Drug Discovery Services Market By Process (Target Selection, Target Validation, Hit-To-Lead-Identification, Lead Optimization), By Drug Type (Small Molecules Drug and Biologics Drug), By Type, By Therapeutics Area, By End User, By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

-

25056

-

March 2023

-

190

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

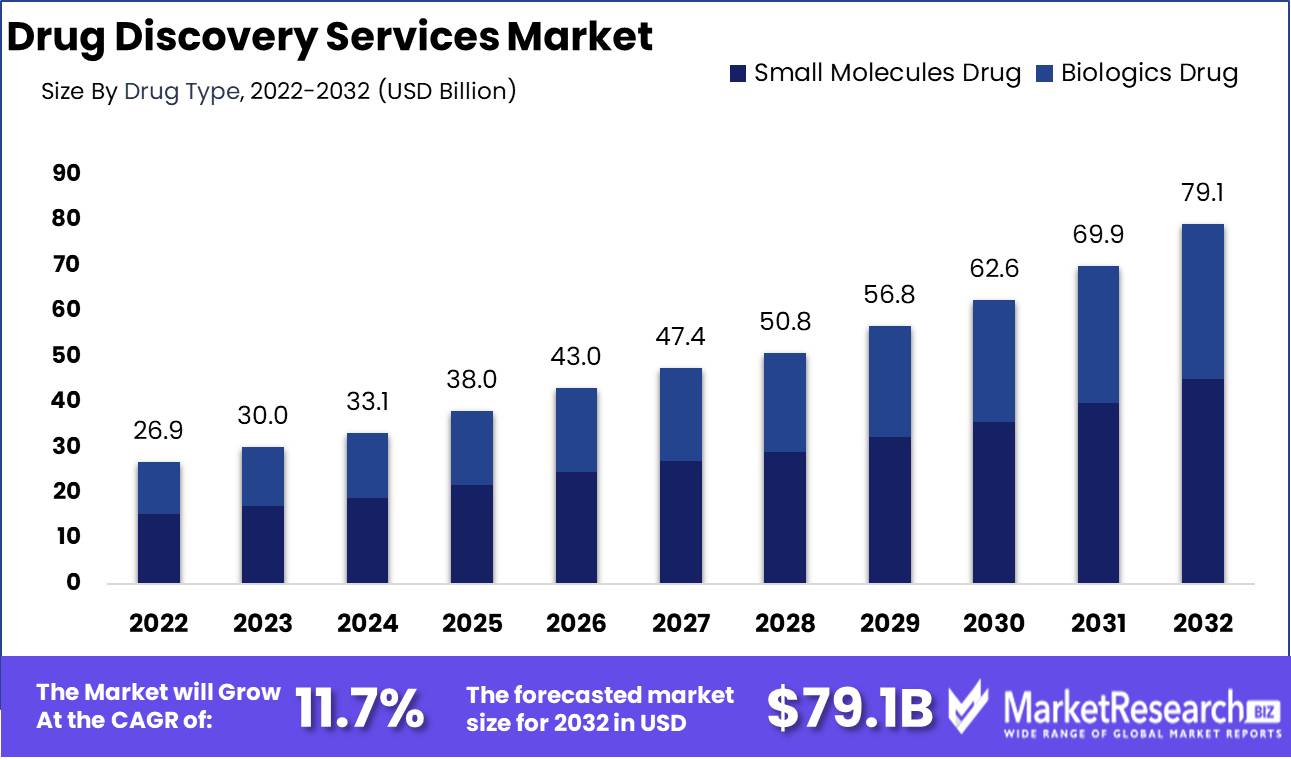

Drug Discovery Services Market size is expected to be worth around USD 79.1 Bn by 2032 from USD 26.9 Bn in 2022, growing at a CAGR of 11.7% during the forecast period from 2023 to 2032.

