Global Commodity Services Market By Commodity Type(Energy, Metals, Agricultural, Others), By End user(Business, Individuals), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

20845

-

April 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

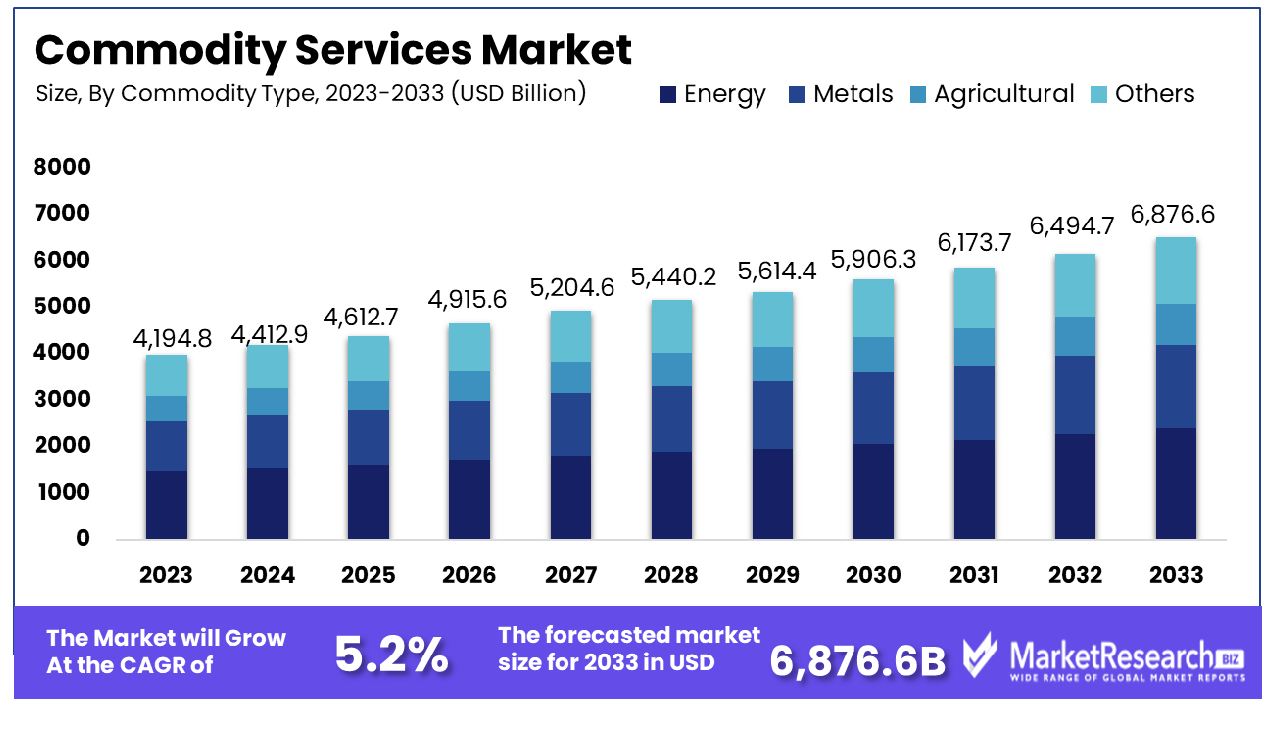

The Global Commodity Services Market was valued at USD 4,194.8 billion in 2023. It is expected to reach USD 6,876.6 billion by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

The surge in demand in metal industry and other large enterprises and SMEs are some of the main driving factors for the commodity service market expansion. The commodity service market is multifaceted and constantly progressing. It is a marketplace for the import, export, and trading of raw materials. These are of two types hard commodities and soft commodities. Hard commodities comprise the natural resources that are extracted through mining like gold, rubber, and oil but soft commodities are the agricultural by-products like wheat, coffee, sugar, and many others.

The commodity service market permits manufacturers and customers of commodity products to get easy access to a centralized and liquid market. Such a market is used for commodities end products to evade future production. Investors and entrepreneurs play a vital role in such types of marketplaces.

There are some commodities like precious metals that have been a good hedge against inflation and a wide set of commodities as substitute assets class that can support multiple portfolios. The price of commodities inclines to move in antagonism to stocks and some of the investors also depend on commodities at the time of market volatility. Precious metal commodities are rare as they act as both investments as well as industrial components.

