Female Infertility Drugs Market Report By Type (Gonadotropins, Aromatase Inhibitors, Selective Estrogen Receptor Modulators (SERMs), Dopamine Agonists, Clomiphene Citrate, Others), By Route of Administration (Oral, Injectable, Transdermal, Intrauterine, Others), By Treatment Setting (Fertility Clinics, Hospitals, Specialty Clinics, Home-based Treatment), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

45325

-

May 2024

-

290

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

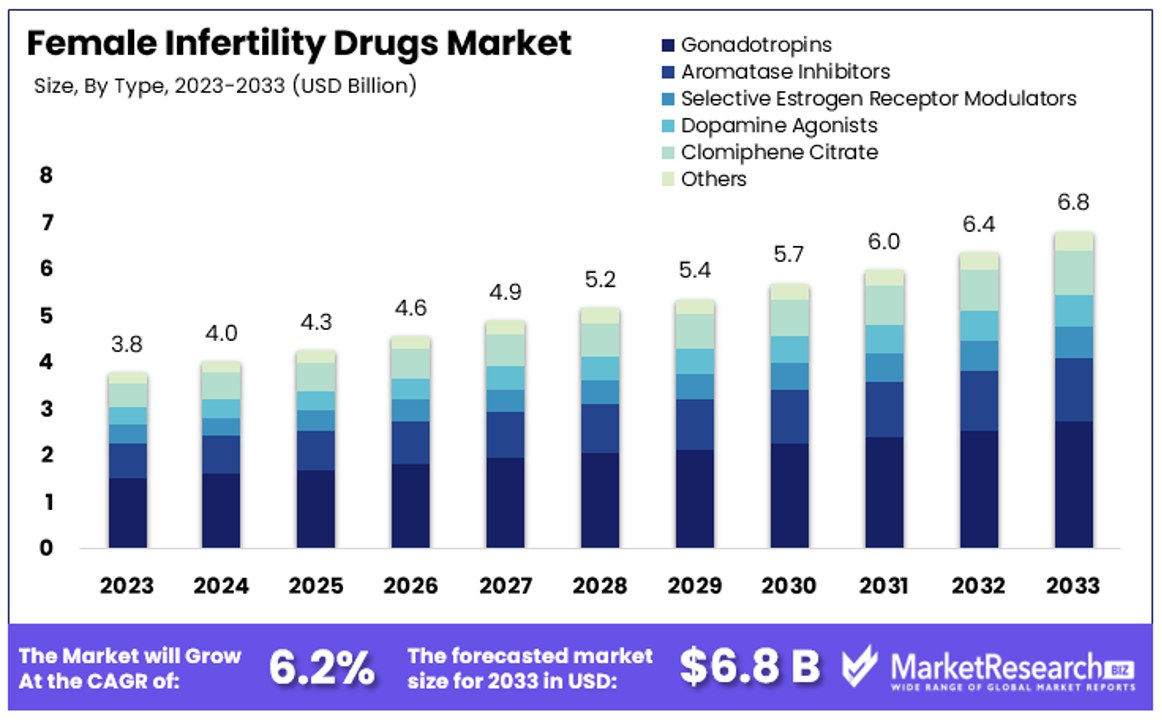

The Global Female Infertility Drugs Market size is expected to be worth around USD 6.8 Billion by 2033, from USD 3.8 Billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

The Female Infertility Drugs Market encompasses a range of pharmaceutical products aimed at addressing issues related to infertility in women. These drugs are designed to enhance reproductive health by improving hormonal balances, stimulating ovulation, and supporting other facets of the female reproductive system.

As fertility challenges become more recognized globally, the demand for these medications is increasing, making this market critical for pharmaceutical companies and healthcare providers.

The Female Infertility Drugs Market is experiencing significant growth, driven by increasing awareness and diagnostic rates of infertility issues among women globally. According to the World Health Organization (WHO), female factors alone account for 37% of infertility cases in couples, with both male and female causes identified in 35% of couples. This highlights a substantial market need for effective treatments, underpinning the demand for infertility drugs.

Age remains a critical factor influencing infertility rates, with women aged 15 to 34 experiencing infertility rates between 7.3% and 9.1%. This rate escalates dramatically as women age, reaching 25% among those aged 35 to 39, and surging to 30% in women aged 40 to 44. These statistics emphasize the urgency and demand for fertility treatments among older women, a demographic that continues to seek assistance at a higher rate due to trends towards later childbearing.

