Global Exhaust System Market By Component(Exhaust Manifold, Muffler, Catalytic Converter, Oxygen Sensor, Exhaust Pipes), By Fuel Type(Gasoline, Diesel), By Vehicle Type(Passenger Car, Commercial Vehicles), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48850

-

July 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

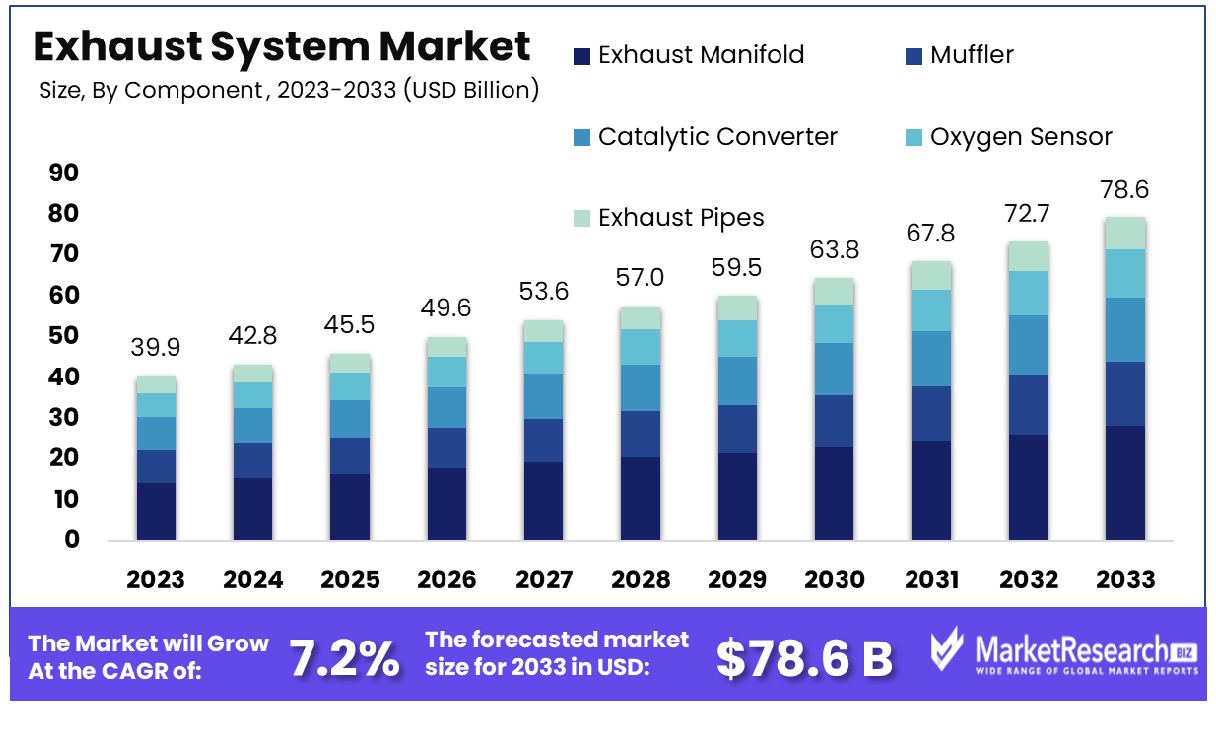

The Global Exhaust System Market was valued at USD 39.9 billion in 2023. It is expected to reach USD 78.6 billion 7.2% billion by 2033, with a CAGR of 7.2% during the forecast period from 2024 to 2033.

The Exhaust System Market comprises the production, distribution, and sales of critical components designed to manage vehicular emissions. These systems are pivotal in routing exhaust gases away from an engine, mitigating environmental impact, and optimizing vehicle performance. The market caters to a wide range of vehicles, including passenger cars, commercial vehicles, and motorcycles.

