Diabetes Injection Pens Market By Type (Disposable Injection Pens, Reusable Injection Pens), By End Users (Home-care Settings, Hospital and clinics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

49268

-

July 2024

-

137

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

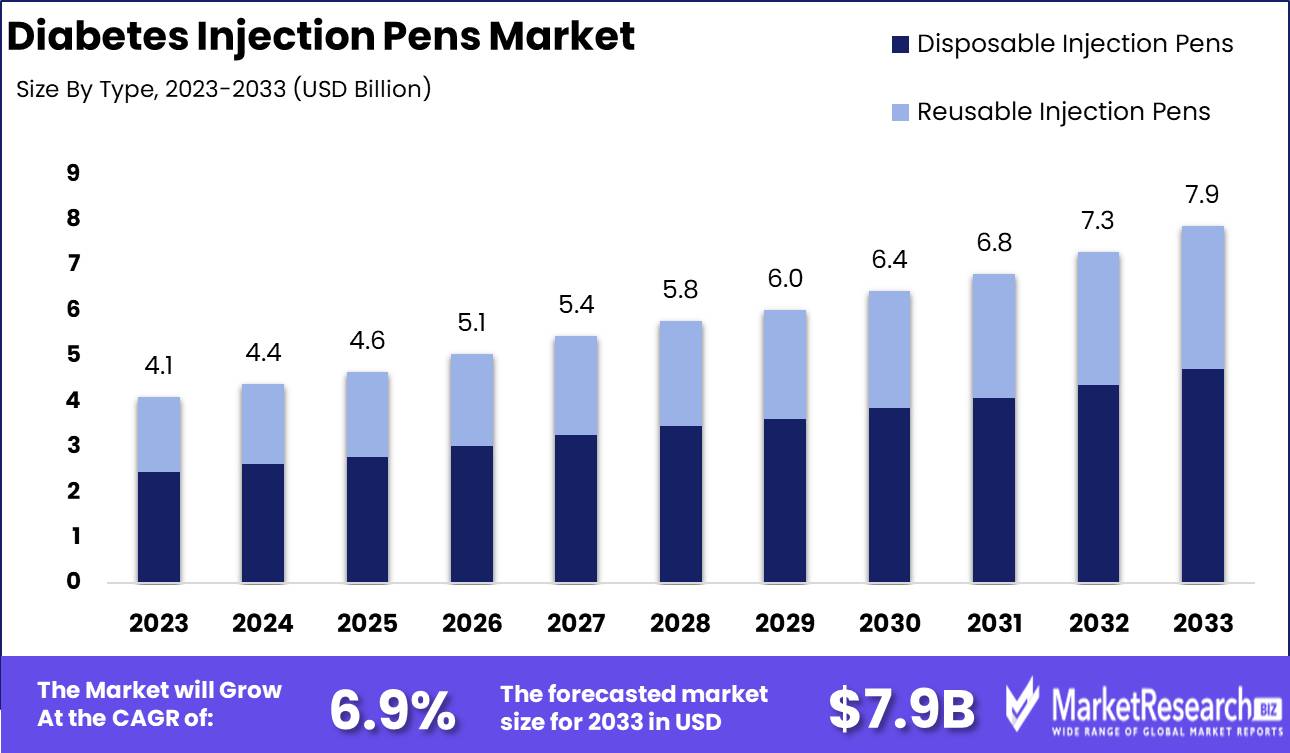

The Global Diabetes Injection Pens Market was valued at USD 4.1 Bn in 2023. It is expected to reach USD 7.9 Bn by 2033, with a CAGR of 6.9% during the forecast period from 2024 to 2033.

The Diabetes Injection Pens Market includes devices specifically designed for the administration of insulin and other injectable medications for diabetes management. These pens offer ease of use, precise dosing, and improved patient compliance compared to traditional syringes. The market comprises various types of pens, including reusable and disposable options, designed to meet the diverse needs of diabetes patients globally.

