Global Digestive Biscuits Market By Micronutrients(Fibre, Phosphorous, Iron, Minerals, Other), By End User(Children, Adults, Elderly), By Distribution Channel(Convenience Stores, Supermarkets/Hypermarkets, Specialist Retailers, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

37926

-

August 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

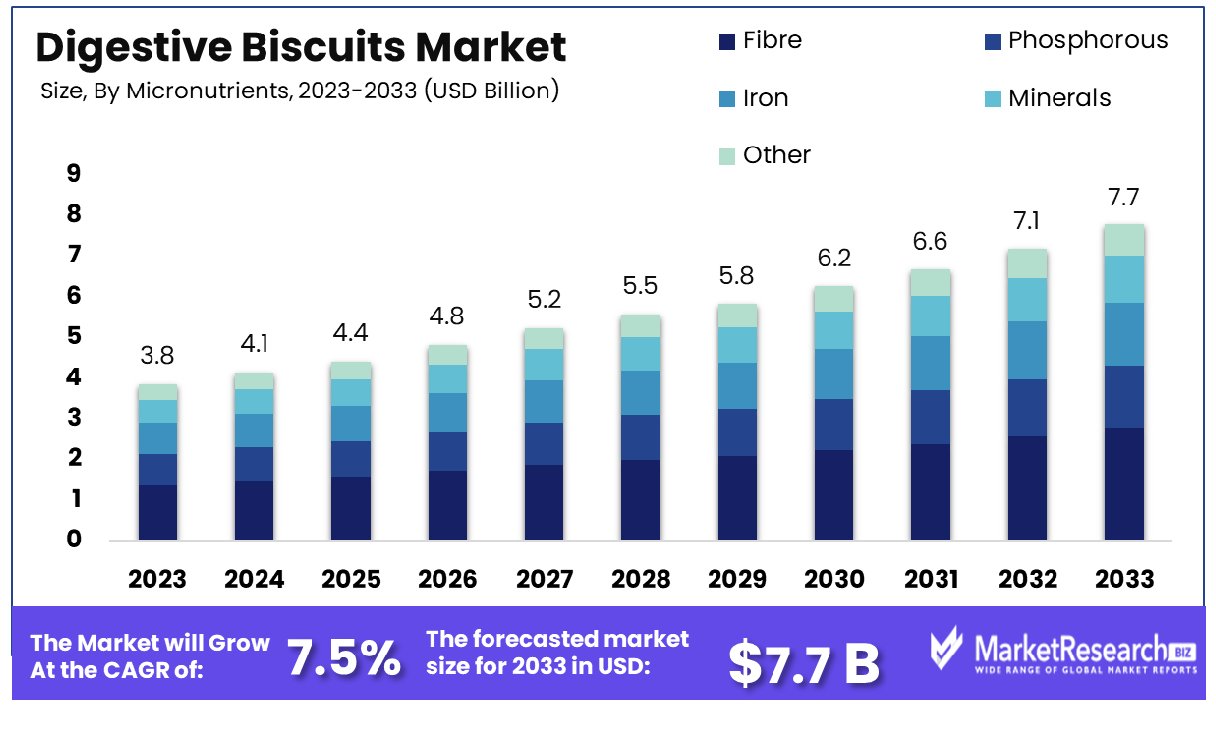

The Global Digestive Biscuits Market was valued at USD 3.8 billion in 2023. It is expected to reach USD 7.7 billion by 2033, with a CAGR of 7.5% during the forecast period from 2024 to 2033.

The Digestive Biscuits Market encompasses the production, distribution, and sales of a specific category of baked goods known for their fibrous content and health benefits. This market caters to a growing consumer base that prioritizes digestive health without compromising on taste. Key market segments include whole wheat, multigrain, and reduced-sugar variants, each addressing the dietary preferences and restrictions of diverse demographics.

