Cosmeceuticals Market Research Report Information, by Product Type (Skincare, Hair Care, Oral Hygiene, and Other Types), by Injectable (Botox, Dermal Fillers, And Other Injectable), by Distribution Channel (Pharmacy/Drug Stores, Online Stores, And Others), And Region - Forecast 2023-2032

-

40265

-

Feb 2022

-

165

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

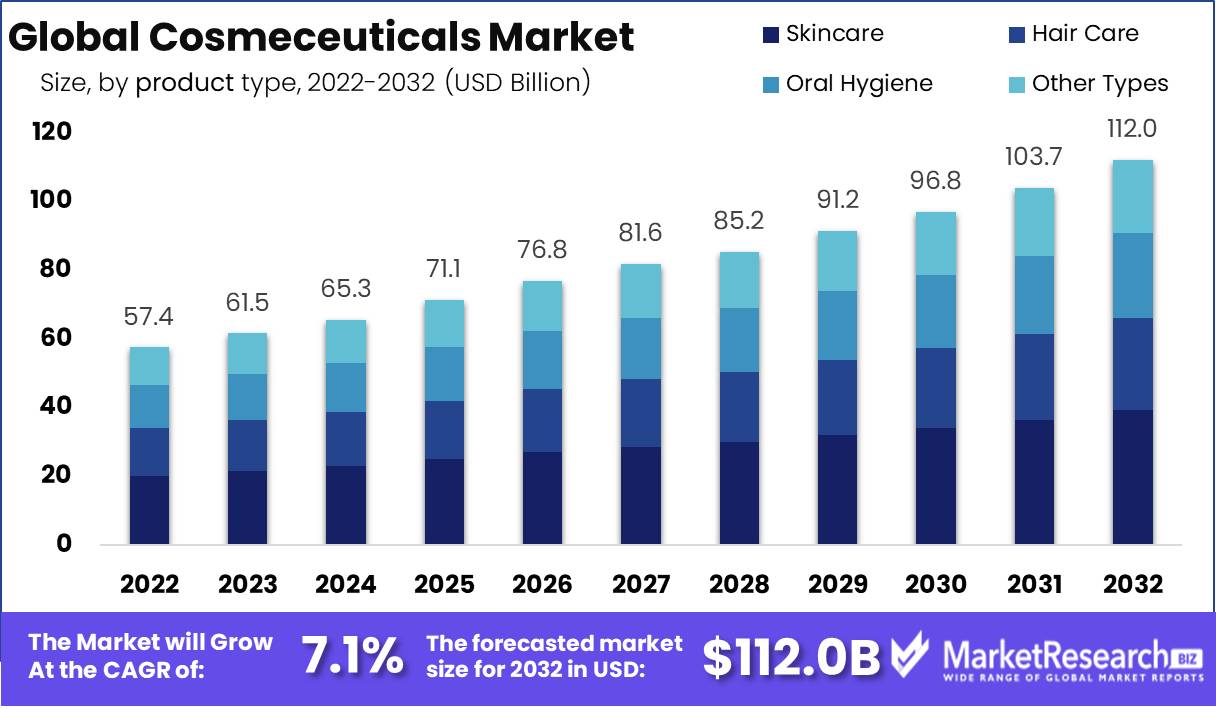

Cosmeceuticals Market size is expected to be worth around USD 112.0 Bn by 2032 from USD 57.4 Bn in 2022, growing at a CAGR of 7.1% during the forecast period from 2023 to 2032.

Cosmeceuticals are restorative beauty care products that contain naturally active synthetic substances and profess to give clinical or drug-like benefits. Corrective drugs are headways in superficial dermatological things, and innovative skincare is in the vogue age. These items upgrade the presence of and support the skin and treat restoratively compromised skin cells. The presentation of cosmeceuticals rebuilt the beauty care products and individual consideration business, and the cosmeceuticals industry is supposed to ascend as clients' familiarity with their appearance develops. Cosmeceutical brands are available without a prescription and are ordinarily utilized related to other skincare items to assist with further developing pigmentation, complexion, surface, and fine kinks.

Within the beauty and skincare industry, the cosmeceuticals market is a dynamic and rapidly evolving sector. These products are known for their combination of cosmetic and pharmaceutical properties, which provide consumers with innovative solutions to various skin concerns.

