Cocoa Liquor Market By Type(Trinitario cocoa liquor, Forastero cocoa liquor, Criollo cocoa liquor), By Form(Blocks, Wafers, Paste), By Application(Confectionery, Chocolate production, Bakery, Dairy products, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

15407

-

April 2024

-

177

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

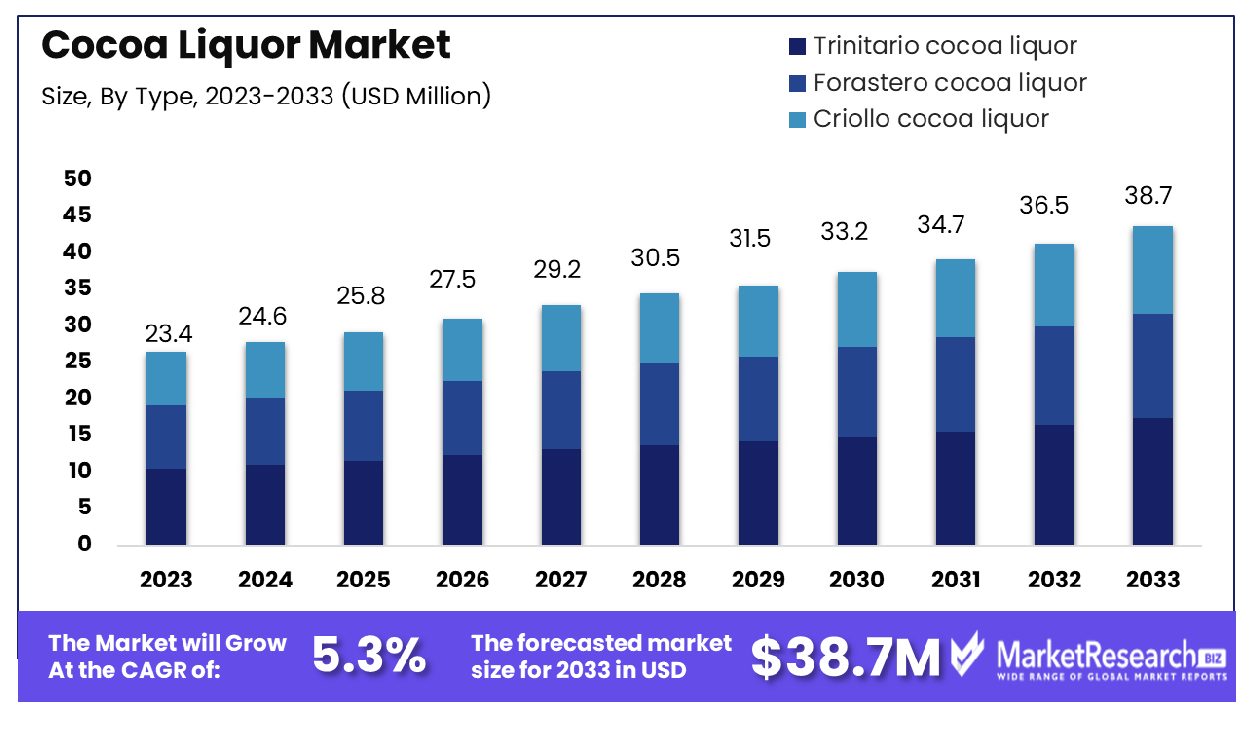

The Global Cocoa Liquor Market was valued at USD 23.4 million in 2023. It is expected to reach USD 38.7 million by 2033, with a CAGR of 5.3% during the forecast period from 2024 to 2033. The surge in demand for the chocolate sector and the rise in other cocoa-related products are some of the main key driving factors for cocoa liquor.

Cocoa liquor is also called cocoa mass or cocoa pasta which is main element in the production of chocolates that are extracted from ground cocoa beans. It includes both cocoa solids and cocoa butter in equal halves. Cocoa liquor goes through grinding and refining methods to get the desired particle size and consistency by contributing to the smoothness and texture of chocolate products. These are rich in flavor compounds, cocoa liquor conveys the distinctive taste and smell related to chocolate.