Market leaders are distinguished by innovative packaging solutions and robust distribution strategies that enhance shelf presence and consumer accessibility. This sector's dynamics are influenced by evolving dietary trends, regulatory standards, and global economic conditions, making it crucial for strategic decision-making in food production and retail industries.

The Digestive Biscuits Market is poised for significant growth, driven by a surging consumer focus on healthier snack options and an increasing awareness of dietary fiber benefits. Each digestive biscuit, typically weighing about 35 grams, offers a balanced caloric count of 70 to 80 calories, making it an appealing choice for health-conscious consumers. These biscuits are notably rich in dietary fibers, with approximately 6.7 grams per serving, contributing to digestive health and offering a satiating effect that aids in weight management.

Market trends indicate a rising preference for biscuits with reduced sugar content. However, the standard digestive biscuit contains about 16.67 grams of total sugars per 100 grams, spotlighting an area ripe for innovation. Market leaders are thus incentivized to invest in research and development to decrease sugar levels without compromising taste, leveraging this as a differentiator in a competitive landscape.

Furthermore, the market benefits from robust distribution channels that facilitate widespread availability across various retail formats—from supermarkets to online platforms—enhancing consumer access to these products. As companies innovate with new flavors and healthier formulations, the market is expected to expand its reach, catering to a broader audience. The strategic implication for stakeholders, particularly in production and marketing, revolves around capitalizing on these health trends and evolving consumer preferences to position their brands effectively in this dynamic market segment.

Key Takeaways

- Market Growth: The Global Digestive Biscuits Market was valued at USD 3.8 billion in 2023. It is expected to reach USD 7.7 billion by 2033, with a CAGR of 7.5% during the forecast period from 2024 to 2033.

