Global Craft Beer Market By Type(Ale, Lager, Pilsners, Others), By Distribution Channel(On-Trade, Off-Trade), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48696

-

July 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

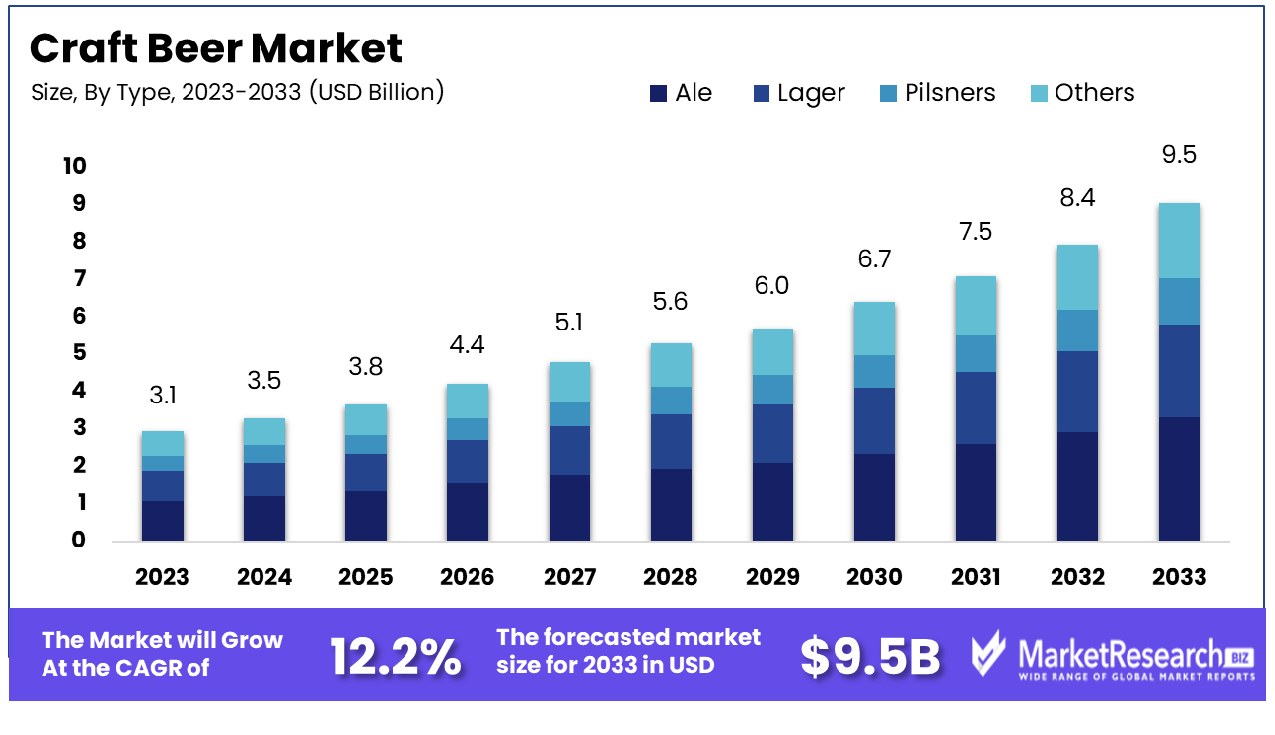

The Global Craft Beer Market was valued at USD 3.1 billion in 2023. It is expected to reach USD 9.5 billion by 2033, with a CAGR of 12.2% during the forecast period from 2024 to 2033.

The craft beer market comprises small, independent, and traditional breweries dedicated to producing beer with a focus on quality, flavor, and brewing techniques. Distinguished by their innovation and emphasis on uniqueness, these breweries often utilize locally sourced ingredients to create a diverse array of styles and flavors.

This market appeals to consumers seeking artisanal, authentic experiences and has witnessed significant growth due to rising consumer interest in premium, bespoke products. For stakeholders and product managers, the craft beer market presents opportunities for differentiation in a competitive industry, fostering brand loyalty and premium positioning.

The craft beer market has exhibited resilience and adaptability in response to shifting consumer preferences and economic challenges. Traditionally characterized by its artisanal approach and emphasis on quality and unique flavors, the craft beer sector continues to attract a discerning clientele despite a broader downturn in beer consumption.

