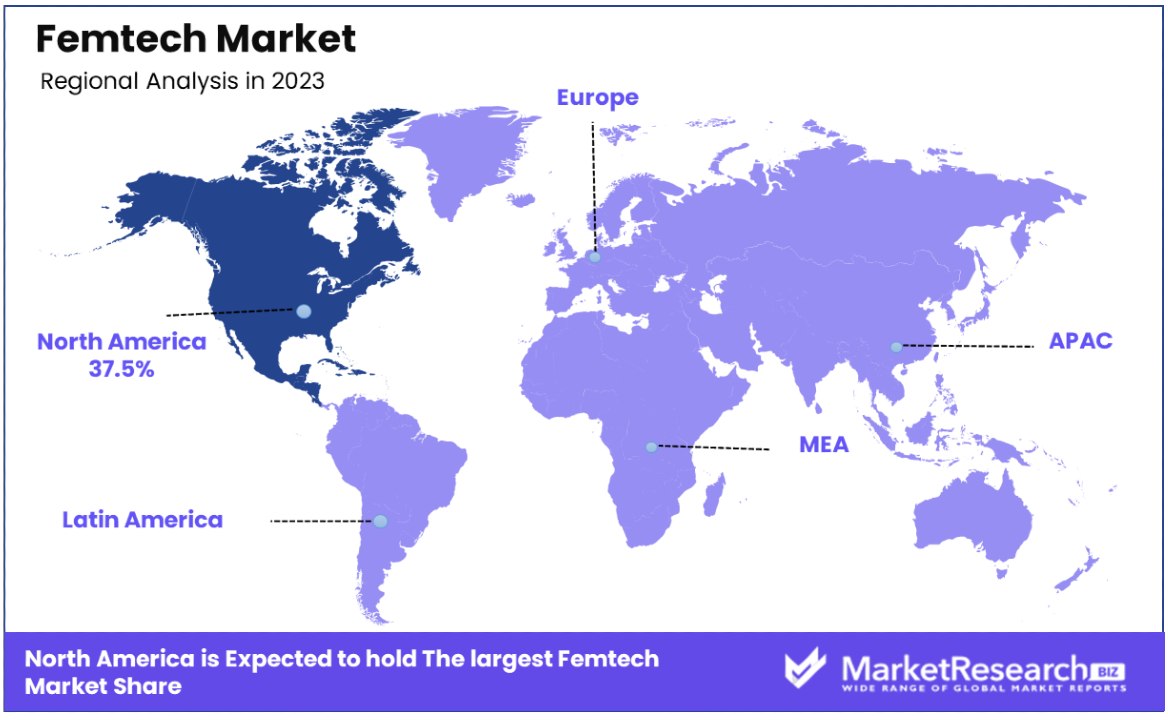

- North America: Commands 37.5% market share, driven by robust healthcare infrastructure and early tech adoption.

- Europe: Benefits from widespread healthcare access and government support.

- Asia Pacific: Emerges as the fastest-growing region, driven by digitalization and rising health awareness.

- Key Players: Leading companies include Flo Health, Apple, Clue, Elvie, and Google, alongside emerging players like iSono Health and Natural Cycles. Diverse offerings from apparel and lifestyle brands indicate a thriving market ecosystem.

Driving Factors

Rising Awareness and Demand Drives Market Growth

The increasing vocalization of women regarding health issues uniquely affecting them, such as menstrual health, fertility, and pregnancy care, serves as a primary catalyst for the Femtech Market's growth. This rising awareness and demand have paved the way for innovative products tailored to women's health needs.

Digital platforms and apps like Flo, which offer menstrual cycle tracking, exemplify how technology meets this demand by providing accessible and personalized health insights. This trend reflects a broader shift towards patient-centered healthcare, emphasizing the importance of understanding and addressing the specific health concerns of women.

