C-Reactive Protein Testing Market By Type (Kits, Reagents), By Application (Cardiovascular Diseases, Infections, Diseases Of Immune System, Rheumatoid Arthritis, Cancers, Inflammatory Bowel Disease, Osteomyelitis, Other Applications), By Assay Type (Immunoturbidimetric Assay, Enzyme-Linked Immunosorbent Assay (ELISA), Chemiluminescence immunoassay Assay (CLIA), High-sensitivity C-reactive protein (hs-CRP) Assay), By End-Use (Hospitals, Laboratories, Healthcare Facilities, Other End-Uses), By Region And Companies - Industry Segment Outlook, Market As

-

29848

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

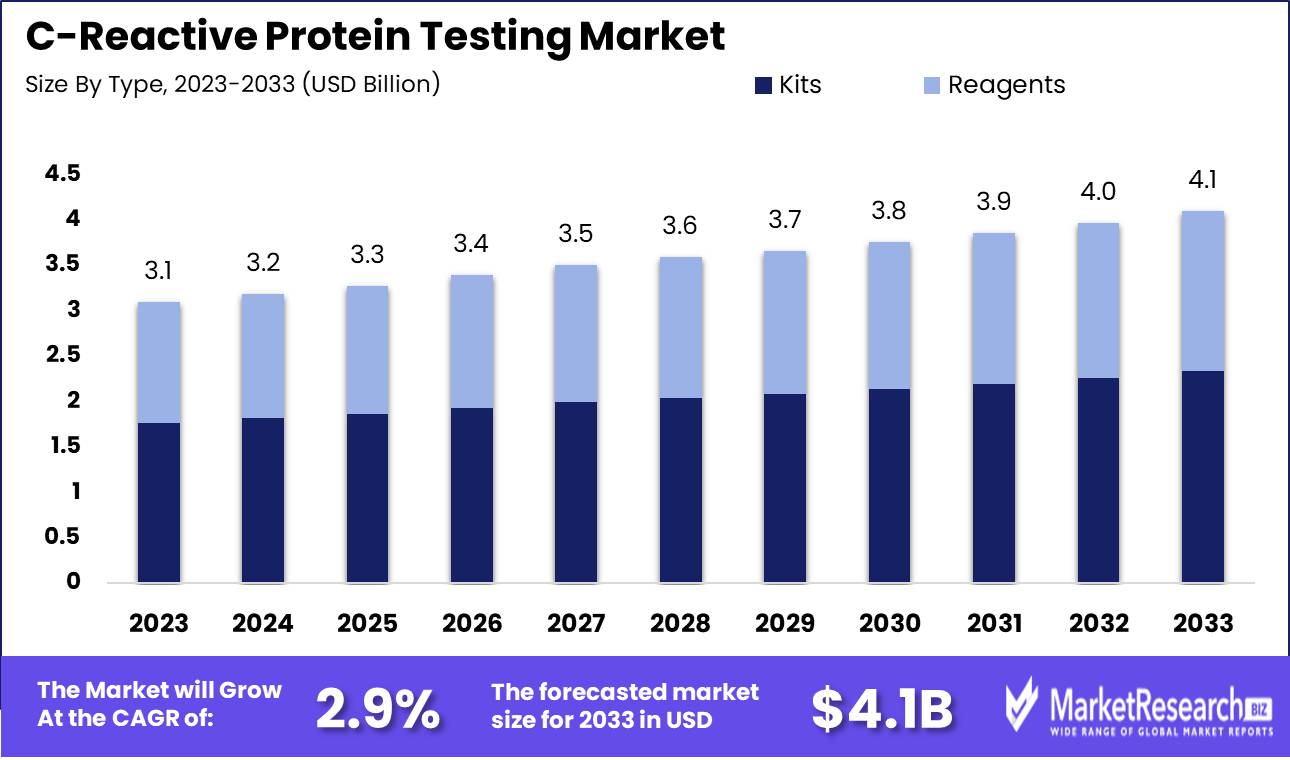

The C-Reactive Protein Testing Market size is estimated at USD 3.1 billion in 2023 and is expected to reach USD 4.1 billion by 2033, growing at a CAGR of 2.9% during the forecast period 2024-2033.

