Cloud Radio Access Network Market Report By Architecture Type (Centralized-RAN, Virtualized/Cloud-RAN), By Service Type (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS)), By Network Type (3G, LTE & 5G), By End User (Telecom Operators, Enterprises, Cloud Service Providers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46270

-

May 2024

-

325

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

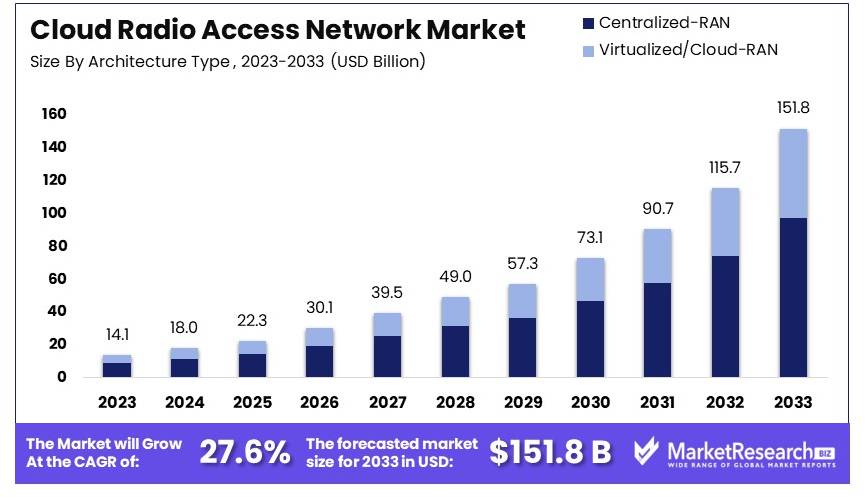

The Global Cloud Radio Access Network (C-RAN) Market size is expected to be worth around USD 151.8 billion by 2033, from USD 14.1 billion in 2023, growing at a CAGR of 27.6% during the forecast period from 2024 to 2033.

The Cloud Radio Access Network (Cloud RAN) Market involves a network architecture that enhances mobile network management and access by centralizing hardware resources. Cloud RAN enables more efficient wireless communication by using cloud computing technologies.

This market is critical for telecommunication companies aiming to reduce operational costs and increase network scalability and flexibility. Understanding this market is essential for leveraging cloud technologies to enhance network performance and support the growing demand for mobile data services, thereby improving customer satisfaction and competitive edge in the telecom sector.

The Cloud Radio Access Network (Cloud RAN) Market is strategically positioned for substantial growth, influenced by the surge in mobile connectivity and evolving telecommunications infrastructure. Currently, 92.3% of internet users access the web via mobile phones, with smartphones alone accounting for 91% of internet traffic. This substantial usage underscores the critical need for efficient network architectures like Cloud RAN, which promises enhanced flexibility and reduced operational costs in handling such vast data traffic.

The trajectory of data consumption illuminates the expanding scope of this market. From the first quarter of 2027 to the second quarter of 2023, the monthly cellular data consumed by the average smartphone globally skyrocketed from 9.68 exabytes (EB) to an astounding 133.68 EB. This exponential growth not only stresses the existing infrastructure but also showcases the potential capacity and scalability offered by Cloud RAN implementations.

Looking ahead, the emergence of 6G technology, although still in its nascent stages, projects a future where network density and efficiency reach unprecedented levels. 6G aims to support up to 10 million devices per square kilometer—a significant leap from 4G’s capacity of 100,000 devices per square kilometer. This advancement could revolutionize network capabilities, making Cloud RAN an even more critical component of future telecom strategies.

Key Takeaways

- Market Value: The Cloud Radio Access Network (C-RAN) Market is projected to grow from USD 14.1 billion in 2023 to approximately USD 151.8 billion by 2033, at a CAGR of 27.6%.

- Architecture Type Analysis: Centralized-RAN dominates with 62.1% due to reduced operational costs and improved network efficiency. This architecture centralizes baseband processing, optimizing resource allocation and enabling advanced network features like Coordinated Multipoint (CoMP).

