Global CVD Diamond Market By Type(polished, rough), By Manufacturing Method:(HPHT, CVD), By Size:(2 carats, 2-4 carats, above 4 carats), By Nature(colorless, colored), By Application:(fashion, industry) and By Region - Global Forecast 2032

-

7801

-

Feb 2024

-

305

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

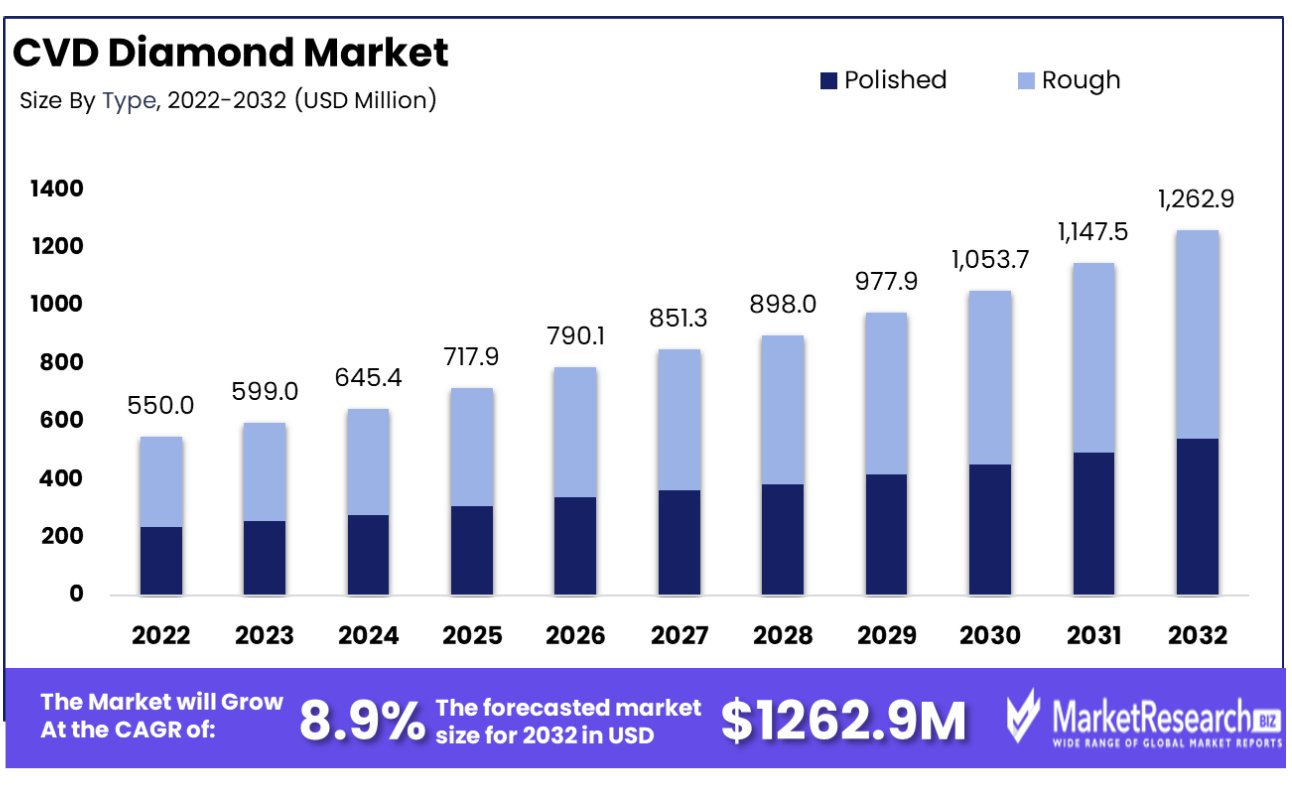

The CVD diamond market was valued at USD 550 million in 2022. It is expected to reach USD 1,262.9 million by 2023, at a CAGR of 8.9% during the forecast period from 2023 to 2032.