The global drug discovery services market is experiencing increased R&D spending in the pharmaceutical and biopharmaceutical industries. Moreover, factors include increased demand for analytical testing services and initiatives to research rare diseases. However, strict animal use and drug discovery regulations are expected to limit drug discovery services market growth. Providers of drug discovery services face a problem with a shortage of skilled professionals.

Driving factors

Growing R &D Expenditure In The Pharma And Biopharma Companies

Pharmaceutical companies are investing heavily in research and development activities. This is primarily to develop new drugs and therapies for various diseases, which is driving the demand for drug discovery services. The number of procedures in North America has increased significantly over the past few years. These procedures are in high demand in developing countries due to the increased purchasing power and dual-income households.

Moreover, the advent of advanced technologies like artificial intelligence (AI), machine learning (ML), and big data analytics in the field of drug discovery has significantly improved the efficiency and speed of drug discovery processes. Several pharmaceutical and biotechnology companies are outsourcing their drug discovery processes to specialized service providers. This is due to the high cost associated with in-house drug discovery processes and the need to reduce the time to drug discovery services market.

Restraining Factors

Stringent Regulations Governing Drug Discovery and Animal Usage

Regulatory authorities are focused on drug approval. These approaches are important for ensuring the quality of products before launching in the market. However, they can significantly increase the cost of drug research and the final product. This factor can significantly impact the acceptance of certain drugs in price-sensitive emerging drug discovery services market. Other than this, manufacturing costs can be increased by various laws that guarantee the quality of the product (such as GMP).

There are strict guidelines regarding the use of animals for drug discovery. The most commonly used animals in drug discovery research are mice, rats, fish, and amphibians. Governments have introduced legislation to ensure animal safety and use. This poses several problems for drug discovery research. Companies have had to find other ways to reduce animal use. Novo Nordisk, for example, uses biosimulation, a method that simulates human biology using computer models. All the companies in the industry still need to adopt this.

Type Analysis

Chemistry Services Segment Dominate The Market

The largest drug discovery services market share for drug discovery services is expected to be held by the medicinal chemistry services segment. This segment has a significant market share due to many factors, including the widespread use of medicinal chemistry. Preclinical and clinical laboratory tests are essential phases in the development of new drugs. Segmental services are crucial in the development of drug candidates.

They help to understand properties like target selectivity, compound stability, solubility, and in-vivo studies. These factors all contribute to the market's growth. The increased use of medicinal chemistry in academia, biotechnology companies, and pharmaceutical companies has also positively affected the drug discovery services market.

Process Analysis

Due to Time and Cost Efficiency, Lead Identification and Candidate Optimization Dominate The Market

Based on the process, the global drug discovery services market is segmented into target selection, target validation, hit-to-lead identification, lead optimization, and candidate validation. With a revenue share of 33.0%, lead identification and candidate optimization dominated the process segment. It is an essential stage in early drug discovery. This has been proven to improve efficiency and scale for drug developers.

The segment growth is supported by the introduction of in-silico technologies to improve lead identification processes, such as Computer-Aided Drug Discovery (CADD) and structure-based drug designs. Lead identification services are increasingly being outsourced as a result of the high cost of integrating the most recent computation technology and the rising demand for skilled individuals with expertise in both metabolic and analytical chemistry.

It is anticipated that the other associated services sector, which includes regulatory assistance, cell line development, upstream and downstream processes, analytical/bioanalytical methods, formulations and quality assessment, and other related services, will experience rapid expansion in the upcoming years. This is because of the high investment in drug discovery, research, and development and the rising use of outsourcing services.

Drug Type Analysis

Due To Small Molecules, The Development Of Advanced Treatments Is Possible, as Such Small Molecule Applications Account For Half Of All Specialty Medicine Sales.

Based on drug types, the global drug discovery services market is segmented into small molecule and biologics drugs. With a share of over 77.3%, the small molecules and pharmaceuticals segment is expected to grow at the fastest CAGR over the forecast period. Depending on the drug, there are two types of markets. Small molecules play a significant role in developing new and advanced treatments for patients across the globe. Recent approval trends also show their significance. In 2019, the FDA approved 48 brand-new medications, 79% of which were small molecules. Small molecules are crucial in creating treatments for the following four primary therapeutic areas: cardiology and oncology.