Key elements include exhaust manifolds, mufflers, catalytic converters, and tailpipes. As regulatory standards on emissions become more stringent globally, the market is driven by advancements in technology and materials science to develop more efficient and sustainable exhaust solutions. This market is crucial for manufacturers aiming to comply with environmental regulations while maintaining vehicle efficiency and performance.

The Exhaust System Market is currently poised at a crucial juncture, characterized by significant technological advancements and regulatory pressures aimed at reducing vehicular emissions. In 2022, the global market for automotive exhaust systems was valued at approximately $77 billion and is anticipated to ascend to $85 billion by the end of 2023, manifesting a robust growth trajectory with a compound annual growth rate (CAGR) of 4-5%. This growth is underpinned by stringent environmental regulations which are spurring the demand for innovative exhaust management solutions across the automotive sector.

A closer examination of trade dynamics reveals a slight uptick in the exports of mufflers and exhaust pipes for motor vehicles, which grew by 1.63% from 2021 to 2022, from $10.1 billion to $10.2 billion. This marginal increase highlights the ongoing demand for traditional exhaust components amidst the transition towards more environmentally friendly technologies.

Furthermore, the market for Gasoline Particulate Filters (GPF) is experiencing an accelerated growth curve, anticipated to reach $3.5 billion by 2023. This rapid expansion is largely driven by the adoption of gasoline vehicles that comply with new emission standards, especially in regions enforcing stringent environmental policies.

Key Takeaways

- Market Growth: The Global Exhaust System Market was valued at USD 39.9 billion in 2023. It is expected to reach USD 78.6 billion by 2033, with a CAGR of 7.2% during the forecast period from 2024 to 2033.