The C-Reactive protein (CRP) Testing Market encompasses the global industry focused on the development, production, and distribution of diagnostic tests that measure CRP levels in the blood. These tests are crucial for detecting inflammation and managing conditions such as cardiovascular diseases, infections, and autoimmune disorders. The market is driven by advancements in diagnostic technologies, the increasing prevalence of chronic diseases, and a growing emphasis on preventive healthcare. Key stakeholders include diagnostic device manufacturers, healthcare providers, and research institutions, all contributing to the innovation and expansion of CRP testing solutions to improve patient outcomes and streamline healthcare processes.

The C-Reactive Protein (CRP) testing market is set to experience robust growth, propelled by heightened awareness of cardiovascular conditions and the indispensable role of CRP as an inflammation biomarker. This growth trajectory is underpinned by technological advancements in diagnostics and the rising incidence of chronic diseases such as diabetes and arthritis, which require ongoing inflammation monitoring.

The incorporation of CRP testing into routine health assessments highlights its significance in early disease detection and management, thereby driving market demand. Furthermore, the shift towards preventive healthcare and the increasing focus on personalized medicine are accelerating the uptake of CRP testing. Innovations in point-of-care testing (POCT) devices, which deliver rapid and accurate results, are enhancing patient convenience and contributing to market expansion in both advanced and developing regions.

According to market reports, the global prevalence of cardiovascular diseases is projected to rise by 3% annually, necessitating more frequent CRP testing for early diagnosis and management. Technological advancements have led to a 20% reduction in the cost of CRP test kits over the past five years, making them more affordable for a broader demographic. Additionally, the adoption rate of POCT CRP testing is growing at a compound annual growth rate (CAGR) of 8%, reflecting the market's shift towards more efficient diagnostic solutions. These key factors collectively indicate a robust growth trajectory for the CRP Testing Market, driven by the dual imperatives of improving patient outcomes and optimizing healthcare expenditures. As healthcare systems worldwide continue to prioritize early detection and efficient management of chronic diseases, the CRP Testing Market is expected to witness sustained expansion and innovation.

Key Takeaways

- Market Growth: The C-Reactive Protein Testing Market size is estimated at USD 3.1 billion in 2023 and is expected to reach USD 4.1 billion by 2033, growing at a CAGR of 2.9% during the forecast period 2024-2033.

- By Type: Kits dominate CRP testing, with reagents essential for laboratory precision.

- By Application: Cardiovascular Diseases dominate the CRP testing market at 22.67% due to prevalence.

