Check Cashing Market Report By Type (Payroll Check Cashing, Government Check Cashing, Personal Check Cashing, Money Orders, Others), By End-User (Individuals, Small Businesses), By Service Channel (In-Store Services, Online Services, Mobile Services), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

36471

-

August 2024

-

321

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

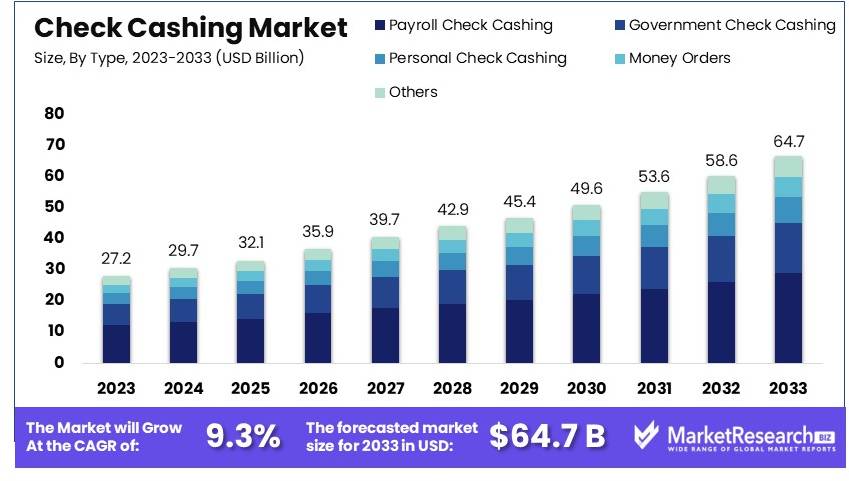

The Global Check Cashing Market size is expected to be worth around USD 64.7 Billion by 2033, from USD 27.2 Billion in 2023, growing at a CAGR of 9.3% during the forecast period from 2024 to 2033.

The check cashing market involves providing financial services that allow individuals to cash checks without needing a bank account. This market is driven by the need for accessible financial services among unbanked and underbanked populations. Key players include check cashing businesses, retailers, and financial service providers.

The market has grown due to the convenience and immediacy of check cashing services. Innovations in digital payment solutions and mobile apps have further expanded the market. Major trends include increased regulation and the shift towards online check cashing services. The market is competitive, with numerous providers catering to different customer needs.

The check cashing market remains a vital financial service sector, especially for unbanked and underbanked populations. In the United States, approximately 13,000 financial service centers provide check cashing services, conducting over 350 million transactions annually, amounting to USD 106 billion. These centers offer a critical service, providing immediate access to cash for those who may not have traditional banking relationships.

The cost of using check cashing services varies significantly. On average, fees range from 1% to 12% of the check's value. For example, Walmart charges USD 4 for checks up to USD 1,000 and USD 8 for checks over USD 1,000, translating to a fee range of 0.4% to 0.8%. While these fees might seem high, they reflect the convenience and immediacy that these services offer. This immediate access to funds is crucial for users who need cash quickly and cannot afford the delays associated with traditional banking processes.

The market dynamics are shaped by the diverse needs of its user base. Many consumers rely on these services due to a lack of access to traditional banking or credit facilities. The flexibility and extended hours of operation offered by check cashing centers add to their appeal, particularly for those with irregular work schedules.

Additionally, the regulatory landscape impacts this market significantly. Regulations aimed at protecting consumers and ensuring fair pricing are continually evolving, influencing service providers' operations.

The check cashing market plays a crucial role in providing financial services to underserved populations. Despite the varying fees, the convenience and accessibility of these services drive their continued use. The market is expected to sustain its growth, driven by the ongoing demand for quick and reliable access to cash.

Key Takeaways

- Market Value: The Check Cashing Market was valued at USD 27.2 billion in 2023 and is projected to reach USD 64.7 billion by 2033, growing at a CAGR of 9.3%.

- By Type Analysis: Payroll Check Cashing dominates with 45%; it is fundamental due to its necessity in everyday financial transactions.

- By End-User Analysis: Individuals hold the majority share at 78%; they represent the primary consumer base for check cashing services.