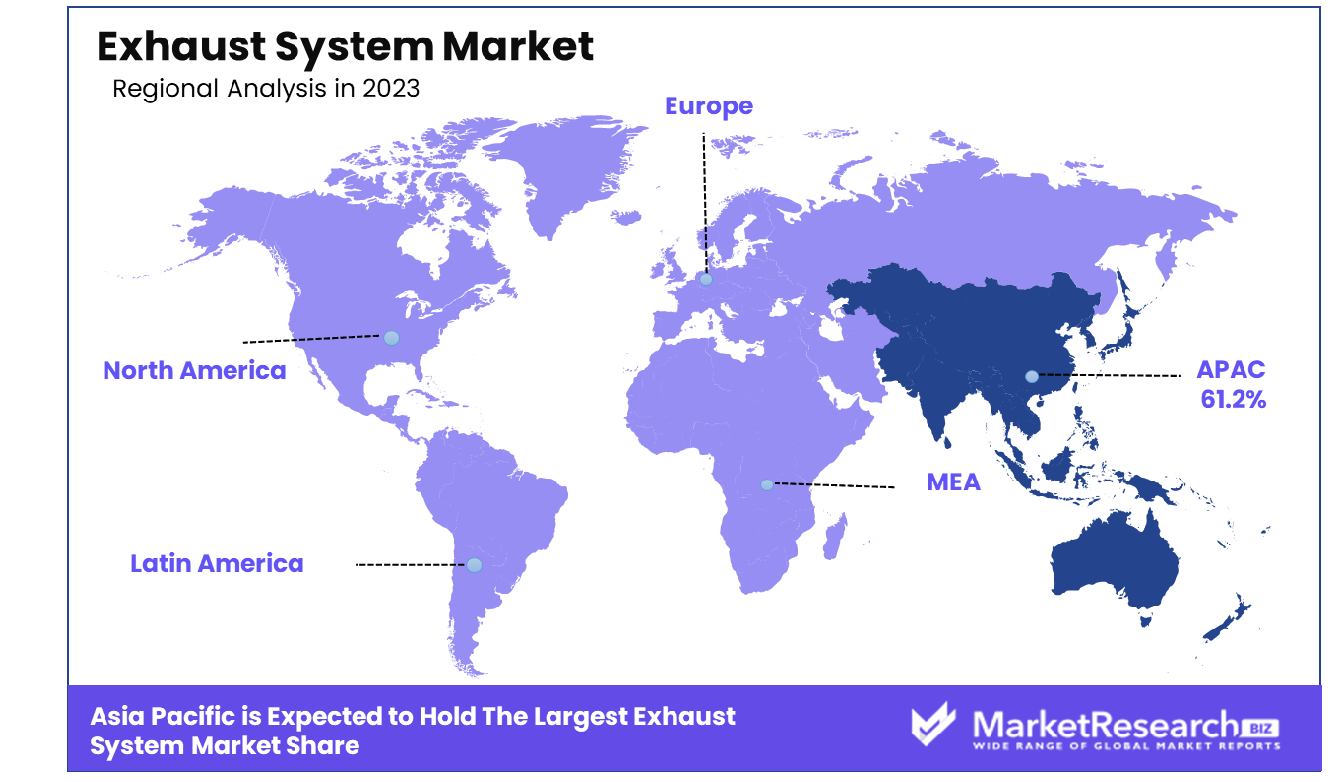

- Regional Dominance: Asia-Pacific dominates the Exhaust System Market with a significant 61.2% share.

- By Component: Exhaust Manifold dominates the components market with a 35% share.

- By Fuel Type: Gasoline fuel type leads, holding a significant 60% market dominance.

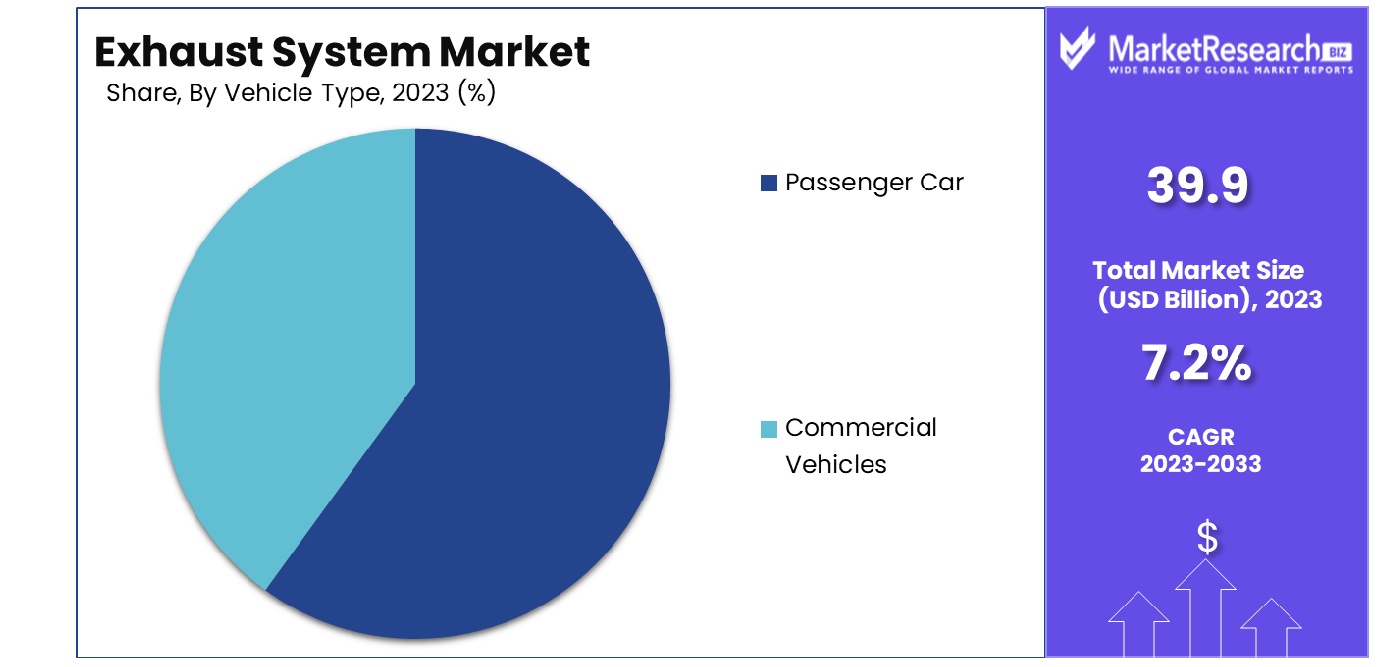

- By Vehicle Type: Passenger cars dominate the vehicle type segment with a 70% share.

