Enteral Feeding Formulas Market By Product (Standard Formula, Disease-specific Formulas), By Stage (Adults, Pediatric), By Application (Oncology, Neurology, Gastroenterology, Diabetes), By End-User (Hospitals, Homecare, Long-Term Care Facilities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

50414

-

Aug 2024

-

302

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

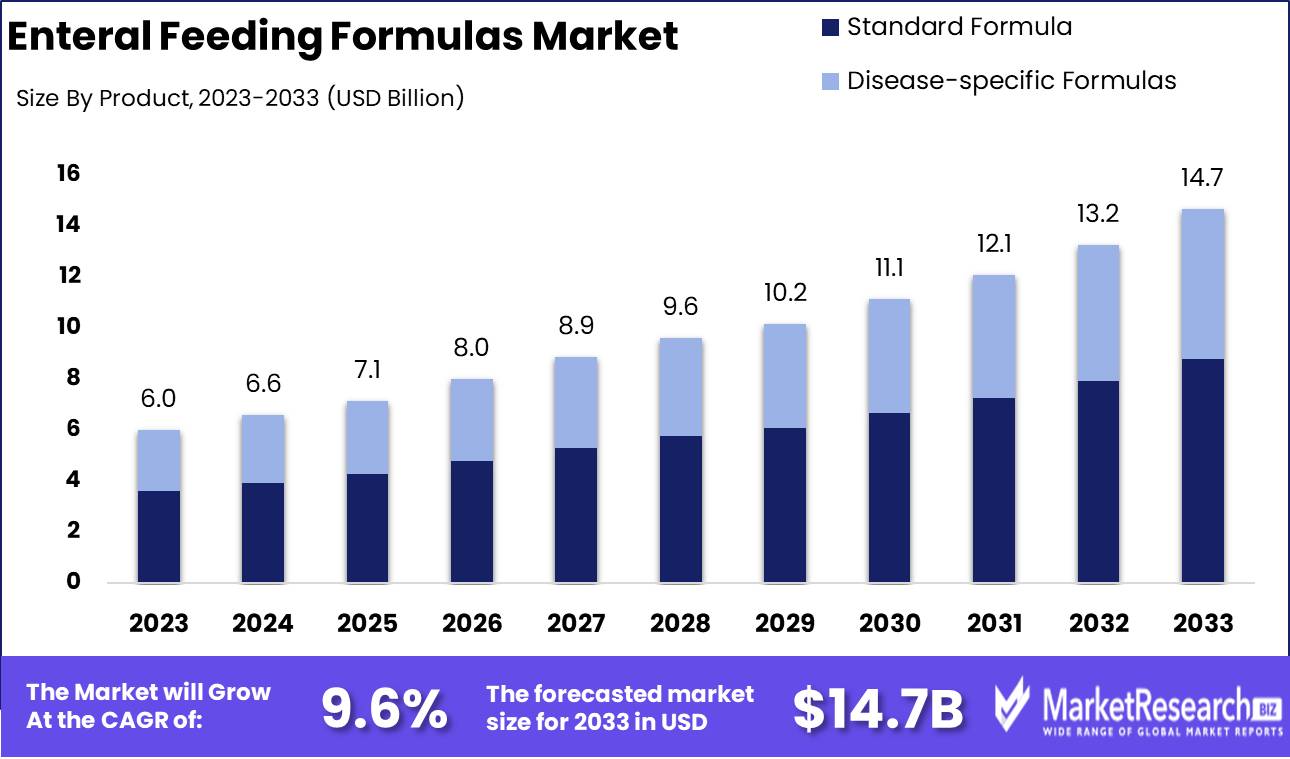

The Global Enteral Feeding Formulas Market was valued at USD 6 Bn in 2023. It is expected to reach USD 14.7 Bn by 2033, with a CAGR of 9.6% during the forecast period from 2024 to 2033.

