Data Center Rack Market By Rack (Open Frame Rack, Cabinet, Others), By Height (Below 42 U, 42 U, Above 42 U), By Width (19 Inch, 23 Inch, Others), By Vertical (BFSI, Government & Defense, Healthcare, IT & Telecom, Energy, Retail, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

51120

-

September 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

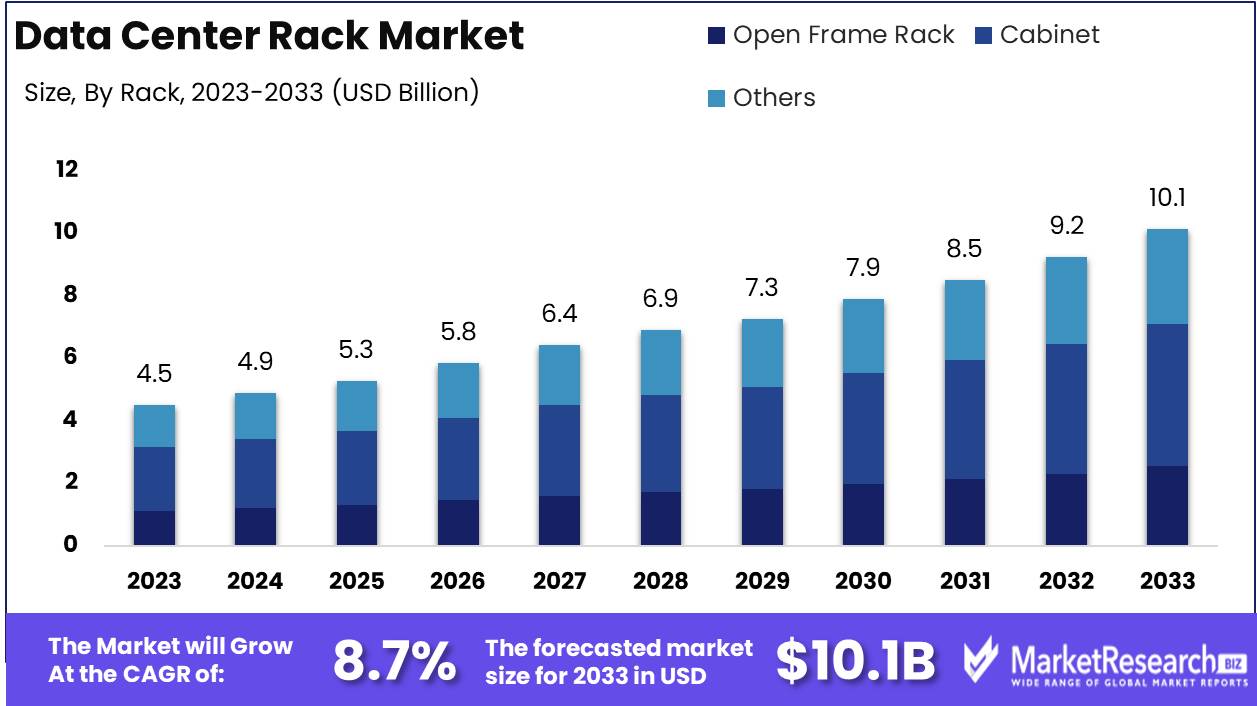

The Data Center Rack Market was valued at USD 4.5 billion in 2023. It is expected to reach USD 10.1 billion by 2033, with a CAGR of 8.7% during the forecast period from 2024 to 2033.

The Data Center Rack Market refers to the industry surrounding the manufacturing, deployment, and integration of racks designed to house and organize servers, networking equipment, and other IT infrastructure in data centers. These racks are critical for optimizing space utilization, cooling, and cable management, ensuring efficient operation of data centers.

The data center rack market is poised for significant growth, driven by the increasing adoption of cloud computing and digital transformation initiatives across industries. As enterprises accelerate their shift to the cloud, there is an increasing demand for flexible, scalable, and high-capacity infrastructure solutions, positioning data center racks as a key component of modern IT ecosystems. These racks support high-density equipment, which is essential for the evolving demands of workloads associated with artificial intelligence, big data, and IoT. This trend aligns with the growing need for hyperscale data centers, particularly as companies seek to consolidate and centralize their IT operations for greater efficiency.

