Data Center Cooling Market By Product type (Air Conditioners, Precision Air Conditioners, Liquid Cooling, Air Handling Units, Others), By Type (Raised Floors, Non-raised Floors), By Structure (Rack-based Cooling, Row-based Cooling, Room-based Cooling), By Application (IT & Telecom, Retail, Healthcare, BFSI, Energy, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

51108

-

September 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

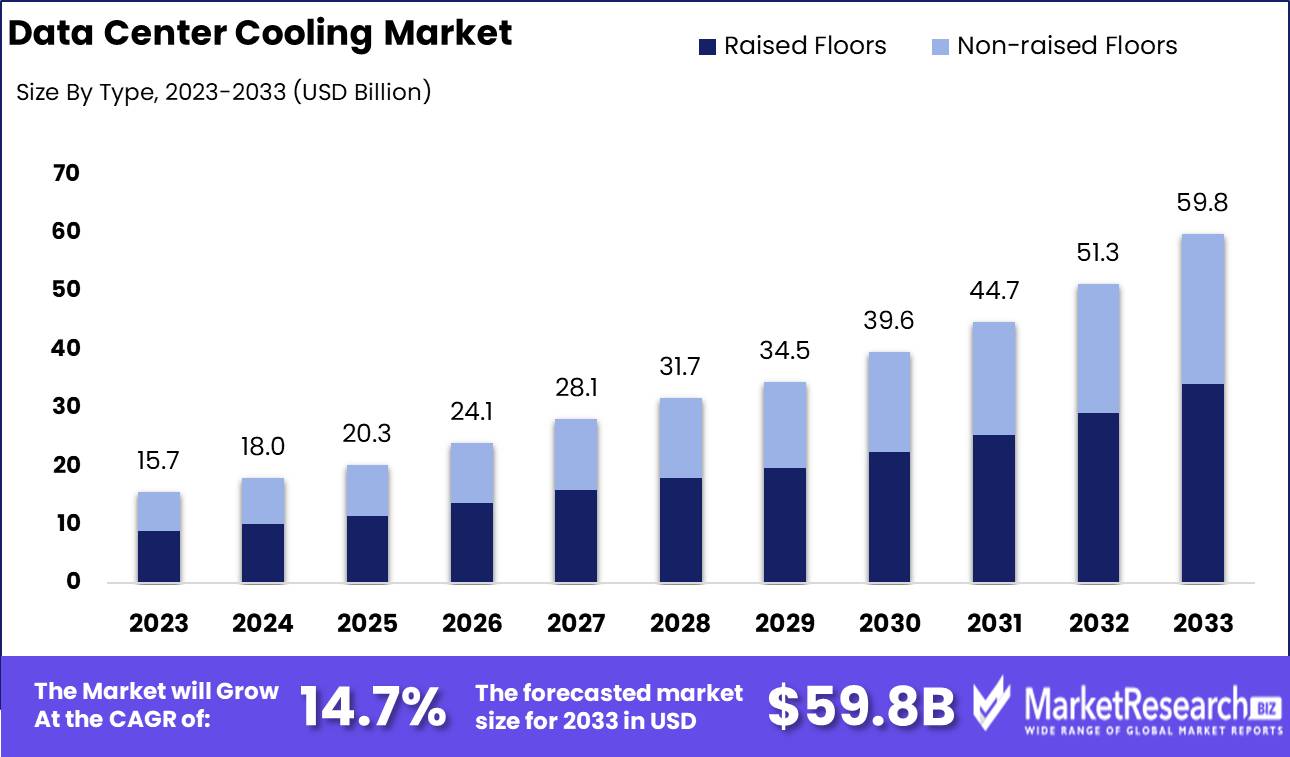

The Data Center Cooling Market was valued at USD 15.7 billion in 2023. It is expected to reach USD 59.8 billion by 2033, with a CAGR of 14.7% during the forecast period from 2024 to 2033.

The Data Center Cooling Market encompasses the technologies and systems designed to regulate the temperature, humidity, and air quality within data centers, ensuring optimal performance and preventing equipment failure. As data centers grow in size and complexity, efficient cooling solutions are critical to managing rising heat levels generated by high-density servers and storage devices.

