Cigar Market Report By Product Type (Machine-Made Cigars, Handmade/Premium Cigars), By Category (Flavored Cigars, Non-Flavored Cigars), By Shape (Parejo, Figurado, Cigarillos), By Size (Small Cigars, Large Cigars), By Distribution Channel (Online Stores, Offline Stores [Tobacco Shops, Supermarkets/Hypermarkets, Convenience Stores, Others]), By End-User (Male, Female), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

11856

-

August 2024

-

321

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

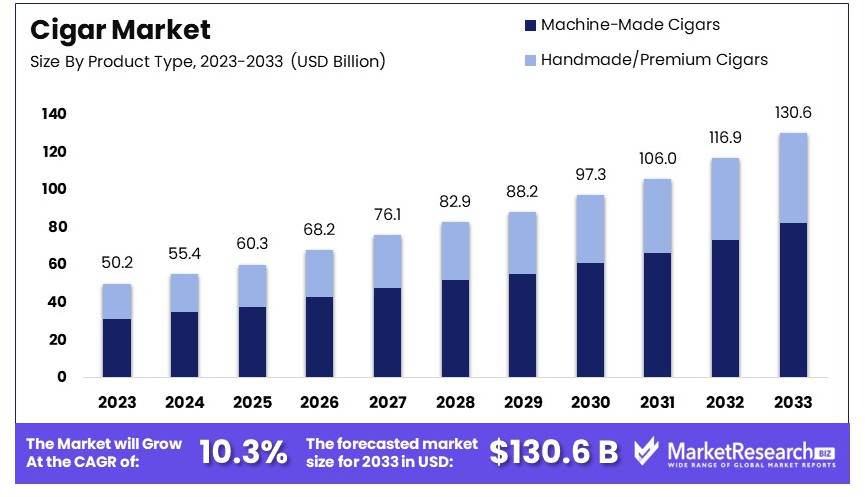

The Global Cigar Market size is expected to be worth around USD 130.6 Billion by 2033, from USD 50.2 Billion in 2023, growing at a CAGR of 10.3% during the forecast period from 2024 to 2033.

The cigar market involves the production, distribution, and sale of cigars. These tobacco products are often associated with luxury and leisure. The market is driven by the demand for premium and handcrafted cigars. Key players include cigar manufacturers, retailers, and distributors.

The market has seen steady growth due to the increasing popularity of cigars among affluent consumers. Innovations in cigar flavors and packaging have enhanced consumer interest. Major trends include the rise of boutique cigar brands and cigar lounges. The market is competitive, with a focus on quality and exclusivity.

The cigar market is experiencing dynamic changes, influenced by regulatory frameworks and robust international trade. Government regulations, particularly in the United States, significantly impact the industry. The U.S. Food and Drug Administration (FDA) enforces the Family Smoking Prevention and Tobacco Control Act, which raised the federal minimum age for purchasing tobacco products from 18 to 21. This regulation aims to reduce minors' access to tobacco and protect public health, reflecting a broader trend of stricter tobacco control measures globally.

Despite regulatory challenges, the global cigar trade remains robust. Countries like the United Arab Emirates (UAE) play a pivotal role in this market. In 2021, the UAE exported over 4.4 billion cigars, underscoring its strong position in the international market. This highlights the sustained demand for cigars as a luxury good, particularly in markets where regulatory environments are less restrictive.

Consumer preferences are also evolving, with a growing appreciation for premium and handcrafted cigars. This trend is driving manufacturers to focus on quality and unique blends to attract discerning customers. Additionally, the rise of e-commerce has facilitated easier access to a wide range of cigar products, further expanding market reach.

Innovation within the industry includes the development of flavored cigars and smaller-sized products to cater to changing consumer tastes. These innovations, coupled with strategic marketing efforts, are helping to maintain consumer interest and drive market growth.

In conclusion, the cigar market is poised for continued growth despite regulatory pressures. Strong international trade, particularly from key exporters like the UAE, and evolving consumer preferences for premium products, support this positive outlook. The industry's ability to innovate and adapt to regulatory changes will be crucial in sustaining this growth trajectory.

Key Takeaways

- Market Value: The Cigar Market was valued at USD 50.2 billion in 2023 and is projected to reach USD 130.6 billion by 2033, growing at a CAGR of 10.3%.

- By Product Type Analysis: Machine-Made Cigars lead with 63%; their consistent quality and affordability boost their demand.

- By Category Analysis: Non-Flavored Cigars hold a majority at 71%; favored for their traditional appeal.

- By Shape Analysis: Parejo shapes are preferred, holding 57%; their classic design is widely accepted.

- By Size Analysis: Large Cigars dominate at 64%; they are popular for their extended smoking duration.

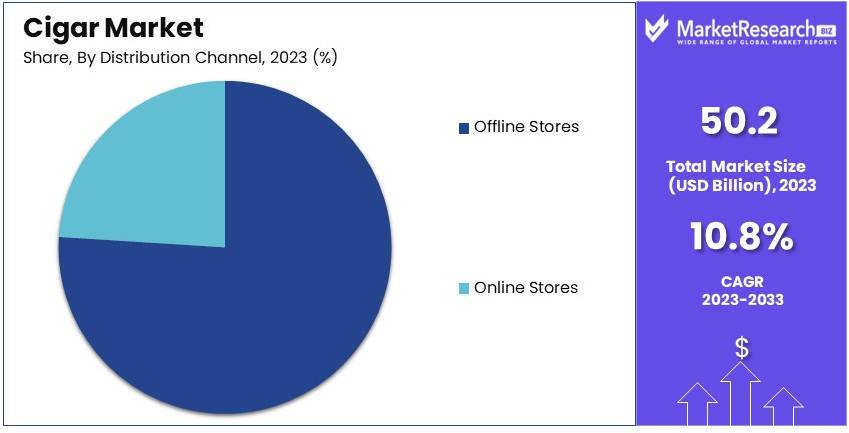

- By Distribution Channel Analysis: Offline Stores are the main channel, with a 76% share; personal service and product variety attract consumers.

- By End-User Analysis: Male consumers dominate the market at 83%; traditionally, cigars have been more popular among men.

- Analyst Viewpoint: The Cigar Market remains less saturated, with high potential for premium and bespoke product offerings driving future growth.

- Growth Opportunities: Expanding the range of premium and artisanal products can help key players stand out in the evolving market dynamics.

Driving Factors

Premiumization and Luxury Positioning Drive Market Growth

The cigar market has seen significant growth in the premium segment, driven by consumers seeking high-quality, luxury experiences. Cigars are increasingly viewed as a symbol of status and sophistication, particularly among affluent consumers.

This trend has led to the success of premium brands like Cohiba, whose limited edition cigars can command prices upwards of USD 100 per unit. The appeal of exclusive, hand-crafted cigars has expanded the market beyond traditional aficionados to include younger, affluent consumers looking for luxury indulgences. The premiumization of cigars is a crucial factor in market growth.

Growing Cigar Culture and Social Smoking Drive Market Growth

There's a rising trend of cigar appreciation as a social activity, with cigar lounges and clubs gaining popularity. This cultural shift has created a new category of occasional smokers who view cigars as a social experience rather than a habitual practice.

For instance, the Cigar Aficionado magazine has played a significant role in popularizing cigar culture, with its events like the Big Smoke attracting thousands of enthusiasts annually. This growing cigar culture has expanded the consumer base beyond traditional demographics. The social aspect of cigar smoking is significantly contributing to market expansion.

