Global Feed technology Market By Ingredient Type (Amino Acids, Phosphates,and Other ), By Application( Poultry, Swine, Other )By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

37396

-

June 2023

-

223

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

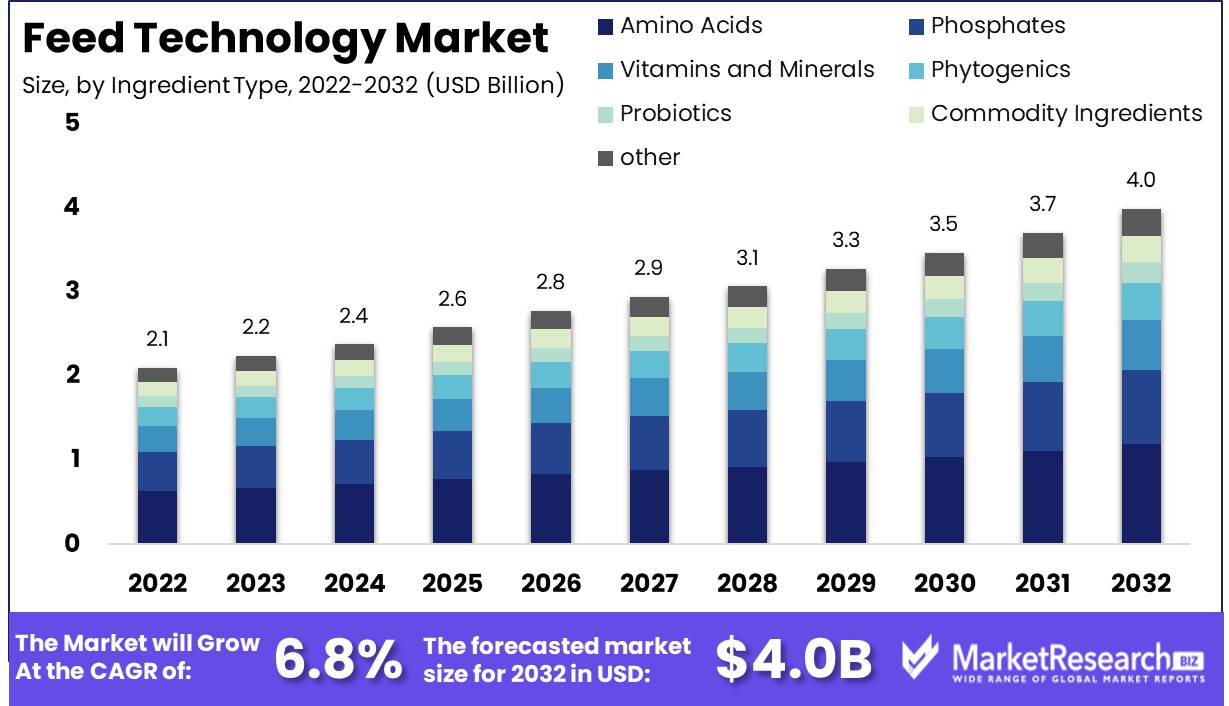

Feed technology Market size is expected to be worth around USD 4.0 Bn by 2032 from USD 2.1 Bn in 2022, growing at a CAGR of 6.8% during the forecast period from 2023 to 2032.

Global Feed technology Market, a fascinating topic with many methods and techniques, helps create feed for cattle and other animals. This diverse field provides animals with the right nutrition to survive, prosper, and stay healthy. The rising global demand for meat and dairy products has boosted the global feed technology market. As the world's population continues to rise, demand for animal protein will rise, driving rising demand for top-tier animal nutrition products. Thus, rising demand has propelled global feed technology market expansion.

Numerous companies and corporations have invested much in pioneering research and development to create innovative feed solutions that revolutionize animal nutrition. This relentless pursuit includes innovative feed formulas, additives, and precision feeding devices. A vibrant ecosystem with novel services like data analytics and feed management software has been created as a result of technology's deep penetration into the feed industry, dramatically changing farmers' strategies for successfully managing their livestock.

The insatiable demand for high-quality animal nutrition products is driving the feed technology business to new heights. This growing industry offers a wide variety of feed additives, precision feeding equipment, and cutting-edge feed management software. These changes affect agriculture, aquaculture, poultry, and even pet food. The rising Global feed technology Market has become an essential part of animal welfare, enabling farmers to masterfully compose a symphony of superior nutrition and care for their cattle.