The data center cooling market is experiencing significant growth, driven by the increasing global demand for data storage and processing due to the rise in data traffic. With the proliferation of cloud computing, artificial intelligence, and the Internet of Things (IoT), data centers are being required to handle larger volumes of data, which in turn increases their energy consumption and heat generation. To maintain operational efficiency and prevent overheating, effective cooling solutions are critical.

Additionally, stringent energy efficiency regulations in various regions are compelling data centers to adopt more efficient and sustainable cooling technologies. This trend is further reinforced by the growing focus on sustainability and green cooling, as companies aim to reduce their carbon footprints in response to both regulatory pressures and corporate sustainability goals.

However, the high capital investment associated with the installation and maintenance of advanced cooling systems remains a key challenge for the market. Energy-efficient cooling technologies, such as liquid cooling and free cooling, offer long-term operational cost savings, but they require substantial upfront investments. As organizations increasingly prioritize sustainable operations, the adoption of green cooling solutions, which include the use of renewable energy sources and eco-friendly refrigerants, is expected to accelerate. This will be a critical factor in the market's long-term expansion, with industry leaders focusing on innovative cooling strategies that balance operational efficiency, energy consumption, and environmental impact. Overall, the data center cooling market is poised for sustained growth, driven by a combination of regulatory mandates, technological advancements, and evolving industry priorities toward sustainability.

Key Takeaways

- Market Growth: The Data Center Cooling Market was valued at USD 15.7 billion in 2023. It is expected to reach USD 59.8 billion by 2033, with a CAGR of 14.7% during the forecast period from 2024 to 2033.

- By Product Type: Air Conditioners dominated the Data Center Cooling Market.

- By Type: Raised floors dominated data center cooling solutions.

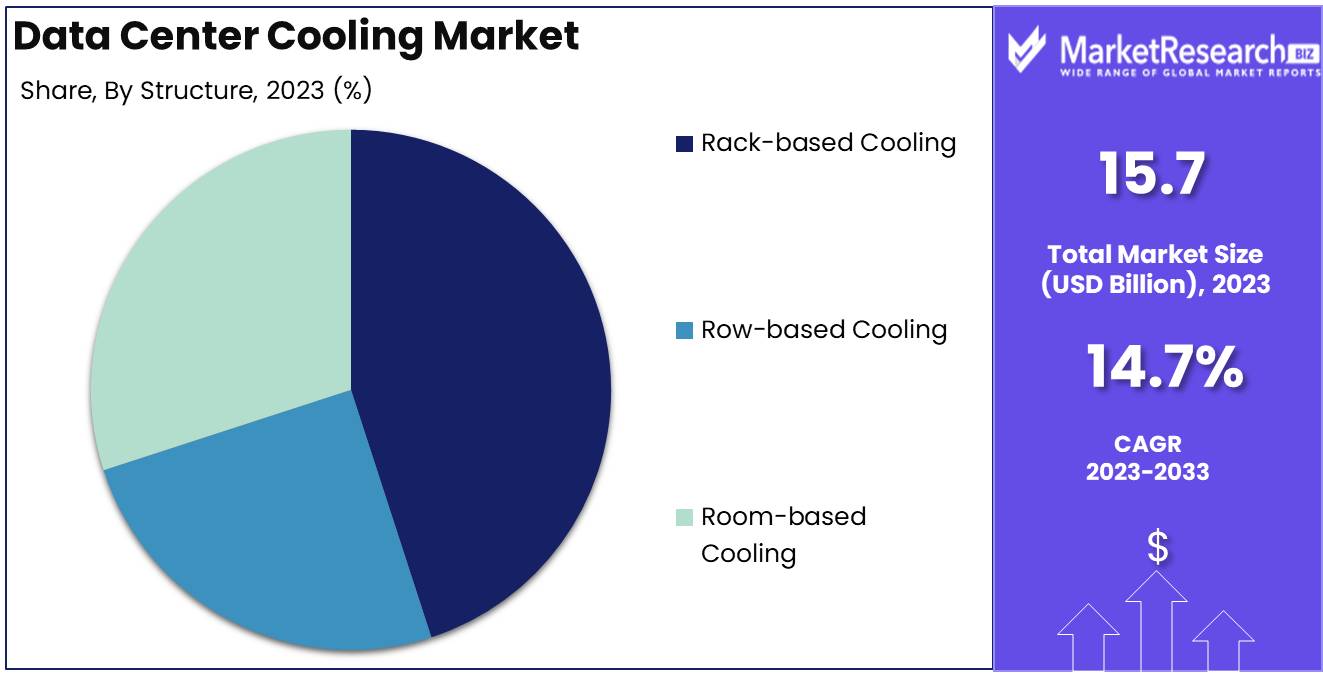

- By Structure: Rack-based cooling dominated due to efficiency in high-density data centers.