Small molecules can potentially be a significant part of the pharmaceutical portfolio due to their high-quality components and increased importance. This is why the small molecules market accounted for the most significant percentage of the overall drug discovery services market. The advantages of smaller molecules over larger molecules have led to increased investment in this field, particularly in cancer research. Because small molecules can be administered orally, particularly for chronic diseases, so that they can be easily manufactured and less expensive than larger molecules, they can also be used in combination with intracellular targets. Ongoing research will influence segment growth to develop and test novel therapeutics for different indications.

Therapeutic Area Analysis

The Increased Prevalence of Different Types of Cancer Among the Population Has Fostered the Growth of the Oncology Segment

Based on therapeutic areas, the global drug discovery services market is segmented into respiratory systems, neurology, oncology, cardiology, infectious and immune system diseases, digestive system diseases, and other therapeutic areas. The respiratory systems emerged as the dominant segment in the global drug discovery services market in 2022, commanding a significant share of 15.0% of the total revenue. This substantial growth is attributed to the escalating prevalence of respiratory disorders, including bronchitis, tuberculosis, Chronic Obstructive Pulmonary Diseases (COPD), and asthma. Additionally, the surge in drug resistance cases has further fueled the expansion of this segment.

The oncology segment emerged as the dominant force in the drug discovery services market, and it is anticipated to maintain its momentum as the fastest-growing segment throughout the forecast period, spanning from 2023 to 2032. The escalating incidence of cancer cases has prompted pharmaceutical companies to intensify their efforts in developing treatments for malignancies. Notably, lung and breast cancer is the most prevalent types of cancer, with the World Health Organization (WHO) reporting over 2.21 million and 2.26 million cases, respectively.