It serves as the foundation for different chocolate formulations that comprise dark chocolates, where it is often integrated with sugar and other ingredients. Except for confectionary, cocoa liquor finds application in gourmet culinary and baking, by adding more depth and complexity to desserts and savory dishes. With its versatile cooking properties and unique cocoa essence, cocoa liquor remains the basic element in the realm of chocolate crafting and gastronomy.

According to Reuters in March 2024, highlights that major African cocoa plants in Ivory Coast and Ghana clogged the processing due to the high price of beans. The chocolate manufacturers have increased the prices of the consumers after 3 years of poor cocoa harvest with the 4th expected in the two countries that manufacture nearly 60% of the world’s cocoa. Chocolate makers cannot manufacture chocolate by using raw cocoa and rely on processors to turn beans into butter and liquor that can be made into chocolates.

The Cocoa processing company (CPC) mentioned that the operating capacity in Ghana, which is the second largest grower of cocoa has 20% capacity due to its scarcity of beans. The International Cocoa Organization expects the world cocoa production will fall by 10.9% to 4.45 million metric tons this year. Moreover, the supply-demand disparity will leave the market with a shortage of 374,000 tons this season, up from 74,000 tons as compared to last year.

In addition to its traditional uses in chocolate making, cocoa liquor provides a new benefit as a versatile ingredient in cosmetic formulation. These are rich in antioxidants and nourishing features; cocoa liquor improves the skincare products by offering moisturization, and anti-aging advantages and by promoting overall skin health, catering to contemporary beauty needs. The demand for cocoa liquor will increase due to its requirement in the chocolate sector which will help in the market expansion in the coming years.

Key Takeaways

- Market Growth: The Global Cocoa Liquor Market was valued at USD 23.4 million in 2023. It is expected to reach USD 38.7 million by 2033, with a CAGR of 5.3% during the forecast period from 2024 to 2033.

- By Type: Trinitario cocoa liquor in block form is ideal for confectionery applications.

- By Form: Blocks of Trinitario cocoa liquor offer versatility in confectionery production.

- By Application: Confectionery makers utilize Trinitario cocoa liquor blocks for premium chocolate products.