The CVD (Chemical Vapor Deposition) Diamond Market encompasses the production and distribution of synthetic diamonds created through a chemical vapor deposition process. This innovative technique involves breaking down molecules of a carbon-rich gas, like methane, in a controlled environment to form diamond crystal layers on a substrate, resulting in high-quality diamonds.

These synthetic diamonds are not only used in jewelry but also have wide-ranging applications in industrial sectors for cutting, grinding, drilling, and as heat sinks in electronics due to their exceptional hardness and thermal conductivity.

The CVD Diamond Market is at a pivotal juncture, with lab-grown diamonds increasingly becoming a significant segment within the broader diamond industry. Recent data from edahngolan highlights an extraordinary trend: lab-grown diamonds are projected to constitute over 50% of all diamonds sold by American jewelry retailers by May 2023. This surge in market share underscores a seismic shift in consumer preferences towards more sustainable and ethically sourced alternatives to traditional mined diamonds.

Price variability, based on carat size, with lab-grown diamonds ranging from $642 to $683 for a 1-carat diamond and $1,188 to $1,249 for a 1.5-carat diamond, illustrates the market's competitive pricing strategy. Such affordability, coupled with the ethical appeal of lab-grown diamonds, is driving their adoption among a broad spectrum of consumers.

This shift is not merely a reflection of changing consumer values but also an indication of the technological advancements in CVD diamond production that have made such diamonds more accessible. The growth of the CVD Diamond Market is a testament to the increasing importance of sustainability in the luxury goods sector, challenging the traditional diamond industry to innovate and adapt.

Key Takeaways

- Market Growth: The CVD diamond market is expected to grow from USD 550 million in 2022 to USD 1,262.9 million by 2023, with a CAGR of 8.9% during the forecast period from 2023 to 2032.

- Dominant Segments:

- By Type Analysis: The "Polished" segment is dominant, driven by consumer awareness of lab-grown diamonds and technological advancements in CVD processes.