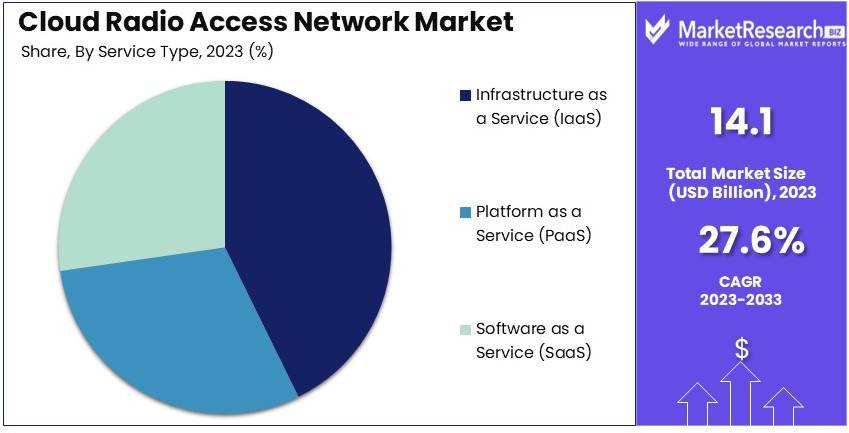

- Service Type Analysis: Infrastructure as a Service (IaaS) leads with 47% market share, offering scalable infrastructure solutions that reduce capital expenditures and support high availability and reliability.

- Network Type Analysis: LTE & 5G networks dominate with 87.6% due to their high-speed connectivity, low latency, and advanced features, crucial for next-generation applications.

- End User Analysis: Telecom Operators hold a significant share, leveraging C-RAN to enhance network performance and reduce operational costs, driving extensive network deployment capabilities.

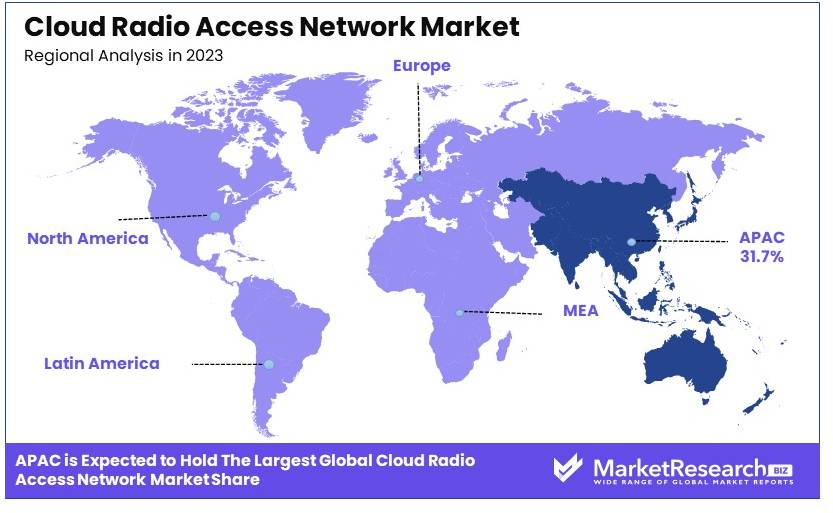

- Dominant Region: APAC dominates with 31.7% market share, driven by rapid adoption of advanced technologies and digital transformation initiatives.

- High Growth Region: North America holds 28.5%, showing significant growth potential in deploying C-RAN solutions to support advanced communication services.

- Analyst Viewpoint: The C-RAN market is poised for rapid growth, driven by increasing mobile data traffic, adoption of advanced network technologies like 5G, and expanding applications in IoT and smart cities. Competition is moderate, with opportunities in technological advancements and expanding network infrastructure.

Driving Factors

Increasing Demand for High-Speed Mobile Data Drives Market Growth

The surge in demand for high-speed mobile data is a primary catalyst for the expansion of the Cloud Radio Access Network (C-RAN) market. As the adoption of smartphones, tablets, and other connected devices escalates, so does the requirement for robust network infrastructure to manage the rising data traffic.

Mobile data traffic is projected to grow at a compound annual growth rate (CAGR) of 25% from 2022 to 2027. This exponential increase necessitates advanced network solutions like C-RAN that can handle large volumes of data efficiently, thus driving market growth.

Cost Optimization and Operational Efficiency Drive Market Growth

C-RAN architecture plays a crucial role in enhancing cost optimization and operational efficiency for mobile network operators (MNOs). By centralizing baseband processing units (BBUs) and pooling resources, C-RAN allows for a reduction in both capital expenditure (CAPEX) and operational expenditure (OPEX).

