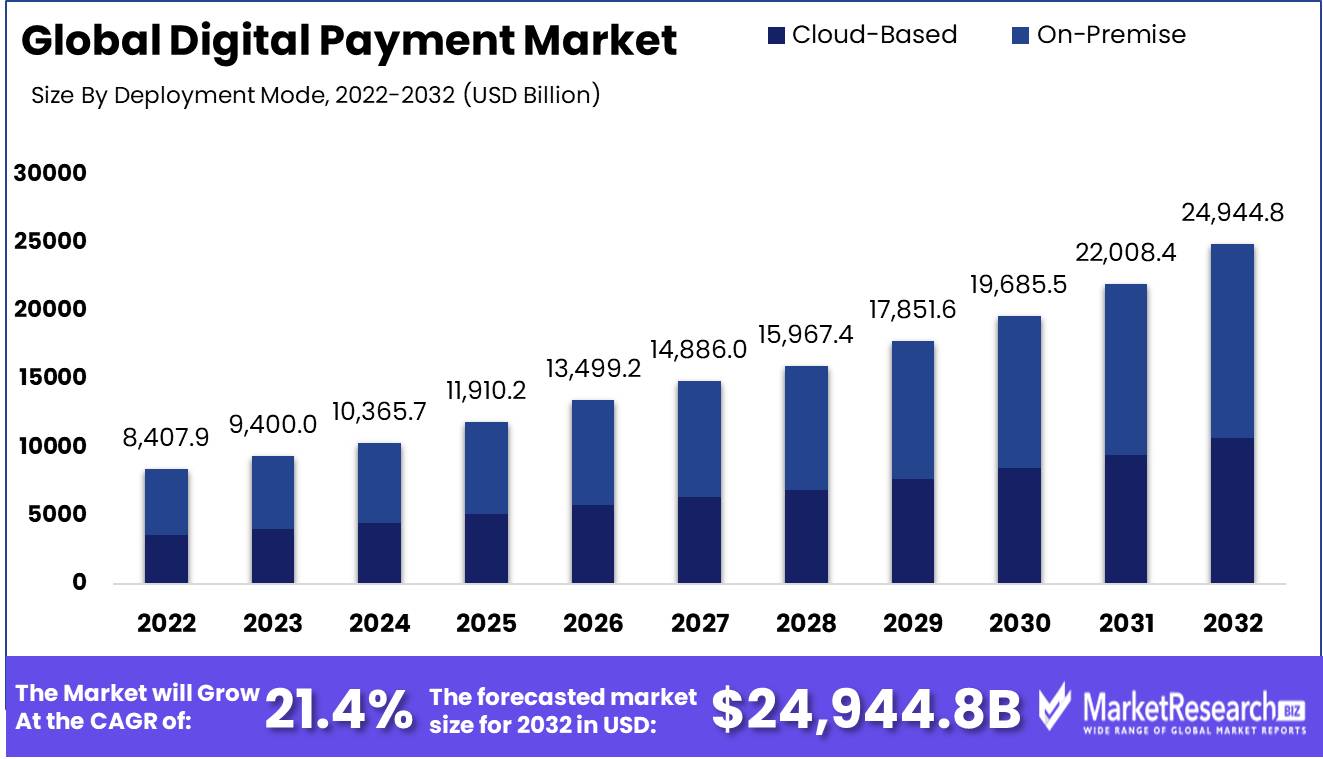

Digital Payment Market By Solution(Application Program Interface, Payment Gateway, Other), By Deployment Mode, (Cloud Based, On-Premise), By Mode of Payment, (Bank Cards, Digital Currencies, Other), By End-Use Industry, (BFSI, Healthcare, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

