Dealcoholized Wine Market By Type (Non Alcoholic Wines and Partly De-alcohol Wines), By Application ,Application I ,Application II ,Application III ,Application IV),By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

-

45081

-

April 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

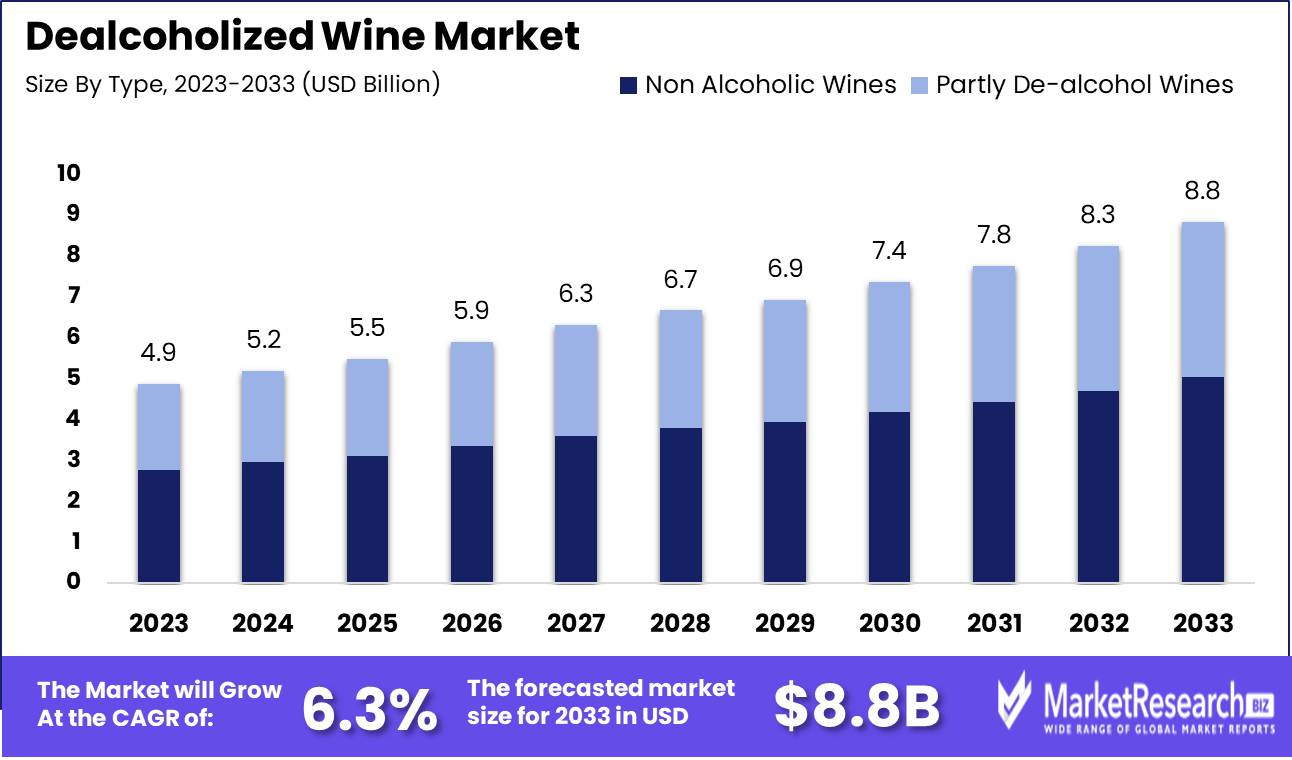

The Dealcoholized Wine Market was valued at USD 4.9 billion in 2023. It is expected to reach USD 8.8 billion by 2033, with a CAGR of 6.3% during the forecast period from 2024 to 2033. The surge in demand for cocktails, and non-alcoholic beverages, and changes in customer preferences are some of the main key driving factors for dealcoholized wine.

Dealcoholized wine is defined as non-alcoholic wine and alcohol-removed wine which is a beverage designed to bear a resemblance to old wine but with substantially decreased or wholly removed alcohol content. The technique of alcoholization comprises od eliminating alcohol from daily wine through methods like vacuum distillation, contrary distillation, or heating. This permits consumers to enjoy the taste and aroma of wine without the hallucinogenic impacts of alcohol. This dealcoholized wine has several features of old wine by comprising flavor profiles, mouthfeel, and acidity, making it an appropriate substitute for individuals looking to restrain alcohol consumption for health, religious reasons, and personal. Moreover, dealcoholized wine provides a choice for those who wish to enjoy wine with meals and social gatherings without any risk of damage. Though the elimination of alcohol may change some aspects of the wine’s taste and texture, advancements in technology and manufacturing methods continue to enhance the quality and authenticity of dealcoholized wine by making it a growing ideal choice in the beverage market.

