Caramel Market Report By Product Types (Liquid Caramels, Soft Caramels, Hard Caramels, Chewy Caramels, Caramel Toppings/Sauces), By Flavors (Traditional Caramel, Salted Caramel, Chocolate Caramel, Fruit-Flavored Caramel, Coffee/Espresso Caramel), By Distribution Channels (Retail Stores, Online Retailers, Others), By End-Use Applications, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

12162

-

March 2024

-

161

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

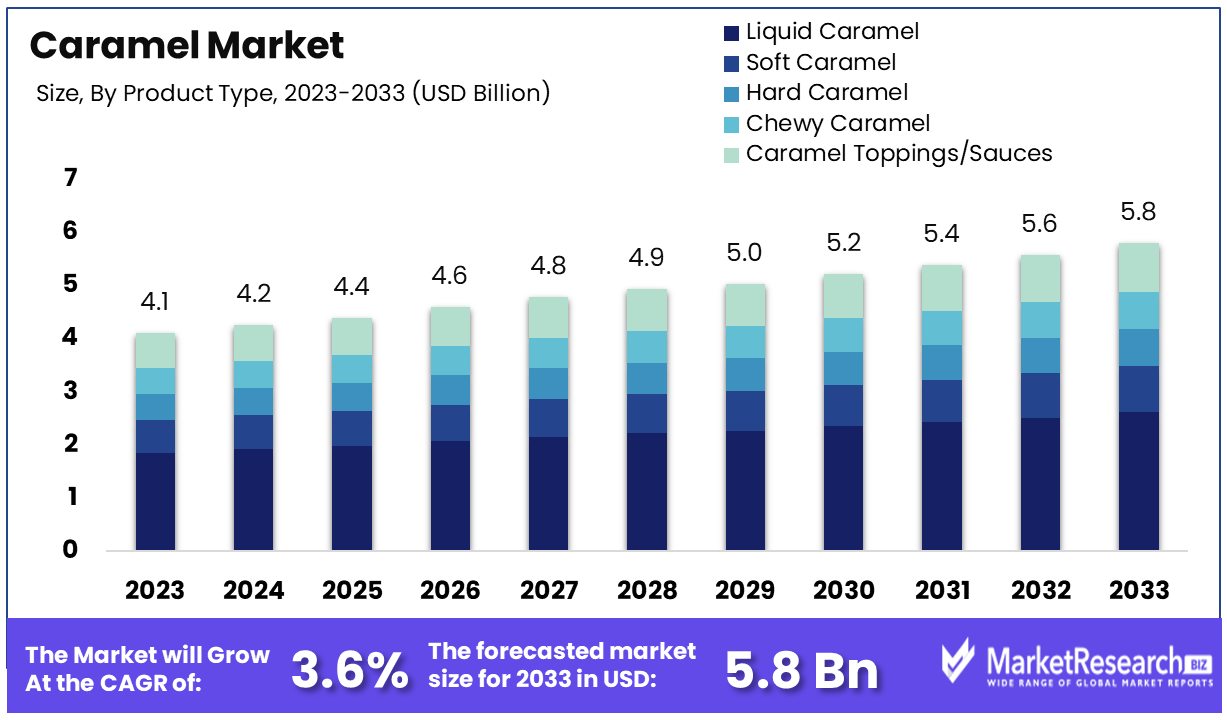

The Global Caramel Market size is expected to be worth around USD 5.8 Billion by 2033, from USD 4.1 Billion in 2023, growing at a CAGR of 3.60% during the forecast period from 2024 to 2033. The surge in demand for the confectionary food items and change in customer preference are some of the main key driving factors for the caramel market.

Caramel is defined as the versatile confectionary ingredient and flavouring agent which is well-known for its rich, sweet taste and golden brown colour. It is designed through the process of heating sugar which is either alone or with other ingredients such as butter or cream to a particular temperature.

As the sugar gets caramelizes, it undergoes a chemical change that result in the characteristic caramel flavour and color. It is made in different types of form that comprises of soft, caramel sauce, chewy candies and hard caramelized sugar for decoration. It is broadly used in deserts like chocolates, cakes, adding sweetness, hint of bitterness and candies.