7514

-

Jul 2023

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

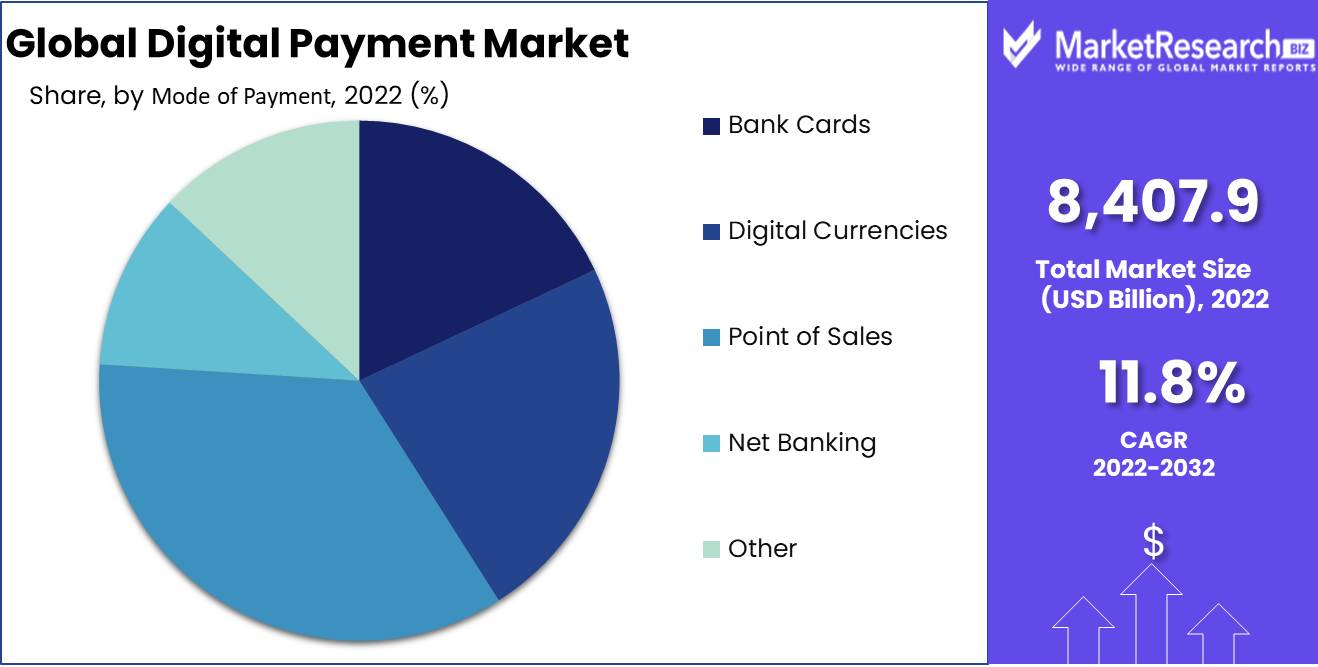

Digital Payment Market size is expected to be worth around USD 24,944.8 Bn by 2032 from USD 8,407.9 Bn in 2022, growing at a CAGR of 11.8% during the forecast period from 2023 to 2032.

The digital payment market encompasses a variety of financial technologies that facilitate secure and convenient electronic transactions for businesses and individuals. Its primary goal is to provide a seamless and efficient method for conducting financial transactions, thereby eliminating the need for tangible cash and conventional payment methods. This market encompasses a variety of digital payment methods, including mobile payments, online transactions, and contactless payments.

The importance of the digital payment market cannot be exaggerated, as it provides consumers and businesses with numerous benefits. The convenience it provides is a major advantage. With digital payments, individuals can conduct transactions on their mobile devices or computers at any time and in any location. This eliminates the need for carrying cash or credit cards and the inconvenience of lengthy lines. The instantaneous transmission of funds facilitated by digital payments promotes quicker and more efficient transactions.

There have been notable innovations in the digital payment market that have increased convenience and security. For instance, mobile wallets enable users to store their credit card information securely on their devices. This facilitates on-the-go payments with a simple tap or scan, expediting and simplifying transactions. In addition, the implementation of biometric authentication, such as fingerprint or facial recognition, has increased the security of digital payments and decreased the likelihood of fraudulent activities.

