Global Drone Payload Market By Type (EO/IR, Cameras, Search and Rescue, Signal Intelligence, Electronics Intelligence, Communication Intelligence, Maritime Patrol Radar, Laser Sensors, CBRN Sensors, Optronics), By End-User(Defense, Commercial), By Application(Mapping and Surveying, Photography, Monitoring, Intelligence, Surveillance and Reconnaissance, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

8697

-

July 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

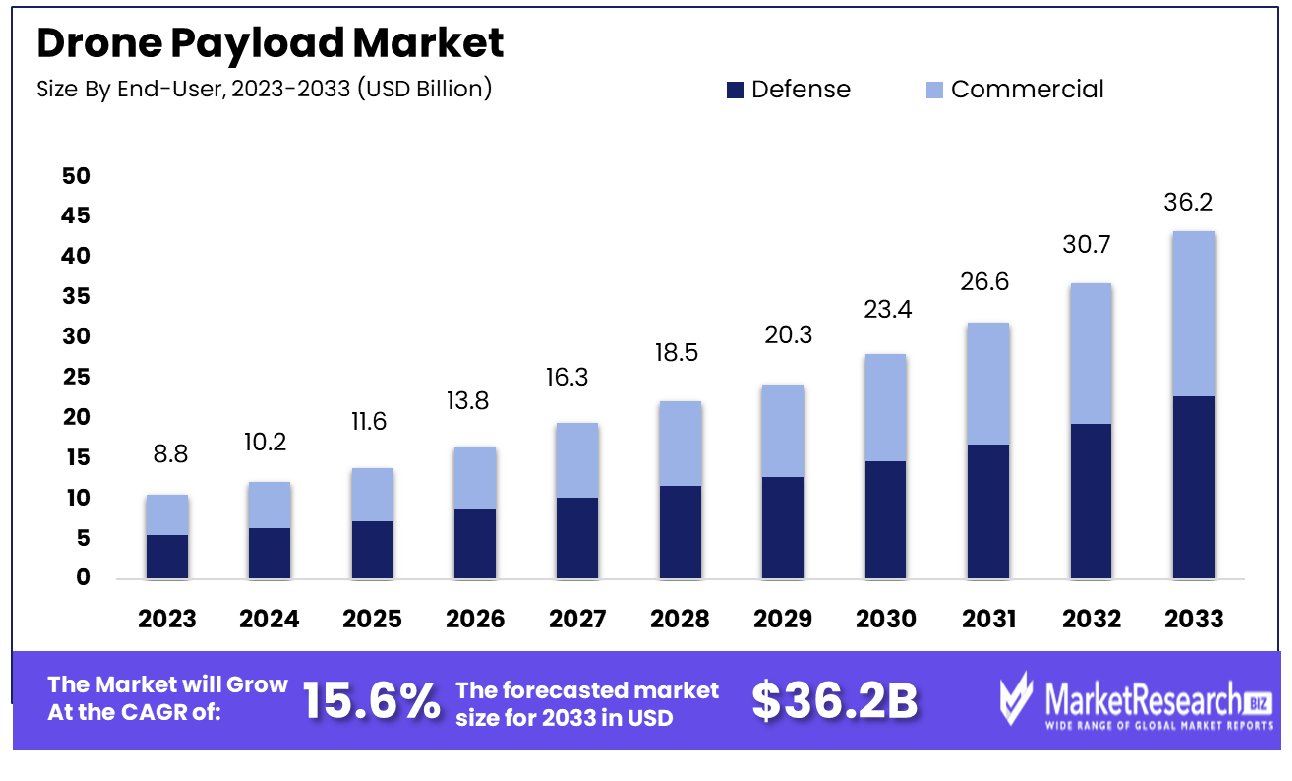

The Global Drone Payload Market was valued at USD 8.8 billion in 2023. It is expected to reach USD 36.2 billion by 2033, with a CAGR of 15.6% during the forecast period from 2024 to 2033.

