Global Digital Scent Technology Market By Hardware(E-nose, Scent Synthesizer), By Application(Smartphones, Smelling Screens, Music & Video Games, Explosives Detectors, Quality Control Hardware devices, Medical Diagnostic Hardware devices, Others), By End User(Military & Defense, Medical, Marketing, Environmental Monitoring, Entertainment, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48787

-

July 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

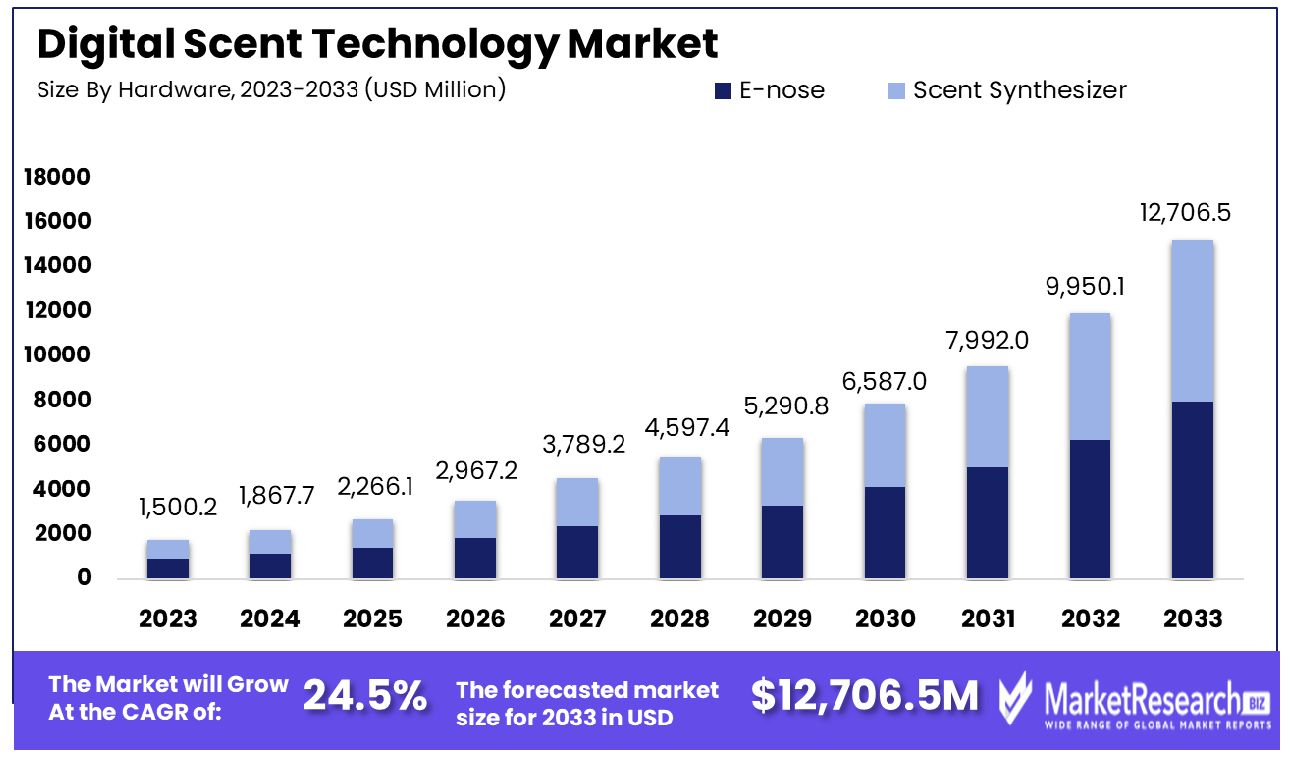

The Global Digital Scent Technology Market was valued at USD 1,500.2 Million in 2023. It is expected to reach USD 12,706.5 Million by 2033, with a CAGR of 24.5% during the forecast period from 2024 to 2033.

The Digital Scent Technology Market encompasses innovative solutions designed to simulate olfactory senses through electronic means, enabling the digital transmission and reception of scents. This technology is pivotal for industries such as virtual reality, gaming, marketing, and healthcare, offering enhanced user experiences by integrating scent into digital interactions.

