Global Seasonal Chocolates Market By Chocolate Type:(Dark, Milk, White), By Fillings:(Filled seasonal chocolates, Unfilled seasonal chocolates), By Distribution Channel:(Non-Store Based, Store-Based) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

7661

-

May 2023

-

190

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

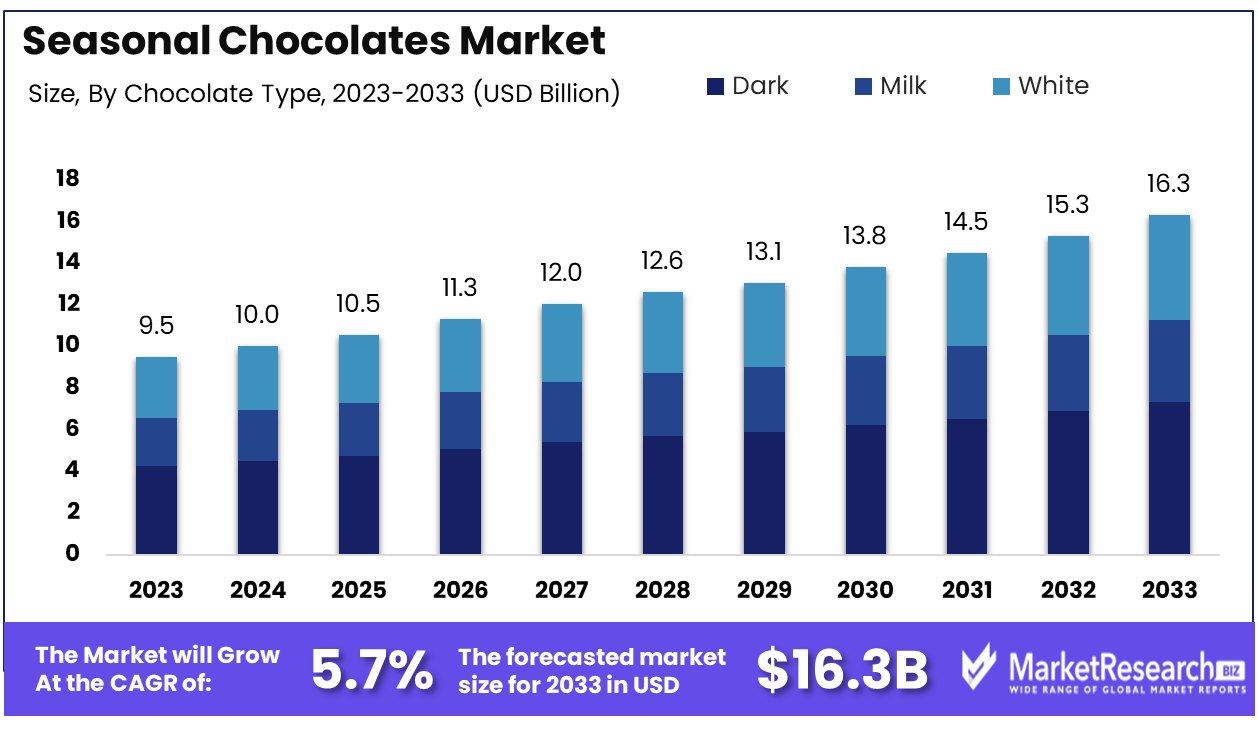

The global Seasonal Chocolates Market was valued at USD 9.5 Billion in 2023, It is expected to reach USD 16.3 billion by 2033, with a CAGR of 5.7% during the forecast period from 2024 to 2033.

Driving factors

Festive Traditions: Catalyst for Seasonal Demand

Festive traditions play a pivotal role in shaping the Seasonal Chocolates Market, serving as a primary catalyst for the significant spikes in demand observed during key holiday periods. These traditions, deeply ingrained in cultural and societal norms, drive consumer behavior toward the purchase of themed chocolate products as gifts and celebratory items. For instance, during Christmas, it is estimated that over 50% of annual chocolate sales in many Western countries are realized, underscoring the profound impact of festive traditions on market dynamics. The creation of limited-edition and holiday-specific products by manufacturers taps into the consumer desire to partake in these traditions, thereby fueling sales growth and market expansion.