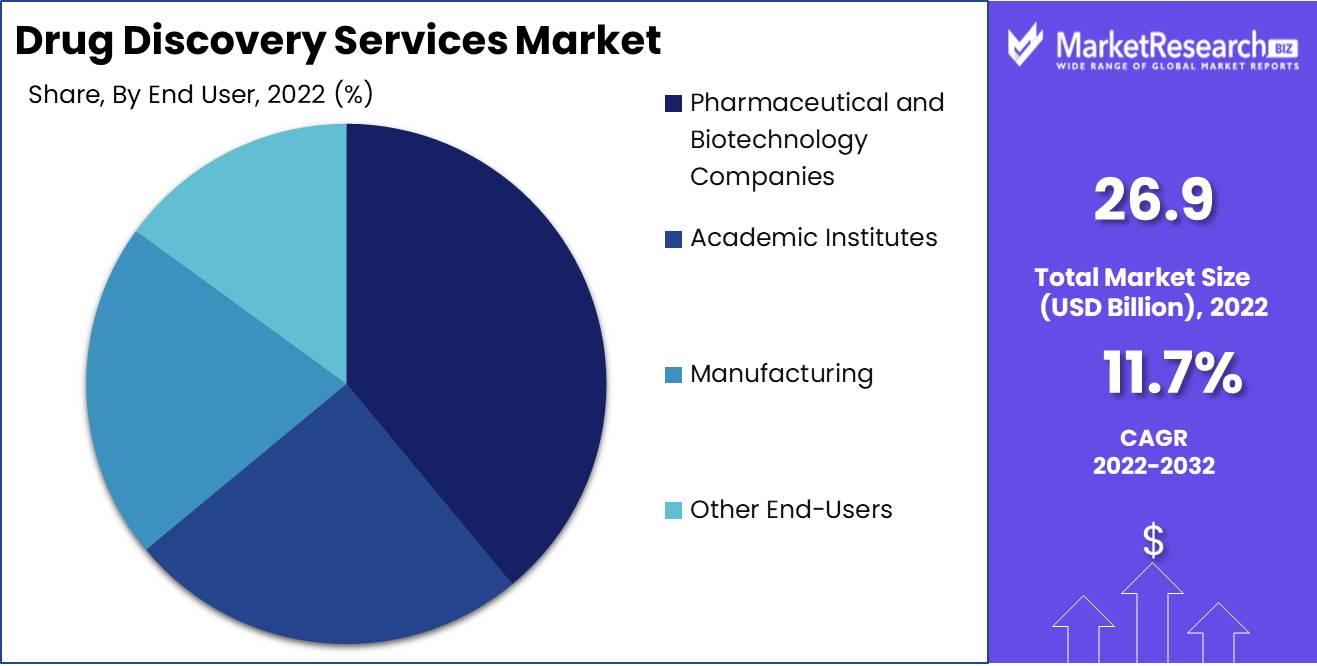

End-User Analysis

Based on End-Users, the global drug discovery services market is segmented into Pharmaceutical and Biotechnology Companies, Academic Institutes, Manufacturing, and Other End-Users. One of the most common strategies observed among players is international collaboration. In addition, in the fast-moving drug development industry, agility is essential in a fragmented business like pharmaceuticals, which can provide high-quality service offerings and a wide range of capabilities. Collaborations with Contract Development and Manufacturing Organizations (CDMOs) are preferred over CMO collaborations.

Key Market Segments

Based on Process

- Target Selection

- Target Validation

- Hit-To-Lead-Identification

- Lead Optimization

- Candidate Validation

Based On Drug Type

- Small Molecules Drug

- Biologics Drug

Based On Type

- Chemistry Services

- Biology Services

Based on Therapeutics Area

- Respiratory System

- Neurology

- Oncology

- Cardiology

- Infectious and Immune System Diseases

- Digestive System Diseases

- Other Therapeutic Area

Based On End User

- Pharmaceutical and Biotechnology Companies

- Academic Institutes

- Manufacturing

- Other End-Users

Growth Opportunity

Growth In Drugs and Biologics Market Despite Of Covid-19 Pandemic

The field of personalized medicine is proliferating. It involves developing therapies tailored to individual patients' genetic and health profiles. This presents a significant opportunity for drug discovery services to develop more targeted and effective treatments. Integrating advanced technologies like AI, ML, and big data in drug discovery can lead to more effective and efficient drug discovery processes. This presents a significant opportunity for service providers in drug discovery services market.

There is a growing demand for biologics and biosimilars due to their effectiveness in treating various chronic and autoimmune diseases. This presents an opportunity for drug discovery services focused on biologics. Moreover, small-molecule drugs dominate the global pharmaceutical market, and hence, shares of biologics, biosimilars, and large-molecule drugs are increasing. This is due to the launch of new biologic-based medicines and the increased revenue from existing biologics. Specialty testing is required at every stage of biosimilars and biologics, which require more services than for small molecules. In the next few years, drug discovery services market is expected to grow because of the increasing demand to outsource these services to CROs.

Latest Trends

Preclinical research's increasing demand for innovative formulation strategies has been predicted to catalyze innovation.

There has been an increase in contract research organizations in emerging countries in recent years. This is likely to be a cost-saving factor for researchers in pharmaceutical industries. The market's growing demand for innovative formulation strategies in preclinical research has also been predicted to catalyze innovation. These factors will also boost the sales opportunities for drug discovery services during the forecast period. The field of drug discovery informatics is experiencing significant changes. There is also an increase in the use of computational methods to assist candidates. These factors will likely increase the growth opportunities for drug discovery services.