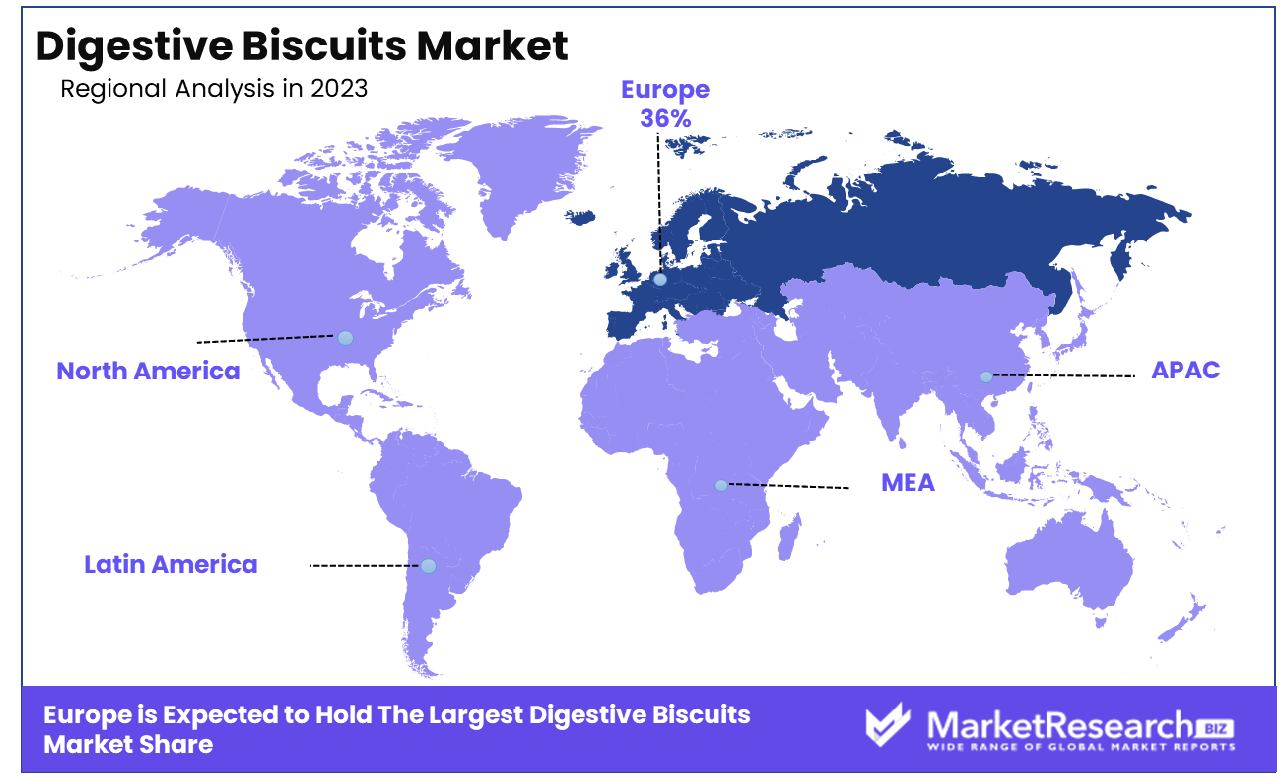

- Regional Dominance: Europe dominates the Digestive Biscuits Market with a 36% share.

- By Micronutrients: Fibre dominates micronutrients in the Digestive Biscuits Market at 38%.

- By End User: Adults are the leading end users, dominating at 50%.

- By Distribution Channel: Supermarkets and hypermarkets lead distribution with a 65% share.

Driving factors

Increasing Consumer Awareness of Healthy Dietary Choices

The growth of the Digestive Biscuits Market can be largely attributed to the rising consumer awareness of healthy dietary choices. As individuals become more attuned to the benefits of maintaining a balanced diet, there is a noticeable shift towards products that offer nutritional advantages without compromising on taste.

Digestive biscuits, known for their high fiber content and low sugar levels, align well with this health-centric consumer trend. Market data indicates that products labeled as "healthy" or "nutritious" see a higher consumer uptake, suggesting that health awareness directly contributes to the increased sales of digestive biscuits.

Growing Popularity of Convenient, Health-Focused Snack Options

The intersection of convenience and health has become a pivotal area of growth within the snack industry, significantly impacting the Digestive Biscuits Market. Today’s consumers, especially millennials and working professionals, seek snack options that are not only healthy but also easy to consume on the go.

Digestive biscuits serve this demand effectively, offering a quick, nutritious alternative to traditional snacking choices. This trend is supported by statistics showing a robust increase in the sale of convenient health-focused snacks, propelling the market forward as busy lifestyles continue to influence food choices.

Expansion of the Global Retail Sector

The expansion of the global retail sector, particularly through supermarkets and online sales channels, has provided a significant boost to the Digestive Biscuits Market. Supermarkets offer wide visibility and accessibility to a variety of brands, which helps new consumers experiment with different health-centric products like digestive biscuits.

Simultaneously, the surge in online shopping has made it easier for consumers to purchase these products with convenience, often influenced by online marketing and promotions. Market analyses reveal that online sales channels are rapidly growing, indicating a strong correlation between retail expansion and increased market penetration of digestive biscuits, further supported by a consumer preference for seamless shopping experiences.

Restraining Factors

Competition from Other Healthy Snack Alternatives

One of the significant restraining factors for the Digestive Biscuits Market is the intense competition from a plethora of other healthy snack alternatives. Consumers have a vast array of choices ranging from protein bars to fruit snacks, each offering unique health benefits and convenience.

This diversity splits consumer attention and spending, which can limit the market share for digestive biscuits specifically. Statistics might show a fluctuation in market dynamics where the introduction of innovative snacks correlates with dips in digestive biscuit sales, emphasizing the impact of competitive pressure on market growth.

Volatility in the Prices of Raw Materials

The volatility in the prices of essential raw materials, such as whole wheat and fiber ingredients, also poses a considerable challenge to the Digestive Biscuits Market. These ingredients are fundamental in producing digestive biscuits, and their price instability can lead to inconsistent production costs. When the cost of raw materials increases, it often results in higher retail prices for the end product, which can deter price-sensitive consumers and reduce overall sales volumes.

