Cell Based Assays Market Report By Type (Reporter Gene Assays, Cell Proliferation Assays, Cell Viability Assays, Cytotoxicity Assays, Cell Migration and Invasion Assays, Apoptosis Assays, Toxicity Assays, Others), By Application (Drug Discovery and Development, Cancer Research, Toxicology Testing, Basic Research, Regenerative Medicine, Personalized Medicine, Others), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

49612

-

Feb 2025

-

325

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

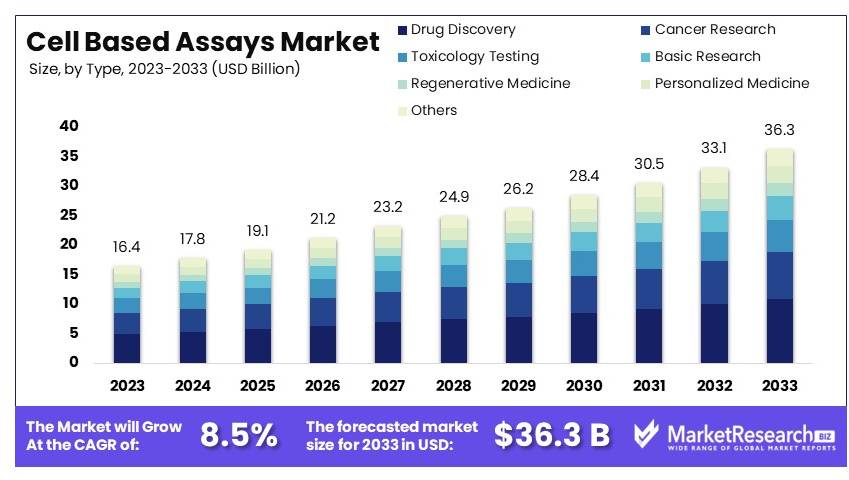

The Global Cell Based Assays Market size is expected to be worth around USD 36.3 Billion by 2033, from USD 16.4 Billion in 2023, growing at a CAGR of 8.5% during the forecast period from 2024 to 2033.

The cell based assays market focuses on products and services used to conduct research and testing in life sciences. These assays are crucial for drug discovery, toxicity testing, and biological research. Key drivers include the rising demand for personalized medicine, increasing pharmaceutical R&D activities, and advancements in biotechnology.

The market is segmented by product type, application, end-user, and region. Innovations in high-throughput screening and automation are shaping market trends. Major players invest in developing robust and reproducible assays to meet the growing demand for precise and reliable data in scientific research.

The cell-based assays market is experiencing significant growth, driven by advancements in drug discovery and development. These assays are essential for high-throughput screening (HTS) of large compound libraries to identify potential drug candidates. For example, the National Cancer Institute uses a panel of 60 human cancer cell lines to screen new compounds, highlighting the role of cell-based assays in identifying anti-cancer properties. This widespread use in pharmaceutical and biotechnology companies underscores their critical importance in the drug development pipeline.

Technological innovations have enhanced the accuracy and efficiency of cell-based assays. These improvements allow for more precise measurement of cellular responses, which is crucial in early-stage drug development. Additionally, the integration of automation and robotics in HTS processes has accelerated the pace of drug discovery, making cell-based assays even more valuable.

The market is also benefiting from increased investment in research and development by pharmaceutical companies. As the demand for new and effective therapies rises, the need for reliable and efficient screening methods like cell-based assays grows. This trend is further supported by the rising prevalence of chronic diseases and the continuous search for novel therapeutic solutions.

Despite the positive outlook, the market faces challenges such as high costs associated with advanced assay technologies and the need for skilled personnel to operate complex equipment. Addressing these challenges is essential for sustained growth.

The cell-based assays market is poised for continued expansion. The role of these assays in drug discovery, coupled with technological advancements and increased R&D investment, drives market growth. Companies that can innovate and optimize these processes are likely to thrive in this dynamic market.

Key Takeaways

- Market Value: The Cell Based Assays Market was valued at USD 16.4 billion in 2023 and is expected to reach USD 36.3 billion by 2033, with a CAGR of 8.5%.

- By Type Analysis: Reporter Gene Assays dominated with 30%; crucial for their role in monitoring gene expression and cellular responses.

- By Application Analysis: Drug Discovery and Development dominated with 40%; vital due to its extensive use in pharmaceutical research and development.

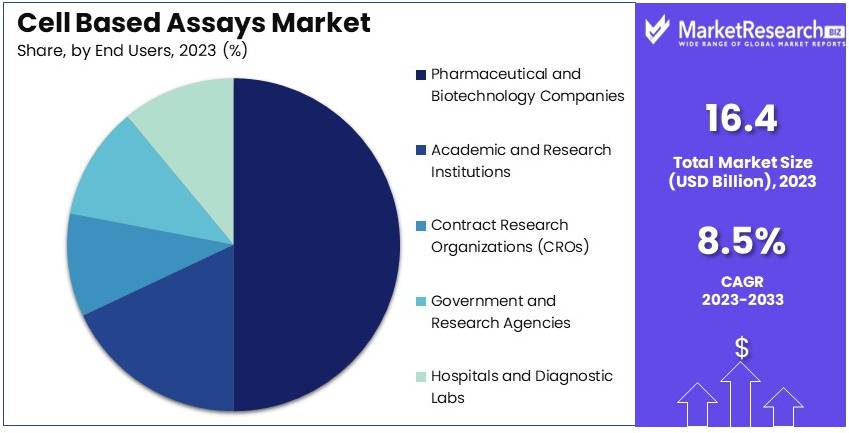

- By End-User Analysis: Pharmaceutical and Biotechnology Companies dominated with 50%; indicating their substantial investment in cell-based assay technologies.

