Circulating Tumor Cells Market By Technology(CTC Detection & Enrichment Methods, Advanced CTC Detection Technologies), By Specimen(Blood, Bone Marrow, Other Body Fluids), By Product(Kits & Reagents, Blood Collection Tubes, Devices or Systems), By Application(Clinical/Liquid Biopsy, Research) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

42950

-

Jan 2024

-

183

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Circulating Tumor Cells Market Size, Share, Trends Analysis

- Driving Factors

- Restraining Factors

- Circulating Tumor Cells Market Segmentation Analysis

- Circulating Tumor Cells Industry Segments

- Growth Opportunities

- Circulating Tumor Cells Market Regional Analysis

- Circulating Tumor Cells Industry By Region

- Circulating Tumor Cells Market Key Player Analysis

- Circulating Tumor Cells Industry Key Players

- Circulating Tumor Cells Market Recent Development

- Report Scope

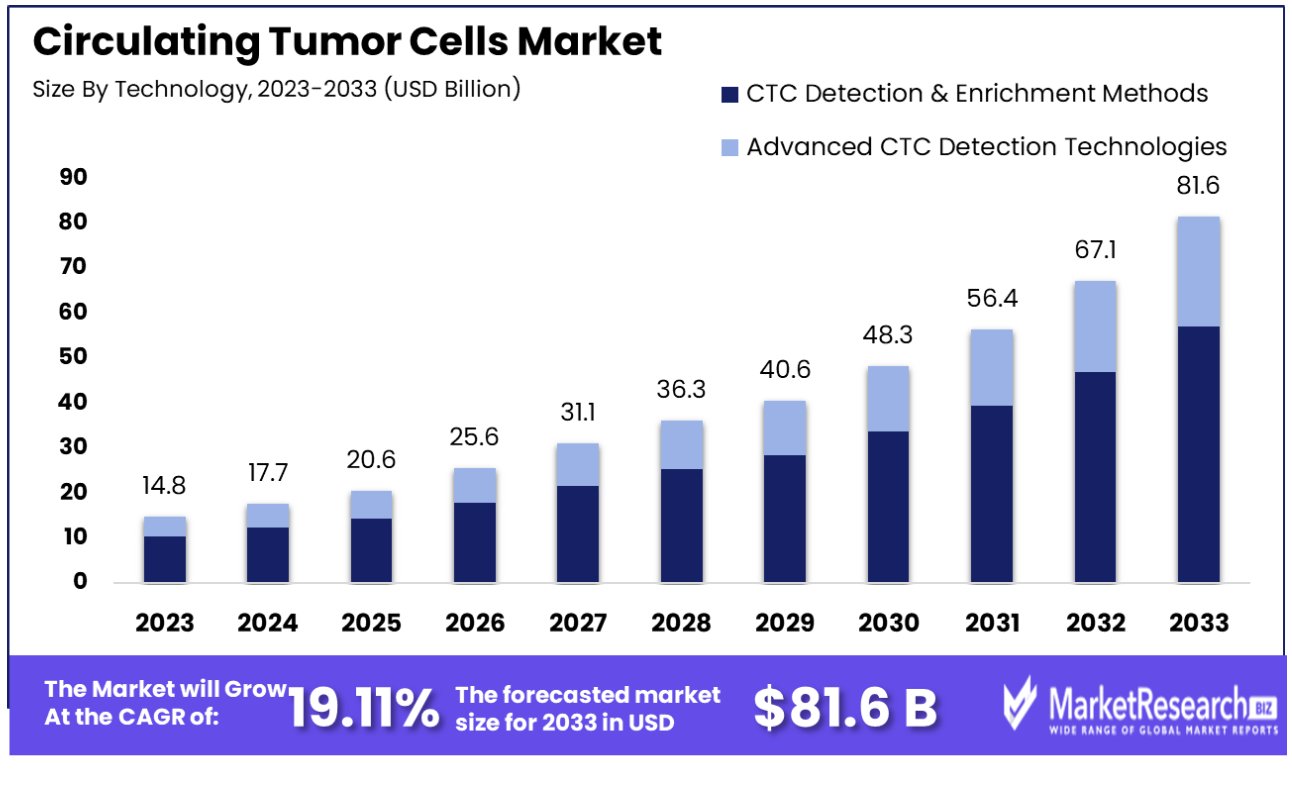

The circulating tumor cells market was valued at USD 14.84 billion in 2023. It is expected to reach USD 81.6 billion by 2033, with a CAGR of 19.11% during the forecast period from 2024 to 2033.