The Diabetes Injection Pens Market is experiencing robust growth driven by the increasing prevalence of diabetes and the rising demand for user-friendly drug delivery systems. A significant indicator of this trend is the 2010 survey where 96% of U.S. participants with type 2 diabetes reported using pen injectors for self-administering their medications. This high adoption rate underscores the convenience and efficiency that injection pens offer over traditional methods.

A global trend towards shorter needles is emerging, with 30% of patients opting for 4- and 8-mm needles. This preference highlights the industry’s focus on improving patient comfort and reducing injection-related anxiety, which is crucial for enhancing treatment adherence.

The market is further propelled by continuous advancements in pen technology, including features like dose memory, digital displays, and Bluetooth connectivity. These innovations not only enhance the user experience but also improve the accuracy and reliability of diabetes management. As healthcare systems worldwide emphasize patient-centered care, the demand for such sophisticated injection devices is expected to grow.

Companies operating in this market must invest in R&D to develop next-generation injection pens that cater to evolving patient needs. Additionally, educational initiatives aimed at training healthcare providers and patients on the optimal use of these devices will be critical in maximizing their benefits. By focusing on innovation and patient education, stakeholders can capitalize on the opportunities within the Diabetes Injection Pens Market and contribute to better diabetes management outcomes globally.

Key Takeaways

- Market Value: The Global Diabetes Injection Pens Market was valued at USD 4.1 Bn in 2023. It is expected to reach USD 7.9 Bn by 2033, with a CAGR of 6.9% during the forecast period from 2024 to 2033.

- By Type: Disposable Injection Pens are the predominant choice, representing 60% of the market, favored for their convenience and hygiene.