The drone payload market encompasses the various sensors, cameras, and communication technologies affixed to unmanned aerial vehicles (UAVs) to enhance their operational capabilities. This market is pivotal in sectors such as defense, agriculture, and environmental monitoring, where the payloads not only gather critical data but also execute complex processing tasks.

As technological advancements proliferate, the market is expected to expand, driven by the growing demand for sophisticated imaging, increased payload capacities, and enhanced data processing abilities. The strategic incorporation of these advanced payloads enables enterprises and defense bodies to achieve significant efficiencies and operational enhancements.

The drone payload market is positioned for substantial growth, catalyzed by burgeoning applications across multiple sectors including defense, agriculture, and surveillance. In 2020, the market was valued at $7.2 billion, and it is projected to burgeon to $33.3 billion by 2030, demonstrating a robust compound annual growth rate (CAGR) of 16.9% from 2021 to 2030. This upward trajectory is underpinned by the escalating incorporation of advanced technologies within drone payloads, which significantly augment the functional capabilities of drones.

The enhancement of payload capacities is a critical factor propelling this market. For instance, the MQ-9A Reaper drone boasts a substantial payload capacity of approximately 1,746 kg (3,850 lbs), which enables it to perform a range of complex missions, from tactical strikes to reconnaissance and surveillance. Conversely, on the commercial front, drones like the DJI AGRAS T40, with a payload capacity of 50 kg (110 lbs), are revolutionizing agricultural practices through high-efficiency crop spraying and monitoring.

The market’s expansion is further fueled by continuous technological advancements that are making drone payloads lighter, more powerful, and more energy-efficient. These innovations not only enhance the performance and versatility of drones but also expand their potential applications. As a result, drones are increasingly becoming integral to operations in sectors that require high precision and reliability. Enterprises and defense organizations leveraging these advanced drone capabilities are positioned to gain significant competitive advantages, underscoring the strategic importance of investments in this rapidly evolving market segment.

Key Takeaways

- Market Growth: The Global Drone Payload Market was valued at USD 8.8 billion in 2023. It is expected to reach USD 36.2 billion by 2033, with a CAGR of 15.6% during the forecast period from 2024 to 2033.

