Global Digital Experience Platforms Market By Component(Platform, Services), By Deployment(On-premise, Cloud), By Application(Business-to-Consumer, Business-to-Business, Others), By End-use(Retail, BFSI, Healthcare, IT & Telecom, Manufacturing, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

45317

-

April 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

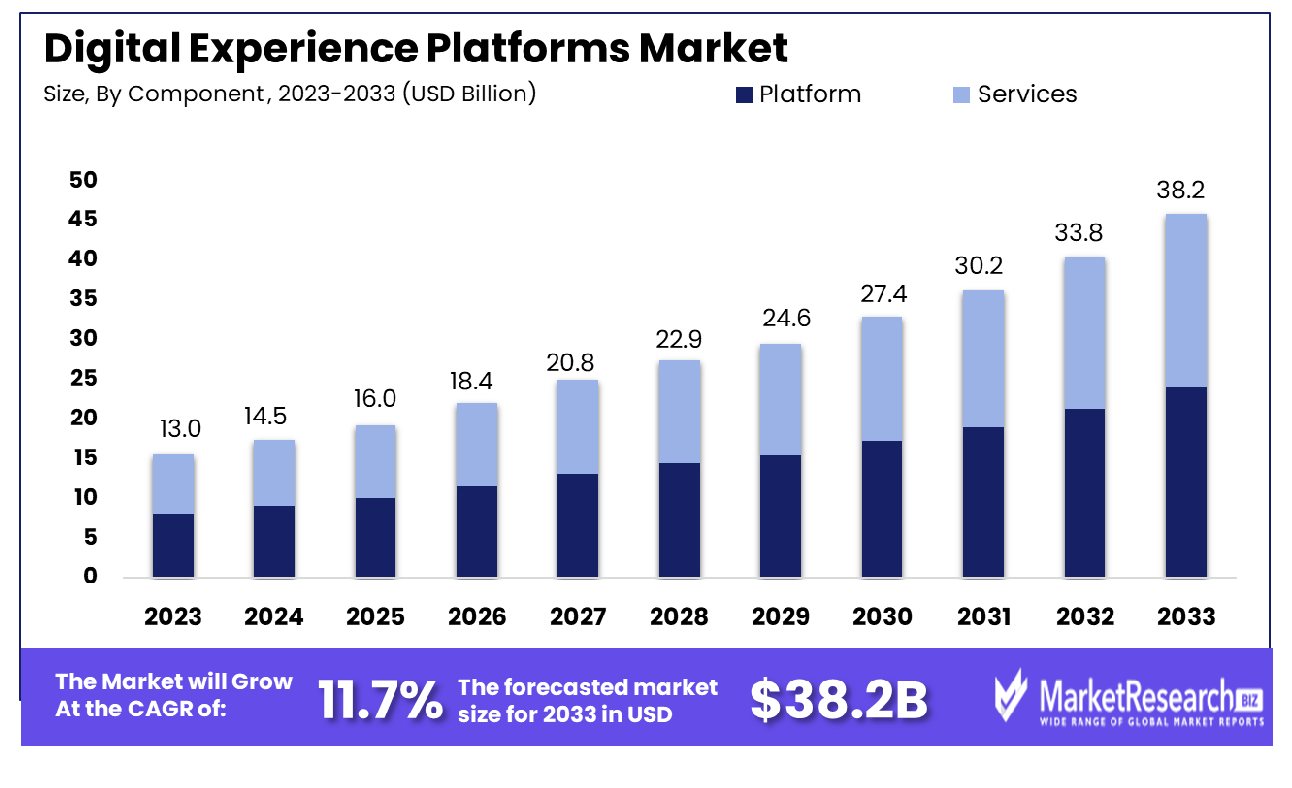

The Global Digital Experience Platforms Market was valued at USD 13.0 billion in 2023. It is expected to reach USD 38.2 billion by 2033, with a CAGR of 11.7% during the forecast period from 2024 to 2033.

The Digital Experience Platforms (DXP) Market refers to a dynamic ecosystem of integrated technologies designed to enhance customer interactions across digital channels. These platforms consolidate various tools, including content management systems, analytics, personalization engines, and marketing automation, to deliver seamless and personalized experiences.