Additionally, endometriosis, which affects 10% to 15% of women of reproductive age, is also a significant driver of the market. The condition not only complicates conception but also represents a recurrent issue that often requires ongoing treatment, further fueling the demand for specialized pharmaceutical solutions.

The market for female infertility drugs presents robust growth opportunities. Pharmaceutical companies are thus incentivized to innovate and expand their product offerings to address the nuanced needs of this diverse patient demographic. This market segment, crucial for healthcare providers and investors, offers substantial prospects for development in therapies that could improve outcomes for millions of women worldwide, positioning it as a key area of focus in the pharmaceutical industry.

Key Takeaways

- Market Value: The Global Female Infertility Drugs Market is projected to witness significant growth, reaching a substantial value by 2033, from USD 3.8 billion in 2023, with a CAGR of 6.2% during the forecast period from 2024 to 2033.

- Type Analysis: Gonadotropins lead with a dominant share of 40% due to their efficacy in stimulating ovulation, essential for assisted reproductive technologies such as IVF. Other segments include Aromatase Inhibitors, SERMs, Dopamine Agonists, and Clomiphene Citrate, each offering alternative treatment options to address diverse patient needs.

- Route of Administration Analysis: Injectables dominate the segment, offering precise and controlled delivery of medication crucial for treatments like Gonadotropins. Other routes include oral, transdermal, and intrauterine, catering to different patient preferences and medical requirements.

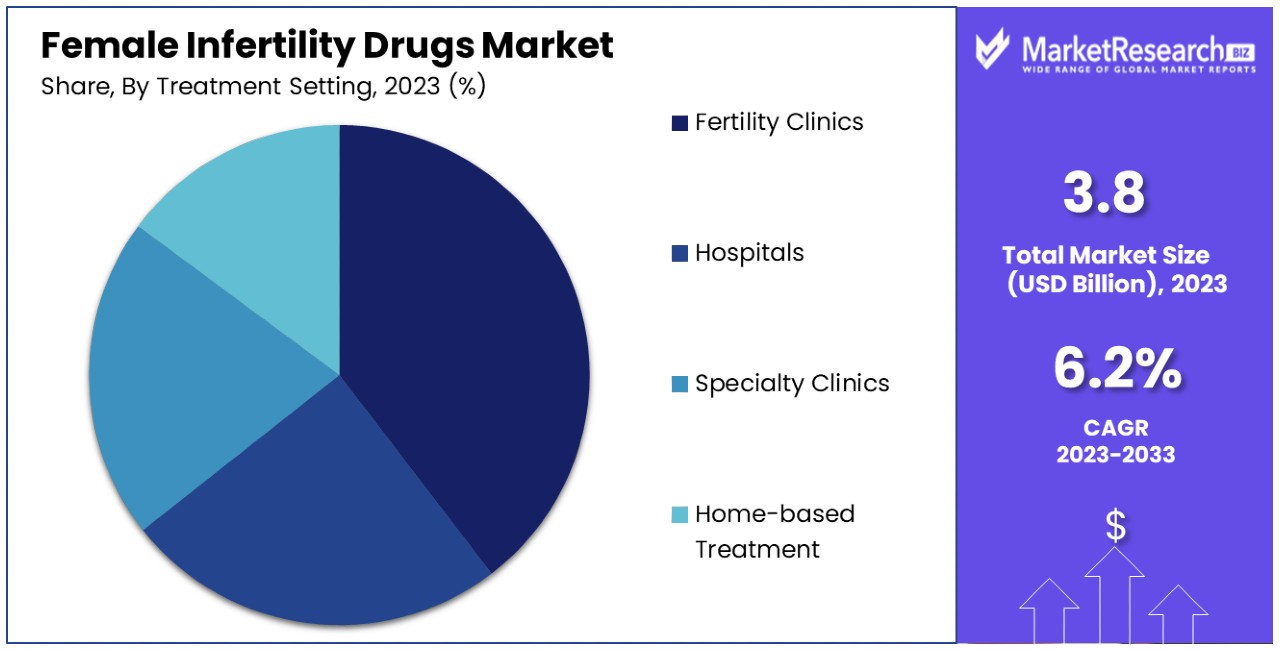

- Treatment Setting Analysis: Fertility clinics dominate the market due to specialized care and advanced treatment technologies, enhancing success rates. Other settings include hospitals, specialty clinics, and home-based treatments, providing options for patients at different levels of care and complexity.

