Construction Scaffolding Market By Material (Steel, Aluminum, Wood), By Type (Supported Scaffolding, Suspended Scaffolding, Rolling Scaffolding), By Application (Construction, Cultural Use, Others) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

44479

-

April 2024

-

300

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

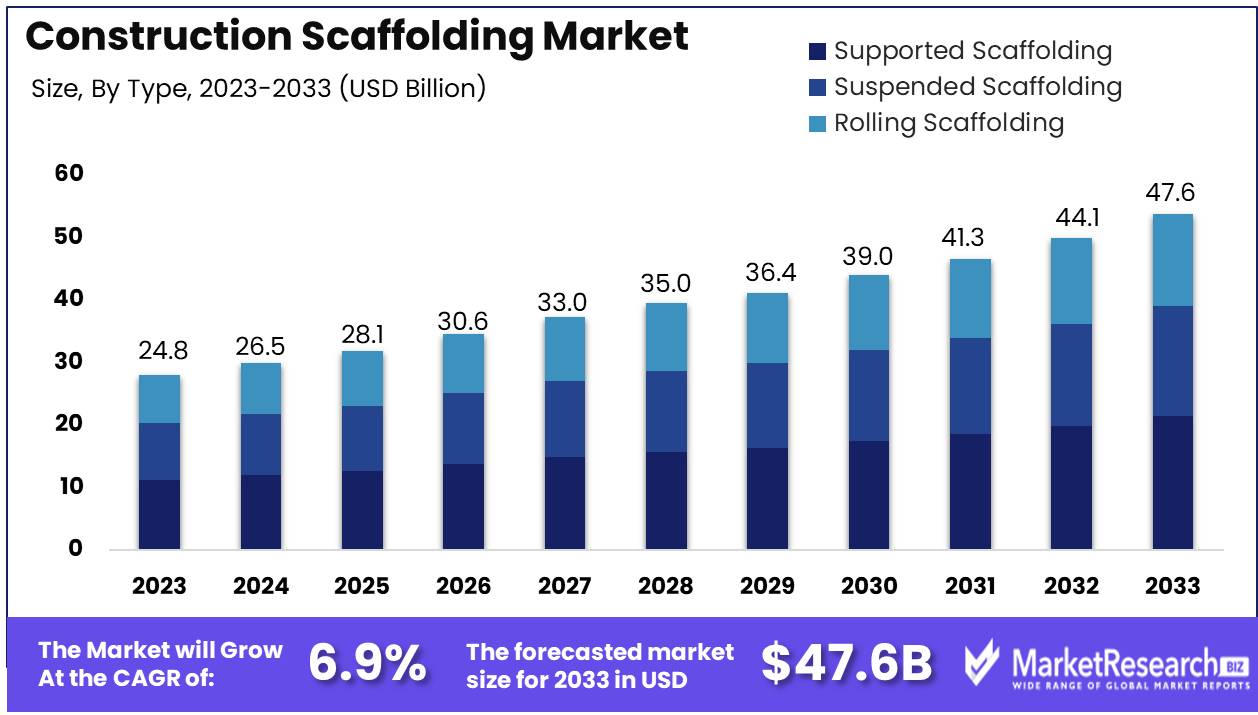

The Construction Scaffolding Market was valued at USD 24.8 billion in 2023. It is expected to reach USD 47.6 billion by 2033, with a CAGR of 6.9% during the forecast period from 2024 to 2033.

The surge in demand in the construction industry and privatizations are some of the main driving factors for the construction scaffolding market expansion. Construction scaffoldings are the impermanent structures used by the workers to offer support on heights and provide materials at the time of the construction process for developing any structure or building. Scaffolding in construction makes the work much easier and more convenient for the workers at elevated heights. Additionally, it also offers great support to a standing infrastructure or building throughout the construction phase.

The population is increasing day by day, and there is a huge demand for construction. According to the National Investment Promotion and Facilitation Agency India, India will reach a massive population of 1.64 billion by 2047 and it is anticipated that 51% of India’s population will prefer to stay in urban areas by the United Nations projects. Moreover, the construction development industry will inflow USD 26.4 billion from April 2000 to June 2023. There will be 100% FDI in the construction sector in India under automatic routes allowed in completed projects for management and operations work of townships, commercial complexes, and business constructions. Also, there will be 100% FDI in the construction industry that will be permitted under the automatic route for urban constructions such as urban transportation, sewerage, and sewage treatment.