In a recent development, Oriflame, a prominent player in the cosmetics and beauty industry, made significant strides in the Indian cosmeceuticals market beginning in January 2023. They debuted a new product line called 'NovAge Proceuticals.' This product line is strategically designed to address Indian consumers' specific skin concerns, reflecting the company's commitment to providing tailored solutions in this competitive market.

In addition, in the same month, Gencor unveiled a game-changing innovation in the cosmeceuticals industry. They developed a dispersible form of palmitoylethanolamide (PEA) known as 'Levagen+.' This one-of-a-kind product is intended to protect the skin from oxidative stress-induced damage. The incorporation of Pharamako Biotechnologies' LipiSperse technology, which improves the bioavailability and functionality of PEA for beauty applications, distinguishes Levagen+.

Driving factors

Increasing The Public's Awareness of Cosmetics and Introducing Cutting-Edge Products To Boost Market Expansion

A greater number of people worldwide use these products because of the strong emphasis placed on initiatives by government agencies and market players to raise public awareness of skin and hair health. In addition, one of the primary factors driving the adoption of these products in both established and emerging economies is the creation of active ingredients by cosmeceutical market participants.

For instance, in the year 2021, a number of specialized campaigns sponsored by the American Academy of Dermatology will emphasize skin and hair health alongside overall health. The month of May is skin cancer awareness month, highlighting the importance of sun protection through the use of sunscreen products and the harm caused by UV rays to the skin are two examples. The demand for professional skincare products is rising as a result of the rising incidence of skin conditions in both children and adults.

Various cosmeceuticals market players have been encouraged to develop novel formulations with a focus on the development of active ingredients, such as plant-based alternatives, as a result of this and the global adoption of organic products. The cosmeceuticals market's expansion can be attributed to an increase in key product launches and product development. Explore the numerous benefits of cosmeceuticals in addressing dry skin with advanced skin care anti-aging solutions, driving growth in the cosmeceuticals market.

Restraining Factors

High Cost of Branded Products To Affect Demand for Cosmeceuticals

The cosmetic industry is in high demand all over the world due to the rising number of people with skin and hair conditions, the aging population, and public awareness of dermatological treatments. It is anticipated that the market's expansion will be stifled by the prohibitive price of branded cosmeceuticals sold by major cosmeceutical market players.

The high costs incurred by the end consumer are the result of the growing number of important businesses positioning themselves as extravagance brands in this sector, the high recovery costs of products as a result of spending on novel product research and development, and brand campaigns.

A major impediment to cosmeceuticals market expansion is the availability of low-quality alternates as a result of a lack of strict regulation. During the forecast period, the demand for these products in developing nations is also hindered by the absence of insurance reimbursement.

Type Analysis

In 2022, The Dominance Of The Skin Care Segment Resulted From An Increase In Product Adoption.

The cosmeceuticals market is divided into skin care, hair care, Oral Hygiene, and other types by product type. Anti-aging, sun protection, skin whitening, anti-acne cosmetics, professional skincare, and other segments further divide the skincare industry. The general public's rising awareness of skin diseases and increasing use of personal care products contributed to this market's dominance.

Due to the growing number of people who are getting older and the growing awareness of anti-aging products that effectively manage skin aesthetics like wrinkles, the anti-aging category dominated the skincare market. Cosmeceuticals offer essential benefits for dry skin, revolutionizing skincare.

The Cosmeceuticals Market has witnessed remarkable industry growth within the skincare segment. Consumers prioritize skin health, addressing skin concerns with cosmetic products. This trend has spurred innovation in both skincare and makeup products, driving advancements in the cosmetics industry.