However, the surge in high-power density equipment is presenting notable challenges, particularly in terms of heat dissipation and cooling efficiency. Addressing these issues is crucial, as failure to do so can lead to performance degradation and increased operational costs. As a result, market players are focusing on innovative rack designs and cooling solutions to accommodate the power requirements of advanced computing technologies.

Additionally, the growing emphasis on sustainability in data center operations is driving demand for energy-efficient rack solutions. Companies are under increasing pressure to reduce their carbon footprint, prompting the adoption of greener technologies and more sustainable cooling methods. As sustainability becomes a core priority for enterprises, vendors that can offer energy-efficient, scalable, and future-ready rack solutions will be well-positioned to capitalize on this evolving market. The data center rack market is thus expected to experience steady growth, driven by both technological advancements and the rising importance of sustainability.

Key Takeaways

- Market Growth: The Data Center Rack Market was valued at USD 4.5 billion in 2023. It is expected to reach USD 10.1 billion by 2033, with a CAGR of 8.7% during the forecast period from 2024 to 2033.

- By Rack: Cabinet racks dominated the Data Center Rack Market.

- By Height: Below 42 U segment dominated the Data Center Rack Market.

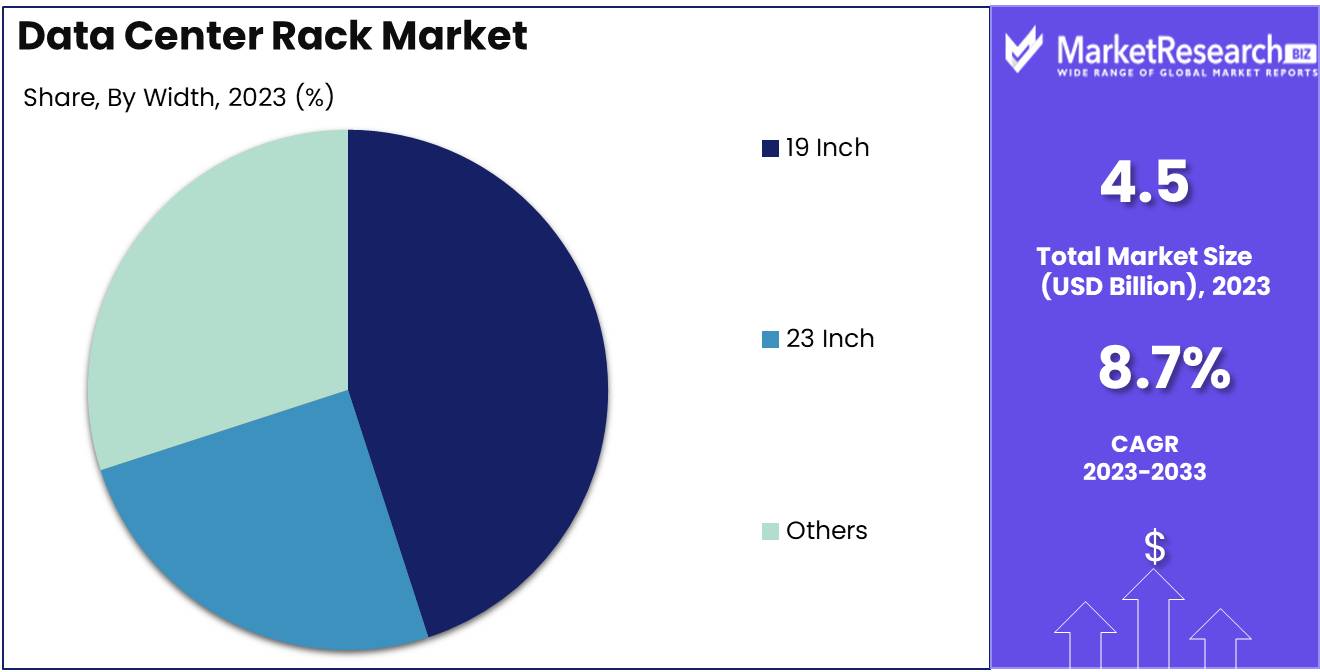

- By Width: 19-inch racks dominated the data center rack market.