There are different types of scaffolding used in the construction industry such as trestle scaffoldings, steel scaffoldings, patented scaffolding, suspended scaffolding, cantilever scaffolding, and kwikstage scaffoldings. Each of these scaffoldings has its own functionality and requirement in the construction industry. These scaffoldings play a vital role in the construction industry as they ease the positioning, ensure safety and it is easy to access. The right scaffoldings are needed not only to build tall commercial or residential buildings but also to carry out maintenance and repair work on any elevated high-rise buildings. Scaffoldings help in the quick completion of the construction work as well as make sure to safeguard workers and the public in construction areas. The demand for construction scaffoldings will increase due to its high-end requirement in the construction industry which will help in market expansion in the forecast period.

Key Takeaways

- Market Growth: The Construction Scaffolding Market was valued at USD 24.8 billion in 2023. It is expected to reach USD 47.6 billion by 2033, with a CAGR of 6.9% during the forecast period from 2024 to 2033.

- By Material: Steel dominated the Construction Scaffolding Market, reflecting intrinsic advantages and industry dynamics.

- By Type: Supported scaffolding dominates Construction Scaffolding Market due to stability, safety, versatility, and expected sustained growth.

- By Application: In 2023, construction dominated the scaffolding market, driven by global urbanization, while cultural and other sectors grew steadily.

- Growth Opportunity: The 2024 global construction scaffolding market thrives on increasing construction activities and integrating digital tools for growth.

Driving factors

Expanding Construction Industry: Catalyst for Scaffolding Demand

The expansion of the construction industry serves as a primary driver for the growth of the Construction Scaffolding Market. This sector's growth, often measured in annual increments of GDP contribution and new projects, directly correlates with the heightened demand for scaffolding solutions. As construction activities increase to accommodate residential, commercial, and industrial needs, scaffolding becomes essential for ensuring worker safety and efficiency. The direct relationship between construction industry growth and scaffolding demand underscores the scaffolding market's sensitivity to construction trends and economic cycles.

Infrastructure Development: Scaffolding's Role in Modernization

Infrastructure development, encompassing transportation, utilities, and public facilities, significantly influences the Construction Scaffolding Market. This factor is particularly potent in emerging economies, where rapid urbanization and governmental focus on infrastructure improvement drive scaffolding demand.

As countries prioritize modernizing their infrastructure to boost economic growth and improve quality of life, the need for reliable and versatile scaffolding systems escalates. This trend not only highlights scaffolding's critical role in supporting construction efforts but also positions the scaffolding market as a beneficiary of global infrastructural investments.

Lack of Innovation and Delayed Adoption: A Double-Edged Sword

The scaffolding market's growth is paradoxically affected by the lack of innovation and delayed adoption of new technologies. This stagnation can initially hinder market growth by slowing the adoption of efficient, cost-effective, and safer scaffolding solutions. However, it also creates a pent-up demand for innovation, driving eventual market growth as the industry seeks to overcome these challenges. Forward-thinking companies that invest in R&D to introduce innovative scaffolding solutions can thus capture significant market share, turning this barrier into an opportunity for differentiation and leadership in the market.

Restraining Factors

Enhanced Safety Regulations Propel Innovations

Unsafe scaffold designs have historically been a major concern in construction safety, leading to increased scrutiny and regulatory requirements. This focus has propelled innovation within the construction scaffolding market. Manufacturers are now investing in primary research and development to create safer, more reliable scaffolding systems. These advancements not only address safety concerns but also increase efficiency and versatility in construction projects. As a result, the demand for these improved scaffolding solutions is growing, driving market expansion.

Demand for Advanced Braking Systems

The issue of malfunctioning brakes in scaffolding equipment underscores the critical need for advanced safety mechanisms. Brakes are essential for ensuring the stability and security of mobile scaffolding, protecting workers from potential accidents.