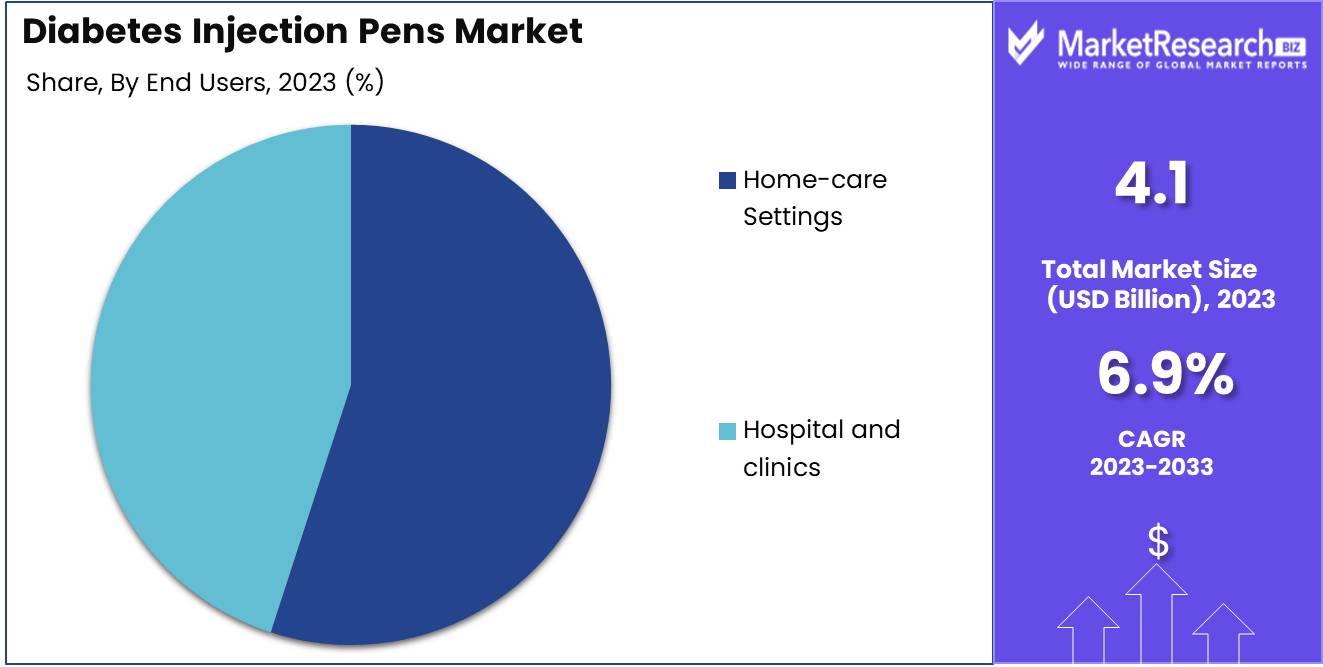

- By End Users: Home-care Settings utilize 55%, reflecting the growing preference for self-management of diabetes.

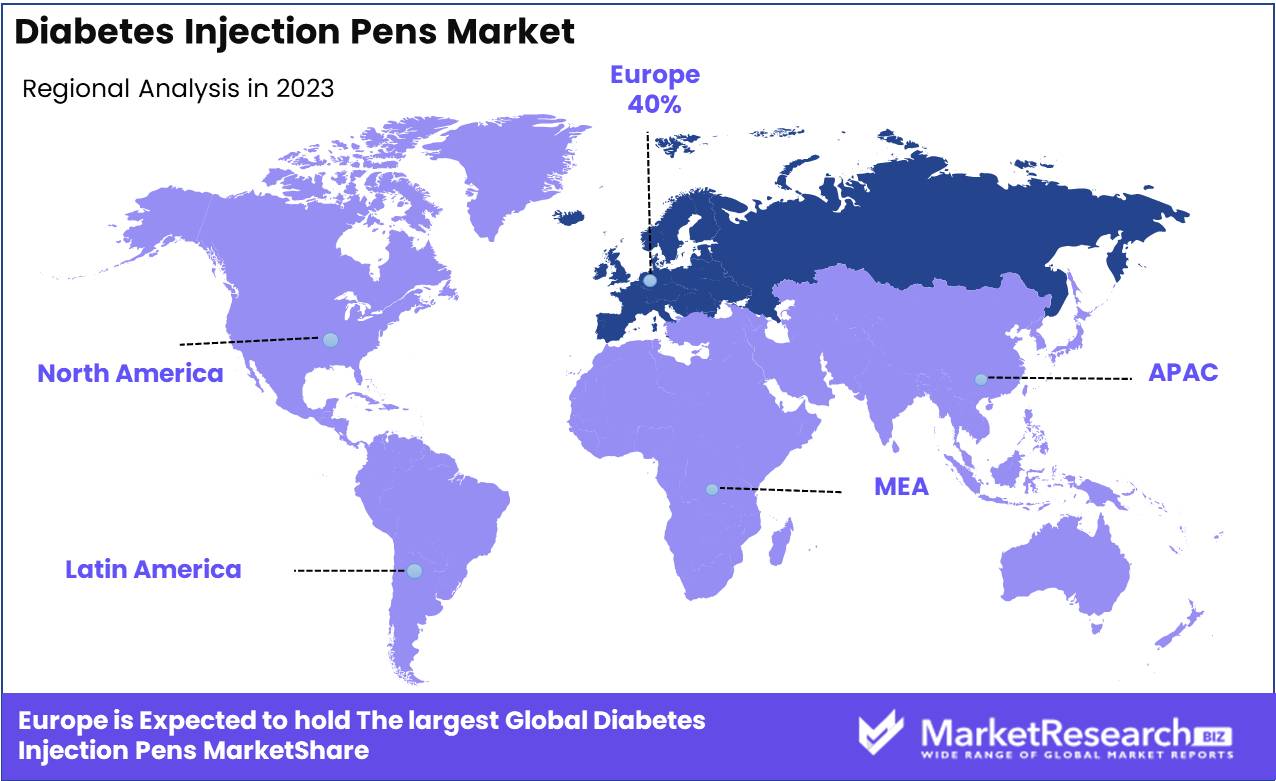

- Regional Dominance: Europe holds a 40% market share, influenced by a high prevalence of diabetes and strong healthcare infrastructure.