Health Concerns: Influencing Product Innovation

Health concerns among consumers have increasingly influenced the Seasonal Chocolates Market, prompting a shift towards healthier options and ingredient transparency. This trend is not just a minor shift but a substantial market driver, as evidenced by the growing demand for chocolates with reduced sugar, no artificial additives, and enhanced nutritional profiles. Manufacturers are responding by innovating their product lines to include dark chocolate variants, which are rich in antioxidants, and options catering to dietary restrictions such as gluten-free or sugar-free. This adaptation not only meets the health-centric demands of consumers but also expands the market to include a wider audience, ultimately contributing to growth. The sales of such health-conscious options have seen a double-digit growth rate annually, indicating a significant impact on the overall market.

High Demand for Organic and Vegan Chocolates: Expanding Market Segments

The surge in demand for organic and vegan chocolates represents a transformative trend within the Seasonal Chocolates Market. This demand is driven by a combination of health concerns, ethical considerations regarding animal welfare, and environmental sustainability. Organic chocolates, made from ingredients grown without synthetic pesticides or fertilizers, and vegan chocolates, which exclude all animal products, are increasingly popular. They cater not only to specific dietary preferences but also to a broader consumer base seeking premium, ethically produced goods. The market for organic chocolates alone has witnessed an impressive growth rate of over 20% in recent years, demonstrating the significant potential for expansion within this niche segment. By aligning product offerings with these values, companies are tapping into new consumer segments and driving market growth.

Restraining Factors

Fluctuating Raw Material Prices: A Volatile Foundation

The Seasonal Chocolates Market is significantly impacted by the fluctuation of raw material prices, particularly cocoa, sugar, and dairy products, which constitute the core ingredients of chocolate. The volatility in these prices can be attributed to a variety of factors including climatic changes, political instability in producing countries, and variations in global demand. For instance, cocoa prices can see substantial fluctuations; a report by the International Cocoa Organization highlighted a range where prices oscillated by over 10% within a single growing season. These fluctuations pose a challenge to chocolate manufacturers by increasing production costs and reducing profit margins, which in turn can lead to higher retail prices for seasonal chocolates. This volatility makes it difficult for companies to maintain consistent pricing strategies, potentially dampening consumer demand during key seasonal peaks.

Manufacturing Costs: The Price of Quality

In addition to raw material costs, the Seasonal Chocolates Market faces challenges from the high costs associated with manufacturing. Seasonal chocolates often require intricate designs, special packaging, and limited-edition flavors, all of which contribute to higher production costs. These increased costs can reduce the market's overall profitability, especially if companies are unable to pass these costs onto consumers without affecting demand. High manufacturing costs also limit the ability of smaller players to compete effectively in the market, potentially reducing the diversity of offerings available to consumers. The balance between maintaining quality and managing production costs is a critical challenge for manufacturers, impacting the growth potential of the seasonal chocolate sector.

Adulteration: Eroding Consumer Trust

Adulteration, the practice of adding inferior materials or removing superior quality ingredients from chocolate products, poses a significant threat to the integrity and growth of the Seasonal Chocolates Market. This issue is not only a health concern but also erodes consumer trust in chocolate brands. Instances of adulteration can lead to public health scares, damaging the reputation of involved companies and the industry at large. The impact of such practices can be far-reaching, leading to increased regulatory scrutiny and consumer skepticism. Maintaining consumer trust is paramount for the growth of the seasonal chocolate market, especially as consumers become more health-conscious and demand higher transparency and quality in their food products. Addressing adulteration and ensuring product integrity is thus crucial for sustaining market growth and consumer confidence.

By Chocolate Type Analysis

The dark chocolate segment experienced a robust growth trajectory, driven by increasing consumer awareness of health benefits associated with high cocoa content, such as improved heart health and antioxidant properties. Market research indicates that the demand for dark chocolate in seasonal offerings saw an uptick, with consumers leaning towards more sophisticated, bitter flavors and health-conscious choices. This segment capitalized on trends towards organic and vegan options, with manufacturers expanding their seasonal product lines to include premium dark chocolate varieties. The appeal of dark chocolate in the seasonal market is further bolstered by its perception as a luxury product, making it a popular choice for gift-giving during holidays.

Milk chocolate maintained its position as the most popular choice among consumers in the Seasonal Chocolates Market in 2023, attributed to its creamy texture and balanced sweetness. This segment thrived on traditional consumer preferences, with seasonal variations featuring nuts, caramel, and fruit infusions to enhance the festive appeal. Despite facing competition from the growing dark chocolate segment, milk chocolate's versatility and widespread acceptance ensured its continued dominance in seasonal sales. However, manufacturers in this segment also navigated challenges related to fluctuating dairy prices, impacting production costs and necessitating strategic pricing approaches to retain market share.