The market’s growth is driven by advances in sensory technology and increasing consumer demand for immersive technology experiences. For executives and product managers, understanding the strategic implications of digital scent technology is essential for leveraging its potential in creating differentiated products and engaging customer experiences.

The Digital Scent Technology Market is poised for significant growth, driven by technological advancements and expanding applications across diverse sectors. This market primarily leverages electronic nose devices equipped with sensor arrays that detect and analyze odors, creating digital "fingerprints." These fingerprints enable the precise identification and replication of scents, an innovation that holds transformative potential for industries like virtual reality (VR) and augmented reality (AR). In these sectors, digital scent technologies are integrated to enhance immersive experiences by adding realistic odors, thus deepening user engagement and satisfaction.

Furthermore, the application of digital scent technology extends beyond entertainment, showing promising utility in the healthcare sector. Researchers are exploring its capabilities for early disease diagnosis through the detection of volatile organic compounds in patients' breath or urine. This could revolutionize diagnostic processes by enabling non-invasive, accurate, and early detection methods, potentially reducing the reliance on more cumbersome traditional diagnostic techniques.

As organizations seek to innovate and capture consumer interest, the integration of digital scent technology into products could serve as a key differentiator in the market. For industry leaders and product managers, the strategic incorporation of this technology could not only enhance customer experience but also open new avenues for product development and marketing strategies. In conclusion, the Digital Scent Technology Market represents a burgeoning field with substantial opportunities for growth and innovation, making it a critical area for investment and development in the coming years.

Key Takeaways

- Market Growth: The Global Digital Scent Technology Market was valued at USD 1,500.2 Million in 2023. It is expected to reach USD 12,706.5 Million by 2033, with a CAGR of 24.5% during the forecast period from 2024 to 2033.

- By Hardware: E-nose dominates the hardware segment with a substantial 55% market share.

- By Application: Explosives detectors lead the application segment, holding 25% of the market.