- Growth Opportunity: Innovations in pen designs that improve dose accuracy and user comfort can significantly enhance market growth, particularly in regions with rising diabetes prevalence.

Driving factors

Increasing Prevalence of Diabetes

The rising prevalence of diabetes is a primary driver of the diabetes injection pens market. According to the International Diabetes Federation, the global prevalence of diabetes is expected to increase to 700 million by 2045, up from 463 million in 2019. This surge in diabetes cases necessitates effective and efficient management solutions, such as injection pens, which offer precise and controlled insulin administration. The growing number of diabetic patients, particularly in developing regions with changing lifestyles and diets, significantly boosts the demand for insulin pens.

Advancements in Injection Pen Technology

Technological advancements in injection pens have markedly contributed to market growth. Innovations include features such as dose memory, easier dose setting, and fine-gauge needles that minimize pain. Additionally, the development of smart insulin pens that can connect to mobile apps for real-time monitoring and dosage tracking further enhances user convenience and adherence to treatment regimens. These technological improvements not only improve patient outcomes but also make insulin pens a preferred choice over traditional syringes.

Growing Preference for Self-Administration

There is a growing preference for self-administration among diabetic patients, which significantly supports the market for injection pens. Self-administration empowers patients with greater control over their treatment and reduces the need for frequent clinical visits. Injection pens are designed to be user-friendly, promoting ease of use and increasing patient compliance. As healthcare systems worldwide emphasize patient autonomy and home-based care, the demand for self-administration devices like insulin pens continues to rise.

Restraining Factors

High Cost of Insulin Pens

The high cost of insulin pens is a significant barrier to market growth. Insulin pens are more expensive than traditional vials and syringes, which can limit their accessibility, especially in low-income regions. This cost disparity can be a deterrent for widespread adoption among patients who are unable to afford the higher prices, thereby restraining market expansion.

Availability of Alternative Diabetes Treatments

The availability of alternative diabetes treatments also poses a challenge to the diabetes injection pens market. Alternatives such as oral medications, insulin pumps, and emerging non-invasive technologies offer different methods of managing diabetes. These options can reduce the dependency on injection pens, particularly for patients seeking less invasive or more affordable treatments.

By Type Analysis

In 2023, Disposable Injection Pens held a dominant market position in the By Type segment of the Diabetes Injection Pens Market, capturing more than a 60% share.

In 2023, Disposable Injection Pens held a dominant market position in the By Type segment of the Diabetes Injection Pens Market, capturing more than a 60% share. This significant market share is driven by the convenience, ease of use, and growing preference for single-use devices to avoid cross-contamination. Disposable injection pens are designed for single-use and come pre-filled with insulin, making them user-friendly, especially for elderly patients and those with limited dexterity. The increasing incidence of diabetes globally, coupled with the demand for efficient and reliable insulin delivery methods, supports the dominance of disposable injection pens.

Reusable Injection Pens are also important in the diabetes injection pens market, offering cost-effective and environmentally friendly options. These pens can be used multiple times with replaceable insulin cartridges, making them economical in the long term. However, their market share is smaller compared to disposable injection pens due to the need for regular maintenance and cleaning, which may be less convenient for some users.

By End Users Analysis

In 2023, Home-care Settings held a dominant market position in the By End Users segment of the Diabetes Injection Pens Market, capturing more than a 55% share.

In 2023, Home-care Settings held a dominant market position in the By End Users segment of the Diabetes Injection Pens Market, capturing more than a 55% share. The dominance of home-care settings is driven by the increasing trend of self-management of diabetes, where patients prefer administering insulin in the comfort of their homes. The convenience and privacy offered by home-care settings make them the preferred choice for many diabetes patients. The growing availability of user-friendly and portable injection pens, along with educational initiatives promoting self-care, further supports the widespread adoption of diabetes management at home.