- By Application: IT & Telecom dominated the Data Center Cooling market.

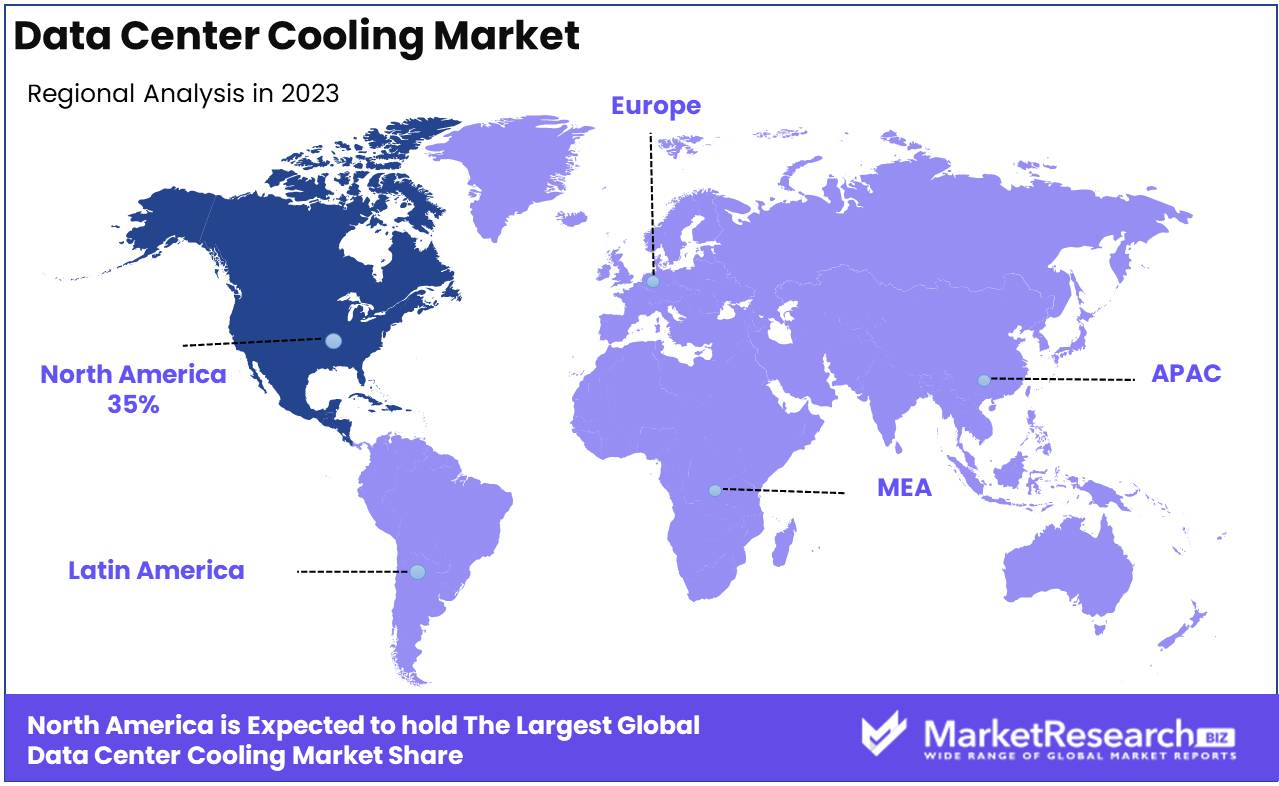

- Regional Dominance: North America dominates the data center cooling market with a 35% largest share.

- Growth Opportunity: The data center cooling market is driven by liquid cooling adoption and increased AI/ML use, creating opportunities for efficient, cost-effective cooling solutions in high-performance computing environments.