The demand for scaffolding with robust, fail-safe braking systems has led to technological enhancements that improve safety and operational efficiency. This demand acts as a catalyst for market growth, as construction companies prioritize the procurement of scaffolding that incorporates these advanced safety features to comply with stringent safety standards and mitigate risks.By Material Analysis

Steel dominated the Construction Scaffolding Market, reflecting intrinsic advantages and industry dynamics.

In 2023, the construction scaffolding market witnessed steel's continued dominance within its "By Material" segment, outshining aluminum and wood through its unparalleled strength, durability, and reliability, particularly in complex and high-rise constructions. Steel's predominance is attributed not only to its inherent properties but also to broader market trends such as increasing sustainability focus, technological advancements in material engineering, and stringent safety regulations, which collectively underscore its suitability for modern construction demands. Despite the initial cost implications, steel's recyclability and longevity present a cost-effective solution over time.

However, the evolving landscape with innovations in aluminum and wood, alongside shifting industry priorities towards sustainability and material science advancements, suggests a competitive and diverse future for the scaffolding materials market, necessitating strategic adaptability among stakeholders to navigate these changes effectively.

By Type Analysis

Supported scaffolding dominates the Construction Scaffolding Market due to stability, safety, versatility, and expected sustained growth.

In 2023, Supported Scaffolding held a dominant market position in the Construction Scaffolding Market's Basis of Type Analysis segment. Supported scaffolding systems, characterized by their sturdy structure supported by poles, beams, or frames, accounted for a significant share of the market due to their widespread use across construction sites globally. The versatility, safety, and ease of assembly associated with supported scaffolding made it a preferred choice for various construction projects.

Supported scaffolding dominates the Construction Scaffolding Market due to its superior stability, load-bearing capacity, and modular design, catering to various construction tasks effectively. Its robust construction and adherence to safety standards ensure a secure working environment, reducing on-site accidents. Advanced materials and design features further boost its performance and efficiency.

The market is poised for sustained growth driven by infrastructure projects, urbanization, and stringent safety regulations, prompting manufacturers to innovate and enhance scaffolding systems for improved customer satisfaction and safety standards compliance.