Hospitals and Clinics are also crucial end-users of diabetes injection pens, providing professional medical care and management for diabetes patients. These healthcare facilities are essential for initial diabetes diagnosis, education, and training on the proper use of injection pens. However, their market share is smaller compared to home-care settings due to the increasing shift towards outpatient care and self-management of chronic conditions like diabetes.

Key Market Segments

By Type

- Disposable Injection Pens

- Reusable Injection Pens

By End Users

- Home-care Settings

- Hospital and clinics

Growth Opportunity

Development of Smart Insulin Pens with Connectivity Features

One of the most promising opportunities in 2024 lies in the development of smart insulin pens with connectivity features. These pens can sync with mobile apps to provide real-time data on insulin doses, track glucose levels, and remind patients of upcoming doses. Such connectivity enhances patient adherence to treatment plans and enables better management of diabetes through personalized insights. The integration of digital health technologies with insulin pens is expected to drive significant market growth by improving patient outcomes and simplifying diabetes management.

Expansion in Emerging Markets

The expansion of the diabetes injection pens market in emerging markets presents substantial growth opportunities. Countries in Asia, Latin America, and Africa are experiencing a rapid increase in diabetes prevalence due to urbanization, lifestyle changes, and improved diagnostic capabilities. These regions also show a growing demand for advanced healthcare solutions. By focusing on these markets, manufacturers can tap into a large, underserved patient population, thereby driving market growth. Moreover, initiatives to improve healthcare infrastructure and affordability in these regions will further facilitate the adoption of insulin pens.

Latest Trends

Integration with Mobile Apps for Dosage Tracking

A significant trend in the diabetes injection pens market is the integration of mobile apps for dosage tracking. These apps offer features such as automated dose reminders, logging of injection history, and real-time glucose monitoring. This integration allows patients to manage their diabetes more effectively and share accurate data with healthcare providers for better treatment adjustments. As digital health continues to evolve, the seamless connection between insulin pumps and mobile medical apps is set to become a standard feature, enhancing patient engagement and treatment adherence.

Use of Eco-Friendly Materials in Pen Manufacturing

The use of eco-friendly materials in the manufacturing of insulin pens is another emerging trend. As environmental concerns gain prominence, manufacturers are focusing on sustainability by using biodegradable and recyclable materials for pen production. This shift not only reduces the environmental impact of medical waste but also aligns with the growing consumer preference for eco-friendly products. Companies that prioritize sustainable practices are likely to gain a competitive edge in the market, attracting environmentally conscious consumers and healthcare providers.

Regional Analysis

Europe is the dominant region in the Diabetes Injection Pens Market, with a 40% share.

In 2023, Europe dominated the Diabetes Injection Pens Market, capturing 40% of the market share. This dominance is driven by the high prevalence of diabetes, advanced healthcare infrastructure, and significant adoption of advanced insulin delivery devices in countries like Germany, France, and the UK. The presence of major market players and extensive research and development activities further support the market growth in this region.

North America follows Europe with substantial market participation, driven by the high incidence of diabetes and the widespread use of advanced medical devices for diabetes management. The United States and Canada lead in the adoption of innovative insulin delivery solutions.

Asia Pacific is experiencing rapid growth, fueled by the increasing prevalence of diabetes and the rising awareness of advanced diabetes management solutions in countries like China, India, and Japan. The region's large population base and improving healthcare infrastructure contribute to market expansion.

Middle East & Africa show potential for growth, supported by increasing investments in healthcare infrastructure and the growing prevalence of diabetes. However, the market share remains modest due to economic constraints and limited access to advanced healthcare technologies.

Latin America is emerging as a growing market, with Brazil and Mexico leading the demand for diabetes injection pens. The region benefits from improving healthcare infrastructure and increasing awareness of diabetes management solutions.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Novo Nordisk A/S leads the market with its innovative diabetes care products, including advanced injection pens. Their commitment to research and patient-centric solutions drives their market dominance.