Ethical and responsible farming becomes essential as animal protein demand soars. Global feed technology Market ensures animals receive the best nourishment and care in this noble pursuit. This revolution seeks safe and effective feed products and additives. Precision feeding systems delicately dance the tango of avoiding waste and maximizing animal well-being, evoking environmental sustainability. Accountability, openness, and explanation are key to introducing ethical feed technology.

Driving Factors

The ever-increasing desire for goods obtained from animals

In recent years, there has been a general upward trend in the Global Feed Technology Market. This may be attributed to the growing demand for products generated from animals, such as meat, milk, and eggs. In addition, there has been a general rise in the average age of the global population. Because of this ever-increasing demand, there is a pressing need for efficient and sustainable solutions for animal feed that may satisfy the dietary requirements of animals while reducing the negative effects on the environment.

Recent technological developments in the areas of feed processing and formulation

The expansion of the feed technology market has also been helped by developments in technologies that are used in the processing and formulation of feed. Because of these advancements, it is now possible to make feed that has a high nutritional value while simultaneously minimizing the amount of potentially dangerous additives and chemicals that are used.

Pay attention to the nutrition and health of the animals.

Focusing on animal health and nutrition is another aspect that is propelling the Global Feed Technology Market. Because consumers are becoming more conscious of the impact that animal feed has on the health and welfare of animals, there has been a greater emphasis placed on providing feed of high quality in recent years. Because of this, there has been a subsequent rise in the use of feed additives and supplements that improve the overall health of animals and their diets.

Restraining Factors

Variable Costs of Feed Ingredients

The prices of feed ingredients, such as soybean meal, maize, wheat, and other grains, fluctuate continuously. Several variables, including the weather, supply and demand, and transportation costs, can impact the prices. Therefore, feed manufacturers must be strategic in their purchasing decisions, taking current market conditions into account. This can be challenging, as prices can fluctuate swiftly, affecting the business's profitability.

Several strategies, including forward contracting, hedging, and risk management, can be utilized by feed manufacturers to reduce the impact of fluctuating pricing. These strategies can aid in ensuring a steady supply of feed ingredients, minimizing the financial risks associated with price volatility, and bringing some predictability to the market.

Potential Environmental Effects of Animal Agriculture

The potential environmental impacts of intensive animal husbandry, including modern industrialized livestock production, are one of the major issues associated with it. Intensive agricultural practices, such as large-scale monoculture crop cultivation for animal feed, the use of antibiotics, and large-scale waste management, could result in environmental degradation, soil and water contamination, and greenhouse gas emissions.

In response to these problems, numerous nations are introducing new regulations and standards to reduce the environmental impact of intensive animal husbandry practices. Manufacturers of animal feed must conform to these regulations and invest in environmentally responsible and sustainable production methods. They can achieve these objectives by adopting new technologies, such as precision agriculture, employing sustainable agricultural methods, and utilizing alternative feed sources.

Ingredient Type Analysis

Amino Acids Segment has recently established dominance in the Global Feed Technology Market. Amino acids are the building elements of proteins and are essential for animal development and growth. They are utilized to increase animal productivity and overall health. Increased use of amino acids in animal nutrition is primarily due to the benefits they provide.

Adoption of the Amino Acids Segment is driven by the economic development of emerging economies. Countries such as China, India, Indonesia, and Brazil have experienced accelerated economic expansion in recent years. As a consequence, these nations have increased their food production capabilities by investing heavily in agriculture. The incorporation of amino acids into livestock feed increases the quality and quantity of animal products such as meat, milk, and eggs.

