Global Dating and Matchmaking Market By Service (Matchmaking, Social Dating, Adult Dating, and Niche Dating), By Demographics (Adult and Generation X), By Subscription (Annually and Quarterly), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032.

-

36150

-

April 2023

-

177

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

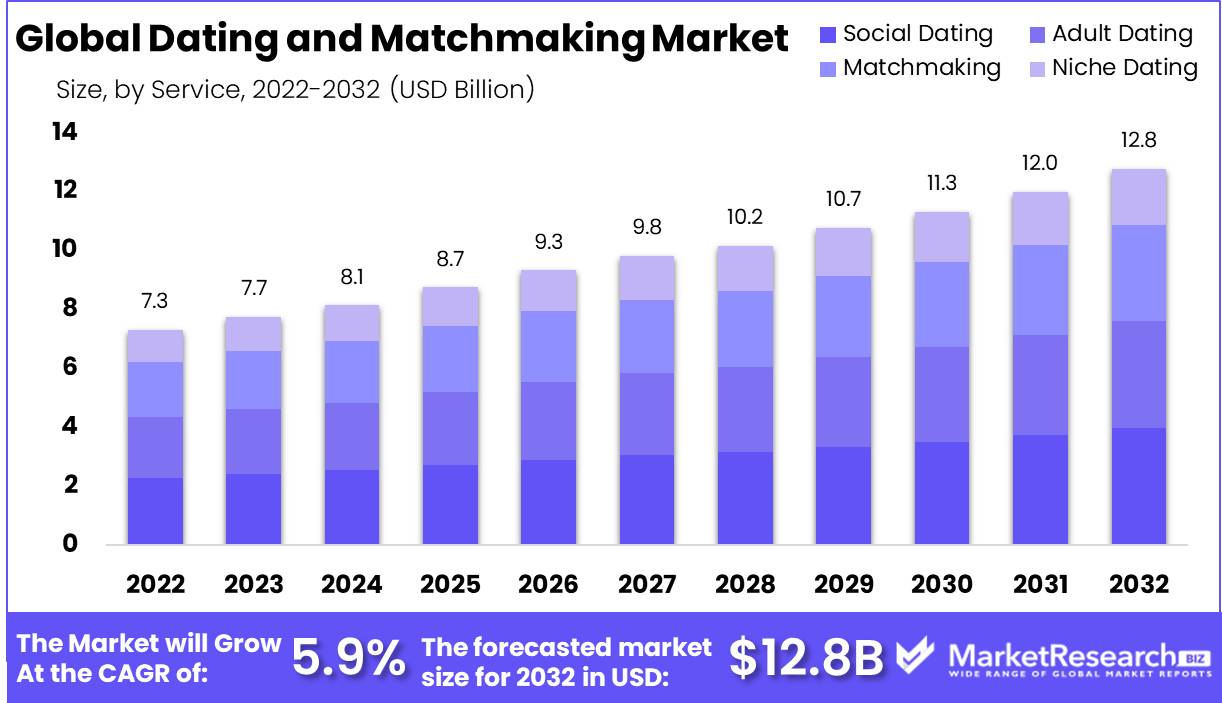

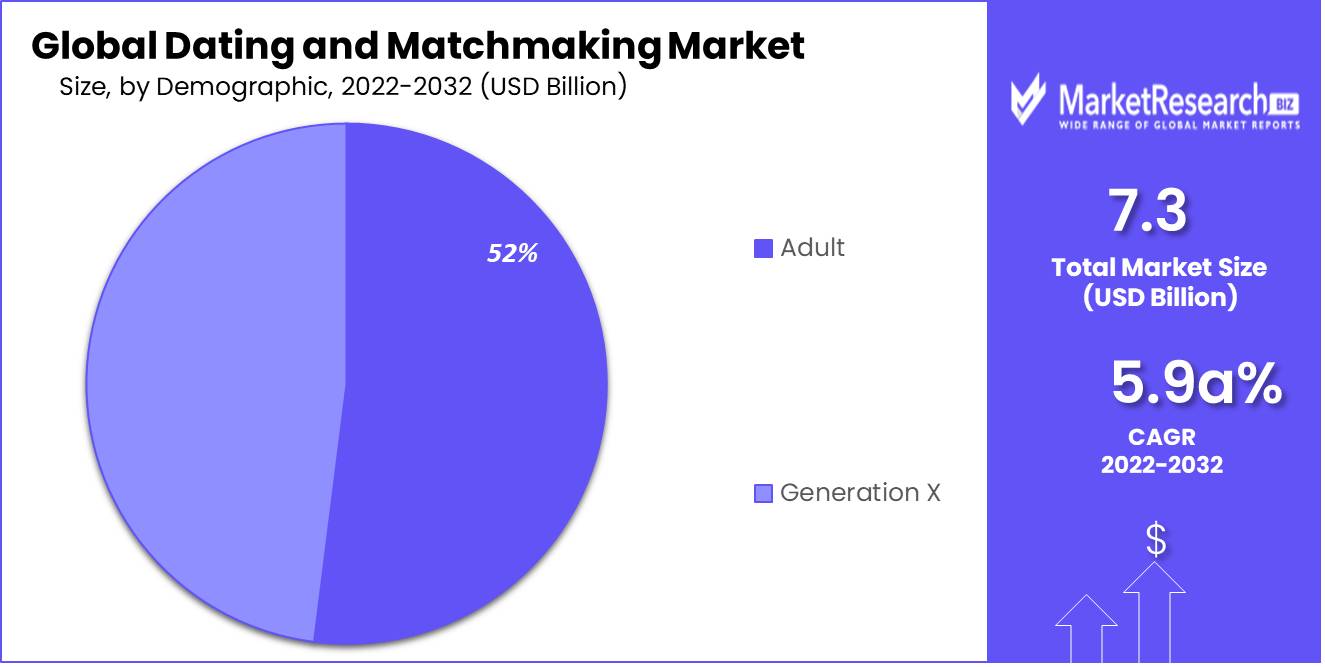

Global Dating and Matchmaking Market size is expected to be worth around USD 12.8 Bn by 2032 from USD 7.3 Bn in 2022, growing at a CAGR of 5.9% during the forecast period from 2023 to 2032.

Online dating is a service provided through a web-based computer system or mobile phone application by using the GPS tracker feature and it has quick access to mobile wallets and digital photo galleries to improve the process of online dating and matchmaking. These platforms speed up and simplify the process of chatting, flirting, and meeting becoming romantic when involved in traditional online dating services. There are several advantages to using these online dating and matchmaking platforms. These apps are developed by using special algorithms to detect people with similar interests and likes. It has lots of possibilities for users can find the same matched person in the online dating app. The users will find several types of people with the same pastime and same hobbies on this app.

Market Scope

Service Analysis

Social Matchmaking Holds Largest Shares in the Market During the Forecast Period 2022

On the basis of service, the market is segmented into adult dating, social dating, niche dating, and matchmaking. Social dating is the most dominating segment in this market. Due to factors such as non-monogamous and instant hookup relationships. Due to an increase in the number of single people, a rise in per capita income, and an increase in customer preference for non-monogamous relationships in a greater rate of subscription for online dating services.

The widespread application of Artificial Intelligence helps to extend training for profile recommendations life coaching and relationships. Social dating has two altered types of business models, which includes free subscription. The paid subscription provides profitable services and simplifies easy access to find the partner as per their preferences. The availability of internet connectivity and smartphones increases the use of dating services among the millennials and it allows service providers to expand their business.

Demographics Analysis

The adult Segment is the most Dominating Group in the Dating and Matchmaking Service Market

Based on demographics, the market is segmented into Adults and Generation X. Most people find their partner through the online dating and matchmaking app sits. Some young people are focused on their goals and prefer non-committed relationships instead of committed relationships. The social dating apps such as Tinder serve as an ideal platform for these people. It is the reason that dating and matchmaking services are more popular among the above 18 aged people.

Subscription Analysis

Quarterly Segment Held Largest Shares in the Market During the Forecast Period 2022

Based on subscription, the market is divided into annual, quarterly, monthly, and weekly. The quarterly subscription is the most dominating subscription model in the market. The business player in the online dating and matchmaking market is coming with attractive contracts that increase the subscription base and revenue such factors help the growth of the online dating and matchmaking market. Businesses such as Tinder provide offers to the users for the subscription after more than one repetition. These strategies boost the overall growth of this segment.