Data from Stats NZ underscores this point, revealing a decline in overall beer availability in New Zealand—from over 294 million liters in previous years to 281 million liters for the year ending March 2023, marking a significant consumption shift. While the general beer market contracts, the craft beer segment has managed to maintain considerable traction, albeit not without challenges. In 2019, the craft beer industry generated impressive revenues of $29.3 billion.

However, by 2022, this figure had modestly declined to $28.4 billion, reflecting broader market volatilities and economic pressures. Despite this slight revenue dip, the market's core attributes—innovation, quality, and local sourcing—continue to play a critical role in sustaining consumer interest and loyalty. These factors are pivotal for VPs, CEOs, CMOs, and product managers strategizing to capitalize on the enduring appeal of craft beers and leverage their unique selling propositions in a competitive beverage market.

Key Takeaways

- Market Growth: The Global Craft Beer Market was valued at USD 3.1 billion in 2023. It is expected to reach USD 9.5 billion by 2033, with a CAGR of 12.2% during the forecast period from 2024 to 2033.

- By Type: Ale dominates the craft beer type segment with a significant 45% share.

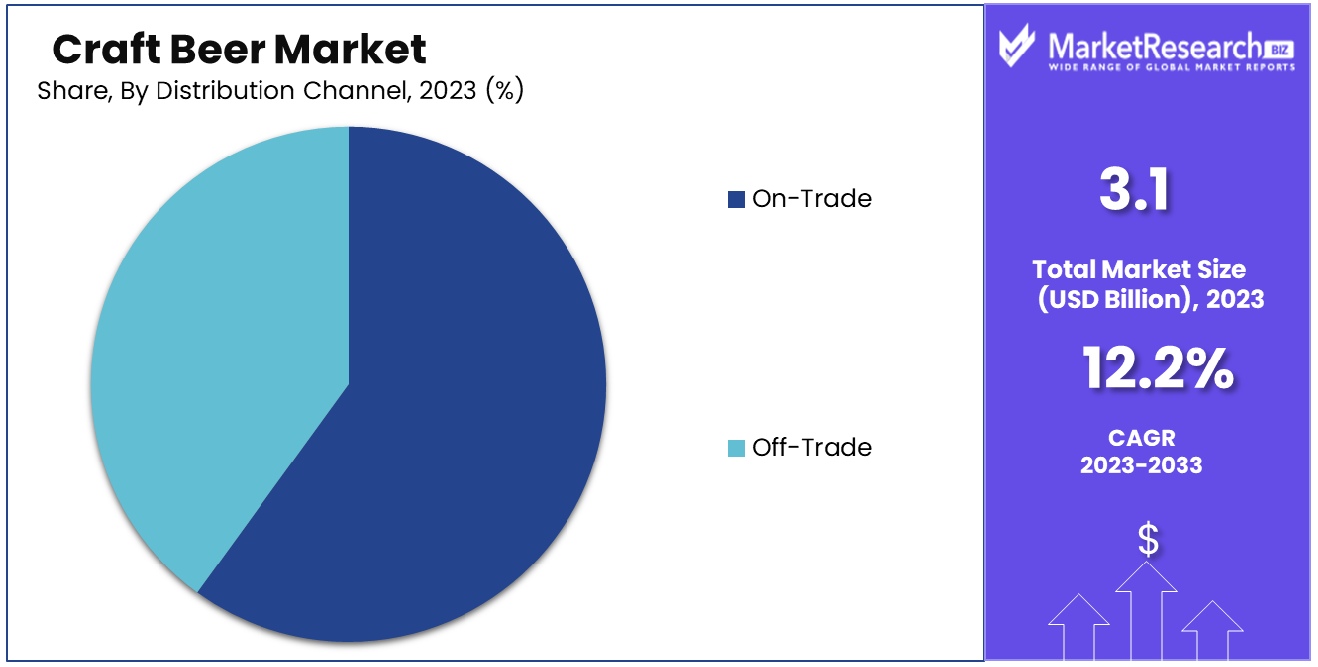

- By Distribution Channel: On-trade distribution channels lead, capturing 60% of the craft beer market.