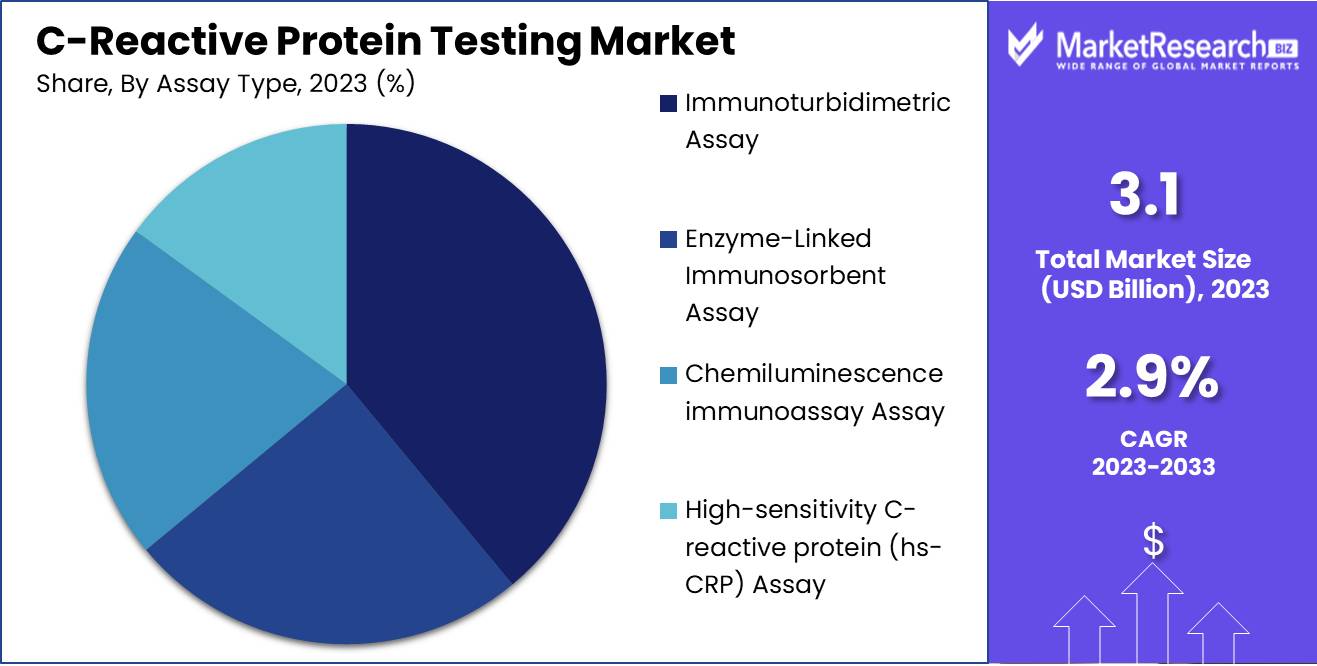

- By Assay Type: In 2023, Immunoturbidimetric dominated C-reactive protein Testing by assay type.

- By End-User: In 2023, Hospitals dominated the CRP Testing Market's End-Use segment with 28.01%.

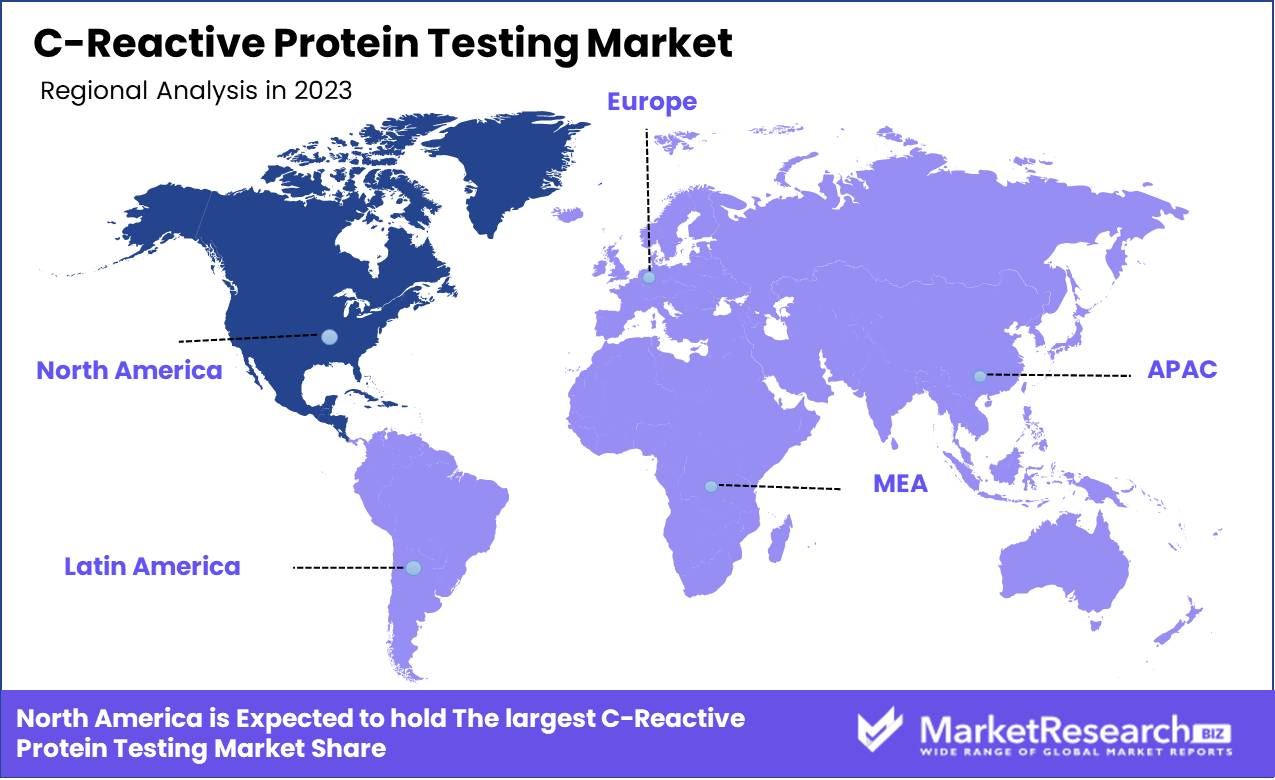

- Regional Dominance: North America dominates CRP Testing with a 40% market share due to advanced healthcare.