Moreover, caramel is popular flavouring in beverages such as cocktails, liqueurs and coffee. It can be incorporated into savory dishes to put complexity and balance to sauces and marinades. With such unique taste and versatility, caramel remains a beloved ingredient in cooking creation globally.

According to an article published by foodbev media in March 2023, highlights that Mondelez International owned Cadbury Caramel has launched a new salted caramel flavour that range in the UK. Moreover, the tablet has classic Cadbury chocolate with a smooth caramel centre and widens on the achievement of its small blocks format which costs RRP £1.49.

These salted caramel nibbles highlight a Cadbury milk chocolate that coats around a soft caramel centre that values RRP £1.50 for a sharing bag. Additionally, the salted caramel fingers witness an extra of salted caramel to the old chocolate and biscuit confections that costs RRP £1.85.

Caramel has a great importance that acts as a mere sweetener to versatile culinary enhancers. The richness in caramel adds more complex flavour profiles to both sweet and savory dishes that augments the whole gastronomic experience.

Moreover, the chefs are using caramel in new ways such as in the sauces, beverages and savory dishes to get an ideal blend of the sweetness and depth. This dynamic ingredient has become a central part in the modern cuisine and rise above its conventional role that inspires the chefs to push the boundaries of trying different types of flavours. The demand for the caramel will increase due to its requirement in the confectionary food items and in the food & beverages industry that will help in market expansion in the coming years.

Key Takeaways

- Market Value Projection: The Global Caramel Market is anticipated to reach around USD 5.8 Billion by 2033, marking growth from USD 4.1 Billion in 2023, with a CAGR of 3.60% during the forecast period from 2024 to 2033.

- Major Segments:

- Product Types: Liquid Caramels lead as the dominant sub-segment due to their versatility, capturing a significant market share. Other segments like Soft Caramels, Hard Caramels, Chewy Caramels, and Caramel Toppings/Sauces contribute diversely to the market.

- Flavors: Traditional Caramel remains a cornerstone flavor, while emerging flavors like Salted Caramel, Chocolate Caramel, and Others introduce contemporary twists, catering to evolving consumer preferences.

- Distribution Channels: Online Retailers emerge as the dominant distribution channel, reflecting changing consumer behaviors driven by convenience and variety. Retail Stores, Specialty Stores, Supermarkets/Hypermarkets, and Convenience Stores complement online platforms, creating a comprehensive market ecosystem.