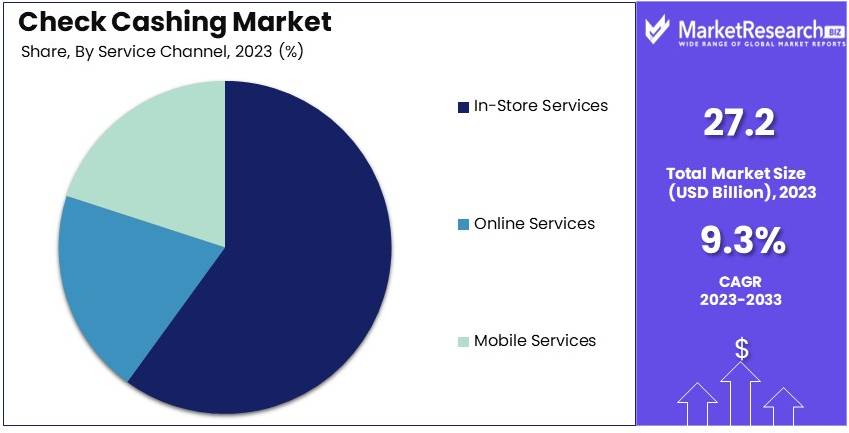

- By Service Channel Analysis: In-Store Services lead with 60%; the need for immediate access to funds makes these services indispensable.

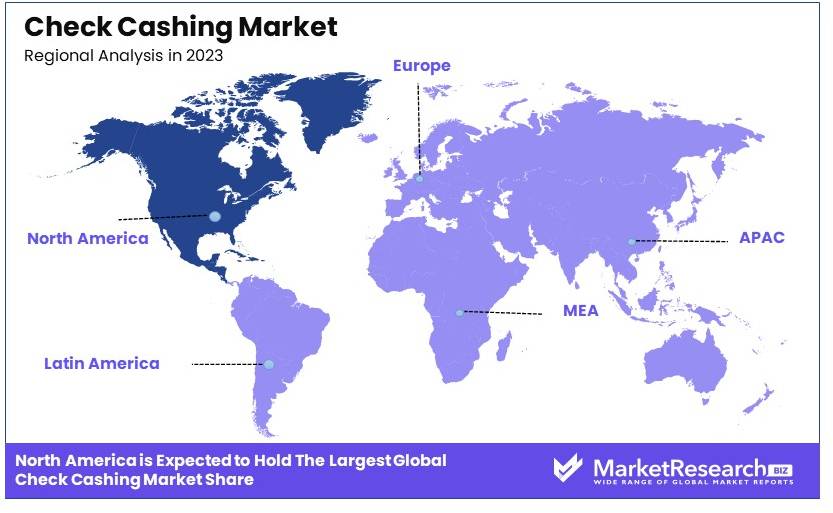

- Dominant Region: North America leads with 45.8%; a well-established financial service infrastructure supports growth.

- Analyst Viewpoint: The Check Cashing Market is moderately saturated with substantial competition; the focus on digital and mobile solutions is expected to influence future trends.

- Growth Opportunities: Diversification into mobile and online platforms could provide competitive advantages, meeting the growing demand for convenient financial services.

Driving Factors

Underbanked Population Drives Market Growth

A significant portion of the population remains underbanked or unbanked, driving demand for check cashing services. These individuals often lack access to traditional banking services due to factors such as poor credit history, lack of proper identification, or distrust in banks.

According to the Federal Reserve, as of 2019, approximately 6% of U.S. adults were unbanked. Check cashing services provide a vital financial service for this demographic, allowing them to access their funds quickly and conveniently. For example, ACE Cash Express, a leading check cashing service provider, reported serving over 38 million customers annually, highlighting the substantial market for these services. The underbanked population’s reliance on alternative financial services underscores the critical role of check cashing in financial inclusion.

Immediate Access to Funds Drives Market Growth

Check cashing services offer instant access to cash, which is particularly attractive to individuals living paycheck to paycheck or those facing unexpected expenses. Unlike traditional banks that may place holds on deposited checks, check cashing stores provide immediate liquidity.

This immediacy is crucial for many customers who cannot afford to wait for checks to clear through the banking system. For instance, PLS Financial Services, a major player in the check cashing market, emphasizes its "immediate cash" offering as a key selling point, catering to customers who need rapid access to their funds. The ability to provide instant cash access interacts with the financial urgency of customers, driving growth in the check cashing market.

Convenience and Extended Operating Hours Drive Market Growth

Check cashing stores often operate during hours when traditional banks are closed, including evenings, weekends, and holidays. This convenience factor is a significant driver for the market, especially for workers with non-traditional schedules.