Advancements in Wearables and Apps Fuel Innovation

The Femtech market is witnessing a surge in digital health technologies, particularly in the development of wearables and apps. The introduction of smart bras, smart tampons, and menstrual cups with Bluetooth connectivity represents a leap forward in personal health monitoring.

Moreover, the use of AI and data analytics in apps offers personalized insights, enhancing the user experience and efficacy of health management tools. For example, the advent of a radiant wristband that monitors vital signs during pregnancy illustrates how these advancements are directly contributing to improved health outcomes.

Investments and Funding Signal High Growth Potential

The Femtech sector's growth trajectory is significantly bolstered by increasing investments and funding from both venture capitalists and large corporations like Amazon and Google. The sector's ability to attract substantial financial backing is indicative of its high growth potential.

For instance, the Essence App's successful funding round of $600,000 to enhance female employee performance through hormonal cycle scheduling demonstrates investor confidence in Femtech's innovative solutions and market viability. This influx of capital not only enables the development and scaling of groundbreaking technologies but also signifies the market's maturity and readiness for further expansion.

Restraining Factors

High Cost Restrains Market Growth

The elevated pricing of Femtech devices and services significantly hampers market expansion, particularly in low and middle-income countries. Premium products, such as the Elvie breast pump which retails for $500, illustrate the financial barrier to entry for a vast segment of the potential user base.

This high cost limits accessibility and adoption, as the price point is beyond the reach of many who could benefit from these innovations. The affordability issue not only reduces the potential market size but also exacerbates the digital divide in healthcare access, hindering the universal adoption of Femtech solutions.

Data Privacy and Security Concerns Limit Adoption

Femtech apps and devices, by their nature, collect and store sensitive health data, making data privacy and security paramount concerns. These apprehensions about the potential for data misuse and breaches are significant obstacles to user adoption.

Without stringent, transparent data policies and robust encryption measures, companies struggle to build trust with their user base. The anxiety surrounding data privacy and security not only deters potential users but also invites regulatory scrutiny, posing a complex challenge for Femtech companies aiming to innovate while ensuring user data remains secure and confidential.

Reproductive Health Analysis

The Femtech Market, with its diverse range of applications aimed at enhancing women's health, positions Reproductive Health as its dominant segment. This preeminence is not accidental but a reflection of the critical importance and broad scope that reproductive health holds within women's healthcare. Addressing everything from menstrual health to sexually transmitted infections, this segment has seen significant growth, driven by increased awareness, technological advancements, and the growing demand for personalized healthcare solutions.

Reproductive Health's dominance is further solidified by the advent of innovative products like smart menstrual cups and fertility tracking devices, which not only offer convenience but also empower women with valuable insights into their health. The rise of this segment is indicative of a broader shift towards more open discussions and proactive approaches to women's health issues.

Complementing the Reproductive Health segment are Fertility Tracking and Optimization, Sexual Wellness, Pregnancy and Postpartum Care, and Pelvic Health Solutions. Each plays a vital role in the Femtech ecosystem, addressing specific aspects of women's health and contributing to the market's growth. Fertility Tracking and Optimization, for instance, caters to the increasing number of women seeking to understand and improve their fertility through technology.

Sexual Wellness focuses on products and services that enhance sexual health and wellbeing, reflecting a growing market segment as societal attitudes evolve. Pregnancy and Postpartum Care offer support during critical life stages, utilizing technology to monitor and manage health, while Pelvic Health Solutions address health conditions like incontinence and pelvic floor disorders, areas previously underserved by traditional healthcare models.

Wearable Devices Analysis

In the realm of technological focus within the Femtech Market, Wearable Devices emerge as the leading segment, reflecting the increasing consumer preference for health and wellness solutions that integrate seamlessly into daily life. This trend towards wearables, including fitness trackers, smartwatches, and specialized health monitoring devices, highlights a shift in how women manage their health, favoring real-time data and personalized insights.

