Equity Management Software Market By Type (Basic (Under $50/Month), Standard ($50-100/Month), Senior (Above $100/Month)), By Application (Start-Ups, Private Corporation, Listed Company, Other), By Deployment (Cloud-Based, On-Premise), By End-User (Banking & Financial Services, Insurance, Retail & E-Commerce, Manufacturing, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46556

-

May 2024

-

136

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

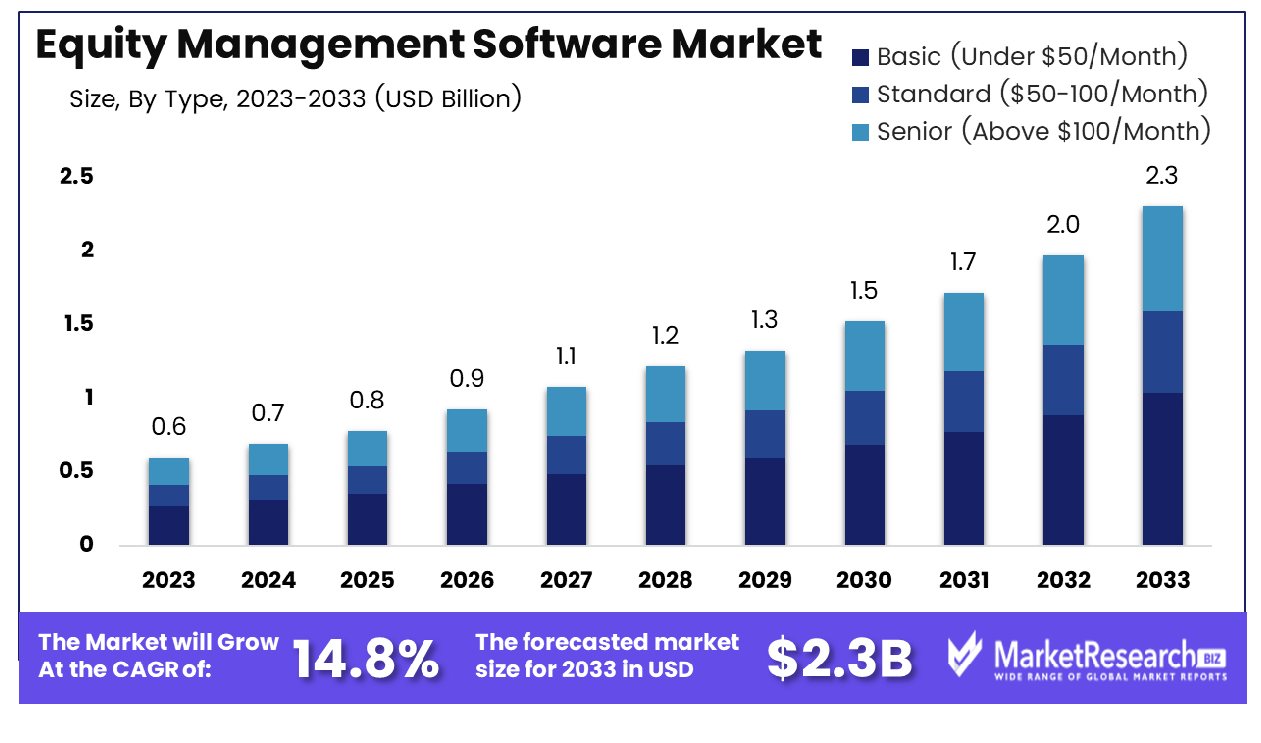

The Global Equity Management Software Market was valued at USD 0.6 Bn in 2023. It is expected to reach USD 2.3 Bn by 2033, with a CAGR of 14.8% during the forecast period from 2024 to 2033.

The Equity Management Software Market encompasses solutions designed to streamline and automate the processes involved in managing company equity. These software systems provide comprehensive tools for cap table management, stock option administration, compliance with regulatory requirements, and financial reporting. By integrating with existing HR, finance, and legal systems, equity management software enhances accuracy, efficiency, and transparency in equity transactions. This market addresses the needs of companies ranging from startups to large enterprises, enabling them to manage equity distribution, track employee ownership, and ensure adherence to governance standards, ultimately supporting strategic decision-making and fostering organizational growth.