According to a report published by Foods and Wines from Spain in July 2022, the new innovative UVESTE winery obligates to the dealcoholized wine segment. This winery is based in Requena which is already a giant in organic cava production and is now seeking to expand its footprints. In 2022, it has plans to deal with 1.6 million liters of wine to meet the requirements. Moreover, an article published by BevZero in October 2023, highlights that dealcoholized wine has slight adjustments for style such as 15% above to 14% above or for a low alcohol product down to 8% above, or down to <0.5% above for non-alcoholic.

Dealcoholized wine provides many advantages that comprise lower calorie content as compared to old wine by making it an appropriate alternative for those watching their caloric intake. It also permits individuals to enjoy the taste and aroma of wine without experiencing the inebriating impacts of alcohol by making it optimal for designated drivers, pregnant women, and individuals refraining from alcohol for health and personal reasons. Moreover, dealcoholized wine adds well with different dishes by improving the dining experience. The demand for dealcoholized wine products will increase due to their requirement in the beverages industry which will help in market expansion in the coming years.

Key Takeaways

- Market Growth: The dealcoholized wine market was valued at USD 4.9 billion in 2023. It is expected to reach USD 8.8 billion by 2033, with a CAGR of 6.3% during the forecast period from 2024 to 2033.

- By Type: In 2023, Non-Alcoholic Wines led the Dealcoholized Wine Market due to health trends and regulatory shifts.

- By Application: In 2023, Application I dominated the dealcoholized wine market, fueled by millennials' health-conscious preferences.

- Regional Dominance: North America leads the dealcoholized wine market, influencing global trends with a 35% share.

- Growth Opportunity: The dealcoholized wine market will thrive on technological innovation and diversification of consumption occasions.

Driving factors

Growing Consumer Demand: Health-Conscious Consumer Trends Propel Market Expansion

Growing consumer demand is a pivotal driver for the dealcoholized wine market, predominantly fueled by increasing health consciousness among consumers worldwide. Individuals are progressively opting for healthier lifestyle choices, and dealcoholized wine offers a beneficial alternative to traditional alcoholic beverages. The allure lies in its lower calorie content and the absence of alcohol, which aligns with the broader consumer trend towards moderation and wellness.

Statistically, this trend is mirrored in the rising sales volumes of dealcoholized wines. For example, market analysis indicates a significant increase in the consumption of non-alcoholic wines, with some regions observing growth rates exceeding 30% annually. This surge is underpinned by a broader demographic of consumers, including younger generations and pregnant women, who are particularly attracted to the health benefits and social inclusivity offered by non-alcoholic options.

Market Growth Potential: Untapped Segments and Innovation Drive Expansion

The dealcoholized wine market exhibits substantial growth potential, driven by both untapped consumer segments and technological innovations in production. The process of removing alcohol from wine has improved significantly, allowing manufacturers to retain the taste and quality that appeal to wine enthusiasts. This technological advancement not only enhances product appeal but also broadens the market to include consumers who avoid alcohol for health, religious, or personal reasons.

Emerging markets represent a significant untapped potential, particularly in regions with stringent alcohol regulations or high populations of teetotalers. As local preferences and regulatory landscapes evolve, these markets offer new growth opportunities. Moreover, innovations such as improved dealcoholization methods and flavor enhancement techniques are critical in attracting consumers who are new to non-alcoholic wines but are seeking high-quality beverage alternatives.

Global Popularity: Cultural Acceptance and Strategic Marketing Amplify Reach

The global popularity of dealcoholized wine underscores its role in the market’s growth. This popularity is fueled by increased cultural acceptance and strategic marketing campaigns that resonate with a diverse consumer base. In many societies, there is a growing trend towards low- and no-alcohol lifestyles, supported by government initiatives aimed at reducing alcohol consumption due to health concerns.

Marketing efforts by leading brands have effectively positioned dealcoholized wine as a sophisticated and socially acceptable alternative to alcoholic drinks. These campaigns often highlight the product’s suitability for all occasions, further enhancing its appeal. The global reach of dealcoholized wines is also facilitated by the rise of social media and digital marketing, enabling brands to connect with a global audience more effectively and efficiently.