The popularity of wearable devices is buoyed by advancements in sensor technology, which have made it possible to monitor a wide array of health metrics more accurately and non-invasively than ever before. This segment's growth is a testament to the value placed on convenience, immediacy, and the empowerment of women through technology to take control of their health.

Supporting the dominant Wearable Devices segment are Mobile Applications and Telemedicine and Telehealth services. Mobile Applications offer a broad platform for health management, from fertility tracking to mental health support, and have become integral to the Femtech ecosystem. Their accessibility and the personalized nature of the services they provide have made them indispensable to women seeking to manage various aspects of their health.

Telemedicine and Telehealth, on the other hand, represent a rapidly expanding segment, particularly in light of global health events that have accelerated the adoption of remote healthcare services. These services break down geographical and logistical barriers to healthcare access, making professional consultation and care more accessible than ever.

Diagnostics Analysis

In the Femtech market, Diagnostics emerges as a critical service segment, underpinned by the increasing demand for early detection and management of women's health issues. This segment encompasses a wide array of technologies and services aimed at diagnosing conditions related to fertility, menstrual health, cancers specific to women, and other gynecological issues.

The emphasis on diagnostics is driven by a growing awareness among women about the importance of early detection and preventive care, coupled with advancements in medical technology that enable more precise and less invasive diagnostic procedures. The availability of at-home diagnostic kits, for instance, reflects a significant shift towards empowering women with tools for self-monitoring and management of their health, fostering a proactive approach to healthcare.

While Diagnostics leads in terms of demand and innovation, the Monitoring and Therapeutic services play complementary roles in the Femtech market. Monitoring services, which include wearable devices and mobile apps for tracking various health parameters, support continuous management of conditions and wellness.

On the other hand, Therapeutic services offer treatments and interventions for diagnosed conditions, including both digital therapies and physical devices designed to address specific health issues. These segments, together with Diagnostics, form a comprehensive ecosystem that addresses the spectrum of women's health needs, from prevention and detection to management and treatment, driving the overall growth of the Femtech market.

Diagnostic Centers Analysis

Diagnostic Centers stand out as the dominant end-user segment within the Femtech market, primarily due to their central role in the early detection and diagnosis of women's health issues. These centers are equipped with specialized technologies and expertise to offer a wide range of diagnostic services, from routine screenings to more complex diagnostic tests.

The reliance on Diagnostic Centers is attributed to their accessibility and the trust they engender among patients seeking accurate and timely health assessments. This segment's growth is further bolstered by partnerships between Femtech companies and diagnostic centers, aimed at integrating innovative diagnostic tools and technologies to enhance the quality and efficiency of healthcare services.

Surgical Centers, Hospitals, Fertility Clinics, and Direct-to-Consumer channels also contribute to the Femtech market's diversity and growth. Surgical Centers and Hospitals provide critical care and treatment for more severe conditions diagnosed through Femtech solutions, ensuring a continuum of care. Fertility Clinics represent a specialized segment addressing the growing demand for fertility and reproductive health services, utilizing Femtech products for monitoring and treatment.

The Direct-to-Consumer model, meanwhile, highlights the shift towards personalized and accessible healthcare solutions, allowing consumers to directly engage with Femtech products and services. Each of these end-user segments complements the Diagnostic Centers by offering integrated care solutions and expanding the reach and impact of Femtech innovations across the healthcare landscape.

Key Market Segments

By Application Type

- Reproductive Health

- Fertility Tracking and Optimization

- Sexual Wellness

- Pregnancy and Postpartum Care

- Pelvic Health Solutions

By Technological Focus

- Wearable Devices

- Mobile Applications

- Telemedicine and Telehealth

By Service

- Diagnostics

- Monitoring

- Therapeutic

By End User

- Diagnostic Centers

- Surgical Centers

- Hospitals

- Fertility Clinics

- Direct to Consumer

Growth Opportunities

Unmet Needs for Menstrual Health and Comfort Offers Growth Opportunity

The demand for innovative products that address menstrual health and comfort highlights a significant growth opportunity within the Femtech Market. Products such as smart tampons, menstrual cups, and pain relief wearables are gaining popularity for their role in providing comfort and convenience during menstruation.