The white chocolate segment, often considered a niche within the broader market, saw a steady increase in consumer interest in 2023, particularly during seasonal peaks. Its unique flavor profile and creamy texture appealed to those seeking an alternative to cocoa-rich products. Seasonal offerings in the white chocolate segment leveraged innovative combinations, such as incorporating spices or contrasting flavors, to attract attention during festive periods. While this segment represents a smaller portion of the market compared to milk and dark chocolate, its growth reflects a broader trend toward diversification and experimentation in consumer tastes.

By Fillings Analysis

Filled seasonal chocolates emerged as a dynamic segment, characterized by their innovation and variety, which significantly appealed to consumers seeking unique and luxurious taste experiences. These chocolates, often infused with a range of fillings such as gourmet caramel, fruit creams, liqueurs, and exotic spices, catered to a growing consumer demand for sophisticated flavor profiles and textures. The allure of filled chocolates was particularly strong during the holiday seasons, when the desire for premium, gift-worthy products surged. Manufacturers leveraged this trend by introducing limited-edition filled chocolates that incorporated seasonal themes and ingredients, effectively tapping into the festive spirit. This segment's growth was further propelled by the rise in artisanal and craft chocolate makers entering the market, who differentiated their offerings through quality ingredients and innovative filling combinations, thus driving consumer interest and premium pricing opportunities.

On the other hand, the unfilled seasonal chocolate segment continued to hold a substantial market share, driven by the timeless appeal of pure, unadulterated chocolate in its classic forms. This segment benefited from a consumer base that appreciated the simplicity and rich flavors of solid chocolate bars, discs, and shapes without the addition of fillings. Unfilled seasonal chocolates remained popular for their versatility and broad appeal, serving as a staple in holiday celebrations and gift exchanges. Manufacturers in this segment focused on quality and purity, highlighting the origin of the cocoa beans and the craftsmanship involved in the chocolate-making process. Despite the simplicity, innovation was still present through the introduction of unique cocoa blends, single-origin chocolates, and variations in cocoa content to cater to both traditionalists and adventurous chocolate enthusiasts.