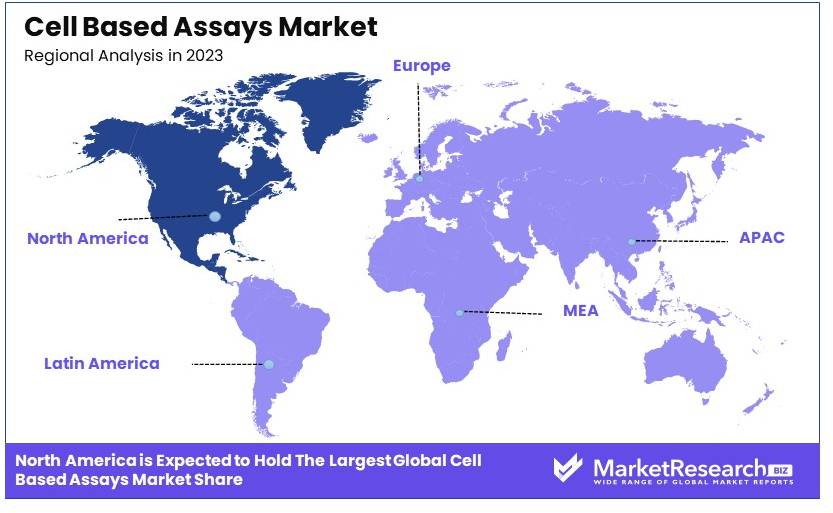

- Dominant Region: North America 45%; driven by robust research infrastructure and high investment in biotechnology.

- High Growth Region: Asia-Pacific; expected to grow due to increasing R&D activities and expanding pharmaceutical industry.

- Analyst Viewpoint: The market is highly competitive with continuous innovations in assay technologies. Future growth will be driven by advancements in personalized medicine and biotechnology research.

- Growth Opportunities: Companies can leverage advancements in high-throughput screening and automation technologies to enhance assay efficiency and accuracy.

Driving Factors

Increasing Drug Discovery and Development Activities Drive Market Growth

The pharmaceutical industry's growing focus on developing new therapeutics is fueling the demand for cell-based assays. These assays are crucial in early-stage drug discovery services, allowing researchers to assess drug efficacy and toxicity in a more physiologically relevant context compared to biochemical assays.

For example, companies like Promega Corporation offer cell-based assays that can measure multiple parameters simultaneously. This capability enables more efficient and cost-effective drug screening processes. The demand for new drugs drives the need for reliable and effective testing methods, making cell-based assays essential.

This increasing drug discovery activity enhances the overall market for cell-based assays, as more pharmaceutical companies invest in these technologies to streamline their development processes and bring new drugs to market faster.

Rising Prevalence of Chronic Diseases Drives Market Growth

The global increase in chronic diseases such as cancer, cardiovascular disorders, and neurological conditions is driving the need for more effective treatments. Cell-based assays play a vital role in understanding disease mechanisms and identifying potential therapeutic targets.

For instance, the use of patient-derived cell lines in oncology research allows for personalized drug screening. This approach helps identify the most effective treatments for individual cancer patients. As the prevalence of chronic diseases rises, the demand for cell-based assays in research and drug development grows.

The focus on developing targeted therapies and personalized medicine further boosts the market, as researchers rely on cell-based assays to develop and test new treatments.

Advancements in Cell Biology and Imaging Technologies Drive Market Growth

Technological progress in areas such as cell culture, high-content screening, and live-cell imaging is expanding the capabilities and applications of cell-based assays. These advancements enable researchers to obtain more detailed and physiologically relevant data.

For example, Corning Life Sciences offers 3D cell culture platforms that allow for the creation of complex tissue models. These models provide a more accurate representation of in vivo conditions for drug testing and disease modeling. The ability to create more realistic cell environments enhances the reliability and relevance of cell-based assays.

These technological advancements not only improve the quality of data obtained but also broaden the scope of applications for cell-based assays. This continuous innovation drives market growth, as more researchers adopt advanced techniques to enhance their studies.

Restraining Factors

High Costs Associated with Advanced Cell-Based Assays Restrain Market Growth

The high costs associated with developing and implementing advanced cell-based assays significantly restrain market growth. Sophisticated assays involving primary cells, stem cells, or complex 3D models are expensive. These costs limit adoption, especially among smaller research organizations or in regions with constrained research budgets.

For example, using patient-derived organoids in drug screening is highly informative but comes with significant expenses related to sample collection, culture maintenance, and specialized equipment. These financial barriers make it difficult for smaller entities to participate fully in the market, thus slowing overall growth and innovation in the field.

Complexity and Variability of Living Cell Systems Restrain Market Growth

The complexity and variability of living cell systems pose significant challenges to the growth of the cell-based assays market. Standardizing these assays is difficult due to the inherent variability in living cells. Factors such as cell passage number, culture conditions, and environmental changes can affect results, leading to inconsistencies.

In drug discovery, where reproducibility is crucial, these inconsistencies are problematic. For instance, researchers at AstraZeneca have reported difficulties in replicating cell-based assay results across different sites, which necessitates extensive standardization efforts. This need for rigorous standardization increases operational complexity and can delay research progress, thereby restraining market growth.

Type Analysis

Reporter Gene Assays dominate with 30% due to their critical role in understanding gene expression and regulation.

In the Cell Based Assays Market, Reporter Gene Assays lead with a 30% share. These assays are vital for studying gene expression and regulation, making them essential tools in drug discovery and development. They help researchers identify how genes are turned on or off in response to various treatments. The high demand for understanding genetic mechanisms and the development of new therapies drives this segment's growth. Reporter Gene Assays are also crucial in cancer research, where understanding gene expression is key to developing targeted therapies.

Cell Proliferation Assays hold a 20% market share. These assays are used to measure the number of cells growing in response to various stimuli. They are important in cancer research, drug discovery, and regenerative medicine. Cell Proliferation Assays help in screening potential drug candidates and understanding their effects on cell growth, which is crucial for developing effective treatments.

Cell Viability Assays account for 15% of the market. These assays determine the health of cells by measuring the number of live cells in a sample. They are widely used in drug discovery and toxicology testing to assess the safety and efficacy of new compounds. The ability to quickly and accurately measure cell viability is essential for screening large numbers of compounds in the early stages of drug development.