The surge in demand for changing lifestyles and the rise in genetic disorders are some of the main key driving factors for the circulating tumor cells market. Circulating tumor cells are an alternative method to study cancer through liquid biopsy. These cells not only disclose the presence of a tumor but also specify that a cancer is developing or spreading. Circulating tumor cells are rare and heterogeneous. This can be also found in the initial stages of cancer.

According to an article published by the American Cancer Society on January 12, 2023, there are more than 1,958,310 new cancer cases and 609,820 cancer deaths reported in the US. Moreover, according to an article published, In India, more than 14,61,427 cancer cases were reported in 2022. Likewise, according to a BMC cancer report in December 2023, circulating tumor cells were reported in 122 out of 125 patients with tumors which has a positive rate of 96.7%.

Circulating tumor cells are seeds for metastases, they preserve tumor heterogeneity and impersonate tumor features that permit them to be used by therapeutic targets and clinical biomarkers for screening the disease, dynamic supervision, and forecasting prognosis. However, circulating tumor cells, which are also known as CTC, are derived 3D organoid models that can be used to screen tests for drug sensitivity and analysis of multiplexed proteomics of circulating tumor cells. Although there are certain restraints, the growth of circulating tumor cells isolation and culture are important for therapy, disease evolution, and actual real-time genomic classification.

Detecting circulating tumor cells is a novel liquid biopsy technology that simplifies accurate diagnosis and treatment of tumors. The circulating tumor cells have several benefits of easy procurement and the potential to offer dynamic monitoring information. Moreover, the usage of live CTCs can get in vitro analysis of tumor morphology and function. The counting of CTCs, molecular typing, and downstream analysis have a wide prospect for applications in tumor efficacy valuation, prognosis assessment, and auxiliary treatment decision-making.

There are several circulating tumor cells identifying methods that have been created which are based on exceptional molecular substances within tumor cells as detection targets to get detection and grouping of tumor cells. Such methodology is highly sensitive and particular and also identifies single tumor cells. Due to some intricacy of tumors, the identifying efficacy of CTCs in varied types of tumors and their practical supervision for the prevalence and development of tumors are issues that require further advancement. The rise of the prevalence of circulating tumor cancer will expand due to its mimic feature with cancer that will help in therapeutic and medical treatment which will also support market expansion in the coming years.

Driving Factors

Early Cancer Detection Accelerates Circulating Tumor Cells Market

The use of circulating tumor cells (CTCs) in early cancer detection is a vital growth driver for the market. CTCs, shed by tumors into the bloodstream, can be indicative of cancer recurrence and metastasis at a stage when traditional imaging might not detect it. The ability of CTCs to provide early warnings allows for timely intervention, potentially improving patient outcomes. This aspect of early detection is crucial, especially in cancers known for their aggressive nature and late discovery. The technology's growing precision in identifying these cells furthers its utility and market demand.

Treatment Monitoring Enhances Market Dynamics

Monitoring treatment efficacy through changes in CTC counts is revolutionizing cancer care. The substantial improvement in the 5-year relative survival rate for cancers, from 39% to 70% in white patients and 27% to 63% in black patients, underscores the importance of effective treatment monitoring. CTCs offer a dynamic tool for tracking the progress of cancer treatment, providing real-time feedback. This ability to gauge treatment response accurately allows for timely modifications in therapy, aligning with evolving patient needs. The integration of CTC analysis into treatment protocols is significantly propelling market growth.

Personalized Medicine Propels Market Expansion

Personalized medicine's rise, with over 75,000 genetic testing products and 300 personalized medicines available, is a significant growth factor for the CTC market. Analyzing CTCs provides insights into specific cancer biomarkers and mutations unique to each patient. This information is invaluable in crafting personalized treatment plans and offering more targeted and effective therapies. The growing emphasis on tailor-made medical approaches, driven by unique patient profiles, underpins the expanding role and market for CTC analysis, marking a shift towards more individualized and effective cancer treatment strategies.

Restraining Factors

Technical Challenges in Isolating CTCs Restrict Circulating Tumor Cells Market Expansion

The technical challenges associated with isolating and capturing rare circulating tumor cells (CTCs) significantly limit the growth of the CTC market. Isolating CTCs from blood requires complex and expensive systems due to the rarity of these cells. This technical complexity hinders widespread adoption, as it demands specialized equipment and expertise that may not be readily available in many laboratories. The need for highly sophisticated technology to find and analyze these cells creates a barrier to broader implementation in clinical settings, thereby constraining the market's growth potential.