Significant investments have been made in the digital payment market, and it has been incorporated into a wide range of products and services. Companies acknowledge the potential of digital payments and are integrating them into their offerings to improve consumer experiences. In order to provide a hassle-free experience for their consumers, service-based businesses such as ride-sharing companies have embraced digital payments.

With applications expanding across various industries, the digital payment market has enormous growth potential. Several industries, including retail, hospitality, healthcare, and transportation, have made substantial investments in digital payment technologies. This increasing adoption is driven by a number of factors, including the pervasive use of smartphones, growing consumer awareness of the advantages of digital payments, and changing consumer behavior.

Driving factors

E-commerce and Online Transactions are Expanding

In tandem with the increasing adoption of smartphones and internet connectivity, the growth of e-commerce and online transactions has been a crucial factor driving the expansion of the digital payment market. E-commerce has revolutionized the way people shop and conduct business by providing worldwide consumers with convenience, accessibility, and a vast array of options. The rise of online purchasing platforms has increased the demand for streamlined and secure payment methods, leading to the development of innovative digital payment technologies.

Advancements in Mobile Payment Technologies

The rapid advancements in mobile payment technologies are another driving factor that has revolutionized the digital payment market. With the introduction of near-field communication (NFC), biometric authentication, and QR code scanning, mobile devices are now capable of facilitating secure and convenient digital payments. These advanced technologies have eliminated the need for traditional physical payment methods such as cash and credit cards, providing users with a more convenient and streamlined payment experience.

Expansion of Digital Banking and Financial Technology

The growth of digital banking and fintech solutions has been driving the expansion of the digital payment market. The digitization of financial processes has significantly transformed traditional banking services, allowing consumers to administer their accounts, transfer funds, and make payments online or via mobile applications. Digital banking's convenience and accessibility have attracted a large number of consumers, leading to an increase in demand for digital payment options.

Escalating Interest in Contactless and Secure Payment Options

The growing demand for contactless and secure payment options has been a major driving factor in the digital payment market. As consumers become more cognizant of the importance of security and pursue convenience in their transactions, the use of contactless payment methods has exploded in popularity. Contactless payments, facilitated by technologies such as NFC and QR codes, enable users to conduct transactions by tapping or scanning their mobile devices, eliminating the need for physical contact or the exchange of cash or cards.

Restraining Factors

Potential Compliance and Regulatory Requirements

Governments and regulatory agencies are acutely aware of the need to safeguard consumers and businesses from fraudulent activities and financial offenses. Different jurisdictions' stringent requirements can create entry barriers for digital payment service providers. Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, for instance, may incur substantial administrative and operational expenses. These expenses can be passed on to users in the form of higher fees, which discourages adoption. To surmount these potential obstacles, industry participants should collaborate actively with regulatory bodies to develop policies that strike a balance between protecting users and fostering innovation.

Possible Infrastructure Restriction in Various Regions

In spite of the fact that digital payment technologies offer the promise of seamless transactions, infrastructure constraints in certain regions can hinder their widespread adoption. In developing nations and rural areas, insufficient internet connectivity and limited access to electricity can present significant obstacles.

To overcome these limitations, technological advances must be coupled with investments in infrastructure. In order to bridge the digital divide and enable the digital payment market to flourish in underserved areas, it is essential to construct broadband networks and expand the reach of electricity infrastructures. Collaboration with governments, telecommunications companies, and financial institutions is necessary to ensure the availability of the infrastructure required to support digital payment initiatives in all regions.

Solution Analysis

In recent years, the digital payment market has experienced significant growth, with the payment processing segment emerging as the industry's dominant force. This segment consists of various solutions that facilitate the authorization and processing of digital transactions. With a growing reliance on online purchasing and the widespread adoption of mobile payment applications, the payment processing segment has become an integral component of the digital payment ecosystem.