Cytotoxicity Assays, making up 10%, are used to assess the toxicity of substances on cells. These assays are critical in drug development and toxicology testing to ensure that new drugs are safe for human use. Cytotoxicity Assays help identify potential side effects early in the development process, reducing the risk of harmful effects in later stages.

Cell Migration and Invasion Assays hold a 10% share. These assays are important in cancer research and wound healing studies. They help researchers understand how cancer cells spread and how new treatments can inhibit this process. In wound healing, these assays are used to study how cells move and regenerate tissue.

Apoptosis Assays account for 5% of the market. These assays measure programmed cell death, a crucial process in cancer treatment and other diseases. Understanding apoptosis helps in developing therapies that can trigger or prevent cell death in various conditions.

Toxicity Assays also hold 5%. They are used to evaluate the safety of new drugs and chemicals by measuring their effects on cells. These assays are essential for regulatory approval and ensuring that new compounds are safe for human use.

Other assays make up the remaining 5%. This category includes specialized assays used in niche applications and emerging areas of research.

Application Analysis

Drug Discovery and Development dominates with 40% due to the high demand for new therapeutics and precision medicine.

In the Cell Based Assays Market, Drug Discovery and Development lead with a 40% share. This segment is driven by the ongoing need for new drugs and the development of precision medicine. Cell based assays are critical in identifying potential drug candidates and understanding their effects on biological systems. They provide valuable data on the efficacy and safety of new compounds, helping to streamline the drug development process and reduce costs.

Cancer Research holds a 25% market share. The high prevalence of cancer and the need for effective treatments drive this segment. Cell based assays are used to study cancer biology, identify new drug targets, and develop targeted therapies. They help researchers understand how cancer cells grow, spread, and respond to treatments, leading to more effective and personalized therapies.

Toxicology Testing accounts for 15% of the market. This segment is essential for ensuring the safety of new drugs, chemicals, and consumer products. Cell based assays provide reliable data on the toxic effects of substances on cells, helping to identify potential risks early in the development process. This reduces the likelihood of adverse effects in humans and supports regulatory approval.

Basic Research holds a 10% share. Cell based assays are fundamental tools in biological research, helping scientists understand cellular processes and disease mechanisms. They are used in various fields, including genetics, immunology, and neuroscience, providing insights that drive scientific discovery and innovation.

Regenerative Medicine accounts for 5% of the market. This emerging field focuses on repairing or replacing damaged tissues and organs. Cell based assays are used to study stem cells, tissue engineering, and cell-based therapies, supporting the development of new treatments for a wide range of conditions.

Personalized Medicine also holds 5%. This approach tailors medical treatment to individual patients based on their genetic profile and other factors. Cell based assays are crucial in developing personalized therapies and identifying the most effective treatments for each patient.

Other applications make up the remaining 5%. These include niche areas such as environmental testing, food safety, and bioterrorism research, where cell based assays provide valuable data on the biological effects of various substances.

End-User Analysis

Pharmaceutical and Biotechnology Companies dominate with 50% due to their significant investment in drug discovery and development.

In the Cell Based Assays Market, Pharmaceutical and Biotechnology Companies lead with a 50% share. These companies invest heavily in drug discovery and development, driving the demand for cell based assays. They use these assays to screen potential drug candidates, study disease mechanisms, and evaluate the safety and efficacy of new compounds. The ongoing need for new and effective therapies ensures steady demand from this segment.

Academic and Research Institutions hold a 25% market share. These institutions use cell based assays for basic research and to advance scientific knowledge. They study cellular processes, disease mechanisms, and potential therapeutic targets, providing valuable insights that support drug discovery and development. The focus on scientific discovery and innovation drives demand from this segment.

Contract Research Organizations (CROs) account for 15% of the market. CROs provide outsourced research services to pharmaceutical and biotechnology companies. They use cell based assays to support drug development, offering expertise and resources that help companies accelerate their research and development efforts. The growing trend towards outsourcing in the pharmaceutical industry drives demand from this segment.

Government and Research Agencies hold a 5% share. These agencies fund and conduct research to advance public health and scientific knowledge. They use cell based assays to study diseases, develop new treatments, and ensure the safety of drugs and chemicals. The focus on public health and safety drives demand from this segment.

Hospitals and Diagnostic Labs make up the remaining 5%. These institutions use cell based assays for diagnostic purposes and to develop new diagnostic tests. They study cellular responses to diseases and treatments, providing valuable data that support clinical decision-making and patient care.

Key Market Segments

By Type

- Reporter Gene Assays

- Cell Proliferation Assays

- Cell Viability Assays

- Cytotoxicity Assays

- Cell Migration and Invasion Assays

- Apoptosis Assays

- Toxicity Assays

- Others

By Application

- Drug Discovery and Development

- Cancer Research

- Toxicology Testing

- Basic Research

- Regenerative Medicine

- Personalized Medicine

- Others

By End-User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutions

- Contract Research Organizations (CROs)

- Government and Research Agencies

- Hospitals and Diagnostic Labs

Growth Opportunities

Integration of Artificial Intelligence and Machine Learning Offers Growth Opportunity

The incorporation of AI and machine learning in cell-based assay analysis presents a significant growth opportunity. These technologies can enhance data interpretation, predict cellular responses, and optimize experimental design, leading to more efficient and cost-effective drug discovery processes.

For instance, companies like Recursion Pharmaceuticals are using AI to analyze high-content screening data from cell-based assays, accelerating the identification of potential drug candidates. By integrating AI and machine learning, the cell-based assays market can improve research efficiency, reduce costs, and expedite the drug discovery process, driving market growth.

Development of Organ-on-a-Chip Technology Offers Growth Opportunity

The advancement of organ-on-a-chip platforms offers a unique opportunity to create more physiologically relevant models for drug testing and disease modeling. These microfluidic devices can mimic the structure and function of human organs, providing a bridge between traditional cell culture and animal studies.

For example, Emulate Bio's Organ-Chips are being used by pharmaceutical companies to better predict human responses to drugs, potentially reducing the need for animal testing and improving the success rate of clinical trials. By developing and utilizing organ-on-a-chip technology, the cell-based assays market can enhance drug testing accuracy, reduce research costs, and increase the likelihood of successful clinical trials, fostering market growth.