For instance, Verizon's deployment of C-RAN solutions led to a significant reduction in costs, with a 35% decrease in CAPEX and a 28% drop in OPEX. This cost-effective approach not only supports the profitability of MNOs but also contributes to the broader adoption and scalability of C-RAN technologies in the market.

Network Densification and 5G Deployment Drive Market Growth

The rollout of 5G networks is intricately linked with the adoption of C-RAN solutions, primarily due to the need for network densification. C-RAN facilitates the centralized coordination and management of multiple small cells, which is essential for the dense deployment required by 5G networks. This centralized management enables efficient spectrum utilization and enhances overall network performance.

Major mobile network operators, including AT&T, Verizon, and T-Mobile, have been actively deploying C-RAN solutions to support their expanding 5G infrastructure. The integration of C-RAN into 5G deployment strategies underscores its pivotal role in meeting the demands of next-generation mobile communications and driving market growth.

Restraining Factors

High Initial Investment and Deployment Costs Restrain Market Growth

The necessity for substantial initial investment in infrastructure like centralized baseband processing units (BBUs), fronthaul networking equipment, and cloud infrastructure makes deploying Cloud Radio Access Network (C-RAN) solutions a substantial financial challenge.

These high deployment costs can deter smaller mobile network operators (MNOs) or those in emerging markets from adopting C-RAN technologies. A major MNO in the United States reported spending several billion dollars on C-RAN deployment, highlighting the significant capital requirements that can inhibit market growth by limiting participation to only the most financially robust companies.

Fronthaul Network Complexity and Scalability Challenges Restrain Market Growth

C-RAN architectures depend on high-bandwidth, low-latency fronthaul networks, which present complexity and scalability challenges. These networks are essential for connecting remote radio heads (RRHs) to centralized BBU pools, but integrating them seamlessly with existing infrastructure, especially in densely populated urban areas or remote locations, remains challenging.

For instance, during Ericsson's deployment of C-RAN for a major European operator, issues related to fronthaul capacity emerged, demonstrating the difficulties in ensuring reliable and scalable network infrastructure. These challenges can significantly slow down the adoption and expansion of C-RAN solutions in the market.

Architecture Type Analysis

Centralized-RAN dominates with 62.1% due to reduced operational costs and improved network efficiency.

In the Cloud Radio Access Network (C-RAN) market, the architecture type plays a crucial role in defining the operational framework and efficiency of the network. Centralized-RAN, holding a dominant market share of 62.1%, is preferred due to its ability to centralize the baseband processing functions. This centralization significantly reduces operational costs by optimizing resource allocation and minimizing the need for extensive hardware deployment at individual cell sites. Additionally, the centralized approach enhances network efficiency by allowing dynamic resource management and easier implementation of advanced network features like Coordinated Multipoint (CoMP).

The centralized architecture facilitates easier upgrades and maintenance, contributing to its widespread adoption. By centralizing the processing units, network operators can efficiently manage and scale their networks to meet increasing demand without substantial infrastructure investments. This flexibility is particularly beneficial in densely populated urban areas where network traffic is high and consistent performance is crucial.

Moreover, the rise in mobile data traffic and the need for enhanced network capacity and coverage are driving the adoption of Centralized-RAN. It allows for better utilization of spectrum resources and supports advanced network functionalities, such as real-time data processing and low-latency communication, which are essential for emerging applications like IoT and smart cities.

On the other hand, Virtualized/Cloud-RAN is also gaining traction in the market. While it does not hold the majority share, its role in growth is significant. Virtualized/Cloud-RAN offers even greater flexibility by leveraging cloud computing technologies to virtualize network functions. This approach allows for a more scalable and adaptable network infrastructure, capable of quickly responding to changing demands. Although currently less dominant, Virtualized/Cloud-RAN is expected to grow as operators seek more innovative and cost-effective solutions to manage their networks.

Service Type Analysis

Infrastructure as a Service (IaaS) dominates with 47% due to scalable infrastructure solutions.

In the Cloud Radio Access Network market, the service type is a critical factor determining the delivery and management of network services. Infrastructure as a Service (IaaS) leads this segment with a 47% market share. IaaS provides scalable infrastructure solutions, allowing network operators to lease virtualized computing resources over the internet. This model significantly reduces the need for physical infrastructure investments and enables operators to scale their operations according to demand, ensuring cost efficiency and operational flexibility.