Driving factors

Stringent Emission Regulations Driving Demand for Advanced Exhaust Systems

The global thrust towards stringent emission regulations is a pivotal driver for the growth of the Exhaust System Market. As governments worldwide impose tighter norms to combat air pollution, the demand for advanced exhaust systems that can efficiently manage and reduce harmful emissions has surged.

These systems, including upgraded catalytic converters and gasoline particulate filters, are essential for vehicle compliance with environmental standards. The projection that the market for gasoline particulate filters will reach $3.5 billion by 2023 underscores the direct impact of regulatory frameworks on market expansion.

Expansion of Global Automotive Production and Sales

Parallel to regulatory pressures, the growth in global automotive production and sales fundamentally supports the expansion of the Exhaust System Market. As the automotive industry rebounds and expands, particularly in emerging economies, the demand for exhaust systems naturally escalates.

The continuous increase in vehicle production not only stimulates direct demand for new exhaust systems but also encourages advancements in exhaust technology to support diverse vehicle types, from passenger cars to commercial vehicles.

Rising Demand for Fuel-Efficient Vehicles

Fuel efficiency remains a critical concern for consumers and manufacturers alike, influencing market trends significantly. The increasing demand for fuel-efficient vehicles drives the need for exhaust systems that contribute to reducing fuel consumption and emissions.

Innovations in exhaust system design, such as lightweight materials and improved aerodynamics, are increasingly adopted to enhance vehicle fuel efficiency. This trend not only aligns with environmental objectives but also with economic incentives for consumers, further propelling market growth.

Restraining Factors

High Cost of Advanced Emission Control Technologies

The development and implementation of advanced emission control technologies, essential for meeting stringent environmental regulations, present a significant cost barrier in the Exhaust System Market. These sophisticated technologies, such as advanced catalytic converters and gasoline particulate filters, involve high material and production costs.

For instance, the incorporation of precious metals in catalytic converters increases the financial burden on manufacturers and, subsequently, consumers. This high cost can restrain market growth by limiting market entry for new players and reducing consumer affordability, especially in cost-sensitive markets.

Shift Towards Electric Vehicles Reducing Demand for Traditional Exhaust Systems

The accelerating shift towards electric vehicles (EVs) poses a fundamental challenge to the traditional Exhaust System Market. As EVs do not require exhaust systems, the increasing adoption of electric mobility directly impacts the demand for traditional exhaust components.

With governments worldwide promoting EVs through incentives and regulatory support to reduce greenhouse gas emissions, the penetration of electric vehicles is expected to increase, thereby diminishing the market share for conventional exhaust systems. This transition represents a pivotal shift in the automotive industry's dynamics, necessitating an adaptation in strategies for companies traditionally focused on exhaust systems for internal combustion engines.

By Component Analysis

The Exhaust Manifold dominated the market, holding a substantial 35% share.

In 2023, Exhaust Manifold held a dominant market position in the By Component segment of the Exhaust System Market, capturing more than a 35% share. The segment includes key components such as Muffler, Catalytic Converter, Oxygen Sensor, and Exhaust Pipes. Each component plays a critical role in the functioning and efficiency of automotive exhaust systems, but the Exhaust Manifold has proven particularly vital due to its role in efficiently collecting engine gases from multiple cylinders and directing them into one pipe.

The Muffler, responsible for reducing the noise produced by the engine's exhaust gases, held the second largest share, followed closely by the Catalytic Converter, which is crucial for reducing the toxicity of emissions. The Oxygen Sensor, essential for measuring the oxygen level in the exhaust gases to optimize combustion and reduce emissions, also maintained a significant market presence. Meanwhile, Exhaust Pipes, which transport exhaust gases from the manifold to the muffler, rounded out the segment.