Restraining Factors

Regulations and Compliance: Shaping the Framework for Market Expansion

The regulatory landscape for dealcoholized wine plays a pivotal role in shaping the market. In regions with stringent alcohol consumption laws, such as certain Middle Eastern countries, or where alcohol taxes are high, like in Scandinavia, the appeal of dealcoholized wines increases significantly. These regulations often prompt consumers to seek alternatives to traditional alcoholic beverages, positioning dealcoholized wine as an attractive option. Furthermore, compliance with these regulations ensures that manufacturers are legally able to market their products across diverse geographic regions, thus broadening the potential consumer base.

For instance, in the European Union, wines can only be labeled as "dealcoholized" if they contain no more than 0.5% alcohol by volume, a standard set to maintain both consumer safety and product integrity. This clear regulatory framework aids manufacturers in aligning their production processes and marketing strategies, thereby facilitating smoother entry into markets and enhancing consumer trust in these products.

Health Risks: Driving Consumer Shift Towards Safer Alternatives

The rising awareness of health risks associated with alcohol consumption, such as the increased likelihood of developing liver diseases and other health complications, significantly fuels the demand for deal-alcoholized wines. This shift is particularly noticeable among health-conscious consumers, including millennials and older generations who are more susceptible to health issues related to alcohol.

Statistics indicate that the non-alcoholic beverage market, including dealcoholized wine, has seen growth rates exceeding those of their alcoholic counterparts. For example, the global dealcoholized wine market has been expanding at a compound annual growth rate (CAGR) of approximately 7-10%, suggesting a robust shift in consumer preferences towards healthier beverage choices. This trend is supported by a growing body of research that links moderate to high alcohol consumption with numerous health risks, compelling consumers to reconsider their dietary choices in favor of safer, non-alcoholic options.

By Type Analysis

In 2023, Non-Alcoholic Wines led the Dealcoholized Wine Market due to health trends and regulatory shifts.

In 2023, Non-Alcoholic Wines held a dominant market position in the "By Type" segment of the Dealcoholized Wine Market, which broadly categorizes offerings into Non-Alcoholic Wines and Partly De-alcoholized Wines. This leadership in the segment can be attributed to several converging factors that emphasize consumer preferences and emerging market dynamics.

Firstly, the shift towards healthier lifestyles has significantly influenced consumer preferences, encouraging a move away from alcoholic beverages. Non-alcoholic wines, containing less than 0.5% alcohol by volume, cater adeptly to this health-conscious demographic, offering a compelling alternative that aligns with their wellness goals without compromising on the social and cultural aspects of wine consumption.

Secondly, regulatory changes and increased awareness regarding the risks associated with alcohol consumption have propelled the demand for Non-Alcoholic Wines. Governments and health organizations worldwide are intensifying their efforts to reduce alcohol consumption, which has invariably benefitted the non-alcoholic segment. These wines are also gaining traction as a suitable option for consumers who must avoid alcohol due to health conditions or medication interactions, thereby broadening the consumer base.