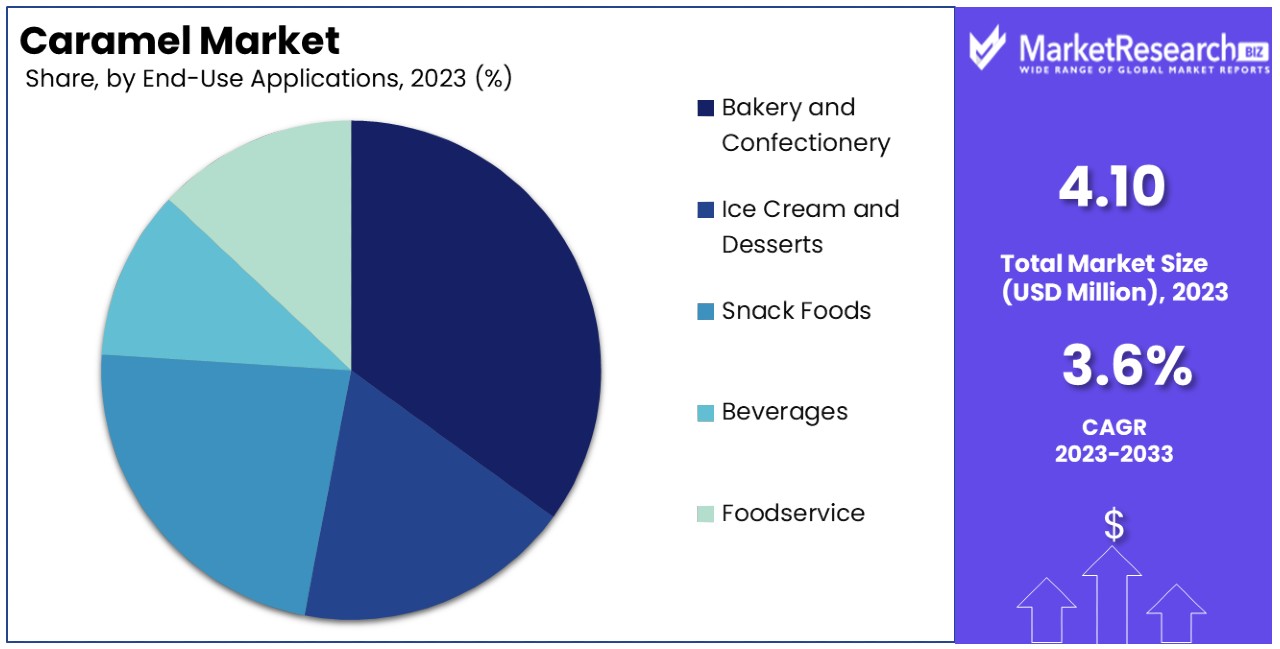

- End-Use Applications: Bakery and Confectionery lead as the dominant end-use application, driven by caramel's versatility and flavor enhancement capabilities. Ice Cream and Desserts, Snack Foods, Beverages, and Foodservice sectors contribute to market diversification.

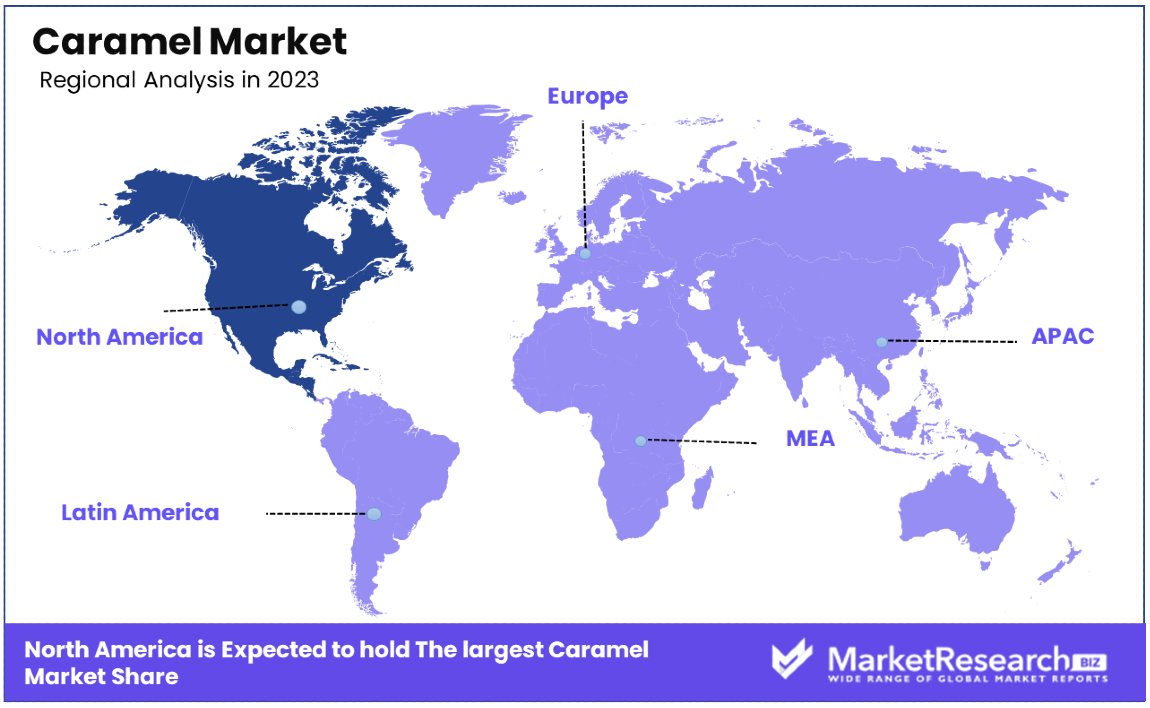

- Regional Dynamics: North America dominates the caramel market with a 30% market share, reflecting a strong tradition of confectionery and evolving consumer preferences. Europe holds approximately 25% of the market share.