As product manager, understanding the DXP landscape is crucial for orchestrating comprehensive digital strategies. DXPs empower organizations to drive engagement, foster brand loyalty, and optimize customer journeys, ultimately leading to enhanced conversion rates and revenue growth. Stay ahead in the competitive landscape by harnessing the potential of Digital Experience Platforms to meet evolving consumer expectations.

The Digital Experience Platforms (DXP) market continues to exhibit robust growth, driven by the increasing demand for seamless, personalized customer experiences across digital touchpoints. As businesses prioritize enhancing customer engagement and satisfaction, the adoption of DXP solutions emerges as a strategic imperative.

The convergence of various technologies, including content management, analytics, and omnichannel delivery, within DXP offerings, empowers organizations to create immersive digital experiences tailored to individual preferences. This trend aligns with the evolving expectations of consumers who seek cohesive interactions across the web, mobile, social media, and other digital platforms.

Supporting this viewpoint are the marketing automation statistics for 2022 and 2023, which reveal significant insights into industry trends. In 2023, email marketing emerged as the most automated channel, with 63% of marketers leveraging its capabilities. Moreover, a staggering 96% of marketers utilized marketing automation platforms, highlighting the widespread adoption of automation solutions across industries.

Studies underscore the transformative impact of marketing automation, indicating a substantial increase in qualified leads and improved sales pipeline contribution upon its implementation. Notably, the global market for martech and sales tech solutions reached an estimated value of $509.8 billion in 2022, underscoring the substantial investments directed toward enhancing digital marketing capabilities.

In conclusion, the Digital Experience Platforms market presents a lucrative opportunity for businesses to differentiate themselves through enhanced customer experiences. By leveraging DXP solutions in tandem with marketing automation technologies, organizations can position themselves for sustained growth and competitive advantage in an increasingly digital landscape.

Key Takeaways

- Market Growth: The Global Digital Experience Platforms Market was valued at USD 13.0 billion in 2023. It is expected to reach USD 38.2 billion by 2033, with a CAGR of 11.7% during the forecast period from 2024 to 2033.

- By Component: Platform dominance stands at 69.2%, a significant share in the component segment.