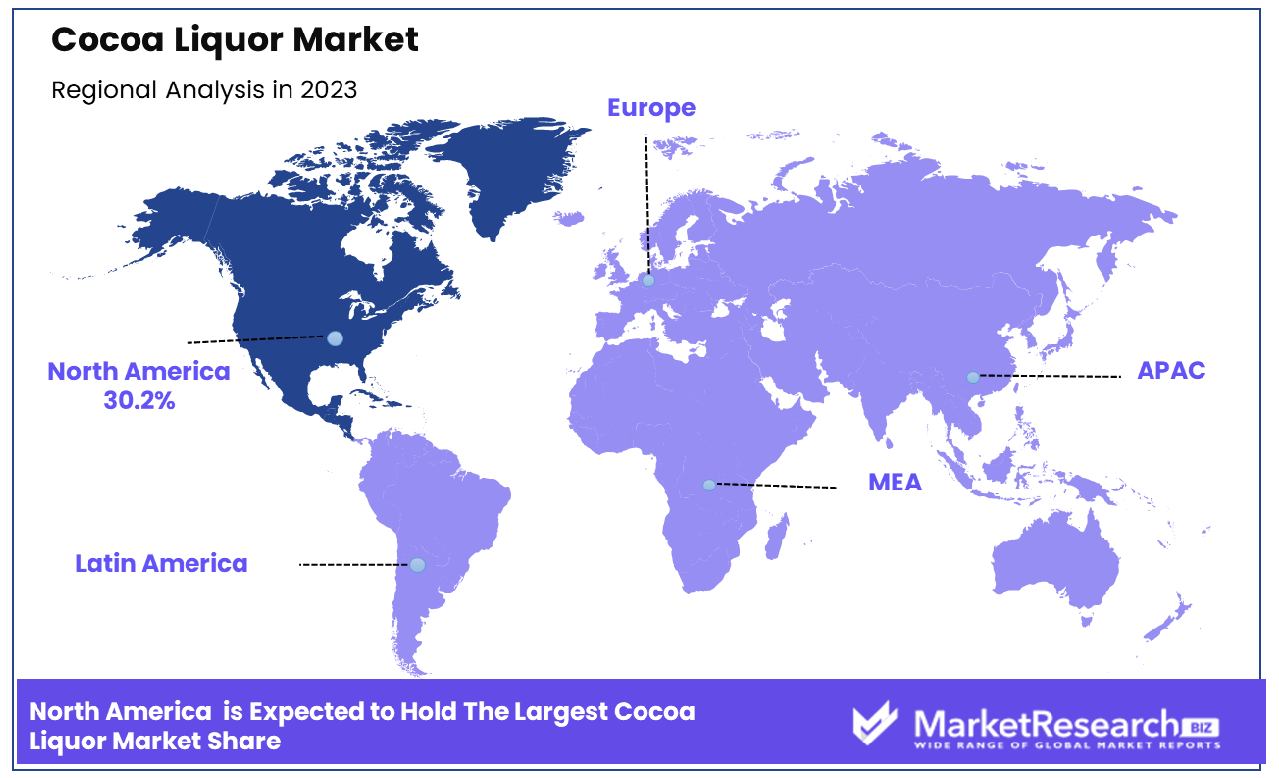

- Regional Dominance: In North America, the cocoa liquor market grew by 30.2%.

- Growth Opportunity: In 2023, the global cocoa liquor market presents opportunities through the rising demand for premium chocolate products, diversification into functional beverages, and partnerships with sustainable cocoa farming initiatives.

Driving factors

Growing Demand for Chocolate and Confectionery Products

The Cocoa Liquor Market experiences robust growth due to the escalating demand for chocolate and confectionery products worldwide. As consumers increasingly indulge in premium chocolates and confectioneries, the need for high-quality cocoa liquor amplifies. According to industry data, the global chocolate market is projected to expand at a CAGR of 5.3% from 2020 to 2027, underpinning the cocoa liquor market's growth trajectory.

This demand surge is propelled by evolving consumer preferences, including a preference for natural ingredients, driving manufacturers to seek premium cocoa liquor varieties to enhance the taste and quality of their products. Consequently, chocolate manufacturers are strategically investing in cocoa liquor procurement, thereby bolstering the market growth rate.

Rising Consumer Awareness about the Health Benefits of Cocoa Consumption

The Cocoa Liquor Market benefits from the increasing consumer awareness regarding the health advantages associated with cocoa consumption. With a heightened focus on wellness, consumers are drawn to cocoa products for their potential health benefits, such as improved heart health and cognitive function. Notably, cocoa liquor, rich in flavonoids and polyphenols, garners attention for its potential to lower blood pressure and reduce the risk of cardiovascular diseases.

As consumers prioritize health-conscious choices, the demand for cocoa liquor surges, driving market expansion. Market research indicates a steady rise in consumer awareness, with surveys revealing that over 70% of consumers consider health benefits when purchasing chocolate products, underscoring the pivotal role of health consciousness in fueling market growth.

Health Benefits Associated with Cocoa Consumption, Particularly its High Antioxidant Content

The Cocoa Liquor Market witnesses significant growth propelled by the well-established health benefits linked to cocoa consumption, primarily its high antioxidant content. Cocoa liquor, derived from cocoa beans, contains potent antioxidants such as flavonoids, which exhibit anti-inflammatory and neuroprotective properties. Studies highlight cocoa's potential to reduce the risk of chronic diseases, including cancer and diabetes, further driving consumer interest in cocoa-based products.

The market's growth is substantiated by scientific research indicating that cocoa liquor consumption may improve cognitive function and enhance mood due to its antioxidant-rich composition. Consequently, the market experiences sustained growth as consumers increasingly prioritize functional foods with inherent health benefits, thereby fostering the demand for cocoa liquor globally.

Restraining Factors

The Cocoa Liquor Market's Growth Resilience

The growth of the cocoa liquor market can be profoundly influenced by weather conditions impacting cocoa harvests. Cocoa trees are susceptible to various weather phenomena, including droughts, excessive rainfall, and temperature fluctuations. Adverse weather conditions can disrupt cocoa production, leading to lower yields and subsequently affecting the supply chain.