- Analyst Viewpoint: Analysts foresee steady growth in the caramel market, driven by product innovation, evolving consumer tastes, and expanding distribution channels. The market's adaptability to emerging flavors and consumer preferences presents opportunities for continued growth and market expansion.

- Growth Opportunities: Opportunities lie in the development of new flavors, leveraging online retail channels, exploring applications in emerging markets, and enhancing product visibility through strategic partnerships and marketing initiatives. Innovation in flavor profiles and packaging formats, alongside sustainable practices, presents avenues for differentiation and growth in the caramel market.

Driving Factors

Growing Demand for Premium Confectionery Products Drives Market Growth

The caramel market is experiencing robust growth, fueled by a rising consumer preference for premium confectionery products. Caramel's unique taste and texture enhance the appeal of high-end chocolates, candies, and bakery items, meeting the demand for indulgent experiences.

Luxury brands like Godiva and Lindt have expanded their offerings with caramel-filled delights, tapping into this trend. The U.S. confectionery industry, employing nearly 58,000 people and supporting an additional 700,000 jobs, showcases the economic significance of this segment. This shift towards premiumization in confectionery underscores the caramel market's expansion, highlighting its essential role in crafting luxurious and flavorful products.

Rise of Artisanal and Specialty Food Trends Fuels Market Expansion

The burgeoning artisanal and specialty food movement is propelling the caramel market forward. Consumers' growing appetite for handcrafted, small-batch products with unique flavors has spotlighted artisanal caramel producers. Brands , known for their gourmet caramel sauces and candies, exemplify the market's shift towards quality and authenticity. This trend not only diversifies the market but also emphasizes the value of craftsmanship and high-quality ingredients in driving consumer interest and market growth.

Increasing Use in Beverages and Desserts Enriches Market Dynamics

Caramel's versatility is a significant driver of its increased usage in beverages and desserts, marking a 14.92% popularity surge in the past year. Its integration into a wide array of products, from Starbucks' Caramel Macchiato to Häagen-Dazs Caramel Cone ice cream, demonstrates its expansive role beyond traditional confectionery. This adaptability in various culinary applications underlines caramel's growing influence in the food and beverage sector, contributing to its widespread consumption and enhancing its market presence.

Growth of the Foodservice Industry Bolsters Caramel Demand

The expansion of the foodservice industry plays a pivotal role in the caramel market's growth. Caramel's application as a versatile ingredient in restaurants, cafés, and catering services—ranging from dessert toppings to glazes for meats—underscores its importance in adding value and flavor to dishes. The industry's creativity in incorporating caramel into menu items not only meets consumer demand for indulgent flavors but also stimulates further market development, showcasing caramel's enduring appeal in the culinary world.

Restraining Factors

Health Concerns and Sugar Consumption Restrain Market Growth

The increasing consumer awareness of health risks linked to high sugar intake significantly impacts the caramel market. Caramel, being rich in sugar, faces scrutiny from health-conscious consumers aiming to reduce obesity, diabetes, and other related health issues.

The World Health Organization's recommendation to limit free sugars adds to the challenge, influencing consumers to curtail their consumption of sugar-dense products like caramel confectioneries. This shift towards healthier eating habits and reduced sugar consumption presents a notable barrier to the market's growth, as consumers increasingly opt for lower-sugar alternatives.

Competition from Alternative Sweeteners and Flavors Limits Market Expansion

The emergence of alternative sweeteners and innovative flavors within the confectionery sector poses a substantial threat to the traditional caramel market. As consumer preferences evolve towards healthier and more diverse taste profiles, products incorporating natural sweeteners (e.g., stevia, monk fruit) or exotic flavors (e.g., matcha, yuzu) gain traction.

Brands capitalizing on this trend, such as Unreal and SmartSweets, offer lower-calorie options that appeal to health-conscious consumers, challenging the dominance of caramel-based treats. This competitive landscape, enriched by alternatives, constrains the caramel market's growth potential, diverting consumer interest towards novel and health-aligned options.