Sanofi S.A. offers a range of insulin pens designed for ease of use and accuracy. Their focus on improving patient outcomes through innovative solutions strengthens their competitive position.

F. Hoffmann-La Roche AG integrates advanced technology with user-friendly designs in their injection pens, aiming to enhance patient adherence and satisfaction.

Eli Lilly and Company emphasizes innovation and quality in their diabetes care products, offering reliable and effective injection pens that cater to diverse patient needs.

Becton, Dickinson and Company (BD) leverages its expertise in medical devices to provide high-quality injection pens that ensure precise and comfortable administration.

Medtronic plc offers advanced diabetes management solutions, including smart injection pens that integrate with digital health platforms for improved patient monitoring and outcomes.

Tandem Diabetes Care, Inc. focuses on innovative and user-friendly insulin delivery systems, enhancing patient experience and adherence.

Insulet Corporation (Omnipod) revolutionizes diabetes care with its tubeless insulin delivery systems, offering an alternative to traditional injection pens.

Dexcom, Inc. provides continuous glucose monitoring systems that complement injection pen usage, enhancing overall diabetes management for patients.

Market Key Players

- Novo Nordisk A/S

- Sanofi S.A.

- F. Hoffmann-La Roche AG

- Eli Lilly and Company

- Becton, Dickinson and Company

- Medtronic plc

- Tandem Diabetes Care, Inc.

- Insulet Corporation (Omnipod)

- Dexcom, Inc.

Recent Development

- In May 2024, Novo Nordisk launched a next-generation insulin pen with integrated Bluetooth technology, improving dose tracking and patient compliance.

- In April 2024, Sanofi introduced a reusable injection pen with enhanced accuracy and ease of use, aimed at improving diabetes management.

Report Scope

Report Features Description Market Value (2023) USD 4.1 Bn Forecast Revenue (2033) USD 7.9 Bn CAGR (2024-2033) 6.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Disposable Injection Pens, Reusable Injection Pens), By End Users (Home-care Settings, Hospital and clinics) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Novo Nordisk A/S, Sanofi S.A., F. Hoffmann-La Roche AG, Eli Lilly and Company, Becton, Dickinson and Company, Medtronic plc, Tandem Diabetes Care, Inc., Insulet Corporation (Omnipod), Dexcom, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Diabetes Injection Pens Market Overview

- 2.1. Diabetes Injection Pens Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Diabetes Injection Pens Market Dynamics

- 3. Global Diabetes Injection Pens Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Diabetes Injection Pens Market Analysis, 2016-2021

- 3.2. Global Diabetes Injection Pens Market Opportunity and Forecast, 2023-2032

- 3.3. Global Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 3.3.1. Global Diabetes Injection Pens Market Analysis by By Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 3.3.3. Disposable Injection Pens

- 3.3.4. Reusable Injection Pens

- 3.4. Global Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By By End Users, 2016-2032

- 3.4.1. Global Diabetes Injection Pens Market Analysis by By End Users: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Users, 2016-2032

- 3.4.3. Home-care Settings

- 3.4.4. Hospital and clinics

- 4. North America Diabetes Injection Pens Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Diabetes Injection Pens Market Analysis, 2016-2021

- 4.2. North America Diabetes Injection Pens Market Opportunity and Forecast, 2023-2032

- 4.3. North America Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 4.3.1. North America Diabetes Injection Pens Market Analysis by By Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 4.3.3. Disposable Injection Pens

- 4.3.4. Reusable Injection Pens

- 4.4. North America Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By By End Users, 2016-2032

- 4.4.1. North America Diabetes Injection Pens Market Analysis by By End Users: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Users, 2016-2032

- 4.4.3. Home-care Settings

- 4.4.4. Hospital and clinics

- 4.5. North America Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Diabetes Injection Pens Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Diabetes Injection Pens Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Diabetes Injection Pens Market Analysis, 2016-2021