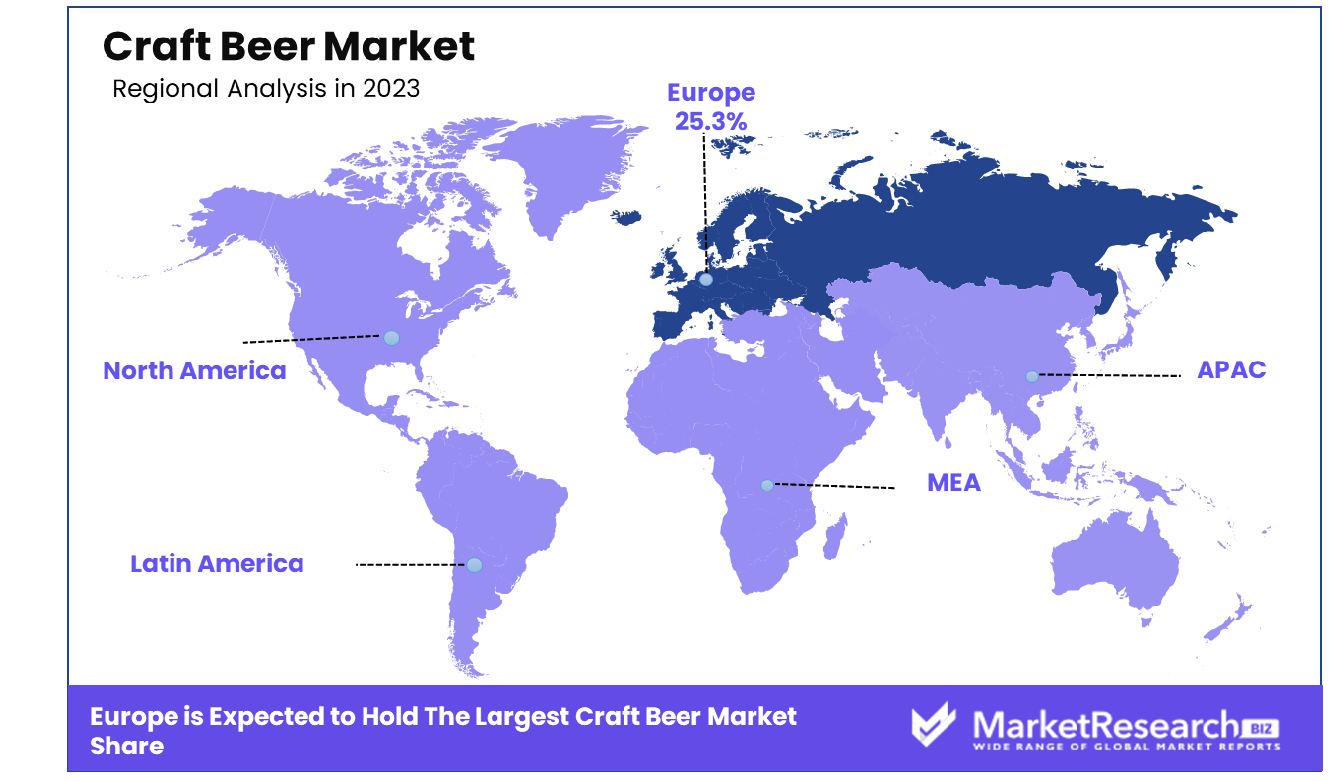

- Regional Dominance: The craft beer market in Europe holds a significant 25.3% share.

Driving factors

Consumer Preference for Artisanal and Flavorful Beers

The Craft Beer Market is significantly driven by a rising consumer preference for artisanal and flavorful beers. This trend is rooted in the increasing desire for unique taste experiences and product differentiation that craft beers offer over mainstream beer options.

As consumers become more adventurous with their palate, they increasingly seek out diverse flavors and brewing techniques, propelling the demand for craft beers. This shift is also indicative of a broader trend towards personalized and premium product experiences in the beverage sector.

Expansion of Microbreweries and Brewpubs

The proliferation of microbreweries and brewpubs has been a pivotal factor in the growth of the Craft Beer Market. These establishments not only serve as production sites but also as experiential venues where consumers can engage directly with the brewing process and culture.

This has helped foster a strong community around craft beer, enhancing consumer loyalty, and spreading awareness. Microbreweries often innovate with local flavors and sustainable practices, further appealing to the modern consumer’s preference for localism and environmental consciousness.

Increased Disposable Income and Premium Spending

Economic factors such as increasing disposable incomes play a crucial role in the expansion of the Craft Beer Market. As consumers’ spending power grows, so does their ability to purchase premium products, including craft beers which are often priced higher than their commercial counterparts.