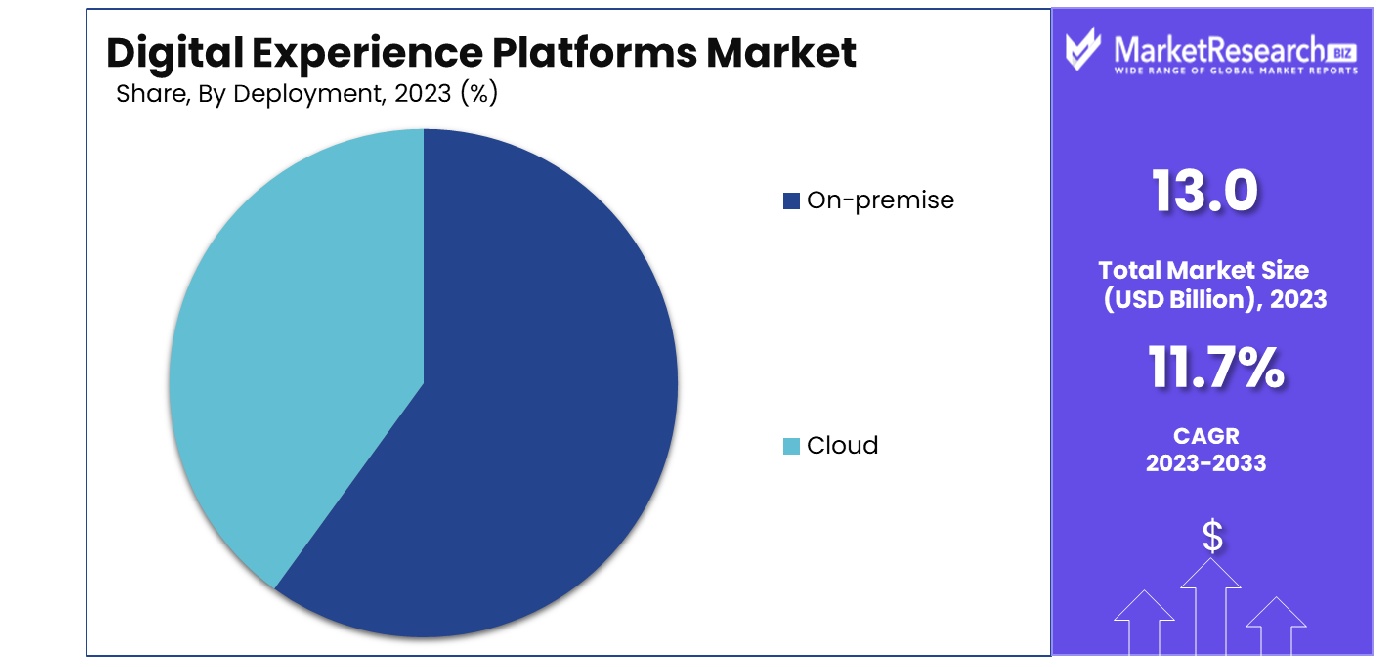

- By Deployment: On-premise deployment leads with 50.1%, reflecting a preference for localized systems.

- By Application: Business-to-Consumer applications dominate at 55.4%, indicating strong consumer-facing strategies.

- By End-use: Retail sector leads end-use with 29.3%, highlighting its pivotal role in market dynamics.

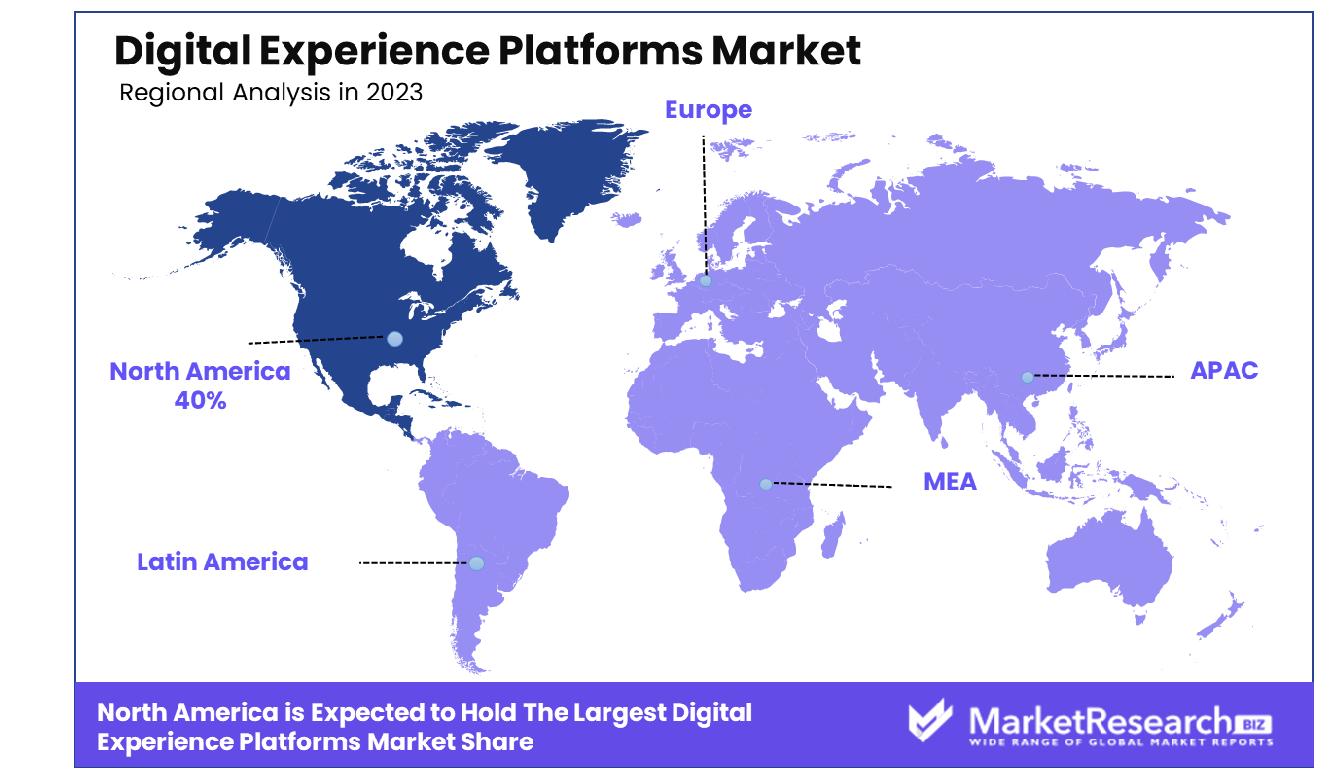

- Regional Dominance: North America holds a 40% share in the global Digital Experience Platforms market.