- By Vertical: BFSI dominated the Data Center Rack Market by verticals.

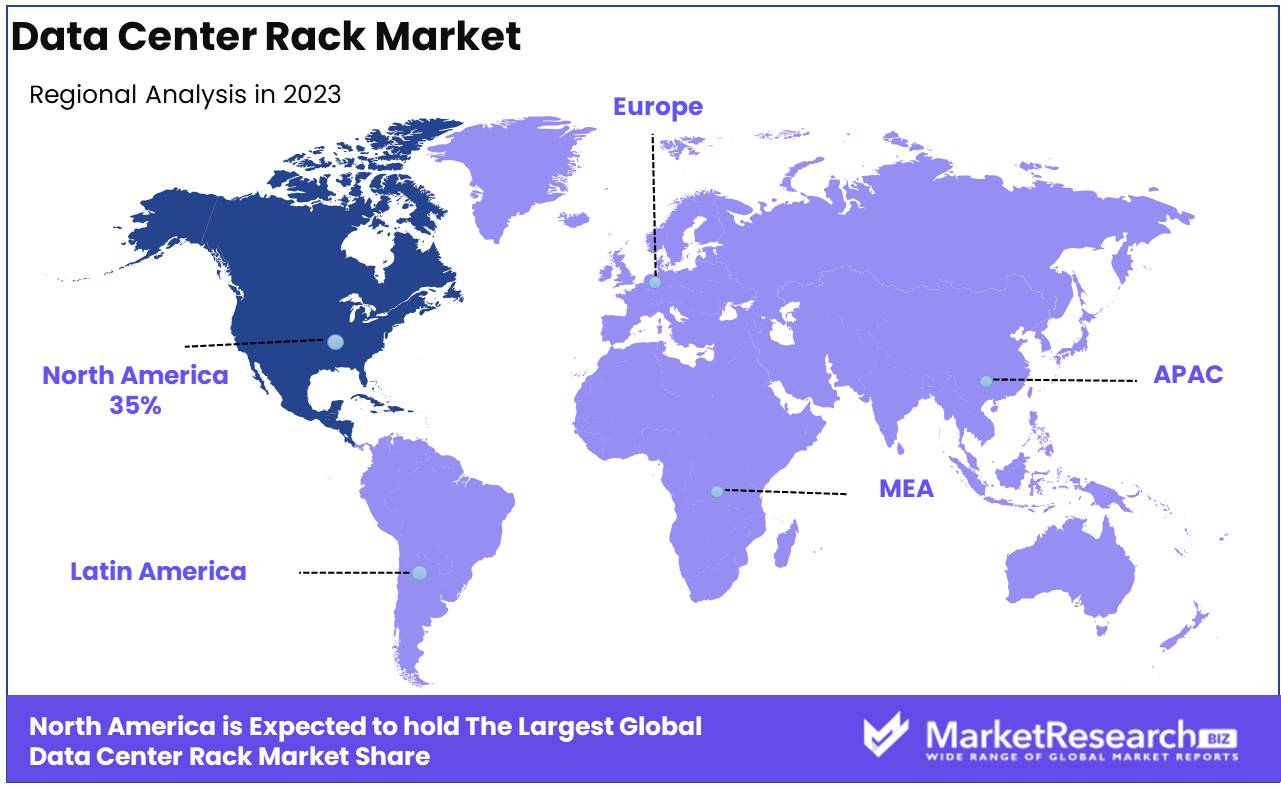

- Regional Dominance: North America leads the data center rack market with over a 35% largest share.

- Growth Opportunity: The global data center rack market will benefit from increased data center investments and the growing adoption of high-density server racks, driving significant growth and scalability opportunities.

Driving factors

Increasing Deployment of Data Centers Worldwide: Catalyzing Infrastructure Expansion

The global expansion of data centers acts as a fundamental driver for the Data Center Rack Market. As organizations across various sectors strive to manage enormous volumes of data and ensure high-speed data access, the demand for robust data center infrastructure surges. This trend is underpinned by the continuous digitization of businesses, escalating online consumer behaviors, and burgeoning big data analytics. Data from a recent industry report highlights that the number of data centers globally is expected to grow significantly, with a projected compound annual growth rate (CAGR) of over 12% from 2021 to 2026. This expansion necessitates a proportional increase in data center racks, which are essential for housing and organizing IT equipment efficiently.