The Enteral Feeding Formulas Market encompasses the production and distribution of nutritional solutions specifically designed for patients who require direct gastrointestinal feeding. These formulas provide essential nutrients to individuals unable to consume food orally due to medical conditions such as gastrointestinal disorders, neurological impairments, or severe illness. The market is driven by increasing incidences of chronic diseases, rising elderly populations, and advancements in healthcare infrastructure. With ongoing innovation in formula composition and delivery systems, this market is poised for significant growth, addressing the critical needs of patients in both hospital settings and home care environments.

The Enteral Feeding Formulas Market is experiencing a notable expansion, fueled by the increasing prevalence of chronic diseases, an aging global population, and the growing demand for effective nutritional support in clinical and home care settings. As healthcare systems globally focus on improving patient outcomes, the market for enteral feeding solutions has become increasingly vital. These formulas are engineered to deliver 100% of the adult Dietary Reference Intakes (DRIs) within a daily intake of 1,000 to 1,500 mL, ensuring that patients receive comprehensive nutrition despite their inability to consume food orally.

The Enteral Feeding Formulas Market is experiencing a notable expansion, fueled by the increasing prevalence of chronic diseases, an aging global population, and the growing demand for effective nutritional support in clinical and home care settings. As healthcare systems globally focus on improving patient outcomes, the market for enteral feeding solutions has become increasingly vital. These formulas are engineered to deliver 100% of the adult Dietary Reference Intakes (DRIs) within a daily intake of 1,000 to 1,500 mL, ensuring that patients receive comprehensive nutrition despite their inability to consume food orally.Strategic acquisitions within the industry are further shaping market dynamics. A significant development occurred in February 2022, when Nestlé acquired a majority stake in Orgain, a company specializing in plant-based nutrition. This acquisition underscores the industry's pivot towards more diverse and specialized nutritional solutions, particularly in the plant-based segment, which is increasingly being incorporated into enteral feeding formulas. Such moves are indicative of the market's evolution towards addressing specific dietary needs and preferences, thereby expanding its consumer base.

The Enteral Feeding Formulas Market is poised for sustained growth, driven by continuous advancements in formula composition, including the integration of plant-based ingredients, and innovations in delivery systems. As healthcare providers seek to improve patient care and outcomes, the demand for these nutritionally complete solutions is expected to rise, solidifying the market's critical role in the broader healthcare ecosystem. Companies that strategically align their portfolios to meet these evolving demands will be well-positioned to capitalize on this growth trajectory.

Key Takeaways

- Market Value: The Global Enteral Feeding Formulas Market was valued at USD 6 Bn in 2023. It is expected to reach USD 14.7 Bn by 2033, with a CAGR of 9.6% during the forecast period from 2024 to 2033.

- By Product: Standard Formula dominates with 60%, providing balanced nutrition for a wide range of patients.

- By Stage: Adults represent 70% of the market, reflecting the high demand for enteral nutrition in adult care.

- By Application: Oncology constitutes 35%, highlighting the use of enteral feeding in cancer patient care.

- By End-User: Hospitals account for 50%, utilizing enteral formulas as part of comprehensive patient care.