Many check cashing outlets are strategically located in high-traffic areas or within retail stores, making them easily accessible. For example, Money Mart, a well-known check cashing chain, operates many of its locations 24/7, providing round-the-clock service to customers who need to cash checks outside of regular banking hours. The combination of extended operating hours and strategic locations enhances the convenience of check cashing services, thereby supporting market expansion.

Restraining Factors

Increasing Digitalization of Financial Services Restrains Market Growth

The rise of digital payment, mobile check deposit apps, and peer-to-peer payment platforms poses a significant threat to traditional check cashing services. As more people adopt these technologies, the need for physical check cashing locations may diminish.

For example, the popularity of mobile banking apps like Chime, which offers mobile check deposit and early direct deposit features, has grown rapidly, with Chime reaching over 12 million users by 2021. This shift towards digital solutions could reduce foot traffic to check cashing stores, especially among younger, more tech-savvy consumers. The convenience and accessibility of digital financial services present a significant challenge to the growth of the traditional check cashing market.

Regulatory Scrutiny and Compliance Costs Restrain Market Growth

The check cashing industry faces increasing regulatory oversight, particularly concerning anti-money laundering (AML) and know-your-customer (KYC) requirements. Compliance with these regulations can be costly and complex, potentially squeezing profit margins for smaller operators.

For instance, in 2021, the Financial Crimes Enforcement Network (FinCEN) proposed new regulations that would require check cashing businesses to report transactions over USD 2,000, down from the previous USD 3,000 threshold. Such regulatory changes increase operational costs and administrative burdens for check cashing businesses. These added expenses and complexities can hinder market expansion and profitability for smaller check cashing services.

Type Analysis

Payroll Check Cashing dominates with 45% due to steady demand from unbanked workers.

The check cashing market is segmented by type into payroll check cashing, government check cashing, personal check cashing, money orders, and others. Payroll check cashing holds the dominant position with 45% of the market share. This dominance is driven by the steady demand from unbanked and underbanked workers who need immediate access to their wages.

Many employees in low-income jobs, temporary positions, or those without access to traditional banking services rely on payroll check cashing services to access their funds promptly. The convenience and immediacy of these services make them indispensable to this segment of the workforce.

Government check cashing is another significant segment, accounting for 25% of the market. This segment includes the cashing of Social Security checks, unemployment checks, and other government-issued payments. The stability and reliability of government checks ensure a consistent flow of customers to check cashing services. These customers often include retirees, veterans, and individuals receiving public assistance, who depend on these services for timely access to their funds.

Personal check cashing, while less prevalent, still plays a role in the market, holding a 15% share. This segment caters to individuals who need to cash personal checks from friends or family. Although smaller in volume, personal check cashing is essential for those without bank accounts who require immediate cash for personal expenses.

Money orders, which account for 10% of the market, provide a secure and reliable method for individuals to send money, particularly for those who do not have access to electronic payment methods. The remaining 5% of the market is comprised of other check cashing services, which include business checks and other non-standard types of checks. These services add to the overall diversity and resilience of the check cashing market by catering to niche needs and specific customer requirements.

End-User Analysis

Individuals dominate with 78% due to higher demand for accessible financial services.

In the check cashing market, individuals make up the largest end-user segment, accounting for 78% of the market. This dominance is due to the higher demand for accessible financial services among unbanked and underbanked populations.

Many individuals, particularly those in lower-income brackets, rely on check cashing services to manage their finances. These services provide a crucial lifeline for accessing cash quickly and efficiently without the need for a traditional bank account. The convenience and speed offered by check cashing services are essential for individuals who need immediate access to funds to cover daily expenses, bills, and other necessities.

Small businesses represent the remaining 22% of the market. These businesses often use check cashing services to manage their cash flow more effectively. For example, small businesses might cash checks received from customers to ensure they have the necessary funds to pay employees, suppliers, and other operational expenses. By using check cashing services, small businesses can avoid the delays associated with traditional banking processes, allowing for more streamlined financial management. This segment, while smaller than the individual end-user segment, plays a critical role in supporting the operations of local economies and providing financial stability to small business owners.

The growth of the individual end-user segment is also influenced by demographic factors such as age, income level, and employment status. Younger individuals, those with lower incomes, and those working in temporary or part-time positions are more likely to use check cashing services. As the economy continues to evolve and more people seek flexible employment opportunities, the demand for check cashing services among individuals is expected to remain strong. Meanwhile, small businesses will continue to rely on these services for efficient cash flow management, contributing to the overall growth and stability of the check cashing market.

Service Channel Analysis

In-Store Services dominate with 60% due to the personalized experience and immediate cash access.