- Growth Opportunity: The global CRP Testing market is set for robust growth driven by rising health awareness and advancements in companion diagnostics.

Driving factors

Increasing Prevalence of Inflammatory Diseases: Driving Demand for Diagnostic Tools

The rising incidence of inflammatory diseases such as rheumatoid arthritis, lupus, and cardiovascular diseases significantly boosts the demand for C-reactive protein (CRP) testing. According to recent epidemiological data, the prevalence of rheumatoid arthritis alone affects about 0.5-1% of the global population, translating to millions of individuals requiring regular monitoring. CRP is a critical biomarker used to detect inflammation and manage these chronic conditions effectively. As more individuals are diagnosed with these diseases, the necessity for regular CRP testing becomes paramount. This ongoing demand underscores the pivotal role of CRP testing in both initial diagnosis and ongoing disease management, propelling the market's growth.

Growing Demand for Point-of-Care Testing: Enhancing Accessibility and Timeliness

Point-of-care (POC) testing represents a significant shift in the CRP testing market by improving the accessibility and timeliness of diagnostics. POC tests enable healthcare providers to conduct CRP tests at the bedside or in outpatient settings, delivering immediate results. This is particularly advantageous in emergency situations or in remote locations where access to traditional laboratory facilities may be limited.

The global POC diagnostics market is expected to reach USD 45.4 billion by 2024, with a substantial portion attributed to inflammatory disease diagnostics. The convenience and rapid turnaround of POC testing not only enhance patient care but also increase the frequency and volume of CRP tests conducted, thereby fueling market expansion.

Advancements in Assay Technologies: Improving Accuracy and Efficiency

Technological advancements in assay methodologies have significantly enhanced the accuracy, sensitivity, and efficiency of CRP tests. Innovations such as high-sensitivity CRP (hs-CRP) assays have expanded the clinical applications of CRP testing, allowing for the detection of lower levels of inflammation, which is crucial in cardiovascular risk assessment.

The development of automated and multiplex assays has also streamlined the testing process, reducing labor costs and increasing throughput. For example, the integration of advanced immunoassay techniques has led to more reliable and reproducible results, which are essential for the clinical management of patients. These technological improvements not only improve patient outcomes but also drive the adoption of CRP testing across various healthcare settings, thereby stimulating market growth.

Restraining Factors

Limited Availability of Advanced Diagnostic Equipment in Low-Resource Settings: A Barrier to Market Penetration

The limited availability of advanced diagnostic equipment in low-resource settings significantly restrains the growth of the C-reactive protein (CRP) Testing Market. This challenge is predominantly faced in developing countries with underdeveloped healthcare infrastructure and financial resources. Advanced diagnostic tools, essential for accurate CRP testing, are often expensive and require substantial investment in equipment and trained personnel. As a result, healthcare facilities in these regions tend to rely on basic diagnostic methods, which do not include sophisticated CRP tests.

According to a recent study, only 30% of healthcare facilities in low-income countries possess the necessary equipment for advanced diagnostic testing, which includes CRP testing. This limited availability hinders the early and accurate diagnosis of inflammatory conditions, ultimately affecting patient outcomes. Moreover, the lack of diagnostic infrastructure impedes the overall market growth as manufacturers of CRP testing equipment face reduced demand in these regions, deterring investment and expansion.

Insufficient Positive Predictive Value for Sole Diagnostic Use: Limiting Clinical Adoption

The insufficient positive predictive value (PPV) of CRP tests when used as a sole diagnostic tool presents another substantial challenge to the market's growth. CRP is a nonspecific marker of inflammation, and elevated levels can be associated with a wide range of conditions, including infections, chronic inflammatory diseases, and even cancer. The PPV of CRP tests is relatively low, meaning that a positive test result does not reliably indicate a specific disease, leading to potential misdiagnosis or unnecessary further testing.

Clinical studies indicate that the PPV of CRP tests alone can be as low as 30-40% for certain conditions. This limitation reduces the confidence of healthcare providers in using CRP tests as standalone diagnostics, often necessitating additional tests to confirm a diagnosis. The need for supplementary testing increases healthcare costs and complicates the diagnostic process, thereby reducing the appeal of CRP testing in clinical practice.

By Type Analysis

Kits dominate CRP testing, with reagents essential for laboratory precision.