The Equity Management Software Market is poised for significant growth, driven by increasing complexities in equity management and the necessity for compliance with stringent regulatory frameworks. Companies are seeking advanced solutions to manage their equity-related processes efficiently, from cap table management to stock option administration and financial reporting. The market's expansion is underpinned by the need for seamless integration with existing HR, finance, and legal systems, ensuring enhanced accuracy and transparency in equity transactions.

The Equity Management Software Market is poised for significant growth, driven by increasing complexities in equity management and the necessity for compliance with stringent regulatory frameworks. Companies are seeking advanced solutions to manage their equity-related processes efficiently, from cap table management to stock option administration and financial reporting. The market's expansion is underpinned by the need for seamless integration with existing HR, finance, and legal systems, ensuring enhanced accuracy and transparency in equity transactions.A notable example highlighting the market's potential is Morningstar, which currently manages over US$265 billion in assets. This substantial portfolio underscores the critical need for sophisticated equity management tools to maintain precise oversight and reporting. Additionally, Morningstar's acquisition of NRSRO DBRS in 2019 for $669 million exemplifies the market's consolidation trend and the strategic importance of integrating comprehensive equity management capabilities. Such acquisitions indicate a broader industry move towards leveraging technology to streamline equity processes and enhance corporate governance.

The Equity Management Software Market is evolving rapidly as organizations recognize the imperative for efficient and compliant equity management. This market is not only catering to the needs of large enterprises but is also becoming essential for startups and mid-sized companies aiming for scalable and sustainable growth. As the market matures, we can expect increased innovation and a greater adoption of these software solutions, further driving market growth and competitive differentiation.

Key Takeaways

- Market Growth: The Global Equity Management Software Market was valued at USD 0.6 Bn in 2023. It is expected to reach USD 2.3 Bn by 2033, with a CAGR of 14.8% during the forecast period from 2024 to 2033.

- By Type: Standard ($50-100/Month) positioned as a versatile option, the standard tier secures 45% market dominance, appealing to a broad range of businesses.

- By Application: Start-Ups is a basic and standard tiers might dominate due to cost-effectiveness and simplicity, claiming 50% of the market,