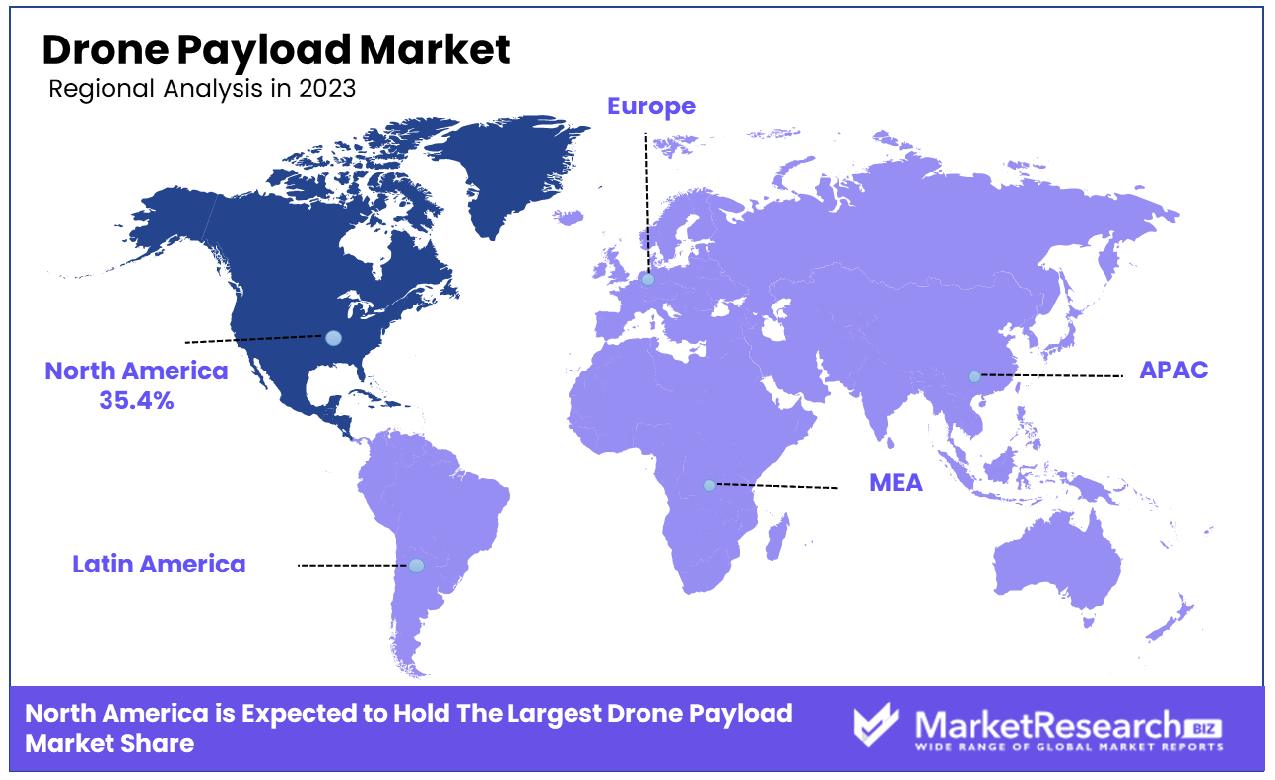

- Regional Dominance: North America Leads Drone Payload Market with 35.4% Share.

- By Type: EO/IR dominates drone payload types with a 22.4% market share.

- By End-User: Defense leads as the primary end-user, capturing 70.1% of the market.

- By Application: Intelligence applications lead at 25.3% in drone payload use.

Driving factors

Expanded Utilization Across Multiple Domains

The increased adoption of drones for commercial, military, and recreational uses is a primary driver fueling the growth of the drone payload market. This diversification in usage scenarios extends the market's reach and intensifies the demand for specialized payloads.

Commercially, drones are becoming indispensable in industries such as agriculture for crop monitoring and in real estate for aerial photography. Militarily, they are crucial for surveillance, tactical operations, and border security. Recreational uses, though smaller in scale, also contribute to broader market penetration and innovation, supporting continuous growth.

Technological Advancements in Payloads

Advancements in sensor and imaging technologies are significantly enhancing drone capabilities, which in turn drives market expansion. Modern drones are equipped with payloads that offer high-resolution imaging, thermal sensing, and multi-spectral cameras, all of which are becoming more sophisticated and cost-effective.

These technological improvements not only increase the efficiency and effectiveness of drones but also open new avenues for their application. For instance, enhanced imaging technology is critical for detailed geographical surveys and infrastructure inspections, thereby broadening the scope of drone applications.

Demand Surge in Critical Operations

The growing demand for drones in key areas such as surveillance, agriculture, and disaster management catalyzes the development of the drone payload market. In surveillance, drones equipped with advanced payloads offer unparalleled advantages in terms of real-time monitoring and situational awareness. In agriculture, drones optimize resource use and improve crop yields through precision farming techniques.

During disaster management, drones play a pivotal role in damage assessment and in coordinating response efforts. The critical nature of these applications underscores the importance of robust and versatile drone payloads, promoting sustained market growth.

Restraining Factors

Regulatory and Safety Constraints

Regulatory and safety concerns regarding drone operations significantly impact the drone payload market. As drones become more prevalent in both urban and sensitive environments, regulatory bodies worldwide are imposing stricter guidelines to ensure safe and responsible usage. These regulations often limit the type of payloads that can be carried, the environments in which drones can operate, and the specific applications for drone technology.

For instance, certain jurisdictions may restrict the use of drones for surveillance purposes, impacting the demand for related high-capacity imaging payloads. Additionally, safety concerns, such as the risk of collisions or malfunctions, further compel manufacturers to invest in safety technologies, potentially slowing market growth due to increased costs and extended development periods.

Technical Integration and Performance Challenges

Technical challenges related to payload integration and drone performance also restrain the drone payload market. Integrating advanced sensors and imaging equipment without compromising the drone’s performance—such as flight duration and maneuverability—presents significant engineering challenges.