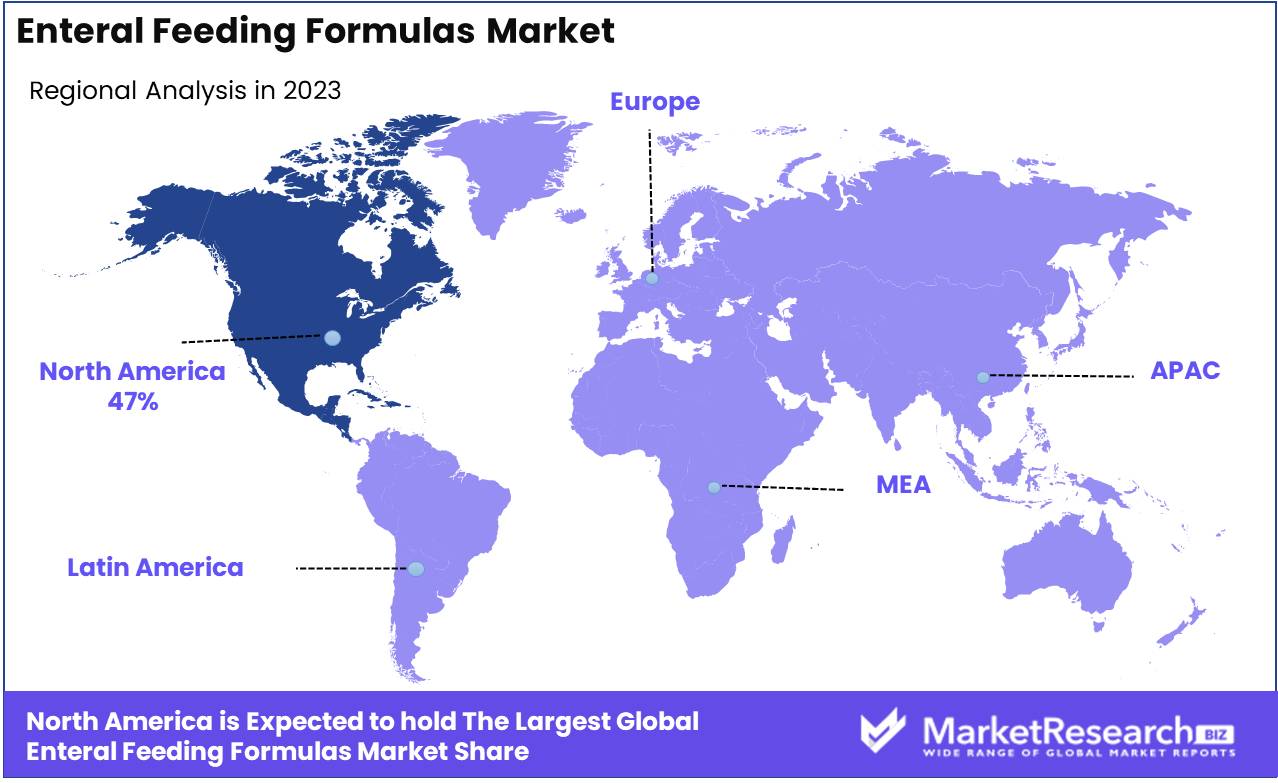

- Regional Dominance: North America holds a 47% market share, driven by a high prevalence of chronic diseases and advanced healthcare systems.

- Growth Opportunity: Developing specialized formulas for specific medical conditions can address unmet needs and drive market growth.

Driving factors

Increasing Prevalence of Chronic Diseases and Aging Population

The rising prevalence of chronic diseases, such as cancer, diabetes, and neurological disorders, has significantly increased the demand for enteral feeding formulas. These conditions often impair patients' ability to ingest food orally, necessitating the use of nutritional support through enteral feeding. Additionally, the aging global population, which is more susceptible to chronic illnesses and malnutrition, further drives the market. As the elderly population continues to grow, so too does the need for specialized nutritional solutions, making enteral feeding formulas a critical component in managing the health and well-being of these individuals.

Growth in Demand for Home Enteral Nutrition (HEN)

The shift towards home-based care has led to a substantial increase in the demand for home enteral nutrition (HEN). Patients and healthcare providers are increasingly opting for at-home nutritional support due to the convenience, cost-effectiveness, and reduced risk of hospital-acquired infections. This trend has expanded the market for enteral feeding formulas, as they are tailored for easy administration and use in a home setting. The growth in HEN not only broadens the market's reach but also fosters innovation in product development to cater to the specific needs of home care patients.

Advancements in Formula Composition and Delivery Systems

Innovations in the composition of enteral feeding formulas and the delivery systems used have played a pivotal role in market growth. Manufacturers are continually improving formulas to ensure they meet the nutritional needs of specific patient groups, such as those with diabetes, renal issues, or critical illnesses. Advancements in delivery systems, including more efficient and user-friendly feeding pumps and tubes, have made enteral feeding more accessible and comfortable for patients. These technological improvements not only enhance the efficacy of the formulas but also improve patient outcomes, thereby boosting market adoption.