This economic dynamic is crucial, especially in less affluent markets where consumers prioritize cost over health benefits. The market analysis might reflect that periods of high raw material prices see a slowdown in the growth rate of the digestive biscuits market, illustrating the direct impact of raw material costs on market performance.

By Micronutrients Analysis

Fibre dominates the micronutrient segment in the Digestive Biscuits Market with a significant 38% share.

In 2023, Fibre held a dominant market position in the "By Micronutrients" segment of the Digestive Biscuits Market, capturing more than a 38% share. Fibre's significant market share is indicative of the growing consumer preference for healthier snack options that support digestive health and provide essential dietary fiber. The segment includes various micronutrients such as Phosphorous, Iron, Minerals, and others, each contributing to the overall nutritional value and market appeal of digestive biscuits.

Phosphorous followed as the second most prominent micronutrient, underlining its vital role in bone health and metabolic processes, which resonates with consumers looking for multifunctional health benefits in their dietary choices. Iron, integral for combating dietary deficiencies, captured a notable market share, reflecting increased awareness and demand for biscuits that contribute to daily iron intake.

Minerals collectively accounted for a substantial portion of the segment. This reflects a broad consumer awareness of the benefits derived from a mineral-rich diet, further propelled by innovations in biscuit formulations that enhance mineral content without compromising taste or texture.

The category labeled as "Other" encompasses a variety of emerging micronutrients that are being recognized for their health benefits. This segment's smaller share suggests a niche but growing interest and potential for expansion as consumer preferences evolve towards specific dietary needs.

Overall, the "By Micronutrients" segment of the Digestive Biscuits Market highlights a robust consumer trend towards health-centric food choices, with fibre leading the way. This trend is supported by a growing body of research promoting digestive health as a core component of overall wellness, pushing manufacturers to innovate and expand their offerings to meet this demand.

By End User Analysis

Adults are the primary end users, capturing 50% of the Digestive Biscuits Market.

In 2023, Adults held a dominant market position in the "By End User" segment of the Digestive Biscuits Market, capturing more than a 50% share. This substantial market share underscores the significant consumption of digestive biscuits among adults, driven by an increasing focus on health-conscious eating habits and the demand for convenient, nutritious snack options.

Children represented a notable segment, reflecting the growing parental inclination towards providing healthier snack alternatives for younger demographics. The segment benefits from fortified products that cater to developmental needs while maintaining appealing flavors and textures that are key to gaining acceptance among younger consumers.

The Elderly segment, though smaller, is steadily gaining traction. This increase can be attributed to the specific health benefits of digestive biscuits, such as high fiber content, which is crucial for addressing common digestive issues faced by older adults. Products tailored for this demographic often emphasize easy-to-consume textures and added nutrients to support overall health maintenance.

The segmentation by end users highlights a broader trend within the market where manufacturers are increasingly tailoring their product portfolios to meet the diverse nutritional needs and preferences of different age groups. This strategic focus not only broadens market reach but also enhances brand loyalty by addressing specific consumer needs with precision and care.

Overall, the dominance of adults in this market segment reflects broader dietary trends and a growing consumer awareness of the benefits associated with balanced, nutrient-rich snacks in maintaining overall health and well-being in a fast-paced world.