Heavier or more complex payloads can reduce operational efficiency and require more robust power sources, which may not always be feasible or cost-effective. Furthermore, ensuring compatibility between different types of drones and their respective payloads necessitates ongoing research and development, incurring additional costs and potentially delaying product launches. These technical hurdles must be addressed to fully realize the potential of drone technologies and expand market reach.

By Type Analysis

EO/IR payloads dominate the drone market, holding a 22.4% share by type.

In 2023, EO/IR (Electro-Optical/Infrared) systems held a dominant market position in the "By Type" segment of the Drone Payload Market, capturing more than a 22.4% share. This leadership can be attributed to the extensive application of EO/IR systems across various operational settings, including military, surveillance, and environmental monitoring. As these systems provide critical capabilities for real-time, high-quality imaging and target tracking, their demand has surged, particularly in sectors requiring precise and reliable observational data.

The drone payload landscape also features other significant segments, including cameras, which are essential for both commercial and recreational drone applications due to their versatility in capturing visual data. Search and Rescue (SAR) operations leverage specific payload technologies like thermal imaging to enhance efficiency and response times during missions. Signal Intelligence (SIGINT), Electronic Intelligence (ELINT), and Communication Intelligence (COMINT) payloads are increasingly adopted for defense and intelligence operations, where they play a pivotal role in information gathering and threat assessment.

Maritime Patrol Radars and Laser Sensors also form crucial components of the market, particularly in maritime security and topographical mapping. Meanwhile, Chemical, Biological, Radiological, and Nuclear (CBRN) sensors are gaining traction in response to rising global security concerns, underpinning their development and integration into drone technologies. Optronics, combining optical and electronic technologies, further extends the capabilities of drones, enhancing their utility in complex environments.

These segments collectively underscore the diverse technological integration within the Drone Payload Market, driven by advancing capabilities and widening application spectra. The robust position of EO/IR systems highlights their indispensable role in modern aerial operations, anchoring the market's growth trajectory as industries continue to explore and expand the frontiers of drone technology.

By End-User Analysis

Defense emerges as the primary end-user in the drone payload sector, dominating at 70.1%.

In 2023, Defense held a dominant market position in the "By End-User" segment of the Drone Payload Market, capturing more than a 70.1% share. This substantial market share is driven by heightened global military spending and the increasing adoption of unmanned systems for defense and security applications. Drones equipped with advanced payloads have become integral components of modern military operations, offering capabilities ranging from surveillance and reconnaissance to combat and logistics support, thereby enhancing operational effectiveness while reducing risks to personnel.

The Commercial sector, constituting the other significant segment of the market, has also seen robust growth. Commercial drones are extensively used in agriculture for crop monitoring, in real estate for aerial photography, and infrastructure for inspection and maintenance. The diversification of drone applications in the commercial domain is spurred by continuous technological advancements and regulatory developments that facilitate broader commercial use.

The stark contrast in market share between these two segments highlights the current focus on drone payload technology development and deployment. Defense applications not only demand high specificity and reliability in challenging environments but also drive the technological innovation that gradually trickles down to commercial uses. As drone technologies evolve, the potential for increased market penetration in commercial applications exists, particularly as businesses seek to leverage drones for cost reduction and efficiency improvements.

Overall, the Drone Payload Market is characterized by a strong defense sector presence, underpinning the market's dynamics and future growth prospects. However, the expanding utility and application areas in the commercial sector are expected to provide new growth avenues, balancing the market's composition over time.