The Flex disc, a notable example, underscores the market's readiness for solutions that offer an improved menstrual experience. This segment's expansion is propelled by an increasing consumer preference for products that not only meet basic needs but also enhance quality of life.

Fertility and Contraceptive Innovations Offer Market Expansion

The advancements in fertility and contraceptive technologies present a notable opportunity for growth in the Femtech sector. Innovations such as at-home hormone testing kits and ovulation prediction tools are becoming increasingly adopted, reflecting a shift towards more personalized and accessible fertility solutions.

Additionally, the development of contraceptive wearables, like silicon rings, introduces a new dimension to reproductive health management, blending convenience with effectiveness. These innovations respond to a broader trend of individuals seeking greater control over their reproductive health, supported by technology that offers precise, user-friendly solutions.

Trending Factors

Rise of Wearables and Connected Devices Are Trending Factors

The surge in popularity of wearables and connected devices within the Femtech Market is a testament to the sector's innovative approach to women's health.

Smart bras, menstrual pain relief devices, and other wearables equipped with sensors and app connectivity are not just trends but pivotal advancements that offer personalized and real-time health tracking. This category's growth is fueled by the consumer's increasing desire for health management tools that are not only effective but also seamless to integrate into daily life.

Telehealth and Virtual Care Are Trending Factors

The expansion of telehealth and virtual care services tailored to women's health needs is reshaping the Femtech landscape. Emerging platforms like e-clinics and applications, such as Tia, which offer virtual gynecology visits, are setting new standards for accessibility and convenience in healthcare.

This trend reflects a broader societal shift towards digital solutions in response to the demand for more flexible and accessible healthcare options. By enabling remote consultations and care, telehealth services are breaking down traditional barriers to healthcare access, such as geographical limitations and time constraints, thereby widening the Femtech market's reach.

Shift Towards At-Home and Self-Care Are Trending Factors

The Femtech industry is witnessing a significant trend towards at-home testing, diagnosis, and self-care, particularly for conditions like PCOS and endometriosis. This shift is driven by a growing preference for convenience, privacy, and control over one's health journey.

The ability to conduct health assessments and monitor conditions from the comfort of one's home represents a critical development in healthcare accessibility and patient empowerment. This trend not only caters to the immediate needs of individuals seeking to manage their health independently but also aligns with broader health and wellness trends prioritizing preventive care and personalized health management.

Regional Analysis

North America Dominates with 37.5% Market Share

North America's commanding 37.5% share of the Femtech Market is a reflection of the region's robust healthcare infrastructure, high consumer spending power, and the early adoption of digital health solutions. Factors such as significant investments in health tech startups, a strong focus on women's health research, and supportive regulatory policies have propelled the market's growth.

The region's market dynamics are characterized by a highly engaged user base, with a preference for innovative and personalized healthcare solutions. This dominance is expected to continue, driven by ongoing technological advancements and the increasing prevalence of chronic diseases among women, further cementing North America's leadership position in the global Femtech landscape.

Europe's Strategic Market Position

Europe holds a strategic position in the Femtech Market, driven by widespread healthcare access, increasing digital health adoption, and supportive government initiatives promoting women's health. The region's emphasis on data protection and privacy, combined with a strong network of healthcare providers and tech companies, fosters a conducive environment for Femtech growth.

Asia Pacific The Fastest Growing With 29% Share

Asia Pacific's remarkable market share of 29% in the Femtech Market is attributed to its vast population, increasing internet penetration, and rising awareness of women's health issues. The region benefits from a booming digital health sector, fueled by government initiatives aimed at improving healthcare accessibility and the adoption of mobile technologies.