Restraining Factors

High Cost of Specialized Enteral Formulas

The high cost of specialized enteral feeding formulas presents a substantial barrier to market growth. These formulas are often more expensive due to the advanced ingredients and tailored nutritional profiles required to meet the needs of specific patient groups, such as those with metabolic disorders or severe allergies.

The elevated cost can limit accessibility for patients, particularly in regions with inadequate healthcare coverage or lower income levels. This financial burden may discourage the adoption of specialized enteral feeding formulas, thus restraining market expansion.

Complications and Risks Associated with Enteral Feeding

Complications and risks associated with enteral feeding, such as infections, tube dislodgment, and gastrointestinal issues, can deter both patients and healthcare providers from utilizing enteral feeding solutions. These risks can lead to increased healthcare costs, prolonged hospital stays, and additional medical interventions, further complicating patient care.

The potential for adverse outcomes may result in reluctance to adopt enteral feeding, particularly in cases where less invasive nutritional support options are available. This hesitation can limit the market’s growth potential, as safety concerns remain a critical factor in treatment decisions.

By Product Analysis

In 2023, Standard Formula held a dominant market position in the By Product segment of the Enteral Feeding Formulas Market, capturing more than a 60% share.

Standard formulas are widely preferred due to their balanced nutritional content, designed to meet the general dietary needs of most patients. These formulas are typically used for patients with normal digestive and absorptive capacities, offering a comprehensive blend of recombinant proteins, carbohydrates, fats, vitamins, and minerals. The ease of use and cost-effectiveness of standard formulas contribute significantly to their dominance in the market. They are the go-to choice in various clinical settings, particularly for patients requiring short-term enteral nutrition, further solidifying their leading position.

Disease-specific formulas, though vital for patients with specific medical conditions such as diabetes, renal disorders, or pulmonary diseases, represent a smaller share of the market. These specialized formulas are tailored to address particular nutritional needs and complications but are often more expensive and less frequently required than standard formulas. Despite their importance in patient care, the broader applicability of standard formulas ensures they maintain the largest market share.

By Stage Analysis

In 2023, Adults held a dominant market position in the By Stage segment of the Enteral Feeding Formulas Market, capturing more than a 70% share.

The adult population constitutes the largest demographic requiring enteral feeding, particularly among patients with chronic illnesses, post-surgical recovery, and long-term care needs. The prevalence of conditions such as cancer, neurological disorders, and severe gastrointestinal issues is higher among adults, driving the demand for enteral feeding formulas specifically designed for this age group. The increasing aging population globally is a significant factor contributing to the dominance of the adult segment in this market.

While the pediatric segment is crucial, especially for children with congenital disabilities, prematurity, or critical illnesses, it accounts for a smaller portion of the market. Pediatric formulas are specially formulated to meet the nutritional needs of growing children, but their application is more limited compared to the broad adult population. The extensive need for enteral nutrition in adults, particularly in hospital and long-term care settings, keeps this segment at the forefront of the market.

By Application Analysis

In 2023, Oncology held a dominant market position in the By Application segment of the Enteral Feeding Formulas Market, capturing more than a 35% share.

Oncology patients often experience significant nutritional challenges due to the effects of cancer and its treatments, such as chemotherapy and radiation. Enteral feeding formulas are essential in managing malnutrition and maintaining strength and energy levels in these patients. The high incidence of cancer globally and the critical role of nutrition in patient recovery and quality of life contribute to the oncology segment's leading position in the market.

Other significant applications include neurology, gastroenterology, and diabetes, where enteral feeding formulas are vital in managing patients who cannot meet their nutritional needs through oral intake. Neurology patients, such as those with stroke or neurodegenerative diseases, often require long-term enteral feeding, making this another critical segment. The widespread prevalence of cancer and the specific nutritional needs of oncology patients ensure that this application remains the largest market share.