Many manufacturers are using metal commodities for various types of products such as electronic parts, jewelry, and dental products. Investors gather coins and bars which are made up of such metals.The use of metal in valuable metal trading enables investors to visualize these commodities as having better value than money. Among metal trading gold is the most important metal. Gold signifies its resilience and malleability. Gold is used in producing electronic parts at times, as it is the main requirement in the production of jewelry. Many customers see metal commodities made up of gold as a form of funding.

As per the US customs and borders protection, base metals comprise of commodities such as aluminum, steel, tin, iron lead, and others. These base metal commodities include an overall list of industrial and commercial applications. The demand for the commodity services will increase due to their high requirement in the metal industry for everyday use which will help in market expansion in the forecast period.

Key Takeaways

- Market Growth: The Global Commodity Services Market was valued at USD 4,194.8 billion in 2023. It is expected to reach USD 6,876.6 billion by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

- By Commodity Type: Energy commands 45% dominance within the commodity type segment.

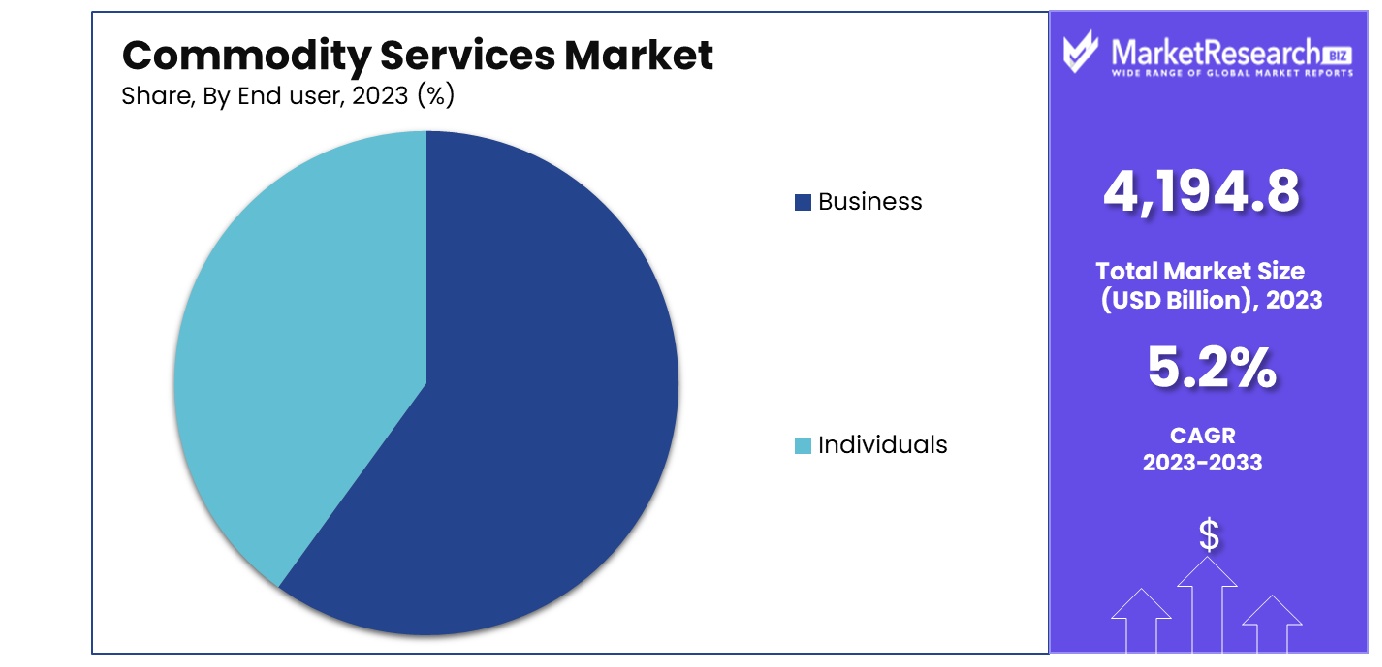

- By End-user: Businesses hold a dominant 70% share within the end-user category.