Regional Analysis

North America Region Dominates The Drug Discovery Services Market

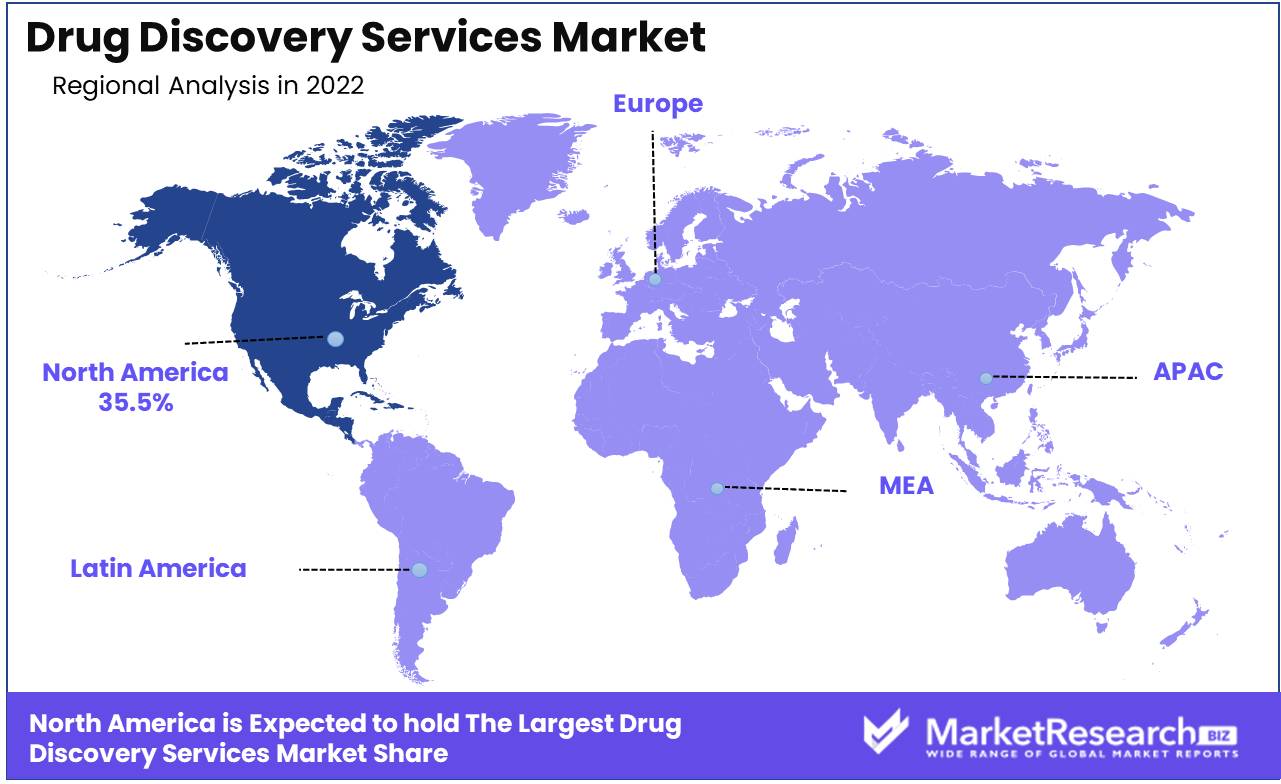

North America was the dominant drug discovery services market, accounting for 35.5% of global revenue. The market's growth can be attributed primarily to technological advances, the presence of key players, well-established research infrastructure, and higher investments in drug discovery R&D. Asia is expected to experience the highest CAGR over the forecast period. Due to the availability of a skilled workforce, low costs, favorable regulatory environments, and high-quality data, the region is becoming a hub for drug discovery outsourcing activities.

Japan is the third largest pharmaceutical market globally and will provide strong opportunities for CROs to drive the market. Japan's revised Pharmaceutical Affairs Law will support tissue diagnosis and cancer research, which is expected to boost drug discovery services market growth. Japan Agency for Medical Research and Development was created to manage clinical trial and investigation data, improve R&D infrastructure, and promote international strategies. This agency exemplifies the various initiatives taken to increase Japan's market growth.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging market players are focusing on various strategies to develop their respective businesses in domestic and international markets. Players increasingly embrace international partnerships as a strategic move to expand their product’s presence. CROs from the U.K., for instance, are more likely to collaborate with Swiss players in the pharmaceutical sector. A fragmented industry such as pharmaceutical requires agility. This can be achieved by offering quality services and a wide range of capabilities. Partnerships with contract development and manufacturing organizations are preferred to contract manufacturing organizations.