The market's growth can be attributed to stringent environmental regulations that require advanced exhaust systems to reduce harmful emissions. Additionally, the increasing demand for fuel-efficient vehicles has bolstered the development of components that enhance exhaust system performance. The dominance of the Exhaust Manifold within this sector is also supported by advancements in materials technology that improve durability and performance under high temperatures, ensuring it remains a pivotal component in meeting global emissions standards.

By Fuel Type Analysis

Gasoline engines led, commanding a dominant 60% of the market.

In 2023, Gasoline held a dominant market position in the By Fuel Type segment of the Exhaust System Market, capturing more than a 60% share. This segment primarily comprises Gasoline and Diesel as the key fuel types utilized in automotive exhaust systems. The substantial lead in gasoline-powered vehicles is largely attributed to their widespread adoption in passenger cars, owing to the fuel’s availability, cost-effectiveness, and lower initial vehicle purchase price compared to diesel and other alternatives.

Diesel, while holding a smaller portion of the market, remains significant, particularly in commercial vehicles and heavy-duty transportation, where its efficiency and durability in high-mileage scenarios are prized. However, the market share for diesel has been impacted by stringent emission standards and growing environmental concerns, which have accelerated the adoption of gasoline and alternative fuel technologies in several regions.

The gasoline segment's dominance in the exhaust system market is further bolstered by innovations in exhaust technologies and emission controls specifically designed for gasoline engines. These advancements include improved catalytic converters and sophisticated oxygen sensors that help in reducing emissions while maintaining engine performance and fuel efficiency. As the automotive industry continues to evolve with hybrid and electric vehicles gaining traction, gasoline-powered systems are expected to maintain a significant market presence, supported by ongoing developments in emission reduction technologies.

By Vehicle Type Analysis

Passenger Cars were predominant, capturing a significant 70% market share.

In 2023, Passenger Cars held a dominant market position in the Vehicle Type segment of the Exhaust System Market, capturing more than a 70% share. This segment is primarily divided into Passenger Car and Commercial Vehicles. The pronounced dominance of passenger cars can be attributed to the high volume of global vehicle sales in the consumer sector, coupled with increasing consumer awareness regarding environmental standards and fuel efficiency.

Commercial vehicles, while holding a smaller share of the market, are nonetheless critical due to their roles in transportation and logistics. Despite their lesser proportion, the demand for advanced exhaust systems in commercial vehicles is driven by stringent emissions regulations and the need for fuel-efficient operations, especially in long-haul services.

The substantial lead of passenger cars in the exhaust system market is supported by continual innovations in exhaust and emission control technologies tailored to meet stringent environmental standards while enhancing vehicle performance and fuel economy. Additionally, the shift towards electric and hybrid models in the passenger car segment introduces new dynamics and challenges in exhaust system management, necessitating ongoing technological advancements.

Overall, the market's composition reflects broader automotive trends and regulatory environments, emphasizing the importance of efficient and environmentally friendly exhaust systems across vehicle types. The ongoing development and implementation of stricter emission norms globally are expected to further influence market dynamics, maintaining the significant share held by passenger cars while potentially boosting advancements in commercial vehicle exhaust systems.

Key Market Segments

By Component

- Exhaust Manifold

- Muffler

- Catalytic Converter

- Oxygen Sensor

- Exhaust Pipes

By Fuel Type

- Gasoline

- Diesel

By Vehicle Type

- Passenger Car

- Commercial Vehicles

Growth Opportunity

Development of New Materials and Technologies to Enhance System Efficiency and Durability

In 2023, significant growth opportunities for the global Exhaust System Market arise from the ongoing development of new materials and technologies aimed at enhancing system efficiency and durability. Innovations such as lightweight, heat-resistant materials and advanced filtering technologies not only improve the performance of exhaust systems but also extend their operational life, thus providing a competitive edge in the market.