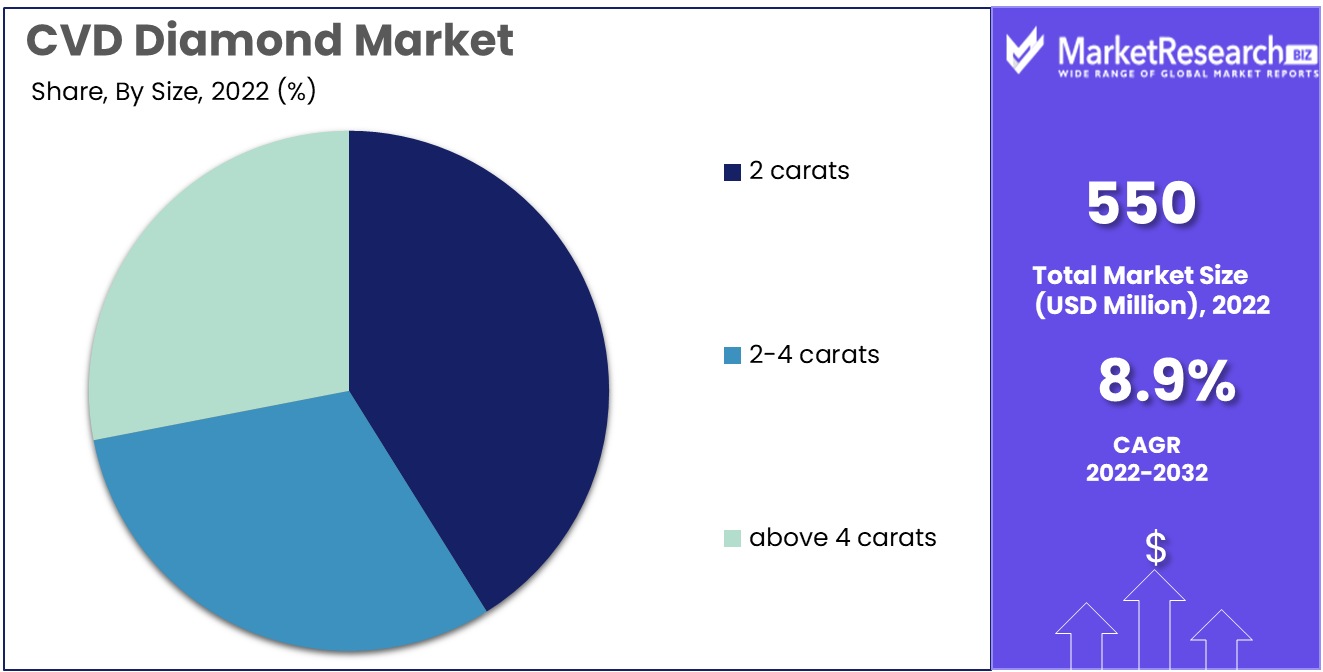

- By Size Analysis: "2 Carats" emerges as the dominant size segment, offering a balance of size and affordability, with potential growth in larger segments like "2-4 Carats" and "Above 4 Carats".

- By Nature Analysis: "Colorless" diamonds lead in nature, catering to consumers seeking traditional diamond aesthetics, while the "Colored" segment presents opportunities for unique and personalized jewelry.

- By Application Analysis: The "Fashion" segment dominates applications, fueled by consumer preference for sustainable and affordable options, while the "Industrial" segment remains crucial for various industrial uses.

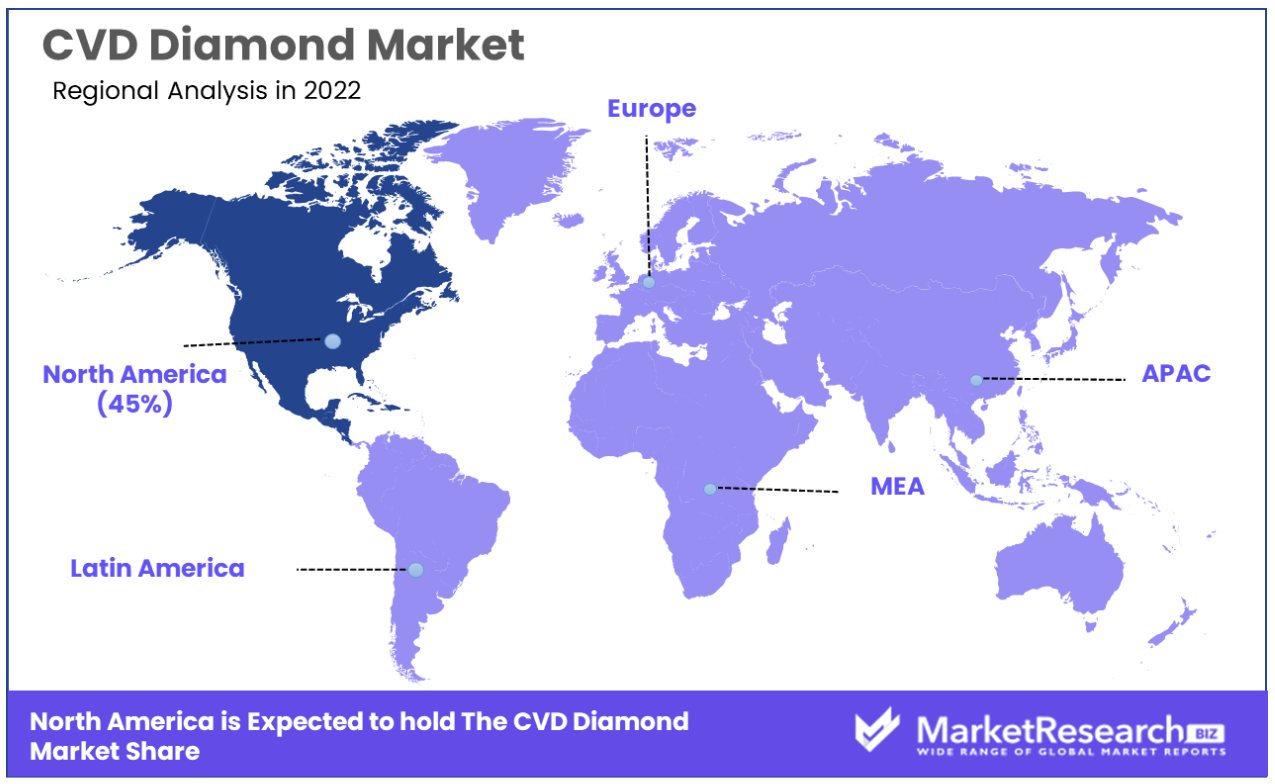

- Regional Dominance: North America holds a 45% market share in the CVD diamond market, driven by technological advancements and strong industrial demand.