By Application Analysis

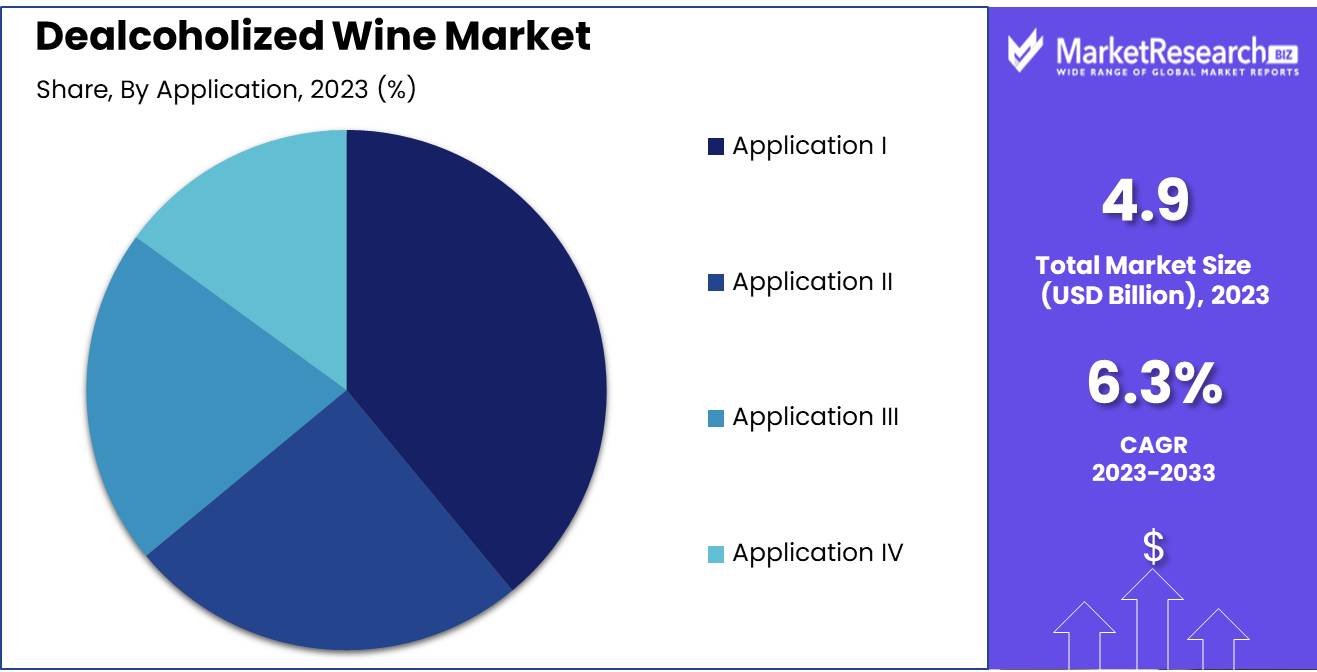

In 2023, Application I dominated the dealcoholized wine market, fueled by millennials' health-conscious preferences.

In 2023, Application I held a dominant market position in the by-application segment of the dealcoholized wine market. This segment, which encompasses various user contexts such as retail consumer use and high-end gastronomy, benefited significantly from shifting consumer preferences towards non-alcoholic beverages. The rise in health-conscious consumers, particularly among millennials and Gen Z, has propelled the demand for alternatives that mimic the sensory experience of traditional wine without the alcohol content.

Application II, which typically focuses on the hospitality sector, including hotels and restaurants, also saw substantial growth. This can be attributed to the increasing incorporation of non-alcoholic options in menus, driven by consumer demand for inclusivity in social settings that cater to nondrinkers or health-conscious individuals. The trend towards sophisticated dining experiences where the choice of beverage is as important as the food has further fueled this segment's expansion.

Meanwhile, Application III, concentrated on corporate and celebratory events, capitalized on the rising trend of corporate health responsibility. Companies are increasingly adopting healthier beverage options for their events as part of their corporate wellness programs. This shift not only reflects a growing corporate commitment to employee health but also aligns with broader social trends toward moderation and wellness.

Application IV, which deals with online sales channels, experienced accelerated growth driven by the e-commerce boom. The convenience of online shopping, coupled with the increased penetration of internet usage, has made it easier for consumers to access a wider variety of deal-alcoholized wines, boosting this segment considerably.

Key Market Segments

By Type

- Non Alcoholic Wines

- Partly De-alcohol Wines

By Application

- Application I

- Application II

- Application III

- Application IV

Growth Opportunity

Expanding Production Techniques and Taste Profiles

As the global beverage market continues to evolve, the dealcoholized wine segment is witnessing significant growth, driven by consumer demand for healthier lifestyle choices and sophisticated non-alcoholic alternatives. One of the most compelling opportunities lies in the expansion of taste and production techniques.

Innovative methods such as vacuum distillation and reverse osmosis are enhancing the flavor profiles of dealcoholized wines, making them more appealing to a discerning palate accustomed to traditional wines. This advancement not only improves the quality but also broadens the market's appeal, attracting consumers who are reluctant to compromise on taste for the sake of health benefits.

Diversification of Consumption Occasions

Another strategic opportunity is the diversification of consumption occasions. Dealcoholized wines are increasingly becoming a staple in various social and dining scenarios where alcohol is traditionally served. By promoting these wines as suitable complements to meals, for toasting special occasions, or as refreshments in business environments, marketers can tap into new consumer segments. This approach not only broadens the market's scope but also positions dealcoholized wines as a versatile, inclusive option suitable for any occasion.