Adoption of Cloud Computing and Edge Computing: Enhancing Efficiency and Data Processing Capabilities

Cloud computing and edge computing have emerged as transformative forces within the IT landscape, influencing the Data Center Rack Market profoundly. The shift towards cloud environments, characterized by the migration from on-premises data storage to cloud services, demands scalable and flexible data center infrastructures. Concurrently, the rise of edge computing, which brings data processing closer to the end-user to reduce latency, necessitates the deployment of more localized data centers. These technologies collectively promote the development of new data centers equipped with modern racking solutions to accommodate the increased load and complexity of network architectures. This dual adoption is anticipated to propel the data center rack market forward, aligning with forecasts predicting a surge in cloud services usage, which is expected to double by 2025.

Necessity for Heat Management in Data Centers: Ensuring Operational Integrity and Energy Efficiency

Effective heat management within data centers is crucial to maintain system reliability and prevent hardware malfunctions. As data center racks become densely packed with high-performance equipment, the potential for heat accumulation increases, posing risks to operational stability. The market for data center racks is adapting by incorporating advanced cooling strategies and thermal management solutions. Innovations in rack design, such as improved airflow management and integration with cooling units, are becoming increasingly prevalent. This not only supports the operational efficiency of data centers but also contributes to energy conservation efforts. The demand for racks that support high-density configurations and advanced cooling mechanisms is expected to grow in tandem with the increasing power and heat density of modern data center equipment.

Restraining Factors

High Costs Associated with Building and Maintaining Data Center Facilities

The capital-intensive nature of constructing and maintaining data center facilities serves as a significant restraint in the growth of the Data Center Rack Market. Data centers require substantial upfront investments in infrastructure, cooling systems, power supply, and security protocols. This financial burden affects both new market entrants and existing players looking to expand their capacity, as the high costs can limit scalability and slow down the pace of new data center construction.

According to industry estimates, the average cost to build a data center ranges from $10 million to $25 million per megawatt (MW) of capacity, depending on the location and specific requirements. Moreover, operational costs, including energy consumption and facility maintenance, can add significant ongoing expenses. Energy efficiency is a key factor, as data centers often consume between 1% and 2% of the world's total electricity output, further increasing long-term costs. These high expenditures may reduce the willingness of organizations to invest in new or expanded data centers, leading to slower growth in demand for data center racks.

Additionally, the rising costs of land in urban and high-demand regions where data centers are typically located amplify this restraint. Data center operators face challenges in securing affordable real estate, which directly impacts their ability to expand. As a result, these high costs create a financial barrier for both small and medium-sized enterprises (SMEs) and large corporations, inhibiting the broader adoption of data center racks.

Requirement of Skilled Personnel to Handle Rack Deployment and Maintenance

The need for specialized personnel to manage the deployment, configuration, and maintenance of data center racks is another factor limiting market expansion. Data center environments are highly complex, requiring expertise in fields such as electrical engineering, IT systems, network configuration, and cooling technologies. Finding and retaining individuals with the necessary skill set can be a challenge, particularly in regions facing a shortage of qualified technical staff.

It is estimated that the data center industry currently experiences a skills shortage, with over 70% of organizations globally reporting difficulty in hiring skilled personnel. This scarcity of expertise directly impacts the efficiency of rack deployment and maintenance, as improperly managed racks can lead to downtime, hardware failures, or security vulnerabilities. As a result, companies may delay investments in new data center infrastructure, including racks, until they can secure the requisite talent, further slowing market growth.

Additionally, the ongoing need for specialized training and certifications for data center staff adds to operational costs. This investment in human capital is necessary to ensure that personnel are equipped to manage evolving technologies, such as high-density racks, power distribution units (PDUs), and advanced cooling systems. However, the costs associated with training programs can be a disincentive for organizations, contributing to the overall restraint on the market.

By Rack Analysis

In 2023, Cabinet racks dominated the Data Center Rack Market.