The check cashing market is segmented by service channel into in-store services, online services, and mobile services. In-store services dominate this segment, holding a 60% market share. The dominance of in-store services can be attributed to the personalized experience and immediate cash access they provide.

Customers appreciate the ability to visit a physical location, interact with staff, and receive their cash on the spot. This face-to-face interaction builds trust and confidence, particularly among those who may be wary of digital transactions or who do not have access to online services. Additionally, in-store services often offer extended hours, making it convenient for customers to access their funds outside of traditional banking hours.

Online services are gaining traction, holding a 25% share of the market. These services cater to tech-savvy customers who prefer the convenience of cashing checks from the comfort of their homes. Online check cashing services typically involve scanning or photographing checks and submitting them through a website or mobile app. The funds are then deposited into a prepaid card or directly to a bank account. This method offers a high level of convenience and can be particularly appealing to younger consumers and those with access to the necessary technology.

Mobile services, while the smallest segment, account for 15% of the market and are rapidly growing. Mobile check cashing apps allow customers to cash checks using their smartphones, providing a seamless and convenient experience. These services are especially popular among younger generations and individuals who are always on the go. The growth of mobile services is driven by the increasing adoption of smartphones and mobile banking technologies. As more consumers become comfortable with mobile transactions, this segment is expected to expand further, offering a flexible and efficient alternative to traditional in-store services.

The in-store service channel remains dominant due to its ability to provide a personalized and immediate cashing experience. However, the rapid growth of online and mobile services indicates a shifting preference towards digital solutions, driven by technological advancements and changing consumer behaviors. As the market continues to evolve, the balance between these service channels will likely shift, with digital services playing an increasingly important role in meeting the needs of check cashing customers.

Key Market Segments

By Type

- Payroll Check Cashing

- Government Check Cashing

- Personal Check Cashing

- Money Orders

- Others

By End-User

- Individuals

- Small Businesses

By Service Channel

- In-Store Services

- Online Services

- Mobile Services

Growth Opportunities

Integration of Fintech Solutions Offers Growth Opportunity

There is an opportunity for check cashing businesses to integrate fintech solutions to streamline operations and offer more competitive services. This could include implementing blockchain technology for faster, more secure transactions or partnering with digital wallet providers.

For example, Ingo Money, a fintech company, has partnered with several check cashing businesses to offer instant digital check cashing services, allowing customers to deposit checks directly to their prepaid cards or digital wallets. Such innovations can help check cashing businesses stay relevant in an increasingly digital financial landscape. By embracing fintech, check cashing services can improve efficiency, security, and customer satisfaction.

Expansion of Services to Cater to Gig Economy Workers Offers Growth Opportunity

The growing gig economy presents an opportunity for check cashing services to cater to freelancers and independent contractors who may have irregular income patterns. These workers often face challenges with traditional banking services and may prefer the flexibility of check cashing outlets.

For instance, some check cashing businesses are exploring partnerships with gig economy platforms to offer specialized services for these workers, such as instant payouts or tailored financial products. By addressing the unique financial needs of gig workers, check cashing services can expand their customer base and enhance their relevance in a changing labor market.

Trending Factors

Mobile Check Cashing Apps Are Trending Factors

The trend of developing mobile apps for check cashing services is growing, allowing businesses to reach customers who prefer digital solutions while still catering to those who need cash. These apps often use advanced image recognition technology to verify checks remotely.

For instance, Ingo Money's mobile check cashing app has gained popularity, processing billions of dollars in check deposits annually. This trend allows check cashing businesses to compete with banks' mobile deposit features while still offering the option of immediate cash access. Mobile apps enhance convenience and accessibility, broadening the customer base and increasing market competitiveness.

Cryptocurrency Integration Are Trending Factors

As cryptocurrencies gain mainstream acceptance, there is a growing trend of check cashing businesses exploring cryptocurrency services. This could include offering Bitcoin ATMs or allowing customers to convert their cashed checks into cryptocurrencies.

For example, Coinme has partnered with Coinstar to offer Bitcoin purchasing services at thousands of locations, many of which are in stores that also offer check cashing services. This integration can attract tech-savvy customers and provide a new revenue stream for check cashing businesses, positioning them at the forefront of financial innovation.

Regional Analysis

North America Dominates with 45.8% Market Share in the Check Cashing Market

North America's commanding 45.8% market share in the check cashing market is primarily driven by the widespread use of checks for personal and business transactions across the United States and Canada. High banking penetration and a substantial unbanked population rely on check cashing services for their financial needs. Additionally, the prevalence of small businesses that prefer checks for payments contributes significantly.