Trending Factors

Adoption of 3D Cell Culture Models Are Trending Factors

There's a growing trend towards using 3D cell culture models instead of traditional 2D cultures. These models better mimic the in vivo cellular environment, providing more physiologically relevant data for drug discovery and toxicity testing.

Companies like InSphero are at the forefront of this trend, offering 3D microtissues for various applications in drug discovery and safety testing. By adopting 3D cell culture models, researchers can improve the accuracy and relevance of their studies, leading to more effective drug development processes and driving market trends in cell-based assays.

Increased Use of Patient-Derived Cells and Organoids Are Trending Factors

The trend towards personalized medicine is driving the increased use of patient-derived cells and organoids in drug screening and disease modeling. These models offer a more accurate representation of individual patient responses to treatments.

For example, the HUB Organoid Technology spin-off from Utrecht University has developed a biobank of patient-derived organoids used for personalized drug screening in cancer and other diseases. By using patient-derived cells and organoids, researchers can develop more targeted therapies, enhance treatment efficacy, and drive market trends towards personalized medicine in cell-based assays.

Regional Analysis

North America Dominates with 45% Market Share in the Cell Based Assays Market

North America holds a significant 45% share of the global cell based assays market, driven by robust pharmaceutical research and development activities. The region's strong infrastructure for biotechnology and significant investments in drug discovery enhance its market position. Additionally, collaborations between academic institutions and biopharmaceutical companies facilitate the rapid adoption of advanced cell based assays technologies.

The cell based assays market in North America benefits from the presence of major pharmaceutical and biotech companies focused on innovation in drug discovery. High healthcare spending and a stringent regulatory framework support rigorous research standards, further boosting the market. The prevalence of chronic diseases in the region also increases the demand for novel therapeutic drugs, driving the need for cell based assays in research and development.

The future impact of North America in the cell based assays market is expected to grow, with continued advancements in biotechnology and an increasing focus on personalized medicine. Ongoing investments in healthcare technology and the expansion of research capabilities are likely to sustain North America's leading position. Moreover, the trend towards automation and high-throughput screening methods in laboratories will facilitate quicker and more efficient drug development processes.

Regional Market Share and Growth Statistics

- Europe: Europe accounts for 30% of the market, propelled by its strong emphasis on research and innovation in pharmaceutical and biotechnology sectors.

- Asia Pacific: Holding 20% of the market, Asia Pacific shows rapid growth due to increasing investments in healthcare infrastructure and a rising number of research outsourcing activities to countries like India and China.

- Middle East & Africa: This region captures a smaller share of 3%, but is slowly growing with the development of healthcare facilities and rising government initiatives in research and development.

- Latin America: Representing 2% of the market, Latin America is gradually advancing with improvements in healthcare systems and a growing focus on research and pharmaceutical development.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Thermo Fisher Scientific, Inc. and Merck KGaA are leading players in the cell based assays market, known for their extensive product offerings and technological advancements. Danaher Corporation and Becton, Dickinson and Company provide comprehensive assay solutions, enhancing their market positions. PerkinElmer, Inc. and Promega Corporation offer specialized assays, catering to diverse research needs.

Lonza Group and Bio-Rad Laboratories, Inc. are recognized for their high-quality assay products, strengthening their market influence. Corning Incorporated and Cell Signaling Technology, Inc. bring innovative solutions to the market, driving growth. DiscoverX Corporation and Charles River Laboratories provide reliable assay services, enhancing their competitive edge. Abcam plc, Cisbio Bioassays, and Enzo Life Sciences, Inc. focus on specific assay applications, contributing to their strong market presence.

These companies leverage advanced technologies, diverse product lines, and strong research capabilities to lead the cell based assays market. Their commitment to innovation and quality ensures continued market influence and growth.

Market Key Players

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Danaher Corporation

- Becton, Dickinson and Company

- PerkinElmer, Inc.

- Promega Corporation

- Lonza Group

- Bio-Rad Laboratories, Inc.

- Corning Incorporated

- Cell Signaling Technology, Inc.

- DiscoverX Corporation

- Charles River Laboratories

- Abcam plc

- Cisbio Bioassays

- Enzo Life Sciences, Inc.

Recent Developments

- May 2023: Sartorius released a free ebook exploring the use of CRISPR applications and single-cell sequencing for drug discovery. These advanced techniques enable precise genetic modifications and detailed cellular analyses, facilitating the identification of novel drug targets and therapeutic strategies. This innovation is expected to significantly enhance the efficiency and accuracy of drug discovery processes.

Report Scope

Report Features Description Market Value (2023) USD 16.4 Billion Forecast Revenue (2033) USD 36.3 Billion CAGR (2024-2033) 8.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Reporter Gene Assays, Cell Proliferation Assays, Cell Viability Assays, Cytotoxicity Assays, Cell Migration and Invasion Assays, Apoptosis Assays, Toxicity Assays, Others), By Application (Drug Discovery and Development, Cancer Research, Toxicology Testing, Basic Research, Regenerative Medicine, Personalized Medicine, Others), By End-User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutions, Contract Research Organizations (CROs), Government and Research Agencies, Hospitals and Diagnostic Labs) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., Merck KGaA, Danaher Corporation, Becton, Dickinson and Company, PerkinElmer, Inc., Promega Corporation, Lonza Group, Bio-Rad Laboratories, Inc., Corning Incorporated, Cell Signaling Technology, Inc., DiscoverX Corporation, Charles River Laboratories, Abcam plc, Cisbio Bioassays, Enzo Life Sciences, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Cell Based Assays Market Overview

- 2.1. Cell Based Assays Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Cell Based Assays Market Dynamics

- 3. Global Cell Based Assays Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Cell Based Assays Market Analysis, 2016-2021

- 3.2. Global Cell Based Assays Market Opportunity and Forecast, 2023-2032

- 3.3. Global Cell Based Assays Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 3.3.1. Global Cell Based Assays Market Analysis by Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 3.3.3. Reporter Gene Assays