The economic development of emerging economies drives the adoption of payment processing solutions. These economies are growing rapidly and have a rapidly expanding middle class with rising disposable income. The demand for digital payment solutions, such as payment processing, has increased as these economies transition towards a cashless society. Government initiatives promoting digital transactions and financial inclusion in these regions provide additional support.

Deployment Mode Analysis

The payment processing segment dominates the digital payment market, but the on-premise segment is also a major participant in this industry. On-premise solutions are software and hardware installations that are managed and operated on the premises of an organization. Despite the development of cloud-based and SaaS (Software as a Service) solutions, many businesses still prefer on-premise deployments for their control and customization.

As businesses in these regions expand and scale their operations, they need payment solutions that are robust and scalable. On-premise deployments offer businesses the flexibility to tailor their payment infrastructure to their unique requirements while ensuring data security and compliance.

Mode of Payment Analysis

The point of sales (POS) segment dominates the digital payment market, offering solutions for in-person transactions. Card readers, mobile POS devices, and contactless payment terminals are included in these solutions. With the increasing integration of digital payment systems into brick-and-mortar stores, the POS segment has acquired considerable momentum.

The adoption of point-of-sale (POS) solutions is propelled by economic growth in emerging economies. As businesses in these regions expand and modernize their operations, they seek to provide customers with convenient payment methods. The incorporation of POS terminals enables seamless in-person transactions, eliminating the need for currency or conventional card payments.

Convenience and usability have a significant impact on consumer trends and behaviors toward POS solutions. In particular, contactless payments have gained widespread acceptance due to their rapidity and convenience. The ability to make payments by tapping a card or mobile device on a terminal has resonated with consumers all over the globe.

Key Market Segments

By Solution

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security & Fraud Management

- Other

By Deployment Mode

- Cloud-Based

- On-Premise

By Mode of Payment

- Bank Cards

- Digital Currencies

- Point of Sales

- Net Banking

- Other

By End-Use Industry

- BFSI

- Healthcare

- IT & Telecom

- Media & Entertainment

- Retail & E-commerce

- Other

Growth Opportunity

Implementation of Blockchain Technology for Safe and Efficient Transactions

In the financial sector, blockchain, the technology underlying cryptocurrencies, has surfaced as a game-changer. Blockchain has the potential to revolutionize digital payment by leveraging decentralization, transparency, and immutability. Integrating blockchain technology into digital payment solutions improves security, reduces transaction fees, eliminates middlemen, and facilitates settlements in near-real time. It has enormous potential for secure and efficient international transactions, particularly in emerging markets. With blockchain-based payment solutions, consumers and businesses can benefit from faster, more secure, and more cost-effective transactions, ultimately driving the growth of the digital payment market and further establishing it as the preferred method for conducting international transactions.

Adopting Artificial Intelligence and Machine Learning to Facilitate Personalized Payments

Artificial Intelligence (AI) and Machine Learning (ML) have become integral parts of many industries, including the digital payment industry. By leveraging the power of AI and ML algorithms, payment providers can offer personalized user experiences, individualized recommendations, and streamlined transaction processes. Utilizing these technologies, payment platforms are able to analyze immense quantities of consumer data, identify spending patterns, and provide relevant incentives and rewards. Additionally, AI-powered chatbots and voice-activated assistants facilitate customer service, expedite problem resolution, and increase user satisfaction.

Multi-factor Authentication and Biometrics Provide Enhanced Security

With cyberattacks and identity theft on the increase, it is crucial to implement robust security measures for digital payments. Advanced biometric technologies, such as fingerprint, facial recognition, and iris detection, are gradually replacing conventional password-based authentication methods. Biometric authentication increases security by supplying a unique, non-replicable identifier for each user. In addition, the combination of biometrics and multi-factor authentication adds an additional layer of security, making it considerably more difficult for fraudsters to compromise payment systems. By incorporating biometric authentication, digital payment providers can engender customer confidence, reduce fraud risk, and foster market growth as customers feel more secure conducting transactions.