By Application Analysis

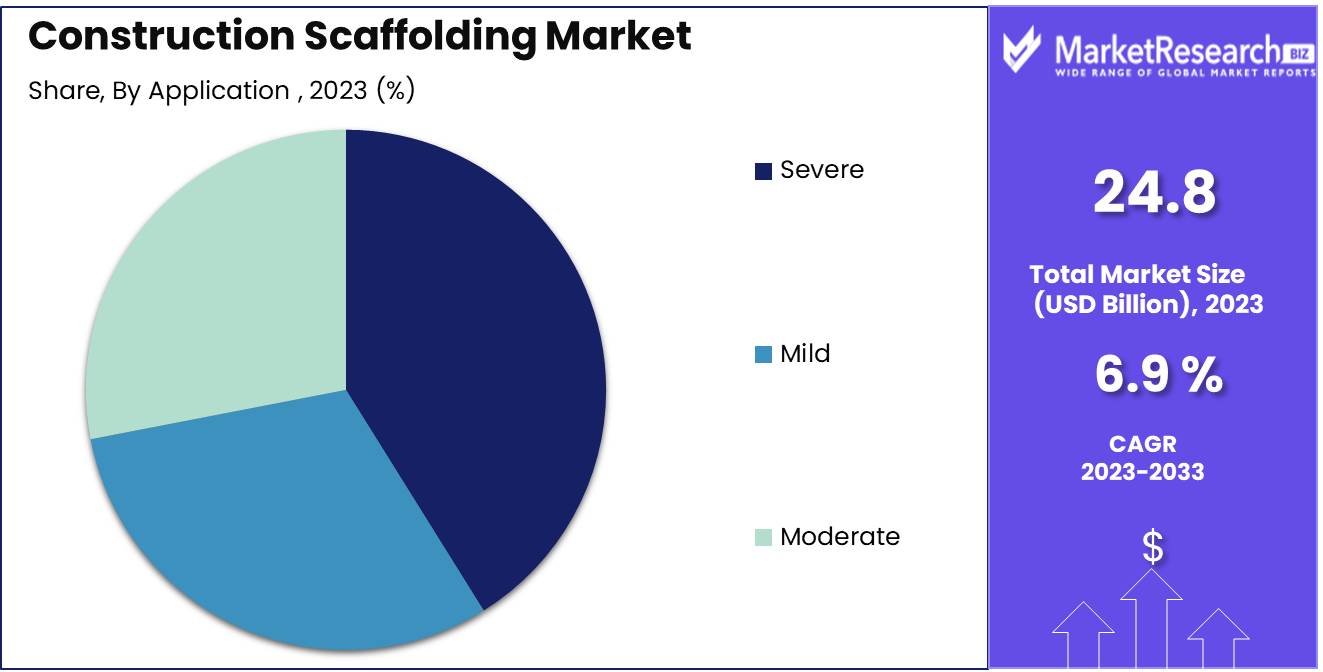

In 2023, construction dominated the scaffolding market, driven by global urbanization, while cultural and other sectors grew steadily.

In 2023, the Construction segment emerged as the dominant force in the By Application Analysis segment of the Construction Scaffolding Market, driven by the increasing demand for scaffolding in construction projects globally amidst urbanization and infrastructure development.

Simultaneously, Cultural Use gained significance as preservation efforts for heritage sites and monuments necessitated specialized scaffolding solutions, contributing to steady market growth. Moreover, the Others category, encompassing diverse applications like event management and industrial maintenance, represented a niche but impactful segment. While Construction held sway due to widespread construction activities, the combined influence of Cultural Use and Other applications highlighted the varied utility and adaptability of scaffolding across different sectors, shaping the market landscape in 2023.

Key Market Segments

By Material

- Steel

- Aluminum

- Wood

By Type

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Application

- Construction

- Cultural Use

- Others

Growth Opportunity

Increasing Construction Activities

The surge in construction activities worldwide is a primary driver for the growth of the scaffolding market. Rapid urbanization, infrastructure development projects, and government initiatives for affordable housing are fueling the demand for construction scaffolding. Emerging economies in Asia-Pacific, Latin America, and Africa are witnessing robust construction activities, creating a substantial market for scaffolding solutions. Additionally, the renovation and restoration projects in mature markets like Europe and North America contribute to market expansion.

Integration of Digital Tools and Automation

The integration of digital tools and automation in construction processes is revolutionizing the scaffolding industry. Technologies such as Building Information Modeling (BIM), drones, and augmented reality are enhancing efficiency, safety, and precision in scaffolding operations. Advanced scaffold design software allows for better planning and optimization of scaffold structures, reducing material wastage and project timelines. Automation in scaffold erection and dismantling processes improves productivity and minimizes manual labor risks.

Latest Trends

Digitalization and Automation

In 2024, the global construction scaffolding market is witnessing a significant transformation driven by the integration of digitalization and automation. Construction firms are increasingly adopting digital tools and automated solutions to enhance efficiency, safety, and productivity in scaffolding operations. Digital technologies such as Building Information Modeling (BIM) are revolutionizing the design and planning phase, enabling precise scaffolding layouts and minimizing material wastage. Moreover, advanced sensors and IoT-enabled devices are being utilized for real-time monitoring of scaffold structures, ensuring compliance with safety standards and facilitating proactive maintenance.

Modular and Prefabricated Scaffolding

Another prominent trend shaping the construction scaffolding market in 2024 is the rising adoption of modular and prefabricated scaffolding systems. With the growing emphasis on project timelines and cost-efficiency, modular scaffolding solutions offer versatility and ease of assembly, catering to diverse construction requirements. Prefabricated scaffolding components are manufactured off-site under controlled conditions, reducing on-site labor and accelerating project schedules. Additionally, modular systems promote sustainability by enabling the reuse and recycling of scaffold parts, aligning with the industry's green initiatives.