With the presence of many local and regional players, the market for companion diagnostics is fragmented. Market players are subject to intense competition from top market players, particularly those with strong brand recognition and high distribution networks. Companies have gained various expansion strategies, such as partnerships and product launches, to stay in the market.

Top Key Players in Drug Discovery Services Market

- Albany Molecular Research Inc.

- EVOTEC SE

- Laboratory Corporation of America Holdings

- GenScript ProBio

- Pharmaceutical Product Development, LLC

- Charles River Laboratories

- WuXi AppTec

- Merck & Co., Inc.

- Thermo Fisher Scientific Inc.

- Dalton Pharma Services

- Oncodesign Services

- Jubilant Biosys

- DiscoverX Corp.

- QIAGEN

- Eurofins SE

- Syngene International Limited

- Reddy Laboratories Ltd.

- Pharmaron Beijing Co., Ltd.

- TCG Lifesciences Pvt Ltd.

- Domainex Ltd.

- Other Key Players

Recent Development

- In January 2022: Boehringer Ingelheim and Evotec worked on a drug development collaboration which was focusing on iPSC-based disease modeling for ophthalmologic illnesses.

- In October 2022: Verge Genomics is a biotechnology company that has reached the clinical stage and uses technology to enable drug discovery. It announced the dosing of the first subject in the Phase 1 clinical trial for VRG50635.

- In October 2022: Topline results from the CATALINA Phase 2 Trial of NGM621 in patients with geographic atrophy (GA) caused by age-related macular degeneration were released by NGM Bio.

Report Scope:

Report Features Description Market Value (2022) USD 26.9 Bn Forecast Revenue (2032) USD 79.1 Bn CAGR (2023-2032) 11.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Process- Target Selection, Target Validation, Hit-To-Lead-Identification, Lead Optimization, Candidate Validation; By Drug Type- Small Molecules Drug, Biologics Drug; By Type- Chemistry Services, Biology Services; By Therapeutics Area- Respiratory System, Neurology, Oncology, Cardiology, Infectious and Immune System Diseases, Digestive System Diseases, and Other Therapeutic Area; By End User- Pharmaceutical and Biotechnology Companies, Academic Institutes, Manufacturing, and Other End-Users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Albany Molecular Research Inc., EVOTEC A.G., Laboratory Corporation of America Holdings, GenScript ProBio, Pharmaceutical Product Development, LLC, Charles River Laboratories, WuXi AppTec, Merck & Co., Inc., Thermo Fisher Scientific Inc., Dalton Pharma Services, Oncodesign Services, Jubilant Biosys, DiscoverX Corp., QIAGEN, Eurofins SE, Syngene International Limited, Dr. Reddy Laboratories Ltd., Pharmaron Beijing Co., Ltd., TCG Lifesciences Pvt Ltd., Domainex Ltd., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Albany Molecular Research Inc.

- EVOTEC SE

- Laboratory Corporation of America Holdings

- GenScript ProBio

- Pharmaceutical Product Development, LLC

- Charles River Laboratories

- WuXi AppTec

- Merck & Co., Inc.

- Thermo Fisher Scientific Inc.

- Dalton Pharma Services

- Oncodesign Services

- Jubilant Biosys

- DiscoverX Corp.

- QIAGEN

- Eurofins SE

- Syngene International Limited

- Reddy Laboratories Ltd.

- Pharmaron Beijing Co., Ltd.

- TCG Lifesciences Pvt Ltd.

- Domainex Ltd.

- Other Key Players