Product Types Analysis

Within the caramel market, Liquid Caramels stand out as the dominant sub-segment. This preference is likely due to their versatility and ease of use in various culinary applications, from baking and confectionery to beverages. Liquid caramels serve as an essential ingredient in both home cooking and professional food services, enabling a wide range of flavor profiles and textures in dishes.

Other sub-segments, including Soft Caramels, Hard Caramels, Chewy Caramels, and Caramel Toppings/Sauces, each contribute to the market's diversity. Soft and chewy caramels are favored for their texture and are often consumed as standalone treats or used in desserts. Hard caramels appeal to those who enjoy a longer-lasting caramel experience, often used as lozenges or in candy dishes. Caramel toppings and sauces, while similar to liquid caramels, are specifically designed for use as garnishes, adding a rich, sweet layer to desserts and drinks. Each of these sub-segments caters to different consumer preferences, contributing to the overall growth and dynamism of the caramel market.

Flavors Analysis

In the realm of flavors, Traditional Caramel is the cornerstone of the market, revered for its classic, rich taste that appeals to a broad audience. This enduring popularity underscores the timeless appeal of caramel's signature sweetness and depth of flavor, making it a staple in both traditional and innovative recipes.

Emerging flavors like Salted Caramel, Chocolate Caramel, and Fruit-Flavored Caramel, including apple and raspberry, introduce a contemporary twist to the traditional caramel profile. Salted caramel, in particular, has seen a surge in popularity, balancing sweetness with savory notes to create a complex, layered flavor experience. Chocolate caramel combines two beloved confectionery elements, catering to consumers seeking a decadent treat. Fruit-flavored caramels offer a refreshing contrast to the rich sweetness of traditional caramel, appealing to those looking for a unique and often lighter taste. Coffee/Espresso Caramel taps into the growing trend of coffee-flavored sweets, offering a sophisticated, adult-oriented flavor profile that complements the natural richness of caramel.

Distribution Channels

The distribution channel analysis for the caramel market reveals a significant evolution in consumer purchasing behaviors, primarily driven by technological advancements and changing lifestyle dynamics. Among these, Online Retailers emerge as the dominant sub-segment, a testament to the digital era's influence on shopping habits. This shift can be attributed to the convenience, variety, and competitive pricing offered by online platforms, attracting a broad spectrum of consumers.

The remaining sub-segments, including Retail Stores, Specialty Stores, Supermarkets/Hypermarkets, and Convenience Stores, though not leading, play crucial roles in the market's expansion. Supermarkets/Hypermarkets, for instance, offer extensive visibility and accessibility to caramel products, facilitating impulse purchases. Specialty Stores contribute by catering to niche markets with premium offerings, whereas Convenience Stores serve immediate consumption needs. Together, these channels complement the digital marketplace, creating a comprehensive ecosystem for the caramel market's growth.

End-Use Applications

In the domain of end-use applications, Bakery and Confectionery stands out as the dominant sub-segment, accounting for a significant 32% of the caramel market. This prominence is rooted in traditional and enduring consumer preferences for sweet treats, where caramel's versatility and flavor enhancement capabilities are unparalleled. Bakery and Confectionery's dominance is further bolstered by ongoing innovations in caramel products, such as salted caramel, which have rejuvenated interest and expanded its use in various recipes.

The other sub-segments, namely Ice Cream and Desserts, Snack Foods, Beverages, and Foodservice, contribute to the market's diversification and adaptability. Ice Cream and Desserts, for instance, benefit from caramel's appeal as a core or complementary flavor, driving consumer demand. Snack Foods and Beverages explore the ingredient's potential in creating new taste experiences, whereas the Foodservice sector leverages caramel to elevate the culinary appeal of dishes. Each of these sub-segments, by embracing caramel in unique applications, supports the market's overall growth trajectory, underlining the ingredient's versatility and enduring popularity.