- Key Players: Major companies in the CVD diamond market include Element Six UK Ltd., IIa Technologies, Sumitomo Electric Industries Ltd., De Beers, and others, emphasizing innovation and product quality.

Driving Factors

Increase in Demand for CVD Diamonds Drives Market Growth

The increase in demand for Chemical Vapor Deposition (CVD) diamonds is a fundamental driver of market growth. CVD diamonds, known for their purity and quality, are gaining popularity due to their wide range of applications, spanning from industrial uses to jewelry. In industries, CVD diamonds are valued for their hardness and thermal conductivity, making them ideal for cutting, grinding, and drilling applications. In the jewelry sector, the appeal lies in their ethical production and cost-effectiveness compared to mined diamonds.

This growing demand is supported by advancements in CVD technology, making diamond production more efficient and cost-effective. As consumer and industry awareness of CVD diamonds increases, the market is expected to continue expanding, potentially disrupting traditional diamond markets and paving the way for broader acceptance and use of synthetic diamonds.

Growing Interest in CVD Lab-Grown Diamonds in the Gem and Jewelry Sector Boosts Market

The growing interest in CVD lab-grown diamonds in the gem and jewelry sector significantly contributes to the market's expansion. Consumers are increasingly drawn to lab-grown diamonds for their ethical production, lower environmental impact, and affordability. These diamonds, indistinguishable from mined ones, cater to a growing segment of socially conscious consumers.

Jewelers are responding to this shift by incorporating CVD diamonds into their collections, thereby legitimizing and promoting their use. The luxury market's gradual embrace of lab-grown diamonds is not only expanding consumer choice but also influencing perceptions of value and sustainability in fine jewelry. This ongoing trend is likely to continue, with CVD diamonds gaining a stronger foothold in the luxury market.

Advancements in Technology Propel CVD Diamond Market

Advancements in technology are propelling the CVD diamond market to new heights. Technological improvements in CVD processes have enabled the production of larger, higher-quality diamonds at a lower cost. Innovations in controlling the deposition environment, such as temperature and pressure, have resulted in diamonds that can meet specific industrial and jewelry requirements.

These technological advancements extend the potential applications of CVD diamonds, making them more accessible for various uses. The ongoing development in CVD technology is expected to lead to further market growth, making CVD diamonds a more prevalent choice in both industrial and consumer markets.

Growing Demand for Flexible Electronics and Optoelectronic Devices Fuels Market

The growing demand for flexible electronics and optoelectronic devices is fueling the CVD diamond market. CVD diamonds possess exceptional electronic properties, such as high electrical carrier mobility, making them suitable for use in advanced electronic and optoelectronic applications. Their incorporation into devices like high-performance transistors, sensors, and high-power electronic devices highlights their importance in the evolving electronics industry.

As the electronics industry continues to innovate, particularly in areas like wearable technology and high-speed electronics, the demand for materials that can offer durability, flexibility, and superior performance, like CVD diamonds, is expected to increase. This trend suggests a significant potential for CVD diamonds in shaping future electronic applications.

Growing Demand for Diamond-Based Heat Sinks Expands Market

The growing demand for diamond-based heat sinks is expanding the CVD diamond market. CVD diamonds are highly effective in thermal management due to their extraordinary thermal conductivity. In high-power electronic devices, where efficient heat dissipation is crucial, diamond-based heat sinks are becoming indispensable.