In 2023, Kits held a dominant market position in the By Type segment of the C-Reactive Protein (CRP) Testing Market. This dominance can be attributed to the widespread adoption of kits due to their convenience, accuracy, and ease of use in various healthcare settings. Kits streamline the testing process, reducing the need for specialized equipment and extensive training, which makes them particularly appealing to smaller clinics and point-of-care testing environments. Additionally, advancements in kit technology have enhanced their reliability and sensitivity, further boosting their market appeal.

Reagents also play a crucial role in the CRP testing market, though they occupy a secondary position to kits. Reagents are essential for laboratory-based CRP testing, where high-throughput and detailed analysis are required. They are integral to automated systems in large hospitals and diagnostic laboratories, providing precise and consistent results necessary for monitoring inflammation and managing chronic diseases. The demand for reagents is driven by their critical role in sophisticated diagnostic procedures, ensuring they remain a vital component of the market despite the rising preference for user-friendly kits.

By Application Analysis

Cardiovascular Diseases dominate the C-reactive protein testing market at 22.67% due to prevalence.

In 2023, Cardiovascular Diseases held a dominant market position in the By Application segment of the C-reactive protein (CRP) Testing Market, capturing more than a 22.67% share. This significant share can be attributed to the rising prevalence of cardiovascular conditions and the critical role CRP testing plays in diagnosing and managing these diseases.

Infections followed closely, driven by the increasing incidence of bacterial and viral infections where CRP testing is pivotal for early detection and treatment monitoring. Diseases of the Immune System, including lupus and multiple sclerosis, also showed strong market engagement, as CRP levels serve as key indicators for disease activity and response to therapy.

Rheumatoid Arthritis benefited from CRP testing due to its utility in assessing inflammation levels, crucial for treatment decisions. Cancers represented a growing segment, with CRP tests being used to monitor inflammation, which is often associated with tumor progression and patient prognosis. Inflammatory Bowel Disease (IBD) leveraged CRP testing for monitoring disease activity and treatment efficacy. Osteomyelitis, though less prevalent, saw consistent demand for CRP tests as a reliable marker for infection severity and treatment response. Other Applications included diverse conditions where inflammation is a key factor concern, further expanding the CRP testing market's reach.

By Assay Type Analysis

In 2023, Immunoturbidimetric Assays dominated C-reactive protein Testing by assay type.

In 2023, the Immunoturbidimetric Assay segment held a dominant market position in the basis of Assay Type segment of the C-Reactive Protein Testing Market. This dominance is attributed to its widespread adoption due to its high accuracy, cost-effectiveness, and ease of use in routine clinical laboratories. ELISA (Enzyme-Linked Immunosorbent Assay) followed, recognized for its high sensitivity and specificity, making it a preferred choice for research applications and complex diagnostic procedures. Chemiluminescence Immunoassay (CLIA) also captured a significant market share, driven by its enhanced sensitivity and rapid turnaround time, beneficial for high-throughput testing environments.

High-sensitivity C-reactive protein (hsCRP) Assay, though smaller in market share, exhibited notable growth owing to its critical role in cardiovascular risk assessment and chronic inflammatory condition monitoring. The increasing prevalence of cardiovascular diseases and growing emphasis on early detection is likely to bolster the hsCRP Assay segment further. An hsCPR test is widely used to predict the risk of heart disease among the population. Collectively, these assay types highlight a competitive landscape where advancements in technology and clinical applications are key drivers, underscoring the critical role of accurate and efficient diagnostic tools in healthcare management.

By End-Use Analysis

In 2023, Hospitals dominated the CRP Testing Market's End-Use segment with 28.01%.

In 2023, Hospitals held a dominant market position in the By End-Use segment of the C-reactive protein (CRP) Testing Market, capturing more than a 28.01% share. This significant share can be attributed to the increasing prevalence of chronic diseases requiring regular CRP monitoring and the advanced diagnostic capabilities of hospital facilities. Laboratories followed closely, benefiting from technological advancements and the growing demand for accurate and rapid testing, allowing them to secure a substantial market share.

Healthcare Facilities, including clinics and specialized diagnostic centers, have also seen notable growth due to their accessibility and cost-effective testing services, catering to an expanding patient base. Other End-users, such as research institutions and home healthcare, contribute to the market by fostering innovations in CRP testing methodologies and expanding the application spectrum. These segments collectively highlight the diverse and evolving landscape of the CRP testing market, driven by the imperative for early detection and monitoring of inflammatory conditions, thereby underscoring the critical role of varied healthcare providers in meeting patient needs and advancing diagnostic accuracy.