This is particularly evident in developing economies, where the middle class is expanding, and lifestyles are becoming more urbanized and westernized. The willingness to invest in higher-quality, distinctive products is a direct reflection of rising economic prosperity and the evolving consumer values that prioritize quality and experience over price.

Restraining Factors

High Production Costs of Craft Beers

The Craft Beer Market faces significant challenges due to the high production costs associated with crafting these unique beers. Unlike mass-produced beers, craft beers often require superior-quality ingredients, such as specialty grains, hops, and yeasts, which are more expensive. Additionally, the production processes in craft brewing are generally less automated and more labor-intensive, leading to higher labor costs.

These factors contribute to the elevated price point of craft beers, which can limit market growth by making these products less accessible to price-sensitive consumers. This economic barrier is particularly influential in regions with lower disposable incomes, where the premium pricing of craft beers may deter widespread adoption.

Regulatory and Taxation Challenges

Craft beer producers often encounter formidable regulatory and taxation hurdles that vary significantly across different regions. These challenges include complex licensing requirements, strict zoning laws for brewpubs and microbreweries, and varying state and national alcohol taxes, which can inhibit market entry and expansion. For instance, in some countries, alcohol taxation is structured in a way that disproportionately affects smaller-scale producers like craft breweries. Moreover, navigating these regulations requires resources and legal expertise, diverting focus and funds away from production and innovation.

This regulatory environment not only restricts the operational capabilities of craft breweries but also impacts their profitability and scalability, posing a considerable restraint on the growth of the Craft Beer Market. Together, these factors create a challenging landscape for new and existing craft brewers, influencing the overall market dynamics and growth potential.

By Type Analysis

Ale dominates the Craft Beer Market by type, holding a substantial 45% share of preferences.

In 2023, Ale held a dominant market position in the "By Type" segment of the Craft Beer Market, capturing more than a 45% share. The segment is characterized by various types, including Lager, Pilsners, and other categories, yet Ale continues to lead in preference and consumption across diverse demographics. The appeal of Ale can be attributed to its rich variety of flavors and brewing techniques, which resonate with the evolving palate of craft beer enthusiasts.

Lager, following Ale, constitutes approximately 35% of the market share. Renowned for its crisp and clean taste, Lager appeals to consumers seeking a lighter and often more approachable beer. The popularity of Lagers is supported by their versatility and lower fermentation temperatures, making them a favored choice in warmer climates.

Pilsners, which are a subset of Lager, account for about 10% of the craft beer market. Their distinct hop flavor and golden hue appeal to those who prefer a balance of malty sweetness and a mild bitter finish. This style's craftsmanship is recognized among connoisseurs who appreciate the historical brewing methods that remain integral to its production.

The remaining 10% of the market is comprised of other types, including Stouts, Porters, and specialty beers, which cater to niche audiences seeking unique and bold flavors. These varieties often embody local ingredients and experimental brewing techniques, further enriching the craft beer landscape.

By Distribution Channel Analysis

On-trade distribution channels lead, commanding 60% of the market, and showcasing robust consumer engagement in venues.

In 2023, On-Trade held a dominant market position in the "By Distribution Channel" segment of the Craft Beer Market, capturing more than a 60% share. This distribution channel includes venues such as bars, restaurants, and breweries where craft beer is consumed on the premises. The preference for On-Trade channels can be largely attributed to the consumer's desire for a premium and authentic drinking experience, which these venues typically provide.

Off-trade, which encompasses retail industry outlets like supermarkets, liquor stores, and independent retailers where consumers purchase craft beers to consume off the premises, accounts for the remaining 40% of the market share. The convenience and variety offered by these outlets appeal to a broad consumer base, facilitating access to a wide range of craft beer options that might not be available in On-Trade settings.

The substantial lead of On-Trade in the market is bolstered by the growing trend of craft beer tourism and the consumer preference for specialty and locally brewed beer, which are often best enjoyed fresh and in the unique ambiance of a taproom or pub. Moreover, the direct interaction between consumers and brewers at On-Trade venues enhances consumer loyalty and engagement, further driving the segment’s growth.

In contrast, the Off-Trade segment benefits from the increasing consumer interest in home consumption and the expansion of craft beer availability in mainstream retail channels. This segment is expected to witness steady growth as distribution channels broaden and consumer purchasing behaviors continue to evolve in response to changing lifestyle patterns.