This demand is particularly relevant in industries where reliability and performance are critical, such as in aerospace, military, and high-performance computing. The increased use of high-power electronics is expected to continue driving the demand for diamond-based heat sinks, highlighting the role of CVD diamonds in advanced thermal management solutions. This key trend is likely to contribute significantly to the growth of the CVD diamond market, as industries seek effective solutions to thermal challenges in increasingly powerful electronic devices.

Restraining Factors

Complex Manufacturing Process Restrains CVD Diamond Market Growth

The growth of the Chemical Vapor Deposition (CVD) diamond market is significantly limited by the complexity of its manufacturing process. Creating CVD diamonds involves intricate and high-tech procedures, requiring substantial investment in equipment and expertise. This complexity results in higher production costs and limits the ability to scale up production efficiently. The need for specialized knowledge and technology acts as a barrier to entry for new manufacturers, thereby restricting competition and innovation within the market.

Limited Availability of High-Quality CVD Diamonds Restrains Market Growth

High-quality CVD diamonds are in limited supply, a factor that restrains market growth. The production of CVD diamonds that meet the highest quality standards – with regard to clarity, color, and size – is challenging. Maintaining consistency in quality across production batches can be difficult, leading to variability in the end product. This limitation affects the reliability and reputation of CVD diamonds in markets that demand high precision and quality, such as in luxury types of jewelry and high-tech industrial applications.

Competition from Natural Diamonds Restrains CVD Diamond Market Growth

The CVD diamond market faces strong competition from the established market of natural diamonds. Natural diamonds have a longstanding cultural and historical significance and are often perceived as more desirable due to their rarity and traditional appeal. This competition is particularly intense in the gemstone market, where consumer preferences and perceptions heavily favor natural diamonds. Overcoming this entrenched preference poses a significant challenge to the growth of the CVD diamond market.

By Type Analysis

In the CVD Diamond Market, the "Polished" segment emerges as the dominant sub-segment. Polished CVD diamonds, known for their brilliance and aesthetic appeal, are highly sought after in the jewelry industry, particularly for engagement rings, earrings, and necklaces.

This preference is driven by consumers' growing awareness and acceptance of lab-grown diamonds as a sustainable and ethically sourced alternative to mined diamonds. The polished segment's growth is further fueled by technological advancements in CVD processes that enhance the quality and durability of the final product, making it indistinguishable from its natural counterparts to the naked eye.

The "Rough" segment, although not the dominant market share holder, plays a crucial role in the industry's supply chain. Rough CVD diamonds are essential for various industrial applications, including cutting, grinding, and drilling tools, where the material's hardness and thermal conductivity are unparalleled. This segment's growth is driven by the expanding demand for high-performance materials in manufacturing, electronics, and construction.

By Size Analysis

The "2 Carats" segment stands out as the dominant sub-segment within the CVD Diamond Market. Diamonds of this size are particularly popular in the fashion and jewelry sector, offering a balance between perceptible size and affordability.

The appeal of 2-carat CVD diamonds lies in their ability to serve a broad consumer base, providing access to luxury goods at a fraction of the cost of similar-sized mined diamonds. This segment's attractiveness is enhanced by the increasing quality of CVD diamonds, which allows for larger stones without compromising on clarity or color.

Segments representing diamonds "2-4 Carats" and "Above 4 Carats" are experiencing growth, driven by consumer demand for larger, statement pieces. Although these segments cater to a niche market due to higher price points, advancements in CVD technology are making larger lab-grown diamonds more accessible, potentially increasing their market share in the future.

By Nature Analysis

"Colorless" CVD diamonds constitute the dominant sub-segment, prized for their purity and traditional diamond aesthetic. Colorless diamonds are the standard in both fashion and engagement jewelry, appealing to consumers seeking timeless elegance. The consistent demand for colorless diamonds supports the segment's strong market position, with technological improvements in CVD processes enhancing the quality and availability of these gems.

The "Colored" segment, though smaller, is significant for its unique market niche. Colored CVD diamonds, available in a spectrum of hues, offer designers and consumers creative options beyond the traditional colorless diamond. This segment benefits from growing consumer interest in personalized and distinctive jewelry pieces, marking it as an area with potential for expansion.