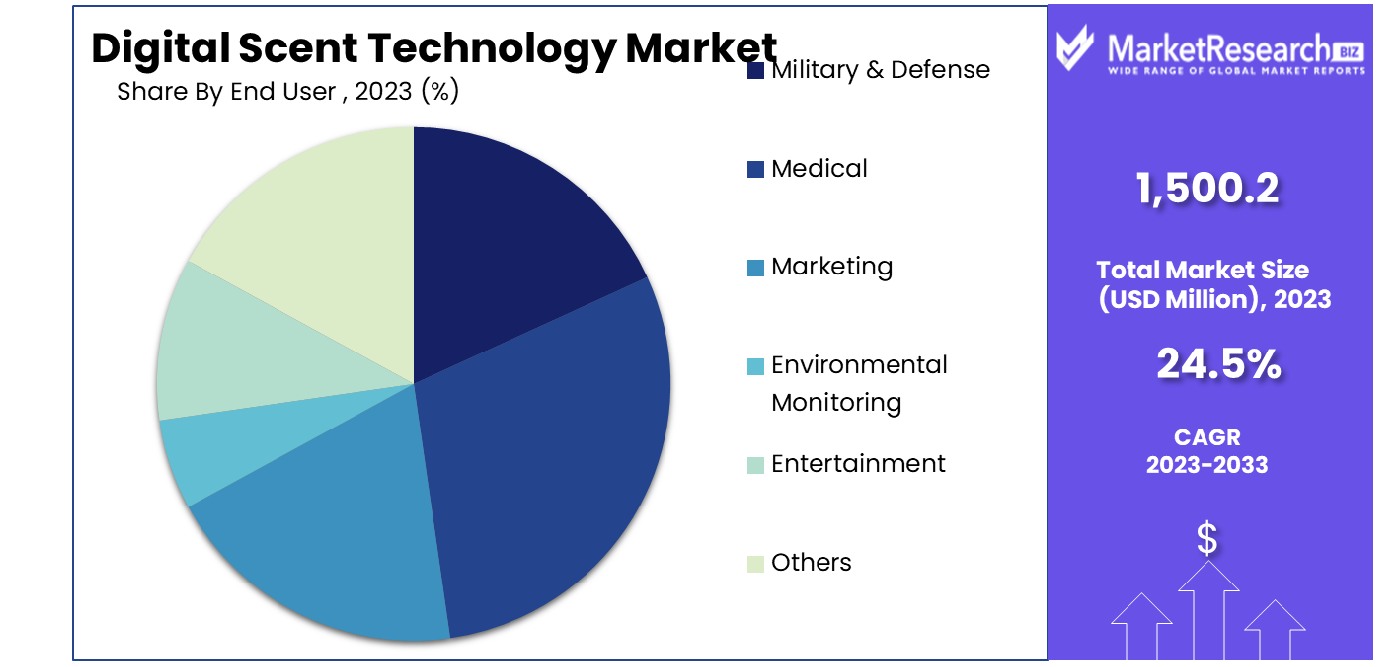

- By End User: The medical sector is the largest end-user, commanding a 25% share.

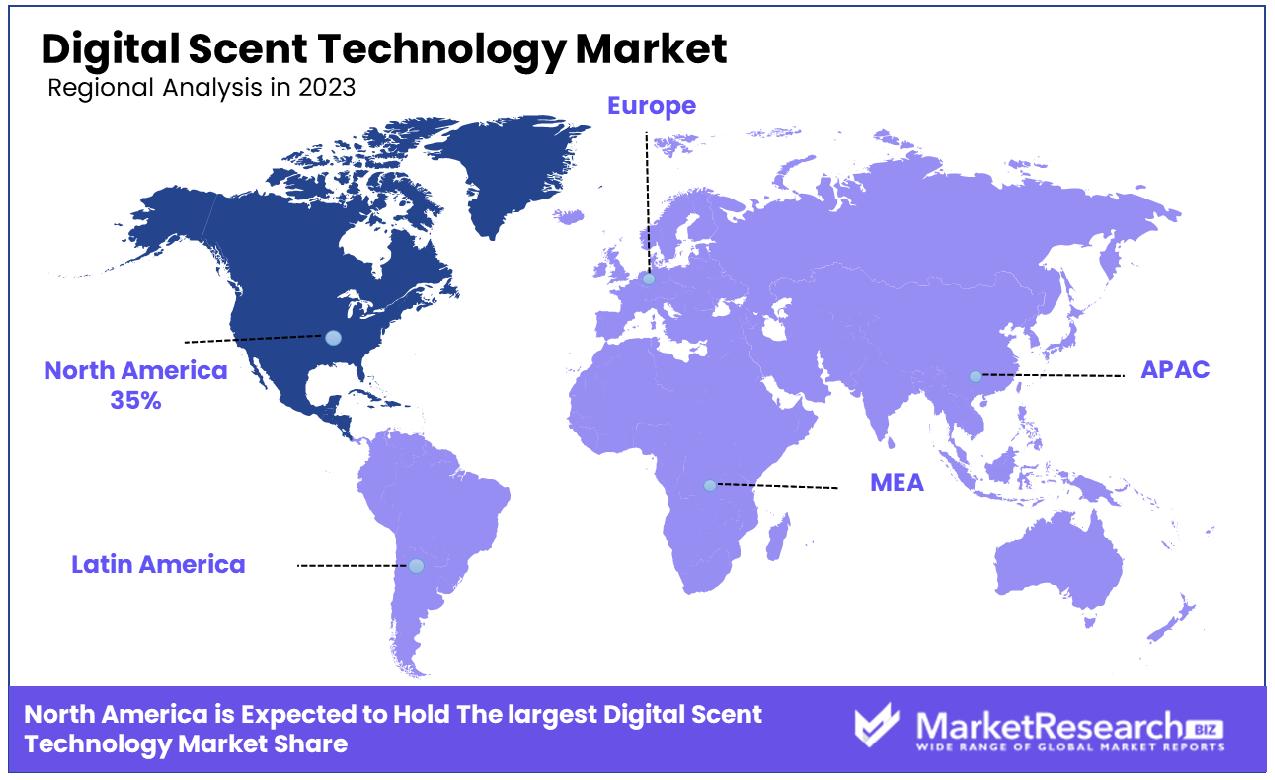

- Regional Dominance: North America leads the Digital Scent Technology Market with a 35% share.