Distribution Channel Analysis

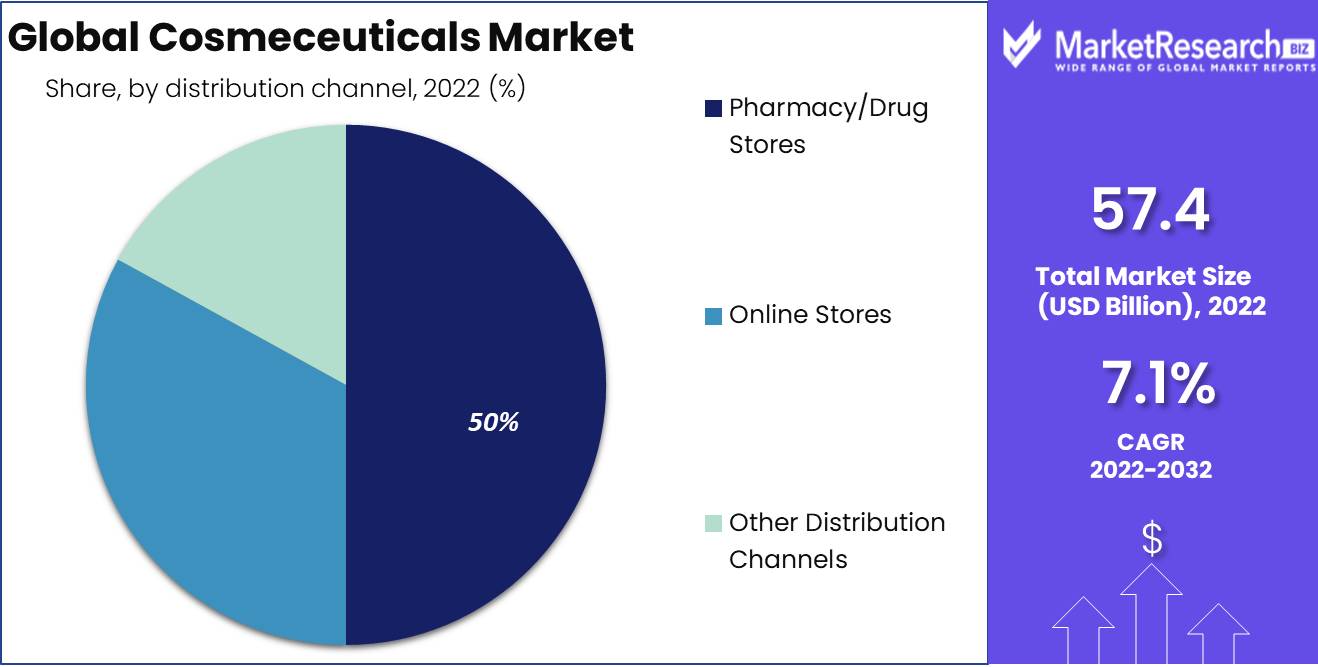

A Stable Distribution System To Support The Pharmacy/Drug Store Sector's Dominance Of The Global Market From 2023 To 2032

Based on the distribution channel, the global cosmeceuticals market is divided into drug stores/pharmacies, online stores, and others. In 2022, the segment of drug stores and pharmacies held the largest share of the global market. The retail stores' discounts and the introduction of cutting-edge products at reasonable prices are to blame for the segment's dominance. Additionally, the robust network of these stores in developed nations and stronger penetration of larger store chains are to blame for the strong growth of the pharmacy/drug stores segment in the global industry.

In contrast, the online store's segment is expected to experience a higher CAGR than the other segments. The entry of major players that are investing in the growth of e-commerce and digital platforms to engage customers in real-time is credited with the higher growth of online channels. In addition, the COVID-19 pandemic has significantly influenced consumers' preference for online stores over retail ones. Online segments have driven the annual growth rate of the cosmeceuticals market, becoming the primary online distribution channel for these products.

Key Market Segments

Based on Type

- Skincare

- Hair Care

- Oral Hygiene

- Other Types

By Injectable

- Botox

- Dermal Fillers

- Other Injectable

By Distribution Channel

- Pharmacy/Drug Stores

- Online Stores

- Other Distribution Channels

Growth Opportunity

Personalized cosmeceutical products, tailored to an individual's specific skin type and concerns, have become increasingly popular. Companies that offer customizable solutions may find a unique selling point in the market. To dominate the cosmeceuticals market, leveraging growth factors is imperative. Key development strategies must align with evolving consumer demands. Balancing traditional products with innovative offerings is vital to secure the largest market share. Effective development activities are pivotal for sustained success in this competitive landscape.

This, in turn, has created opportunities for new introductions and innovations in the cosmetic industry, thus making the manufacturers focus on active anti-aging-based skin products. The cosmeceutical market growth has been witnessed due to the increasing demand for high-product quality. Consumers are seeking active anti-aging-based skin products. However, it's essential to address harmful effects and ensure safety, especially with the increase in skin disorders in this dynamic market.