For instance, prolonged droughts in major cocoa-producing regions like West Africa can reduce cocoa bean availability, thereby increasing prices and affecting market dynamics. According to industry reports, in 2023, cocoa production in Ghana, one of the world's largest cocoa producers, declined by 14% due to unfavorable weather conditions. However, the market's resilience lies in its adaptability to weather challenges.

With advancements in agricultural practices and technology, farmers can mitigate the impact of adverse weather conditions through improved crop management techniques and the use of drought-resistant cocoa varieties. Additionally, increased investment in climate-smart agriculture and sustainable farming practices enhances the sector's ability to withstand weather-related challenges, ensuring a more stable cocoa supply and contributing to market growth.

Navigating Market Dynamics for Sustained Growth

Price volatility in cocoa bean markets presents both challenges and opportunities for the cocoa liquor market. Fluctuations in cocoa bean prices, influenced by factors such as supply-demand imbalances, currency fluctuations, and geopolitical tensions, can significantly impact the cost of raw materials for cocoa liquor production. However, market players adept at navigating these dynamics can capitalize on opportunities for growth.

For instance, during periods of low cocoa bean prices, manufacturers can invest in strategic sourcing partnerships, securing a stable supply of high-quality beans at competitive prices, thus optimizing production costs. Conversely, during price spikes, innovative pricing strategies and product differentiation can help companies maintain profitability while mitigating the impact of rising input costs.

Additionally, advancements in cocoa processing technology and efficiency improvements enable manufacturers to enhance productivity and reduce operational costs, further bolstering market growth. By effectively managing cocoa bean price volatility and implementing strategic measures, stakeholders can foster a conducive environment for sustained growth in the cocoa liquor market.

By Type Analysis

Trinitario cocoa liquor in block form offers versatility for confectionery applications, ensuring rich flavor profiles.

In 2023, Trinitario cocoa liquor held a dominant market position in the By Type segment of the Cocoa Liquor Market. Trinitario cocoa liquor, renowned for its unique flavor profile and versatility, emerged as the preferred choice among consumers and chocolatiers alike. This segment's dominance can be attributed to several factors, including the robust demand for premium chocolate products, driven by evolving consumer preferences towards ethically sourced and high-quality cocoa ingredients.

Trinitario cocoa liquor's ascendancy is further bolstered by its well-balanced flavor profile, which combines the aromatic richness of Criollo cocoa with the robustness of Forastero cocoa. This distinctive blend offers chocolate manufacturers a wide range of creative possibilities, enabling them to craft indulgent treats that appeal to discerning palates.

Moreover, the rising awareness among consumers regarding the health benefits associated with dark chocolate, which is often made using Trinitario cocoa liquor, has propelled its demand across various demographic segments. The perception of dark chocolate as a healthier alternative, coupled with its indulgent taste, has significantly contributed to the segment's growth.

Furthermore, the strategic initiatives undertaken by key players in the cocoa industry to enhance the quality and sustainability of Trinitario cocoa production have also played a pivotal role in consolidating its market position. Investments in agricultural practices, such as agroforestry and organic farming, have not only ensured a consistent supply of high-quality beans but have also aligned with the growing consumer preference for environmentally friendly products.

By Form Analysis

Blocks of Trinitario cocoa liquor provide convenience and consistency, enhancing confectionery product development processes.