- 3.3.4. Cell Proliferation Assays

- 3.3.5. Cell Viability Assays

- 3.3.6. Cytotoxicity Assays

- 3.3.7. Cell Migration and Invasion Assays

- 3.3.8. Apoptosis Assays

- 3.3.9. Toxicity Assays

- 3.3.10. Others

- 3.4. Global Cell Based Assays Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 3.4.1. Global Cell Based Assays Market Analysis by Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 3.4.3. Drug Discovery and Development

- 3.4.4. Cancer Research

- 3.4.5. Toxicology Testing

- 3.4.6. Basic Research

- 3.4.7. Regenerative Medicine

- 3.4.8. Personalized Medicine

- 3.4.9. Others

- 3.5. Global Cell Based Assays Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 3.5.1. Global Cell Based Assays Market Analysis by End-User: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 3.5.3. Pharmaceutical and Biotechnology Companies

- 3.5.4. Academic and Research Institutions

- 3.5.5. Contract Research Organizations (CROs)

- 3.5.6. Government and Research Agencies

- 3.5.7. Hospitals and Diagnostic Labs

- 4. North America Cell Based Assays Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Cell Based Assays Market Analysis, 2016-2021

- 4.2. North America Cell Based Assays Market Opportunity and Forecast, 2023-2032

- 4.3. North America Cell Based Assays Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 4.3.1. North America Cell Based Assays Market Analysis by Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 4.3.3. Reporter Gene Assays

- 4.3.4. Cell Proliferation Assays

- 4.3.5. Cell Viability Assays

- 4.3.6. Cytotoxicity Assays

- 4.3.7. Cell Migration and Invasion Assays

- 4.3.8. Apoptosis Assays

- 4.3.9. Toxicity Assays

- 4.3.10. Others

- 4.4. North America Cell Based Assays Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 4.4.1. North America Cell Based Assays Market Analysis by Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 4.4.3. Drug Discovery and Development

- 4.4.4. Cancer Research

- 4.4.5. Toxicology Testing

- 4.4.6. Basic Research

- 4.4.7. Regenerative Medicine

- 4.4.8. Personalized Medicine

- 4.4.9. Others

- 4.5. North America Cell Based Assays Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 4.5.1. North America Cell Based Assays Market Analysis by End-User: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 4.5.3. Pharmaceutical and Biotechnology Companies

- 4.5.4. Academic and Research Institutions

- 4.5.5. Contract Research Organizations (CROs)

- 4.5.6. Government and Research Agencies

- 4.5.7. Hospitals and Diagnostic Labs

- 4.6. North America Cell Based Assays Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Cell Based Assays Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Cell Based Assays Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Cell Based Assays Market Analysis, 2016-2021

- 5.2. Western Europe Cell Based Assays Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Cell Based Assays Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 5.3.1. Western Europe Cell Based Assays Market Analysis by Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 5.3.3. Reporter Gene Assays

- 5.3.4. Cell Proliferation Assays

- 5.3.5. Cell Viability Assays

- 5.3.6. Cytotoxicity Assays

- 5.3.7. Cell Migration and Invasion Assays

- 5.3.8. Apoptosis Assays

- 5.3.9. Toxicity Assays

- 5.3.10. Others

- 5.4. Western Europe Cell Based Assays Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 5.4.1. Western Europe Cell Based Assays Market Analysis by Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 5.4.3. Drug Discovery and Development

- 5.4.4. Cancer Research

- 5.4.5. Toxicology Testing

- 5.4.6. Basic Research

- 5.4.7. Regenerative Medicine

- 5.4.8. Personalized Medicine

- 5.4.9. Others

- 5.5. Western Europe Cell Based Assays Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 5.5.1. Western Europe Cell Based Assays Market Analysis by End-User: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 5.5.3. Pharmaceutical and Biotechnology Companies

- 5.5.4. Academic and Research Institutions

- 5.5.5. Contract Research Organizations (CROs)

- 5.5.6. Government and Research Agencies

- 5.5.7. Hospitals and Diagnostic Labs

- 5.6. Western Europe Cell Based Assays Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Cell Based Assays Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Cell Based Assays Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Cell Based Assays Market Analysis, 2016-2021

- 6.2. Eastern Europe Cell Based Assays Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Cell Based Assays Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 6.3.1. Eastern Europe Cell Based Assays Market Analysis by Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 6.3.3. Reporter Gene Assays

- 6.3.4. Cell Proliferation Assays

- 6.3.5. Cell Viability Assays

- 6.3.6. Cytotoxicity Assays

- 6.3.7. Cell Migration and Invasion Assays

- 6.3.8. Apoptosis Assays

- 6.3.9. Toxicity Assays

- 6.3.10. Others

- 6.4. Eastern Europe Cell Based Assays Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 6.4.1. Eastern Europe Cell Based Assays Market Analysis by Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 6.4.3. Drug Discovery and Development

- 6.4.4. Cancer Research

- 6.4.5. Toxicology Testing

- 6.4.6. Basic Research

- 6.4.7. Regenerative Medicine

- 6.4.8. Personalized Medicine

- 6.4.9. Others

- 6.5. Eastern Europe Cell Based Assays Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 6.5.1. Eastern Europe Cell Based Assays Market Analysis by End-User: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 6.5.3. Pharmaceutical and Biotechnology Companies

- 6.5.4. Academic and Research Institutions

- 6.5.5. Contract Research Organizations (CROs)

- 6.5.6. Government and Research Agencies

- 6.5.7. Hospitals and Diagnostic Labs

- 6.6. Eastern Europe Cell Based Assays Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Cell Based Assays Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Cell Based Assays Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Cell Based Assays Market Analysis, 2016-2021

- 7.2. APAC Cell Based Assays Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Cell Based Assays Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 7.3.1. APAC Cell Based Assays Market Analysis by Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 7.3.3. Reporter Gene Assays

- 7.3.4. Cell Proliferation Assays

- 7.3.5. Cell Viability Assays

- 7.3.6. Cytotoxicity Assays

- 7.3.7. Cell Migration and Invasion Assays

- 7.3.8. Apoptosis Assays

- 7.3.9. Toxicity Assays

- 7.3.10. Others

- 7.4. APAC Cell Based Assays Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 7.4.1. APAC Cell Based Assays Market Analysis by Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 7.4.3. Drug Discovery and Development