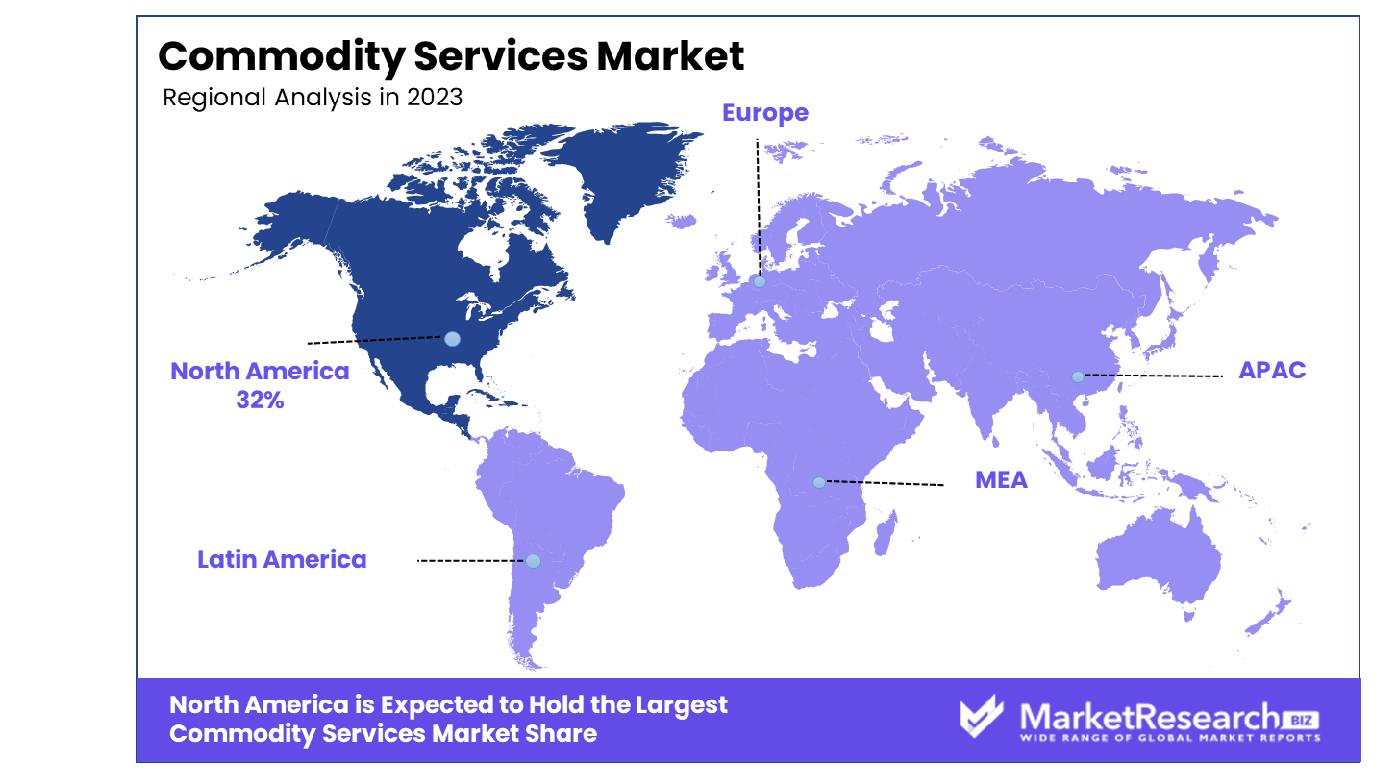

- Regional Dominance: In North America, the Commodity Services Market captures a significant 32% share.

- Growth Opportunity: In 2023, the global commodity services market sees opportunities to embrace circular economy initiatives for sustainability and integrate augmented reality applications in logistics for enhanced efficiency and competitiveness.

Driving factors

Proportion of Income Spent on Commodities: Impact on Price Elasticity and Demand

The proportion of income allocated to commodities plays a pivotal role in shaping the price elasticity of demand within the Commodity Services Market. As consumers allocate a higher proportion of their income to commodities, the demand becomes more elastic, resulting in a greater sensitivity to price changes. Consequently, this elasticity exerts downward pressure on prices, compelling market players to adjust pricing strategies to maintain competitiveness.

For instance, if a significant portion of consumers' income is earmarked for commodities such as food staples or energy, fluctuations in prices can have pronounced effects on overall demand within the market. Therefore, understanding the proportion of income devoted to commodities is crucial for market participants to gauge demand dynamics and adapt pricing strategies accordingly.

Employment and Wages: Driving Force Behind Consumer Demand

Employment levels and wage rates directly influence consumer purchasing power and, consequently, demand within the Commodity Services Market. Higher levels of employment and wages typically correlate with increased consumer spending on goods, including commodities. This heightened demand often translates to upward pressure on prices within the market.