Driving factors

Technological Evolution in VR and AR: Catalyzing Digital Scent Integration

Advancements in virtual reality (VR) and augmented reality (AR) technologies are pivotal driving factors for the Digital Scent Technology Market. These technologies aim to create more immersive experiences, and integrating scent has proven to significantly enhance the sense of presence and realism in virtual environments.

As VR and AR technologies become more sophisticated and widespread, the demand for complementary technologies like digital scents increases. For instance, in the gaming and entertainment industries, adding olfactory dimensions can transform user engagement, making experiences far more vivid and memorable.

Enhanced Consumer Engagement Through Sensory Marketing

The increasing application of digital scent technology in marketing and consumer experience enhancement is another significant growth driver. Brands are continuously seeking innovative ways to differentiate their products and create memorable customer interactions.

By incorporating scent, which is closely tied to emotion and memory, marketers can craft more impactful consumer touchpoints. For example, retail environments that utilize ambient scenting can influence consumer behavior, increase dwell times, and potentially boost sales, making the investment in digital scent technology highly attractive for businesses aiming to enhance customer experience.

Convergence with Wearable and Smart Home Devices

The integration of digital scent technology with wearable and smart home devices represents a growing trend that broadens the market's scope. Wearables that can emit personal scents or health-related alerts through olfactory signals, and smart home devices that enhance environmental ambiance or monitor safety by detecting hazardous gases, contribute to this sector’s expansion.

This integration not only enhances personal and home device utility but also opens up new avenues for health monitoring and environmental control, pushing the boundaries of how and where digital scent technology can be applied.

Restraining Factors

High Costs of Scent Synthesis and Delivery Technology

One of the primary restraining factors in the Digital Scent Technology Market is the high costs associated with scent synthesis and delivery systems. These technologies require significant investment in research and development to effectively capture and replicate a wide array of scents. Moreover, the mechanisms needed to deliver these scents in a controlled and user-specific manner often involve complex and costly hardware, such as advanced olfactometers and microencapsulation techniques.

These high initial costs can deter investment from companies, especially small and medium-sized enterprises that may find the cost-to-benefit ratio unattractive. The economic barrier also slows down the rate of market penetration and consumer adoption, as end products incorporating these technologies tend to be priced higher, limiting their accessibility to a broader audience.

Technical Challenges in Accurate Scent Reproduction

The technical challenges associated with accurately reproducing scents further compound the market's growth limitations. Scent is a highly subjective sense, and creating digital representations that are universally recognizable and appealing requires precise chemical analysis and synthesis capabilities. The difficulty in standardizing scent experiences across different devices and platforms can lead to inconsistent user experiences, thereby impacting consumer confidence and acceptance.

Furthermore, ensuring that these technologies are capable of operating efficiently and consistently over time without degradation of scent quality remains a significant hurdle, affecting the reliability and appeal of scent-enabled products. Together, these technical and economic challenges significantly influence the pace and direction of growth within the Digital Scent Technology Market.

By Hardware Analysis

The E-nose hardware dominates the market, holding a substantial 55% share in hardware segments.

In 2023, the E-nose held a dominant market position in the Hardware segment of the Digital Scent Technology Market, capturing more than a 55% share. This significant market share underscores the technology's pivotal role in applications ranging from quality control in the food and beverage industry to new developments in security and diagnostics. The E-nose's ability to analyze volatile organic compounds with precision has propelled its adoption across diverse sectors.

Simultaneously, the Scent Synthesizer sector, although smaller, demonstrated robust growth potential. With a focus on recreating complex odors, this technology finds critical application in virtual reality environments and consumer experience enhancements in retail and entertainment sectors. The integration of scent synthesizers with digital media offers a sensory dimension that enriches user engagement and opens new avenues for market expansion.