These advancements are crucial in meeting both regulatory standards and consumer demands for higher efficiency and lower maintenance costs. Companies that invest in research and development to push these technological boundaries are likely to capture greater market share and establish leadership in this evolving sector.

Expansion into Emerging Markets

Another substantial growth opportunity in 2023 is the strategic expansion into emerging markets, where vehicle production is on the rise, coupled with growing environmental consciousness. Regions such as Asia-Pacific, Latin America, and parts of Eastern Europe are witnessing an increase in automotive manufacturing activities. Moreover, these regions are progressively adopting stricter emission norms, mirroring trends observed in more developed markets.

Companies that can effectively navigate these markets by offering cost-effective, compliant exhaust solutions are positioned to benefit from new revenue streams and enhanced market presence. Leveraging local partnerships and tailoring products to meet specific regional requirements will be key strategies for capitalizing on these emerging opportunities.

Latest Trends

Integration of Exhaust Heat Recovery Systems

A prominent trend in the 2023 global Exhaust System Market is the integration of exhaust heat recovery systems, which significantly enhance engine efficiency. These systems utilize the waste heat generated by the exhaust process to improve overall thermal efficiency, thereby reducing fuel consumption and emissions. As fuel efficiency continues to be a major focus for consumers and regulatory bodies, the adoption of these systems is expected to increase.

This integration not only offers environmental benefits but also provides economic advantages in terms of fuel savings, making it an attractive option for both manufacturers and vehicle owners. Companies that are early adopters of this technology are likely to see a competitive advantage in markets increasingly driven by sustainability concerns.

Adoption of Selective Catalytic Reduction (SCR) Technology

Another key trend is the widespread adoption of Selective Catalytic Reduction (SCR) technology, which is becoming increasingly important as emission standards worldwide become more stringent. SCR technology reduces nitrogen oxide emissions, a major pollutant, by converting them into harmless nitrogen and water vapor through the use of a urea-based reagent.

This technology is crucial for manufacturers to comply with regulatory mandates such as Euro 6 and EPA standards, which are aimed at minimizing the environmental impact of diesel engines. As more regions enforce tougher emission norms, the demand for SCR-equipped exhaust systems is expected to surge, offering substantial growth opportunities for companies in the exhaust system sector.

Regional Analysis

The Asia-Pacific region dominates the Exhaust System Market, holding a significant 61.2% market share.

The global Exhaust System Market is segmented into key regions including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each contributing distinctly based on their automotive production capacities and environmental regulations.

Asia Pacific dominates the Exhaust System Market, holding a substantial market share of 61.2%. This region's leadership is driven by high vehicle production rates, especially in countries like China, India, and Japan, where automotive manufacturing is a major economic sector. Additionally, increasing environmental awareness and stringent emission standards are pushing manufacturers to adopt advanced exhaust technologies, further propelling market growth in this region.

In Europe, the market is significantly influenced by rigorous EU emissions regulations, which mandate the adoption of advanced technologies such as SCR and GPF in vehicles. European automakers are leading in the development and integration of these technologies, making Europe a crucial market for innovative exhaust systems designed to meet strict environmental standards.

North America, particularly the United States and Canada, also show robust demand for exhaust systems, primarily due to similar stringent emission norms and a high rate of vehicle ownership, which necessitates periodic upgrades to existing systems to comply with regulatory standards.

The Middle East & Africa and Latin America, while smaller in market share, are experiencing gradual growth. Increased vehicle sales and a budding awareness of emission control are the main drivers in these regions. However, the adoption of advanced systems is slower compared to other regions, due to less stringent regulatory environments and varying economic conditions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Exhaust System Market will see significant contributions from a diverse array of key companies, each bringing unique innovations and strategic advancements. Companies like Yutaka Giken Company Limited, Tenneco, Inc., and Faurecia S.A. are at the forefront, driving technological advancements and expanding their global footprint through strategic partnerships and expansions.