Expansion of Flavored and Infused Cigars Drive Market Growth

The introduction of flavored and infused cigars has attracted new consumers, particularly younger adults and those who might find traditional cigars too strong. Brands like Acid by Drew Estate have successfully tapped into this market with their aromatic, infused cigars.

Acid's success has led to a proliferation of flavored options across the industry, from coffee-infused to fruit-flavored varieties, broadening the appeal of cigars to a more diverse consumer base. The variety and novelty offered by flavored and infused cigars are key drivers in attracting a broader range of consumers, thereby growing the market.

Restraining Factors

High Taxation and Price Sensitivity Restrain Market Growth

Many countries impose heavy taxes on tobacco products, including cigars, as part of public health initiatives. These taxes can significantly increase the retail price of cigars, making them less accessible to a broader consumer base.

For example, in New York City, a 75% tax on the wholesale price of cigars has led to some of the highest cigar prices in the United States. This potentially limits market growth in such regions and drives some consumers to seek cheaper alternatives or reduce consumption.

Competition from Alternative Tobacco and Nicotine Products Restrains Market Growth

The rise of e-cigarettes, vaping devices, and other alternative nicotine delivery systems has created competition for the cigar market. These products often appeal to younger consumers and those looking for perceived less harmful alternatives to traditional tobacco products.

For instance, JUUL's rapid rise to dominance in the e-cigarette market demonstrated the potential for alternative products to capture market share from traditional tobacco segments, including cigars. This competition can limit the growth of the cigar market.

Product Type Analysis

Machine-Made Cigars dominate with 63% due to affordability and consistent quality.

The cigar market is segmented into machine-made cigars and handmade/premium cigars. Machine-made cigars dominate this segment, holding a significant market share of 63%. This dominance can be attributed to their affordability and consistent quality. Machine-made cigars are produced using advanced manufacturing processes that ensure uniformity and efficiency. They appeal to a broader audience due to their lower price point, making them accessible to casual smokers and those new to cigar smoking. Additionally, the convenience of machine-made cigars in terms of availability and ease of purchase further boosts their market position.

Handmade/premium cigars, while not as dominant, play a crucial role in the cigar market. These cigars are crafted by skilled artisans, offering a unique smoking experience that machine-made cigars cannot replicate. Handmade cigars are often associated with luxury and status, attracting connoisseurs and seasoned smokers who appreciate the craftsmanship and complex flavors. The premium segment is also driven by a strong demand for exclusivity and high-quality tobacco, often sourced from renowned regions. Though this sub-segment holds a smaller market share of 37%, it contributes significantly to the overall revenue of the cigar market due to its higher price points.

Handmade cigars also benefit from a loyal customer base that values the tradition and history behind each brand. Events and gatherings, such as cigar festivals and clubs, further support the growth of this sub-segment. While the market for handmade cigars is niche, it remains robust and continues to attract new aficionados, contributing to the overall diversity and growth of the cigar market.

Category Analysis

Non-Flavored Cigars dominate with 71% due to traditional preferences and authentic tobacco experience.

In the category segmentation of the cigar market, non-flavored cigars hold the dominant position with a market share of 71%. This dominance is largely due to the traditional preferences of cigar smokers who seek an authentic tobacco experience. Non-flavored cigars are preferred by purists who enjoy the natural taste and aroma of tobacco, which is often aged and blended to create a rich and complex flavor profile. These cigars are often perceived as more sophisticated and are associated with a classic smoking experience.

Flavored cigars, while less dominant, have a significant presence in the market with a 29% share. They cater to a different segment of consumers who seek variety and novelty in their smoking experience. Flavored cigars are infused with various flavors such as vanilla, cherry, chocolate, and coffee, which make them appealing to new smokers and those looking for a different sensory experience. This sub-segment has seen growth due to its appeal to younger and female smokers who might find the flavors more enjoyable and less intense than traditional cigars.

The growth of flavored cigars is also supported by innovative marketing strategies and product diversification. Brands are continually introducing new flavors and limited-edition releases to attract consumers. Despite their smaller market share, flavored cigars contribute to the overall vibrancy and expansion of the cigar market by broadening the consumer base and offering a wide range of options to suit different preferences.

Shape Analysis

Parejo dominates with 57% due to simplicity in manufacturing and popularity among consumers.

In terms of shape, Parejo cigars lead the market with a 57% share. Parejos are the simplest and most common cigar shape, characterized by a straight cylindrical body, a rounded head, and an even foot. This straightforward design makes them easier to manufacture compared to more complex shapes, resulting in lower production costs. Parejos are popular among consumers for their familiarity and ease of smoking, contributing to their dominant market position.

Figurado cigars, although less prevalent, play a vital role in the market. Figurado shapes include torpedoes, pyramids, and perfectos, which are more challenging to roll and often associated with higher craftsmanship. These cigars appeal to experienced smokers who appreciate the unique aesthetics and nuanced smoking experience they offer. Figurado cigars are often considered premium products, adding an element of exclusivity and sophistication to the market. While their market share is smaller, at 28%, they contribute significantly to the cigar market's premium segment, attracting aficionados seeking a distinctive and luxurious smoking experience.

Cigarillos, smaller and thinner cigars, also contribute to the market by offering a quicker smoking option for those with limited time. They hold a market share of 15% and are particularly popular in regions with strict smoking regulations and among consumers who prefer a shorter smoking session. The versatility of cigarillos in terms of packaging and flavors makes them an important sub-segment, complementing the overall growth of the cigar market.

Size Analysis

Large Cigars dominate with 64% due to longer smoking experience and better flavor profile.

In the size segmentation, large cigars dominate with a 64% market share. Large cigars, including robusto, toro, and Churchill sizes, are favored for their longer smoking experience and enhanced flavor profile. These cigars allow for a more relaxed and prolonged smoking session, which is often appreciated by seasoned smokers. The larger size also provides more room for complex tobacco blends, resulting in richer and more nuanced flavors. This preference for a more immersive smoking experience drives the demand for large cigars.

Small cigars, although less dominant, play an essential role in the market. They cater to smokers who seek a quicker and more convenient smoking option. Small cigars are popular among those with limited time or those who prefer shorter smoking sessions. They hold a market share of 36%. Small cigars are also easier to transport and store, making them a practical choice for on-the-go smokers. The versatility and convenience of small cigars contribute to their steady demand, complementing the overall market growth.

Small cigars also benefit from their appeal to new smokers and those transitioning from cigarettes. Their size and often milder flavors make them an attractive entry point into the cigar market. As smoking regulations become stricter and consumers seek more convenient options, small cigars are likely to see sustained growth, supporting the broader cigar market's expansion.

Distribution Channel Analysis

Offline Stores dominate with 76% due to the sensory experience and immediate availability.

The distribution channel analysis reveals that offline stores hold a dominant position with a 76% market share. This dominance is driven by the sensory experience and immediate availability that physical stores offer. Tobacco shops, supermarkets, hypermarkets, and convenience stores provide consumers with the opportunity to see, smell, and sometimes even taste the cigars before purchasing. This sensory interaction is crucial for cigar enthusiasts who value the quality and characteristics of their cigars.