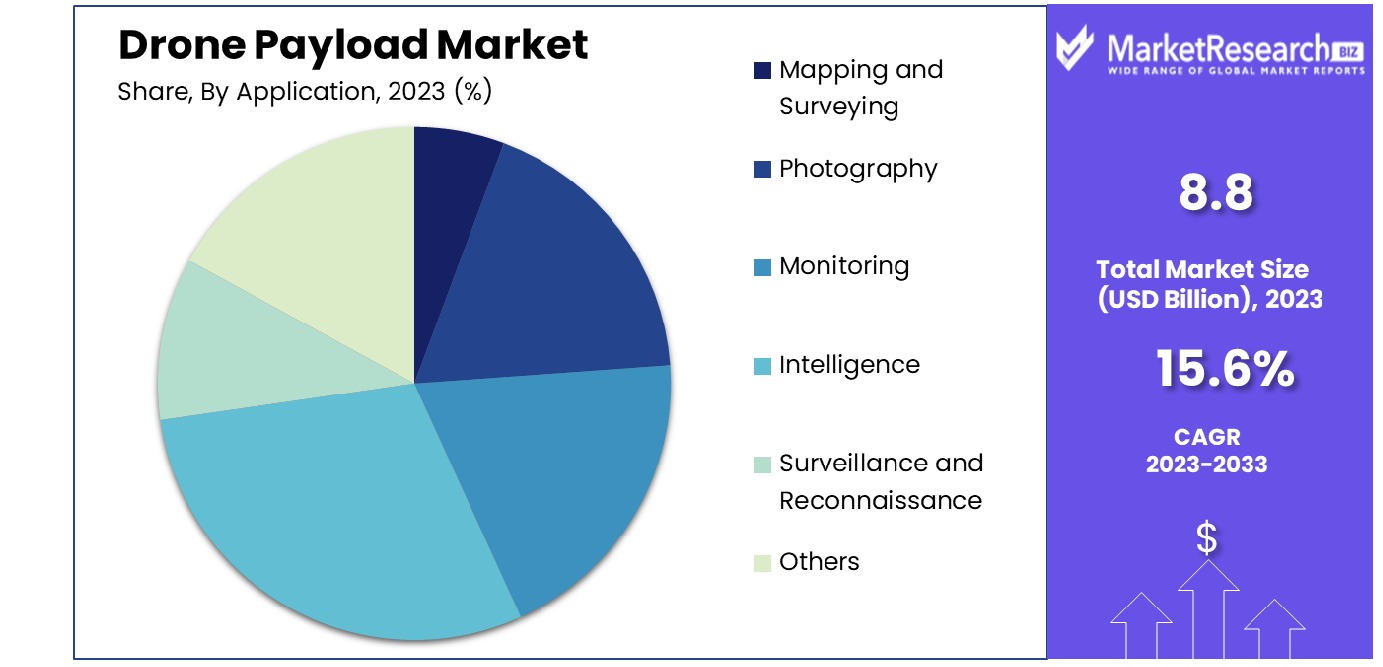

By Application Analysis

Intelligence applications lead in drone payload use, accounting for 25.3% of the market.

In 2023, Intelligence held a dominant market position in the "By Application" segment of the Drone Payload Market, capturing more than a 25.3% share. This prominent positioning reflects the growing strategic importance of intelligence applications in both civilian and military domains. Drones equipped with specialized payloads for intelligence tasks are crucial for gathering, analyzing, and disseminating actionable insights, thereby enhancing decision-making processes across various sectors.

Other key segments within this market include Surveillance and Reconnaissance, which closely aligns with intelligence applications, primarily in defense and security operations. These drones are vital for continuous monitoring of areas of interest, often in real-time, providing critical data for situational awareness and operational planning. Mapping and Surveying applications also hold a significant share, driven by the need for precise geospatial data in urban planning, construction, and environmental management.

Photography remains a robust segment, particularly in the media, real estate, and tourism industries, where high-quality aerial imagery is essential. Monitoring applications are increasingly prevalent in environmental and agricultural settings, where drones monitor climate conditions, crop health, and wildlife populations. The "Others" category encompasses emerging applications such as cargo delivery and communication relay, highlighting the market's dynamic nature and potential for innovation.

Collectively, these segments underscore the versatility and expanding utility of drone technologies. As payloads become more sophisticated and integrated, the capabilities of drones expand, opening new avenues for application and market growth. The strong foothold of intelligence applications showcases the pivotal role of advanced data acquisition and analysis in leveraging drone technology to its full potential.