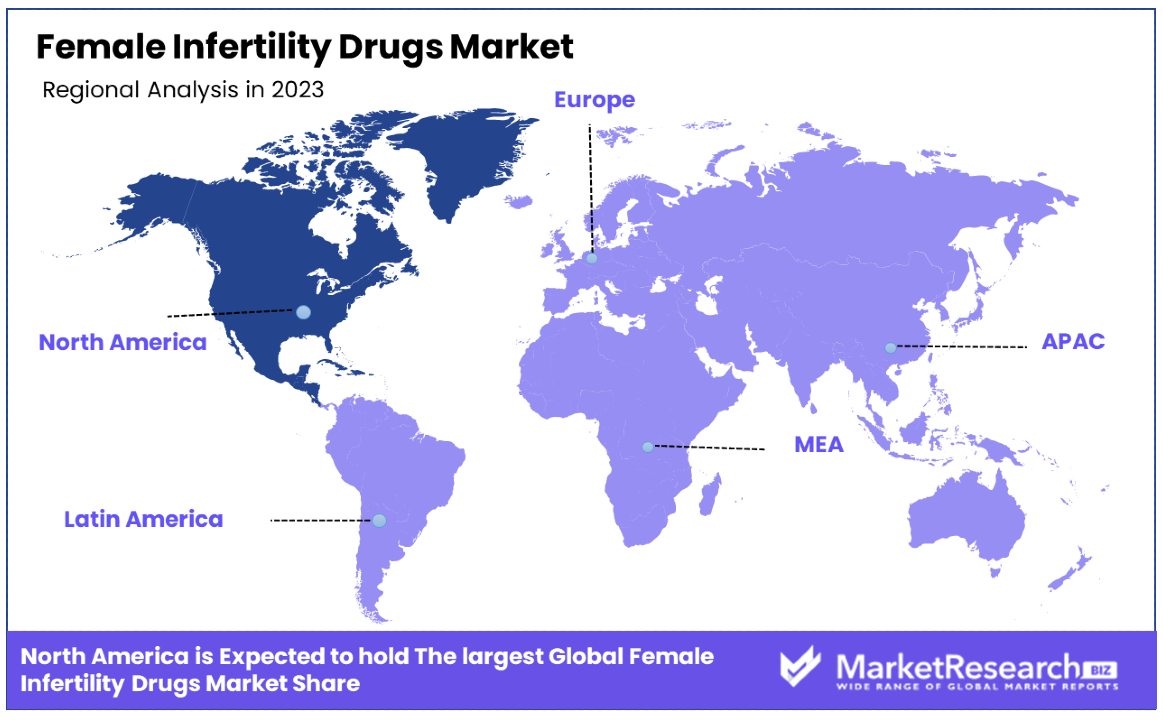

- North America: Dominates with a 40% market share, reflecting advanced healthcare infrastructure and significant investments in fertility treatments.

- Europe: Holds approximately 30% of the market share, supported by favorable healthcare policies and high awareness about fertility treatments.

- Analyst Viewpoint: The dominance of Gonadotropins underscores the importance of stimulating ovulation in female infertility treatment, highlighting the significance of assisted reproductive technologies in addressing infertility. Fertility clinics play a crucial role in providing specialized care and advanced treatment options, contributing to higher success rates and patient satisfaction.

Driving Factors

Increasing Prevalence of Infertility Among Women Drives Market Growth

The growing incidence of infertility among women significantly propels the Female Infertility Drugs Market. Current data from the Centers for Disease Control and Prevention (CDC) indicates that approximately 12% of women aged 15 to 44 in the United States face challenges in conceiving or sustaining a pregnancy.

Factors contributing to this rise include delayed childbearing as women pursue educational and career goals, lifestyle-related health issues such as obesity, and the increasing prevalence of conditions like polycystic ovary syndrome (PCOS). These trends necessitate effective treatment solutions, thereby boosting the demand for infertility drugs. As fertility challenges become more prevalent, the urgency for advanced therapeutic options escalates, ensuring sustained growth in the demand for these pharmaceuticals.

Technological Advancements in Assisted Reproductive Technologies (ART) Drives Market Growth

Technological advancements in assisted reproductive technologies (ART) like in vitro fertilization (IVF) and intracytoplasmic sperm injection (ICSI) have revolutionized the Female Infertility Drugs Market. Innovations in these areas have improved the success rates of fertility treatments, thereby increasing the reliance on and demand for supporting drugs.