Latest Trends

Demand for Contactless and Near Field Communication Payment Options

In recent years, contactless payment solutions have acquired significant traction and are experiencing unprecedented demand. With the rise of near-field communication (NFC) technology, consumers can now make payments by tapping their cards or mobile devices against contactless-enabled terminals. The ease and speed of contactless payments have increased their popularity, especially in retail settings where speedy transactions are essential.

NFC-based payments not only improve the user experience but also provide increased security. NFC technology employs encrypted communication, making it extremely secure and virtually impossible to counterfeit compared to traditional magnetic stripe cards, which can be easily duplicated. As a result, contactless payment solutions are gaining popularity among consumers and merchants around the globe.

Digital Payments Employing Blockchain and Cryptocurrencies

The use of blockchain technology in conjunction with traditional methods of payment, such as credit cards, is a growing trend. The decentralized and immutable nature of blockchain technology enhances the security, transparency, and efficacy of financial transactions. By eliminating the need for intermediaries, blockchain-based digital payments allow for speedier settlement times, lower costs, and improved privacy.

For digital transactions, cryptocurrencies such as Bitcoin and Ethereum have emerged as viable alternatives to traditional fiat currencies. These digital assets facilitate peer-to-peer transactions without the need for intermediaries, granting individuals greater financial autonomy.

Increase in QR Code and Scan-to-Pay Technologies

QR code payments have exploded in popularity, particularly in Asia, where they have become ubiquitous in daily transactions. By scanning a unique code displayed on a retailer's point-of-sale terminal, consumers can make payments using QR codes. This method eliminates the requirement for physical payment cards and simplifies the payment procedure for users.

Scan-to-pay methods offer numerous benefits, including usability, lower infrastructure requirements, and compatibility with a vast array of devices, such as smartphones and feature phones. In addition, QR code payments have made it possible for small businesses and street vendors to accept digital payments at a low cost, closing the financial inclusion gap and fostering economic development in developing economies.