Umicore and Johnson Matthey excel in integrating environmentally sustainable practices by focusing on emission control technologies that cater to stringent global regulations. Their expertise in catalysts and particulate filters positions them as crucial contributors to the market's adaptation to ever-tightening environmental standards.

Milltek Sport and Klarius Products Ltd highlight the performance segment of the market, offering high-end exhaust systems that enhance vehicle performance and sound, appealing to a niche but lucrative sector of automotive enthusiasts.

Sejong Industrial Co. Ltd., Sango Co. Ltd., and Futaba Industrial Co. Ltd. maintain robust production capabilities in Asia, aligning well with the region’s dominance in the global market. Their capacity to innovate and efficiently produce at scale supports Asia-Pacific's leading position in the industry.

Eberspächer and Continental AG are noteworthy for their integration of exhaust technology with broader automotive systems, promoting developments in exhaust heat recovery and emissions management that align with emerging trends in hybrid and high-efficiency combustion vehicles.

Lastly, companies like Bosal International N.V., Benteler International AG, and BASF SE are pivotal in their roles in material science and engineering, focusing on lightweight and durable materials that enhance the overall efficiency and environmental compliance of exhaust systems.

Market Key Players

- Yutaka Giken Company Limited

- Umicore

- Milltek Sport

- Tenneco, Inc.

- Sejong Industrial Co. Ltd.

- Sango Co. Ltd.

- Klarius Products Ltd

- Johnson Matthey

- Harbin Airui Automotive Exhaust Systems Co. Ltd.

- Futaba Industrial Co. Ltd.

- Friedrich Boysen GmbH & Co. KG

- Faurecia S.A.

- Eberspancher Climate Control Systems GmbH & Co. KG

- Continental AG

- Mercedes

- Bosal International N.V.

- Benteler International AG

- BASF SE

Recent Development

- In July 2024, Umicore, a global materials technology and recycling group, revealed a major merger with a European catalyst company. This strategic move aims to enhance their capabilities in developing eco-friendly exhaust systems. Umicore also reported a 15% increase in sales of their emission control catalysts

- In July 2024, Milltek Sport, a UK-based manufacturer known for high-performance exhaust systems, announced the launch of a new titanium exhaust line. This new product is designed for sports cars and offers a 30% weight reduction compared to traditional steel systems.

- In July 2024, Tenneco, Inc., an American company specializing in automotive components, revealed a $500 million investment to upgrade its exhaust system production facilities. This investment aims to increase efficiency and support the production of new, more efficient exhaust systems.

Report Scope

Report Features Description Market Value (2023) USD 39.9 Billion Forecast Revenue (2033) USD 78.6 Billion CAGR (2024-2032) 7.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Exhaust Manifold, Muffler, Catalytic Converter, Oxygen Sensor, Exhaust Pipes), By Fuel Type(Gasoline, Diesel), By Vehicle Type(Passenger Car, Commercial Vehicles) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Yutaka Giken Company Limited, Umicore, Milltek Sport, Tenneco, Inc., Sejong Industrial Co. Ltd., Sango Co. Ltd., Klarius Products Ltd, Johnson Matthey, Harbin Airui Automotive Exhaust Systems Co. Ltd., Futaba Industrial Co. Ltd., Friedrich Boysen GmbH & Co. KG, Faurecia S.A., Eberspancher Climate Control Systems GmbH & Co. KG, Continental AG, Mercedes, Bosal International N.V., Benteler International AG, BASF SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Yutaka Giken Company Limited

- Umicore

- Milltek Sport

- Tenneco, Inc.

- Sejong Industrial Co. Ltd.

- Sango Co. Ltd.

- Klarius Products Ltd

- Johnson Matthey

- Harbin Airui Automotive Exhaust Systems Co. Ltd.

- Futaba Industrial Co. Ltd.

- Friedrich Boysen GmbH & Co. KG

- Faurecia S.A.

- Eberspancher Climate Control Systems GmbH & Co. KG

- Continental AG

- Mercedes

- Bosal International N.V.

- Benteler International AG

- BASF SE