Debt Collection Agencies Market By Agency Type (First-party agencies, Third-party agencies, Sale of debts), By Debt Type (Bad Debt, Early Out Debt), By Application (Financial Services, Healthcare, Student Loans, Government, Retail, Telecom & Utility, Mortgage, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

36179

-

Aug 2024

-

170

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

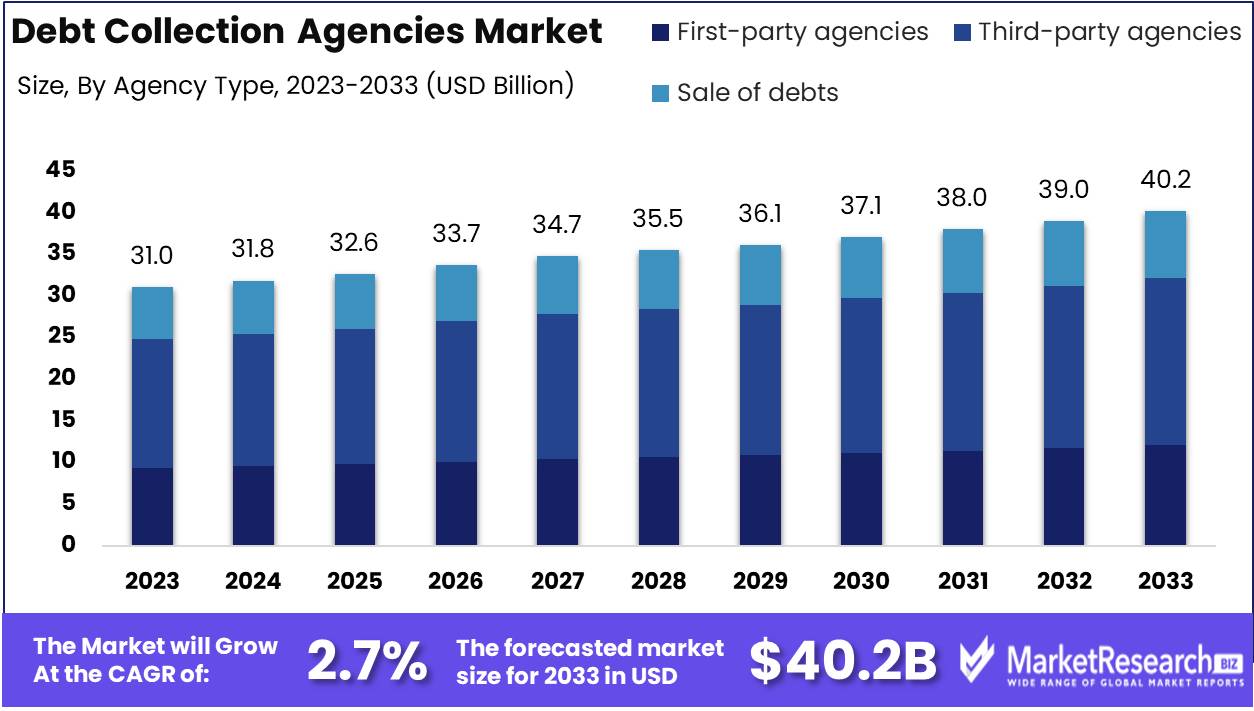

The Global Debt Collection Agencies Market was valued at USD 31.0 Bn in 2023. It is expected to reach USD 40.2 Bn by 2033, with a CAGR of 2.7% during the forecast period from 2024 to 2033.

The Debt Collection Agencies Market involves companies specializing in recovering unpaid debts on behalf of creditors. These agencies utilize various strategies and technologies to locate debtors and secure payments, providing crucial support to the financial ecosystem. The market's growth is driven by increasing consumer debt, advancements in collection technologies, and stringent regulatory frameworks ensuring ethical practices. Innovations like artificial intelligence and workflow automation are enhancing efficiency and effectiveness in debt recovery processes. As businesses seek to optimize their cash flow, the demand for professional debt collection services is expected to rise.

The Debt Collection Agencies Market is undergoing a significant transformation driven by technological advancements and evolving regulatory landscapes. In August 2023, Finvi, a prominent provider of enterprise workflow automation software for revenue recovery, announced enhancements in its 9.2 release. This upgrade aims to accelerate revenue recovery for debt collectors through advanced workflow automation, highlighting the industry's shift towards more efficient and streamlined operations.