- 7.4.4. Cancer Research

- 7.4.5. Toxicology Testing

- 7.4.6. Basic Research

- 7.4.7. Regenerative Medicine

- 7.4.8. Personalized Medicine

- 7.4.9. Others

- 7.5. APAC Cell Based Assays Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 7.5.1. APAC Cell Based Assays Market Analysis by End-User: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 7.5.3. Pharmaceutical and Biotechnology Companies

- 7.5.4. Academic and Research Institutions

- 7.5.5. Contract Research Organizations (CROs)

- 7.5.6. Government and Research Agencies

- 7.5.7. Hospitals and Diagnostic Labs

- 7.6. APAC Cell Based Assays Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Cell Based Assays Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Cell Based Assays Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Cell Based Assays Market Analysis, 2016-2021

- 8.2. Latin America Cell Based Assays Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Cell Based Assays Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 8.3.1. Latin America Cell Based Assays Market Analysis by Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 8.3.3. Reporter Gene Assays

- 8.3.4. Cell Proliferation Assays

- 8.3.5. Cell Viability Assays

- 8.3.6. Cytotoxicity Assays

- 8.3.7. Cell Migration and Invasion Assays

- 8.3.8. Apoptosis Assays

- 8.3.9. Toxicity Assays

- 8.3.10. Others

- 8.4. Latin America Cell Based Assays Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 8.4.1. Latin America Cell Based Assays Market Analysis by Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 8.4.3. Drug Discovery and Development

- 8.4.4. Cancer Research

- 8.4.5. Toxicology Testing

- 8.4.6. Basic Research

- 8.4.7. Regenerative Medicine

- 8.4.8. Personalized Medicine

- 8.4.9. Others

- 8.5. Latin America Cell Based Assays Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 8.5.1. Latin America Cell Based Assays Market Analysis by End-User: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 8.5.3. Pharmaceutical and Biotechnology Companies

- 8.5.4. Academic and Research Institutions

- 8.5.5. Contract Research Organizations (CROs)

- 8.5.6. Government and Research Agencies

- 8.5.7. Hospitals and Diagnostic Labs

- 8.6. Latin America Cell Based Assays Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Cell Based Assays Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Cell Based Assays Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Cell Based Assays Market Analysis, 2016-2021

- 9.2. Middle East & Africa Cell Based Assays Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Cell Based Assays Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 9.3.1. Middle East & Africa Cell Based Assays Market Analysis by Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 9.3.3. Reporter Gene Assays

- 9.3.4. Cell Proliferation Assays

- 9.3.5. Cell Viability Assays

- 9.3.6. Cytotoxicity Assays

- 9.3.7. Cell Migration and Invasion Assays

- 9.3.8. Apoptosis Assays

- 9.3.9. Toxicity Assays

- 9.3.10. Others

- 9.4. Middle East & Africa Cell Based Assays Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 9.4.1. Middle East & Africa Cell Based Assays Market Analysis by Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 9.4.3. Drug Discovery and Development

- 9.4.4. Cancer Research

- 9.4.5. Toxicology Testing

- 9.4.6. Basic Research

- 9.4.7. Regenerative Medicine

- 9.4.8. Personalized Medicine

- 9.4.9. Others

- 9.5. Middle East & Africa Cell Based Assays Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 9.5.1. Middle East & Africa Cell Based Assays Market Analysis by End-User: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 9.5.3. Pharmaceutical and Biotechnology Companies

- 9.5.4. Academic and Research Institutions

- 9.5.5. Contract Research Organizations (CROs)

- 9.5.6. Government and Research Agencies

- 9.5.7. Hospitals and Diagnostic Labs

- 9.6. Middle East & Africa Cell Based Assays Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Cell Based Assays Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Cell Based Assays Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Cell Based Assays Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Cell Based Assays Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Thermo Fisher Scientific, Inc.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Merck KGaA

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Danaher Corporation

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Becton, Dickinson and Company

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. PerkinElmer, Inc.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Promega Corporation

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Lonza Group

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Bio-Rad Laboratories, Inc.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Corning Incorporated

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Cell Signaling Technology, Inc.

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. DiscoverX Corporation

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Abcam plc

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Cisbio Bioassays

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Enzo Life Sciences, Inc.

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Cell Based Assays Market Revenue (US$ Mn) Market Share by Type in 2022

- Figure 2: Global Cell Based Assays Market Attractiveness Analysis by Type, 2016-2032

- Figure 3: Global Cell Based Assays Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 4: Global Cell Based Assays Market Attractiveness Analysis by Application, 2016-2032

- Figure 5: Global Cell Based Assays Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 6: Global Cell Based Assays Market Attractiveness Analysis by End-User, 2016-2032

- Figure 7: Global Cell Based Assays Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Cell Based Assays Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Cell Based Assays Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Cell Based Assays Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Cell Based Assays Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 12: Global Cell Based Assays Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 13: Global Cell Based Assays Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 14: Global Cell Based Assays Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Cell Based Assays Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 16: Global Cell Based Assays Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 17: Global Cell Based Assays Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 18: Global Cell Based Assays Market Share Comparison by Region (2016-2032)

- Figure 19: Global Cell Based Assays Market Share Comparison by Type (2016-2032)

- Figure 20: Global Cell Based Assays Market Share Comparison by Application (2016-2032)

- Figure 21: Global Cell Based Assays Market Share Comparison by End-User (2016-2032)

- Figure 22: North America Cell Based Assays Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 23: North America Cell Based Assays Market Attractiveness Analysis by Type, 2016-2032

- Figure 24: North America Cell Based Assays Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 25: North America Cell Based Assays Market Attractiveness Analysis by Application, 2016-2032

- Figure 26: North America Cell Based Assays Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 27: North America Cell Based Assays Market Attractiveness Analysis by End-User, 2016-2032

- Figure 28: North America Cell Based Assays Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Cell Based Assays Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Cell Based Assays Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Cell Based Assays Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 33: North America Cell Based Assays Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 34: North America Cell Based Assays Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 35: North America Cell Based Assays Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Cell Based Assays Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 37: North America Cell Based Assays Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 38: North America Cell Based Assays Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 39: North America Cell Based Assays Market Share Comparison by Country (2016-2032)