Notably, the development of advanced ovulation-inducing medications such as Gonal-f (follitropin alfa) and Ovidrel (choriogonadotropin alfa) has enhanced ovarian stimulation and fertilization outcomes. These technological enhancements not only support direct treatment success but also bolster confidence in fertility treatment efficacy, further driving market growth as more couples opt for these advanced treatment options.

Increasing Awareness and Acceptance of Fertility Treatments Drives Market Growth

The rising awareness and acceptance of fertility treatments have significantly impacted the Female Infertility Drugs Market. Societal shifts towards more positive views on fertility issues have reduced stigma and increased public discourse about treatment options. This cultural change, coupled with expanded insurance coverage in many countries, has made fertility treatments more accessible and appealing to a broader demographic.

As a result, there is a marked increase in the number of couples seeking medical interventions for infertility, which directly boosts the demand for infertility drugs. The enhanced accessibility and acceptance create a supportive environment for market growth, as more individuals are willing to explore and invest in available fertility solutions.

Restraining Factors

High Cost of Fertility Treatments Restrains Market Growth

The substantial cost of fertility treatments, including medications, continues to act as a significant barrier in the Female Infertility Drugs Market. For many couples, the financial burden is considerable, with a single IVF cycle costing between $10,000 and $15,000 in the United States.

This high expense makes fertility treatments inaccessible for a significant portion of the population, particularly those without adequate insurance coverage or in lower income brackets. As a result, the high costs directly limit market growth by reducing the overall number of individuals who can afford these treatments, despite growing demands and advancements in fertility technologies.

Potential Side Effects and Health Risks Restrains Market Growth

The side effects and health risks associated with female infertility drugs, especially those used for ovarian stimulation, present significant challenges to market expansion. Drugs that induce ovulation can lead to complications such as ovarian hyperstimulation syndrome (OHSS), which can be severe and sometimes life-threatening.

Additionally, mood swings and the increased likelihood of multiple pregnancies are concerns that might deter patients from opting for these treatments. The fear of adverse effects and the potential long-term health implications can discourage some women from using these drugs, thereby restraining the market's growth. This concern is heightened by the increasing consumer awareness and sensitivity towards health impacts of medical treatments.

Type Analysis

Gonadotropins dominate with 40% due to their efficacy in stimulating ovulation.

The Female Infertility Drugs Market by type is significantly led by Gonadotropins, which hold a dominant share of 40%. This category includes drugs that are pivotal in stimulating ovulation, making them essential for assisted reproductive technologies such as IVF. The efficacy of Gonadotropins in enhancing fertility rates has cemented their position as a primary choice for treatment, driving their high adoption rate.

Other segments within this market include Aromatase Inhibitors, Selective Estrogen Receptor Modulators (SERMs), Dopamine Agonists, Clomiphene Citrate, and others. Aromatase Inhibitors are utilized to improve hormone levels and enhance fertility, while SERMs are used to correct hormonal imbalances. Dopamine Agonists address specific conditions like hyperprolactinemia, which can affect reproductive functions. Clomiphene Citrate, another crucial drug, is often the first line of treatment for inducing ovulation but has a lower market share compared to Gonadotropins due to its varying success rates and side effects. These remaining segments, while not as dominant, play crucial roles in offering alternative and supplementary treatment options, contributing to the market's depth and addressing diverse patient needs.

Route of Administration Analysis

Injectables dominate with significant usage due to their direct and controlled delivery of medication.

In the route of administration segment of the Female Infertility Drugs Market, injectables lead prominently. This dominance is attributed to the precise control these formulations offer in the delivery of drugs, crucial for treatments like Gonadotropins where dosage accuracy is vital for effectiveness. The direct administration into the body ensures maximum bioavailability and faster onset of action, which is critical in timed fertility treatments.

Other routes of administration include oral, transdermal, intrauterine, and others. Oral medications are widely used due to their ease of administration but often face limitations in terms of bioavailability and the potential for systemic side effects. Transdermal and intrauterine routes offer alternatives that can provide sustained release of medication but are less commonly used due to the specific and limited types of drugs suitable for these methods. Each of these routes contributes to the market by catering to different patient preferences and medical requirements, enhancing the overall market structure by providing varied treatment modalities.

Treatment Setting Analysis

Fertility clinics dominate due to specialized care and advanced treatment technologies.

The treatment setting segment is predominantly led by fertility clinics. These clinics specialize in treating infertility and are equipped with advanced technologies and specialized staff, making them the preferred choice for patients seeking comprehensive fertility treatments. The focused care and expertise available at fertility clinics enhance the success rates of infertility treatments, thereby attracting a larger patient base.