Tobacco shops, in particular, play a vital role in the offline segment. They offer a wide range of products and expert advice, enhancing the shopping experience. These specialized stores often have a loyal customer base and host events that promote cigar culture. Supermarkets and hypermarkets also contribute to the offline dominance by providing easy access to cigars as part of their extensive product offerings. Convenience stores cater to on-the-go consumers, ensuring cigars are readily available for spontaneous purchases.

Online stores, while less dominant, are growing rapidly with a market share of 24%. They cater to consumers seeking convenience and a broader selection of products. Online platforms offer the advantage of home delivery and often have detailed product descriptions and customer reviews, aiding informed decision-making. The growth of e-commerce and digital marketing strategies are driving the online segment, making it a crucial part of the overall distribution landscape.

End-User Analysis

Male end-users dominate with 83% due to traditional consumption patterns and higher purchasing power.

The end-user analysis highlights that male consumers dominate the cigar market, accounting for 83% of the market share. This dominance is attributed to traditional consumption patterns and higher purchasing power among men. Historically, cigar smoking has been associated with masculinity and luxury, leading to a strong male consumer base. Men are more likely to participate in social and professional settings where cigars are smoked, further reinforcing their dominance in this segment.

Female consumers, while a smaller segment, are becoming increasingly significant with a market share of 17%. The rise in female cigar smokers can be linked to changing social norms and growing acceptance of women in traditionally male-dominated activities. Marketing strategies targeting female consumers, such as introducing milder flavors and aesthetically pleasing packaging, are also contributing to this growth. Women are seeking cigars as a means of relaxation and socialization, adding a new dimension to the market.

The increasing presence of female smokers is encouraging diversification in product offerings and marketing approaches. As the industry adapts to cater to both male and female consumers, the overall growth and dynamism of the cigar market are enhanced. The role of female consumers, though currently smaller, is pivotal in driving future trends and expanding the market's reach.

Key Market Segments

By Product Type

- Machine-Made Cigars

- Handmade/Premium Cigars

By Category

- Flavored Cigars

- Non-Flavored Cigars

By Shape

- Parejo

- Figurado

- Cigarillos

By Size

- Small Cigars

- Large Cigars

By Distribution Channel

- Online Stores

- Offline Stores

- Tobacco Shops

- Supermarkets/Hypermarkets

- Convenience Stores

- Others

By End-User

- Male

- Female

Growth Opportunities

Sustainable and Organic Cigars Offer Growth Opportunity

There is a growing opportunity for cigars produced using sustainable farming practices and organic tobacco. As consumers become more environmentally conscious, cigars marketed as eco-friendly or organic could capture a niche but growing segment of the market.

For example, the Plasencia family, known for their high-quality cigars, has been pioneering organic tobacco cultivation, appealing to environmentally conscious cigar enthusiasts. These sustainable practices not only attract eco-conscious consumers but also enhance the brand's reputation and market reach. By focusing on sustainability and organic production, cigar companies can differentiate themselves and tap into a new demographic of mindful consumers.

Limited Edition and Collaborative Releases Offer Growth Opportunity

Limited edition cigars and collaborations with luxury brands or celebrities represent a significant growth opportunity. These exclusive releases create buzz and drive demand among collectors and enthusiasts.

For instance, the Fuente Fuente OpusX 20 Years Celebration cigar, released in limited quantities, generated significant interest and commanded premium prices, showcasing the potential of this strategy. Such releases not only enhance brand prestige but also attract high-end consumers willing to pay a premium for exclusivity. By leveraging collaborations and limited editions, cigar companies can boost sales and create lasting market impact.

Trending Factors

Cigar Tourism and Experiences Are Trending Factors

There is a growing trend of cigar-focused tourism, particularly to tobacco-producing regions like Cuba, the Dominican Republic, and Nicaragua. This presents opportunities for cigar brands to offer immersive experiences, factory tours, and cigar-making classes.

For example, La Aurora in the Dominican Republic offers factory tours and cigar-making workshops, attracting tourists and enhancing brand loyalty. These experiences allow consumers to connect more deeply with the product, fostering a loyal customer base and creating additional revenue streams through tourism and educational programs.

Digital Content and Community Building Are Trending Factors

The trend of creating digital content around cigar culture, including reviews, pairing suggestions, and lifestyle content, is growing. This presents opportunities for brands to engage with consumers through social media, YouTube channels, and podcasts.

For instance, Cigar Aficionado's YouTube channel has over 100,000 subscribers, indicating the strong interest in cigar-related content. By building a digital community, brands can engage with a wider audience, foster brand loyalty, and create an interactive platform for enthusiasts, thus driving market growth through enhanced customer engagement.

Regional Analysis

North America Dominates with 35% Market Share in the Cigar Market

North America's substantial 35% market share in the cigar industry is driven by a robust culture of cigar consumption and a significant number of luxury cigar aficionados in the United States. High disposable incomes allow consumers to indulge in premium cigars, and the region hosts numerous exclusive cigar lounges and clubs that elevate the status of cigar smoking as a prestigious activity.

The regional dynamics are influenced by both traditional and luxury consumer segments. The U.S., in particular, has a strong heritage of cigar manufacturing and consumption, supported by favorable trade relationships with major cigar-producing countries like Cuba and Nicaragua. The regulatory environment, although strict, has been relatively stable, allowing for consistent market growth.

The influence of North America on the global cigar market is expected to continue, especially with trends showing an increased interest in artisanal and premium cigars among younger demographics. Innovations in cigar flavors and sustainable production practices may also boost market growth. The expanding culture of cigar clubs and the normalization of cigar smoking in movies and media are likely to sustain interest and consumption.

Regional Market Shares:

- Europe: Holds about 30% of the market. Europe's market is bolstered by a similar culture of luxury and traditional smoking, with countries like Spain and France leading in consumption.

- Asia Pacific: Asia Pacific accounts for approximately 20% of the market, driven by increasing disposable incomes and the adoption of Western luxury habits, particularly in China and Japan.

- Middle East & Africa: This region captures about 5% of the market share. The growth is primarily due to increasing luxury tourism and the cultural acceptance of smoking.

- Latin America: With around 10% market share, Latin America benefits from being a major producer of cigars, which supports strong local and export markets.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The cigar market is influenced by key players with strategic positioning and significant market impact. Scandinavian Tobacco Group A/S and Swisher International, Inc. dominate with extensive product portfolios and global distribution networks. Imperial Brands plc and Altadis S.A. leverage their strong brand heritage and market reach.

Habanos S.A. and Drew Estate LLC focus on premium and artisanal cigars, attracting connoisseurs and luxury consumers. Oettinger Davidoff AG and General Cigar Company Inc. emphasize quality and craftsmanship, enhancing their market prestige.

Gurkha Cigar Group, Inc. and Rocky Patel Premium Cigars, Inc. innovate with unique blends and limited editions, creating demand among collectors. J.C. Newman Cigar Company and Arturo Fuente Cigar Company maintain strong family traditions, ensuring brand loyalty.

Davidoff of Geneva USA, Inc., Imperial Tobacco Group, and Swedish Match AB capitalize on diverse product lines and strategic market expansions. These companies collectively enhance market growth through brand strength, product diversity, and consumer engagement.

Market Key Players

- Scandinavian Tobacco Group A/S

- Swisher International, Inc.

- Imperial Brands plc

- Altadis S.A.

- Habanos S.A.