Latest Trends

Increasing Preference of General Population Toward Natural Products To Boost Demand For Cosmeceuticals

Bringing to light the advantages that natural ingredients offer over conventional products, such as fewer side effects like skin cracking and hair loss. The cosmeceuticals market is expected to expand as a result of major market players' efforts to raise awareness of organic outcomes through different brand drives and dermatologists' growing preference for prescribing natural alternatives such as organic products for skin and hair care. In addition, the major players in the market are working on the creation of e-commerce media, such as Direct to Consumer (DTC) dispersal media, in order to meet the growing demand, which is anticipated to support the expansion of organic outcomes.

Regional Analysis

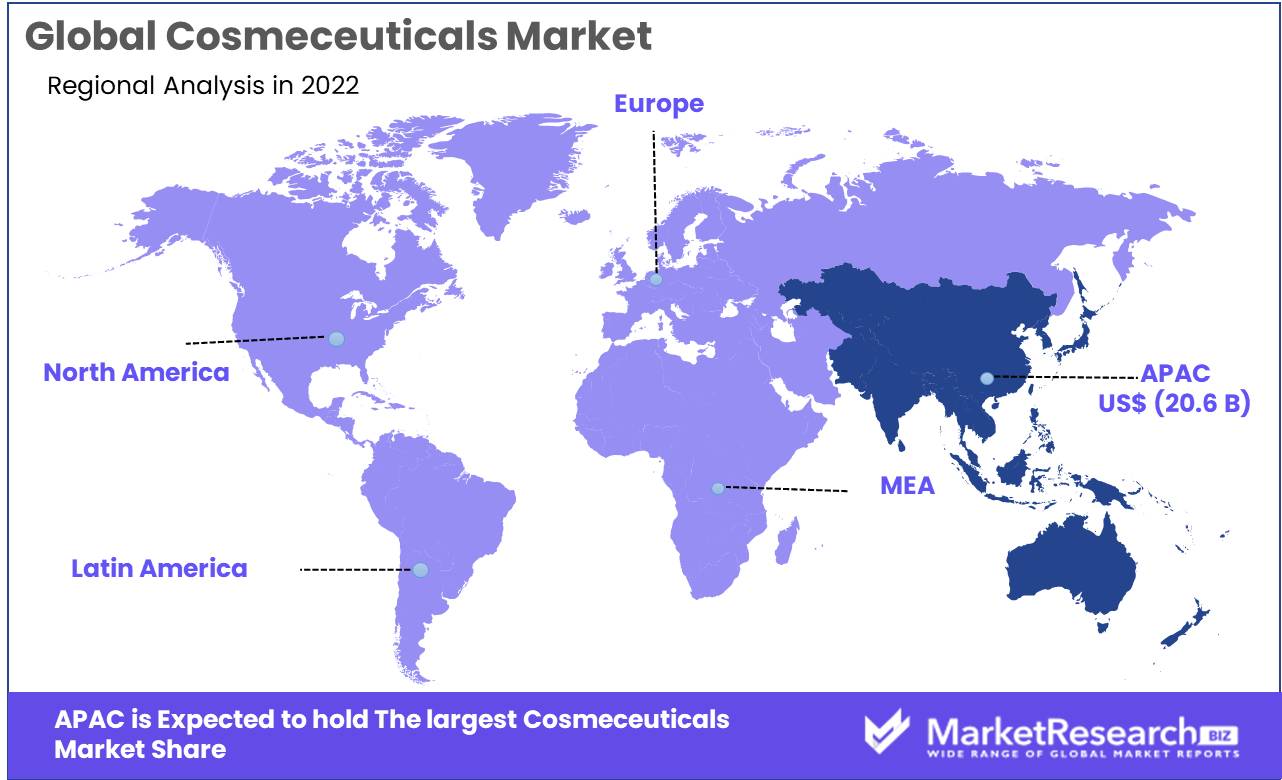

Asia-Pacific Region Accounted Significant Share Of The Global Cosmeceuticals Market

Asia Pacific dominated the cosmeceuticals market. The Asian market's expansion can be attributed to the increasing emphasis on strategic partnerships and product launches by market players as well as investments in digital infrastructure to boost product distribution and appeal to consumers. In addition, the Asia-Pacific market is being driven by a number of key factors, including a growing population and increased public awareness of these products.

In addition, consumers of cosmeceuticals in Asia-Pacific are likely to grow gradually due to rising market demand for products and a growing awareness of skin and hair health, medical aesthetics, and dermatological disorders.