Conversely, stagnant or declining employment rates and wages may constrain consumer purchasing power, leading to subdued demand and potentially lower prices for commodities. Therefore, fluctuations in employment and wage trends serve as vital indicators for market stakeholders, guiding strategic decisions regarding pricing, production, and market positioning.

Prices and Inflation: Navigating Consumer Spending Behavior

The interplay between prices and inflation profoundly impacts consumer behavior and spending patterns within the Commodity Services Market. Elevated inflation rates and escalating prices can erode consumers' purchasing power, prompting them to adjust their spending habits and prioritize essential commodities. Consequently, higher inflation rates and prices often correlate with reduced consumer demand and downward pressure on prices within the market.

Conversely, stable or declining inflation rates may bolster consumer confidence and stimulate spending on commodities, fostering market growth. Market participants must monitor price and inflation dynamics meticulously to anticipate shifts in consumer behavior and adjust business strategies accordingly, ensuring resilience and competitiveness within the Commodity Services Market.

Restraining Factors

Financialization of Commodity Markets: Impact on Market Dynamics

The increasing financialization of commodity markets presents a significant restraining factor for the growth of the Commodity Services Market. As financial instruments such as futures contracts and exchange-traded funds (ETFs) gain prominence in commodity trading, market dynamics become more complex and volatile. Financialization can introduce speculative behavior and short-term trading strategies that may not align with the fundamental supply and demand dynamics of commodities.

Consequently, this speculative activity can exacerbate price volatility, creating uncertainty for market participants and hindering long-term investment in commodity services. According to recent statistics, the proportion of financial investors in commodity markets has surged, contributing to heightened price fluctuations and market instability. Therefore, mitigating the adverse effects of financialization is essential for fostering sustainable growth within the Commodity Services Market.

Influence of Financial Investors: Shaping Market Sentiment and Pricing

The influence of financial investors represents another restraining factor impacting the growth trajectory of the Commodity Services Market. Financial investors, including hedge funds, pension funds, and institutional investors, exert considerable influence on market sentiment and pricing through their trading activities. Their investment decisions, driven by factors such as macroeconomic trends and risk appetite, can introduce additional volatility and speculation into commodity markets.

Recent data indicates a notable increase in the participation of financial investors in commodity trading, amplifying market fluctuations and posing challenges to market stability. Furthermore, the interconnectedness between financial markets and commodity prices underscores the need for effective risk management strategies to mitigate the adverse impacts of financial investor behavior. Market participants must closely monitor the actions of financial investors and implement robust risk management practices to navigate the complexities of the Commodity Services Market and foster sustainable growth.

By Commodity Type Analysis

Energy accounts for 45% dominance in the market, categorized by commodity type.

In 2023, Energy held a dominant market position in the By Commodity Type segment of the Commodity Services Market, capturing more than a 45% share. This robust performance can be attributed to the increasing global demand for energy resources, coupled with advancements in renewable energy technologies. The Energy segment encompasses various commodities such as crude oil, natural gas, coal, and renewable energy sources like solar power and wind power.

Within the Energy segment, the demand for renewable energy sources witnessed significant growth, driven by concerns over environmental sustainability and government initiatives promoting clean energy adoption. As a result, investments in renewable energy projects surged, bolstering the market position of the Energy segment.

Metals emerged as another prominent category within the Commodity Services Market, driven by the growing infrastructure development and industrial activities worldwide. The demand for metals such as iron, steel, aluminum, and copper remained robust, fueled by construction projects, automotive manufacturing, and electronics production.

Agricultural commodities also maintained a strong presence in the market, supported by population growth, changing dietary preferences, and the need to enhance food security. Staple crops like wheat, corn, and soybeans, along with livestock products, contributed significantly to the Agricultural segment's market share.

The "Others" category encompasses a diverse range of commodities such as precious metals, chemicals, and rare earth elements. This segment benefited from niche market opportunities, technological advancements, and evolving consumer trends.

By End-user Analysis

The market is primarily dominated by businesses, comprising 70% of end-user

In 2023, Business held a dominant market position in the By End-user segment of the Commodity Services Market, capturing more than a 70% share. This commanding presence reflects the substantial reliance of businesses on commodity services to support their operations, ranging from manufacturing and construction to transportation and energy production.