By Distribution Channel Analysis

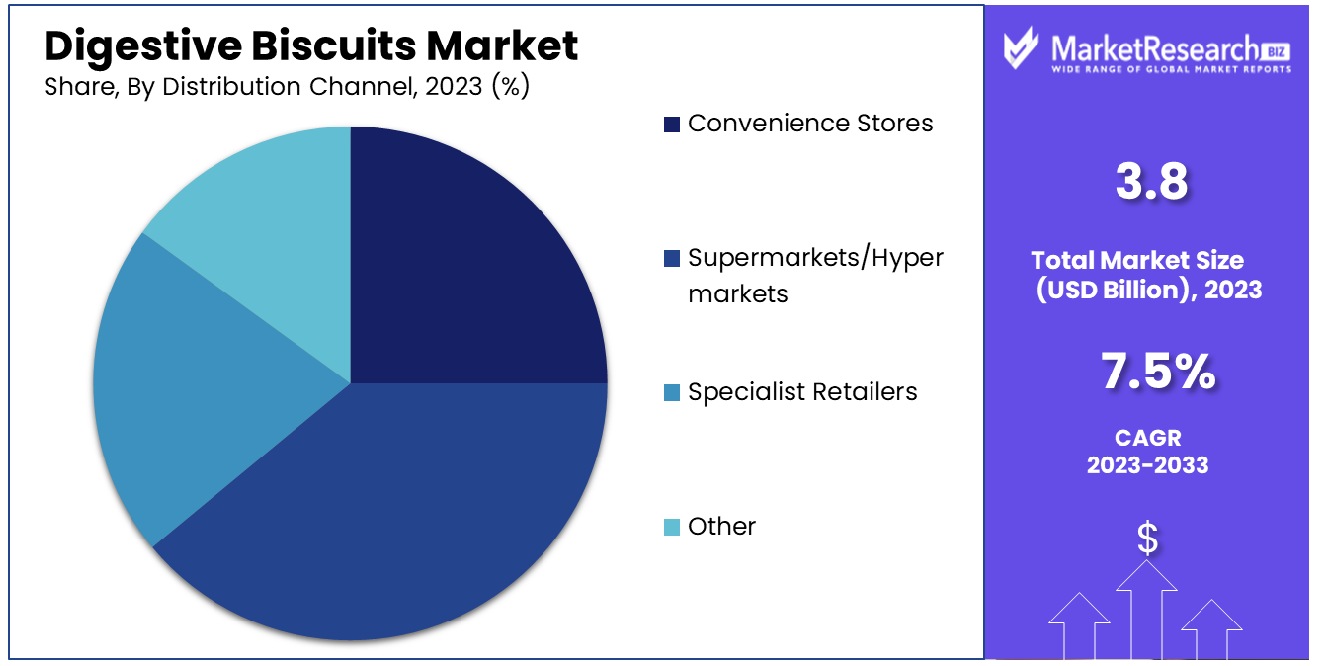

Supermarkets and hypermarkets lead distribution channels, holding a dominant 65% share of the market.

In 2023, Supermarkets/Hypermarkets held a dominant market position in the "By Distribution Channel" segment of the Digestive Biscuits Market, capturing more than a 65% share. This significant dominance underscores the pivotal role these outlets play in the consumer purchase journey, offering extensive product assortments and the advantage of physical product verification, which contributes to higher consumer trust and repeated sales.

Convenience Stores also played a crucial role, particularly in urban and densely populated areas where quick access is valued. These stores cater to the on-the-go consumer, providing easy and fast purchasing options, albeit with a smaller selection of products compared to supermarkets/hypermarkets.

Specialist Retailers, while having a smaller share, focus on premium and niche market segments. These outlets often offer specialized digestive biscuits that cater to specific dietary needs such as gluten-free or organic options, attracting a discerning clientele willing to pay a premium for tailored products.

The category labeled "Other" includes various non-traditional sales channels, such as online platforms and direct-to-consumer options, which are growing in popularity due to the increasing digitalization of shopping and the convenience of home delivery.

The dominance of supermarkets/hypermarkets in the distribution channel segment reflects their established infrastructure, consumer trust, and ability to provide a diverse range of products, catering to the broad needs and preferences of consumers. As market dynamics evolve, the role of digital platforms is expected to grow, potentially redistributing market shares across these distribution channels in response to changing consumer behaviors.