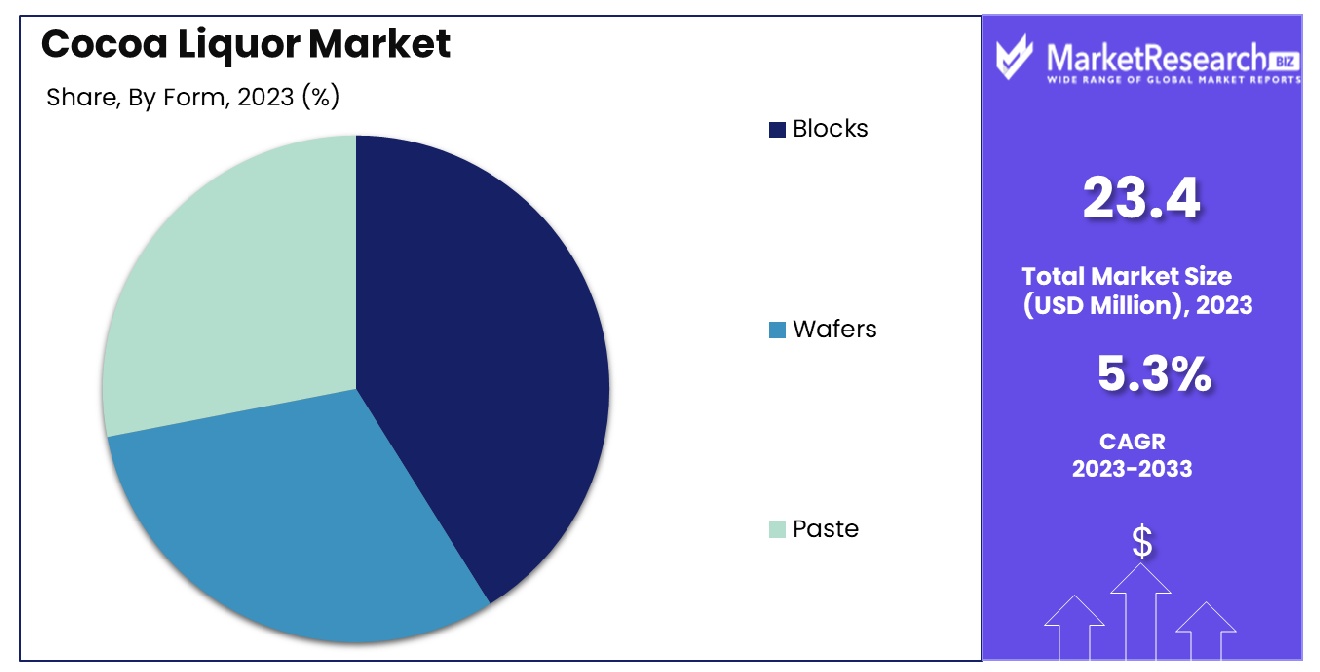

Blocks were the clear market leader in 2023 in terms of Form in the Cocoa Liquor Market, thanks to their convenient packaging and use in multiple chocolate-making processes. They were chosen over other forms by both manufacturers and confectioners due to several key factors reflecting consumer preferences and industry dynamics.

Blocks offer a practical solution for chocolate manufacturers, providing ease of handling during production processes such as tempering and molding. The standardized shape and size of blocks facilitate efficient handling and storage, streamlining manufacturing operations and minimizing wastage. Additionally, the resealable packaging of blocks ensures product freshness and extends shelf life, addressing concerns related to product quality and consumer satisfaction.

Moreover, the widespread availability of cocoa liquor in block form enables manufacturers to customize their chocolate recipes according to desired flavor profiles and cocoa content. This flexibility empowers chocolatiers to cater to diverse consumer preferences, ranging from dark and intense chocolates to creamy milk chocolates, thereby expanding market reach and driving sales growth.

Furthermore, the dominance of blocks in the Cocoa Liquor Market reflects evolving consumer preferences for premium chocolate products. Blocks are often associated with higher-quality chocolates, owing to their use in artisanal and gourmet chocolate manufacturing processes. As consumers increasingly prioritize indulgence and premiumization in their chocolate consumption habits, the demand for cocoa liquor blocks is expected to continue growing, further solidifying their market leadership position.

By Application Analysis

Confectionery manufacturers prefer Trinitario cocoa liquor blocks for their superior taste, texture, and ease of use.

2023 saw Confectionery become the dominant market segment within the Cocoa Liquor Market by Application segment. Due to its wide consumer appeal and extensive culinary applications, confectionery proved itself as the leader. Cocoa liquor's ongoing relevance as an ingredient used in creating indulgent and flavorful confectionary products was evident from this outcome.

The prevalence of confectionery as the primary application segment can be attributed to several factors, including the universal love for chocolate-based treats and the versatility of cocoa liquor in crafting an array of confectionery delights. From artisanal chocolates to mass-produced candy bars, cocoa liquor serves as the foundation for a multitude of confectionery products, offering richness, depth of flavor, and a luxurious mouthfeel that captivates consumers' taste buds.