The Debt Collection Agencies Market is undergoing a significant transformation driven by technological advancements and evolving regulatory landscapes. In August 2023, Finvi, a prominent provider of enterprise workflow automation software for revenue recovery, announced enhancements in its 9.2 release. This upgrade aims to accelerate revenue recovery for debt collectors through advanced workflow automation, highlighting the industry's shift towards more efficient and streamlined operations.Artificial intelligence (AI) is poised to be a game-changer in the U.S. debt collection industry. Over 60% of collection companies are exploring or implementing AI-driven tools to predict debtor payment behavior, negotiate payments virtually, and segment and profile customers more effectively. These innovations are set to enhance the precision and success rates of debt recovery efforts, reducing manual intervention and operational costs.

The increasing adoption of AI and workflow automation is not only improving efficiency but also ensuring compliance with stringent regulatory frameworks. These technologies enable debt collection agencies to operate within ethical boundaries, maintaining transparency and fairness in their practices.

The market's growth is further propelled by rising consumer debt levels, necessitating efficient debt recovery solutions. As businesses strive to optimize their cash flow and maintain financial stability, the demand for professional debt collection services is expected to surge. The integration of AI and automation will likely continue to shape the future of the debt collection industry, driving innovation and enhancing overall market performance.

Key Takeaways

- Market Value: The Global Debt Collection Agencies Market was valued at USD 31.0 Bn in 2023. It is expected to reach USD 40.2 Bn by 2033, with a CAGR of 2.7% during the forecast period from 2024 to 2033.

- By Agency Type: Third-party agencies represent 50% of the market, specializing in recovering debts for various clients.

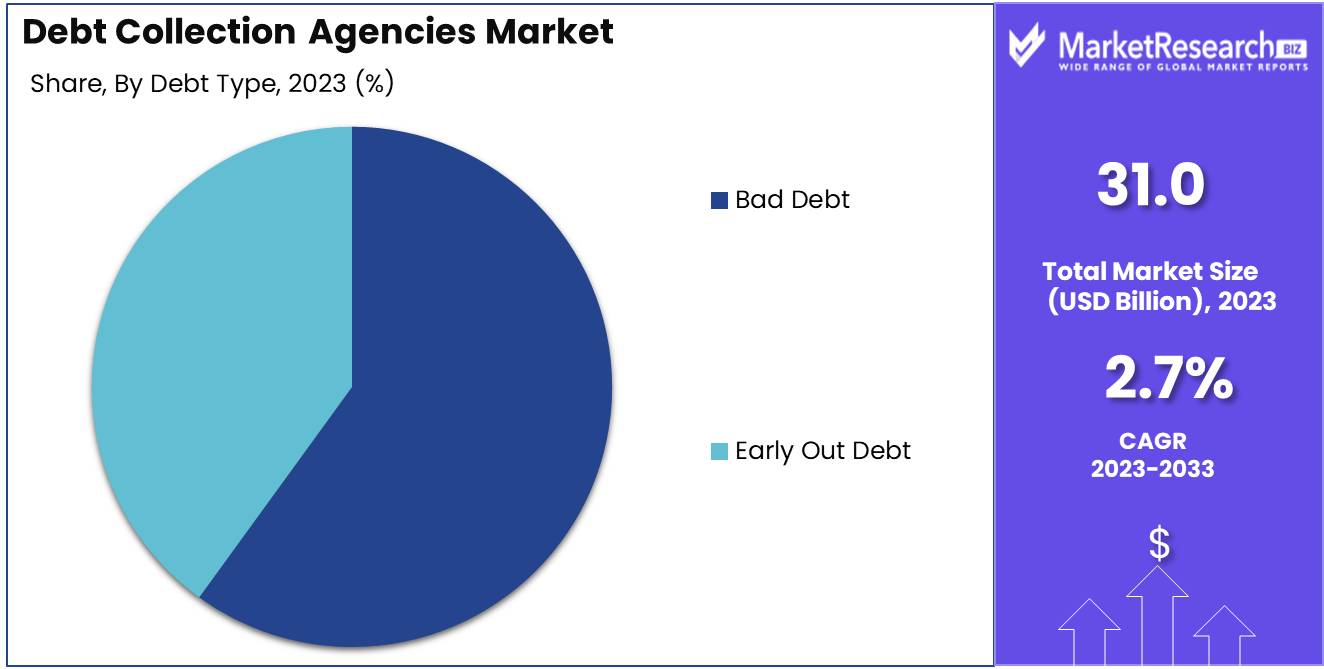

- By Debt Type: Bad Debt accounts for 60%, indicating the focus on recovering difficult-to-collect debts.