The dominance of IaaS can be attributed to its ability to offer robust, scalable, and on-demand infrastructure services. Network operators benefit from the pay-as-you-go model, which reduces capital expenditures and provides the agility to respond to fluctuating market demands. This flexibility is crucial for managing large-scale network deployments and accommodating the growing demand for mobile data services.

Additionally, IaaS supports the deployment of various applications and services, enhancing network functionality and performance. It allows operators to quickly deploy and manage network resources, ensuring high availability and reliability. The growing adoption of cloud services across different industries is further driving the demand for IaaS, as businesses seek efficient and scalable solutions to support their digital transformation initiatives.

While IaaS holds the majority share, Platform as a Service (PaaS) and Software as a Service (SaaS) also contribute to the market's growth. PaaS offers a platform for developing, testing, and deploying applications, providing network operators with tools and services to create customized network solutions. SaaS delivers software applications over the internet, enabling operators to access advanced network management tools and services without significant upfront investments. Both PaaS and SaaS play a vital role in enhancing network capabilities and supporting the deployment of innovative applications and services.

Network Type Analysis

LTE & 5G dominates with 87.6% due to high-speed connectivity and advanced features.

The network type is a pivotal element in the Cloud Radio Access Network market, determining the speed, capacity, and overall performance of the network. LTE & 5G networks dominate this segment with an overwhelming market share of 87.6%. This dominance is driven by the demand for high-speed connectivity, low latency, and the advanced features offered by these technologies.

LTE (Long Term Evolution) and 5G (fifth generation) networks provide superior data speeds and network performance, meeting the increasing demand for mobile data services. The deployment of 5G networks, in particular, is accelerating, driven by its capabilities to support ultra-reliable low-latency communications (URLLC), massive machine-type communications (mMTC), and enhanced mobile broadband (eMBB). These features are essential for supporting next-generation applications such as autonomous vehicles, smart cities, and augmented reality (AR).

The rapid adoption of 5G is transforming the telecommunications landscape, enabling new business models and revenue streams for network operators. The enhanced capabilities of 5G networks are driving investments in network infrastructure and pushing the boundaries of what is possible in mobile communications. The integration of 5G with C-RAN architecture further enhances network efficiency and performance, making it a preferred choice for network operators.

While LTE & 5G dominate the market, 3G networks also play a role in growth. Although 3G is considered a legacy technology, it still serves as a fallback network in many regions, ensuring continuous connectivity. The presence of 3G networks is crucial in areas where LTE and 5G coverage is not yet fully established. However, the focus remains on transitioning from 3G to more advanced technologies to meet the evolving demands of the market.

End User Analysis

Telecom Operators dominate with a significant share due to extensive network deployment capabilities.

The end-user segment in the Cloud Radio Access Network market is diverse, encompassing various stakeholders who benefit from the deployment and management of C-RAN solutions. Telecom operators hold a significant share in this segment, driven by their extensive network deployment capabilities and the need to provide high-quality services to their customers.

Telecom operators are at the forefront of the C-RAN market, leveraging the technology to enhance network performance, reduce operational costs, and meet the growing demand for mobile data services. The adoption of C-RAN allows operators to centralize network functions, optimize resource utilization, and improve overall network efficiency. This centralization is crucial for managing large-scale network deployments and ensuring consistent performance across different regions.

Enterprises are also key players in the C-RAN market, seeking to improve their communication infrastructure and support digital transformation initiatives. By adopting C-RAN, enterprises can enhance their network capabilities, support high-speed connectivity, and deploy advanced applications and services. The flexibility and scalability of C-RAN make it an attractive solution for businesses looking to improve their operational efficiency and customer experience.

Cloud service providers play a vital role in the growth of the C-RAN market, offering cloud-based solutions and services that support the deployment and management of network functions. Their expertise in cloud computing and network virtualization enables the delivery of scalable and cost-effective solutions, driving the adoption of C-RAN across different industries.

Other stakeholders, including government agencies, educational institutions, and healthcare providers, also contribute to the market's growth. These end users leverage C-RAN technology to enhance their communication infrastructure, support remote services, and improve overall efficiency. The diverse range of end users highlights the widespread applicability and benefits of C-RAN solutions in various sectors.