In 2023, The Cabinet rack segment held a dominant market position in the Data Center Rack Market. The Cabinet rack, characterized by its enclosed structure, provides enhanced security and cooling solutions, making it the preferred choice for data centers managing sensitive or high-density equipment. With the rise of cloud computing, hyperscale data centers, and increased demand for colocation services, cabinet racks have become essential for managing complex server environments and ensuring optimal performance.

The Open Frame rack, while also a significant contributor, is typically used in environments requiring ease of access and cable management, making it more suitable for smaller-scale or budget-conscious operations. Open-frame racks offer better ventilation but lack the physical security of cabinet solutions.

The “Others” category, which includes specialized racks like wall-mounted or portable racks, caters to niche applications, such as edge computing or small enterprise deployments. However, it constitutes a smaller market share compared to the cabinet and open frame racks. As data center infrastructure continues to evolve, the Cabinet rack segment is projected to maintain its lead, driven by scalability and security requirements.

By Height Analysis

In 2023, The Below 42 U segment dominated the Data Center Rack Market.

In 2023, The Data Center Rack Market was distinctly segmented by height into three main categories: Below 42 U, 42 U, and Above 42 U. Each segment caters to varying infrastructure requirements and has witnessed different growth dynamics. The Below 42 U segment held a dominant market position, primarily driven by its extensive adoption in small to medium-sized data centers where space optimization is crucial. These racks are favored for their ability to house equipment efficiently, thereby reducing the physical footprint and maximizing space utilization in confined areas.

Conversely, the 42 U racks represent a standard size that balances capacity and space, suitable for both expanding enterprises and established data centers looking to maintain flexibility in equipment and server deployment. This segment benefits from its versatility, supporting a wide array of IT equipment, which makes it a preferred choice for companies seeking scalable solutions.

The Above 42 U segment, while smaller in market share, is gaining traction in high-density configurations, particularly favored by large enterprises and cloud service providers. These racks accommodate greater capacities, are essential for supporting increased power and cooling requirements, and are integral to operations demanding extensive data storage and high computational power. Each segment's growth is influenced by specific industry needs, technological advancements, and the evolving landscape of data center demands.

By Width Analysis

In 2023, 19-inch racks dominated the data center rack market.

In 2023, The 19-inch data center rack segment held a dominant market position in the by-width category of the Data Center Rack Market. This prominence can be attributed to its widespread industry adoption, particularly in enterprise and colocation data centers. The 19-inch racks are standard in design, ensuring compatibility with a wide range of IT equipment, including servers, switches, and routers. Their modularity and scalability appeal to data centers looking for flexibility in managing infrastructure. Additionally, the extensive availability of accessories and components for 19-inch racks further strengthens their position in the market.

The 23-inch rack segment, while smaller in comparison, caters to specific use cases where larger equipment or non-standardized gear is required. This segment primarily serves niche industries and applications with unique space and cooling needs.

The Others category, which includes custom or proprietary racks, remains less significant due to its limited compatibility and higher costs. However, these racks may be preferred in specialized data centers with unique infrastructure requirements, where custom solutions provide specific advantages over standardized offerings.

By Vertical Analysis

In 2023, BFSI dominated the Data Center Rack Market by verticals.

In 2023, The BFSI (Banking, Financial Services, and Insurance) sector held a dominant market position in the 'By Vertical' segment of the Data Center Rack Market. This prominence can be attributed to the increasing digitalization of financial services and the need for high-security data storage solutions to handle sensitive financial information. The expansion of digital banking, online transactions, and data-driven financial services necessitates robust IT infrastructure, which has significantly driven the demand for advanced data center racks.

Other key verticals contributing to the market growth include Government & Defense, Healthcare, IT & Telecom, Energy, Retail, and Others. The Government & Defense sector demand highly secure and resilient data storage solutions, which has led to increased adoption of specialized data center racks. In Healthcare, the surge in telemedicine and electronic health records propels the need for data centers.

IT & Telecom, being inherently data-intensive, continues to be a major consumer, while the Energy sector’s push towards digitalization to optimize resource management also contributes to the market. Retail's shift towards e-commerce platforms requires robust data management systems, further expanding the data center rack market. The aggregated demand from these sectors underscores the diverse and expanding applications of data center racks across different industries.