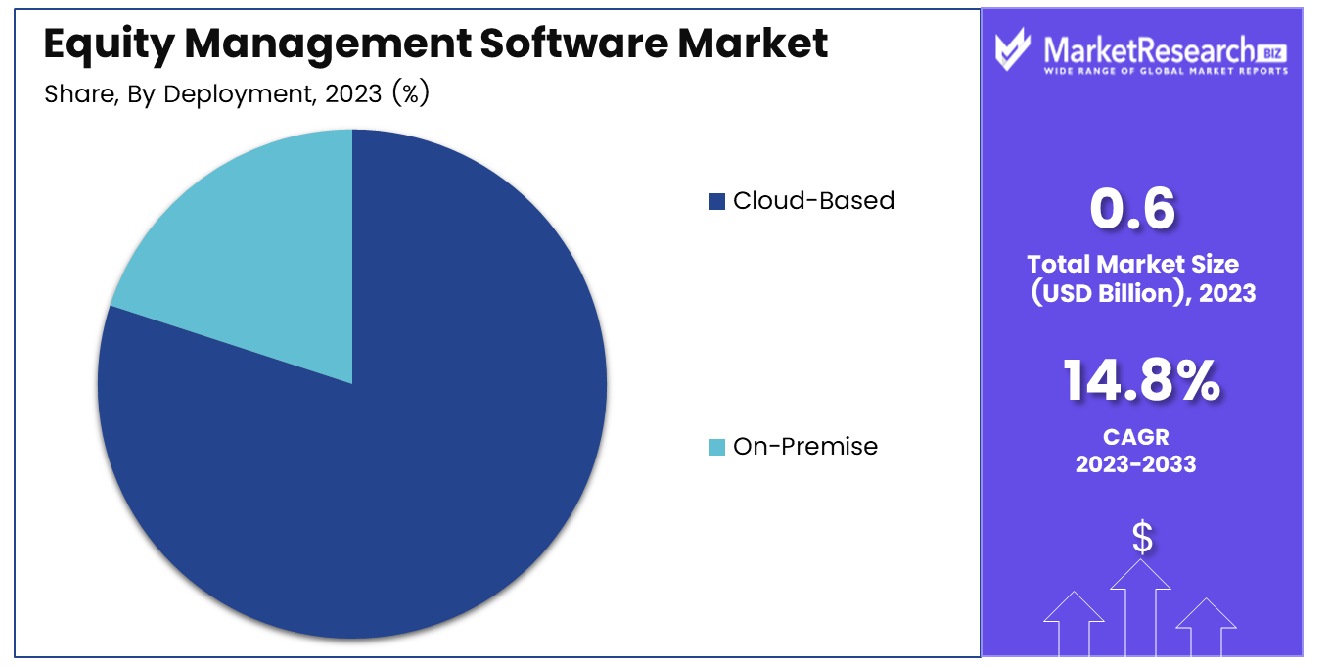

- By Deployment: Cloud-Based segment offering scalability and accessibility, cloud-based solutions command an impressive 80% of the market share.

- By End-User: Banking & Financial Services are reflecting the need for robust features, the senior tier leads with 55%.

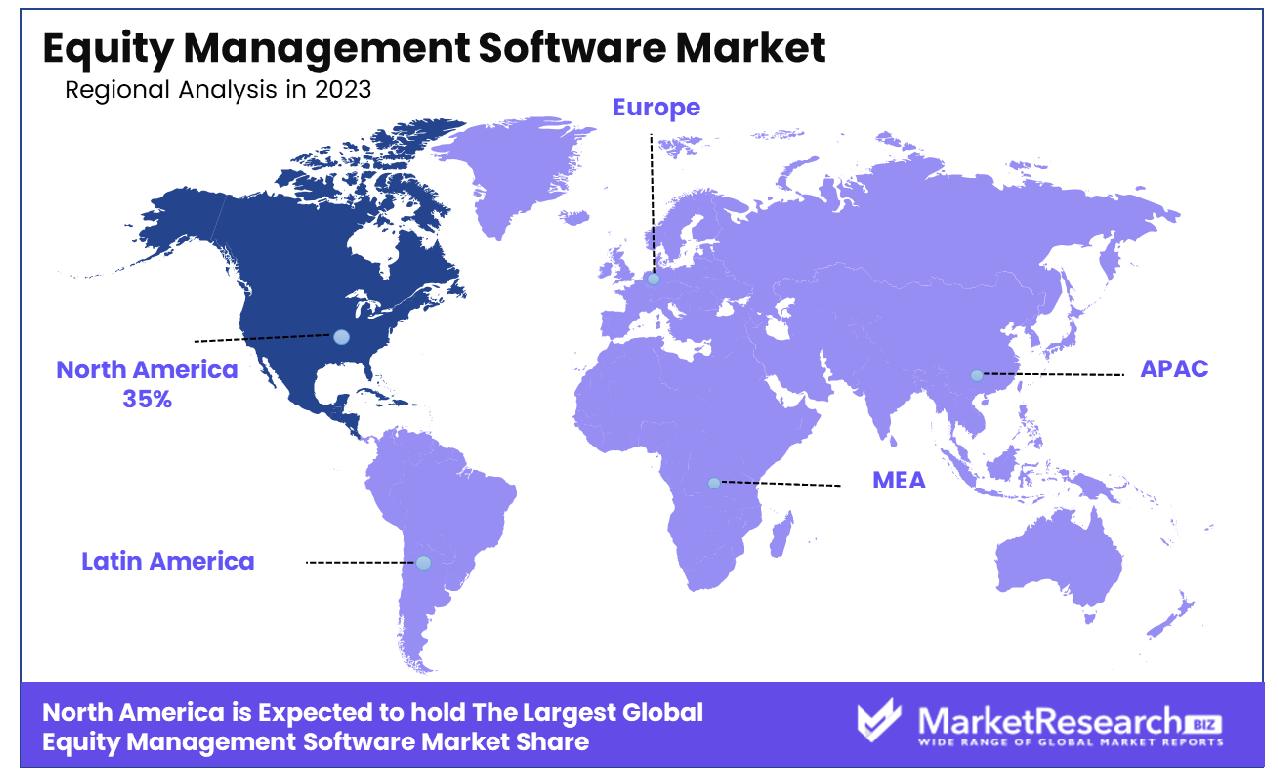

- Regional Dominance: North America leads the Equity Management Software market with a substantial 35% dominance, driven by the presence of numerous financial institutions.