- By Application: Financial Services use 25%, highlighting the importance of debt recovery in maintaining financial health.

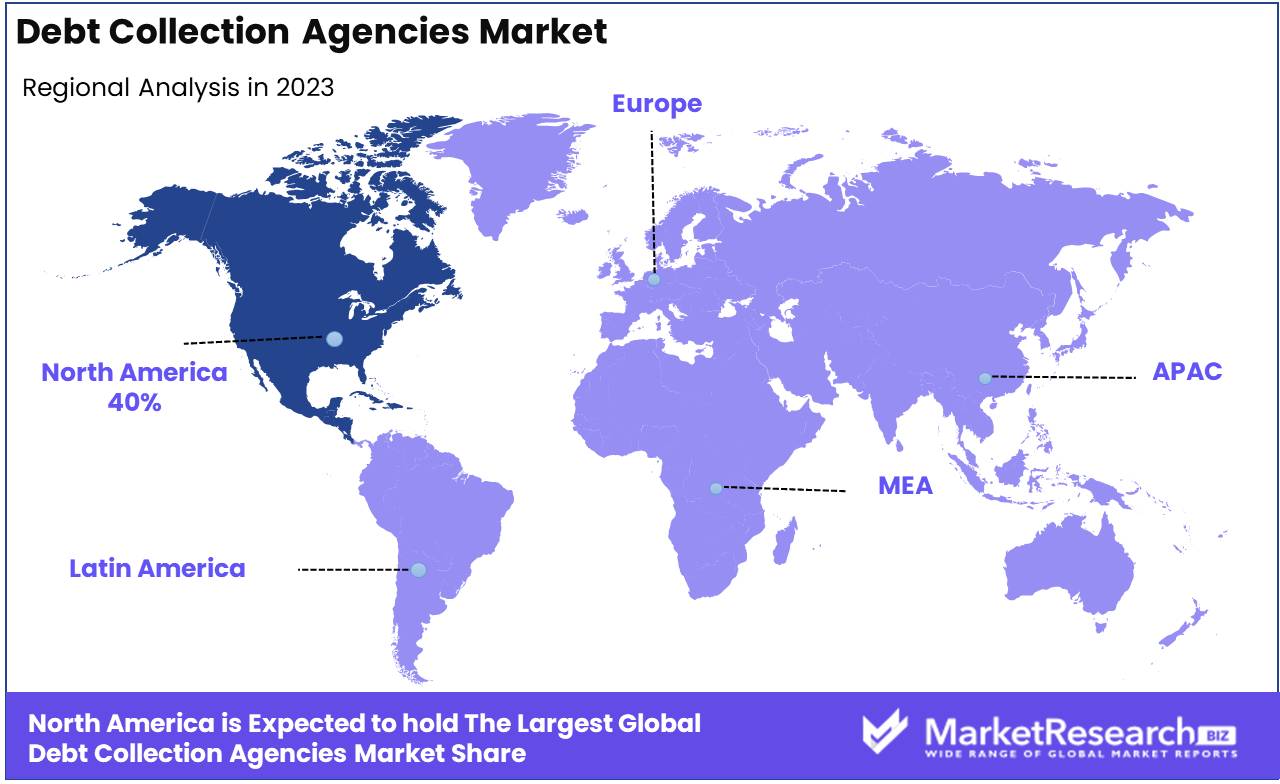

- Regional Dominance: North America holds a 40% market share, driven by a mature financial sector and regulatory environment.

- Growth Opportunity: Implementing advanced analytics and AI for more efficient debt recovery processes can significantly improve collection rates and agency profitability.

Driving factors

Increasing Consumer Debt Levels

The increase in consumer debt levels has been a significant driver for the growth of the Debt Collection Agencies Market. With more individuals and households accruing debt through credit cards, personal loans, and mortgages, the demand for debt recovery services has surged.