Key Market Segments

By Type

- Ale

- Lager

- Pilsners

- Others

By Distribution Channel

- On-Trade

- Off-Trade

Growth Opportunity

Expansion into New Markets: Asia and Eastern Europe

The global Craft Beer Market presents substantial growth opportunities in 2023, particularly through expansion into new geographical markets such as Asia and Eastern Europe. These regions exhibit growing middle classes with increasing disposable incomes, coupled with a burgeoning interest in Western lifestyle trends, including craft beer consumption. For instance, countries like China, India, and Poland have seen a noticeable uptick in consumer demand for diverse and high-quality beer options.

The unique flavor profiles and artisanal quality of craft beers position them well to capture the interest of these new demographics. Successfully penetrating these markets, however, requires understanding local consumer preferences and adapting offerings accordingly, which can range from flavor profiles to alcohol content, to align with regional tastes and legal requirements.

Collaboration and Innovation in Craft Beer

Another pivotal growth avenue in 2023 lies in heightened collaboration and innovation within the craft beer industry, particularly concerning flavor experimentation, packaging, and marketing strategies. Collaborative efforts between craft breweries and local artisans, such as coffee roasters and chocolatiers, can lead to innovative flavor profiles that cater to the adventurous palates of craft beer enthusiasts.

Additionally, sustainable and eye-catching packaging designs can attract environmentally conscious consumers and enhance shelf presence. Innovative marketing strategies, leveraging digital platforms for storytelling and customer engagement, can significantly enhance brand visibility and consumer loyalty. These collaborative and innovative approaches not only differentiate craft brewers in a competitive market but also drive consumer interest and retention, crucial for sustained growth in the craft beer sector.

Latest Trends

Emphasis on Organic and Locally Sourced Ingredients

In 2023, the global Craft Beer Market continues to evolve with a significant emphasis on organic and locally sourced ingredients, resonating with the broader consumer trend towards sustainability and ethical consumption. This shift not only appeals to environmentally conscious consumers but also enhances the brand narrative of craft breweries as stewards of local economies and sustainable practices.

By sourcing ingredients such as hops, barley, and unique additives from local farms, craft breweries can reduce their carbon footprint and support local agriculture, creating a compelling selling point. Moreover, organic certification can serve as a key differentiator in a crowded market, potentially commanding a premium price and attracting a niche segment of health-conscious consumers. This trend also fosters a closer connection between the consumer and the product, as buyers increasingly seek transparency in how and where their beverages are produced.

Increasing Popularity of Limited-Edition and Seasonal Craft Beers

Another notable trend in 2023 is the increasing popularity of limited-edition and seasonal craft beers. These offerings create a sense of urgency and exclusivity that can drive consumer interest and repeat purchases. Seasonal releases allow brewers to experiment with flavors and styles that correspond with changes in consumer preferences throughout the year, such as spiced ales during winter or fruity, lighter beers in summer.

Limited editions, often released in collaboration with other brands or for specific events, can generate buzz and foster community engagement. Such strategies not only boost sales but also enhance consumer engagement through anticipation and collectibility, contributing to the dynamic and innovative image of the craft beer industry.

Regional Analysis

The Craft Beer Market in Europe has experienced a robust growth rate of 25.3% recently.

Europe is the dominant region in the Craft Beer Market, holding a substantial share of 25.3%. The region's market leadership can be attributed to a robust beer culture and an early adoption of craft brewing innovations. European consumers are highly knowledgeable about various beer styles and show a strong preference for premium, artisanal products.

North America, particularly the United States, is a significant player in the craft beer scene, characterized by a high degree of market maturity and consumer awareness. The region has witnessed a proliferation of microbreweries and craft beer establishments, supported by an enthusiastic craft beer community. Innovations in flavors and brewing techniques continue to drive interest and consumption.

Asia Pacific is experiencing rapid growth in the craft beer sector, driven by rising disposable incomes and a growing middle class. Countries like China and India are seeing an increasing presence of craft breweries, with local producers experimenting with regional flavors and ingredients to cater to local tastes.

Latin America and the Middle East & Africa are emerging regions in the craft beer landscape. These markets are gradually embracing craft beer, spurred by urbanization and the influence of Western drinking habits. However, growth in these regions is somewhat tempered by regulatory challenges and cultural factors.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Craft Beer Market is significantly influenced by several key players, each contributing unique strengths and strategic approaches to the industry. Among these, Anheuser-Busch InBev SA/NV, Diageo PLC, and Asahi Group Holdings, Ltd. stand out due to their extensive portfolios and innovative market strategies.