- Growth Opportunity:A significant growth opportunity lies in expanding Equity Management Software adoption within emerging markets, driven by increasing regulatory complexities and the need for streamlined financial management solutions.

Driving factors

Enhancing Efficiency and Accuracy

The surge in automation demand within the equity management software market stems from a collective need among financial institutions and investment firms to streamline their operations. Automation not only expedites processes but also minimizes errors, fostering greater accuracy in managing equity portfolios.

As companies increasingly seek to optimize their workflows and reduce manual intervention, the adoption of automated equity management solutions becomes imperative. This demand is further fueled by the growing complexity of financial instruments and investment strategies, where automation offers a reliable means to navigate intricate transactions swiftly and securely.

Driving Adoption of Specialized Solutions

In an era marked by stringent regulatory frameworks, compliance remains a paramount concern for financial institutions and investment firms alike. The intricate web of regulations governing equity management necessitates robust software solutions tailored to ensure adherence to regulatory standards. The escalating complexity of compliance requirements, coupled with the ever-evolving regulatory landscape, underscores the critical role of specialized equity management software in facilitating regulatory compliance.

By leveraging advanced technologies such as artificial intelligence and machine learning, these solutions offer comprehensive compliance functionalities, enabling organizations to navigate regulatory complexities with ease and confidence. Market studies indicate a growing demand for compliance-centric equity management software, with projections pointing towards sustained market expansion driven by the imperative need for regulatory adherence.

Elevating the Importance of User Experience

In an increasingly competitive landscape, talent retention has emerged as a strategic priority for financial institutions seeking to retain skilled professionals within their ranks. The deployment of intuitive and user-friendly equity management software plays a pivotal role in fostering employee satisfaction and retention.

By offering an intuitive interface and seamless user experience, these software solutions empower finance professionals to efficiently manage equity portfolios, thereby enhancing productivity and job satisfaction. Moreover, as the millennial workforce increasingly prioritizes workplace technology that mirrors consumer-grade applications in terms of usability and accessibility, the emphasis on user experience becomes even more pronounced.

Restraining Factors

Balancing Investment with Long-Term Benefits

Implementation costs represent a significant consideration for organizations contemplating the adoption of equity management software. While the initial investment can seem daunting, it's crucial to view it as a strategic expenditure with long-term benefits.

By streamlining processes, enhancing efficiency, and mitigating operational risks, equity management software ultimately delivers substantial returns on investment. Advancements in technology and evolving market dynamics have led to competitive pricing models and flexible deployment options, making these solutions more accessible to a broader range of organizations.

Safeguarding Confidential Information

Data security concerns loom large in the decision-making process surrounding equity management software adoption. With sensitive financial information at stake, ensuring robust data protection measures is non-negotiable. Leading software providers prioritize data security by implementing encryption protocols, access controls, and regular security audits to safeguard confidential information from unauthorized access or breaches.

Adherence to industry-specific compliance standards such as GDPR and PCI DSS further underscores the commitment to maintaining data integrity and privacy, instilling confidence among users and stakeholders alike. As organizations continue to prioritize data security in an increasingly digitized landscape, the demand for equity management software fortified with robust security features is poised to escalate.

By Type Analysis

Standard ($50-100/Month) captured over 45% market share in the Type segment of the Equity Management Software Market in 2023.

In 2023, Standard ($50-100/Month) held a dominant market position in the By Type segment of the Equity Management Software Market, capturing more than a 45% share.

Positioned as the middle-tier option, the Standard segment of equity management software attracted a significant portion of the market share, exceeding 45% in 2023. This segment is characterized by its comprehensive features tailored to meet the needs of both individual investors and small to medium-sized enterprises. Key functionalities include portfolio tracking, performance analysis, and customizable reporting tools. The robust performance of Standard software can be attributed to its balanced combination of features and affordability, making it a popular choice among a wide range of investors seeking advanced capabilities without the premium price tag.