Key Market Segments

By Service

- Matchmaking

- Social Dating

- Adult Dating

- Niche Dating

By Demographics

- Adult

- Generation X

By Subscription

- Annually

- Quarterly

Market Dynamics

Drivers

Increase in Usage of Internet Services

The increasing use of internet services also rises the visibility of several online platforms for dating and matchmaking services which helps to grow the dating and matchmaking services market. The adult population increasingly uses Internet services to find a companion is driving the growth of the dating and matchmaking market. Dating and matchmaking sites provide video dating, chat dating, and others dating features. Increasing the number of marriage failures and also an increase in the number of software and websites for dating and matchmaking increases the growth of the dating and matchmaking market. Social trends outside traditional social circles increasing the rates of interracial marriage drive the growth of the dating and matchmaking services market.

Restraints

Increasing Fake Accounts

The growth of the dating and matchmaking service market is hindered due to different online frauds known as love scams, which are essentially impeding the expansion of the internet business. Some people believe that internet dating is more harmful, raising concerns about the safety of women. Scammer abuse, the publication of intimate images, attacks, and criminal cases are all factors limiting the expansion of the online dating market.

Opportunity

Emerging Advanced Features in the Dating and Matchmaking Apps

People in the world are looking for particular characteristics of a suitable partner. The characteristic involves similar mindedness, same interests, and others. Online dating and matchmaking apps help them find such kind of partners who shares the same characteristics due to several features and easy availability of particular peoples on online platform for dating and matchmaking because of these factors these dating platforms are in high demand. The market is anticipated to witness the advanced features in the apps, ethnicity, sexual orientation, and other metrics to become more inclusive by allowing representation of all users. Online dating and matchmaking are easy to use, quick, and convenient and it requires less effort. However, it allows a limit for the number of people who can contact them by using many available features.

Trends

Many companies launched new features to remind the COVID-19 situation. They introduced new facilities of the epidemic containing a virtual badge that shows people a video call, a virtual dating site, chat gamification, a vaccinated person badge, and many others. Grindr made some kind of changes to its existing features. Which includes video chats that are freely available to all users. It is also a shared COVID-19 pandemic-related sexual health guide developed by New York to help users understand the risk of transmitting the virus.