By Application Analysis

The "Fashion" segment is the clear leader in the application of CVD diamonds, with their use in jewelry dominating the market. The fashion industry's embrace of lab-grown diamonds has been bolstered by changing consumer attitudes towards sustainability and ethical sourcing, making CVD diamonds a popular choice for new and traditional jewelry brands alike. This segment benefits from the broad appeal of CVD diamonds across various demographics, driven by their affordability, ethical credentials, and high quality.

The "Industrial" segment, while not the primary market driver, is crucial for the CVD diamond market's overall ecosystem. Industrial applications of CVD diamonds in tools and equipment leverage the material's exceptional hardness and thermal properties. This segment is set to grow as industries seek more efficient and durable materials to improve performance and reduce costs.

Key Market Segments

By Type

- Polished

- Rough

By Size

- 2 Carats

- 2-4 Carats

- Above 4 Carats

By Nature

- Colorless

- Colored

By Application

- Fashion

- Industrial

Growth opportunities

Growing Demand for Industrial Applications Drives Growth Opportunities in CVD Diamond Market

The increasing demand for industrial applications is a significant driver of expansion in the CVD diamond market. CVD (Chemical Vapor Deposition) diamonds offer exceptional hardness, thermal conductivity, and durability, making them ideal for various industrial uses.

These applications range from cutting, grinding, and drilling tools to heat sinks and optical windows. As industries seek advanced materials that can withstand harsh conditions and improve efficiency, the demand for CVD diamonds is rising. Manufacturers and suppliers of high-quality CVD diamond materials are poised for growth, catering to the evolving needs of industrial sectors worldwide.

Growing Demand for Diamond-Based Wear-Resistant Coatings Propels Market Expansion

The growing demand for diamond-based wear-resistant coatings is a driving force behind the expansion of the CVD diamond market. Diamond coatings are renowned for their exceptional hardness and wear resistance, making them ideal for extending the lifespan of various components, including cutting tools, molds, and precision instruments.

As industries prioritize cost-effective and durable solutions to combat wear and tear, the demand for diamond-based coatings is surging. Manufacturers specializing in CVD diamond coatings and related technologies are well-positioned to tap into this expanding market opportunity.

Increasing Demand for Diamond-Based Electronic Components Fuels Market Growth

The increasing demand for diamond-based electronic components is a key factor driving market growth in the CVD diamond industry. Diamond's unique electrical properties, such as high thermal conductivity and electrical insulating capabilities, make it valuable for electronic applications.

These applications include high-power electronic devices, RF transistors, and advanced sensors. As technology continues to advance, particularly in sectors like telecommunications and aerospace, the demand for diamond-based electronic components is growing. Companies specializing in CVD diamond materials for electronics are poised to benefit from this expanding market demand, offering innovative solutions to meet industry needs.

Regional Analysis

North America Dominates with a 45% Market Share in the CVD Diamond Market

North America commands a 45% share of the global CVD (Chemical Vapor Deposition) diamond market, underpinned by its advanced technological landscape and strong industrial base. The region's dominance is driven by substantial investments in R&D, particularly in sectors like electronics and semiconductor manufacturing where CVD diamonds are increasingly used due to their superior thermal and electrical properties.

The market dynamics in North America are also influenced by the presence of key players in the CVD diamond industry and a robust demand from the industrial sector. This demand is further bolstered by the region's focus on high-precision and technologically advanced applications in fields like telecommunications, laser optics, and high-power electronics.

Europe:

Europe holds a significant position in the global CVD diamond market. This is largely due to the region's strong focus on technological innovation and a well-established industrial sector that extensively utilizes CVD diamonds for various applications, including cutting tools, heat sinks, and optical components.

The European market is likely to witness sustained growth, driven by continued R&D in enhancing CVD diamond production techniques and the growing demand for high-quality industrial diamonds in various manufacturing processes.

Asia-Pacific:

The Asia-Pacific region is rapidly emerging as a significant player in the CVD diamond market. The growth in this region is primarily driven by the expanding electronics and semiconductor industries, especially in countries like China, Japan, and South Korea.