Driving factors

Proliferation of Cloud Computing Drives Data Center Cooling Market Expansion

The increasing reliance on cloud computing is one of the key factors driving the growth of the data center cooling market. Cloud computing's widespread adoption by businesses and consumers alike has led to a significant rise in the demand for data centers, which are essential for hosting cloud-based services. This proliferation of data centers has, in turn, fueled the need for effective cooling systems to ensure optimal performance and reliability. As cloud-based services expand across various industries, including finance, healthcare, and retail, the volume of data and the number of servers required have multiplied. This increase in server density results in higher heat output, necessitating advanced and efficient cooling solutions. According to industry estimates, the global cloud computing market was valued at over USD 545.8 billion in 2022, further indicating the critical need for scalable cooling systems to support this growing infrastructure.

Big Data and IoT Spur Demand for Advanced Cooling Solutions

The rapid growth of Big Data and the Internet of Things (IoT) has accelerated the expansion of the data center cooling market. Both Big Data and IoT generate vast amounts of information, which require substantial data storage and processing power. This rise in data generation has prompted organizations to expand their data center capacity to handle large volumes of real-time data, creating additional heat in server environments. As the volume of data processed in real-time increases, maintaining the necessary operating temperatures within data centers becomes a critical concern. By 2027, the global Big Data market is projected to reach USD 273.4 billion, highlighting the ongoing need for sophisticated cooling technologies that can accommodate the growing data processing needs and maintain the energy efficiency of these facilities. IoT devices, which are projected to reach 29 billion by 2030, are also contributing to the higher demand for data centers and, consequently, for innovative cooling mechanisms.

Energy Efficiency Requirements Drive Innovation in Cooling Technologies

Energy efficiency has become a primary consideration in the design and operation of data centers, and this trend is significantly contributing to the growth of the data center cooling market. As data centers consume large amounts of electricity, regulators and operators alike are prioritizing the reduction of energy consumption and carbon emissions. Cooling systems account for a substantial portion of a data center's energy use, often comprising up to 40% of the total power consumption.

Consequently, energy-efficient cooling technologies are in high demand to reduce operating costs and meet regulatory requirements. The adoption of energy-efficient systems, such as liquid cooling and free cooling technologies, has been driven by these energy concerns. Furthermore, government initiatives aimed at promoting sustainability and reducing carbon footprints in IT operations have accelerated the shift toward innovative, energy-efficient cooling solutions. By 2025, energy-efficient data center cooling is expected to become a core requirement, driving the adoption of sustainable cooling methods.

Restraining Factors

High Investment Costs: A Significant Barrier to Market Expansion

The high upfront investment required for data center cooling solutions poses a significant restraining factor for the growth of the market. The deployment of advanced cooling technologies, such as liquid cooling systems, requires substantial capital, both in terms of equipment and infrastructure. According to industry estimates, the cost of setting up efficient cooling systems can account for approximately 40-50% of the total cost of building a data center. These high initial expenses limit the market's accessibility, particularly for smaller enterprises and startups that may not have the necessary financial resources.

Additionally, companies may hesitate to invest in new cooling technologies due to the ongoing costs of maintenance and operational complexities. The challenge is further compounded by the rapid pace of technological advancement, which increases the risk of current investments becoming obsolete before they yield a sufficient return, thereby slowing down the adoption of new systems.

Reliability Limitations: Impediments to Long-Term Market Confidence

The reliability of cooling systems in maintaining consistent, efficient operation within data centers is another critical restraining factor. Cooling failures can result in overheating, leading to data center downtime and, potentially, hardware damage. The growing density of data centers, especially with the rise of high-performance computing and artificial intelligence applications, exacerbates this issue. The industry has reported instances where cooling system malfunctions have led to financial losses due to service disruptions. As data center operators prioritize uptime and operational reliability, concerns regarding the dependability of existing cooling solutions, particularly in extreme climates or under heavy computational loads, can delay adoption decisions.

These reliability limitations also feed into long-term cost considerations, as frequent system failures or inefficiencies can increase operational expenses and reduce the overall cost-effectiveness of cooling solutions. Therefore, despite the availability of advanced cooling technologies, the perceived and real risks associated with their reliability restrain the overall market growth by inhibiting more widespread implementation.