Regional Analysis

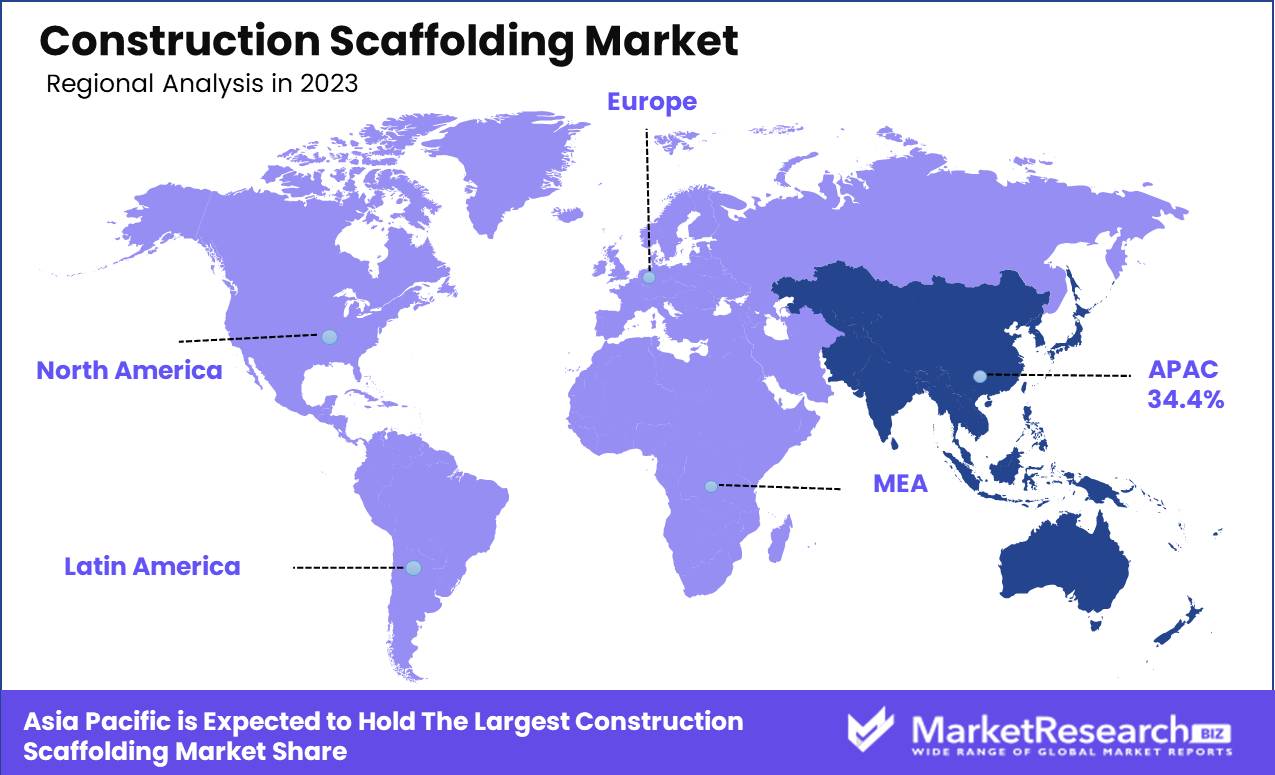

The construction scaffolding market showcases distinct trends across various regions, each influenced by unique economic, regulatory, and infrastructural factors. The Asia Pacific emerges as the dominating region in the construction scaffolding market, commanding a substantial largest share of 36.4% in 2023. Rapid urbanization, coupled with extensive infrastructural development initiatives in countries like China, India, and Southeast Asian nations, propels the demand for scaffolding systems. Furthermore, the region's burgeoning construction industry, driven by robust economic growth and government investments, fuels market expansion.

In North America, the market is characterized by stringent safety regulations and advanced construction techniques, fostering the demand for innovative scaffolding solutions. The region's market is projected to witness steady growth, driven by ongoing infrastructural development projects and renovations.

Europe, boasting a mature construction industry, maintains a significant share in the global scaffolding market. With a focus on sustainable construction practices and increasing urbanization, European countries continue to invest in construction activities, driving the adoption of scaffolding solutions.

In the Middle East & Africa, the construction scaffolding market is witnessing notable growth, fueled by large-scale infrastructure projects and urban development initiatives. Countries like the UAE, Saudi Arabia, and South Africa are leading contributors to the region's scaffolding market growth.