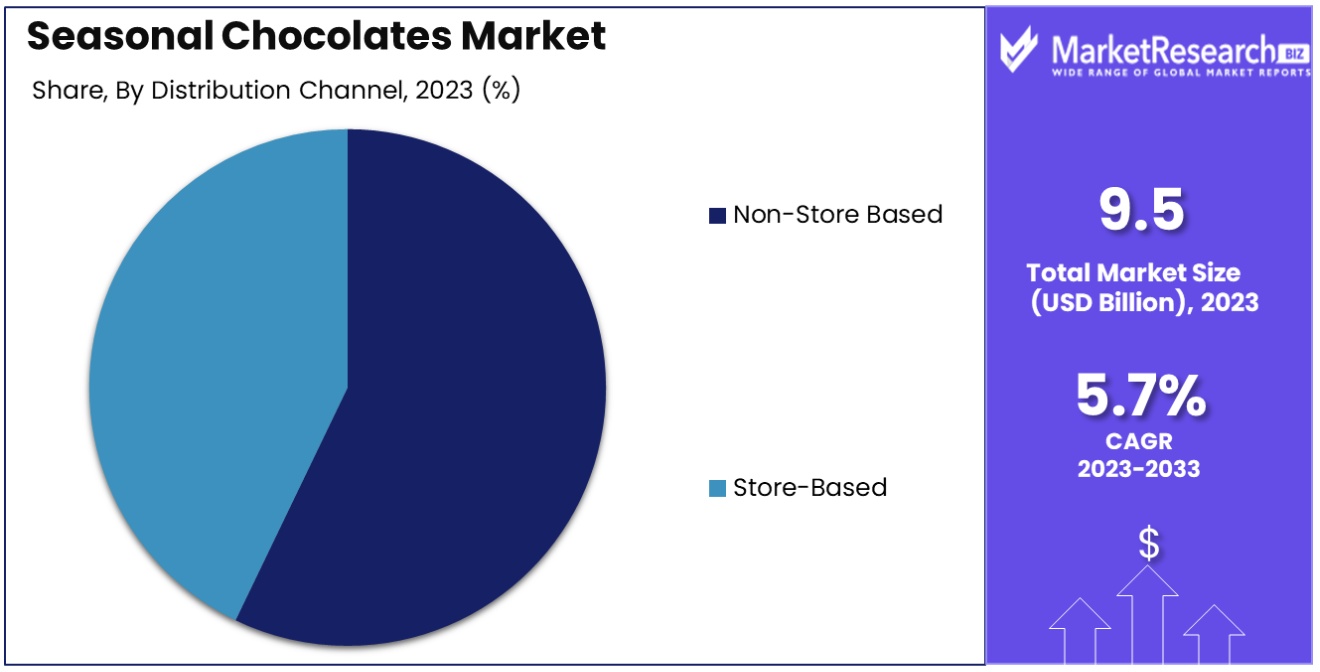

By Distribution Channel Analysis

The non-store-based segment experienced substantial growth in 2023, driven by the increasing consumer preference for online shopping and the convenience it offers. This segment includes e-commerce platforms, direct-to-consumer sales, and social media marketplaces, which have become vital for reaching consumers who prefer shopping from the comfort of their homes.

The rise of digital marketing strategies and targeted advertising has further propelled the growth of this segment, enabling chocolate manufacturers and retailers to engage directly with consumers during key seasonal periods. The non-store-based channel also facilitated the expansion of the market's reach, allowing smaller artisanal brands to compete alongside established players by leveraging online platforms to showcase their unique seasonal offerings. This segment's growth reflects a broader trend toward digital transformation within the retail sector, emphasizing the importance of an online presence in capturing consumer interest and driving sales.

Despite the surge in online shopping, the store-based segment maintained a significant share of the Seasonal Chocolates Market in 2023. This segment encompasses traditional retail outlets such as supermarkets, hypermarkets, specialty stores, and convenience stores. The physical presence of these outlets offers consumers the advantage of immediate product access and the tactile experience of selecting chocolates, which is particularly appealing during seasonal shopping periods when consumers seek to personally select gifts or indulge in impulse purchases.

Store-based retailers capitalized on this by creating visually appealing displays and offering exclusive in-store promotions to attract foot traffic and enhance the shopping experience during the holiday seasons. The tactile and sensory appeal of in-store shopping, coupled with the immediacy of purchase, ensured the continued relevance and vitality of the store-based segment within the Seasonal Chocolates Market.

Key Market Segments

By Chocolate Type:

- Dark

- Milk

- White

By Fillings:

- Filled seasonal chocolates

- Unfilled seasonal chocolates

By Distribution Channel:

- Non-Store Based

- Store-Based

Growth Opportunity

Innovation Drives Market Expansion:

The thrust toward innovative product offerings, especially those incorporating unique flavors, textures, and packaging, is significantly broadening the market's appeal. This trend not only captures the imagination of consumers but also taps into the growing demand for novel culinary experiences. According to market research, products that blend traditional and exotic flavors are witnessing a surge, with a projected growth rate of 7.5% in the seasonal segment over the next five years.

Personalization Enhances Consumer Engagement:

Personalization has emerged as a key driver in forging deeper connections with consumers. The ability to customize chocolates for specific occasions and preferences is elevating the consumer experience, thereby fostering loyalty and repeat purchases. This trend is particularly strong among millennials and Gen Z consumers, who value individuality and personal touches in their purchases. Market analysts predict that personalized seasonal chocolates could see an uplift in sales by up to 10% annually.

Premiumization Elevates Market Value:

The shift towards premium, artisanal, and ethically sourced chocolates is significantly enhancing the market's value proposition. Consumers are increasingly willing to pay a premium for chocolates that offer superior quality, unique origin stories, and sustainable credentials. This premiumization trend is contributing to an average price increase of 5-8% across the seasonal chocolate market, aligning with the growing consumer emphasis on quality over quantity.

Latest Trends

Technology Integration Fuels Market Advancements:

The integration of advanced technologies within the seasonal chocolate production and distribution processes marks a transformative trend. Digitalization, including AI-driven consumer analytics, blockchain for traceability, and automation in manufacturing, is enhancing operational efficiency and product customization capabilities. This technological leap is facilitating a more responsive supply chain, capable of adapting to seasonal demands with greater agility. Market analysis indicates that technology adoption could lead to a reduction in production costs by up to 15%, while simultaneously enhancing product personalization, thereby stimulating a growth projection of approximately 8-12% in market reach over the next three years.

Cocoa Prices: An Indirect Influence on Market Dynamics:

The volatility of cocoa prices remains a significant indirect factor impacting the seasonal chocolate market. Fluctuations in cocoa prices can affect profit margins and pricing strategies for chocolate manufacturers. In 2023, an anticipated 5% increase in cocoa prices due to climatic conditions and geopolitical tensions in key producing regions is expected to compel manufacturers to innovate in cost management and sourcing strategies. This scenario necessitates a strategic balance between maintaining product quality and managing retail price points to sustain consumer demand, particularly in premium segments.