High Cost of CTC Testing Limits Market Accessibility

The high cost of circulating tumor cell testing presents a major obstacle to market growth. Many laboratories and medical facilities cannot afford the high equipment and testing costs associated with CTC analysis. For instance, Michigan Medicine reported that the cost of a CTC test is approximately $2,689.00, which includes a $451.00 fee for professional interpretation. This cost, often not covered by insurance, becomes the patient's responsibility, making it prohibitive for many. The lack of affordable options restricts the accessibility and adoption of CTC testing, particularly in settings where funding and insurance coverage are limited. This financial barrier is a significant hindrance to the widespread use and growth of the circulating tumor cells market.

Circulating Tumor Cells Market Segmentation Analysis

By Technology Analysis

CTC Detection & Enrichment Methods form the dominant segment in the circulating tumor cells market, with a market share of 60.4%. The reason for this is the crucial role played by these methods in the detection and examination of CTCs from blood samples.

Detection and enrichment technologies such as CellSearch and AdnaTest are instrumental in identifying CTCs, which are rare and difficult to isolate. These methods employ a combination of immunoaffinity-based and physical property-based techniques to enhance the sensitivity and specificity of CTC detection. The advancements in these technologies have significantly improved the ability to detect CTCs even at low concentrations, making them vital for cancer diagnosis, prognosis, and therapy selection.

The Advanced CTC Detection Technologies segment, though smaller, is rapidly evolving and includes methods like RT-PCR and next-generation sequencing. These technologies offer more detailed molecular profiling of CTCs, but their complexity and cost currently limit their widespread adoption compared to traditional detection and enrichment methods.

By Specimen Analysis

Blood is the most popular sample type of the CTC market, having a market share of 42.7 percent. The decision to use blood samples originates from the less-invasive nature of blood draws compared to other methods and the capability of CTCs in blood to offer valuable insight into the molecular properties of cancers. The tests based on blood, also known as liquid biopsies allow the identification and analysis of CTCs without the requirement for invasive tissue biopsies.

Bone Marrow and Other Body Fluids are also used for CTC analysis but to a lesser extent. Bone marrow samples are particularly important in certain types of cancers, such as hematological malignancies, while other body fluids like pleural effusions can also contain CTCs. However, the ease and minimal invasiveness of blood sampling make it the most widely used specimen for CTC analysis.

By Product Analysis

Kits and Reagents are the most popular products within the CTC market, claiming a market share of 35 percent. Kits and reagents designed to aid in CTC identification, detection, and analysis are crucial components of research and clinical contexts. They provide standard and efficient methods of removing CTCs from blood samples and other types of specimens. These are vital for ensuring the validity and precision of CTC analysis.

Blood Collection Tubes and Devices or Systems are also holding significant places on the market. They are blood collection Tubes specially designed to protect their integrity CTCs throughout storage and transport as well as Devices and Systems, like automatized platforms are employed to enrich and detect CTCs. However, the widespread use and the fundamental function of Kits & Reagents in CTC analysis prove their superiority in the market segment.