The competitive landscape in 2023 showed that key players are investing in research and development to enhance the accuracy and range of detectable scents. These innovations are aimed at expanding the practical applications of E-noses and scent synthesizers, thereby driving further market growth. Strategic partnerships and acquisitions are also shaping the market dynamics, as companies seek to leverage synergies to address the increasing demand for more sophisticated digital scent solutions.

By Application Analysis

Explosives detectors are the leading application, capturing 25% of the market in their category.

In 2023, Explosives Detectors held a dominant market position in the Application segment of the Digital Scent Technology Market, capturing more than a 25% share. This substantial market share is reflective of the heightened global emphasis on security measures in both public and private sectors. The utility of scent technology in detecting explosives at airports, train stations, and high-security buildings has been pivotal in preventing potential threats.

The sector of Smartphones, integrating digital scent technologies, is emerging as users seek more immersive experiences. Smelling Screens and enhancements in Music & Video Games are being increasingly adopted for interactive advertising and gaming, enhancing consumer engagement through multi-sensory experiences.

Quality Control Hardware devices also marked significant usage in industries such as food and beverage and manufacturing, where scent detection plays a crucial role in maintaining product standards. Meanwhile, Medical Diagnostic Hardware devices are gaining traction by facilitating the early detection of diseases through scent markers, which is expected to revolutionize healthcare diagnostics.

Other applications, while holding smaller shares, show promise in niche markets, providing innovative solutions to specialized problems. The competitive dynamics in this segment are driven by continuous advancements in technology and strategic alliances among key players, aiming to expand their technological capabilities and market reach.

By End User Analysis

In end-user segments, the medical sector emerges as the top user, also at 25%.

In 2023, the Digital Scent Technology market was segmented into several end-user categories, notably Military & Defense, Medical, Marketing, Environmental Monitoring, Entertainment, and Others. The Medical sector held a dominant position in this segmentation, capturing more than a 25% share. This substantial market share can be attributed to the increasing integration of digital scent technology in healthcare applications, including patient diagnostics and therapy. Innovations in this field are primarily driven by the need to enhance diagnostic accuracy and patient experience by incorporating olfactory elements into virtual reality simulations and patient care protocols.

The Military & Defense sector also represented a significant portion of the market. Digital scent technology in this sector is utilized for simulation training environments, enhancing the realism of training scenarios for personnel. In the Marketing segment, scent technology has been creatively used to enhance brand engagement through sensory marketing campaigns, aiming to deepen consumer connection and recall.

Environmental Monitoring saw an adoption of scent technology for detecting and analyzing pollutants and toxins, thereby contributing to real-time air quality monitoring systems. The Entertainment sector explored immersive experiences, utilizing scent to create a more engaging and realistic virtual environment.

The 'Others' category, which includes applications in food and beverage, education, and more, continues to explore potential uses of scent technology, suggesting a growing interest and diversification in the market.

Key Market Segments

By Hardware

- E-nose

- Scent Synthesizer

By Application

- Smartphones

- Smelling Screens

- Music & Video Games

- Explosives Detectors

- Quality Control Hardware devices

- Medical Diagnostic Hardware devices

- Others

By End User

- Military & Defense

- Medical

- Marketing

- Environmental Monitoring

- Entertainment

- Others

Growth Opportunity

Expanding Therapeutic Applications: A New Frontier for Digital Scent Technology

In 2023, the global Digital Scent Technology Market is poised to capitalize on significant growth opportunities, particularly through expansion into new applications such as healthcare. The therapeutic uses of scent have been recognized in clinical settings for enhancing patient outcomes, managing pain, and reducing anxiety through aromatherapy.

Leveraging digital scent technology in healthcare can revolutionize how these benefits are delivered, offering more precise and controlled scent dispersal, potentially integrated into telemedicine or home care settings. This approach not only broadens the market for digital scents but also aligns with the increasing demand for innovative, non-pharmacological treatment options in mental health and holistic care, thereby opening substantial new revenue streams within the healthcare sector.