Latest Trends

Growing Popularity of Low- and No-Alcohol Beverages

The dealcoholized wine segment is poised to benefit significantly from the broader shift toward low- and no-alcohol beverages. This trend is driven by a growing consumer focus on health and wellness, particularly among millennials and Gen Z consumers who are increasingly prioritizing moderation in their lifestyle choices. As societal attitudes continue to shift towards more health-conscious consumption, the demand for alternatives that offer the social and cultural experience of traditional alcoholic beverages without the associated health drawbacks is rising. This has prompted both established wine producers and new entrants to innovate aggressively in the dealcoholized space, enhancing the quality and variety available to consumers.

Increased Demand for Dealcoholized Wine

Parallel to the rise in health-centric beverages, the dealcoholized wine market is witnessing a surge in demand that extends beyond just health motivations. Factors such as the inclusivity of non-drinkers in social settings, the ability to enjoy wine without the effects of alcohol, and legal implications like reduced drink-driving risks contribute to this demand. Market research indicates a growing acceptance and integration of dealcoholized wines in traditional wine-consuming countries, with expanded distribution channels in both retail and hospitality sectors boosting accessibility. This has also led to strategic partnerships and expansions, as companies aim to capitalize on this emerging market segment.

Regional Analysis

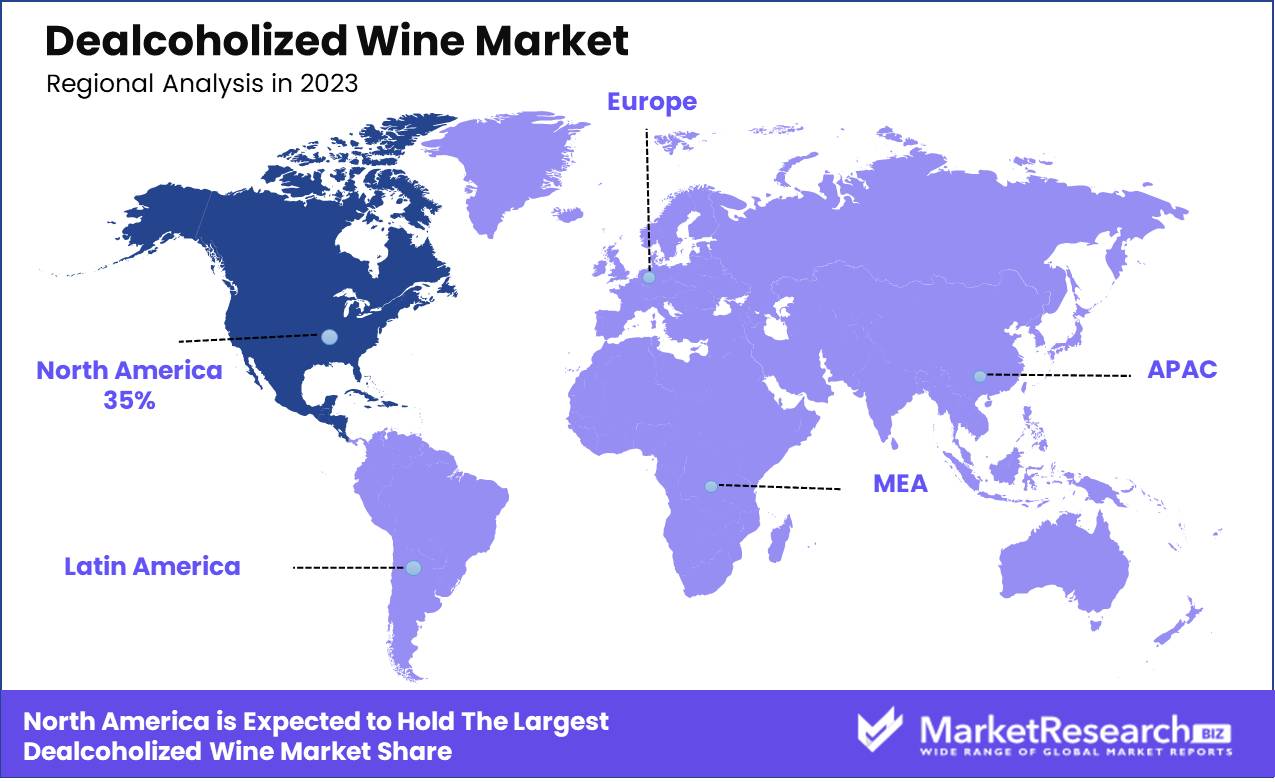

North America leads the dealcoholized wine market, influencing global trends with a 35% share.