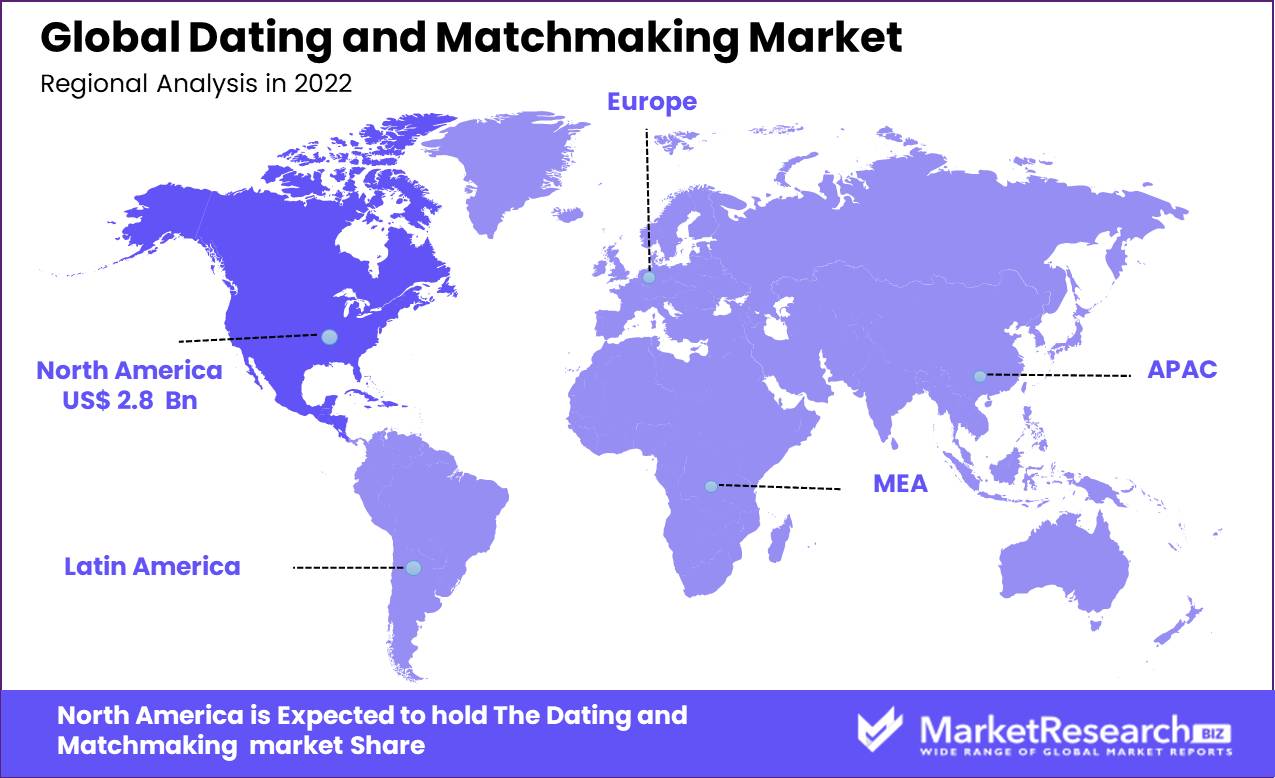

Regional Analysis

North America will be the Most Dominating Region in the Dating and Matchmaking market in 2022

On the basis of geography, North America is the most dominating region with the largest revenue shares of the online dating and matchmaking services market during the projection period. North America is considered a mature market for dating and matchmaking services. This is due to the increasing number of people who are using online dating site services. The recent development of dating and matchmaking services using technology drives the growth of the market all around the world.

For example, several companies adopted AI to provide the best services to customers. Asia Pacific has 2 billion active internet users which account for 49% of the population. India, Japan, and China are some of the most dominant internet users in the Asian Countries. In Asia-Pacific online services for dating and matchmaking is in their initial growth stage and which is anticipated to gain traction during the projection period.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Developing key players are concentrated on a variety of strategies to develop their particular companies in foreign markets. Several Dating and Matchmaking market companies are concentrating on growing their R&D facilities and existing operations. Furthermore, businesses in the Dating and Matchmaking market are developing a portfolio and new product expansion strategies through mergers, investments and acquisitions. In addition, numerous key players are now concentrating on different marketing strategies such as increasing awareness about advanced features, which is expanding the growth of target products.

- Match Group, LLC

- Bumble Inc.

- Grindr LLC

- eHarmony, Inc.

- Spark Networks, Inc.

- The Meet Group, Inc.

- com.au Pty Ltd

- Coffee Meets Bagel

- Ruby Life Inc.

- Mobeze, Inc.

- C-Date

- Other key players

Recent Developments

- In September 2021: Tinder Inc. expanded its business around Constant with a Short Film. Tinder Inc. introduced a film title closure to navigate through the tricky terrain of consent all around the world of advanced dating and matchmaking services.

- In March 2020, Tinder Inc. Declared that the business recorded greater than 3 billion which helps the advance of dating and matchmaking sites.

- In May 2022, Bumble declared a partnership with Cosmopolitan to increase awareness of its virtual dating and matchmaking offer. The initiative was developed in collaboration with JUMP, Partnerships Hub, and Havas Media Groups content.

Report Scope

Report Features Description Market Value (2022) USD 7.3 Bn Forecast Revenue (2032) USD 12.8 Bn CAGR (2023-2032) 5.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service (Matchmaking, Social Dating, Adult Dating, and Niche Dating); By Demographics (Adult and Generation X); By Subscription (Annually and Quarterly) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Match Group, LLC, Bumble Inc., Grindr LLC, eHarmony, Inc., Spark Networks, Inc., The Meet Group, Inc., rsvp.com.au Pty Ltd, Coffee Meets Bagel, Ruby Life Inc., Mobeze, Inc., C-Date and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Match Group, LLC

- Bumble Inc.

- Grindr LLC

- eHarmony, Inc.

- Spark Networks, Inc.

- The Meet Group, Inc.

- com.au Pty Ltd

- Coffee Meets Bagel

- Ruby Life Inc.

- Mobeze, Inc.

- C-Date

- Other key players