- Drew Estate LLC

- Oettinger Davidoff AG

- General Cigar Company Inc.

- Gurkha Cigar Group, Inc.

- Rocky Patel Premium Cigars, Inc.

- J.C. Newman Cigar Company

- Arturo Fuente Cigar Company

- Davidoff of Geneva USA, Inc.

- Imperial Tobacco Group

- Swedish Match AB

Recent Developments

2024: Cuban cigar exports have soared by 31% over the past year, driven by increased global demand for luxury products. The growth is attributed to the island nation's strong reputation for high-quality cigars, appealing to affluent consumers worldwide.

2023: The trend towards ultra-premium cigars, such as Rocky Patel's USD 100 Conviction cigar, is creating a market divide. While these high-end products elevate the perception of quality and craftsmanship, they may alienate casual smokers. Balancing luxury with accessibility remains a challenge for the industry.

Report Scope

Report Features Description Market Value (2023) USD 50.2 Billion Forecast Revenue (2033) USD 130.6 Billion CAGR (2024-2033) 10.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Machine-Made Cigars, Handmade/Premium Cigars), By Category (Flavored Cigars, Non-Flavored Cigars), By Shape (Parejo, Figurado, Cigarillos), By Size (Small Cigars, Large Cigars), By Distribution Channel (Online Stores, Offline Stores [Tobacco Shops, Supermarkets/Hypermarkets, Convenience Stores, Others]), By End-User (Male, Female) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Scandinavian Tobacco Group A/S, Swisher International, Inc., Imperial Brands plc, Altadis S.A., Habanos S.A., Drew Estate LLC, Oettinger Davidoff AG, General Cigar Company Inc., Gurkha Cigar Group, Inc., Rocky Patel Premium Cigars, Inc., J.C. Newman Cigar Company, Arturo Fuente Cigar Company, Davidoff of Geneva USA, Inc., Imperial Tobacco Group, Swedish Match AB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Cigar Market Overview

- 2.1. Cigar Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Cigar Market Dynamics

- 3. Global Cigar Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Cigar Market Analysis, 2016-2021

- 3.2. Global Cigar Market Opportunity and Forecast, 2023-2032

- 3.3. Global Cigar Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 3.3.1. Global Cigar Market Analysis by Product Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 3.3.3. Machine-Made Cigars

- 3.3.4. Handmade/Premium Cigars

- 3.4. Global Cigar Market Analysis, Opportunity and Forecast, By Category, 2016-2032

- 3.4.1. Global Cigar Market Analysis by Category: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Category, 2016-2032

- 3.4.3. Flavored Cigars

- 3.4.4. Non-Flavored Cigars

- 3.5. Global Cigar Market Analysis, Opportunity and Forecast, By Shape, 2016-2032

- 3.5.1. Global Cigar Market Analysis by Shape: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Shape, 2016-2032

- 3.5.3. Parejo

- 3.5.4. Figurado

- 3.5.5. Cigarillos

- 3.6. Global Cigar Market Analysis, Opportunity and Forecast, By Size, 2016-2032

- 3.6.1. Global Cigar Market Analysis by Size: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Size, 2016-2032

- 3.6.3. Small Cigars

- 3.6.4. Large Cigars

- 3.7. Global Cigar Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 3.7.1. Global Cigar Market Analysis by Distribution Channel: Introduction

- 3.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 3.7.3. Online Stores

- 3.7.4. Offline Stores

- 3.8. Global Cigar Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 3.8.1. Global Cigar Market Analysis by End-User: Introduction

- 3.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 3.8.3. Male

- 3.8.4. Female

- 4. North America Cigar Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Cigar Market Analysis, 2016-2021

- 4.2. North America Cigar Market Opportunity and Forecast, 2023-2032

- 4.3. North America Cigar Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 4.3.1. North America Cigar Market Analysis by Product Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 4.3.3. Machine-Made Cigars

- 4.3.4. Handmade/Premium Cigars

- 4.4. North America Cigar Market Analysis, Opportunity and Forecast, By Category, 2016-2032

- 4.4.1. North America Cigar Market Analysis by Category: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Category, 2016-2032

- 4.4.3. Flavored Cigars

- 4.4.4. Non-Flavored Cigars

- 4.5. North America Cigar Market Analysis, Opportunity and Forecast, By Shape, 2016-2032

- 4.5.1. North America Cigar Market Analysis by Shape: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Shape, 2016-2032

- 4.5.3. Parejo

- 4.5.4. Figurado

- 4.5.5. Cigarillos

- 4.6. North America Cigar Market Analysis, Opportunity and Forecast, By Size, 2016-2032

- 4.6.1. North America Cigar Market Analysis by Size: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Size, 2016-2032

- 4.6.3. Small Cigars

- 4.6.4. Large Cigars

- 4.7. North America Cigar Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 4.7.1. North America Cigar Market Analysis by Distribution Channel: Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 4.7.3. Online Stores

- 4.7.4. Offline Stores

- 4.8. North America Cigar Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 4.8.1. North America Cigar Market Analysis by End-User: Introduction

- 4.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 4.8.3. Male

- 4.8.4. Female

- 4.9. North America Cigar Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.9.1. North America Cigar Market Analysis by Country : Introduction

- 4.9.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.9.2.1. The US

- 4.9.2.2. Canada

- 4.9.2.3. Mexico

- 5. Western Europe Cigar Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Cigar Market Analysis, 2016-2021

- 5.2. Western Europe Cigar Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Cigar Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 5.3.1. Western Europe Cigar Market Analysis by Product Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 5.3.3. Machine-Made Cigars

- 5.3.4. Handmade/Premium Cigars

- 5.4. Western Europe Cigar Market Analysis, Opportunity and Forecast, By Category, 2016-2032

- 5.4.1. Western Europe Cigar Market Analysis by Category: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Category, 2016-2032

- 5.4.3. Flavored Cigars

- 5.4.4. Non-Flavored Cigars

- 5.5. Western Europe Cigar Market Analysis, Opportunity and Forecast, By Shape, 2016-2032

- 5.5.1. Western Europe Cigar Market Analysis by Shape: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Shape, 2016-2032

- 5.5.3. Parejo

- 5.5.4. Figurado

- 5.5.5. Cigarillos

- 5.6. Western Europe Cigar Market Analysis, Opportunity and Forecast, By Size, 2016-2032

- 5.6.1. Western Europe Cigar Market Analysis by Size: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Size, 2016-2032

- 5.6.3. Small Cigars

- 5.6.4. Large Cigars

- 5.7. Western Europe Cigar Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 5.7.1. Western Europe Cigar Market Analysis by Distribution Channel: Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 5.7.3. Online Stores

- 5.7.4. Offline Stores

- 5.8. Western Europe Cigar Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 5.8.1. Western Europe Cigar Market Analysis by End-User: Introduction

- 5.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 5.8.3. Male

- 5.8.4. Female

- 5.9. Western Europe Cigar Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.9.1. Western Europe Cigar Market Analysis by Country : Introduction

- 5.9.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.9.2.1. Germany

- 5.9.2.2. France

- 5.9.2.3. The UK

- 5.9.2.4. Spain

- 5.9.2.5. Italy

- 5.9.2.6. Portugal

- 5.9.2.7. Ireland

- 5.9.2.8. Austria

- 5.9.2.9. Switzerland

- 5.9.2.10. Benelux

- 5.9.2.11. Nordic

- 5.9.2.12. Rest of Western Europe

- 6. Eastern Europe Cigar Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Cigar Market Analysis, 2016-2021