- Growth Opportunity: In 2023, the DXP market focuses on cloud-enabled, composable platforms for tailored digital solutions and emphasizes scalable, omnichannel experiences to enhance user engagement and operational efficiency.

Driving factors

Integration Challenges Impact Market Growth

Integration and business process issues during implementation significantly influence the growth trajectory of the Digital Experience Platforms (DXP) market. Enterprises often encounter complexities when integrating DXP solutions with existing systems and workflows. The intricate nature of integration demands substantial time, resources, and expertise, deterring some organizations from adopting DXP solutions.

Moreover, challenges in aligning DXP functionalities with diverse business processes can hinder seamless implementation. Despite the market's potential, these integration hurdles restrain adoption rates and stall market expansion.

Update Deployment Reluctance Stifles Market Growth

Reluctance in the deployment of updates poses a notable barrier to the advancement of the Digital Experience Platforms (DXP) market. While updates are crucial for enhancing security, performance, and feature offerings, some enterprises hesitate to implement them due to concerns over potential disruptions and compatibility issues.

This reluctance stagnates market growth by impeding the widespread adoption of the latest DXP capabilities. As a result, the market's growth trajectory is hindered, limiting its full potential.

Skills Gap Hinders DXP Market Expansion

The lack of a skilled workforce for operating DXP solutions constrains the growth of the Digital Experience Platforms (DXP) market. As the demand for DXP solutions rises, so does the need for professionals proficient in their implementation and management.

However, the scarcity of individuals with specialized DXP skills creates a bottleneck in market expansion. Enterprises face challenges in finding qualified personnel capable of maximizing the potential of DXP solutions. Consequently, the market growth is stifled by the shortage of skilled workforce, hindering its ability to reach its full market potential.

Restraining Factors

High Initial Investment Stifles Market Growth

The Digital Experience Platforms (DXP) market faces a significant hindrance due to the high initial investment required for development. Enterprises seeking to implement DXP solutions encounter substantial upfront costs associated with software licenses, infrastructure setup, customization, and integration.

This financial barrier impedes the entry of some businesses into the market, especially small and medium-sized enterprises (SMEs) with constrained budgets. Consequently, the market's growth potential is limited by the reluctance of certain organizations to make substantial financial commitments, thereby slowing overall market expansion.

Limited Supply Chain of Refurbished Products Restrains Market Growth

The Digital Experience Platforms (DXP) market experiences a restraint in growth due to the limited supply chain of refurbished products. While refurbished DXP solutions present a cost-effective alternative for budget-conscious enterprises, the availability of such products is often constrained. This limitation stems from factors such as the finite pool of pre-owned DXP licenses and the complexities involved in refurbishing and certifying software for resale.

As a result, businesses seeking refurbished DXP solutions may face challenges in sourcing reliable products, inhibiting their adoption and impeding market growth. Additionally, the limited supply chain of refurbished products exacerbates the financial burden on organizations, as they may be compelled to opt for new, more expensive DXP offerings. Consequently, the market's growth potential is constrained by the scarcity of refurbished options, hindering its ability to cater to a broader range of consumers and industries.

By Component Analysis

Platform dominates the market at 69.2% by component, showcasing its pivotal role in industry infrastructure.

In 2023, Platform held a dominant market position in the By Component segment of the Digital Experience Platforms (DXP) Market, capturing more than a 69.2% share. Platform Services within the DXP landscape represent a critical component, facilitating seamless integration, customization, and optimization of digital experiences across various touchpoints. These services encompass a wide array of functionalities, including content management, analytics, personalization, and e-commerce capabilities, among others.

The robust growth of Platform Services can be attributed to several factors. Firstly, the increasing demand for omnichannel experiences has driven organizations to adopt comprehensive DXP solutions that offer seamless integration across web, mobile, social media, and other digital channels. Platform Services play a pivotal role in enabling this integration by providing unified management and orchestration capabilities.