Key Market Segments

By Rack

- Open Frame Rack

- Cabinet

- Others

By Height

- Below 42 U

- 42 U

- Above 42 U

By Width

- 19 Inch

- 23 Inch

- Others

By Vertical

- BFSI

- Government & Defense

- Healthcare

- IT & Telecom

- Energy

- Retail

- Others

Growth Opportunity

Increased Data Center Investments

The global data center rack market is expected to witness significant growth, driven by increased investments in data centers. The rapid expansion of cloud computing, big data, and IoT applications has prompted enterprises to invest heavily in expanding their IT infrastructure. Data centers are becoming a focal point for businesses aiming to enhance their operational efficiency, and as a result, the demand for data center racks is projected to rise. According to recent market trends, the surge in investments is particularly evident in regions such as North America, Europe, and the Asia-Pacific, where large-scale data center projects are being commissioned to accommodate growing data traffic.

Adoption of High-Density Server Racks

Another critical growth driver in the global data center rack market is the rising adoption of high-density server racks. With advancements in computing technologies and the growing need for efficient data storage solutions, data centers are shifting towards high-density racks that offer greater scalability and performance. These racks can support more servers per square foot, allowing data center operators to optimize space while enhancing cooling efficiency. This shift is particularly relevant in hyperscale data centers, where maximizing space utilization is crucial to handling the massive data volumes generated by cloud services and digital enterprises.

Latest Trends

Implementation of Software-Defined Data Centers (SDDCs)

The rise of software-defined data centers (SDDCs) is expected to significantly impact the data center rack market As enterprises shift towards more agile, automated, and virtualized infrastructures, SDDCs enable the seamless management of compute, storage, and networking resources through software. This transformation places a growing demand on data center racks to support increased density and advanced cooling solutions, as workloads become more distributed and dynamic. Consequently, vendors are anticipated to introduce racks that are optimized for SDDC environments, incorporating features like enhanced power management, integrated cable management, and intelligent rack monitoring systems.

Adoption of Modular and Scalable Rack Designs

The growing need for flexibility in data center infrastructure is driving the adoption of modular and scalable rack designs. The enterprises will increasingly favor racks that can be easily customized and expanded as their needs evolve. Modular racks allow for a phased investment approach, reducing upfront capital expenditure while enabling capacity to be scaled according to demand. Scalable designs also improve operational efficiency by accommodating higher power and cooling densities as data processing requirements grow. This trend is particularly relevant for colocation data centers and hyperscale environments, where agility and scalability are critical to meeting fluctuating customer requirements and data loads.

Regional Analysis

North America leads the data center rack market with over a 35% largest share.

The global data center rack market exhibits significant regional disparities driven by differing levels of digital infrastructure development, cloud adoption, and data traffic. North America dominates the market, accounting for over 35% of the total market share. This dominance is attributed to the region's advanced IT infrastructure, rapid adoption of cloud computing, and strong presence of key industry players such as Amazon Web Services, Microsoft, and Google. The United States, with its high concentration of hyperscale data centers, plays a crucial role in driving growth in this region.

Europe follows closely, with robust growth fueled by increasing investments in data center modernization and compliance with data privacy regulations such as GDPR. The region holds approximately 25% of the market share, led by countries like Germany, the UK, and France.

The Asia Pacific region is expected to witness the highest growth rate due to the expansion of cloud services, the rising adoption of artificial intelligence, and increasing demand for colocation services. China and India are key contributors, supported by government initiatives and growing digital economies.

The Middle East & Africa and Latin America, while smaller in market share, are experiencing gradual growth driven by increasing digitization efforts and investments in new data centers, particularly in countries like the UAE, Brazil, and South Africa.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global data center rack market is expected to witness robust growth, driven by the expanding adoption of cloud computing, big data analytics, and increased demand for hyperscale data centers. Key players in this market are leveraging innovation, expanding their product portfolios, and focusing on strategic partnerships to capture market share.

Hewlett Packard Enterprise Development LP and Dell Technologies Inc. are poised to maintain significant market positions due to their comprehensive data center solutions, including scalable rack offerings. These firms' global reach and focus on integrating next-gen technologies such as artificial intelligence and edge computing will likely strengthen their competitive edge.