Key Market Segments

By Architecture Type

- Centralized-RAN

- Virtualized/Cloud-RAN

By Service Type

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

By Network Type

- 3G

- LTE & 5G

By End User

- Telecom Operators

- Enterprises

- Cloud Service Providers

- Others

Growth Opportunities

Private 5G Networks Offer Growth Opportunity

The demand for private 5G networks in industries like manufacturing, logistics, and healthcare presents a significant growth opportunity for Cloud Radio Access Network (C-RAN) solutions. These private networks require dense, localized coverage and can benefit from the flexibility, scalability, and cost-efficiency of C-RAN architectures.

For example, Nokia partnered with Sandvik to deploy a private 5G C-RAN network for underground mining operations, enhancing connectivity, automation, and safety. The localized, high-performance nature of these networks makes C-RAN a perfect fit, driving market expansion as more industries adopt private 5G solutions.

Open RAN Offers Growth Opportunity

The adoption of Open RAN (O-RAN) and disaggregated RAN architectures promotes open interfaces and multi-vendor interoperability, aligning well with the principles of C-RAN. C-RAN solutions can leverage O-RAN standards for flexible and cost-effective deployments, thus driving market growth.

For instance, Rakuten Mobile's partnership with Altiostar uses O-RAN principles to deploy a cloud-native, virtualized C-RAN solution. This trend towards open, interoperable networks supports rapid innovation and lowers costs, providing a substantial growth opportunity for the C-RAN market.

Trending Factors

Virtualization and Cloud-Native Solutions Are Trending Factors

The trend towards virtualization and cloud-native architectures in telecommunications aligns well with the principles of C-RAN. Cloud-native C-RAN solutions offer greater flexibility, scalability, and automation, enabling mobile network operators (MNOs) to efficiently manage and optimize their networks.

For example, Altiostar offers a cloud-native, virtualized C-RAN solution leveraging containers and microservices for agile deployments and seamless upgrades. This alignment with industry trends supports improved network efficiency and reduced operational costs, making virtualization and cloud-native solutions a trending factor in the C-RAN market.

AI and ML Integration Are Trending Factors

The integration of artificial intelligence (AI) and machine learning (ML) capabilities into C-RAN solutions is a growing trend, enabling intelligent network optimization, predictive maintenance, and automated resource allocation.

These technologies can enhance network performance, efficiency, and user experience. For instance, Parallel Wireless offers an AI-enabled C-RAN solution that uses machine learning for automated network optimization and self-healing capabilities. This trend towards intelligent automation supports more efficient network management and better service quality, highlighting AI and ML integration as a trending factor in the C-RAN market.

Regional Analysis

APAC Dominates with 31.7% Market Share

APAC's dominance in the Cloud Radio Access Network (C-RAN) market, with a 31.7% share, is driven by rapid technological advancements and significant investments in 5G infrastructure. Major economies like China, Japan, and South Korea are at the forefront of 5G deployment. The region's large population and growing demand for high-speed mobile data services also contribute to this dominance. Additionally, strong government support and favorable regulatory policies encourage investment in advanced telecommunications technologies.

The high population density in APAC countries necessitates efficient and scalable network solutions. C-RAN's ability to centralize and virtualize network functions makes it ideal for addressing these needs. Urbanization and the proliferation of smart devices further increase the demand for robust network infrastructure. Competitive market conditions and the presence of leading technology companies in the region also drive innovation and adoption of C-RAN solutions.

North America: 28.5% Market Share

North America's C-RAN market holds a 28.5% share, driven by advanced telecom infrastructure and significant investments in 5G technology. The presence of major telecom companies and early adoption of new technologies contribute to this market share. The region's focus on improving network efficiency and capacity supports the growth of C-RAN solutions.

Europe: 24.2% Market Share

Europe's C-RAN market accounts for 24.2% of the global share. The region benefits from strong regulatory support and significant investments in 5G and smart city projects. European countries emphasize sustainable and efficient network solutions, which aligns well with the principles of C-RAN. The growth rate in Europe is steady, driven by continuous technological advancements.

Middle East & Africa: 8.1% Market Share

The Middle East & Africa region has an 8.1% share in the C-RAN market. Growing investments in telecom infrastructure and increasing mobile penetration drive this market. The adoption of advanced network technologies is slower compared to other regions, but the potential for growth remains high as digital transformation initiatives gain momentum.