Key Market Segments

By Type

- EO/IR

- Cameras

- Search and Rescue

- Signal Intelligence

- Electronics Intelligence

- Communication Intelligence

- Maritime Patrol Radar

- Laser Sensors

- CBRN Sensors

- Optronics

By End-User

- Defense

- Commercial

By Application

- Mapping and Surveying

- Photography

- Monitoring

- Intelligence

- Surveillance and Reconnaissance

- Others

Growth Opportunity

Multi-Purpose Payload Innovation

The development of multi-purpose payloads represents a significant opportunity for the global drone payload market in 2023. These versatile payloads are designed to perform multiple functions, reducing the need for operators to invest in multiple specialized units. By integrating various capabilities—such as high-resolution cameras, thermal imaging, and environmental sensors—into a single payload, manufacturers can offer solutions that are not only cost-effective but also highly adaptable to diverse operational needs.

This innovation caters to sectors like agriculture, where drones can simultaneously perform soil analysis, crop monitoring, and irrigation management, significantly enhancing the appeal and utility of drone technologies in the market.

Market Expansion in Emerging Economies

Emerging markets present a substantial growth opportunity for the drone payload market, particularly in regions with less stringent regulations. These markets, often characterized by rapid technological adoption and high demand for innovative solutions, provide fertile ground for the expansion of drone services. In countries where regulatory frameworks are still developing, there is a unique window to establish market presence and influence local regulatory developments.

This strategic expansion not only broadens the geographic footprint of drone companies but also allows them to tap into new industries and applications, ranging from disaster response in remote areas to infrastructure development in fast-growing urban centers. The less-regulated environment in these regions offers a pathway for faster deployment and potential market dominance.

Latest Trends

Integration of Artificial Intelligence in Payload Operations

The integration of artificial intelligence (AI) in drone payload operations is a transformative trend reshaping the global drone payload market in 2023. AI technologies enable drones to operate autonomously, making complex decisions without human intervention. This capability significantly enhances the efficiency and effectiveness of drone applications, from precision agriculture to advanced surveillance systems.

AI-driven payloads can analyze data in real time, optimizing routes and tasks based on environmental variables and mission objectives. This not only maximizes the operational capabilities of drones but also opens up new possibilities for their use in intricate scenarios like emergency response and traffic monitoring, where real-time data and adaptive responses are crucial.

Adoption of Thermal and Multispectral Sensors

The rising use of thermal and multispectral sensors in ecological and agricultural assessments is another prominent trend in the drone payload market. These sensors play a pivotal role in monitoring environmental changes and managing agricultural practices. Thermal sensors are crucial for detecting heat variations that are indicative of various ecological phenomena, such as forest fires or wildlife movements.

Meanwhile, multispectral sensors provide vital data on plant health by capturing light across different wavelengths, which is invaluable for precision farming. The ability to gather detailed, actionable insights about the environment and crop health helps stakeholders make informed decisions, enhancing productivity and sustainability. The increasing demand for environmental and agricultural intelligence is expected to continue driving the adoption of these advanced sensors in the drone payload market.

Regional Analysis

North America Leads Drone Payload Market with Dominant 35.4% Share in Global Industry

The global drone payload market exhibits significant regional diversification with North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America all contributing to its dynamic landscape. North America dominates the market with a share of 35.4%, underpinned by robust technological advancements and substantial government and private sector investment in drone technology. The region's leadership is further bolstered by a strong presence of key industry players and early adoption in both commercial and military sectors.

Europe follows, with a well-established drone market driven by increasing applications in agricultural and environmental monitoring. The region's strict regulatory framework for drone operations ensures high safety standards and innovation in drone payload technologies.

Asia Pacific is experiencing rapid growth due to expanding industrial sectors and rising acceptance of drones for commercial uses. Countries like China and Japan are at the forefront, integrating drone technologies into everything from logistics to disaster management, significantly boosting the regional market.

The Middle East & Africa region, though smaller in comparison, is witnessing growing interest in drone technology, particularly for security and infrastructure monitoring purposes. Investments in smart city projects and oil and gas monitoring are likely to further propel the market.