The regional characteristics that affect the industry include a robust financial services infrastructure and a diverse consumer base that includes both banked and unbanked individuals. The presence of numerous check cashing outlets, coupled with stringent but clear regulatory frameworks, supports market operation and growth. The convenience of quick access to cash without the need for a bank account appeals to a significant portion of the population.

The future influence of North America in the check cashing market is expected to remain strong, although it may face challenges from increasing digital payment solutions. However, the persistent need for immediate fund access and the slow pace of change in payment habits among certain demographic groups will likely sustain demand for check cashing services.

Regional Market Shares:

- Europe: Holds about 25% of the market. The European market is less reliant on check-based transactions due to higher adoption of electronic and mobile payment technologies.

- Asia Pacific: This region accounts for approximately 15% of the market share, driven by still prevalent traditional banking practices in many areas, alongside growing financial inclusion initiatives.

- Middle East & Africa: Captures about 5% of the global market share. Growth in this region is limited by the rapid shift to mobile and digital payments, outpacing the development of traditional financial services like check cashing.

- Latin America: With around 10% of the market, Latin America sees varying degrees of reliance on check transactions, influenced by uneven access to banking services across the region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The check cashing market is driven by key players known for their strategic positioning and market influence. ACE Cash Express, Inc. and The Check Cashing Store lead with extensive service networks and strong brand recognition. PLS Financial Services, Inc. and Check Into Cash focus on customer convenience and diverse financial services.

Moneytree, Inc. and CFSC (Community Financial Service Centers) emphasize community-based services and local presence. Speedy Cash and Cash America International, Inc. leverage technological advancements to enhance service delivery.

Western Union and MoneyGram International, Inc. integrate check cashing with global money transfer services, offering comprehensive financial solutions. Pay-O-Matic and United Check Cashing maintain strong regional dominance, providing tailored services to local markets.

USA Checks Cashed, Friendly Check Cashing, Inc., and Cash Express, LLC focus on accessibility and quick service. These companies collectively drive market trends through innovation, customer service, and strategic expansion.

Market Key Players

- ACE Cash Express, Inc.

- The Check Cashing Store

- PLS Financial Services, Inc.

- Check Into Cash

- Moneytree, Inc.

- CFSC (Community Financial Service Centers)

- Speedy Cash

- Cash America International, Inc.

- Western Union

- MoneyGram International, Inc.

- Pay-O-Matic

- United Check Cashing

- USA Checks Cashed

- Friendly Check Cashing, Inc.

- Cash Express, LLC

Recent Developments

2024: PayPal continues to promote its "Cash a Check" service, which allows users to cash checks directly through their mobile app. This service is particularly aimed at providing quick access to funds with options for immediate cash for a fee or a no-fee option that takes longer. PayPal is leveraging its platform to cater to a broader range of financial services, traditionally handled by physical banking locations.

2024: Regions Bank has been promoting its "Now Banking" suite, which includes check cashing services that don’t require a traditional bank account. This service is part of a broader effort to provide financial services that are accessible to a wider audience, including those who are unbanked or underbanked, a significant step towards financial inclusion.

Report Scope

Report Features Description Market Value (2023) USD 27.2 Billion Forecast Revenue (2033) USD 64.7 Billion CAGR (2024-2033) 9.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Payroll Check Cashing, Government Check Cashing, Personal Check Cashing, Money Orders, Others), By End-User (Individuals, Small Businesses), By Service Channel (In-Store Services, Online Services, Mobile Services) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ACE Cash Express, Inc., The Check Cashing Store, PLS Financial Services, Inc., Check Into Cash, Moneytree, Inc., CFSC (Community Financial Service Centers), Speedy Cash, Cash America International, Inc., Western Union, MoneyGram International, Inc., Pay-O-Matic, United Check Cashing, USA Checks Cashed, Friendly Check Cashing, Inc., Cash Express, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- ACE Cash Express, Inc.

- The Check Cashing Store

- PLS Financial Services, Inc.

- Check Into Cash

- Moneytree, Inc.

- CFSC (Community Financial Service Centers)

- Speedy Cash

- Cash America International, Inc.

- Western Union

- MoneyGram International, Inc.

- Pay-O-Matic

- United Check Cashing

- USA Checks Cashed

- Friendly Check Cashing, Inc.

- Cash Express, LLC