- 6.2. Eastern Europe Cigar Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Cigar Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 6.3.1. Eastern Europe Cigar Market Analysis by Product Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 6.3.3. Machine-Made Cigars

- 6.3.4. Handmade/Premium Cigars

- 6.4. Eastern Europe Cigar Market Analysis, Opportunity and Forecast, By Category, 2016-2032

- 6.4.1. Eastern Europe Cigar Market Analysis by Category: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Category, 2016-2032

- 6.4.3. Flavored Cigars

- 6.4.4. Non-Flavored Cigars

- 6.5. Eastern Europe Cigar Market Analysis, Opportunity and Forecast, By Shape, 2016-2032

- 6.5.1. Eastern Europe Cigar Market Analysis by Shape: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Shape, 2016-2032

- 6.5.3. Parejo

- 6.5.4. Figurado

- 6.5.5. Cigarillos

- 6.6. Eastern Europe Cigar Market Analysis, Opportunity and Forecast, By Size, 2016-2032

- 6.6.1. Eastern Europe Cigar Market Analysis by Size: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Size, 2016-2032

- 6.6.3. Small Cigars

- 6.6.4. Large Cigars

- 6.7. Eastern Europe Cigar Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 6.7.1. Eastern Europe Cigar Market Analysis by Distribution Channel: Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 6.7.3. Online Stores

- 6.7.4. Offline Stores

- 6.8. Eastern Europe Cigar Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 6.8.1. Eastern Europe Cigar Market Analysis by End-User: Introduction

- 6.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 6.8.3. Male

- 6.8.4. Female

- 6.9. Eastern Europe Cigar Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.9.1. Eastern Europe Cigar Market Analysis by Country : Introduction

- 6.9.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.9.2.1. Russia

- 6.9.2.2. Poland

- 6.9.2.3. The Czech Republic

- 6.9.2.4. Greece

- 6.9.2.5. Rest of Eastern Europe

- 7. APAC Cigar Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Cigar Market Analysis, 2016-2021

- 7.2. APAC Cigar Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Cigar Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 7.3.1. APAC Cigar Market Analysis by Product Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 7.3.3. Machine-Made Cigars

- 7.3.4. Handmade/Premium Cigars

- 7.4. APAC Cigar Market Analysis, Opportunity and Forecast, By Category, 2016-2032

- 7.4.1. APAC Cigar Market Analysis by Category: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Category, 2016-2032

- 7.4.3. Flavored Cigars

- 7.4.4. Non-Flavored Cigars

- 7.5. APAC Cigar Market Analysis, Opportunity and Forecast, By Shape, 2016-2032

- 7.5.1. APAC Cigar Market Analysis by Shape: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Shape, 2016-2032

- 7.5.3. Parejo

- 7.5.4. Figurado

- 7.5.5. Cigarillos

- 7.6. APAC Cigar Market Analysis, Opportunity and Forecast, By Size, 2016-2032

- 7.6.1. APAC Cigar Market Analysis by Size: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Size, 2016-2032

- 7.6.3. Small Cigars

- 7.6.4. Large Cigars

- 7.7. APAC Cigar Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 7.7.1. APAC Cigar Market Analysis by Distribution Channel: Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 7.7.3. Online Stores

- 7.7.4. Offline Stores

- 7.8. APAC Cigar Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 7.8.1. APAC Cigar Market Analysis by End-User: Introduction

- 7.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 7.8.3. Male

- 7.8.4. Female

- 7.9. APAC Cigar Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.9.1. APAC Cigar Market Analysis by Country : Introduction

- 7.9.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.9.2.1. China

- 7.9.2.2. Japan

- 7.9.2.3. South Korea

- 7.9.2.4. India

- 7.9.2.5. Australia & New Zeland

- 7.9.2.6. Indonesia

- 7.9.2.7. Malaysia

- 7.9.2.8. Philippines

- 7.9.2.9. Singapore

- 7.9.2.10. Thailand

- 7.9.2.11. Vietnam

- 7.9.2.12. Rest of APAC

- 8. Latin America Cigar Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Cigar Market Analysis, 2016-2021

- 8.2. Latin America Cigar Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Cigar Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 8.3.1. Latin America Cigar Market Analysis by Product Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 8.3.3. Machine-Made Cigars

- 8.3.4. Handmade/Premium Cigars

- 8.4. Latin America Cigar Market Analysis, Opportunity and Forecast, By Category, 2016-2032

- 8.4.1. Latin America Cigar Market Analysis by Category: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Category, 2016-2032

- 8.4.3. Flavored Cigars

- 8.4.4. Non-Flavored Cigars

- 8.5. Latin America Cigar Market Analysis, Opportunity and Forecast, By Shape, 2016-2032

- 8.5.1. Latin America Cigar Market Analysis by Shape: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Shape, 2016-2032

- 8.5.3. Parejo

- 8.5.4. Figurado

- 8.5.5. Cigarillos

- 8.6. Latin America Cigar Market Analysis, Opportunity and Forecast, By Size, 2016-2032

- 8.6.1. Latin America Cigar Market Analysis by Size: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Size, 2016-2032

- 8.6.3. Small Cigars

- 8.6.4. Large Cigars

- 8.7. Latin America Cigar Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 8.7.1. Latin America Cigar Market Analysis by Distribution Channel: Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 8.7.3. Online Stores

- 8.7.4. Offline Stores

- 8.8. Latin America Cigar Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 8.8.1. Latin America Cigar Market Analysis by End-User: Introduction

- 8.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 8.8.3. Male

- 8.8.4. Female

- 8.9. Latin America Cigar Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.9.1. Latin America Cigar Market Analysis by Country : Introduction

- 8.9.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.9.2.1. Brazil

- 8.9.2.2. Colombia

- 8.9.2.3. Chile

- 8.9.2.4. Argentina

- 8.9.2.5. Costa Rica

- 8.9.2.6. Rest of Latin America

- 9. Middle East & Africa Cigar Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Cigar Market Analysis, 2016-2021

- 9.2. Middle East & Africa Cigar Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Cigar Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 9.3.1. Middle East & Africa Cigar Market Analysis by Product Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 9.3.3. Machine-Made Cigars

- 9.3.4. Handmade/Premium Cigars

- 9.4. Middle East & Africa Cigar Market Analysis, Opportunity and Forecast, By Category, 2016-2032

- 9.4.1. Middle East & Africa Cigar Market Analysis by Category: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Category, 2016-2032

- 9.4.3. Flavored Cigars

- 9.4.4. Non-Flavored Cigars

- 9.5. Middle East & Africa Cigar Market Analysis, Opportunity and Forecast, By Shape, 2016-2032

- 9.5.1. Middle East & Africa Cigar Market Analysis by Shape: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Shape, 2016-2032

- 9.5.3. Parejo

- 9.5.4. Figurado

- 9.5.5. Cigarillos

- 9.6. Middle East & Africa Cigar Market Analysis, Opportunity and Forecast, By Size, 2016-2032

- 9.6.1. Middle East & Africa Cigar Market Analysis by Size: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Size, 2016-2032

- 9.6.3. Small Cigars

- 9.6.4. Large Cigars

- 9.7. Middle East & Africa Cigar Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 9.7.1. Middle East & Africa Cigar Market Analysis by Distribution Channel: Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 9.7.3. Online Stores