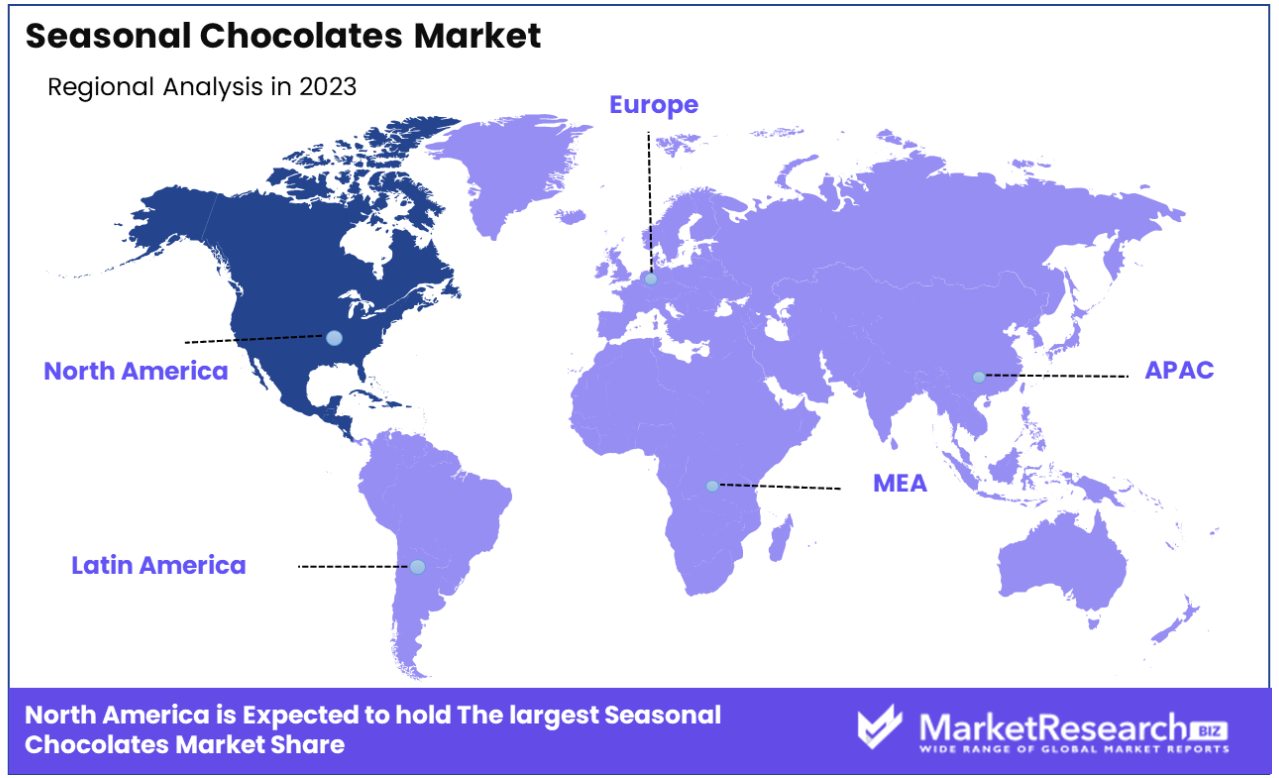

Regional Analysis

In North America, the market dominance is evident, capturing a substantial share of 37%.

This dominance is driven by a strong tradition of holiday celebrations, particularly during Christmas and Halloween, which fuel robust demand for seasonal chocolates. The region also benefits from a high disposable income and a penchant for premium chocolate products, leading to a thriving market landscape. Statistically, the annual growth rate of the seasonal chocolates market in North America is projected to be around 5.3%, reflecting sustained consumer interest and market expansion.

Europe emerges as another key player in the seasonal chocolate market, characterized by a rich history of chocolate consumption and a diverse array of cultural festivals and traditions. The region accounts for a significant portion of global sales, with countries such as Switzerland, Belgium, and Germany renowned for their chocolate craftsmanship and heritage. The annual growth rate in Europe is estimated to be approximately 4.8%, driven by a combination of traditional chocolate markets and emerging trends towards premiumization and health-conscious consumption.