North America is a dominant player in the dealcoholized wine sector, commanding a significant market share. In the United States and Canada, health-conscious consumers and demographic shifts toward younger drinkers who prioritize well-being are key growth drivers. North America accounts for approximately 35% of the global dealcoholized wine market. The U.S. leads with innovative production techniques and a robust distribution network, making it pivotal in setting industry trends.

Europe follows closely, with a rich wine culture and increasing consumer preference for non-alcoholic alternatives, especially in countries like Germany and the UK. The region benefits from stringent labeling laws that help maintain product quality, appealing to health-aware consumers.

Asia Pacific shows promising growth, spurred by changing social norms and an increase in disposable incomes. Countries like Japan and Australia are seeing a rise in alcohol moderation movements, which support the expansion of non-alcoholic wine options.

In the Middle East & Africa, the market is still nascent but growing due to cultural and religious factors favoring alcohol-free products. The UAE and South Africa are notable markets with potential for growth driven by the tourism sector and urbanization.

Latin America is in the early stages of embracing dealcoholized wine, with a cultural affinity for traditional alcoholic beverages prevailing. However, urban centers in Brazil and Argentina are beginning to show openness to non-alcoholic wine, aligned with global health trends.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the rapidly evolving global dealcoholized wine market, several key players are positioning themselves strategically to capitalize on the growing consumer demand for non-alcoholic beverages. Among these, Sovi Wine Co., LLC, Stella Rosa, and Pierre Chavin are noteworthy for their innovative approaches to wine production and marketing.

Sovi Wine Co., known for its commitment to sustainability and transparency, leverages organic farming practices and a clear labeling strategy to appeal to health-conscious consumers. Stella Rosa, on the other hand, differentiates itself through its strong brand identity and a diverse product range that includes both sparkling and still wines, catering to a broad taste palette. Pierre Chavin stands out with its premium positioning, offering a sophisticated alternative for non-alcoholic wine drinkers who do not wish to compromise on the quality and sensory experience of traditional wine.

Further, along the spectrum, companies like Lussory, Hill Street Beverage Company, and Health Advance Inc. emphasize technological innovation and health benefits. Lussory has gained attention for its alcohol-removal technique that maintains the original flavors and aromas of wine, while Hill Street Beverage Company focuses on crafting award-winning dealcoholized wines and beers, demonstrating a commitment to quality that resonates with discerning consumers.

Health Advance Inc. introduces a wellness angle, blending traditional winemaking with health-oriented enhancements. Meanwhile, Giesen, Freixenet, and Big Brands are expanding their global footprint by leveraging robust distribution networks and localized marketing strategies, thereby ensuring accessibility and relevance in different markets. Collectively, these companies are not only shaping competitive dynamics but also driving the market towards a more sophisticated and nuanced understanding of dealcoholized wines.

Market Key Players

- Sovi Wine Co.

- LLC

- Stella Rosa

- Pierre Chavin

- Lussory

- Hill Street Beverage Company

- Health Advance Inc.

- Giesen

- Freixenet

- Big Brands

Recent Development

- In October 2023, Giesen Group introduced its latest innovation, Giesen 0% Sparkling Brut, responding to the demand for premium non-alcoholic wines with a dry, refreshing profile and low calories.

- In September 2023, the Department of Health and Social Care and Neil O'Brien MP - The UK government proposes raising the threshold for labeling drinks as 'alcohol-free' to 0.5% ABV, aiming to encourage healthier choices and support businesses, while seeking views on measures to prevent children's access to such products.

- In April 2023, ProWein Business Report, The global market for no-low alcohol wines is expanding rapidly, with sparkling wines and whites leading the category, while challenges persist in certain markets like India due to high import duties.

Report Scope

Report Features Description Market Value (2023) USD 4.9 Billion Forecast Revenue (2033) USD 8.8 Billion CAGR (2024-2032) 6.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Non-Alcoholic Wines and Partly De-alcohol Wines), By Application, Application I, Application II, Application III, Application IV) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Sovi Wine Co., LLC, Stella Rosa, Pierre Chavin, Lussory, Hill Street Beverage Company, Health Advance Inc., Giesen, Freixenet, Big Brands Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Sovi Wine Co.

- LLC

- Stella Rosa

- Pierre Chavin

- Lussory

- Hill Street Beverage Company

- Health Advance Inc.

- Giesen

- Freixenet

- Big Brands