Middle East & Africa's Emerging Presence

The Middle East & Africa region is emerging as a significant player in the Femtech Market, albeit from a smaller base. Factors driving growth include increasing government initiatives towards healthcare infrastructure, a rising middle class, and growing awareness of women's health issues.

Latin America's Growing Market Potential

Latin America's Femtech Market is witnessing growth, driven by increased digital connectivity, a growing focus on women's health, and the expansion of healthcare services. The region is experiencing a rise in health tech startups and a growing interest in digital health solutions among its population.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the Femtech Market, key players such as Flo Health, Inc, Apple, Inc, Clue by Biowink GmbH, Elvie, Google, Inc, and others are driving significant advancements and market shifts. Companies like Flo Health and Clue specialize in menstrual and reproductive health, leveraging data analytics to offer personalized insights, while tech giants Apple and Google integrate women's health features into broader health ecosystems, emphasizing the market's integration into everyday technology.

Elvie and HeraMED focus on innovative devices for pregnancy and postpartum care, showcasing the market's diversity in addressing various stages of women's health. Emerging players like iSono Health, Natural Cycles USA Corp, and Withings contribute to the market with niche offerings in breast health monitoring, fertility tracking, and holistic health monitoring, respectively.

The inclusion of apparel and lifestyle brands such as OYA Femtech Apparel, alongside specialized services from Gaia Fertility Limited, Evvy, and Babyscripts, highlights the market's expansion beyond traditional healthcare products into lifestyle and continuous care models. The strategic positioning of these companies, from tech innovators to specialized healthcare solution providers, underscores the Femtech Market's multifaceted approach to addressing women's health, indicating a robust ecosystem ripe for continued growth and innovation.

Market Key Players

- Flo Health, Inc

- Apple, Inc

- Clue by Biowink GmbH

- Elvie

- Google, Inc

- HeraMED

- iSono Health

- Natural Cycles USA Corp

- Withings

- OYA Femtech Apparel

- Gaia Fertility Limited

- Evvy

- Babyscripts

Recent Developments

- Emagine Solutions Technology, a US-based healthtech startup focused on improving the U.S. maternal health system through remote patient monitoring, received a $1 million small business grant from the National Science Foundation (NSF)

- In Feb 2024, The Mindset app, known specifically for its Clementine service, has launched a "transformational" therapy program aimed at supporting women's mental wellbeing by combining cognitive behavioral therapy, positive psychology, neuro-linguistic programming (NLP), and hypnotherapy.

- The Menopause Hub, Ireland's first dedicated menopause clinic, is launching an app to assist in tracking and monitoring menopause symptoms to aid researchers in developing new treatments. The app, set to launch in March 2024, will provide information on hormonal changes during menopause

Report Scope

Report Features Description Market Value (2023) USD 6.9 Billion Forecast Revenue (2033) USD 23.1 Billion CAGR (2024-2033) 13.20% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application Type (Reproductive Health, Fertility Tracking and Optimization, Sexual Wellness, Pregnancy and Postpartum Care, Pelvic Health Solutions), By Technological Focus (Wearable Devices, Mobile Applications, Telemedicine and Telehealth), By Service (Diagnostics, Monitoring, Therapeutic), By End User (Diagnostic Centers, Surgical Centers, Hospitals, Fertility Clinics, Direct to Consumer) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Flo Health, Inc, Apple, Inc, Clue by Biowink GmbH, Elvie, Google, Inc, HeraMED, iSono Health, Natural Cycles USA Corp, Withings, OYA Femtech Apparel, Gaia Fertility Limited, Evvy, Babyscripts Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Flo Health, Inc

- Apple, Inc

- Clue by Biowink GmbH

- Elvie

- Google, Inc

- HeraMED

- iSono Health

- Natural Cycles USA Corp

- Withings

- OYA Femtech Apparel

- Gaia Fertility Limited

- Evvy

- Babyscripts