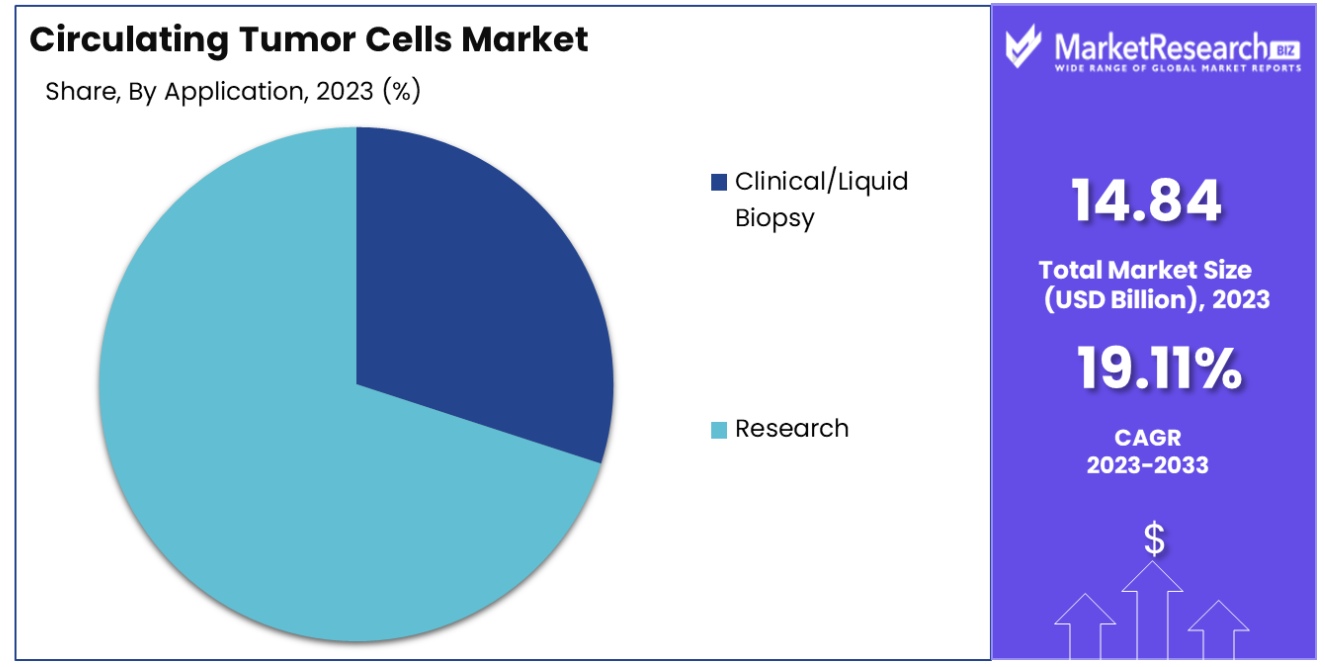

By Application Analysis

Research is the most popular application segment of the CTC market, having 70 percent. A large proportion of research results from the wide utilization of CTCs in research on cancer for studying the biology of tumors in terms of metastasis-related mechanisms and resistance to drugs. CTCs offer a unique method to collect non-invasive tumor samples, allowing researchers to study tumor evolution and heterogeneity throughout time.

Clinical/Liquid Biopsy applications are also significant and growing. In clinical settings, CTC analysis is increasingly being used for cancer diagnosis, monitoring treatment response, and predicting prognosis. However, the current use of CTCs in clinical practice is limited compared to their extensive application in research settings, due to ongoing validation and standardization challenges. The research sector's need for understanding and combating cancer at a molecular level, coupled with the rapid advancements in CTC technologies, continues to drive the segment's dominance in the market.

Circulating Tumor Cells Industry Segments

By Technology

- CTC Detection & Enrichment Methods

- Advanced CTC Detection Technologies

By Specimen

- Blood

- Bone Marrow

- Other Body Fluids

By Product

- Kits & Reagents

- Blood Collection Tubes

- Devices or Systems

By Application

- Clinical/Liquid Biopsy

- Research

Growth Opportunities

Expansion of the Liquid Biopsy Market Elevates the Circulating Tumor Cells (CTCs) Segment

The growth of the liquid biopsy market presents a significant opportunity for the expansion of the circulating tumor cells (CTCs) market segment. Liquid biopsies are increasingly being adopted for cancer testing due to their non-invasive nature, and CTCs, as a critical component of liquid biopsies, stand to benefit from this trend. CTCs offer a safer alternative to traditional tissue biopsies, avoiding their associated risks and discomfort. As the medical community continues to recognize the efficacy and advantages of liquid biopsies, the demand for CTC analysis is expected to grow, propelling the market forward.

Technological Advances Boost CTC Isolation and Analysis, Driving Market Adoption

Technological improvements in the field of circulating tumor cells are key drivers of market growth. Advances in areas like microfluidics and the development of tumor-specific capture molecules enhance the efficiency and accuracy of CTC isolation and analysis. These advancements increase the utility of CTCs in clinical settings, making them more appealing for diagnostic and monitoring purposes in oncology. As these technologies continue to evolve and demonstrate increased precision and reliability, the adoption of CTC analysis in clinical practice is expected to rise, further driving growth in this market sector.