Additionally, the rising significance of customer-centric strategies has propelled the adoption of Platform Services, as organizations strive to deliver personalized and engaging digital experiences tailored to individual preferences and behaviors. The advanced analytics and AI-driven capabilities offered by Platform Services empower businesses to gather actionable insights, segment audiences effectively, and deliver targeted content and experiences, thereby enhancing customer satisfaction and loyalty.

Furthermore, the growing emphasis on agility and scalability has led organizations to prioritize flexible and scalable DXP solutions, driving the demand for Platform Services that can accommodate evolving business needs and rapidly changing market dynamics. The modular and extensible nature of Platform Services allows organizations to adapt and scale their digital experiences efficiently, ensuring long-term competitiveness and growth.

Looking ahead, the Platform Services segment is poised for continued growth, fueled by ongoing digital transformation initiatives across industries and the relentless pursuit of superior customer experiences. As organizations increasingly recognize the strategic importance of robust digital experience platforms, the demand for sophisticated Platform Services is expected to surge, further consolidating the Platform's dominant market position in the DXP landscape.

By Deployment Analysis

On-premise deployment holds sway at 50.1%, indicating a preference for localized data management solutions.

In 2023, On-premise held a dominant market position in the By Deployment segment of the Digital Experience Platforms (DXP) Market, capturing more than a 50.1% share. On-premise deployment refers to the traditional approach of hosting software and infrastructure within an organization's own data centers or servers, offering greater control, security, and customization options compared to cloud-based alternatives.

The significant market share of On-premise deployment can be attributed to several factors. Firstly, industries with stringent regulatory requirements or data privacy concerns, such as healthcare, finance, and government, often prefer On-premise deployment to maintain full control over their data and ensure compliance with regulatory standards.

Additionally, organizations with legacy systems or complex IT environments may opt for On-premise deployment to seamlessly integrate with existing infrastructure and applications, minimizing disruption and migration challenges.

Furthermore, On-premise deployment is favored by enterprises seeking maximum customization and flexibility in their DXP solutions. With On-premise deployment, organizations have the freedom to tailor the platform to their specific requirements, adapt workflows and processes as needed, and maintain full ownership of their digital experiences without reliance on third-party cloud providers.

By Application Analysis

Business-to-consumer applications lead significantly at 55.4%, reflecting consumer-centric digital strategies.

In 2023, Business-to-Consumer (B2C) held a dominant market position in the By Application segment of the Digital Experience Platforms (DXP) Market, capturing more than a 55.4% share. B2C applications of DXPs cater to businesses that directly interact with end consumers, delivering personalized and engaging digital experiences across various touchpoints such as websites, mobile apps, social media platforms, and e-commerce channels.

The substantial market share of B2C applications can be attributed to the relentless focus on customer experience and the growing expectations of consumers for seamless and immersive digital interactions. Organizations across industries, including retail, travel, hospitality, and entertainment, are prioritizing B2C DXPs to differentiate themselves in crowded markets, drive customer loyalty, and increase revenue opportunities through enhanced engagement and conversion rates.

Additionally, the proliferation of mobile devices, the rise of social media influencers, and the increasing trend of online shopping have further fueled the demand for B2C DXPs, as businesses seek to capitalize on these digital channels to reach and connect with their target audiences effectively.

However, while B2C applications dominate the DXP market, other segments such as Business-to-Business (B2B) and Others are also gaining prominence. B2B DXPs cater to organizations that engage in business transactions with other businesses, providing tools and functionalities tailored to the unique needs of B2B interactions, such as account-based marketing, lead generation, and partner collaboration.

By End-use Analysis

Retail emerges as the dominant end-use sector at 29.3%, underscoring its central position in market dynamics.

In 2023, Retail held a dominant market position in the By End-use segment of the Digital Experience Platforms (DXP) Market, capturing more than a 29.3% share. Retailers have increasingly recognized the pivotal role of DXPs in driving customer engagement, enhancing brand loyalty, and driving revenue growth through personalized and seamless digital experiences across various channels.

The significant market share of the Retail segment can be attributed to several factors. Firstly, the shift towards omnichannel retailing has propelled retailers to adopt robust DXPs that enable seamless integration and consistency across online and offline touchpoints, including websites, mobile apps, social media, and brick-and-mortar stores. By leveraging DXPs, retailers can create cohesive customer journeys that span multiple channels, thereby enhancing the overall shopping experience and driving conversion rates.