Other settings include hospitals, specialty clinics, and home-based treatments. Hospitals are critical for providing treatments that require more extensive medical interventions and are typically utilized for more complex cases. Specialty clinics offer focused care but on a smaller scale compared to fertility clinics, while home-based treatments are gaining traction with the availability of drugs that can be safely administered at home, such as oral medications and some injectables. However, the lack of advanced monitoring and technological support at home limits the effectiveness of more complex treatments. Together, these varied treatment settings ensure that patients have access to infertility treatments at different levels of care and complexity, accommodating a wide range of medical needs and personal circumstances.

Key Market Segments

By Type

- Gonadotropins

- Aromatase Inhibitors

- Selective Estrogen Receptor Modulators (SERMs)

- Dopamine Agonists

- Clomiphene Citrate

- Others

By Route of Administration

- Oral

- Injectable

- Transdermal

- Intrauterine

- Others

By Treatment Setting

- Fertility Clinics

- Hospitals

- Specialty Clinics

- Home-based Treatment

Growth Opportunities

Expansion into Emerging Markets Offers Growth Opportunity

The expansion into emerging markets such as India, China, and Brazil presents significant growth opportunities for the Female Infertility Drugs Market. These regions are characterized by large populations, increasing disposable incomes, and a growing awareness of fertility issues and treatments.

This growth is fueled by factors such as rising urbanization, the trend of delayed parenthood, and increasing economic prosperity which enables greater spending on healthcare services. As these markets continue to develop, the demand for infertility treatments is likely to increase, providing a lucrative expansion opportunity for market players who can navigate the unique cultural, economic, and regulatory landscapes of these diverse regions.

Development of Personalized and Targeted Therapies Offers Growth Opportunity

The development of personalized and targeted therapies marks a profound growth opportunity within the Female Infertility Drugs Market. Advances in understanding the genetic and molecular bases of infertility are paving the way for more precise and effective treatments. Companies are now focusing on creating therapies that are tailored to individual genetic profiles and specific infertility causes, enhancing treatment efficacy and reducing potential side effects.

For instance, Ferring Pharmaceuticals is investing in the development of treatments personalized to a woman's unique hormonal and genetic conditions. This shift towards personalized medicine not only promises higher success rates in treatment but also positions the market to cater to increasingly health-conscious consumers who value customized healthcare solutions. This approach is expected to attract a larger patient base and drive market growth through improved patient outcomes and satisfaction.

Trending Factors

Adoption of Fertility Tourism Are Trending Factors

The adoption of fertility tourism has emerged as a trending factor in the Female Infertility Drugs Market, driven by the appeal of lower treatment costs, access to advanced medical technologies, and less restrictive regulatory environments abroad. Countries like Thailand, India, and Mexico are becoming popular destinations for such services, attracting couples from high-cost regions such as the U.S. and Europe.

This trend not only opens new markets for local fertility clinics and pharmaceutical companies but also stimulates global competition and collaboration in the fertility sector. The economic advantages combined with high-quality treatments available in these countries are encouraging more individuals to consider cross-border options for fertility treatments, expanding the market reach and driving innovation across different geographic regions.

Integration of Digital Technologies Are Trending Factors

The integration of digital technologies into fertility care represents another significant trending factor in the Female Infertility Drugs Market. Technologies like telemedicine, mobile apps, and artificial intelligence (AI) are transforming how fertility treatments are managed and delivered. These innovations enable enhanced patient engagement through personalized treatment plans and improved medication adherence.

Companies such as Ava Science and Ovaterra are at the forefront, developing AI-powered devices and apps that assist in monitoring fertility cycles and optimizing treatment timing. This digital shift not only makes fertility care more accessible and convenient but also helps in collecting vast amounts of data for improving treatment outcomes and patient experiences. As digital integration continues to deepen, it is setting new standards for efficiency and patient-centered care in the fertility industry, marking a clear trend towards technology-driven healthcare solutions.

Regional Analysis

North America Dominates with 40% Market Share

North America holds a dominant 40% share of the Female Infertility Drugs Market, primarily driven by advanced healthcare infrastructure, high healthcare spending, and widespread acceptance of advanced medical treatments. The region benefits from the presence of major pharmaceutical companies and cutting-edge fertility clinics that invest heavily in research and development. Additionally, awareness and openness regarding infertility issues are comparatively high, leading to early and increased utilization of fertility treatments.