By Product Type Analysis

In 2023, Air Conditioners dominated the Data Center Cooling Market.

In 2023, Air Conditioners held a dominant market position in the By Product Type segment of the Data Center Cooling Market. This growth is attributed to the increasing need for efficient heat management in data centers, driven by rising data processing demands and the expansion of cloud computing. Traditional air conditioners are widely utilized due to their cost-effectiveness and ease of implementation in small to mid-sized data centers. However, precision air conditioners are gaining traction in applications requiring higher accuracy in temperature and humidity control, which is critical for sensitive equipment.

Additionally, liquid cooling is emerging as a more energy-efficient solution for high-performance computing systems. Its ability to manage higher thermal loads has made it appealing to hyperscale data centers. Air handling units (AHUs) continue to be preferred in larger facilities, offering scalability and robust airflow management. Lastly, the other category includes hybrid systems, combining multiple cooling technologies to enhance overall efficiency and environmental sustainability. These innovations collectively contribute to the expansion of the Data Center Cooling Market, as operators seek to balance cost and energy efficiency.

By Type Analysis

In 2023, Raised floors dominated data center cooling solutions.

In 2023, Raised floors held a dominant market position in the By Type segment of the Data Center Cooling Market. Raised floor systems are highly regarded for their ability to enhance cooling efficiency by providing optimal airflow management. These systems support the integration of underfloor air distribution systems, which offer improved air circulation and cooling to high-density servers. Raised floors also allow for greater flexibility in cabling and power distribution, making them the preferred choice for large-scale data centers. Their adoption is further driven by increasing demand for cloud computing and data storage, leading to more complex and powerful hardware, which in turn necessitates advanced cooling solutions.

Conversely, Non-raised floors are also gaining traction, particularly in edge data centers and smaller facilities. These systems are often chosen for their cost-effectiveness and ease of installation. Non-raised floor systems utilize other cooling strategies, such as containment and in-row cooling, to optimize airflow without the need for raised platforms. This segment is expanding due to the rise in modular and containerized data centers, where space and cost constraints are prioritized.

By Structure Analysis

In 2023, Rack-based cooling dominated due to efficiency in high-density data centers.

In 2023, Rack-based cooling held a dominant market position in the "By Structure" segment of the Data Center Cooling Market. This method, where cooling is applied directly to individual server racks, offers enhanced precision and efficiency, making it the preferred choice for high-density data centers. As data centers grow in complexity and size, rack-based cooling systems are favored for their ability to manage localized heat and optimize cooling performance.

Row-based cooling also gained considerable traction, particularly in medium-sized data centers, where cooling units are positioned between racks in a row. This system enables faster response to thermal loads and provides greater scalability, offering a balance between room-based and rack-based solutions.

Room-based cooling, a more traditional approach where air is cooled and circulated through the entire room, saw reduced demand. While it remains a viable option for smaller data centers with lower heat densities, the growing focus on energy efficiency and precise cooling solutions is shifting preferences toward more advanced technologies like rack and row-based systems. This evolution reflects broader trends in optimizing operational efficiency in data center management.

By Application Analysis

In 2023, IT & Telecom dominated the Data Center Cooling market.

In 2023, The IT & Telecom sector held a dominant market position in the By Application segment of the Data Center Cooling Market. The substantial growth of data generation, driven by advancements in cloud computing, AI, and 5G technologies, significantly increased the demand for data centers. As a result, efficient cooling solutions became critical to ensuring optimal performance and energy efficiency. The rising number of hyperscale data centers in this sector necessitated advanced cooling technologies, such as liquid cooling and immersion cooling systems, to manage the increasing heat loads effectively.

The Healthcare sector followed closely, driven by the expansion of digital health services, electronic health records (EHRs), and telemedicine, requiring robust data center infrastructure to manage sensitive health data. BFSI also saw notable growth due to the increasing reliance on digital banking and financial services.

The Energy sector's digital transformation initiatives and Retail e-commerce boom contributed further to market growth. Other sectors, including government and education, experienced moderate growth, largely fueled by increasing digitization efforts and smart city initiatives. The need for reliable, energy-efficient cooling technologies is projected to intensify across all segments.