- Figure 40: North America Cell Based Assays Market Share Comparison by Type (2016-2032)

- Figure 41: North America Cell Based Assays Market Share Comparison by Application (2016-2032)

- Figure 42: North America Cell Based Assays Market Share Comparison by End-User (2016-2032)

- Figure 43: Western Europe Cell Based Assays Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 44: Western Europe Cell Based Assays Market Attractiveness Analysis by Type, 2016-2032

- Figure 45: Western Europe Cell Based Assays Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 46: Western Europe Cell Based Assays Market Attractiveness Analysis by Application, 2016-2032

- Figure 47: Western Europe Cell Based Assays Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 48: Western Europe Cell Based Assays Market Attractiveness Analysis by End-User, 2016-2032

- Figure 49: Western Europe Cell Based Assays Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Cell Based Assays Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Cell Based Assays Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 54: Western Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 55: Western Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 56: Western Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 58: Western Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 59: Western Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 60: Western Europe Cell Based Assays Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Cell Based Assays Market Share Comparison by Type (2016-2032)

- Figure 62: Western Europe Cell Based Assays Market Share Comparison by Application (2016-2032)

- Figure 63: Western Europe Cell Based Assays Market Share Comparison by End-User (2016-2032)

- Figure 64: Eastern Europe Cell Based Assays Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 65: Eastern Europe Cell Based Assays Market Attractiveness Analysis by Type, 2016-2032

- Figure 66: Eastern Europe Cell Based Assays Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 67: Eastern Europe Cell Based Assays Market Attractiveness Analysis by Application, 2016-2032

- Figure 68: Eastern Europe Cell Based Assays Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 69: Eastern Europe Cell Based Assays Market Attractiveness Analysis by End-User, 2016-2032

- Figure 70: Eastern Europe Cell Based Assays Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Cell Based Assays Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Cell Based Assays Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 75: Eastern Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 76: Eastern Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 77: Eastern Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 79: Eastern Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 80: Eastern Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 81: Eastern Europe Cell Based Assays Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Cell Based Assays Market Share Comparison by Type (2016-2032)

- Figure 83: Eastern Europe Cell Based Assays Market Share Comparison by Application (2016-2032)

- Figure 84: Eastern Europe Cell Based Assays Market Share Comparison by End-User (2016-2032)

- Figure 85: APAC Cell Based Assays Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 86: APAC Cell Based Assays Market Attractiveness Analysis by Type, 2016-2032

- Figure 87: APAC Cell Based Assays Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 88: APAC Cell Based Assays Market Attractiveness Analysis by Application, 2016-2032

- Figure 89: APAC Cell Based Assays Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 90: APAC Cell Based Assays Market Attractiveness Analysis by End-User, 2016-2032

- Figure 91: APAC Cell Based Assays Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Cell Based Assays Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Cell Based Assays Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Cell Based Assays Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 96: APAC Cell Based Assays Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 97: APAC Cell Based Assays Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 98: APAC Cell Based Assays Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Cell Based Assays Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 100: APAC Cell Based Assays Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 101: APAC Cell Based Assays Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 102: APAC Cell Based Assays Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Cell Based Assays Market Share Comparison by Type (2016-2032)

- Figure 104: APAC Cell Based Assays Market Share Comparison by Application (2016-2032)

- Figure 105: APAC Cell Based Assays Market Share Comparison by End-User (2016-2032)

- Figure 106: Latin America Cell Based Assays Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 107: Latin America Cell Based Assays Market Attractiveness Analysis by Type, 2016-2032

- Figure 108: Latin America Cell Based Assays Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 109: Latin America Cell Based Assays Market Attractiveness Analysis by Application, 2016-2032

- Figure 110: Latin America Cell Based Assays Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 111: Latin America Cell Based Assays Market Attractiveness Analysis by End-User, 2016-2032

- Figure 112: Latin America Cell Based Assays Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Cell Based Assays Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Cell Based Assays Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Cell Based Assays Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 117: Latin America Cell Based Assays Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 118: Latin America Cell Based Assays Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 119: Latin America Cell Based Assays Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Cell Based Assays Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 121: Latin America Cell Based Assays Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 122: Latin America Cell Based Assays Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 123: Latin America Cell Based Assays Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Cell Based Assays Market Share Comparison by Type (2016-2032)

- Figure 125: Latin America Cell Based Assays Market Share Comparison by Application (2016-2032)

- Figure 126: Latin America Cell Based Assays Market Share Comparison by End-User (2016-2032)

- Figure 127: Middle East & Africa Cell Based Assays Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 128: Middle East & Africa Cell Based Assays Market Attractiveness Analysis by Type, 2016-2032

- Figure 129: Middle East & Africa Cell Based Assays Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 130: Middle East & Africa Cell Based Assays Market Attractiveness Analysis by Application, 2016-2032

- Figure 131: Middle East & Africa Cell Based Assays Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 132: Middle East & Africa Cell Based Assays Market Attractiveness Analysis by End-User, 2016-2032

- Figure 133: Middle East & Africa Cell Based Assays Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Cell Based Assays Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Cell Based Assays Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Cell Based Assays Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 138: Middle East & Africa Cell Based Assays Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 139: Middle East & Africa Cell Based Assays Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 140: Middle East & Africa Cell Based Assays Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Cell Based Assays Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 142: Middle East & Africa Cell Based Assays Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 143: Middle East & Africa Cell Based Assays Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 144: Middle East & Africa Cell Based Assays Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Cell Based Assays Market Share Comparison by Type (2016-2032)

- Figure 146: Middle East & Africa Cell Based Assays Market Share Comparison by Application (2016-2032)

- Figure 147: Middle East & Africa Cell Based Assays Market Share Comparison by End-User (2016-2032)

"

- List of Tables

- "

- Table 1: Global Cell Based Assays Market Comparison by Type (2016-2032)

- Table 2: Global Cell Based Assays Market Comparison by Application (2016-2032)

- Table 3: Global Cell Based Assays Market Comparison by End-User (2016-2032)