Advancements in Compact and Efficient Scent Delivery Systems

Concurrently, the development of more compact and efficient scent delivery systems presents another substantial growth avenue. As technology advances, reducing the size and improving the efficiency of scent synthesizers and emitters can facilitate their integration into more consumer devices such as smartphones, wearables, and even automotive systems. This miniaturization effort would make the technology more accessible and practical for everyday use, expanding its applications beyond niche markets.

Such innovations could transform digital scent technology from a high-cost novelty into an essential feature in various consumer electronics, significantly enhancing user experience and satisfaction across multiple platforms. These developments are expected to drive considerable market growth, making digital scent technology a critical area for strategic investment in 2023.

Latest Trends

AI-Driven Innovations: Enhancing Scent Creation and Distribution

The 2023 landscape of the global Digital Scent Technology Market is witnessing a transformative trend with the emergence of AI-driven algorithms that enhance the creation and distribution of scents. These advanced algorithms enable the development of more nuanced and complex scent profiles by analyzing large datasets of fragrance formulas and consumer preferences. This AI integration not only streamlines the scent creation process but also facilitates personalized scent experiences, catering to individual preferences and enhancing consumer engagement.

Moreover, AI-driven systems can dynamically adjust scents based on real-time environmental data or user feedback, making digital scent technology more adaptable and responsive. This innovation represents a significant leap forward in making digital scent technology a more integrated part of the digital user experience, expanding its utility and appeal across various sectors.

Digital Scent Technology: Revolutionizing Online Shopping and Entertainment

Simultaneously, the increasing use of digital scent technology in online shopping and entertainment platforms is another prevailing trend shaping the market in 2023. As e-commerce and digital media consumption continue to grow, integrating sensory experiences like scent into these platforms offers a unique way to enhance user engagement and satisfaction. Online shopping, can provide a more immersive experience by allowing consumers to smell products before buying, which is particularly beneficial for items like perfumes, candles, or foods.

In entertainment, from movies to video games, incorporating scents adds a layer of realism and depth, making the virtual experiences more vivid and engaging. This integration of digital scent technology not only enriches the user experience but also opens new avenues for marketing and consumer interaction, signaling robust growth prospects for the market.

Regional Analysis

North America leads the Digital Scent Technology Market, holding a substantial 35% share of the global landscape.

North America dominates the market with a 35% share, driven by robust technological infrastructure and high consumer readiness to adopt new technologies. The region's leadership in innovative sectors such as healthcare, VR/AR, and consumer electronics significantly contributes to this advanced market integration. In Europe, the market is propelled by strong regulatory support for technology innovations and increasing applications in digital marketing and e-commerce, particularly in countries like Germany and the UK.

Asia Pacific is witnessing rapid growth due to its expanding digital user base and significant investments in smart devices and mobile technologies. Countries such as Japan, South Korea, and China are leading in regional market advancements, with their tech-savvy populations eagerly adopting enhanced digital experience platforms. The Middle East & Africa, though still an emerging market, shows potential due to increasing internet penetration and interest in advanced consumer technologies.

Latin America, while currently smaller in market size, is poised for growth influenced by improvements in digital infrastructure and growing interest in immersive technologies among its youthful demographics.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the Digital Scent Technology Market is characterized by a diverse array of key players, each contributing uniquely to the industry's growth and innovation. Companies like Alpha MOS in France and Aryballe Technologies, also in France, are at the forefront, leveraging their advanced sensor technologies to enhance digital olfactory capabilities. These firms are crucial in developing the nuanced electronic noses that find applications ranging from quality control in manufacturing to health diagnostics.

In the U.S., companies such as Electronic Sensor Technology and Sensigent are leading efforts to integrate scent technology with Internet of Things (IoT) applications, enhancing smart home systems and security systems with the ability to detect and analyze airborne compounds. Meanwhile, Aromajoin Corporation from Japan stands out for its innovative approach to creating scent recipes that can be digitally controlled and delivered, disrupting traditional industries like retail and entertainment.