Latin America: 7.5% Market Share

Latin America holds a 7.5% share in the C-RAN market. The region's growth is supported by rising investments in telecom infrastructure and increasing demand for high-speed mobile data services. Challenges such as economic instability and regulatory hurdles exist, but the region shows potential for future growth as technological adoption increases.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Cloud Radio Access Network (Cloud RAN) Market, a diverse set of key players drives innovation and shapes the industry landscape. These companies, including major telecom and technology giants like Huawei Technologies, Nokia Corporation, Ericsson AB, and ZTE Corporation, are pivotal in developing and deploying Cloud RAN solutions that enhance mobile network efficiencies and capabilities.

These players hold significant strategic positions due to their extensive research and development initiatives, robust patent portfolios, and established partnerships with network operators worldwide. Companies like Samsung Electronics and Cisco Systems are known for their technological advancements and contributions to developing scalable and flexible Cloud RAN architectures. Their efforts are crucial in helping telecom operators reduce capital and operational expenditures while improving network performance.

Further enriching the market are specialized contributors such as Altiostar Networks, Mavenir Systems, and Parallel Wireless. These firms focus on specific innovations like software-defined networking (SDN) technologies that allow for more versatile and agile network management, key attributes in a Cloud RAN environment.

Intel Corporation and Fujitsu Limited bring in critical expertise in semiconductor and network technologies, which enhance the processing capabilities and overall efficiency of Cloud RAN systems. Similarly, NEC Corporation and Fujitsu are instrumental in integrating artificial intelligence and machine learning technologies, pushing the boundaries of autonomous network operations.

The influence of these companies extends through strategic collaborations, mergers, and acquisitions, aimed at consolidating their positions and expanding their global footprint. Through these strategies, the key players not only drive technological adoption but also set industry standards and regulatory frameworks, significantly impacting the global rollout and adoption of Cloud RAN solutions.

Market Key Players

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Ericsson AB

- ZTE Corporation

- Samsung Electronics Co., Ltd.

- Cisco Systems, Inc.

- NEC Corporation

- Fujitsu Limited

- Intel Corporation

- Altiostar Networks, Inc.

- Mavenir Systems

- Radisys Corporation

- Parallel Wireless, Inc.

- CommScope Holding Company, Inc.

- Juniper Networks, Inc.

Recent Developments

- On March 29, 2024, NVIDIA announced a 6G research platform called the NVIDIA 6G Research Cloud that empowers researchers with a novel approach to develop the next phase of wireless technology.

- On April 3, 2024, Ericsson deployed its Cloud Radio Access Network (Cloud RAN) technology on AT&T's commercial 5G network in the U.S. The two companies completed a Cloud RAN call as a milestone in deploying Open RAN, with AT&T now having commercial traffic flowing on Cloud RAN sites located south of Dallas, Texas.

- In 2025, AT&T plans to scale the OpenRAN deployment jointly with multiple vendors, including Corning Incorporated, Dell Technologies, Fujitsu, and Intel.

- According to a report by Capgemini, big telcos will spend on average US$1 billion each on network cloud transformation in the next few years. Early adopters are expected to reap the most benefits, recovering 47% of their investment within the initial three-to-five year period.

Report Scope

Report Features Description Market Value (2023) USD 14.1 Billion Forecast Revenue (2033) USD 151.8 Billion CAGR (2024-2033) 27.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Architecture Type (Centralized-RAN, Virtualized/Cloud-RAN), By Service Type (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS)), By Network Type (3G, LTE & 5G), By End User (Telecom Operators, Enterprises, Cloud Service Providers, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Huawei Technologies Co., Ltd., Nokia Corporation, Ericsson AB, ZTE Corporation, Samsung Electronics Co., Ltd., Cisco Systems, Inc., NEC Corporation, Fujitsu Limited, Intel Corporation, Altiostar Networks, Inc., Mavenir Systems, Radisys Corporation, Parallel Wireless, Inc., CommScope Holding Company, Inc., Juniper Networks, Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Ericsson AB

- ZTE Corporation

- Samsung Electronics Co., Ltd.

- Cisco Systems, Inc.

- NEC Corporation

- Fujitsu Limited

- Intel Corporation

- Altiostar Networks, Inc.

- Mavenir Systems

- Radisys Corporation

- Parallel Wireless, Inc.

- CommScope Holding Company, Inc.

- Juniper Networks, Inc.