Circulating Tumor Cells Market Regional Analysis

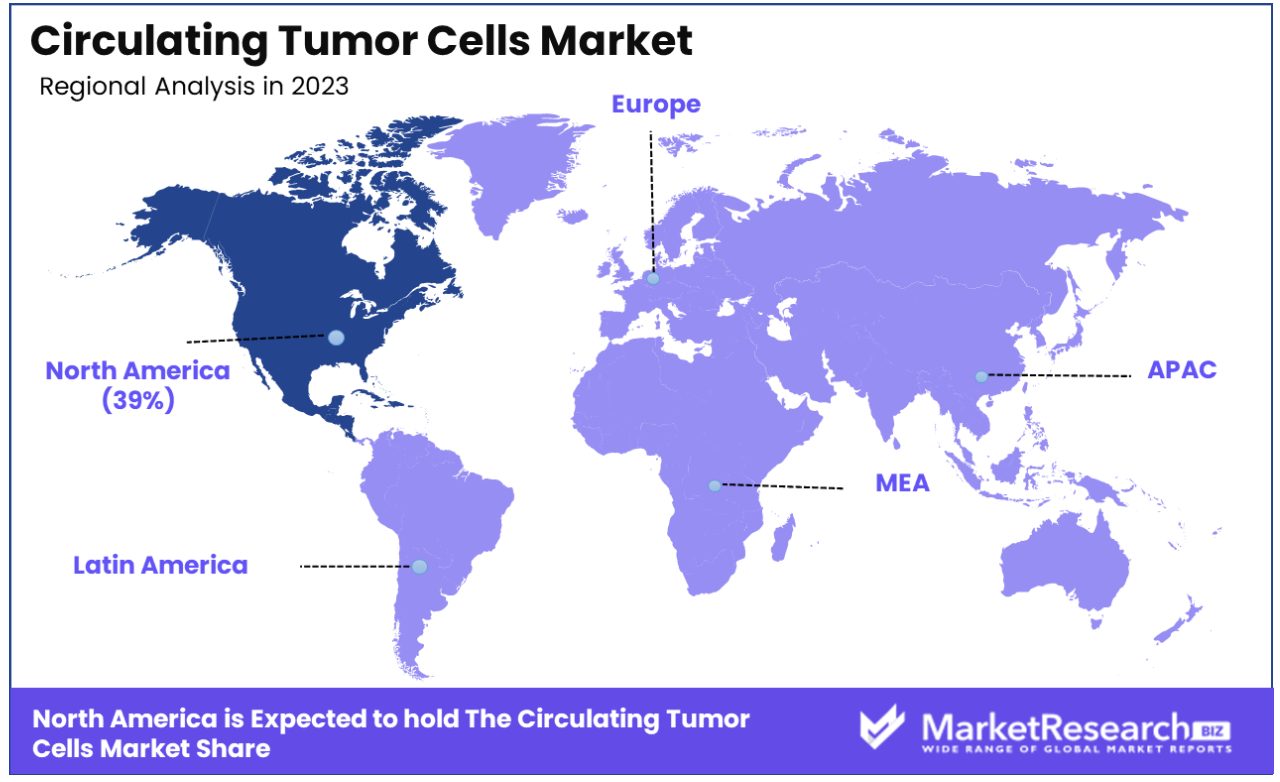

North America Dominates with 39% Market Share in Circulating Tumor Cells Market

North America's substantial 39% market share in the circulating tumor cells (CTC) market is primarily driven by advanced healthcare infrastructure, significant investments in cancer research, and a high prevalence of cancer cases in the region. The United States, in particular, is home to leading biotechnology and pharmaceutical companies engaged in oncology research, contributing to the market's strength. The region's focus on personalized medicine and targeted cancer therapies, which utilize CTCs for early detection and treatment monitoring, also plays a crucial role in driving market growth.

The CTC market in North America is characterized by robust research and development activities, supported by substantial funding from both governmental and private entities. Technological advancements in liquid biopsy and non-invasive cancer diagnostics are key market drivers. Furthermore, collaborations between research institutes and industry players for developing innovative CTC analysis technologies enhance the market dynamics. The region's strong regulatory framework, ensuring high standards in medical research and product approvals, also contributes to market growth.

Europe: Innovation and Stringent Regulatory Environment

Europe's CTC market is driven by innovative research in oncology, supported by a stringent regulatory environment. The presence of renowned cancer research institutes and the emphasis on developing advanced diagnostic technologies contribute to the market. The growing adoption of personalized medicine in countries like Germany, the UK, and France is a key market characteristic.

Asia-Pacific: Rapid Growth and Emerging Markets

In Asia-Pacific, the CTC market is experiencing rapid growth due to the emerging markets in countries like China and India. The region's expanding healthcare infrastructure, increasing cancer prevalence, and rising investments in healthcare research are key drivers. The market benefits from growing awareness about cancer diagnostics and the rising demand for non-invasive diagnostic techniques. The region’s focus on healthcare innovation and increasing collaborations between regional and international players are expected to fuel market growth.