Moreover, the growing demand for personalized shopping experiences and real-time product recommendations has further accelerated the adoption of DXPs among retailers. Advanced analytics and AI-driven capabilities offered by DXPs enable retailers to gather valuable customer insights, segment audiences effectively, and deliver targeted content and promotions tailored to individual preferences and behaviors, thereby maximizing customer satisfaction and lifetime value.

However, while Retail dominates the DXP market in terms of end-users, other sectors such as Banking, Financial Services, Insurance (BFSI), Healthcare, IT & Telecom, Manufacturing, and Others are also witnessing significant adoption of DXPs. In the BFSI sector, for instance, DXPs are utilized to streamline customer onboarding, improve digital banking experiences, and deliver personalized financial advice.

Key Market Segments

By Component

- Platform

- Services

By Deployment

- On-premise

- Cloud

By Application

- Business-to-Consumer

- Business-to-Business

- Others

By End-use

- Retail

- BFSI

- Healthcare

- IT & Telecom

- Manufacturing

- Others

Growth Opportunity

Opportunities in Composable, Cloud-Enabled DXP Platforms

In 2023, the global Digital Experience Platforms (DXP) market is set to capitalize significantly from the development of cloud-enabled, composable DXP solutions. These platforms are designed to provide flexibility and scalability, enabling businesses to tailor digital experiences to their specific needs.

The shift towards composable DXPs allows organizations to selectively integrate various functionalities, such as e-commerce, content management, and customer relationship management, into a unified system that can evolve with changing business requirements. This approach not only enhances the adaptability of businesses but also reduces time-to-market for new initiatives, thereby driving growth in sectors that demand rapid digital innovation.

Empowering Omnichannel Experiences

Another substantial opportunity within the DXP market in 2023 lies in empowering omnichannel experiences. As consumer interactions span across multiple digital touchpoints, businesses are increasingly seeking DXPs that facilitate a seamless and consistent user experience. Scalable, low-complexity DXPs that prioritize value-driven outcomes are essential for businesses aiming to maintain competitive advantage.

These platforms enable the integration of advanced analytics and artificial intelligence to personalize user interactions and optimize customer journeys. The deployment of such technologies not only improves customer engagement but also drives operational efficiencies, contributing to the overall growth of the DXP market.

Latest Trends

Rise of Voice and Conversational AI Interfaces

The global Digital Experience Platforms (DXP) market has witnessed a significant transformation with the advent of voice and conversational AI interfaces in 2023. These technologies are increasingly being integrated into digital platforms to enhance interactive capabilities and personalize user interactions. The integration of voice and AI-driven conversational interfaces is not merely an enhancement of functionality but a pivotal shift in user engagement strategies.

This trend is driven by the growing consumer preference for voice-operated commands and the convenience they offer in navigating digital content. As a result, organizations are adopting these technologies to improve customer experience, increase accessibility, and drive user engagement, thereby expanding their market reach and competitive advantage.

Enhancement of User Experience (UX) Design Tools

Simultaneously, there has been a notable enhancement in User Experience (UX) design tools within the DXP market. The focus has shifted towards more sophisticated, intuitive design frameworks that enable creators to build more engaging and visually appealing digital experiences. Advanced UX tools are now incorporating AI to automate design processes and provide data-driven insights into user behavior.

This evolution is crucial as it allows for the creation of more personalized and contextually relevant user experiences. The enhancements in UX design tools are enabling businesses to optimize their digital interfaces, ensuring higher user satisfaction and retention rates. This trend underscores the importance of investing in cutting-edge UX technologies to maintain relevance and competitiveness in the rapidly evolving digital landscape.

Regional Analysis

North America commands a 40% share of the global Digital Experience Platforms (DXP) market.

North America, spearheaded by the United States, stands as a dominant force in the DXP market, commanding a substantial share of approximately 40%. This leadership position is underpinned by robust digital infrastructure, high internet penetration rates, and a matured digital ecosystem conducive to DXP adoption.