- 9.7.4. Offline Stores

- 9.8. Middle East & Africa Cigar Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 9.8.1. Middle East & Africa Cigar Market Analysis by End-User: Introduction

- 9.8.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 9.8.3. Male

- 9.8.4. Female

- 9.9. Middle East & Africa Cigar Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.9.1. Middle East & Africa Cigar Market Analysis by Country : Introduction

- 9.9.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.9.2.1. Algeria

- 9.9.2.2. Egypt

- 9.9.2.3. Israel

- 9.9.2.4. Kuwait

- 9.9.2.5. Nigeria

- 9.9.2.6. Saudi Arabia

- 9.9.2.7. South Africa

- 9.9.2.8. Turkey

- 9.9.2.9. The UAE

- 9.9.2.10. Rest of MEA

- 10. Global Cigar Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Cigar Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Cigar Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Scandinavian Tobacco Group A/S

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Swisher International, Inc.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Imperial Brands plc

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Altadis S.A.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Habanos S.A.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Drew Estate LLC

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Oettinger Davidoff AG

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. General Cigar Company Inc.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Gurkha Cigar Group, Inc.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Rocky Patel Premium Cigars, Inc.

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. J.C. Newman Cigar Company

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Davidoff of Geneva USA, Inc.

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Imperial Tobacco Group

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Swedish Match AB

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Cigar Market Revenue (US$ Mn) Market Share by Product Type in 2022

- Figure 2: Global Cigar Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 3: Global Cigar Market Revenue (US$ Mn) Market Share by Categoryin 2022

- Figure 4: Global Cigar Market Attractiveness Analysis by Category, 2016-2032

- Figure 5: Global Cigar Market Revenue (US$ Mn) Market Share by Shapein 2022

- Figure 6: Global Cigar Market Attractiveness Analysis by Shape, 2016-2032

- Figure 7: Global Cigar Market Revenue (US$ Mn) Market Share by Sizein 2022

- Figure 8: Global Cigar Market Attractiveness Analysis by Size, 2016-2032

- Figure 9: Global Cigar Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 10: Global Cigar Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 11: Global Cigar Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 12: Global Cigar Market Attractiveness Analysis by End-User, 2016-2032

- Figure 13: Global Cigar Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 14: Global Cigar Market Attractiveness Analysis by Region, 2016-2032

- Figure 15: Global Cigar Market Revenue (US$ Mn) (2016-2032)

- Figure 16: Global Cigar Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 17: Global Cigar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 18: Global Cigar Market Revenue (US$ Mn) Comparison by Category (2016-2032)

- Figure 19: Global Cigar Market Revenue (US$ Mn) Comparison by Shape (2016-2032)

- Figure 20: Global Cigar Market Revenue (US$ Mn) Comparison by Size (2016-2032)

- Figure 21: Global Cigar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 22: Global Cigar Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 23: Global Cigar Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 24: Global Cigar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 25: Global Cigar Market Y-o-Y Growth Rate Comparison by Category (2016-2032)

- Figure 26: Global Cigar Market Y-o-Y Growth Rate Comparison by Shape (2016-2032)

- Figure 27: Global Cigar Market Y-o-Y Growth Rate Comparison by Size (2016-2032)

- Figure 28: Global Cigar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 29: Global Cigar Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 30: Global Cigar Market Share Comparison by Region (2016-2032)

- Figure 31: Global Cigar Market Share Comparison by Product Type (2016-2032)

- Figure 32: Global Cigar Market Share Comparison by Category (2016-2032)

- Figure 33: Global Cigar Market Share Comparison by Shape (2016-2032)

- Figure 34: Global Cigar Market Share Comparison by Size (2016-2032)

- Figure 35: Global Cigar Market Share Comparison by Distribution Channel (2016-2032)

- Figure 36: Global Cigar Market Share Comparison by End-User (2016-2032)

- Figure 37: North America Cigar Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 38: North America Cigar Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 39: North America Cigar Market Revenue (US$ Mn) Market Share by Categoryin 2022

- Figure 40: North America Cigar Market Attractiveness Analysis by Category, 2016-2032

- Figure 41: North America Cigar Market Revenue (US$ Mn) Market Share by Shapein 2022

- Figure 42: North America Cigar Market Attractiveness Analysis by Shape, 2016-2032

- Figure 43: North America Cigar Market Revenue (US$ Mn) Market Share by Sizein 2022

- Figure 44: North America Cigar Market Attractiveness Analysis by Size, 2016-2032

- Figure 45: North America Cigar Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 46: North America Cigar Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 47: North America Cigar Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 48: North America Cigar Market Attractiveness Analysis by End-User, 2016-2032

- Figure 49: North America Cigar Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: North America Cigar Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: North America Cigar Market Revenue (US$ Mn) (2016-2032)

- Figure 52: North America Cigar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: North America Cigar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 54: North America Cigar Market Revenue (US$ Mn) Comparison by Category (2016-2032)

- Figure 55: North America Cigar Market Revenue (US$ Mn) Comparison by Shape (2016-2032)

- Figure 56: North America Cigar Market Revenue (US$ Mn) Comparison by Size (2016-2032)

- Figure 57: North America Cigar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 58: North America Cigar Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 59: North America Cigar Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: North America Cigar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 61: North America Cigar Market Y-o-Y Growth Rate Comparison by Category (2016-2032)

- Figure 62: North America Cigar Market Y-o-Y Growth Rate Comparison by Shape (2016-2032)

- Figure 63: North America Cigar Market Y-o-Y Growth Rate Comparison by Size (2016-2032)

- Figure 64: North America Cigar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 65: North America Cigar Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 66: North America Cigar Market Share Comparison by Country (2016-2032)

- Figure 67: North America Cigar Market Share Comparison by Product Type (2016-2032)

- Figure 68: North America Cigar Market Share Comparison by Category (2016-2032)

- Figure 69: North America Cigar Market Share Comparison by Shape (2016-2032)

- Figure 70: North America Cigar Market Share Comparison by Size (2016-2032)

- Figure 71: North America Cigar Market Share Comparison by Distribution Channel (2016-2032)

- Figure 72: North America Cigar Market Share Comparison by End-User (2016-2032)

- Figure 73: Western Europe Cigar Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 74: Western Europe Cigar Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 75: Western Europe Cigar Market Revenue (US$ Mn) Market Share by Categoryin 2022

- Figure 76: Western Europe Cigar Market Attractiveness Analysis by Category, 2016-2032

- Figure 77: Western Europe Cigar Market Revenue (US$ Mn) Market Share by Shapein 2022

- Figure 78: Western Europe Cigar Market Attractiveness Analysis by Shape, 2016-2032

- Figure 79: Western Europe Cigar Market Revenue (US$ Mn) Market Share by Sizein 2022

- Figure 80: Western Europe Cigar Market Attractiveness Analysis by Size, 2016-2032

- Figure 81: Western Europe Cigar Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 82: Western Europe Cigar Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 83: Western Europe Cigar Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 84: Western Europe Cigar Market Attractiveness Analysis by End-User, 2016-2032

- Figure 85: Western Europe Cigar Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Western Europe Cigar Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Western Europe Cigar Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Western Europe Cigar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Western Europe Cigar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 90: Western Europe Cigar Market Revenue (US$ Mn) Comparison by Category (2016-2032)

- Figure 91: Western Europe Cigar Market Revenue (US$ Mn) Comparison by Shape (2016-2032)