By End-User Analysis

In 2023, Hospitals held a dominant market position in the By End-User segment of the Enteral Feeding Formulas Market, capturing more than a 50% share.

Hospitals are the primary settings where enteral feeding formulas are administered, especially for patients in critical care, post-surgery recovery, and those with severe chronic conditions. The controlled environment of hospitals ensures that patients receive precise nutritional support tailored to their medical needs, which is vital in their recovery and overall health outcomes. The high patient turnover and the need for specialized nutritional care in hospital settings drive the significant demand for enteral feeding formulas in this segment.

Homecare and long-term care facilities are also important end-users of enteral feeding formulas, particularly for patients requiring ongoing nutritional support outside of hospital settings. The growing trend of at-home care for chronic conditions and the aging population contribute to the demand in these segments. The comprehensive care provided in hospitals, along with the complexity of cases requiring enteral feeding, keeps hospitals as the leading end-user segment in the market.

Key Market Segments

By Product

- Standard Formula

- Disease-specific Formulas

By Stage

- Adults

- Pediatric

By Application

- Oncology

- Neurology

- Gastroenterology

- Diabetes

By End-User

- Hospitals

- Homecare

- Long-Term Care Facilities

Growth Opportunity

Development of Disease-Specific and Organic Enteral Formulas

The growing focus on personalized nutrition has led to the development of disease-specific and organic enteral formulas, presenting a significant growth opportunity in the global Enteral Feeding Formulas Market. With chronic conditions such as diabetes, renal failure, and cancer becoming more prevalent, there is an increasing demand for specialized formulas that address the unique nutritional needs of these patients.

The rising consumer preference for organic and clean-label products is driving the demand for organic enteral formulas. These advancements cater to a more health-conscious and informed patient population, expanding the market's reach and offering significant growth potential.

Expansion in Pediatric and Geriatric Nutrition

The expansion of enteral feeding formulas into pediatric and geriatric nutrition is another critical opportunity for market growth in 2024. The pediatric segment is witnessing increased demand due to the rising prevalence of congenital and chronic diseases in children, necessitating long-term nutritional support. The geriatric population, which is projected to grow substantially, presents a lucrative market for enteral formulas designed to address age-related nutritional deficiencies.

This dual expansion into pediatric and geriatric segments not only broadens the market's horizons but also positions enteral feeding formulas as essential components of comprehensive care across all life stages.

Latest Trends

Use of Plant-Based and Hypoallergenic Enteral Formulas

The global Enteral Feeding Formulas Market is increasingly adopting plant-based and hypoallergenic formulas to meet the evolving preferences of patients and healthcare providers. As awareness of plant-based diets and their health benefits grows, there is a significant shift towards incorporating plant-based ingredients into enteral formulas. This trend aligns with the broader movement towards sustainable and ethical consumption.

The rise in food allergies and intolerances has led to the development of hypoallergenic formulas, which cater to patients with specific dietary restrictions. This trend not only expands the market's appeal but also enhances patient outcomes by reducing the risk of adverse reactions.

Integration of Personalized Nutrition in Enteral Feeding

Personalized nutrition is rapidly becoming a cornerstone of modern healthcare, and its integration into enteral feeding represents a key trend in 2024. Advances in technology and data analytics are enabling the customization of enteral formulas based on individual patient needs, such as their genetic profile, health conditions, and metabolic requirements.

This trend is driving the development of more targeted and effective nutritional solutions, which can significantly improve patient care. The move towards personalized enteral feeding is expected to increase patient adherence and satisfaction, leading to better health outcomes and further growth in the market.

Regional Analysis

North America is the dominating region in the Enteral Feeding Formulas Market, commanding a substantial 47% share.