The market in Asia-Pacific is expected to experience significant growth due to increasing industrialization, growing investments in R&D for material sciences, and the rise in demand for high-performance materials in various industrial applications. The region's focus on adopting advanced technologies is likely to further enhance its position in the global CVD diamond market.

CVD Diamond Industry by Region

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Key Player Overview: CVD Diamond Market

In the CVD (Chemical Vapor Deposition) diamond market, the presence of major players companies and industry giants shapes a dynamic competitive landscape in the forecast period. Element Six, a member of the De Beers Group, is a market leader renowned for its advanced technological capabilities and vast range of CVD diamond products. Their strategic positioning emphasizes innovation and high-quality production, setting industry benchmarks.

IIa Technologies and Sumitomo Electric Industries Ltd. are recognized for their large-scale production capabilities and contributions to the advancement of CVD diamond technology. Their market influence is marked by extensive R&D investments and a strong focus on sustainable and ethical production practices.

Adamas One Corp and Scio Diamond Technology Corporation have carved out niches with their unique approaches to diamond synthesis and customization, catering to specific market segments such as jewelry and industrial applications. New Diamond Technology and Applied Diamond Inc. are notable for their specialized offerings in high-quality gemstones and industrial diamonds, respectively.

Overall, these key players drive the CVD diamond market, emphasizing technological innovation, ethical production, and the exploration of new applications, from luxury jewelry to advanced industrial components.

Major Companies in the CVD Diamond Market

- Element Six UK Ltd.

- IIa Technologies

- Sumitomo Electric Industries Ltd.

- De Beers

- Goldiam

- Adamas One Corp

- Sumitomo Electric Industries Ltd.

- Bhandari Group

- Scio Diamond Technology Corporation

- Pure Grown Diamonds

- New Diamond Technology

- Applied Diamond Inc.

- Hebei Plasma Diamond Technology Co., Ltd.

- Washington Diamonds Corporation

- Diamond Materials GmbH

- Morgan Advanced Materials

- Diamond Foundry

- ALTR Created Diamonds

- Ada Diamonds

- AOTC Group

Recent Developments

- 2022: In January, Diamond Materials acquired the CVD diamond technology assets of AkzoNobel to expand its diamond synthesis capabilities.

- 2022: II-VI Inc. opened a new CVD diamond production facility in Michigan in April 2022, with the capacity to meet the growing demand for power electronics.

- 2023: Applied Diamond Inc. plans to launch an upgraded CVD diamond deposition system at SEMICON West 2023, enabling larger diamond wafer production.

- 2023: Element Six announced a $25 million investment in its synthetic diamond production capabilities in Shannon, Ireland to come online in late 2023.

Report Scope

Report Features Description Market Value (2022) USD 550 million Forecast Revenue (2032) USD 1262.9 million CAGR (2023-2032) 8.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(polished, rough), By Manufacturing Method:(HPHT, CVD), By Size:(2 carats, 2-4 carats, above 4 carats), By Nature(colorless, colored), By Application:(fashion, industry) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Element Six UK Ltd., IIa Technologies, Sumitomo Electric, De Beers, Goldiam, Adamas One Corp, Sumitomo Electric Industries Ltd., Scio Diamond Technology Corporation, Pure Grown Diamonds, New Diamond Technology, Applied Diamond Inc., Washington Diamonds Corporation, Morgan Advanced Materials, Diamond Foundry, ALTR Created Diamonds, Ada Diamonds, AOTC Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Element Six UK Ltd.

- IIa Technologies

- Sumitomo Electric

- De Beers

- Goldiam

- Adamas One Corp

- Sumitomo Electric Industries Ltd.

- Bhandari Group

- Scio Diamond Technology Corporation

- Pure Grown Diamonds

- New Diamond Technology

- Applied Diamond Inc.

- Hebei Plasma Diamond Technology Co., Ltd.

- Washington Diamonds Corporation

- Diamond Materials GmbH

- Morgan Advanced Materials

- Diamond Foundry

- ALTR Created Diamonds

- Ada Diamonds

- AOTC Group