Latin America, while still an emerging market, shows potential for growth with the increasing use of drones in agriculture and surveying. The region’s developing regulatory landscape and economic conditions will play a critical role in shaping its market trajectory.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global drone payload market will be significantly shaped by the strategic initiatives and technological advancements of key players. Companies such as Lockheed Martin Corporation and Northrop Grumman Corporation are at the forefront, leveraging their robust defense-oriented technologies to enhance drone payloads with advanced surveillance capabilities and increased payload capacities. These enhancements are crucial for maintaining their competitive edge in both national defense and commercial markets.

AeroVironment, Inc. and Elbit Systems Ltd. continue to innovate in the realm of lightweight and efficient payloads suitable for a wide range of applications from agricultural to military uses. Their focus on integrating cutting-edge sensors and imaging technologies allows them to meet the growing demand for precision in drone operations.

BAE Systems plc and Thales Group are heavily invested in the development of next-generation drone technologies, including AI-enhanced payloads that offer autonomous capabilities, which are becoming increasingly important in complex operational environments. Their commitment to innovation is pivotal in driving the adoption of drones across new and existing markets.

Israel Aerospace Industries Ltd. and Parrot S.A. cater to niche segments, with the former focusing on tactical UAVs and the latter on consumer drones. Their targeted approaches allow them to capture specific market needs and adapt quickly to changing technological landscapes.

Lastly, SZ DJI Technology Co., Ltd. and 3D Robotics, Inc. are key players in the commercial and hobbyist sectors. DJI’s dominance in commercial drone technologies and 3D Robotics’ focus on accessible, user-friendly technology underscore the diverse applications of drone payloads, from entertainment to enterprise solutions. Collectively, these companies not only drive technological advancement but also shape regulatory and market trends within the global drone payload landscape.

Market Key Players

- Lockheed Martin Corporation

- AeroVironment, Inc.

- Elbit Systems Ltd.

- BAE Systems plc

- Northrop Grumman Corporation

- Thales Group

- Israel Aerospace Industries Ltd.

- Parrot S.A.

- SZ DJI Technology Co., Ltd.

- 3D Robotics, Inc.

Recent Development

- In February 2024, Lockheed Martin Corporation unveiled a new drone payload system designed to enhance surveillance capabilities for military drones. This system features advanced imaging and data processing technologies, which the company predicts will increase the effectiveness of reconnaissance missions by 40%.

- In December 2023, Northrop Grumman Corporation announced a significant investment of $100 million in December 2023 to develop a next-generation surveillance payload that incorporates artificial intelligence for real-time threat analysis. This investment aims to position Northrop Grumman at the forefront of AI-integrated drone technologies, with a projected increase in payload efficiency by up to 30%.

- In October 2023, BAE Systems plc launched a new electromagnetic sensor payload designed for maritime patrol drones. This new product allows for the detection of submerged submarines and surface vessels, addressing the growing need for maritime security solutions. BAE anticipates a 15% growth in demand from naval forces globally.

Report Scope

Report Features Description Market Value (2023) USD 8.8 Billion Forecast Revenue (2033) USD 36.2 Billion CAGR (2024-2032) 15.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (EO/IR, Cameras, Search and Rescue, Signal Intelligence, Electronics Intelligence, Communication Intelligence, Maritime Patrol Radar, Laser Sensors, CBRN Sensors, Optronics), By End-User(Defense, Commercial), By Application(Mapping and Surveying, Photography, Monitoring, Intelligence, Surveillance and Reconnaissance, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Lockheed Martin Corporation, AeroVironment, Inc., Elbit Systems Ltd., BAE Systems plc, Northrop Grumman Corporation, Thales Group, Israel Aerospace Industries Ltd., Parrot S.A., SZ DJI Technology Co., Ltd., 3D Robotics, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Lockheed Martin Corporation

- AeroVironment, Inc.

- Elbit Systems Ltd.

- BAE Systems plc

- Northrop Grumman Corporation

- Thales Group

- Israel Aerospace Industries Ltd.

- Parrot S.A.

- SZ DJI Technology Co., Ltd.

- 3D Robotics, Inc.