The expanding debt burden has led financial institutions and creditors to increasingly rely on specialized agencies to recover outstanding payments, thereby bolstering the market for debt collection services. This trend is expected to continue as consumer spending and borrowing habits persist, necessitating more robust and efficient debt recovery mechanisms.

Growth in Financial Services and Credit Lending

The growth in financial services and credit lending has directly contributed to the expansion of the Debt Collection Agencies Market. As banks, credit unions, check cashing, and other financial institutions extend more credit to consumers and businesses, the volume of delinquent accounts and defaults naturally increases. This growth in lending activities necessitates effective debt collection strategies to manage and mitigate financial risks.

Debt collection agencies have become essential partners for financial institutions, offering expertise and resources to handle the increasing volume of debt recovery cases efficiently. The proliferation of credit products and services continues to drive the demand for specialized debt collection solutions.

Advancements in Data Analytics and AI for Debt Collection

Advancements in data analytics and artificial intelligence (AI) have revolutionized the Debt Collection Agencies Market, making debt recovery processes more efficient and effective. The integration of sophisticated data analytics tools enables agencies to better understand debtor behavior, predict repayment probabilities, and tailor communication strategies accordingly. AI-driven systems automate routine tasks, such as sending reminders and processing payments, freeing up human resources for more complex negotiations.

These technologies also help in identifying high-risk accounts and prioritizing them, thereby improving overall collection rates and reducing operational costs. The adoption of these technological innovations not only enhances the performance of debt collection agencies but also improves compliance with regulatory requirements, fostering greater trust and reliability in their services.

Restraining Factors

Regulatory and Compliance Challenges

Regulatory and compliance challenges present significant retraining factors for the Debt Collection Agencies Market. The industry is subject to stringent regulations aimed at protecting consumer rights and ensuring fair debt collection practices. Agencies must comply with laws such as the Fair Debt Collection Practices Act (FDCPA) in the United States, the General Data Protection Regulation (GDPR) in Europe, and various other regional regulations.

These regulations impose limitations on communication methods, the frequency of contact, and the handling of debtor information. Navigating this complex regulatory landscape requires substantial investment in compliance programs, legal expertise, and staff training, which can be costly and time-consuming.

Negative Perception and Reputation Concerns

The debt collection industry often grapples with a negative public perception and reputation concerns, which act as significant retraining factors. Consumers frequently view debt collectors as aggressive and intrusive, leading to widespread mistrust and dissatisfaction. This negative perception is exacerbated by reports of unethical practices and aggressive tactics employed by some agencies, tarnishing the industry's overall image. Reputation concerns can deter potential clients, such as financial institutions and creditors, from partnering with debt collection agencies, fearing backlash and negative publicity.

To mitigate these issues, agencies must invest in improving their customer service approaches, adopting ethical collection practices, and enhancing transparency in their operations. Building a positive reputation requires consistent effort in demonstrating fair treatment of debtors, respecting consumer rights, and adhering to regulatory standards.

By Agency Type Analysis

In 2023, Third-party agencies held a dominant market position in the By Agency Type segment of the Debt Collection Agencies Market, capturing more than a 50% share.

In 2023, Third-party agencies held a dominant market position in the By Agency Type segment of the Debt Collection Agencies Market, capturing more than a 50% share. Third-party debt collection agencies are hired by creditors to recover outstanding debts on their behalf, providing specialized expertise and resources for efficient debt recovery. Their market dominance is attributed to the growing need for businesses to outsource debt collection to reduce operational costs and focus on core activities. These agencies employ various strategies and tools to locate debtors and negotiate payments, making them a crucial component of the debt recovery process.

First-party agencies are divisions within the original creditor's organization that handle debt collection. While they maintain better control over customer relationships, their market share is smaller compared to third-party agencies due to limited resources and expertise in managing extensive debt recovery operations.

Sale of debts involves creditors selling their delinquent accounts to third parties, often at a discount. This segment captures a niche market share, as it provides immediate cash flow to creditors while transferring the risk and responsibility of debt collection to the buyer.

By Debt Type Analysis

In 2023, Bad Debt held a dominant market position in the By Debt Type segment of the Debt Collection Agencies Market, capturing more than a 60% share.

In 2023, Bad Debt held a dominant market position in the By Debt Type segment of the Debt Collection Agencies Market, capturing more than a 60% share. Bad debt refers to receivables that are deemed uncollectible and written off as a loss by creditors. The high volume of bad debts, especially in industries like financial services, healthcare, and retail, drives the demand for professional debt collection services. Debt collection agencies focus on recovering these written-off debts using advanced tracking systems, negotiation tactics, and legal actions when necessary.