Key Market Segments

By Type

- Kits

- Reagents

By Application

- Cardiovascular Diseases

- Infections

- Diseases Of the Immune System

- Rheumatoid Arthritis

- Cancers

- Inflammatory Bowel Disease

- Osteomyelitis

- Other Applications

By Assay Type

- Immunoturbidimetric Assay

- Enzyme-Linked Immunosorbent Assay (ELISA)

- Chemiluminescence immunoassay Assay (CLIA)

- High-sensitivity C-reactive protein (hs-CRP) Assay

By End-Use

- Hospitals

- Laboratories

- Healthcare Facilities

- Other End-Uses

Growth Opportunity

Increasing Health Awareness

A pivotal major factor propelling the CRP Testing market is the increasing global health awareness. As individuals become more informed about the importance of early disease detection and preventive healthcare, the demand for diagnostic testing, including CRP tests, is on the rise. CRP tests are critical in diagnosing conditions like infections, inflammatory diseases, and cardiovascular disorders. With a growing emphasis on wellness and preventive measures, healthcare providers are advocating for routine CRP testing, thereby expanding the market. This trend is particularly notable in developed regions with well-established healthcare systems, where public health campaigns and government initiatives are further driving awareness and adoption.

Advancements in Companion Diagnostics

Another significant opportunity lies in the integration of CRP testing with companion diagnostics. Companion diagnostics are tests used to determine the effectiveness of specific treatments for individual patients, thereby enhancing personalized medicine. The synergy between CRP testing and companion diagnostics is particularly valuable in managing chronic diseases and tailoring treatments. For instance, CRP levels can help monitor the efficacy of anti-inflammatory drugs, enabling more precise and effective therapeutic interventions. This integration not only improves patient outcomes but also opens new revenue streams for diagnostic companies and healthcare providers.

Latest Trends

Increased Demand for Precision Medicine

The global C-reactive protein (CRP) testing market is poised to benefit significantly from the rising demand for precision medicine. Precision medicine emphasizes tailored healthcare, aiming to provide more accurate diagnoses and treatments based on individual variability in genes, environment, and lifestyle. This approach necessitates precise biomarkers like CRP to monitor inflammatory conditions and tailor therapeutic interventions accordingly. With advancements in genomics and personalized healthcare technologies, CRP tests are becoming essential tools for identifying patient-specific inflammatory responses and adjusting treatment plans.

Focus on Preventative Healthcare Driving Market Growth

Preventative healthcare is increasingly becoming a cornerstone of modern medical practice, and CRP testing plays a crucial role in this paradigm. Early detection of inflammation through CRP testing can help identify potential health issues before they become severe, enabling timely intervention and better management of chronic conditions such as cardiovascular diseases and rheumatoid arthritis. This shift towards preventative measures is driven by the growing recognition of the cost-effectiveness and improved quality of life associated with early disease detection and management. As healthcare systems worldwide continue to emphasize the importance of prevention over treatment, the demand for CRP tests is expected to rise, driving market expansion.

Regional Analysis

North America dominates CRP Testing with a 40% market share due to advanced healthcare.

The C-reactive protein (CRP) Testing market exhibits varied growth dynamics across different regions. North America, a dominant force, captures approximately 40% of the market share due to its advanced healthcare infrastructure, high prevalence of chronic diseases, and substantial healthcare expenditure. The United States, in particular, is a key driver within this region, underpinned by robust diagnostic testing and widespread adoption of preventive healthcare measures. Europe follows with significant market contributions, buoyed by increasing awareness of CRP testing and a strong emphasis on early disease detection and management. Germany, France, and the United Kingdom are pivotal markets within Europe, benefiting from well-established healthcare systems and substantial investments in diagnostic technologies.

The Asia Pacific region is poised for rapid growth, driven by rising healthcare spending, growing incidences of chronic ailments, and improving access to healthcare services. China and India are leading the charge, reflecting expanding middle-class populations and heightened health awareness. In the Middle East & Africa, market expansion is supported by increasing investments in healthcare infrastructure and rising disease burden, with the UAE and South Africa being notable contributors. Latin America, though smaller in market size, is experiencing steady growth due to improving healthcare facilities and increasing CRP test adoption, particularly in Brazil and Mexico.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global C-reactive protein (CRP) Testing Market in 2024 is poised for significant growth, driven by the increasing prevalence of inflammatory diseases and advancements in diagnostic technologies. Key players such as Thermo Fisher Scientific Inc., Roche Diagnostics, and Abbott Laboratories are at the forefront, leveraging their extensive R&D capabilities and broad product portfolios to capture market share. Beckman Coulter and Bio-Rad Laboratories continue to innovate, enhancing the accuracy and speed of CRP testing.