Circulating Tumor Cells Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Circulating Tumor Cells Market Key Player Analysis

Within the Circulating Tumor Cells (CTC) Market, which is a crucial area for cancer research and diagnosis The companies listed are essential to creating innovation and making it possible to use precision medicine. BIOCEPT, Inc. and Epic Sciences stand out for their cutting-edge CTC analysis techniques, which contribute significantly to non-invasive cancer diagnosis. Their strategic positioning is focused on the detection and analysis of CTCs and defining the future of personalized treatment for cancer.

Fluxion Biosciences, Inc. and Greiner Bio-One International GmbH offer specialized platforms for the isolation and enumeration of CTCs, reflecting the industry's focus on accurate and efficient detection methods. These technologies are crucial for understanding tumor progression and treatment response.

Miltenyi Biotec and Biolidics Limited are known for their cell separation and detection technologies, playing a critical role in enhancing the sensitivity and specificity of CTC testing. Their contributions are pivotal in advancing research in cancer metastasis and treatment monitoring.

Circulating Tumor Cells Industry Key Players

- Fluxion Biosciences, Inc.

- Greiner Bio One International GmbH

- Canopus Bioscience Ltd.

- QIAGEN Bio-Techne Corporation

- AVIVA Biosciences

- BIOCEPT, Inc.

- Ikonisys Inc.

- Miltenyi Biotec

- IVDiagnostics BioFluidica

- Biolidics Limited

- Creativ MicroTech, Inc.

- LungLife AI, Inc.

- Epic Sciences

Circulating Tumor Cells Market Recent Development

- In January 2024, Researchers at The University of Texas MD Anderson Cancer Center report promising results from the AMPLIFY-201 trial of ELI-002, a vaccine targeting KRAS mutations in colorectal and pancreatic cancer. The "off the shelf" vaccine aims to prevent cancer recurrence and showed a T cell response in over 80% of participants, indicating immune system activation. The phase 2 trial will further assess safety and efficacy.

- In December 2023, Researchers from the Weizmann Institute of Science introduced Zman-seq, a groundbreaking method for time-resolved single-cell transcriptomics, enabling tracking of cellular history within tissues. This innovation may revolutionize cancer therapy by understanding immune dysfunction dynamics in glioblastoma.

- In December 2023, Dr. Howard I. Scher's impactful career in prostate cancer research includes leading the Prostate Cancer Clinical Trials Consortium, pioneering biomarker development, and advancing treatments like abiraterone and enzalutamide. His focus on precision medicine continues with liquid biopsy innovations.

- In December 2023, a New $3.2 million grant fuels the collaborative fight against cancers. The Convergent Science Cancer Consortium (CSCC), funded by the U.S. Department of Defense, unites experts from USC, Cedars-Sinai, Stanford, and Children's Hospital to revolutionize cancer research, focusing on personalized treatments and real-time monitoring for enhanced efficacy.

Report Scope

Report Features Description Market Value (2023) USD 14.84 Billion Forecast Revenue (2033) USD 81.6 Billion CAGR (2024-2032) 19.11% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology(CTC Detection & Enrichment Methods, Advanced CTC Detection Technologies), By Specimen(Blood, Bone Marrow, Other Body Fluids), By Product(Kits & Reagents, Blood Collection Tubes, Devices or Systems), By Application(Clinical/Liquid Biopsy, Research) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape (Fluxion Biosciences, Inc., Greiner Bio-One International GmbH, Canopus Bioscience Ltd., QIAGEN Bio-Techne Corporation, AVIVA Biosciences, BIOCEPT, Inc., Ikonisys Inc., Miltenyi Biotec, IVDiagnostics BioFluidica, Biolidics Limited, Creativ MicroTech, Inc., LungLife AI, Inc., Epic Sciences) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Fluxion Biosciences, Inc.

- Greiner Bio One International GmbH

- Canopus Bioscience Ltd.

- QIAGEN Bio-Techne Corporation

- AVIVA Biosciences

- BIOCEPT, Inc.

- Ikonisys Inc.

- Miltenyi Biotec

- IVDiagnostics BioFluidica

- Biolidics Limited

- Creativ MicroTech, Inc.

- LungLife AI, Inc.

- Epic Sciences