Key Market Segments

By Micronutrients

- Fibre

- Phosphorous

- Iron

- Minerals

- Other

By End User

- Children

- Adults

- Elderly

By Distribution Channel

- Convenience Stores

- Supermarkets/Hypermarkets

- Specialist Retailers

- Other

Growth Opportunity

Innovation in Flavors and Ingredient Combinations

The global Digestive Biscuits Market in 2023 presents substantial opportunities for growth through innovation in flavors and ingredient combinations. By diversifying their product lines to include unique and appealing flavors, manufacturers can cater to a broader demographic, tapping into new consumer segments with varied taste preferences. The introduction of exotic and locally popular flavors could significantly attract consumers looking for both health benefits and new sensory experiences.

Moreover, integrating superfoods and alternative health-focused ingredients like chia seeds or quinoa could further enhance the appeal, aligning with the rising trend of functional foods. Such innovations are not only likely to boost consumer interest but also can set brands apart in a competitive market, potentially leading to an increased market share.

Strategic Marketing and Packaging Initiatives

Additionally, the effectiveness of strategic marketing and packaging initiatives cannot be underestimated in capitalizing on the health-conscious consumer base. In 2023, leveraging sophisticated marketing techniques that highlight the health attributes of digestive biscuits—such as fiber content, low sugar levels, and natural ingredients—can significantly influence buying decisions.

Tailoring packaging to reflect sustainability and health can also play a critical role in attracting environmentally and health-aware consumers. Packaging that is both visually appealing and informative, providing clear nutritional information, will likely resonate well with this demographic. These strategic efforts in marketing and packaging are expected to not only retain existing customers but also attract new ones, thereby driving further growth in the Digestive Biscuits Market.

Latest Trends

Incorporation of Superfoods and Functional Ingredients

In 2023, the global Digestive Biscuits Market is witnessing a significant trend with the incorporation of superfoods and functional ingredients into product formulations. This trend is driven by the growing consumer demand for foods that not only satisfy hunger but also offer additional health benefits. Ingredients such as spirulina, turmeric, and flax seeds are being integrated into digestive biscuits, catering to the wellness-focused consumer who is looking for more than just basic nutrition.

These functional ingredients are known for their health benefits, including anti-inflammatory properties, heart health support, and improved digestive health. By tapping into this trend, manufacturers are not only enhancing the nutritional profile of their products but also differentiating themselves in a crowded market, potentially increasing their market share as they appeal to health-conscious consumers.

Rising Consumer Preference for Gluten-Free and Low-Sugar Options

Another prominent trend in the Digestive Biscuits Market is the rising consumer preference for gluten-free and low-sugar options. With an increasing number of consumers becoming aware of dietary sensitivities and the impact of sugar on health, there is a growing demand for biscuits that cater to these needs. Manufacturers are responding by developing recipes that lower sugar content and substitute traditional wheat flour with gluten-free alternatives like almond flour or oat flour.

This shift not only makes digestive biscuits accessible to a wider audience, including those with gluten intolerance and those managing diabetes, but it also taps into the broader trend of health and wellness that dominates consumer preferences. This strategic alignment with consumer health trends is expected to drive market growth, as consumers increasingly opt for products that align with their dietary restrictions and lifestyle choices.

Regional Analysis

The Digestive Biscuits Market in Europe dominates with a significant 36% share of the global market.

The global Digestive Biscuits Market showcases distinct dynamics across different regions, each influenced by varying consumer preferences and economic conditions. In Europe, the market holds a dominant share, accounting for approximately 36% of the global demand. This region's strong performance is largely attributed to a well-established snacking culture combined with a high consumer emphasis on healthy eating habits. European consumers have a long-standing preference for products that offer nutritional benefits, such as high fiber content, which is a key feature of digestive biscuits.

In North America, the market is experiencing growth driven by increasing health awareness and the rising popularity of gluten-free and organic products. The market is adapting to the demand for healthier snack options, with many brands introducing low-sugar and whole-grain variants that cater to the health-conscious consumer.

The Asia Pacific region presents a rapidly growing market, fueled by changing lifestyle patterns, urbanization, and the increasing influence of Western dietary habits. There is a significant potential for market expansion as domestic and international companies invest in marketing and distribution channels, particularly in densely populated countries like China and India.