In contrast, the Asia Pacific region showcases a rapidly growing market for seasonal chocolates, fueled by increasing disposable incomes, urbanization, and Western influences. Emerging economies such as China, India, and Japan are witnessing a surge in demand for seasonal chocolates, particularly during festivals such as Chinese New Year and Valentine's Day. The market in Asia Pacific is projected to grow at an annual rate of 6.2%, driven by changing consumer preferences and the expansion of chocolate confectionery segments.

Meanwhile, the Middle East & Africa and Latin America regions exhibit untapped potential in the seasonal chocolates market, with growing consumer awareness and evolving retail landscapes driving demand. While these regions account for smaller shares of global sales, they present lucrative opportunities for market players to expand their presence and cater to diverse consumer preferences. With strategic investments in product innovation, distribution channels, and marketing strategies, these regions hold promise for future growth and market penetration in the seasonal chocolates segment.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global chocolate market is dominated by a select group of renowned companies renowned for their quality and innovation. Chocoladefabriken Lindt & Sprüngli AG, with its Swiss heritage and commitment to excellence, offers a luxurious range of seasonal chocolates that captivate consumers worldwide. Ferrero SpA, known for its iconic brands like Ferrero Rocher and Kinder, leverages its diverse portfolio to create irresistible seasonal offerings that drive consumer engagement and loyalty. Mars, Incorporated, with its extensive range of beloved brands such as M&M's and Snickers, excels in the seasonal chocolates market with themed packaging and limited-edition flavors that entice consumers during festive periods.

Mondelez International, the parent company of popular brands like Cadbury and Toblerone, is a key player in the seasonal chocolate market, leveraging its iconic products and strategic marketing to maintain a strong presence during holidays. GODIVA Chocolatier, synonymous with luxury and indulgence, offers premium seasonal collections that delight discerning consumers seeking refined chocolate experiences. The Hershey Company, a stalwart in the American chocolate industry, captivates consumers with seasonal favorites like Hershey's Kisses and Reese's, leveraging its wide distribution network and beloved brands to drive sales during festive seasons.

Smaller players like Anna Banana's Homemade Goodness, Phillips Chocolate, and Gilbert Chocolates contribute to the seasonal chocolates market with their artisanal offerings, crafted with passion and attention to detail. These boutique chocolatiers offer unique and distinctive seasonal creations that appeal to consumers seeking authentic and handcrafted chocolate experiences. Despite the dominance of larger companies, these artisanal chocolatiers add diversity and creativity to the seasonal chocolate market, enriching consumer choices and experiences during holidays and special occasions.

Seasonal Chocolates Industry Key Players

- Chocoladefabriken Lindt & Sprüngli AG

- Ferrero SpA

- Mars, Incorporated

- Mondelez International,

- GODIVA Chocolatier

- The Hershey Company

- Anna Banana's Homemade Goodness

- Phillips Chocolate

- Gilbert Chocolates

- Blue Frog Chocolates

Recent Development

- In December 2023, Mars China advances its commitment to sustainable packaging with the launch of the SNICKERS® bar featuring dark chocolate cereal. The innovative product showcases low-sugar, low-GI content, and individual packaging made from easily recyclable mono-polypropylene material. This aligns with Mars China's "Designed For Recycling" concept, contributing to a healthier planet.

- In November 2023, Milma, Kerala's dairy cooperative, expanded with premium dark chocolate (Deliza brand), milk chocolate, and innovative biscuits. Aligned with 'Repositioning Milma 2023,' the move targets health-conscious consumers, marking a strategic milestone in the dairy market.

Report Scope

Report Features Description Market Value (2023) USD 9.5 Billion Forecast Revenue (2033) USD 16.3 billion CAGR (2024-2032) 5.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Chocolate Type:(Dark, Milk, White), By Fillings:(Filled seasonal chocolates, Unfilled seasonal chocolates), By Distribution Channel:(Non-Store Based, Store-Based) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Chocoladefabriken Lindt & Sprüngli AG, Ferrero SpA, Mars, Incorporated, Mondelez International,, GODIVA Chocolatier, The Hershey Company, Anna Banana's Homemade Goodness, Phillips Chocolate, Gilbert Chocolates, Blue Frog Chocolates Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Chocoladefabriken Lindt & Sprüngli AG

- Ferrero SpA

- Mars, Incorporated

- Mondelez International,

- GODIVA Chocolatier

- The Hershey Company

- Anna Banana's Homemade Goodness

- Phillips Chocolate

- Gilbert Chocolates

- Blue Frog Chocolates