- Figure 92: Western Europe Cigar Market Revenue (US$ Mn) Comparison by Size (2016-2032)

- Figure 93: Western Europe Cigar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 94: Western Europe Cigar Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 95: Western Europe Cigar Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 96: Western Europe Cigar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 97: Western Europe Cigar Market Y-o-Y Growth Rate Comparison by Category (2016-2032)

- Figure 98: Western Europe Cigar Market Y-o-Y Growth Rate Comparison by Shape (2016-2032)

- Figure 99: Western Europe Cigar Market Y-o-Y Growth Rate Comparison by Size (2016-2032)

- Figure 100: Western Europe Cigar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 101: Western Europe Cigar Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 102: Western Europe Cigar Market Share Comparison by Country (2016-2032)

- Figure 103: Western Europe Cigar Market Share Comparison by Product Type (2016-2032)

- Figure 104: Western Europe Cigar Market Share Comparison by Category (2016-2032)

- Figure 105: Western Europe Cigar Market Share Comparison by Shape (2016-2032)

- Figure 106: Western Europe Cigar Market Share Comparison by Size (2016-2032)

- Figure 107: Western Europe Cigar Market Share Comparison by Distribution Channel (2016-2032)

- Figure 108: Western Europe Cigar Market Share Comparison by End-User (2016-2032)

- Figure 109: Eastern Europe Cigar Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 110: Eastern Europe Cigar Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 111: Eastern Europe Cigar Market Revenue (US$ Mn) Market Share by Categoryin 2022

- Figure 112: Eastern Europe Cigar Market Attractiveness Analysis by Category, 2016-2032

- Figure 113: Eastern Europe Cigar Market Revenue (US$ Mn) Market Share by Shapein 2022

- Figure 114: Eastern Europe Cigar Market Attractiveness Analysis by Shape, 2016-2032

- Figure 115: Eastern Europe Cigar Market Revenue (US$ Mn) Market Share by Sizein 2022

- Figure 116: Eastern Europe Cigar Market Attractiveness Analysis by Size, 2016-2032

- Figure 117: Eastern Europe Cigar Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 118: Eastern Europe Cigar Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 119: Eastern Europe Cigar Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 120: Eastern Europe Cigar Market Attractiveness Analysis by End-User, 2016-2032

- Figure 121: Eastern Europe Cigar Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 122: Eastern Europe Cigar Market Attractiveness Analysis by Country, 2016-2032

- Figure 123: Eastern Europe Cigar Market Revenue (US$ Mn) (2016-2032)

- Figure 124: Eastern Europe Cigar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 125: Eastern Europe Cigar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 126: Eastern Europe Cigar Market Revenue (US$ Mn) Comparison by Category (2016-2032)

- Figure 127: Eastern Europe Cigar Market Revenue (US$ Mn) Comparison by Shape (2016-2032)

- Figure 128: Eastern Europe Cigar Market Revenue (US$ Mn) Comparison by Size (2016-2032)

- Figure 129: Eastern Europe Cigar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 130: Eastern Europe Cigar Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 131: Eastern Europe Cigar Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 132: Eastern Europe Cigar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 133: Eastern Europe Cigar Market Y-o-Y Growth Rate Comparison by Category (2016-2032)

- Figure 134: Eastern Europe Cigar Market Y-o-Y Growth Rate Comparison by Shape (2016-2032)

- Figure 135: Eastern Europe Cigar Market Y-o-Y Growth Rate Comparison by Size (2016-2032)

- Figure 136: Eastern Europe Cigar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 137: Eastern Europe Cigar Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 138: Eastern Europe Cigar Market Share Comparison by Country (2016-2032)

- Figure 139: Eastern Europe Cigar Market Share Comparison by Product Type (2016-2032)

- Figure 140: Eastern Europe Cigar Market Share Comparison by Category (2016-2032)

- Figure 141: Eastern Europe Cigar Market Share Comparison by Shape (2016-2032)

- Figure 142: Eastern Europe Cigar Market Share Comparison by Size (2016-2032)

- Figure 143: Eastern Europe Cigar Market Share Comparison by Distribution Channel (2016-2032)

- Figure 144: Eastern Europe Cigar Market Share Comparison by End-User (2016-2032)

- Figure 145: APAC Cigar Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 146: APAC Cigar Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 147: APAC Cigar Market Revenue (US$ Mn) Market Share by Categoryin 2022

- Figure 148: APAC Cigar Market Attractiveness Analysis by Category, 2016-2032

- Figure 149: APAC Cigar Market Revenue (US$ Mn) Market Share by Shapein 2022

- Figure 150: APAC Cigar Market Attractiveness Analysis by Shape, 2016-2032

- Figure 151: APAC Cigar Market Revenue (US$ Mn) Market Share by Sizein 2022

- Figure 152: APAC Cigar Market Attractiveness Analysis by Size, 2016-2032

- Figure 153: APAC Cigar Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 154: APAC Cigar Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 155: APAC Cigar Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 156: APAC Cigar Market Attractiveness Analysis by End-User, 2016-2032

- Figure 157: APAC Cigar Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 158: APAC Cigar Market Attractiveness Analysis by Country, 2016-2032

- Figure 159: APAC Cigar Market Revenue (US$ Mn) (2016-2032)

- Figure 160: APAC Cigar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 161: APAC Cigar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 162: APAC Cigar Market Revenue (US$ Mn) Comparison by Category (2016-2032)

- Figure 163: APAC Cigar Market Revenue (US$ Mn) Comparison by Shape (2016-2032)

- Figure 164: APAC Cigar Market Revenue (US$ Mn) Comparison by Size (2016-2032)

- Figure 165: APAC Cigar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 166: APAC Cigar Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 167: APAC Cigar Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 168: APAC Cigar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 169: APAC Cigar Market Y-o-Y Growth Rate Comparison by Category (2016-2032)

- Figure 170: APAC Cigar Market Y-o-Y Growth Rate Comparison by Shape (2016-2032)

- Figure 171: APAC Cigar Market Y-o-Y Growth Rate Comparison by Size (2016-2032)

- Figure 172: APAC Cigar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 173: APAC Cigar Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 174: APAC Cigar Market Share Comparison by Country (2016-2032)

- Figure 175: APAC Cigar Market Share Comparison by Product Type (2016-2032)

- Figure 176: APAC Cigar Market Share Comparison by Category (2016-2032)

- Figure 177: APAC Cigar Market Share Comparison by Shape (2016-2032)

- Figure 178: APAC Cigar Market Share Comparison by Size (2016-2032)

- Figure 179: APAC Cigar Market Share Comparison by Distribution Channel (2016-2032)

- Figure 180: APAC Cigar Market Share Comparison by End-User (2016-2032)

- Figure 181: Latin America Cigar Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 182: Latin America Cigar Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 183: Latin America Cigar Market Revenue (US$ Mn) Market Share by Categoryin 2022

- Figure 184: Latin America Cigar Market Attractiveness Analysis by Category, 2016-2032

- Figure 185: Latin America Cigar Market Revenue (US$ Mn) Market Share by Shapein 2022

- Figure 186: Latin America Cigar Market Attractiveness Analysis by Shape, 2016-2032

- Figure 187: Latin America Cigar Market Revenue (US$ Mn) Market Share by Sizein 2022

- Figure 188: Latin America Cigar Market Attractiveness Analysis by Size, 2016-2032