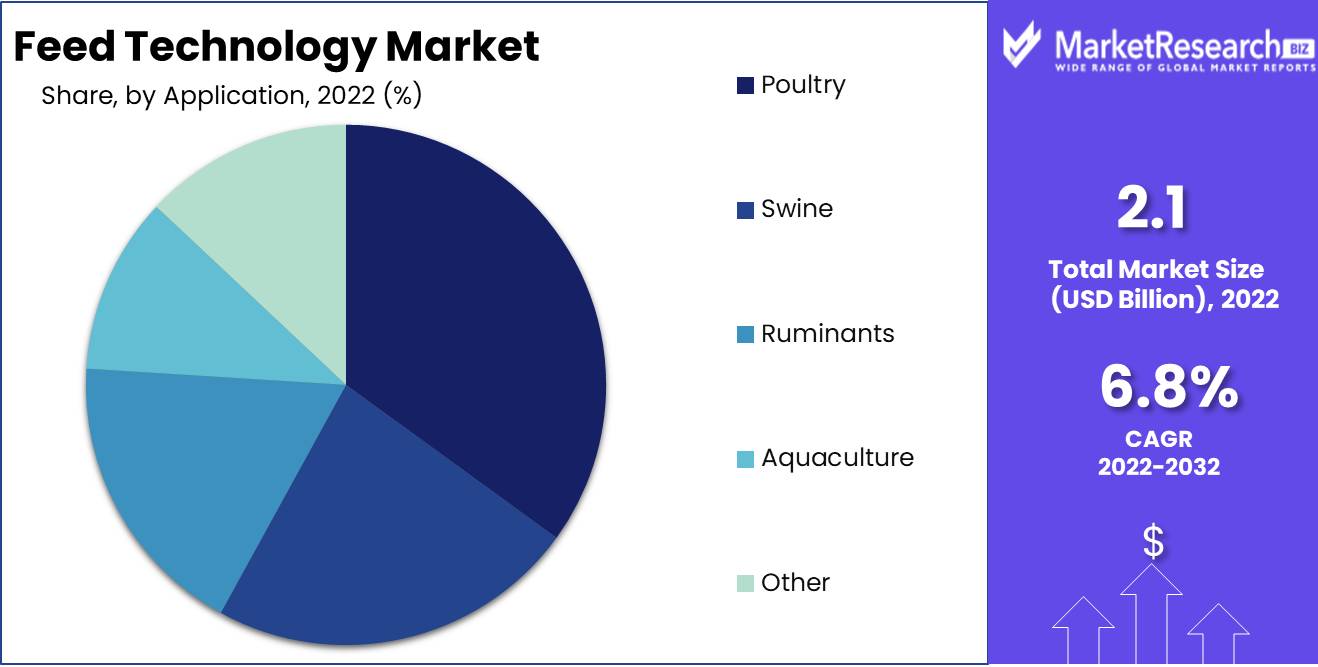

Application Analysis

Poultry Segment Dominates Global Feed Technology Market. Poultry is one of the most widely ingested animal products on a global scale, and the demand for poultry products has increased dramatically over time. Feeding poultry is crucial for maximizing productivity and satisfying the rising demand for poultry products.

Another propelling factor for the adoption of the Poultry Segment is the economic development in emerging economies. Poultry is one of the most cost-effective sources of animal protein, and with a growing population and rising income levels in emergent economies, the demand for poultry products is projected to continue to rise. This has resulted in the growth of the poultry industry, which has increased the demand for poultry feeds.

Key Market Segments

By Ingredient Type

- Amino Acids

- Phosphates

- Vitamins and Minerals

- Phytogenics

- Probiotics

- Commodity Ingredients

- Other Types

By Application

- Poultry

- Swine

- Ruminants

- Aquaculture

- Other Applications

Growth Opportunity

Innovative and Cost-effective Formulations for Animal Feed

The global market for feed technology is undergoing new developments and improvements. The introduction of innovative and cost-effective feed formulations is one of the most significant advancements. These formulations are intended not only to provide optimal nutrition for animals but also to provide farmers with optimum benefits. Utilizing advanced feed formulations enables producers to achieve optimal production with minimal feed input, thereby reducing production costs and increasing profits.

Alternative Protein Sources Utilized in Animal Feed

A lack of high-quality protein sources is one of the most significant obstacles confronting the livestock industry. This has prompted the quest for alternatives to traditional protein sources. In recent years, the use of alternative protein sources in animal feed has garnered momentum. These sources of protein consist of phytoplankton, fungi, insects, and single-cell proteins. Utilizing these alternative protein sources has numerous advantages, such as reducing the demand for conventional protein sources, enhancing animal health, and minimizing environmental impact.

Precision Feeding and Smart Technology Integration

Another trend that has acquired momentum in the global feed technology market is precision feeding. This concept involves feeding animals based on their specific nutritional requirements. Currently, smart technologies such as sensor-enabled feeding, automated feeding systems, and data-driven feeding augment the precision of nutrition. These technologies enhance animal nutrition and health, minimize feed waste, and provide farmers with real-time data.