In the Middle East & Africa, the market growth is relatively slower but shows promise due to urbanization and an expanding retail sector. The introduction of international brands and the adaptation of products to local tastes are key factors that could drive future growth.

Latin America, while a smaller market, is seeing a shift towards healthier snack options. Growth in this region is spurred by an increasing middle-class population and growing health awareness, which are gradually aligning consumer preferences toward products like digestive biscuits.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Digestive Biscuits Market continues to be influenced significantly by key players that have strategically positioned themselves through innovative product offerings and expansive distribution networks. Among these, Bakewell Biscuits Pvt. Ltd. and Bonn Nutrients Pvt. Ltd. are notable for their robust regional presence in emerging markets, leveraging local consumer preferences and cost-effective production techniques. These companies have effectively capitalized on the rising health consciousness among consumers by introducing variations of digestive biscuits that incorporate local flavors and healthier ingredients.

Nestlé, a global giant with a diversified product portfolio, has enhanced its position in the digestive biscuits market by focusing on brand trust and quality. Its commitment to using sustainably sourced ingredients appeals to the environmentally conscious consumer, adding a competitive edge to its offerings.

Burton’s Foods Ltd. and Walkers Shortbread Ltd., both rooted in traditional baking heritage, continue to appeal to consumers looking for authenticity and premium quality. Their focus on maintaining classic recipes while integrating modern health trends has allowed them to remain relevant in a rapidly evolving market landscape.

Kambly SA and Lotus Bakeries NV stand out for their premium positioning and focus on artisanal quality. These brands have successfully expanded their market reach by emphasizing the craftsmanship and heritage associated with their products, appealing to a segment of consumers looking for gourmet snack options.

Parle Products Pvt. Ltd. and Abisco, meanwhile, capitalize on extensive distribution networks and volume-driven strategies to cater to the mass market, focusing on affordability without compromising on health aspects.

Market Key Players

- Bakewell Biscuits Pvt. Ltd.

- Nestle

- Burton’s Foods Ltd.

- Walkers Shortbread Ltd

- Bonn Nutrients Pvt. Ltd.

- Parle Products Pvt. Ltd.

- Kambly SA

- Abisco

- Lotus Bakeries NV

- Other

Recent Development

- In March 2023, Bonn Nutrients Pvt. Ltd. secured significant funding in March 2023 to expand their production facilities. The $50 million investment will be used to increase capacity and introduce automated packaging lines, with an expected increase in production efficiency by 40%.

- In February 2023, Bakewell Biscuits Pvt. Ltd. launched a new line of gluten-free digestive biscuits. This product launch aims to cater to the increasing consumer demand for gluten-free options in the snack market. The company anticipates a 20% increase in sales from this new line.

- In July 2022, Walkers Shortbread Ltd entered into a partnership with a renowned health brand to co-produce a series of co-branded digestive biscuits. This collaboration aims to leverage both brands' strengths and expand the consumer base, aiming at a 30% increase in their distribution channels.

Report Scope

Report Features Description Market Value (2023) USD 3.8 Billion Forecast Revenue (2033) USD 7.7 Billion CAGR (2024-2032) 7.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Micronutrients(Fibre, Phosphorous, Iron, Minerals, Other), By End User(Children, Adults, Elderly), By Distribution Channel(Convenience Stores, Supermarkets/Hypermarkets, Specialist Retailers, Other) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Bakewell Biscuits Pvt. Ltd., Nestle, Burton’s Foods Ltd., Walkers Shortbread Ltd, Bonn Nutrients Pvt. Ltd., Parle Products Pvt. Ltd., Kambly SA, Abisco, Lotus Bakeries NV, Other Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Bakewell Biscuits Pvt. Ltd.

- Nestle

- Burton’s Foods Ltd.

- Walkers Shortbread Ltd

- Bonn Nutrients Pvt. Ltd.

- Parle Products Pvt. Ltd.

- Kambly SA

- Abisco

- Lotus Bakeries NV

- Other