Basic (Under $50/Month) segment of equity management software caters to the needs of small-scale investors or individual traders who seek fundamental functionalities at an affordable price point. Although it represents the entry-level tier, it experienced moderate growth, largely driven by increasing awareness among individual investors about the benefits of using equity management software to optimize their investment portfolios.

The Senior segment represents the high-end offerings in the equity management software market, targeting sophisticated institutional investors, asset managers, and large corporations with complex investment portfolios.

By Application Analysis

Start-Ups commanded more than 50% market share in the Equity Management Software Market's Application segment in 2023.

In 2023, Start-Ups held a dominant market position in the By Application segment of the Equity Management Software Market, capturing more than a 50% share.

This segment of equity management software application caters specifically to newly established businesses and entrepreneurial ventures. In 2023, Start-Ups emerged as the frontrunner in the market, commanding over half of the market share. This dominance can be attributed to the agility and flexibility of software solutions tailored to meet the unique needs and challenges faced by start-up enterprises.

Private corporations represent another significant segment of the equity management software market, comprising established businesses operating outside the realm of public trading. Despite their prominence in the corporate landscape, private corporations held a smaller market share compared to Start-Ups in 2023.

Listed Companies constitute entities whose shares are publicly traded on stock exchanges. Although this segment represents a cornerstone of the equity management software market, it trailed behind Start-Ups in terms of market share in 2023. Listed Companies demand sophisticated software solutions capable of handling large-scale portfolio management, real-time analytics, and regulatory compliance to navigate the complexities of public markets.

The "Other" category encompasses a diverse range of organizations, including non-profit entities, government agencies, and educational institutions, among others. While these entities may have unique requirements for equity management software, they collectively accounted for a smaller portion of the market share in 2023.

By Deployment Analysis

Cloud-Based deployment dominated the Equity Management Software Market, capturing over 80% market share in 2023.

In 2023, Cloud-Based held a dominant market position in the By Deployment segment of the Equity Management Software Market, capturing more than an 80% share.

The Cloud-Based deployment model emerged as the clear leader in the equity management software market in 2023, commanding over 80% of the market share. This dominance can be attributed to the numerous advantages offered by cloud-based solutions, including scalability, accessibility, and cost-efficiency. Cloud-based equity management software enables users to access their investment portfolios and analytics from anywhere with an internet connection, facilitating seamless collaboration and real-time decision-making.

Despite the growing popularity of cloud-based deployment, the On-Premise segment of equity management software retained a smaller but notable share of the market in 2023. On-premise solutions are installed and maintained locally on the organization's own servers and infrastructure, offering greater control and customization options.

By End-User Analysis

Banking & Financial Services led the Equity Management Software Market with over 55% market share in 2023.

In 2023, Banking & Financial Services held a dominant market position in the By End-User segment of the Equity Management Software Market, capturing more than a 55% share.

Banking & Financial Services: The Banking & Financial Services sector emerged as the frontrunner in the equity management software market in 2023, commanding over 55% of the market share. This dominance is a testament to the critical role of equity management software in facilitating investment activities, portfolio optimization, and risk management within the financial industry.

The Insurance sector represents another significant end-user segment of the equity management software market, albeit with a smaller market share compared to Banking & Financial Services. Insurance companies utilize equity management software to manage investment portfolios, Financial Services, assess risk exposure, and optimize returns on investment.

Retail & E-Commerce companies constitute a diverse segment of end-users in the equity management software market, encompassing both traditional brick-and-mortar retailers and online e-commerce platforms.

The Manufacturing sector represents another niche segment of end-users in the equity management software market, encompassing a wide range of industries, including automotive, aerospace, electronics, and consumer goods.

The "Other" category encompasses a diverse range of industries and organizations that utilize equity management software for various purposes. This segment includes sectors such as healthcare, technology, energy, and public sector entities, among others.

Key Market Segments

By Type

- Basic (Under $50/Month)

- Standard ($50-100/Month)

- Senior (Above $100/Month)

By Application

- Start-Ups

- Private Corporation

- Listed Company

- Other

By Deployment

- Cloud-Based

- On-Premise

By End-User

- Banking & Financial Services

- Insurance

- Retail & E-Commerce

- Manufacturing

- Other

Growth Opportunity

Equity Program Expansion

The global Equity Management Software Market stands at the precipice of unprecedented growth opportunities, propelled by a confluence of factors. One such catalyst is the burgeoning expansion of equity programs among organizations worldwide. In response to evolving market dynamics and changing employee expectations, businesses are increasingly embracing equity compensation as a strategic tool to attract and retain top talent.