Anheuser-Busch InBev SA/NV continues to dominate the craft beer scene with its aggressive acquisition strategy, integrating smaller craft breweries to diversify its offerings and leverage its artisanal branding. This strategy not only expands AB InBev’s market presence but also allows it to cater to niche preferences within various global markets, reinforcing its position as a market leader.

Diageo PLC has carved a niche in the craft beer sector by focusing on premiumization and marketing its products as upscale, lifestyle-oriented choices. This U.K.-based company leverages its strong distribution networks and brand reputation to promote its craft beer selections, effectively penetrating both established and emerging markets.

Asahi Group Holdings, Ltd. focuses on innovation and localization in its craft beer offerings. By incorporating local flavors and brewing techniques, particularly in the Asia Pacific region, Asahi addresses regional tastes and preferences, which is crucial for capturing the rapidly growing consumer base in these areas.

Additionally, companies like Suntory Holdings Limited and Pernod Ricard SA enhance their market positions through sustainability and by emphasizing organic ingredients, appealing to the environmentally conscious consumer.

Market Key Players

- Davide Campari-Milano N.V. (Netherlands)

- Diageo PLC (U.K.)

- Halewood International Limited (U.K.)

- Asahi Group Holdings, Ltd. (Japan)

- Accolade Wines (Australia)

- Bacardi Limited (Bermuda)

- Mike's Hard Lemonade Co. (U.S.)

- Castel Group (France)

- Suntory Holdings Limited (Japan)

- Anheuser-Busch InBev SA/NV (Belgium)

- The Brown-Forman Corporation (U.S.)

- United Brands Company, Inc. (U.S.)

- Pernod Ricard SA (France)

- The Miller Brewing Company (U.S.)

Recent Development

- In June 2024, Davide Campari-Milano N.V., based in the Netherlands, acquired a controlling interest in a prominent European craft brewery, further expanding its footprint in the craft beer sector. This strategic move, valued at $120 million, aims to diversify Campari's product offerings and leverage the growing popularity of craft beer in Europe.

- In April 2024, Halewood International Limited entered into a partnership with a leading UK craft brewery, resulting in the launch of a new craft beer range called "Heritage Ales." This collaboration is projected to generate additional revenue of approximately £15 million annually, enhancing Halewood's presence in the competitive craft beer market.

- In March 2024, Japan's Asahi Group Holdings, Ltd. completed the acquisition of an Australian craft brewery for AUD 85 million. This acquisition is part of Asahi's strategy to strengthen its craft beer portfolio and expand its market share in the Asia-Pacific region. The deal is expected to increase Asahi's production capacity by 25%.

- In February 2024, Accolade Wines, based in Australia, ventured into the craft beer market by launching its first-ever craft beer label, "Accolade Brews." The initial launch includes three varieties: Pale Ale, Amber Ale, and Hazy IPA. This new venture is forecasted to contribute an additional AUD 10 million to Accolade Wines' annual revenue

Report Scope

Report Features Description Market Value (2023) USD 3.1 Billion Forecast Revenue (2033) USD 9.5 Billion CAGR (2024-2032) 12.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Ale, Lager, Pilsners, Others), By Distribution Channel(On-Trade, Off-Trade) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Davide Campari-Milano N.V. (Netherlands), Diageo PLC (U.K.), Halewood International Limited (U.K.), Asahi Group Holdings, Ltd. (Japan), Accolade Wines (Australia), Bacardi Limited (Bermuda), Mike's Hard Lemonade Co. (U.S.), Castel Group (France), Suntory Holdings Limited (Japan), Anheuser-Busch InBev SA/NV (Belgium), The Brown-Forman Corporation (U.S.), United Brands Company, Inc. (U.S.), Pernod Ricard SA (France), The Miller Brewing Company (U.S.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Davide Campari-Milano N.V. (Netherlands)

- Diageo PLC (U.K.)

- Halewood International Limited (U.K.)

- Asahi Group Holdings, Ltd. (Japan)

- Accolade Wines (Australia)

- Bacardi Limited (Bermuda)

- Mike's Hard Lemonade Co. (U.S.)

- Castel Group (France)

- Suntory Holdings Limited (Japan)

- Anheuser-Busch InBev SA/NV (Belgium)

- The Brown-Forman Corporation (U.S.)

- United Brands Company, Inc. (U.S.)

- Pernod Ricard SA (France)

- The Miller Brewing Company (U.S.)