Latest Trends

The rise of digital technology and automation:

With the incorporation of technologies such as artificial intelligence (AI), big data analytics, and Internet of Things (IoT), the Feed technology Market is undergoing a move toward digitalization and automation. The processes involved in the manufacture of animal feed are being optimized with the help of these technologies, which also improve efficiency and quality control.

Enhancement of Nutritional Value

The research and development of feed additives and formulations that improve animal nutrition and health is receiving an ever-increasing amount of attention these days. This covers the utilization of innovative components to improve digestion, immunity, and overall function, such as prebiotics, probiotics, enzymes, and organic acids.

Solutions for Sustainable Feeding Practices

The Feed Technology Market is beginning to place a significant emphasis on the issue of sustainability. There is a rising need for environmentally friendly and ethically sourced feed ingredients, as well as attempts to reduce waste and enhance resource efficiency in feed production. In addition, there is a growing demand for eco-friendly and ethically sourced feed ingredients. To lessen their reliance on traditional feed ingredients such as soybean meal and fishmeal, businesses are looking at new sources of protein, such as those derived from insects or single cells.

Assurance of Quality and Availability of Traceability

Transparency and traceability in the food supply chain, particularly that of animal feed, are becoming increasingly important concerns for consumers. This has resulted in the development of technology that enables the tracking of feed ingredients from the farm to the fork, assuring quality control and safety along the entire supply chain. For instance, in the Feed technology Market, blockchain technology is currently being investigated as a potential method to improve traceability and reduce the risk of fraud.