Key Market Segments

By Product type

- Air Conditioners

- Precision Air Conditioners

- Liquid Cooling

- Air Handling Units

- Others

By Type

- Raised Floors

- Non-raised Floors

By Structure

- Rack-based Cooling

- Row-based Cooling

- Room-based Cooling

By Application

- IT & Telecom

- Retail

- Healthcare

- BFSI

- Energy

- Others

Growth Opportunity

Adoption of Liquid Cooling Technologies

The growing adoption of liquid cooling technologies presents a significant opportunity for the global data center cooling market. Traditional air-based cooling systems are reaching efficiency limits, especially as the demand for higher-density data centers rises. Liquid cooling, which offers superior heat dissipation, is becoming a preferred choice for modern data centers. By directly cooling servers and other critical infrastructure components, this technology can reduce energy consumption by up to 30%, leading to lower operational costs and environmental impact. The rise of high-performance computing (HPC) and supercomputing applications in sectors such as finance, healthcare, and research further drives the need for liquid cooling solutions, creating a substantial growth avenue for market players.

Increasing Use of AI and Machine Learning

The increasing integration of AI and machine learning (ML) in data centers is another key growth driver. AI and ML models, known for their heavy computational requirements, generate immense heat, necessitating advanced cooling solutions. As companies continue to deploy AI-driven applications across sectors like finance, healthcare, and logistics, data centers will require more efficient cooling systems to maintain performance levels. AI-driven cooling management systems are also being employed to optimize energy use in real-time, further enhancing the market's attractiveness. This trend is expected to contribute to a robust compound annual growth rate (CAGR) for the data center cooling market in the coming years, as demand for cutting-edge infrastructure grows across industries.

Latest Trends

Adoption of Free Air Cooling Techniques

The data center cooling market is expected to witness a significant shift toward the adoption of free-air cooling techniques. This method leverages external air to regulate temperature, reducing the reliance on traditional energy-intensive cooling systems. The growing emphasis on sustainability and energy efficiency, driven by both regulatory pressures and corporate ESG goals, will encourage data center operators to adopt free air cooling. This approach not only lowers operational costs but also aligns with the global trend toward greener technologies. Regions with moderate climates, such as Northern Europe and North America, are anticipated to lead in the deployment of this technology.

Liquid Cooling Technologies

Another notable trend is the increasing adoption of liquid cooling technologies, particularly in high-performance computing (HPC) environments and hyperscale data centers. As data centers scale to accommodate exponential growth in data traffic, traditional air-based cooling methods are becoming insufficient. Liquid cooling offers higher efficiency in heat dissipation, enabling better performance in compact spaces. This trend is expected to gain traction in regions where space optimization and performance enhancement are critical, such as North America and Asia-Pacific.

Furthermore, the rise of AI-driven applications and machine learning workloads will further drive demand for liquid cooling solutions, positioning this technology as a key driver in the evolution of data center infrastructure.

Regional Analysis

North America dominates the data center cooling market with a 35% largest share.

The global data center cooling market exhibits significant regional variations, with North America emerging as the dominant region. In 2023, North America accounted for over 35% of the global market share, driven by the increasing number of hyperscale data centers and the adoption of advanced cooling technologies such as liquid and immersion cooling. The presence of major cloud service providers like Amazon Web Services, Google, and Microsoft further fuels the demand for efficient cooling systems in the region. The U.S. is a key contributor, with the country experiencing a surge in data center investments due to the rise in IoT, AI, and big data applications.

In Europe, the market is bolstered by stringent environmental regulations and the growing emphasis on energy-efficient data centers. Countries such as Germany, the UK, and the Netherlands lead the region, with investments in green data centers driving growth.

The Asia Pacific region is witnessing rapid expansion due to the increasing penetration of cloud computing and data localization trends. Countries like China, Japan, and India are at the forefront, with government initiatives encouraging the development of large-scale data centers.

Meanwhile, the Middle East & Africa, and Latin America show moderate growth, with countries like UAE and Brazil experiencing increasing data center investments, driven by digitization efforts across industries.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global data center cooling market is expected to witness significant growth, driven by increasing demand for efficient cooling systems due to rising data generation and energy consumption. Key players like Vertiv Holdings Co. and Schneider Electric continue to dominate the market with their extensive product portfolios and innovative cooling technologies designed for large-scale data centers. These companies are leveraging their global footprint to meet demand from hyperscale data centers, a critical growth driver.