With key players like Adobe, Salesforce, and Oracle headquartered in the region, North America maintains a competitive edge, continuously innovating and driving technological advancements within the DXP sphere. Additionally, favorable government policies and investments in digital transformation initiatives further augment market growth.

In Europe, a burgeoning DXP market landscape is characterized by diverse adoption patterns across different sub-regions. Countries like the United Kingdom, Germany, and France exhibit significant traction, buoyed by the proliferation of e-commerce, digitalization initiatives, and evolving consumer behaviors. Despite facing regulatory complexities and data privacy concerns, Europe remains a pivotal market for DXP vendors, showcasing promising growth prospects fueled by increasing investments in omnichannel experiences and personalized customer engagement strategies.

The Asia Pacific region emerges as a hotspot for DXP adoption, propelled by rapid urbanization, expanding internet connectivity, and a burgeoning digital-savvy population. Countries such as China, India, Japan, and South Korea serve as key growth engines, witnessing a surge in digital transformation initiatives across various industries, including retail, BFSI, and healthcare.

Moreover, rising smartphone penetration rates and the advent of 5G technology fuel the demand for seamless digital experiences, positioning Asia Pacific as a lucrative market for DXP vendors seeking expansion opportunities.

In the Middle East & Africa (MEA) and Latin America, nascent but promising DXP markets are gradually gaining traction. Despite facing infrastructural challenges and economic uncertainties, these regions showcase untapped potential driven by increasing digitalization efforts, rising internet penetration, and a growing tech-savvy consumer base.

Strategic partnerships, government-led initiatives, and investments in digital infrastructure are poised to catalyze market growth in MEA and Latin America, offering fertile ground for DXP vendors to establish their presence and capitalize on emerging opportunities.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Digital Experience Platforms (DXP) market witnessed robust competition among key players, each vying for market share and dominance. Among the notable contenders, Acquia Inc., Adobe Inc., and Salesforce.com, Inc. emerged as pivotal forces shaping the landscape of digital experience solutions.

Acquia Inc., renowned for its cloud-based platform, continued to assert its influence with a comprehensive suite of services tailored to meet the evolving needs of enterprises. Leveraging open-source technologies, Acquia provided clients with scalable solutions, empowering them to deliver personalized digital experiences efficiently.

Adobe Inc., a stalwart in the digital experience arena, reinforced its position through innovative offerings spanning content management, analytics, and marketing automation. With a focus on seamless integration and advanced AI capabilities, Adobe's DXP solutions remained a top choice for organizations seeking unparalleled customer engagement.

Salesforce.com, Inc. solidified its presence as a leading provider of customer relationship management (CRM) solutions, extending its reach into the DXP market with robust offerings that emphasized seamless omnichannel experiences. With a strong emphasis on user-centric design and cloud-based architecture, Salesforce DXP solutions enabled businesses to drive meaningful interactions across every touchpoint.

Market Key Players

- Acquia Inc.

- ADOBE INC.

- International Business Machines Corporation

- Liferay, Inc.

- Microsoft Corporation

- Open Text Corporation

- Oracle Corporation

- Salesforce.com, Inc.

- SAP SE

- Sitecore

Recent Developement

- In November 2023, Republic Bank (Ghana) PLC appointed Manasseh Afoh as Chief Information Officer, enhancing strategic IT direction and technology management within the financial institution.

- In July 2023, AccelerateBS India, a digital technology services firm, launched an SME IPO to raise Rs 5.7 crore, including a fresh issuance of Rs 1.7 crore and an offer for sale.

Report Scope

Report Features Description Market Value (2023) USD 13.0 Billion Forecast Revenue (2033) USD 38.2 Billion CAGR (2024-2032) 11.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Platform, Services), By Deployment(On-premise, Cloud), By Application(Business-to-Consumer, Business-to-Business, Others), By End-use(Retail, BFSI, Healthcare, IT & Telecom, Manufacturing, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Acquia Inc., ADOBE INC., International Business Machines Corporation, Liferay, Inc., Microsoft Corporation, Open Text Corporation, Oracle Corporation, Salesforce.com, Inc., SAP SE, Sitecore Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Acquia Inc.

- ADOBE INC.

- International Business Machines Corporation

- Liferay, Inc.

- Microsoft Corporation

- Open Text Corporation

- Oracle Corporation

- Salesforce.com, Inc.

- SAP SE

- Sitecore