This paradigm shift towards equity-centric compensation models not only underscores the growing significance of employee ownership but also fuels the demand for sophisticated equity management software solutions. As organizations seek to optimize their equity programs for enhanced employee engagement and performance, the market for equity management software is poised to witness exponential growth, presenting vendors with a fertile landscape for innovation and expansion.

Catalyzing Market Evolution

The pervasive adoption of cloud technology emerges as a pivotal driver shaping the trajectory of the equity management software market in 2024. Cloud-based solutions offer unparalleled scalability, agility, and cost-efficiency, empowering organizations to seamlessly manage their equity portfolios with enhanced flexibility and accessibility. The scalability of cloud platforms enables businesses to adapt to evolving market demands and scale their operations dynamically, thereby fostering a conducive environment for market growth.

The inherent advantages of cloud computing, including real-time data access, collaborative capabilities, and robust security measures, position cloud-based equity management software as the preferred choice for organizations across diverse industry verticals. As the adoption of cloud technology continues to gain momentum, the equity management software market is poised to capitalize on this paradigm shift, driving innovation and differentiation to meet the evolving needs of modern enterprises.

Latest Trends

Redefining Equity Management Dynamics

In the landscape of equity management software, 2024 heralds a transformative shift towards mobile accessibility as a key trend reshaping user experiences and market dynamics. With the proliferation of smartphones and tablets, professionals increasingly demand the flexibility to access and manage their equity portfolios on the go. Software providers are compelled to prioritize mobile optimization, offering intuitive mobile applications that empower users to monitor and execute equity transactions anytime, anywhere.

This trend not only enhances user convenience and productivity but also reflects the growing preference for seamless cross-platform experiences in today's digital ecosystem. By embracing mobile accessibility, the equity management software market is poised to unlock new avenues for growth and differentiation, catering to the evolving needs of a mobile-centric workforce.

Financial Wellness Integration

In tandem with the rising emphasis on employee well-being, the integration of financial wellness features within equity management software emerges as a prominent trend shaping market dynamics in 2024. Recognizing the interconnectedness between financial health and overall well-being, organizations are increasingly leveraging equity management platforms as vehicles for promoting financial literacy, planning, and empowerment among their workforce.

By incorporating tools for budgeting, goal setting, and investment education, these software solutions foster a culture of financial wellness, enhancing employee engagement and satisfaction. Moreover, as companies strive to differentiate themselves in the competitive talent landscape, the integration of financial wellness features serves as a compelling value proposition, driving adoption and market growth.

Aligning Equity Management

Against the backdrop of mounting environmental, social, and governance (ESG) imperatives, 2024 witnesses a notable trend towards integrating ESG considerations into equity management practices and software solutions. With stakeholders increasingly scrutinizing companies' ESG performance, organizations are compelled to incorporate sustainability criteria into their investment decisions and equity management strategies.

Equity management software providers are responding by offering ESG analytics and reporting capabilities, enabling users to assess and incorporate ESG factors into their investment portfolios. This trend not only reflects the growing importance of sustainable investing but also underscores the role of technology in facilitating ESG integration and transparency. By aligning equity management with sustainable practices, organizations can mitigate risks, enhance stakeholder trust, and drive long-term value creation, positioning ESG considerations as a pivotal trend shaping the future trajectory of the equity management software market.

Regional Analysis

North America emerges as the dominating region in the Equity Management Software market, commanding a substantial 35% share.

North America dominates the Equity Management Software market, commanding a significant 35% share. This region boasts a mature financial services sector coupled with advanced technological infrastructure, driving substantial demand for equity management solutions. The United States, in particular, stands out as a key market player, with major financial institutions and corporations adopting sophisticated software platforms to streamline their equity management processes.

Europe holds a notable position in the Equity Management Software market, although slightly trailing behind North America, with a significant market share. The region benefits from a well-developed financial ecosystem and stringent regulatory frameworks, driving the adoption of equity management solutions across various industries.