Cisco Systems and Schneider Electric are expected to benefit from their leadership in network infrastructure and power management, respectively. Cisco’s strength in networking solutions and Schneider’s expertise in energy-efficient solutions for data centers will remain key drivers.

Huawei Technologies Co., Ltd., Lenovo, and IBM Corporation are likely to expand their influence in the market due to their significant investments in cloud infrastructure, AI-driven data management, and hybrid cloud solutions. Huawei and Lenovo, with their strong presence in the Asia-Pacific region, will drive market growth in this high-demand area.

Emerging players such as Inspur Group and Supermicro are expected to capitalize on the growing trend toward customized and modular data center solutions, focusing on delivering high-density, energy-efficient racks.

Overall, the data center rack market will experience intensified competition with continuous innovation and geographic expansion strategies among these key players.

Market Key Players

- Hewlett Packard Enterprise Development LP

- Fujitsu Limited

- Rittal GmbH & Co. KG

- Great Lakes Data Racks & Cabinets

- Eaton Corporation

- Oracle Corporation

- Black Box

- Samsung Electronics Co., Ltd

- Dell Technologies Inc.

- Schneider Electric

- Lenovo

- Cisco Systems

- Supermicro

- IBM Corporation

- Inspur Group

- Huawei Technologies Co., Ltd.

- NEC Corporation

- Quanta Computer, Inc.

- Wistron Corporation

- Inventec Corporation

- Wiwynn Corporation

- ASUSTeK Computer, Inc. (ASUS)

- Penguin Computing

- ZT Systems

- Advantech Co., Ltd.

- H3C Group

Recent Development

- In April 2024, Schneider Electric launched a new series of environmentally friendly data center racks, featuring enhanced energy efficiency and optimized airflow management. The development targets the growing demand for sustainable data centers, driven by increasing regulatory pressure and the industry's focus on reducing power consumption.

- In March 2024, Eaton introduced a new modular data center solution in North America, designed to support growing demands for edge computing and other high-performance applications. The solution focuses on rapid deployment and flexibility, enhancing rack density and power management for more efficient data center operations.

- In January 2024, Rittal, a key player in the data center rack market, introduced a new line of 23-inch racks, catering to the needs of high-density environments. These racks offer improved cable management and airflow, addressing the thermal management challenges of modern data centers. This launch aligns with the trend towards larger, more complex equipment configurations in data centers.

Report Scope

Report Features Description Market Value (2023) USD 4.5 Billion Forecast Revenue (2033) USD 10.1 Billion CAGR (2024-2032) 8.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Rack (Open Frame Rack, Cabinet, Others), By Height (Below 42 U, 42 U, Above 42 U), By Width (19 Inch, 23 Inch, Others), By Vertical (BFSI, Government & Defense, Healthcare, IT & Telecom, Energy, Retail, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Hewlett Packard Enterprise Development LP, Fujitsu Limited, Rittal GmbH & Co. KG, Great Lakes Data Racks & Cabinets, Eaton Corporation, Oracle Corporation, Black Box, Samsung Electronics Co., Ltd, Dell Technologies Inc., Schneider Electric, Lenovo, Cisco Systems, Supermicro, IBM Corporation, Inspur Group, Huawei Technologies Co., Ltd., NEC Corporation, Quanta Computer, Inc., Wistron Corporation, Inventec Corporation, Wiwynn Corporation, ASUSTeK Computer, Inc. (ASUS), Penguin Computing, ZT Systems, Advantech Co., Ltd., H3C Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Hewlett Packard Enterprise Development LP

- Fujitsu Limited

- Rittal GmbH & Co. KG

- Great Lakes Data Racks & Cabinets

- Eaton Corporation

- Oracle Corporation

- Black Box

- Samsung Electronics Co., Ltd

- Dell Technologies Inc.

- Schneider Electric

- Lenovo

- Cisco Systems

- Supermicro

- IBM Corporation

- Inspur Group

- Huawei Technologies Co., Ltd.

- NEC Corporation

- Quanta Computer, Inc.

- Wistron Corporation

- Inventec Corporation

- Wiwynn Corporation

- ASUSTeK Computer, Inc. (ASUS)

- Penguin Computing

- ZT Systems

- Advantech Co., Ltd.

- H3C Group