Businesses across various industries heavily utilize commodities such as energy resources, metals, and agricultural products as inputs for production processes or as components in finished goods. The Business segment encompasses large corporations, small and medium enterprises (SMEs), and industrial facilities that require a steady supply of commodities to sustain their operations and meet customer demands.

Within the Business segment, industries such as manufacturing, construction, and transportation are major consumers of commodities, driving significant demand for raw materials, energy sources, and intermediate goods. These sectors rely on commodity services to ensure a continuous supply chain and optimize production efficiency.

Individuals represent another important segment within the Commodity Services Market, although their market share is comparatively smaller than that of businesses. Individual consumers primarily engage with commodities through retail channels, purchasing goods such as gasoline, food products, and household items. Their consumption patterns are influenced by factors like disposable income, consumer preferences, and lifestyle choices.

Key Market Segments

By Commodity Type

- Energy

- Metals

- Agricultural

- Others

By End-user

- Business

- Individuals

Growth Opportunity

Focus on Circular Economy Initiatives

In 2023, the global commodity services market presents a significant opportunity spurred by the growing emphasis on circular economy initiatives. As sustainability takes center stage across industries, businesses are increasingly adopting strategies to minimize waste and maximize resource efficiency. This shift towards circularity presents ample opportunities for commodity service providers to align their offerings with the principles of sustainability. By integrating circular economy practices into their operations, companies can not only reduce their environmental footprint but also unlock new revenue streams and enhance brand reputation.

The growth of the global commodity services market can be attributed to the rising demand for eco-friendly solutions, driven by both regulatory pressures and consumer preferences. Businesses are seeking innovative ways to repurpose waste materials, optimize resource utilization, and establish closed-loop systems. Commodity service providers can capitalize on this trend by offering solutions that enable clients to source, process, and distribute goods more sustainably. From waste management and recycling to renewable energy sourcing, there is a broad spectrum of opportunities for companies operating in the commodity services sector to contribute to the circular economy paradigm.

Augmented Reality Applications in Logistics

Another key opportunity shaping the global commodity services market in 2023 is the integration of augmented reality (AR) applications in logistics. As supply chains become increasingly complex and interconnected, there is a growing need for innovative technologies to streamline operations and enhance efficiency. AR offers a transformative solution by overlaying digital information onto the physical world, providing real-time insights, and optimizing various aspects of the logistics process.

The adoption of AR in logistics holds immense potential for commodity service providers to revolutionize warehousing, inventory management, and transportation operations. By leveraging AR-enabled devices such as smart glasses or handheld devices, logistics personnel can gain instant access to critical data, visualize inventory layouts, and navigate complex warehouse environments with ease. Moreover, AR-powered training modules can improve workforce productivity and safety by providing immersive learning experiences.

Latest Trends

Rise of Precision Agriculture for Efficient Resource Utilization

In 2023, the global commodity services market is witnessing a notable trend with the rise of precision agriculture. With the world population continuously growing and the demand for food increasing, there is a pressing need for more efficient and sustainable farming practices. Precision agriculture leverages advanced technologies such as GPS, drones, and sensors to optimize various aspects of farming, including crop planting, irrigation, fertilization, and pest control.

By precisely tailoring inputs to match specific crop requirements, farmers can minimize waste, reduce environmental impact, and improve overall productivity. This trend presents significant opportunities for commodity service providers to offer innovative solutions and support farmers in adopting precision agriculture practices. From providing data analytics and decision support tools to offering precision farming equipment and services, there is a growing demand for offerings that enable farmers to optimize resource utilization and maximize yields.

Development of Sustainable Packaging Solutions

Another prominent trend shaping the global commodity services market in 2023 is the development of sustainable packaging solutions. With increasing consumer awareness and regulatory scrutiny on environmental issues, businesses are under pressure to reduce plastic waste and adopt eco-friendly packaging alternatives. As a result, there is a growing demand for sustainable packaging materials and technologies that offer comparable performance while minimizing environmental impact.

Commodity service providers are well-positioned to capitalize on this trend by offering a diverse range of sustainable packaging solutions, including biodegradable materials, recyclable packaging, and innovative designs that optimize material usage. By partnering with packaging manufacturers and leveraging their expertise in supply chain management, commodity service providers can play a crucial role in driving the adoption of sustainable packaging practices across industries.

Regional Analysis

In North America, the Commodity Services Market is expected to grow by 32% in 2023.