Asia Pacific presents substantial growth opportunities in the Equity Management Software market, driven by rapid economic development, expanding financial sectors, and increasing adoption of digital technologies. With the rise of startups and small to medium-sized enterprises (SMEs) in the region, there is a growing demand for cost-effective equity management solutions tailored to their needs.

The Middle East & Africa region exhibits moderate growth in the Equity Management Software market, with ongoing efforts to modernize financial services and enhance regulatory compliance standards.

Latin America represents a growing market for Equity Management Software, characterized by increasing investments in technology infrastructure and rising awareness of the importance of equity management among businesses.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Equity Management Software Market is witnessing a dynamic landscape with a plethora of key players vying for market share. Among these, certain companies stand out with their innovative solutions, robust platforms, and comprehensive offerings.

Certent, Inc. remains a frontrunner in the market, leveraging its advanced technology to provide end-to-end equity management solutions. With a focus on compliance, reporting, and analytics, Certent continues to attract clients seeking reliable and efficient software solutions.

Preqin Solutions is another key player, known for its data-driven approach and customizable platforms tailored to meet the unique needs of clients across various industries. Its emphasis on data security and analytics capabilities has positioned it as a preferred choice for enterprises globally.

Ledgy, with its user-friendly interface and emphasis on transparency, has gained traction among startups and small to medium-sized enterprises (SMEs). Its cloud-based platform offers seamless equity management solutions, making it an attractive option for companies looking to streamline their operations.

High Castle's innovative approach to equity management, particularly in the realm of blockchain technology, has garnered attention in the market. By offering secure and decentralized solutions, High Castle addresses the evolving needs of modern businesses in managing equity transactions.

Euronext TruEquity, with its comprehensive suite of services spanning from equity plan administration to financial reporting, caters to the diverse requirements of clients in both public and private sectors. Its integration capabilities and scalable solutions make it a formidable player in the market.

These key players, along with others such as Capshare, Carta, and Computershare, are shaping the global Equity Management Software Market landscape through their innovative offerings, customer-centric approach, and commitment to driving efficiency and compliance in equity management processes. As the market continues to evolve, collaboration, and partnerships among these players are likely to drive further innovation and growth in the industry.

Market Key Players

- Certent, Inc.

- Preqin Solutions

- Ledgy

- High Castle

- Euronext TruEquity

- Capshare

- Carta

- Imagineer Technology Group

- KOGER Inc.

- Solium

- Astrella

- Computershare

- Altvia Solutions

- EquityEffect

- Imagineer Technology Group

- Eqvista Inc.

- Gust Equity Management

- Global Shares,

- Vestd Ltd.

Recent Development

- In March 2024, Morgan Stanley launched the Private Markets Transaction Desk platform, facilitating secondary market trading of private company shares, enhancing trading opportunities and investor interest in private markets.

- In January 2024, EquityZen introduced a new platform feature, allowing employees of private companies to directly sell their shares, enhancing liquidity and access to the secondary market for private equity.

Report Scope

Report Features Description Market Value (2023) USD 0.6 Bn Forecast Revenue (2033) USD 2.2 Bn CAGR (2024-2033) 14.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Basic (Under $50/Month), Standard ($50-100/Month), Senior (Above $100/Month)), By Application (Start-Ups, Private Corporation, Listed Company, Other), By Deployment (Cloud-Based, On-Premise), By End-User (Banking & Financial Services, Insurance, Retail & E-Commerce, Manufacturing, Other) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Certent, Inc., Preqin Solutions, Ledgy, High Castle, Euronext TruEquity, Capshare, Carta, Imagineer Technology Group, KOGER Inc., Solium, Astrella, Computershare, Altvia Solutions, EquityEffect, Imagineer Technology Group, Eqvista Inc., Gust Equity Management, Global Shares,, Vestd Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Certent, Inc.

- Preqin Solutions

- Ledgy

- High Castle

- Euronext TruEquity

- Capshare

- Carta

- Imagineer Technology Group

- KOGER Inc.

- Solium

- Astrella

- Computershare

- Altvia Solutions

- EquityEffect

- Imagineer Technology Group

- Eqvista Inc.

- Gust Equity Management

- Global Shares,

- Vestd Ltd.