European players such as The eNose Company from the Netherlands and Smiths Detection Group Ltd. from the U.K. focus on leveraging digital scent technology for safety and detection, emphasizing its utility in public health and safety. Similarly, OW Smell Made Digital in the Netherlands and SmartNanotubes Technologies GmbH in Germany are pioneering new pathways in consumer electronics and environmental monitoring, respectively.

Market Key Players

- Alpha MOS (France)

- Electronic Sensor Technology (U.S.)

- The eNose Company (Netherlands)

- Sensigent (U.S.)

- Aromajoin Corporation (Japan)

- AIRSENSE Analytics GmbH (Germany)

- Owlstone Inc. (U.K.)

- Smiths Detection Group Ltd. (U.K.)

- ScentSational Technologies LLC. (U.S.)

- Teledyne FLIR LLC (U.S.)

- Aryballe Technologies (France)

- Inhalio, Inc. (U.S.)

- E-Nose Pty Ltd (Australia)

- MUI Robotics Co., Ltd. (South Korea)

- OVR Technology (U.S.)

- Olorama Technology Ltd. (Spain)

- AerNos, Inc. (U.S.)

- OW Smell Made Digital (Netherlands)

- SmartNanotubes Technologies GmbH (Germany)

- Breathomix (Netherlands)

Recent Development

- In June 2023, Alpha MOS (France) company launched a new version of its electronic nose, designed to enhance sensory analysis capabilities in the food and beverage industry. This innovation aims to provide more accurate and faster results, which could revolutionize quality control processes within these sectors.

- In May 2024, Electronic Sensor Technology, located in the United States, secured a significant funding round aimed at advancing its digital scent technology for security applications. The company plans to utilize these funds to develop technologies that can detect explosives and narcotics with greater precision.

- In January 2024, Aromajoin Corporation from Japan launched a novel fragrance mixing technology called "Aroma Mixer." This device allows users to create and control scents digitally for various applications, including retail and personal wellness.

Report Scope

Report Features Description Market Value (2023) USD 1,500.2 Million Forecast Revenue (2033) USD 12,706.5 Million CAGR (2024-2032) 24.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Hardware(E-nose, Scent Synthesizer), By Application(Smartphones, Smelling Screens, Music & Video Games, Explosives Detectors, Quality Control Hardware devices, Medical Diagnostic Hardware devices, Others), By End User(Military & Defense, Medical, Marketing, Environmental Monitoring, Entertainment, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Alpha MOS (France), Electronic Sensor Technology (U.S.), The eNose Company (Netherlands), Sensigent (U.S.), Aromajoin Corporation (Japan), AIRSENSE Analytics GmbH (Germany), Owlstone Inc. (U.K.), Smiths Detection Group Ltd. (U.K.), ScentSational Technologies LLC. (U.S.), Teledyne FLIR LLC (U.S.), Aryballe Technologies (France), Inhalio, Inc. (U.S.), E-Nose Pty Ltd (Australia), MUI Robotics Co., Ltd. (South Korea), OVR Technology (U.S.), Olorama Technology Ltd. (Spain), AerNos, Inc. (U.S.), OW Smell Made Digital (Netherlands), SmartNanotubes Technologies GmbH (Germany), Breathomix (Netherlands) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Alpha MOS (France)

- Electronic Sensor Technology (U.S.)

- The eNose Company (Netherlands)

- Sensigent (U.S.)

- Aromajoin Corporation (Japan)

- AIRSENSE Analytics GmbH (Germany)

- Owlstone Inc. (U.K.)

- Smiths Detection Group Ltd. (U.K.)

- ScentSational Technologies LLC. (U.S.)

- Teledyne FLIR LLC (U.S.)

- Aryballe Technologies (France)

- Inhalio, Inc. (U.S.)

- E-Nose Pty Ltd (Australia)

- MUI Robotics Co., Ltd. (South Korea)

- OVR Technology (U.S.)

- Olorama Technology Ltd. (Spain)

- AerNos, Inc. (U.S.)

- OW Smell Made Digital (Netherlands)

- SmartNanotubes Technologies GmbH (Germany)

- Breathomix (Netherlands)