- Table 4: Global Cell Based Assays Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Cell Based Assays Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Cell Based Assays Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Cell Based Assays Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 8: Global Cell Based Assays Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 9: Global Cell Based Assays Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Table 10: Global Cell Based Assays Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Cell Based Assays Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 12: Global Cell Based Assays Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 13: Global Cell Based Assays Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Table 14: Global Cell Based Assays Market Share Comparison by Region (2016-2032)

- Table 15: Global Cell Based Assays Market Share Comparison by Type (2016-2032)

- Table 16: Global Cell Based Assays Market Share Comparison by Application (2016-2032)

- Table 17: Global Cell Based Assays Market Share Comparison by End-User (2016-2032)

- Table 18: North America Cell Based Assays Market Comparison by Application (2016-2032)

- Table 19: North America Cell Based Assays Market Comparison by End-User (2016-2032)

- Table 20: North America Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Cell Based Assays Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Cell Based Assays Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 24: North America Cell Based Assays Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 25: North America Cell Based Assays Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Table 26: North America Cell Based Assays Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Cell Based Assays Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 28: North America Cell Based Assays Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 29: North America Cell Based Assays Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Table 30: North America Cell Based Assays Market Share Comparison by Country (2016-2032)

- Table 31: North America Cell Based Assays Market Share Comparison by Type (2016-2032)

- Table 32: North America Cell Based Assays Market Share Comparison by Application (2016-2032)

- Table 33: North America Cell Based Assays Market Share Comparison by End-User (2016-2032)

- Table 34: Western Europe Cell Based Assays Market Comparison by Type (2016-2032)

- Table 35: Western Europe Cell Based Assays Market Comparison by Application (2016-2032)

- Table 36: Western Europe Cell Based Assays Market Comparison by End-User (2016-2032)

- Table 37: Western Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Cell Based Assays Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 41: Western Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 42: Western Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Table 43: Western Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 45: Western Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 46: Western Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Table 47: Western Europe Cell Based Assays Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Cell Based Assays Market Share Comparison by Type (2016-2032)

- Table 49: Western Europe Cell Based Assays Market Share Comparison by Application (2016-2032)

- Table 50: Western Europe Cell Based Assays Market Share Comparison by End-User (2016-2032)

- Table 51: Eastern Europe Cell Based Assays Market Comparison by Type (2016-2032)

- Table 52: Eastern Europe Cell Based Assays Market Comparison by Application (2016-2032)

- Table 53: Eastern Europe Cell Based Assays Market Comparison by End-User (2016-2032)

- Table 54: Eastern Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Cell Based Assays Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 58: Eastern Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 59: Eastern Europe Cell Based Assays Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Table 60: Eastern Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 62: Eastern Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 63: Eastern Europe Cell Based Assays Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Table 64: Eastern Europe Cell Based Assays Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Cell Based Assays Market Share Comparison by Type (2016-2032)

- Table 66: Eastern Europe Cell Based Assays Market Share Comparison by Application (2016-2032)

- Table 67: Eastern Europe Cell Based Assays Market Share Comparison by End-User (2016-2032)

- Table 68: APAC Cell Based Assays Market Comparison by Type (2016-2032)

- Table 69: APAC Cell Based Assays Market Comparison by Application (2016-2032)

- Table 70: APAC Cell Based Assays Market Comparison by End-User (2016-2032)

- Table 71: APAC Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Cell Based Assays Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Cell Based Assays Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 75: APAC Cell Based Assays Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 76: APAC Cell Based Assays Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Table 77: APAC Cell Based Assays Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Cell Based Assays Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 79: APAC Cell Based Assays Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 80: APAC Cell Based Assays Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Table 81: APAC Cell Based Assays Market Share Comparison by Country (2016-2032)

- Table 82: APAC Cell Based Assays Market Share Comparison by Type (2016-2032)

- Table 83: APAC Cell Based Assays Market Share Comparison by Application (2016-2032)

- Table 84: APAC Cell Based Assays Market Share Comparison by End-User (2016-2032)

- Table 85: Latin America Cell Based Assays Market Comparison by Type (2016-2032)

- Table 86: Latin America Cell Based Assays Market Comparison by Application (2016-2032)

- Table 87: Latin America Cell Based Assays Market Comparison by End-User (2016-2032)

- Table 88: Latin America Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Cell Based Assays Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Cell Based Assays Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 92: Latin America Cell Based Assays Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 93: Latin America Cell Based Assays Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Table 94: Latin America Cell Based Assays Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Cell Based Assays Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 96: Latin America Cell Based Assays Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 97: Latin America Cell Based Assays Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Table 98: Latin America Cell Based Assays Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Cell Based Assays Market Share Comparison by Type (2016-2032)

- Table 100: Latin America Cell Based Assays Market Share Comparison by Application (2016-2032)

- Table 101: Latin America Cell Based Assays Market Share Comparison by End-User (2016-2032)

- Table 102: Middle East & Africa Cell Based Assays Market Comparison by Type (2016-2032)

- Table 103: Middle East & Africa Cell Based Assays Market Comparison by Application (2016-2032)

- Table 104: Middle East & Africa Cell Based Assays Market Comparison by End-User (2016-2032)

- Table 105: Middle East & Africa Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Cell Based Assays Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Cell Based Assays Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Cell Based Assays Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 109: Middle East & Africa Cell Based Assays Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 110: Middle East & Africa Cell Based Assays Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Table 111: Middle East & Africa Cell Based Assays Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Cell Based Assays Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 113: Middle East & Africa Cell Based Assays Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 114: Middle East & Africa Cell Based Assays Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Table 115: Middle East & Africa Cell Based Assays Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Cell Based Assays Market Share Comparison by Type (2016-2032)

- Table 117: Middle East & Africa Cell Based Assays Market Share Comparison by Application (2016-2032)

- Table 118: Middle East & Africa Cell Based Assays Market Share Comparison by End-User (2016-2032)

- 1. Executive Summary

-

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Danaher Corporation

- Becton, Dickinson and Company

- PerkinElmer, Inc.

- Promega Corporation

- Lonza Group

- Bio-Rad Laboratories, Inc.

- Corning Incorporated

- Cell Signaling Technology, Inc.

- DiscoverX Corporation

- Charles River Laboratories

- Abcam plc

- Cisbio Bioassays

- Enzo Life Sciences, Inc