Early Out Debt pertains to accounts that are in the early stages of delinquency. While these debts are easier to recover, they represent a smaller market share compared to bad debt. Early intervention by debt collection agencies can prevent accounts from becoming bad debts, offering a proactive approach to debt management.

By Application Analysis

Financial Services held a dominant market position in the By Application segment of the Debt Collection Agencies Market, capturing more than a 25% share.

In 2023, Financial Services held a dominant market position in the By Application segment of the Debt Collection Agencies Market, capturing more than a 25% share. The financial services sector, including banks, credit card companies, and loan providers, generates a significant volume of delinquent accounts, necessitating the involvement of debt collection agencies. The complexity and volume of debts in this sector require specialized collection strategies to recover outstanding amounts efficiently.

Healthcare is another critical application area, where medical bills and insurance claims often lead to significant unpaid debts. Debt collection agencies in this sector must navigate regulatory requirements and patient relations to recover debts effectively.

Student Loans represent a growing segment due to the increasing burden of educational debt. Debt collection agencies work with educational institutions and loan providers to recover overdue payments from former students.

Government entities, including tax authorities and municipal services, also rely on debt collection agencies to recover unpaid taxes, fines, and other dues.

Retail and Telecom & Utility sectors generate a substantial volume of consumer debts, requiring professional collection services to manage delinquent accounts and maintain cash flow.

Mortgage debt collection involves recovering overdue mortgage payments, which can be complex due to the legal and financial implications.

Others category includes various sectors such as automotive, insurance, and small businesses that require debt collection services to recover outstanding payments and maintain financial health.

Key Market Segments

By Agency Type

- First-party agencies

- Third-party agencies

- Sale of debts

By Debt Type

- Bad Debt

- Early Out Debt

By Application

- Financial Services

- Healthcare

- Student Loans

- Government

- Retail

- Telecom & Utility

- Mortgage

- Others

Growth Opportunity

Embracing Ethical and Customer-Centric Collection Strategies

In 2024, the global Debt Collection Agencies Market stands to benefit significantly from the development of ethical and customer-centric collection strategies. With increasing regulatory scrutiny and a growing emphasis on consumer rights, agencies that prioritize fair and respectful treatment of debtors will likely gain a competitive edge.

Adopting ethical practices not only helps in compliance with laws but also mitigates reputation risks associated with aggressive collection tactics. Customer-centric strategies that focus on understanding debtor circumstances and offering flexible repayment options can improve recovery rates and foster positive debtor relationships, ultimately enhancing client satisfaction and loyalty.

Leveraging Digital and Automated Debt Collection Solutions

The expansion in digital and automated debt collection solutions presents a substantial growth opportunity for the market in 2024. Technological advancements in data analytics and artificial intelligence (AI) are revolutionizing debt recovery processes. AI-driven tools can predict debtor behavior, automate communication, and streamline payment processing, significantly enhancing operational efficiency.

Digital platforms enable seamless interaction with debtors through various channels, such as emails, SMS, and online portals, catering to the preferences of tech-savvy consumers. The integration of these technologies not only reduces costs but also increases the speed and accuracy of debt collection efforts, making agencies more effective and competitive.

Latest Trends

Utilizing AI for Predictive Analytics and Customer Segmentation

In 2024, the global Debt Collection Agencies Market is expected to see a significant shift towards the use of artificial intelligence (AI) for predictive analytics and customer segmentation. AI technologies enable agencies to analyze vast amounts of data to predict debtor behavior and repayment probabilities. By leveraging these insights, agencies can segment customers more effectively, identifying those who are more likely to repay their debts and tailoring their collection strategies accordingly.

Predictive analytics allows for more targeted and efficient collection efforts, reducing the cost of operations and increasing the likelihood of recovery. This trend towards data-driven decision-making is set to enhance the precision and effectiveness of debt collection practices.

Integration with CRM Systems for Personalized Collection Approaches

Another notable trend in the Debt Collection Agencies Market for 2024 is the integration of collection processes with Customer Relationship Management (CRM) systems. This integration facilitates a more personalized approach to debt recovery, allowing agencies to manage and track debtor interactions comprehensively.