The market dynamics in North America are influenced by regulatory support for drug approvals and a strong emphasis on reproductive health. Insurance coverage for infertility treatments is more comprehensive in this region compared to others, which further boosts access to these drugs. The high prevalence of infertility-related conditions, coupled with lifestyle factors such as delayed parenthood, also plays a crucial role in sustaining demand within the market.

North America is expected to maintain its leadership in the Female Infertility Drugs Market due to ongoing innovations in drug development and a robust healthcare sector. Emerging trends such as personalized medicine and digital health interventions for fertility management are likely to reinforce the region's market position by enhancing treatment effectiveness and patient satisfaction.

Regional Market Share and Growth Rates:

- Europe: Holds approximately 30% of the market share, supported by favorable healthcare policies and high awareness about fertility treatments.

- Asia Pacific: Fastest-growing with an expected growth rate of around 10% CAGR, driven by increasing disposable incomes and expanding healthcare infrastructure.

- Middle East & Africa: Smaller market share at around 10%, but gradually increasing due to improving healthcare systems and growing awareness.

- Latin America: Approximately 10% market share, with growth influenced by improving healthcare access and regional economic development.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Female Infertility Drugs Market, companies like Merck & Co., Inc., Novartis AG, and Ferring B.V. play crucial roles in shaping market dynamics through their robust drug portfolios and extensive R&D initiatives. These companies are strategically positioned, focusing on innovative treatments that address a broad spectrum of infertility issues. Sanofi S.A. and Bayer AG are key players whose market influence is bolstered by their long-standing global presence and strong brand reputations, which enhance their credibility and patient trust.

Additionally, newer entrants like Organon Group of Companies and Berlex Laboratories Inc. are making significant impacts by focusing on niche segments and advanced therapeutic solutions. Companies such as Eli Lilly and Co., and Pfizer Inc. leverage their vast resources to foster market development and increase accessibility to infertility treatments across diverse geographical regions. Collectively, these companies drive forward the global agenda on female infertility by enhancing drug efficacy and patient outcomes, positioning them as leaders in this critical healthcare field.

Market Key Players

- Abbott Duphaston

- Sanofi S.A.

- Merck & Co., Inc.

- Novartis AG

- Ferring B.V.

- Berlex Laboratories Inc.

- Eli Lilly and Co.

- Serono Inc.

- Novogyne Pharmaceuticals

- Pfizer, Inc.

- Ferring Pharmaceuticals Inc

- Pfizer Inc.

- Merck KGaA

- Novartis International AG

- Bayer AG

- Organon Group of Companies

Recent Developments

- On April 2024, Gameto, a female-led biotechnology company, partnered with Stacey Bendet to launch the "Your Eggsperience Matters" campaign during National Infertility Awareness Week, aiming to raise awareness and funds for RESOLVE.

- On April 2024, Perelel collaborated with Whitney Port to introduce the 'Fertility, Unfiltered' series, shedding light on infertility and loss, and supporting women's journeys to motherhood. The series aims to normalize conversations around these challenges and provide support to all women.

- On February 2024, Lupin launched Ganirelix Acetate Injection in the US to inhibit premature luteinizing hormone surges in women undergoing fertility treatment. This injection is recommended to prevent ovulation in women during controlled ovarian hyperstimulation.

Report Scope

Report Features Description Market Value (2023) USD 3.8 Billion Forecast Revenue (2033) USD 6.8 Billion CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Gonadotropins, Aromatase Inhibitors, Selective Estrogen Receptor Modulators (SERMs), Dopamine Agonists, Clomiphene Citrate, Others), By Route of Administration (Oral, Injectable, Transdermal, Intrauterine, Others), By Treatment Setting (Fertility Clinics, Hospitals, Specialty Clinics, Home-based Treatment) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Abbott Duphaston, Sanofi S.A., Merck & Co., Inc., Novartis AG, Ferring B.V., Berlex Laboratories Inc., Eli Lilly and Co., Serono Inc., Novogyne Pharmaceuticals, Pfizer, Inc., Ferring Pharmaceuticals Inc., Pfizer Inc., Merck KGaA, Novartis International AG, Bayer AG, Organon Group of Companies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Abbott Duphaston

- Sanofi S.A.

- Merck & Co., Inc.

- Novartis AG

- Ferring B.V.

- Berlex Laboratories Inc.

- Eli Lilly and Co.

- Serono Inc.

- Novogyne Pharmaceuticals

- Pfizer, Inc.

- Ferring Pharmaceuticals Inc

- Pfizer Inc.

- Merck KGaA

- Novartis International AG

- Bayer AG

- Organon Group of Companies