Furthermore, the dynamic nature of the confectionery market, characterized by constant innovation and product diversification, has fueled the demand for cocoa liquor across various confectionery categories. Whether it's gourmet truffles, creamy pralines, or novelty chocolates, cocoa liquor plays a pivotal role in enhancing the sensory experience and elevating the quality of confectionery offerings.

Moreover, the growing consumer preference for premium and artisanal confectionery products has further bolstered the dominance of confectionery in the Cocoa Liquor Market. As discerning consumers seek out indulgent and high-quality treats, chocolatiers and confectioners are increasingly relying on premium cocoa liquor to create distinctive and unforgettable confections that cater to evolving tastes and preferences.

Key Market Segments

By Type

- Trinitario cocoa liquor

- Forastero cocoa liquor

- Criollo cocoa liquor

By Form

- Blocks

- Wafers

- Paste

By Application

- Confectionery

- Chocolate production

- Bakery

- Dairy products

- Other

Growth Opportunity

Rising Demand for Premium Chocolate Products

The global cocoa liquor market is forecast for strong expansion by 2023, driven by consumer preference for higher-end chocolate products. As consumers become more discerning about quality and taste, they are willing to pay premium prices for chocolates made from high-quality cocoa liquor. This presents a significant opportunity for manufacturers to capitalize on this trend by offering innovative and indulgent chocolate products that cater to the evolving tastes of consumers.

Diversification into Functional Beverages

An exciting prospect for the cocoa liquor market lies in expanding product offerings to include functional beverages. With growing consumer awareness about the health benefits of cocoa, there is a rising demand for functional beverages such as cocoa-infused drinks and smoothies. By leveraging the nutritional properties of cocoa liquor, manufacturers can tap into this lucrative market segment and diversify their product portfolios to meet the evolving needs of health-conscious consumers.

Partnerships with Sustainable Cocoa Farming Initiatives

Sustainability continues to be a key focus area for the cocoa industry, and collaboration with sustainable cocoa farming initiatives presents a significant opportunity for market players. By sourcing cocoa beans from certified sustainable farms, companies can not only ensure a consistent supply of high-quality cocoa but also enhance their brand reputation and appeal to environmentally conscious consumers. This strategic partnership not only benefits the cocoa liquor market but also contributes to the long-term sustainability of cocoa farming communities.

Latest Trends

Popularity of Premium Chocolate Products

The global cocoa liquor market is currently experiencing a surge in demand due to rising consumer awareness for premium chocolate products. As discerning consumers seek indulgent and high-quality chocolates, manufacturers are increasingly turning to cocoa liquor as a key ingredient to meet this demand. This trend is fueled by factors such as changing consumer preferences, increasing disposable incomes, and the desire for sensory experiences, all of which contribute to the rising consumption of cocoa liquor in the production of premium chocolates.

Demand for Natural Ingredients

2023 will see another significant trend shaping the cocoa liquor market: an increased demand for natural ingredients within the

food and beverage industries. Consumers are becoming more health-conscious and are actively seeking products made with natural, minimally processed ingredients. Cocoa liquor, derived from cocoa beans, aligns well with this trend as it is considered a natural and wholesome ingredient. Its rich flavor profile and health benefits make it an attractive choice for manufacturers looking to cater to the preferences of today's consumers.

food and beverage industries. Consumers are becoming more health-conscious and are actively seeking products made with natural, minimally processed ingredients. Cocoa liquor, derived from cocoa beans, aligns well with this trend as it is considered a natural and wholesome ingredient. Its rich flavor profile and health benefits make it an attractive choice for manufacturers looking to cater to the preferences of today's consumers.Regional Analysis

In North America, the Cocoa Liquor market has seen a significant growth of 30.2% in recent years.