Key Market Segments

By Product Types

- Liquid Caramel

- Soft Caramel

- Hard Caramel

- Chewy Caramel

- Caramel Toppings/Sauces

By Flavors

- Traditional Caramel

- Salted Caramel

- Chocolate Caramel

- Fruit-Flavored Caramel

- Coffee/Espresso Caramel

By Distribution Channels

- Retail Stores

- Online Retailers

- Specialty Stores

- Supermarkets/Hypermarkets

- Convenience Stores

By End-Use Applications

- Bakery and Confectionery

- Ice Cream and Desserts

- Snack Foods

- Beverages

- Foodservice

Growth Opportunities

Product Premiumization and Indulgence Offers Growth Opportunity

The trend towards product premiumization and indulgence in the caramel market signifies a substantial growth avenue. Consumers' growing appetite for luxury and unique sensory experiences has paved the way for brands to innovate with artisanal, high-end caramel products.

By leveraging superior ingredients, inventive flavors, and premium packaging, companies are well-positioned to meet the rising demand for gourmet experiences. This consumer willingness to invest in premium, indulgent caramel items, distinguished by their quality and uniqueness, is a pivotal factor driving market growth. Brands like Fat Toad Farm and Liddabit Sweets exemplify success in this segment, with their focus on small-batch, handcrafted caramel products that resonate with consumers seeking distinctiveness and superior taste.

Expansion into Emerging Markets Offers Growth Opportunity

Emerging markets represent a fertile ground for the caramel market's expansion, fueled by economic advancements and increased consumer spending power. Regions such as Asia-Pacific and Latin America are witnessing a surge in demand for confectionery and indulgent treats, driven by a growing middle class with disposable income to spare.

The key to unlocking this potential lies in understanding and adapting to the diverse taste preferences and cultural inclinations of these markets. Companies like Hershey's and Nestlé have already made strides in this direction, introducing caramel-infused products tailored to local tastes, such as caramel-flavored chocolates in India and caramel KitKat in Asia. This strategic focus on localization, coupled with an appreciation of regional tastes, positions caramel manufacturers to capitalize on the expanding opportunities within these dynamic markets.

Trending Factors

Clean Label and Natural Ingredients Are Trending Factors

The move towards clean label and natural ingredients marks a significant trend within the caramel market. This shift is driven by consumers' increasing preference for products composed of simple, recognizable, and minimally processed ingredients, such as cane sugar, cream, and butter, avoiding artificial additives or preservatives.

The demand highlights a growing concern among consumers about artificial ingredients in their food and a desire for transparency regarding product contents. Brands have successfully tapped into this trend, offering organic and non-GMO caramel products that promise purity and simplicity. This consumer-driven movement not only underscores a shift towards healthier eating habits but also opens avenues for growth among manufacturers committed to clean, natural ingredient lists.

Plant-Based and Vegan Caramel Are Trending Factors

The expansion of the plant-based and vegan diet trend into the caramel market illustrates the sector's adaptability to evolving consumer preferences. As more individuals adopt these dietary lifestyles, the demand for caramel products that cater to plant-based and vegan preferences grows. Manufacturers are responding by exploring and incorporating plant-based alternatives to traditional dairy ingredients, such as using coconut milk and cashew butter.

This innovation addresses the needs of consumers with dietary restrictions or those who choose plant-based products for ethical or health reasons. Brands with their vegan caramel sauces made from ingredients like coconut milk and maple syrup, are at the forefront of this trend. This pivot to plant-based and vegan options is not just a response to consumer demand but a proactive step towards inclusivity and sustainability in the caramel market.

Regional Analysis

North America Dominates with 30% Market Share

North America holds a pivotal position in the global caramel market, commanding a 30% share. This dominance is attributed to several key factors including high consumer disposable income, a strong presence of leading confectionery and food & beverage manufacturers, and a growing preference for premium and indulgent products.

The region's market dynamics are influenced by innovative product launches, with a focus on clean label and natural ingredients, responding to the health-conscious trends among North American consumers. Additionally, the rise in plant-based and vegan options has catered to the diverse dietary preferences prevalent in this market.

Looking forward, North America's influence on the global caramel market is expected to continue. The region's ongoing drive for innovation, coupled with its substantial consumer base willing to pay for premium products, sets the stage for sustained growth. The trend towards healthier, more natural products is likely to shape future market offerings, with North America leading these changes.