- Figure 189: Latin America Cigar Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 190: Latin America Cigar Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 191: Latin America Cigar Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 192: Latin America Cigar Market Attractiveness Analysis by End-User, 2016-2032

- Figure 193: Latin America Cigar Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 194: Latin America Cigar Market Attractiveness Analysis by Country, 2016-2032

- Figure 195: Latin America Cigar Market Revenue (US$ Mn) (2016-2032)

- Figure 196: Latin America Cigar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 197: Latin America Cigar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 198: Latin America Cigar Market Revenue (US$ Mn) Comparison by Category (2016-2032)

- Figure 199: Latin America Cigar Market Revenue (US$ Mn) Comparison by Shape (2016-2032)

- Figure 200: Latin America Cigar Market Revenue (US$ Mn) Comparison by Size (2016-2032)

- Figure 201: Latin America Cigar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 202: Latin America Cigar Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 203: Latin America Cigar Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 204: Latin America Cigar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 205: Latin America Cigar Market Y-o-Y Growth Rate Comparison by Category (2016-2032)

- Figure 206: Latin America Cigar Market Y-o-Y Growth Rate Comparison by Shape (2016-2032)

- Figure 207: Latin America Cigar Market Y-o-Y Growth Rate Comparison by Size (2016-2032)

- Figure 208: Latin America Cigar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 209: Latin America Cigar Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 210: Latin America Cigar Market Share Comparison by Country (2016-2032)

- Figure 211: Latin America Cigar Market Share Comparison by Product Type (2016-2032)

- Figure 212: Latin America Cigar Market Share Comparison by Category (2016-2032)

- Figure 213: Latin America Cigar Market Share Comparison by Shape (2016-2032)

- Figure 214: Latin America Cigar Market Share Comparison by Size (2016-2032)

- Figure 215: Latin America Cigar Market Share Comparison by Distribution Channel (2016-2032)

- Figure 216: Latin America Cigar Market Share Comparison by End-User (2016-2032)

- Figure 217: Middle East & Africa Cigar Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 218: Middle East & Africa Cigar Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 219: Middle East & Africa Cigar Market Revenue (US$ Mn) Market Share by Categoryin 2022

- Figure 220: Middle East & Africa Cigar Market Attractiveness Analysis by Category, 2016-2032

- Figure 221: Middle East & Africa Cigar Market Revenue (US$ Mn) Market Share by Shapein 2022

- Figure 222: Middle East & Africa Cigar Market Attractiveness Analysis by Shape, 2016-2032

- Figure 223: Middle East & Africa Cigar Market Revenue (US$ Mn) Market Share by Sizein 2022

- Figure 224: Middle East & Africa Cigar Market Attractiveness Analysis by Size, 2016-2032

- Figure 225: Middle East & Africa Cigar Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 226: Middle East & Africa Cigar Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 227: Middle East & Africa Cigar Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 228: Middle East & Africa Cigar Market Attractiveness Analysis by End-User, 2016-2032

- Figure 229: Middle East & Africa Cigar Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 230: Middle East & Africa Cigar Market Attractiveness Analysis by Country, 2016-2032

- Figure 231: Middle East & Africa Cigar Market Revenue (US$ Mn) (2016-2032)

- Figure 232: Middle East & Africa Cigar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 233: Middle East & Africa Cigar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 234: Middle East & Africa Cigar Market Revenue (US$ Mn) Comparison by Category (2016-2032)

- Figure 235: Middle East & Africa Cigar Market Revenue (US$ Mn) Comparison by Shape (2016-2032)

- Figure 236: Middle East & Africa Cigar Market Revenue (US$ Mn) Comparison by Size (2016-2032)

- Figure 237: Middle East & Africa Cigar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 238: Middle East & Africa Cigar Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 239: Middle East & Africa Cigar Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 240: Middle East & Africa Cigar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 241: Middle East & Africa Cigar Market Y-o-Y Growth Rate Comparison by Category (2016-2032)

- Figure 242: Middle East & Africa Cigar Market Y-o-Y Growth Rate Comparison by Shape (2016-2032)

- Figure 243: Middle East & Africa Cigar Market Y-o-Y Growth Rate Comparison by Size (2016-2032)

- Figure 244: Middle East & Africa Cigar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 245: Middle East & Africa Cigar Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 246: Middle East & Africa Cigar Market Share Comparison by Country (2016-2032)

- Figure 247: Middle East & Africa Cigar Market Share Comparison by Product Type (2016-2032)

- Figure 248: Middle East & Africa Cigar Market Share Comparison by Category (2016-2032)

- Figure 249: Middle East & Africa Cigar Market Share Comparison by Shape (2016-2032)

- Figure 250: Middle East & Africa Cigar Market Share Comparison by Size (2016-2032)

- Figure 251: Middle East & Africa Cigar Market Share Comparison by Distribution Channel (2016-2032)

- Figure 252: Middle East & Africa Cigar Market Share Comparison by End-User (2016-2032)

"

- List of Tables

- "

- Table 1: Global Cigar Market Comparison by Product Type (2016-2032)

- Table 2: Global Cigar Market Comparison by Category (2016-2032)

- Table 3: Global Cigar Market Comparison by Shape (2016-2032)

- Table 4: Global Cigar Market Comparison by Size (2016-2032)

- Table 5: Global Cigar Market Comparison by Distribution Channel (2016-2032)

- Table 6: Global Cigar Market Comparison by End-User (2016-2032)

- Table 7: Global Cigar Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 8: Global Cigar Market Revenue (US$ Mn) (2016-2032)

- Table 9: Global Cigar Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 10: Global Cigar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 11: Global Cigar Market Revenue (US$ Mn) Comparison by Category (2016-2032)

- Table 12: Global Cigar Market Revenue (US$ Mn) Comparison by Shape (2016-2032)

- Table 13: Global Cigar Market Revenue (US$ Mn) Comparison by Size (2016-2032)

- Table 14: Global Cigar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Table 15: Global Cigar Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Table 16: Global Cigar Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 17: Global Cigar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 18: Global Cigar Market Y-o-Y Growth Rate Comparison by Category (2016-2032)

- Table 19: Global Cigar Market Y-o-Y Growth Rate Comparison by Shape (2016-2032)

- Table 20: Global Cigar Market Y-o-Y Growth Rate Comparison by Size (2016-2032)

- Table 21: Global Cigar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Table 22: Global Cigar Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Table 23: Global Cigar Market Share Comparison by Region (2016-2032)

- Table 24: Global Cigar Market Share Comparison by Product Type (2016-2032)

- Table 25: Global Cigar Market Share Comparison by Category (2016-2032)

- Table 26: Global Cigar Market Share Comparison by Shape (2016-2032)

- Table 27: Global Cigar Market Share Comparison by Size (2016-2032)

- Table 28: Global Cigar Market Share Comparison by Distribution Channel (2016-2032)

- Table 29: Global Cigar Market Share Comparison by End-User (2016-2032)

- Table 30: North America Cigar Market Comparison by Category (2016-2032)

- Table 31: North America Cigar Market Comparison by Shape (2016-2032)

- Table 32: North America Cigar Market Comparison by Size (2016-2032)

- Table 33: North America Cigar Market Comparison by Distribution Channel (2016-2032)

- Table 34: North America Cigar Market Comparison by End-User (2016-2032)

- Table 35: North America Cigar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 36: North America Cigar Market Revenue (US$ Mn) (2016-2032)