The Enteral Feeding Formulas Market in North America is experiencing significant growth, driven by a well-established healthcare infrastructure, a high prevalence of chronic diseases, and an aging population. The United States is the primary contributor to the market, with a strong focus on advanced nutritional support for patients with conditions such as cancer, neurological disorders, and gastrointestinal diseases. The region's dominance is further bolstered by the presence of leading manufacturers and extensive research and development activities aimed at enhancing the efficacy and safety of enteral feeding formulas. Favorable reimbursement policies and increasing awareness about the benefits of enteral nutrition contribute to North America's 47% market share.

In Europe, the Enteral Feeding Formulas Market is also expanding, supported by a growing elderly population and an increasing incidence of chronic conditions that require long-term nutritional support. Countries like Germany, France, and the United Kingdom are leading the market, benefiting from strong healthcare systems and a growing emphasis on patient-centered care. The European market is characterized by a rising demand for specialized enteral formulas, particularly for oncology and critical care patients. Government initiatives to improve healthcare services and support for home-based enteral nutrition are further driving market growth in the region.

The Asia Pacific region is emerging as a rapidly growing market for enteral feeding formulas, fueled by increasing healthcare expenditure and a rising prevalence of chronic diseases. Countries such as China, Japan, and India are key players in the region, with growing awareness about the importance of nutritional support in patient care. The region's expanding middle class and improving healthcare infrastructure are contributing to the adoption of enteral feeding formulas in both hospital settings and home care.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Enteral Feeding Formulas Market remains competitive, with several key players shaping its dynamics. Abbott Laboratories leads with a strong portfolio, including the Ensure and Pedialyte brands, which cater to a diverse range of nutritional needs. Abbott’s robust R&D and extensive distribution network bolster its market position, making it a critical player in the sector.

Nestlé S.A. maintains a significant presence through its established brands like Nutren and Peptamen. Nestlé’s emphasis on product innovation and its global reach provide it with a substantial competitive edge, particularly in emerging markets where nutritional needs are rapidly evolving.

Danone S.A., another major player, leverages its specialized products such as Neocate and Fortimel to address specific dietary needs. Danone’s strategic acquisitions and collaborations enhance its ability to offer targeted nutritional solutions, contributing to its strong market performance.

Fresenius Kabi AG and B. Braun Melsungen AG also play vital roles, focusing on providing high-quality enteral nutrition solutions through their well-regarded product lines. Their strong emphasis on safety and efficacy, coupled with significant investments in product development, ensures their continued relevance in the market.

Market Key Players

- Abbott Laboratories

- Nestlé S.A.

- Danone S.A.

- Fresenius Kabi AG

- B. Braun Melsungen AG

- Mead Johnson Nutrition Company

- Hormel Health Labs

- Victus Inc.

- Global Health Products Inc.

- Kate Farms Inc.

Recent Development

- In May 2024, Fresenius Kabi AG secured a strategic partnership to develop specialized enteral feeding formulas for pediatric patients. This collaboration is expected to enhance the company’s portfolio and address a critical market need.

- In March 2024, Nestlé S.A. introduced a plant-based enteral feeding formula to cater to the growing demand for vegan medical nutrition. This launch is anticipated to boost sales by 20% in the coming year.

Report Scope

Report Features Description Market Value (2023) USD 6 Bn Forecast Revenue (2033) USD 14.7 Bn CAGR (2024-2033) 9.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Standard Formula, Disease-specific Formulas), By Stage (Adults, Pediatric), By Application (Oncology, Neurology, Gastroenterology, Diabetes), By End-User (Hospitals, Homecare, Long-Term Care Facilities) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Abbott Laboratories, Nestlé S.A., Danone S.A., Fresenius Kabi AG, B. Braun Melsungen AG, Mead Johnson Nutrition Company, Hormel Health Labs, Victus Inc., Global Health Products Inc., Kate Farms Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Abbott Laboratories

- Nestlé S.A.

- Danone S.A.

- Fresenius Kabi AG

- B. Braun Melsungen AG

- Mead Johnson Nutrition Company

- Hormel Health Labs

- Victus Inc.

- Global Health Products Inc.

- Kate Farms Inc.