- 5.2. Western Europe Diabetes Injection Pens Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 5.3.1. Western Europe Diabetes Injection Pens Market Analysis by By Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 5.3.3. Disposable Injection Pens

- 5.3.4. Reusable Injection Pens

- 5.4. Western Europe Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By By End Users, 2016-2032

- 5.4.1. Western Europe Diabetes Injection Pens Market Analysis by By End Users: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Users, 2016-2032

- 5.4.3. Home-care Settings

- 5.4.4. Hospital and clinics

- 5.5. Western Europe Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Diabetes Injection Pens Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Diabetes Injection Pens Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Diabetes Injection Pens Market Analysis, 2016-2021

- 6.2. Eastern Europe Diabetes Injection Pens Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 6.3.1. Eastern Europe Diabetes Injection Pens Market Analysis by By Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 6.3.3. Disposable Injection Pens

- 6.3.4. Reusable Injection Pens

- 6.4. Eastern Europe Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By By End Users, 2016-2032

- 6.4.1. Eastern Europe Diabetes Injection Pens Market Analysis by By End Users: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Users, 2016-2032

- 6.4.3. Home-care Settings

- 6.4.4. Hospital and clinics

- 6.5. Eastern Europe Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Diabetes Injection Pens Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Diabetes Injection Pens Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Diabetes Injection Pens Market Analysis, 2016-2021

- 7.2. APAC Diabetes Injection Pens Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 7.3.1. APAC Diabetes Injection Pens Market Analysis by By Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 7.3.3. Disposable Injection Pens

- 7.3.4. Reusable Injection Pens

- 7.4. APAC Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By By End Users, 2016-2032

- 7.4.1. APAC Diabetes Injection Pens Market Analysis by By End Users: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Users, 2016-2032

- 7.4.3. Home-care Settings

- 7.4.4. Hospital and clinics

- 7.5. APAC Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Diabetes Injection Pens Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Diabetes Injection Pens Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Diabetes Injection Pens Market Analysis, 2016-2021

- 8.2. Latin America Diabetes Injection Pens Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 8.3.1. Latin America Diabetes Injection Pens Market Analysis by By Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 8.3.3. Disposable Injection Pens

- 8.3.4. Reusable Injection Pens

- 8.4. Latin America Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By By End Users, 2016-2032

- 8.4.1. Latin America Diabetes Injection Pens Market Analysis by By End Users: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Users, 2016-2032

- 8.4.3. Home-care Settings

- 8.4.4. Hospital and clinics

- 8.5. Latin America Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Diabetes Injection Pens Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Diabetes Injection Pens Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Diabetes Injection Pens Market Analysis, 2016-2021

- 9.2. Middle East & Africa Diabetes Injection Pens Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 9.3.1. Middle East & Africa Diabetes Injection Pens Market Analysis by By Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 9.3.3. Disposable Injection Pens

- 9.3.4. Reusable Injection Pens

- 9.4. Middle East & Africa Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By By End Users, 2016-2032

- 9.4.1. Middle East & Africa Diabetes Injection Pens Market Analysis by By End Users: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Users, 2016-2032

- 9.4.3. Home-care Settings

- 9.4.4. Hospital and clinics

- 9.5. Middle East & Africa Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Diabetes Injection Pens Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Diabetes Injection Pens Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Diabetes Injection Pens Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Diabetes Injection Pens Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Novo Nordisk A/S

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Sanofi S.A.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. F. Hoffmann-La Roche AG

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Eli Lilly and Company

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Becton, Dickinson and Company

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Medtronic plc

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Tandem Diabetes Care, Inc.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Insulet Corporation (Omnipod)

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Dexcom, Inc.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- Novo Nordisk A/S

- Sanofi S.A.

- F. Hoffmann-La Roche AG

- Eli Lilly and Company

- Becton, Dickinson and Company

- Medtronic plc

- Tandem Diabetes Care, Inc.

- Insulet Corporation (Omnipod)

- Dexcom, Inc.