In the global market, North America held the second-largest cosmeceutical market size, and share. The widespread availability of patients with dermatological conditions like melanoma and eczema and the expanding use of cutting-edge dermatology products in the region are to blame for this expansion. Additionally, it is anticipated that cosmeceutical products will see an increase in demand as a result of an increasing number of dermatological procedures, such as non-surgical cosmetic procedures.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Strong Portfolio Of Leading Companies' Products To Help Take Over The Market

The global cosmeceuticals market is fragmented, with key market players, such as L’Oréal, Unilever, Estée Lauder Companies Inc., Procter and Gamble, and Shiseido Company Limited, holding a significant market share. The dominance of these players is attributed to the robust product portfolio of skincare products, strategic collaborations, and a strong distribution network. However, the presence of domestic players in the competitive landscape, holding the majority of the market share, varies among different regions. The key companies operating in the market are introducing advancements in key products to gain a competitive advantage over other key market players.

Moreover, there is a strong emphasis on mergers and partnerships with a view to strengthening product portfolios along with a focus on the development of e-commerce platforms to improve product reach and cosmeceuticals market position. Moreover, the other major market players, including ELEMENTIS PLC., Beiersdorf, AVON products Inc., and Allergan (AbbVie Inc.), are focused on offering OTC products to provide to developing markets as well as acquiring prominent market share across the globe.

Top Key Players in Cosmeceuticals Market

- L’Oréal (France)

- Estée Lauder Companies Inc. (U.S.)

- Beiersdorf (Germany)

- Shiseido Company Limited (Japan)

- Procter and Gamble (U.S.)

- Elementis Plc (U.S.)

- Avon Products Inc. (U.K.)

- Allergan (U.S.)

- BASF SE (Germany)

- Croda International Plc (U.K.)

- Unilever (U.K.)

- Coty Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Clarins (France)

- LVMH (France)

- Merck & Company Inc.

- Other Key Players

Recent Development

- In May 2023: CHOSEN, a leading cosmeceuticals brand in India, launched the "Child's Play" detangler serum for messy hair, catering to the Indian market.

- In January 2023: Oriflame launched its first range of cosmeceutical products, NovAge Proceuticals, for the Indian market, addressing specific skin challenges.

- In January 2023: Gencor unveiled a dispersible form of palmitoylethanolamide (PEA) called Levagen+ designed to shield the skin from damage caused by oxidative stress. Pharamako Biotechnologies' LipiSperse technology, integrated into Levagen+, enhances the bioavailability and functionality of PEA for beauty applications, as stated by the company.

- In October 2022: Obagi Cosmeceuticals relocated its corporate headquarters to The Woodlands, Texas, adding to the region's business-friendly environment.

- In September 2022: ESK introduced its Ageless dissolving microneedle eye patches, utilizing innovative technology to improve the delivery of skincare activities.

- In July 2022: L'Oréal Professionnel Paris launched its 'Curl Expression' range in Nigeria, featuring ten products designed specifically for natural and kinky hair textures.

Report Scope:

Report Features Description Market Value (2022) USD 57.4 Bn Forecast Revenue (2032) USD 112.0 Bn CAGR (2023-2032) 7.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Type (Skincare, haircare, Oral Hygiene, Other), By Injectable (Botox, Dermal Fillers, Other Injectable), By Distribution Channel (Pharmacy/Drug Stores, Online Stores, Other Distribution Channels) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape L’Oréal (France) Estée Lauder Companies Inc. (U.S.), Beiersdorf (Germany), Shiseido Company Limited (Japan), Procter and Gamble (U.S.), Elementis Plc (U.S.), Avon (U.K.), Allergan (U.S.), BASF SE (Germany), Croda International Plc (U.K.), Unilever (U.K.), Coty Inc. (U.S.), Johnson & Johnson Services, Inc. (U.S.), Clarins (France), LVMH (France), Merck & Company Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- L’Oréal (France)

- Estée Lauder Companies Inc. (U.S.)

- Beiersdorf (Germany)

- Shiseido Company Limited (Japan)

- Procter and Gamble (U.S.)

- Elementis Plc (U.S.)

- Avon Products Inc. (U.K.)

- Allergan (U.S.)

- BASF SE (Germany)

- Croda International Plc (U.K.)

- Unilever (U.K.)

- Coty Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Clarins (France)

- LVMH (France)

- Merck & Company Inc.

- Other Key Players