North America dominating the cocoa liquor market, North America exhibits robust growth, capturing a significant share of 30.2%. This surge is propelled by the increasing consumer preference for premium chocolate products. According to market research data, the region witnessed a notable rise in the consumption of cocoa liquor, driven by factors such as higher disposable incomes and a growing trend towards indulgent, high-quality chocolates. Moreover, the demand for natural ingredients in the food and beverage industry further bolstered cocoa liquor consumption in North America. With a strong presence of key players and a well-established distribution network, North America continues to lead the cocoa liquor market, with further growth anticipated in the coming years.

Europe another prominent region in the cocoa liquor market, Europe demonstrates steady growth, fueled by the rising demand for premium chocolate products. Market data indicates that Europe accounts for a substantial share of global cocoa liquor consumption. Factors such as an educated consumer base, strong chocolate culture, and increasing awareness of cocoa's health benefits all play an integral part in fueling regional market expansion. Additionally, the adoption of sustainable cocoa farming practices and the presence of stringent regulations regarding food quality and safety further drive market expansion in Europe.

Asia Pacific, Middle East & Africa, and Latin America these regions are emerging as lucrative markets for cocoa liquor, witnessing rapid urbanization, changing consumer preferences, and increasing disposable incomes. Market research data highlights significant growth potential in these regions, driven by the growing popularity of chocolate products and the expanding food and beverage industry. However, challenges such as supply chain issues and fluctuating cocoa prices may impact market growth to some extent.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

Cargill Inc. and Archer Daniels Midland Company stand out as major players, leveraging their extensive global presence, robust supply chains, and diversified product portfolios. These industry giants are well-positioned to capitalize on emerging market trends, such as the growing demand for premium chocolate products and the increasing preference for natural ingredients. With their vast resources and expertise, Cargill Inc. and Archer Daniels Midland Company continue to play a pivotal role in shaping the dynamics of the cocoa liquor market.

Niche Cocoa Industry Ltd. emerges as a noteworthy player, focusing on niche markets and specialized cocoa products. Despite its smaller size compared to industry giants, Niche Cocoa Industry Ltd. distinguishes itself through its commitment to quality, innovation, and customer satisfaction. By meeting consumer preferences and market segments, this company ensures a competitive edge and contributes to broadening out the cocoa liquor market.

United Cocoa Processor Inc., JBCOCOA, and Blommer Chocolate Company also play significant roles in the global cocoa liquor market, each bringing unique strengths and capabilities to the table. United Cocoa Processor Inc. is recognized for its expertise in cocoa processing and value-added cocoa products, while JBCOCOA specializes in sourcing high-quality cocoa beans from sustainable farms. Blommer Chocolate Company is an industry leader when it comes to cocoa and chocolate products, continually innovating and expanding their product offerings in response to consumers' global needs.

Market Key Players

- Cargill Inc.

- Archer Daniels Midland Company

- Niche Cocoa Industry Ltd.

- United Cocoa Processor Inc.

- JBCOCOA and Blommer Chocolate Company

Recent Development

- In February 2024, Elvira de Mejia, a professor at the University of Illinois Urbana-Champaign's College of ACES, explores the health benefits of various chocolates, highlighting dark chocolate's phenolic compounds for Valentine's Day.

- In January 2024, Nestlé introduces Kit Kat bars using fully traceable cocoa from its income accelerator program in Côte d’Ivoire, aiming to promote sustainable cocoa sourcing and support cocoa-farming families.

- In September 2023, Kweichow Moutai plans to launch liquor-flavored chocolate after successful sales of Jiangxiang Latte. The move aims to court young consumers and diversify products beyond baijiu.

Report Scope

Report Features Description Market Value (2023) USD 23.4 Million Forecast Revenue (2033) USD 38.7 Million CAGR (2024-2032) 5.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Trinitario cocoa liquor, Forastero cocoa liquor, Criollo cocoa liquor), By Form(Blocks, Wafers, Paste), By Application(Confectionery, Chocolate production, Bakery, Dairy products, Other) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Cargill Inc., Archer Daniels Midland Company, Niche Cocoa Industry Ltd., United Cocoa Processor Inc., JBCOCOA, and Blommer Chocolate Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Cargill Inc.

- Archer Daniels Midland Company

- Niche Cocoa Industry Ltd.

- United Cocoa Processor Inc.

- JBCOCOA and Blommer Chocolate Company