North America emerges as a dominant force in this landscape, commanding a significant share of approximately 32%. This supremacy is attributed to the region's robust infrastructure, advanced technological capabilities, and established market players. The United States, in particular, stands out as a major contributor to the North American market, driven by its thriving commodity trading ecosystem and strategic alliances with key industry stakeholders. Additionally, Canada's resource-rich landscape and emphasis on sustainable practices further bolster the region's position in the global market.

Europe, another influential market region, showcases a diverse landscape characterized by stringent regulatory frameworks and evolving consumer preferences. Despite facing challenges such as Brexit-induced uncertainties and fluctuating commodity prices, Europe maintains a substantial market share supported by its emphasis on environmental sustainability and digital innovation. Countries like Germany, France, and the United Kingdom are key contributors to the region's market growth, leveraging technological advancements to enhance efficiency and transparency across commodity trading activities.

In the Asia Pacific, rapid industrialization, urbanization, and population growth fuel demand for commodities, positioning the region as a significant player in the global market. China, India, and Japan emerge as key drivers of market expansion, propelled by their burgeoning manufacturing sectors and increasing investments in infrastructure development. Moreover, the Asia Pacific region benefits from a growing emphasis on renewable energy sources and agricultural modernization initiatives, further amplifying its market influence.

The Middle East & Africa and Latin America regions present untapped potential in the Commodity Services Market, characterized by abundant natural resources and evolving regulatory landscapes. While these regions face challenges related to political instability and infrastructure deficiencies, strategic investments in infrastructure development and technological innovation offer promising opportunities for market growth.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Commodity Services Market witnessed notable activity from key players, shaping the industry landscape with their strategic maneuvers and market dominance. Among these key companies, The Vitol Group emerges as a prominent force, leveraging its extensive network and comprehensive portfolio to exert significant influence. With its robust infrastructure and expertise in trading various commodities, The Vitol Group remains a cornerstone in the global market, facilitating seamless transactions and supply chain management across multiple sectors.

Additionally, Glencore plc stands out as another major player, renowned for its diversified operations spanning mining, agriculture, and energy. Its strategic acquisitions and investments reinforce its position as a key player in the Commodity Services Market, contributing to market stability and driving innovation within the industry.

Trafigura Group Pte. Ltd. also commands attention with its innovative approach to commodity trading and logistics solutions. Leveraging advanced technology and strategic partnerships, Trafigura continues to expand its market reach while maintaining a strong focus on sustainability and risk management.

Furthermore, companies such as Mercuria Energy Group Ltd and Cargill Incorporated. exhibit resilience and adaptability in navigating market challenges, positioning themselves as indispensable entities in the global commodity trade ecosystem.

Market Key Players

- The Vitol Group

- Glencore plc

- Trafigura Group Pte. Ltd.

- Mercuria Energy Group Ltd

- Cargill Incorporated.

- National Commodity & Derivatives Exchange Limited

- The Archer Daniels Midland Company

- Gunvor Group Ltd

- Bunge Limited

- Louis Dreyfus Company

Recent Development

- In April 2024, Sol Systems partners with SOLARCYCLE to advance solar panel recycling, aiming for a zero-waste, circular economy. Their innovative process recovers up to 95% of reusable materials, impacting solar sustainability.

- In September 2022, Organizations prioritize speed and resilience over cost in cloud adoption for future-proofing. Cloud computing enables real-time risk monitoring, agile supply chains, and event-driven architectures, as seen in EY's cloud strategy for supply chain optimization.

Report Scope

Report Features Description Market Value (2023) USD 4,194.8 Billion Forecast Revenue (2033) USD 6,876.6 Billion CAGR (2024-2032) 5.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Commodity Type(Energy, Metals, Agricultural, Others), By End user(Business, Individuals) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape The Vitol Group, Glencore plc, Trafigura Group Pte. Ltd., Mercuria Energy Group Ltd, Cargill Incorporated., National Commodity & Derivatives Exchange Limited, The Archer Daniels Midland Company, Gunvor Group Ltd, Bunge Limited, Louis Dreyfus Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- The Vitol Group

- Glencore plc

- Trafigura Group Pte. Ltd.

- Mercuria Energy Group Ltd

- Cargill Incorporated.

- National Commodity & Derivatives Exchange Limited

- The Archer Daniels Midland Company

- Gunvor Group Ltd

- Bunge Limited

- Louis Dreyfus Company