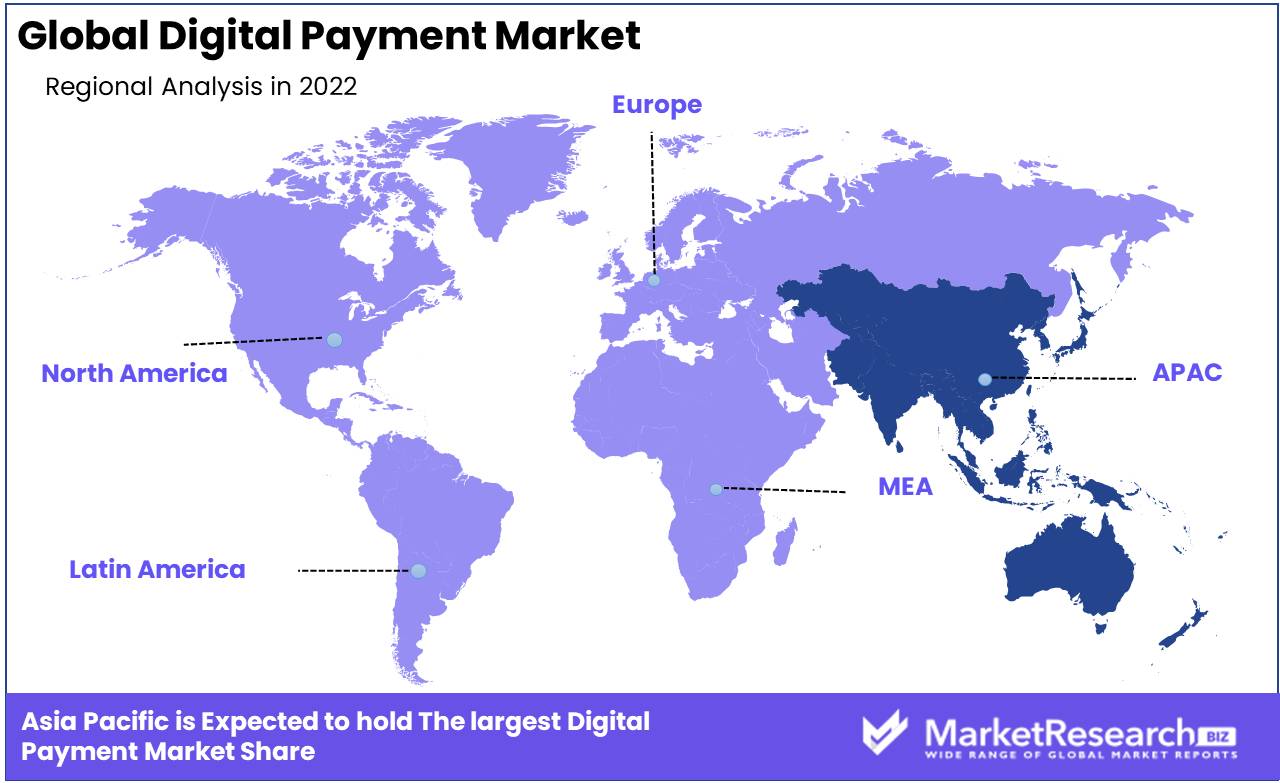

Regional Analysis

The Asia-Pacific region dominates the market for digital payments.

The Asia-Pacific region, which includes countries like China, Japan, India, Australia, and South Korea, is home to a large number of digitally literate consumers. As they offer convenience, security, and a seamless transaction experience, these consumers are increasingly employing digital payment methods. This change in consumer behavior has fueled the growth of digital payment providers, resulting in an increase in their market share.

The ubiquitous acceptance and usage of mobile wallets is one of the primary factors contributing to the dominance of the Asia-Pacific region's digital payment market. Mobile wallets have revolutionized the way in which individuals make payments, allowing them to complete transactions with their handsets with ease. The number of mobile wallet users in the region is staggering, with China dominating the pack. QR code payments, which have acquired immense popularity in China, have accelerated the adoption of mobile wallets in the country. The Asia-Pacific region has become a fertile ground for innovation and experimentation in the digital payment landscape due to its high mobile wallet penetration.

In addition to mobile wallets, the Asia-Pacific region is experiencing accelerated growth in the usage of other digital payment methods, such as online banking, peer-to-peer transfers, and contactless payments. Due to initiatives such as demonetization, countries like India have witnessed a significant transition from traditional cash-based transactions to digital payments. This has further accelerated the adoption of digital payment solutions, positioning the region as the global digital payment revolution's propelling force.

Moreover, government policies and initiatives geared at promoting cashless economies have been instrumental in propelling the Asia-Pacific region's dominance in the digital payment market. By providing incentives, subsidies, and tax benefits, governments throughout the region actively encourage businesses and consumers to adopt digital payment solutions. For instance, the Indian government's drive for a digital economy, through the introduction of initiatives like the Unified Payments Interface (UPI) and Aadhaar-enabled payment systems, has revolutionized the manner in which payments are made in the country. In addition to making digital payments more accessible, these efforts have created a thriving ecosystem for fintech startups, driving innovation and growth.

The dominance of digital payments in the Asia-Pacific region is strengthened by the presence of tech titans that are instrumental in influencing the market. Companies like Alibaba, Tencent, Samsung, and Google are actively investing and expanding their digital payment services in the region. The combination of their expertise and large user base has increased the adoption of digital payments and bolstered the region's position as a global leader.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The United States-based PayPal Holdings Inc is a global champion in online payment solutions. PayPal has established itself as a trusted and secure platform for digital transactions, with millions of active users and a strong presence in over 200 markets worldwide. Their platform enables users to transmit and receive online payments, facilitating transactions between businesses and individuals. Its dominance in the digital payment market can be attributed to PayPal's user-friendly interface, robust security measures, and expansive global reach.