For other regions, the market share and growth rate vary, reflecting diverse consumer preferences and economic conditions:

- Europe: Holding a significant market share of approximately 25%, Europe's caramel market is driven by a rich tradition of confectionery and a strong focus on quality and artisanal products. The region is also seeing a rise in demand for clean label ingredients.

- Asia Pacific: This region is rapidly growing, currently accounting for 20% of the market, fueled by economic development, increasing disposable incomes, and a growing interest in Western-style confections.

- Middle East & Africa: With around 10% market share, this region presents a growing interest in caramel products, driven by expanding retail sectors and urbanization.

- Latin America: Also holding a 10% share, Latin America's market is influenced by local sweet traditions and a growing middle class with increasing purchasing power.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the landscape of the Caramel Market, key players such as Goetze's Candy Company Inc, Dallas Caramel Company, Mondelez International, Cadbury Caramel, Godiva, Lindt, Fat Toad Farm, Liddabit Sweets, Tierra Farm, Hershey's, Nestlé, and Greenville Caramel Company significantly shape market trends and consumer preferences.

Their strategic positioning underscores the robust demand for caramel and confectionery products, with a notable impact on the consumption and sales of these items. These companies have been pivotal in catering to the evolving demand for caramel flavors products and caramel-based products, driving product innovations and development. Their efforts have contributed to a broad product category range and enhanced product availability, enriching the variety of confectionery products available to consumers.

These private companies have also played a crucial role in expanding the sales of beverages and introducing variety in beverages, aligning with the demand forecast for both caramel products and related confectionery items. Through their commitment to diversifying Bakery Products Confectionery Products, these key players have reinforced the market's growth potential.

Their contributions are not just limited to increasing the assortment within the traditional confectionery space but also extend to innovating caramel flavors and formats, thereby meeting consumer demands for novelty and variety in the Caramel Market. This collective approach by the Caramel Market- Key Company List has fortified the market's resilience and adaptability, ensuring sustained interest and engagement from a diverse consumer base.

Market Key Players

- Goetze's Candy Company Inc

- Cargill, Inc.

- Dallas Caramel Company

- Mondelez International

- Cadbury Caramel

- Godiva

- Lindt

- Fat Toad Farm

- Liddabit Sweets

- Tierra Farm

- Hershey's

- Nestlé

- Greenville Caramel Company

Recent Developments

- On November 2023, Sanders Candy, an iconic caramel and chocolate confection company with a heritage dating back to 1875, declared the first-ever National Sea Salt Caramel Day.

- On November 2023, the Reese's brand unveiled the Reese's Caramel Big Cup, introducing a layer of caramel to its classic peanut butter cup in a Big Cup format for the first time ever.

- On November 2023, the Hershey Company's Reese's brand introduced the new Caramel Big Cup, a delightful fusion of Reese's classic peanut cup with a layer of caramel, marking a significant flavor innovation for the renowned confectionery maker.

- On September 2023, Marble Slab Creamery introduced a delectable new flavor to its menu - the Caramel Churro Crunch Ice Cream and Shake.

Report Scope

Report Features Description Market Value (2023) USD 4.1 Billion Forecast Revenue (2033) USD 5.8 Billion CAGR (2024-2033) 3.60% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Types (Liquid Caramels, Soft Caramels, Hard Caramels, Chewy Caramels, Caramel Toppings/Sauces), By Flavors (Traditional Caramel, Salted Caramel, Chocolate Caramel, Fruit-Flavored Caramel, Coffee/Espresso Caramel), By Distribution Channels (Retail Stores, Online Retailers, Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores), By End-Use Applications (Bakery and Confectionery, Ice Cream and Desserts, Snack Foods, Beverages, Foodservice) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Goetze's Candy Company Inc, Dallas Caramel Company, Mondelez International, Cadbury Caramel, Godiva, Lindt, Fat Toad Farm, Liddabit Sweets, Tierra Farm, Hershey's, Nestlé, Greenville Caramel Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Goetze's Candy Company Inc

- Cargill, Inc.

- Dallas Caramel Company

- Mondelez International

- Cadbury Caramel

- Godiva

- Lindt

- Fat Toad Farm

- Liddabit Sweets

- Tierra Farm

- Hershey's

- Nestlé

- Greenville Caramel Company