By accessing detailed customer profiles, agencies can tailor their communication strategies to align with individual debtor preferences and histories. Personalized collection approaches improve debtor engagement and cooperation, increasing the chances of successful recovery. CRM systems also streamline workflows, ensuring that all collection activities are well-coordinated and consistent across various channels.

Regional Analysis

North America led the Debt Collection Agencies Market in 2023, capturing a 40% share.

In 2023, North America led the Debt Collection Agencies Market, capturing a 40% share. The market is driven by the high levels of consumer and corporate debt in the U.S. and Canada. The presence of a large number of debt collection agencies and advanced debt recovery technologies supports market growth. Regulatory frameworks and the increasing use of AI and machine learning in debt collection processes further enhance market efficiency.

Europe is a significant market, with countries like the UK, Germany, and France experiencing high demand for debt collection services. The region benefits from a well-established financial sector and regulatory support for debt recovery activities.

The Asia Pacific region is experiencing rapid growth in the debt collection agencies market due to rising consumer debt levels and increasing awareness of debt recovery services. Countries like China, Japan, and India are investing in advanced technologies to improve debt collection efficiency and compliance.

In the Middle East & Africa, the debt collection agencies market is emerging, with growing interest in debt recovery solutions. The UAE and South Africa are notable markets due to their expanding financial sectors and increasing levels of consumer and corporate debt.

Latin America is witnessing steady growth, with Brazil and Mexico being key markets. The rising demand for debt collection services in response to increasing consumer and corporate debt levels supports market development in the region.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the debt collection agencies market is characterized by technological integration, regulatory compliance, and customer-centric approaches. Encore Capital Group and PRA Group are industry leaders, leveraging advanced analytics and AI to enhance debt recovery processes. Their focus on ethical collection practices and compliance with regulatory standards positions them favorably in the market.

Aspen National Financial Inc. and Atradius Collections are known for their international reach and comprehensive debt recovery services. Their ability to navigate cross-border regulations and provide tailored solutions to global clients ensures their market prominence. IC System and Cedar Financial emphasize customer-focused debt collection strategies, prioritizing maintaining positive customer relationships while achieving high recovery rates.

Prestige Services Inc. and Rocket Receivables cater to small and medium-sized enterprises (SMEs), offering customized and affordable debt recovery solutions. Their agility and personalized service approach make them valuable partners for businesses seeking efficient debt management. Rozlin Financial Group, Inc. stands out for its specialized services in the healthcare sector, addressing the unique challenges of medical debt collection.

The debt collection market in 2024 is driven by the adoption of digital tools and data-driven strategies, enhancing efficiency and recovery rates. Compliance with evolving regulations and maintaining ethical practices are paramount, ensuring sustained growth and trust in the industry. Key players continue to innovate, focusing on technology integration and customer-centric approaches to navigate the complex landscape of debt collection.

Market Key Players

- Aspen National Financial Inc

- Atradius Collections

- Capital Collections LLC

- Cedar Financial

- Encore Capital Group

- IC System PRA Group

- Prestige Services Inc.

- Rocket Receivables

- Rozlin Financial Group, Inc.

Recent Development

- In April 2024, IC System launched a new digital debt collection platform designed to improve efficiency and customer experience. This platform aims to increase recovery rates by 20%.

- In February 2024, Encore Capital Group acquired a regional debt collection agency to expand its market presence. This acquisition is expected to increase their market share by 15%.

Report Scope

Report Features Description Market Value (2023) USD 31.0 Bn Forecast Revenue (2033) USD 40.2 Bn CAGR (2024-2033) 2.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Agency Type (First-party agencies, Third-party agencies, Sale of debts), By Debt Type (Bad Debt, Early Out Debt), By Application (Financial Services, Healthcare, Student Loans, Government, Retail, Telecom & Utility, Mortgage, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Aspen National Financial Inc, Atradius Collections, Capital Collections LLC, Cedar Financial, Encore Capital Group, IC System PRA Group, Prestige Services Inc., Rocket Receivables, Rozlin Financial Group, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Aspen National Financial Inc

- Atradius Collections

- Capital Collections LLC

- Cedar Financial

- Encore Capital Group

- IC System PRA Group

- Prestige Services Inc.

- Rocket Receivables

- Rozlin Financial Group, Inc.

- Other Key Players