Siemens Healthcare and Quest Diagnostics are notable for their expansive diagnostic networks, providing comprehensive testing solutions globally. Ortho Clinical Diagnostics and Randox Laboratories emphasize robust quality control and innovative assays. Boditech Med Inc. and Merck Millipore bring niche technological expertise, catering to specialized segments of the market.

BioMerieux and Trinity Biotech are enhancing their market presence through strategic collaborations and geographic expansion. Alere Inc. (now part of Abbott) and Becton, Dickinson, and Company (BD) focus on point-of-care testing solutions, addressing the demand for rapid and reliable diagnostics. Sekisui Diagnostics, Tosoh Bioscience Inc., DiaSorin S.p.A., Fujifilm Corporation, and Abaxis, Inc. contribute through specialized products and regional market penetration, reinforcing the competitive landscape of the CRP testing market.

Market Key Players

- Thermo Fisher Scientific Inc.

- Roche Diagnostics

- Abbott Laboratories

- Beckman Coulter

- Bio-Rad Laboratories

- Siemens Healthcare

- Quest Diagnostics

- Ortho Clinical Diagnostics

- Randox Laboratories

- Boditech Med Inc.

- Merck Millipore

- BioMerieux

- Trinity Biotech

- Alere Inc.

- Becton, Dickinson and Company (BD)

- Sekisui Diagnostics

- Tosoh Bioscience Inc.

- DiaSorin S.p.A.

- Fujifilm Corporation

- Abaxis, Inc.

Recent Development

- In April 2024, Thermo Fisher Scientific launched a new CRP testing kit compatible with their existing diagnostic platforms. The new kit is designed for improved sensitivity and specificity, catering to both clinical and research needs.

- In March 2024, Siemens Healthineers expanded its portfolio by acquiring cutting-edge CRP test technology from a smaller biotech firm. This acquisition is expected to enhance their testing capabilities and provide more comprehensive diagnostic solutions.

- In January 2024, Roche Diagnostics announced the launch of their new high-sensitivity C-Reactive Protein (hsCRP) test, designed to improve early detection of inflammatory conditions. This new test offers enhanced accuracy and speed, allowing healthcare providers to make quicker and more precise diagnoses.

Report Scope

Report Features Description Market Value (2023) USD 3.1 Billion Forecast Revenue (2033) USD 4.1 Billion CAGR (2024-2032) 2.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Kits, Reagents), By Application (Cardiovascular Diseases, Infections, Diseases Of Immune System, Rheumatoid Arthritis, Cancers, Inflammatory Bowel Disease, Osteomyelitis, Other Applications), By Assay Type (Immunoturbidimetric Assay, Enzyme-Linked Immunosorbent Assay (ELISA), Chemiluminescence immunoassay Assay (CLIA), High-sensitivity C-reactive protein (hs-CRP) Assay), By End-Use (Hospitals, Laboratories, Healthcare Facilities, Other End-Uses) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Thermo Fisher Scientific Inc., Roche Diagnostics, Abbott Laboratories, Beckman Coulter, Bio-Rad Laboratories, Siemens Healthcare, Quest Diagnostics, Ortho Clinical Diagnostics, Randox Laboratories, Boditech Med Inc., Merck Millipore, BioMerieux, Trinity Biotech, Alere Inc., Becton, Dickinson, and Company (BD), Sekisui Diagnostics, Tosoh Bioscience Inc., DiaSorin S.p.A., Fujifilm Corporation, Abaxis, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Thermo Fisher Scientific Inc.

- Roche Diagnostics

- Abbott Laboratories

- Beckman Coulter

- Bio-Rad Laboratories

- Siemens Healthcare

- Quest Diagnostics

- Ortho Clinical Diagnostics

- Randox Laboratories

- Boditech Med Inc.

- Merck Millipore

- BioMerieux

- Trinity Biotech

- Alere Inc.

- Becton, Dickinson and Company (BD)

- Sekisui Diagnostics

- Tosoh Bioscience Inc.

- DiaSorin S.p.A.

- Fujifilm Corporation

- Abaxis, Inc.