Asetek and LiquidStack Holdings B.V. are leading the charge in liquid cooling technologies, offering energy-efficient solutions that align with the industry's shift toward sustainability and reduced power consumption. With data centers contributing to a large share of energy use, such advancements play a crucial role in regulatory compliance and meeting environmental standards.

STULZ GmbH and Rittal GmbH focus on precision cooling systems, providing scalable and modular solutions that cater to varying data center sizes. Similarly, Daikin Industries Ltd. and Mitsubishi Electric Corporation bring strong expertise in HVAC systems, contributing to the development of more integrated cooling systems.

Fujitsu, Dell Technologies Inc., and Hitachi, Ltd. capitalize on their technology portfolios to offer comprehensive cooling solutions alongside their server and storage systems, presenting a one-stop solution for customers. Johnson Controls and Nortek Air Solutions also strengthen their positions through advanced air-cooled solutions tailored for mid-sized facilities.

The competitive landscape is expected to evolve as key players innovate with energy-efficient, sustainable, and scalable cooling technologies to meet the growing demand for data processing and storage capacity.

Market Key Players

- Vertiv Holdings Co.

- Asetek

- Rittal GmbH

- STULZ GMBH

- Schneider Electric

- Fujitsu

- Coolcentric

- Daikin Industries Ltd.

- LiquidStack Holdings B.V

- Nortek Air Solutions

- Air Enterprises

- Climaveneta

- Dell Technologies Inc.

- Hitachi, Ltd.

- Johnson Controls

- Mitsubishi Electric Corporation

- NTT Limited

- Telx Inc

Recent Development

- In January 2024, Aligned Data Centers launched its DeltaFlow™ cooling technology, designed to support high-density computing environments, including AI and HPC workloads. DeltaFlow™ is a liquid-based cooling system that enhances efficiency and reduces operational costs by managing cooling needs for workloads up to 300 kW.

- In September 2023, Gates Corporation expanded its data center cooling product portfolio by launching the Data Master™ Cooling Hose, designed to enhance liquid cooling systems in data centers. This product is engineered to address the increasing demands of liquid cooling systems as data centers scale up to handle the significant heat loads from high-performance servers. The innovation marks Gates’ effort to provide more efficient fluid conveyance solutions in the rapidly evolving data center cooling sector.

- In May 2023, Vertiv introduced the Liebert XDU, an advanced liquid cooling distribution unit aimed at improving the thermal efficiency of data centers. This system is tailored to handle the increasing thermal demands of high-density computing environments, driven by trends in AI and machine learning. Vertiv’s solution supports both single-phase and two-phase liquid cooling systems, helping data centers achieve energy efficiency and reduce environmental impact.

Report Scope

Report Features Description Market Value (2023) USD 15.7 Billion Forecast Revenue (2033) USD 59.8 Billion CAGR (2024-2032) 14.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Air Conditioners, Precision Air Conditioners, Liquid Cooling, Air Handling Units, Others), By Type (Raised Floors, Non-raised Floors), By Structure (Rack-based Cooling, Row-based Cooling, Room-based Cooling), By Application (IT & Telecom, Retail, Healthcare, BFSI, Energy, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Vertiv Holdings Co., Asetek, Rittal GmbH, STULZ GMBH, Schneider Electric, Fujitsu, Coolcentric, Daikin Industries Ltd., LiquidStack Holdings B.V, Nortek Air Solutions, Other Key Players, Air Enterprises, Climaveneta, Dell Technologies Inc., Hitachi, Ltd., Johnson Controls, Mitsubishi Electric Corporation, NTT Limited, Telx Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Vertiv Holdings Co.

- Asetek

- Rittal GmbH

- STULZ GMBH

- Schneider Electric

- Fujitsu

- Coolcentric

- Daikin Industries Ltd.

- LiquidStack Holdings B.V

- Nortek Air Solutions

- Air Enterprises

- Climaveneta

- Dell Technologies Inc.

- Hitachi, Ltd.

- Johnson Controls

- Mitsubishi Electric Corporation

- NTT Limited

- Telx Inc