Latin America, while displaying comparatively slower growth, presents opportunities fueled by infrastructure development and residential construction projects. Brazil, Mexico, and Argentina are key markets within the region, witnessing increased demand for scaffolding solutions to support construction activities.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global Construction Scaffolding Market continues to witness significant growth, driven by robust construction activities across various sectors worldwide. Among the key players, Wilhelm Layher Holding GmbH & Co. KG stands out as a frontrunner. Renowned for its innovative solutions and commitment to safety, Layher has established itself as a trusted name in the scaffolding industry. With a focus on quality and reliability, Layher's products are widely favored by construction companies seeking efficient and durable scaffolding solutions.

Safway Group Holding LLC also remains a dominant force in the market. Leveraging its extensive experience and comprehensive portfolio, Safeway continues to cater to the diverse needs of construction projects globally. The company's emphasis on technological advancements and adherence to strict safety standards further bolster its reputation as a preferred scaffolding provider.

PERI GmbH emerges as another key player, renowned for its cutting-edge formwork and scaffolding solutions. With a strong global presence and a reputation for excellence, PERI continues to play a pivotal role in shaping the construction scaffolding market landscape.

Altrad Group, ULMA Construction, and MJ-Gerüst GmbH are also noteworthy players, contributing significantly to market growth through their innovative products and strategic initiatives.

As the market evolves, companies such as Waco Kwikform Limited, Stepup Scaffold, LLC, ADTO Industrial Group Co., Ltd., Changli XMWY Formwork Scaffolding Co Ltd., and Beijing Kangde are expected to intensify competition by offering competitive pricing, expanding product portfolios, and focusing on enhancing customer experience.

Market Key Players

- Wilhelm Layher Holding GmbH & Co. KG

- Safway Group Holding LLC

- PERI GmbH

- Altrad Group

- ULMA Construction

- MJ-Gerüst GmbH

- Waco Kwikform Limited

- Stepup Scaffold, LLC

- ADTO Industrial Group Co., Ltd.

- Changli XMWY Formwork Scaffolding Co Ltd.

- Beijing Kangde

Recent Development

- In March 2023, Competition and Markets Authority, Ten UK-based construction firms fined over £59 million for bid rigging, affecting 19 contracts worth over £150 million, with three directors disqualified following an investigation into illegal cartel agreements.

- By February 2023, Doka has transformed into a comprehensive destination for formwork and scaffolding solutions, catering to the worldwide construction industry. This acquisition significantly bolsters the company's expansion into a unified global business sector.

- In January 2023, East Coast Rigging & Scaffolding of Florida successfully wrapped up construction on a state-of-the-art Jaguar Land Rover facility in Coral Gables. They utilized Layher, USA scaffolding for this intricate project. The scope of work involved erecting a complete scaffolding enclosure around the 7-story showroom. This intricate setup comprised 16 tiers of scaffolding, facilitating access for various trades to work on the building's facade.

Report Scope:

Report Features Description Market Value (2023) USD 24.8 billion Forecast Revenue (2032) USD 47.6 billion CAGR (2023-2032) 6.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Steel, Aluminum, Wood), By Type (Supported Scaffolding, Suspended Scaffolding, Rolling Scaffolding), By Application (Construction, Cultural Use, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Wilhelm Layher Holding GmbH & Co. KG, Safway Group Holding LLC, PERI GmbH, Altrad Group, ULMA Construction, MJ-Gerüst GmbH, Waco Kwikform Limited, Stepup Scaffold, LLC, ADTO Industrial Group Co., Ltd., Changli XMWY Formwork Scaffolding Co., Ltd., Beijing Kangde Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Wilhelm Layher Holding GmbH & Co. KG

- Safway Group Holding LLC

- PERI GmbH

- Altrad Group

- ULMA Construction

- MJ-Gerüst GmbH

- Waco Kwikform Limited

- Stepup Scaffold, LLC

- ADTO Industrial Group Co., Ltd.

- Changli XMWY Formwork Scaffolding Co., Ltd.

- Beijing Kangde