Fiserv Inc., also headquartered in the United States, is a prominent provider of financial industry technology solutions. Fiserv has become a key participant in the digital payment market due to its vast array of offerings, which include digital payments, mobile banking, and electronic bill presentation. Their exhaustive suite of solutions is tailored to the requirements of financial institutions, enabling them to provide enhanced customer experiences and streamline payment processes.

Alipay, an Ant Group subsidiary, has emerged as one of China's dominant digital payment market participants. Alipay, which has a large user base and a strong presence in the largest consumer market in the world, has revolutionized the way transactions are conducted in China. Alipay provides a variety of services, including mobile payments, money transfers, and bill payments, through its user-friendly mobile app and seamless integration with numerous merchants.

Top Key Players in Digital Payment Market

- PayPal Holdings Inc (U.S.)

- Fiserv Inc (U.S.)

- Alipay (China)

- Apple Inc. (U.S.)

- LLC (U.S.)

- Visa (U.S.)

- Mastercard (U.S.)

- American Express (U.S.)

- Amazon Pay (U.S.)

- Aurus Inc. (U.S.)

- Adyen (Netherlands)

- Kakao Pay Corp (South Korea)

- Grab (India)

- Paytm (India)

- SAMSUNG (South Korea)

- UnionPay International (China)

- MercadoLibre S.R.L (Argentina)

- WeChat Pay (China)

- Financial Software and Systems Pvt. Ltd. (U.S.)

- Novatti Group Ltd (Australia)

Recent Development

- In 2023, Visa, one of the world's largest payment technology companies, announced its intention to acquire Plaid in a game-changing move. Plaid, a well-known provider of digital payment solutions, has risen to prominence due to its innovative technologies that facilitate secure connections between consumers' bank accounts and numerous digital applications.

- In 2022, Mastercard, a prominent global payment technology company, announced its plans to enhance its digital payment capabilities in an effort to capitalize on the immense potential of the Asia-Pacific region. With a continually expanding consumer base, accelerated digitization trends, and a growing middle class, the Asia-Pacific market presents Mastercard with a lucrative opportunity to expand its presence.

- In 2021, PayPal, the well-known digital payment platform, introduced a new product designed to empower businesses of all sizes. The launch of its new digital payment service seeks to provide a seamless and secure payment experience, catering specifically to the changing needs of merchants and businesses.

Report Scope:

Report Features Description Market Value (2022) USD 8,407.9 Bn Forecast Revenue (2032) USD 24,944.8 Bn CAGR (2023-2032) 11.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution(Application Program Interface, Payment Gateway, Other), By Deployment Mode, (Cloud Based, On-Premise), By Mode of Payment, (Bank Cards, Digital Currencies, Other), By End-Use Industry, (BFSI, Healthcare, Other) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape PayPal Holdings Inc (U.S.), Fiserv Inc (U.S.), Alipay (China), Apple Inc. (U.S.), Google, LLC (U.S.), Visa (U.S.), Mastercard (U.S.), American Express (U.S.), Amazon Pay (U.S.), Aurus Inc. (U.S.), Adyen (Netherlands), Kakao Pay Corp (South Korea), Grab (India), Paytm (India), SAMSUNG (South Korea), UnionPay International (China), MercadoLibre S.R.L (Argentina), WeChat Pay (China), Financial Software and Systems Pvt. Ltd. (U.S.), Novatti Group Ltd (Australia) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- First Data Corp.

- PayPal Payments Private Ltd.

- Worldpay, LLC

- Wirecard AG

- Fiserv, Inc.

- Chetu, Inc.

- Total System Services, Inc.

- Novatti Group Ltd.

- ACI Worldwide Inc.

- Global Payments Inc.

- BlueSnap Inc.

- Paysafe Holdings UK Ltd.

- Worldline SA

- Wex Inc.

- SIX Payment Services Ltd.

- Dwolla, Inc.

- Stripe, Inc.

- Adyen N.V.

- PayU Payments Private Ltd.

- YapStone, Inc.