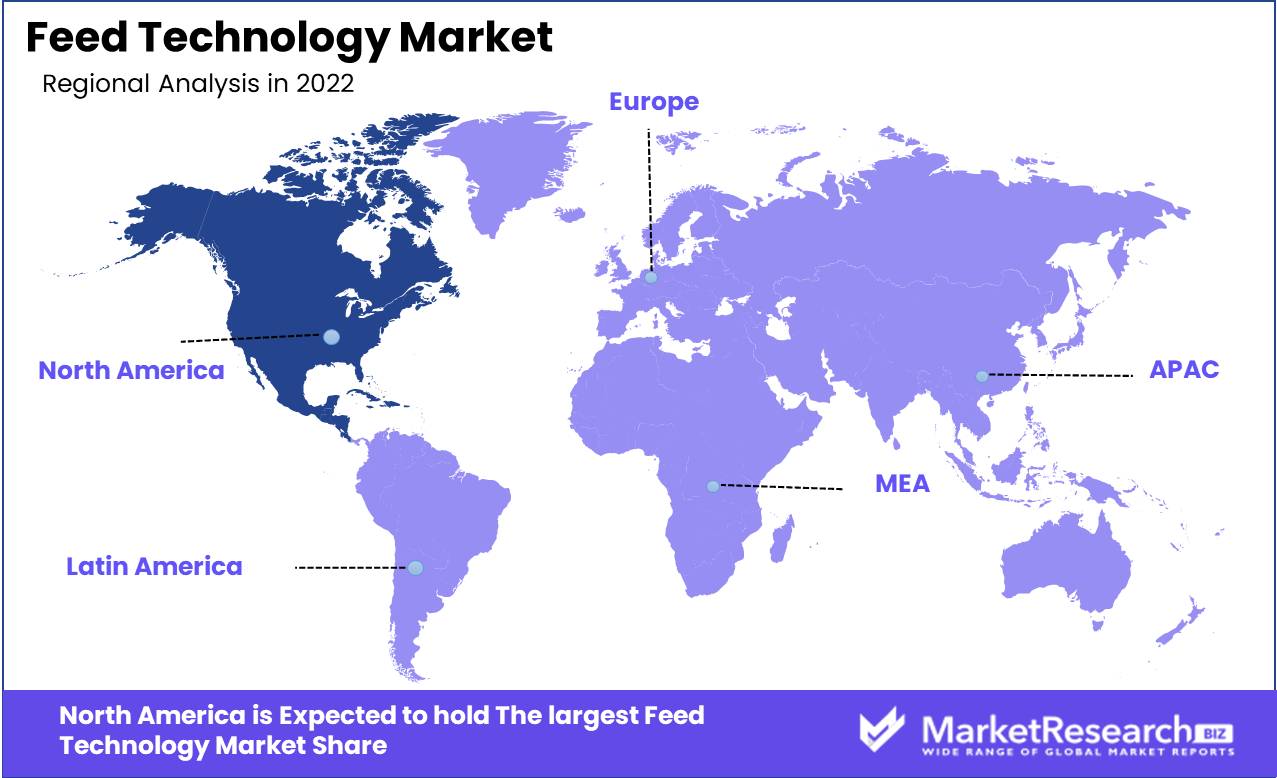

Regional Analysis

North America's feed technology market is growing quickly because more and more people want high-quality animal feed and because feed technology is getting better and better. In addition, the rising popularity of organic agriculture and animal welfare has increased the demand for natural additives and health supplements in animal feed. The region's highly developed livestock industry has also contributed to the expansion of this market.

The dominance of the North American feed technology market can also be attributed to the region's robust supply chain network, extensive research and development, and stringent regulatory framework. These elements have established a standard for the global feed technology market.

The increasing awareness among farmers and livestock producers of the role that feed technology plays in enhancing animal performance is one of the primary factors propelling market expansion. Feed technology focuses on enhancing the nutritional value of feeds, assuring the health and productivity of animals, and decreasing the cost of feed production.

Additionally, the demand for feed technology in North America mirrors the rise in global meat consumption. The feed technology market serves a variety of animal types, including poultry, swine, aquaculture, and companion animals. As meat consumption continues to rise, it is anticipated that the feed technology market will expand proportionally.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- The rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Iincreasednes

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global feed technology market is a rapidly expanding industry, propelled by the agricultural sector's rising demand for animal feed. Companies that provide innovative solutions for animal nutrition, spanning from feed ingredients and additives to feed processing technology, dominate this market. The market has identified the companies listed below as the leading competitors in the global feed technology market.

Cargill is a significant player in the global feed technology market and a multinational agribusiness corporation. Its animal nutrition division offers a variety of products and services designed to improve the health and performance of livestock and pets.

ADM is the foremost provider of animal nutrition products and services worldwide. The company provides a variety of feed ingredients and additives, as well as equipment and services for feed processing.

Evonik is a pioneer in the use of amino acids and other functional feed ingredients. Evonik is a German specialty chemicals enterprise. Its animal nutrition division provides a variety of products and services aimed at enhancing feed efficiency and animal health.

Top Key Players in Feed Technology Market

- Archer Daniels Midland Company

- Cargill, Incorporated

- Evonik

- Nutreco

- Alltech

- Charoen Pokphand Group

- Land O'Lakes, Inc

- New Hope Group

- Sumitomo Chemical

- ForFarmers

- DSM Nutritional Products

- Other Key Players

Recent Development

In 2021, Alltech introduced a new line of feed additives intended to enhance livestock health and performance. The latest offering from the company is designed to provide producers with a more efficient method of managing animal health and optimizing production.

In 2022, Cargill acquired Kemin Industries for a staggering $94 billion, constituting yet another significant event. The transaction is anticipated to strengthen Cargill's portfolio in the animal nutrition sector and expand its global customer offerings.

In 2023, InnovaFeed will develop a new insect protein production facility in France. The company plans to use the new facility to manufacture a variety of natural ingredients for use in animal feed, including high-quality insect-derived protein.

Report Scope

Report Features Description Market Value (2022) USD 2.1 Bn Forecast Revenue (2032) USD 4.0 Bn CAGR (2023-2032) 6.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Ingredient Type (Amino Acids, Phosphates, Vitamins and Minerals, Phytogenics, Probiotics, Commodity Ingredients, Other Types), By Application( Poultry, Swine, Ruminants, Aquaculture, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Archer Daniels Midland Company, Cargill, Incorporated, Evonik, Nutreco, Alltech, Charoen Pokphand Group, Land O'Lakes, Inc, New Hope Group, Sumitomo Chemical, ForFarmers, DSM Nutritional Products, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Archer Daniels Midland Company

- Cargill, Incorporated

- Evonik

- Nutreco

- Alltech

- Charoen Pokphand Group

- Land O'Lakes, Inc

- New Hope Group

- Sumitomo Chemical

- ForFarmers

- DSM Nutritional Products

- Other Key Players